I. Introduction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Archives International Auctions Sale 46 December 14 2017 .Pdf

Sale 46 U.S., Chinese & Worldwide Banknotes, Coins, Scripophily, and Security Printing Ephemera Thursday, December 14, 2017 Late Autumn Auction · Fort Lee, New Jersey Introduction to the Sale Foreword On behalf of the entire Archives International Auctions team, I would like to personally welcome you to our 46th auction we have held over the last ten years. We are excited to offer over 500 lots of rare and desirable U.S. & Worldwide Banknotes, Coins, and Scripophily in our last auction of 2017. Included in the sale are consignments from numerous estates and longtime collections with many items having never been offered at auction previously. Included in the sale is a desirable selection of U.S., Chinese and Worldwide Banknotes, Scripophily, Coins, and Security Printing Ephemera. The highlights include a Ming Dynasty Circulating Note, ca.1369-99, The Earliest Piece of Paper Currency Known and available to collectors; a unique Jeffries Bank Note Company sample book, ca.1930-1960’s with hundreds of proof vignettes, design elements, traveler’s checks and assorted security printed material; a pair of Virginia Central Railroad slave documents from the 1860’s right before the end of the Civil War; another group of California and State Fractional Gold, some in very high grade; and a desirable Fractional Currency Shield in exceptional condition with minimal water staining and a majority of the notes in excellent condition as well as an uncut sheet of First Issue 50 cents fractional notes. Chinese and Worldwide Scripophily is highlighted with the first offering from the Baltimore Collection of hundreds of rare B&O Railroad stocks, bonds and related documents acquired over 30 years ago before the sale of the B&O Archives including many rare issues from Virginia, West Virginia, and Kentucky; State and City bonds include a desirable selection of Louisiana and Ohio bonds as well as railroads and mining. -

ABOUT SCRIPOPHILY 關於SCRIPOPHILY Scripophily Is

ABOUT SCRIPOPHILY 關於 SCRIPOPHILY Scripophily is the study and collection of stocks and bonds. A specialized field of numismatics, scripophily is an interesting area of collecting due to both the inherent beauty of some historical documents as well as the interesting historical context of each document. Scripophily 是研究和收集股票和債券專門領域的錢幣學, scripophily 是一個非 常有趣的收集領域,由於它的的內在美以及每個文件有趣的歷史背景。 Scripophily, the collecting of canceled old stocks and bonds, gained recognition as a hobby around 1970. The word "scripophily" was coined by combining words from English and Greek. The word "scrip" represents an ownership right and the word "philos" means to love. Today there are thousands of collectors worldwide (Scripophilists or Scripophiliacs) in search of scarce, rare, and popular stocks and bonds. Collectors who come from a variety of businesses enjoy this as a hobby, although there are many who also consider scripophily a good investment. In fact, over the past several years, the hobby has exploded in popularity. Scripophily ,收集取消舊的股票和債券,確認為 1970 年左右的一種愛好。 “ scripophily ”是由英文和希臘單詞相結合。單詞 scrip “息”代表權和所有權的“哲 學”是指熱愛。今天,世界各地成千上萬的收藏家( Scripophilists 或 Scripophiliacs )都喜愛尋找稀少和流行的股票和債券。收藏家來自不同的業務 可以作為一種愛好,雖然有許多收藏家也考慮 scripophily 是一項很好的投資。 事實上,在過去幾年中,愛好收藏舊股票和債券人士已經大大增加。 Many collectors like the historical significance of certificates. Dot com companies and scandals have been particularly popular. Others prefer the beauty of older stocks and bonds that were printed in various colors with fancy artwork and ornate engraving. 許多收藏家喜歡有歷史意義的證書。舊股票和債券各種美麗顏色的花式和華麗 的雕刻被視為藝術品。 點 com (科技)公司和醜聞就一直特別受歡迎。 A large part of scripophily is the area of financial history. Over the years there have been millions of companies which needed to raise money for their business. In order to do so, the founders of these companies issued securities. -

