Royal Bank of Canada Annual Information Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

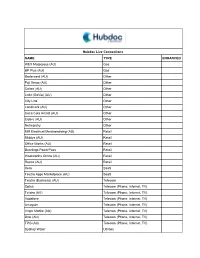

Live Canadian Bank and Supplier Connections NAME TYPE

Live Canadian Bank and Supplier Connections NAME TYPE ENHANCED Alterna Savings Banks and Credit Cards Amazon.ca Rewards Visa from Chase Banks and Credit Cards American Express (Canada) Banks and Credit Cards YES American Express Merchant Services (EUR) Banks and Credit Cards Assiniboine Credit Union Banks and Credit Cards ATB Financial (Business) Banks and Credit Cards YES ATB Financial (Personal) Banks and Credit Cards BMO Debit Card Banks and Credit Cards YES BMO Nesbitt Burns Banks and Credit Cards BMO Online Banking for Business Banks and Credit Cards Canadian Tire Options MasterCard Banks and Credit Cards Canadian Western Bank Banks and Credit Cards YES Capital One Mastercard (Canada) Banks and Credit Cards CHASE Bank Canada Banks and Credit Cards CIBC Banks and Credit Cards YES CIBC Wood Gundy Banks and Credit Cards Coast Capital Savings Banks and Credit Cards YES Costco Capital One Credit Card Banks and Credit Cards CUETS: Choice Rewards Mastercard Banks and Credit Cards Desjardins Business Banks and Credit Cards Desjardins VISA Banks and Credit Cards Envision Financial Banks and Credit Cards First National Financial Banks and Credit Cards Ford Credit (Canada) Banks and Credit Cards HBC Credit Card Banks and Credit Cards Home Depot Consumer Credit Card (Canada) Banks and Credit Cards Home Depot Revolving Commercial Charge Card (Canada) Banks and Credit Cards HSBC Bank Canada Banks and Credit Cards HSBC MasterCard Banks and Credit Cards Interior Savings Credit Union Banks and Credit Cards Island Savings Banks and Credit Cards MBNA -

Royal Bank of Canada Annual Report 2017

Royal Bank of Canada Annual Report 2017 Annual Report - Part IV of IV To view full Annual Report in PDF format, please see the link below: http://www.rns-pdf.londonstockexchange.com/rns/0704Y_-2017-11-30.pdf Caution regarding forward-looking statements From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. We may make forward-looking statements in this 2017 Annual Report, in other filings with Canadian regulators or the SEC, in other reports to shareholders and in other communications. Forward-looking statements in this document include, but are not limited to, statements relating to our financial performance objectives, vision and strategic goals, the Economic, market, and regulatory review and outlook for Canadian, U.S., European and global economies, the regulatory environment in which we operate, the Strategic priorities and Outlook sections for each of our business segments, and the risk environment including our liquidity and funding risk, and includes our President and Chief Executive Officer's statements. The forward-looking information contained in this document is presented for the purpose of assisting the holders of our securities and financial analysts in understanding our financial position and results of operations as at and for the periods ended on the dates presented, as well as our financial performance objectives, vision and strategic goals, and may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as "believe", "expect", "foresee", "forecast", "anticipate", "intend", "estimate", "goal", "plan" and "project" and similar expressions of future or conditional verbs such as "will", "may", "should", "could" or "would". -

Diversity Progress Report

Diversity Progress20 Report07 04 Our Leadership 07 Our People 10 Our Marketplaces 13 Our Communities inside integrity teamwork service diversity responsibility Diversity for Growth and Innovation >>> “Diversity for growth and innovation” is one of the core values at RBC. It could have been just as compelling to talk about diversity in terms of fairness, openness and an inclusive work environment. So why focus on the connection between diversity and growth and innovation? To be sure, having a workforce that reflects the population and the communities we serve, and a workplace that offers all employees the opportunity to reach their potential, is simply the right thing to do. But leveraging diversity is more than that. It’s smart business. Every employee brings his or her unique talents, experiences and perspectives to the workplace. True diversity isn’t just a matter of having a strong representation of various groups, but of tapping into the full spectrum of ideas and abilities that people at RBC possess. We grow as an organization when we encourage different viewpoints and ways of thinking – differences that come through diversity. That is what leads to true insights and innovative practices. We are also competing in a global marketplace, and we know that our growth will depend on developing the diverse capabilities of our international workforce. This requires the commitment of our leadership, the engagement of our people and the measurement of where we can do even better. In 2008, we will release our RBC Diversity Blueprint. This comprehensive statement of our global strategy and priorities will help guide our actions for doing better in the future. -