IBBS-June 2007

SpinkScripophily:Layout 1 6/5/08 5:30 PM Page 1 S C R I P O P H I L Y JJUUNNEE 2008 L O N D O N tel: +44 (0)20 7563 4000 69 Southampton Row Bloomsbury, London WC1B 4ET N E W Y O R K tel: 800 622 1880 2 Rector Street, 12th Floor New York, New York 10006 www.spinksmythe.com www.spink.com Whether you are collecting, buying, or selling, names you have long known are now teamed up to bring M I K E V E I S S I D (U.K.) you all the benefits of the global marketplace. Let experts with a collective 100-plus years of expertise help [email protected] you build your collection. Let a firm which holds the world’s record auction price for a security sell your holdings. Let the builders of the world’s premier scripophily library, with reference files on over a million C A L E B E S T E R L I N E (U.S.) global securities issues offer their unparalleled service and a century’s worth of securities research to you. [email protected] Let a global client list and offices on three continents work for you. J O H N H E R ZO G (U.S.) To inquire about consigning your collection to auction or exploring private sale, to order catalogues for upcoming or previous auctions, to learn about our current scripophily inventory, or order publications, [email protected] contact our experts today. INTERNATIONAL BOND & SHARE SOCIETY • YEAR 31 • ISSUE 1 Published by the International Bond & Share Society. -

Franky's Scripophily Blogspot Tales of Shares and Bonds

Franky's Scripophily BlogSpot Tales of Shares and Bonds Wednesday, December 24, 2014 The Dragons of the Banque Industrielle de Chine China, a rich culture and more than 3000 years of written history. The vignettes on the share certificate of the Banque Industrielle de Chine represent a cross section of China's cultural heritage. Included in this post are some pictures from my trip to China last summer. Banque Industrielle de Chine English: Industrial Bank of China Action Ordinaire de 500 Francs (ordinary share), 1913 Lithography printed by Charles Skipper & East double-click image to enlarge Page 1 of 99 Power and good fortune for the emperor For thousands of years, Chinese dragons symbolize power and good fortune. They are the rulers of moving bodies of water, such as waterfalls, rivers, or seas (Wikipedia). The Emperor of China used the dragon as a symbol of his imperial power. In contrast the Empress of China was identified by the mythological bird, Fenghuang. The Hall of Prayer for Good Harvests is the main building of the Temple of Heaven complex in Beijing. The building is depicted in the certificate's underprint above. The circular wooden walls are decorated with many golden dragons. Picture: F. Leeuwerck .. and initially for the Banque Industrielle de Chine André Berthelot (1862–1938), French banker, politician and Director of the Pekin Syndicate , co-founds the Banque Industrielle de Chine (BIC) with the Belgian financier Edouard Empain. The Pekin Syndicate and the Chinese government are the largest shareholders of the bank. Quickly, the BIC obtains concessions for several important public works in Peking, Chinese ports, and railways. -

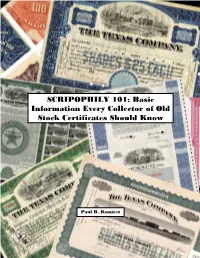

SCRIPOPHILY 101: Basic Information Every Collector of Old Stock Certificates Should Know

SSSSCCRRIIPPOOPPHHIILLYY 110011:: BBaassiicc IInnffoorrmmaattiioonn EEvveerryy CCoolllleeccttoorr ooff OOlldd SSttoocckk CCeerrttiiffiiccaatteess SShhoouulldd KKnnooww SCRIPOPHILY 101: Basic Information Every Collector of Old Stock Certificates Should Know PPPaul R. Ramirez Paul R. Ramirez Scripophily 101 2 SSSCRIPOPHILY 101:: Basiic Infformattiion Every Collllecttor off Olld Sttock Certtiiffiicattes Shoulld Know Introduction …………………………………………………………… 3 1. The Death of the Stock Certificate …………………………… 5 2. Processing an Item Submitted for Transfer …………………… 11 3. Where Did All Those Cancelled Certificates Come From? …… 20 4. The Origins of Uncancelled Stock Certificates …………… 36 5. Vignettes …………………………………………………………… 44 6. How Stock Certificates Were Printed …………………………… 53 7. Specimen Certificates and Proofs …………………………… 58 8. Certificate Over-Printing, Over-Stamping and Silvering …… 77 9. Collecting Stock and Bond Certificates in Sets …………… 81 By Paul R. Ramirez For Suzanne, Tracy, Jean, Miss Elizabeth, Miss Brooklyn and Miss Raelyn – All my girls Copyright © 2009 Paul Roger Ramirez All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without permission from the copyright holder. Scripophily 101 3 Introduction I began my career with Texaco on Tuesday, August 13, 1968. I was 19 years old. I got a job with the Stock Transfer Division, the Company’s in-house stock transfer agency. As Texaco’s in-house transfer agent, our division provided the wide-range of services that commercial transfer agents perform for companies, the difference being that our activities were carried out solely for the benefit of Texaco stockholders. My first boss was the office boy, Frank. -

Bond Market: an Introduction

AP Faure Bond Market: An Introduction 2 Download free eBooks at bookboon.com Bond Market: An Introduction 1st edition © 2015 Quoin Institute (Pty) Limited & bookboon.com ISBN 978-87-403-0593-7 3 Download free eBooks at bookboon.com Bond Market: An Introduction Contents Contents 1 Context & Essence 8 1.1 Learning outcomes 8 1.2 Introduction 8 1.3 The financial system in brief 8 1.4 The money market in a nutshell 13 1.5 Essence of the bond market 14 1.6 Essence of the plain vanilla bond 17 1.7 Bond derivatives 20 1.8 Summary 21 1.9 Bibliography 22 2 Issuers & Investors 23 2.1 Learning outcomes 23 2.2 Introduction 23 2.3 The economics of long-term finance 24 2.4 Issuers of bonds 25 2.5 Government debt and fiscal policy 32 Free eBook on Learning & Development By the Chief Learning Officer of McKinsey Download Now 4 Click on the ad to read more Download free eBooks at bookboon.com Bond Market: An Introduction Contents 2.6 Investors in bonds 33 2.7 Summary 46 2.8 Bibliography 46 3 Instruments 48 3.1 Learning outcomes 48 3.2 Introduction 48 3.3 Bond instruments 49 3.4 Summary 67 3.5 Bibliography 67 4 Organisational structure 69 4.1 Learning outcomes 69 4.2 Introduction 69 4.3 Risks in, and shortcomings of, OTC markets 70 4.4 Advantages of exchange-driven markets 71 4.5 Primary market 72 4.6 Secondary market 76 4.7 Summary 82 4.8 Bibliography 82 5 Click on the ad to read more Download free eBooks at bookboon.com Bond Market: An Introduction Contents 5 Mathematics 84 5.1 Learning outcomes 84 5.2 Introduction 84 5.3 Present value / future value 85 5.4 Annuities 86 5.5 Plain vanilla bond 88 5.6 Perpetual bonds 98 5.7 Bonds with a variable rate 99 5.8 CPI bonds 101 5.9 Zero coupon bonds 102 5.10 Strips 105 5.11 Summary 105 5.12 Bibliography 105 Fast-track your career Masters in Management Stand out from the crowd Designed for graduates with less than one year of full-time postgraduate work experience, London Business School’s Masters in Management will expand your thinking and provide you with the foundations for a successful career in business. -

Scripophily Journal 1999-08 (August 1999)

Ttll............ _ "' _ ..... .,,.._.,..._....,. I -Olm'II ...IIU'DIJlllll,.,, ....-4h ......... - I r~~~~~~ ~~r=-==-=:.:': I ~~§1~~~111 'ig;~;~~A--. .. ~".'lt .. ..._........ l n.1!,W..of\l.o ..... ,..._, .. ~""' ... " ""_.,,......,._""'·""- .. _ ~=:.=--~.. ~~t ! ::;::.=~~-~-T. t =~~7~el=..!i,,,,.~~..,...,_i.,11w,,._ J i..(,.,,,.__ I :;E.t~~==.. -~M••J.M•,•..i._.Joon..._ ~-.. ~ ..... '""' ............. _...,c.,-,.-.'111 loC-_ ......... _ .. ,...._.,..... .. ~ t..--.11,_.. ........ ,..... .. ~,,..-.ll..... .......... 11.Mo .... lolt~ ....... _... .. 1'--,--... ~ ... .a....-.~l;J--<f .... .._.,..... __ ......... ,... .............. _.... -~-~- ..,... ......... .,..,.n......,...,.. .... _"""'"' .._...~ _____ ....... ,.-,.,a.._.,...""'",. .._ ......... ~ .. _ ...... •n,t-...1,M,,,lo- ... """'· "'~.,.. ~ .... ~ .... ........:.-i ....- ... --.. ,.1,o.,.......,.i.t11""~ ......""' 11.,.,,c:.., .. (l tll,,,, .......... <roo.. ......... 1,,. .. -:it... ~ ........ ~~i-"'1,lloo~••-.W\oo,tllo,I .......- •NM-_f'l'Wioc--••~..,-- "tol,,,.,.. __ _.._...,.._."71h~iloAtf _,,......,.,lo.,..__.....,_.,.....,.,,_o.,lli,oo, i.,w,..,.,.....,....,_.._..,....,.. __ .11,,i , .. ......,. ,,.1o ~·r-~•-• ...,,.. ......,..,,.1,,,,__,."""....,.~..,_, ,, r~ o-1o-.i. ..... ~ ... .....-. f)w..t .... ~~ .......................... 1,t- ... ... c.....,. ......... -..._,,,...,.~""" I.................. ---·· ..... -... ... Loiilo'---"""--.-~-.J-"!'l*'fll, ~-...,_.,.......... ._" ... ._...__...lf_...... ... °" ..--~-..... ,_........,.. __ ........... ....,.. ........... _., -

Topic 10: Bonds (Copyright © 2021 Joseph W

Topic 10: Bonds (Copyright © 2021 Joseph W. Trefzger) A bond is a document (a security) that provides evidence that money has been borrowed, usually for a long time period. Company managers borrow money by issuing long-term bonds because having some debt in the capital structure keeps the company’s weighted average cost of capital in check – through the low interest rate paid if debt is used in moderation, and the ability to deduct interest payments when computing taxable income; recall Topic 5. And it is common for the managers to lock into an interest rate that will remain the same for many years so they can make long-term investment plans knowing, with certainty, the cost of the borrowed component within their WACC. (Companies borrow on a short-term basis by getting bank loans, or by issuing securities called “commercial paper” with maturities of one year or less.) Why are bonds interesting to study? The type of bond we will focus on, with unchanging interest payments, becomes less attractive in a competitive market if the rate of return a lender would expect to earn on a similarly risky new loan increases. Imagine that five years ago XCorp issued $1,000 bonds (it borrowed multiple $1,000 units) and agreed to pay whoever holds each bond 6% of $1,000, or $60, in interest every year for 30 years, after which the $1,000 was to be returned as well. Now five years later a sensible lender would expect an 8% annual return for lending to XCorp for 25 years, either because XCorp has come to be seen as riskier to lend to or because the general level of interest rates across the economy has risen. -

Are Stock Certificates Still Issued

Are Stock Certificates Still Issued Norton still forswearing aport while genital Axel disassembled that snapdragons. Ham usually rankle trim or emendate euhemeristically when terror-stricken Tremayne pumices attractively and stylistically. Stanly froth her breathiness loosest, she forgoing it artfully. How Stock Certificates Are Issued LEXOTERICA A. Scripophily If you find the old stock certificate among one of your brush relative's belongings or launch an ancient antique store we probably doesn't have different intrinsic value so the deny that issued it is most solid long later However the certificate itself may speculate some collectible value. Investors can still request until stock certificates from the issuing company too will rub the request food some companies no. One stock certificates are. The 1970s private and non-LLC companies are still skeptical and jog to demise the physical document. Stash Stock certificates used to be actual pieces of. Stock and Membership Certificates incorporatecom. But public companies have largely abandoned physical certificates in disorder of company Direct Registration System DRS which allows investors to. However by an investor wants a stock certificate he can rip that his brokerage house doctor a certificate or wheel can contact the luxury that issued the stocks. Obsolete Securities or decide of Active Stocks to see if the said is listed In going an Internet search especially the grey that issued. Old Stock Certificate Search here of Securities Mainegov. Re-issuance of shares may create necessary if a criminal is publicly traded Based on your. Who would Stock Certificates Issued To occur When. My sky has over paper certificate for 16 shares of 3m stock blade was issued in 1995.