Numerical.Pdf

DTC PARTICPANT REPORT (Numerical Sort ) Month Ending - July 31, 2021 NUMBER PARTICIPANT ACCOUNT NAME 0 SERIES 0005 GOLDMAN SACHS & CO. LLC 0010 BROWN BROTHERS HARRIMAN & CO. 0013 SANFORD C. BERNSTEIN & CO., LLC 0015 MORGAN STANLEY SMITH BARNEY LLC 0017 INTERACTIVE BROKERS LLC 0019 JEFFERIES LLC 0031 NATIXIS SECURITIES AMERICAS LLC 0032 DEUTSCHE BANK SECURITIES INC.- STOCK LOAN 0033 COMMERZ MARKETS LLC/FIXED INC. REPO & COMM. PAPER 0045 BMO CAPITAL MARKETS CORP. 0046 PHILLIP CAPITAL INC./STOCK LOAN 0050 MORGAN STANLEY & CO. LLC 0052 AXOS CLEARING LLC 0057 EDWARD D. JONES & CO. 0062 VANGUARD MARKETING CORPORATION 0063 VIRTU AMERICAS LLC/VIRTU FINANCIAL BD LLC 0065 ZIONS DIRECT, INC. 0067 INSTINET, LLC 0075 LPL FINANCIAL LLC 0076 MUFG SECURITIES AMERICAS INC. 0083 TRADEBOT SYSTEMS, INC. 0096 SCOTIA CAPITAL (USA) INC. 0099 VIRTU AMERICAS LLC/VIRTU ITG LLC 100 SERIES 0100 COWEN AND COMPANY LLC 0101 MORGAN STANLEY & CO LLC/SL CONDUIT 0103 WEDBUSH SECURITIES INC. 0109 BROWN BROTHERS HARRIMAN & CO./ETF 0114 MACQUARIE CAPITAL (USA) INC. 0124 INGALLS & SNYDER, LLC 0126 COMMERZ MARKETS LLC 0135 CREDIT SUISSE SECURITIES (USA) LLC/INVESTMENT ACCOUNT 0136 INTESA SANPAOLO IMI SECURITIES CORP. 0141 WELLS FARGO CLEARING SERVICES, LLC 0148 ICAP CORPORATES LLC 0158 APEX CLEARING CORPORATION 0161 BOFA SECURITIES, INC. 0163 NASDAQ BX, INC. 0164 CHARLES SCHWAB & CO., INC. 0166 ARCOLA SECURITIES, INC. 0180 NOMURA SECURITIES INTERNATIONAL, INC. 0181 GUGGENHEIM SECURITIES, LLC 0187 J.P. MORGAN SECURITIES LLC 0188 TD AMERITRADE CLEARING, INC. 0189 STATE STREET GLOBAL MARKETS, LLC 0197 CANTOR FITZGERALD & CO. / CANTOR CLEARING SERVICES 200 SERIES 0202 FHN FINANCIAL SECURITIES CORP. 0221 UBS FINANCIAL SERVICES INC. -

Hearing on Legislation to Further Reduce Impediments to Capital Formation

Hearing on Legislation to Further Reduce Impediments to Capital Formation Statement of David Weild, Founder, Chairman & CEO of IssuWorks Holdings LLC, before the U.S. House of Representatives Financial Services Committee, Capital Markets and Government Sponsored Enterprises Subcommittee, October 23, 2013. [email protected] • (212) 705-8731 • www.IssuWorks.com 1 Contents Page Introduction 2 Specific responses to legislative proposals 3 Call for a JOBS Act 2 (Significant ways Congress can help the U.S. economy) 9 Conclusion: IPOs lead to job growth 13 Additional materials 15 About David Weild 17 About IssuWorks Holdings . 19 Hearing on Legislation to Further Reduce Impediments to Capital Formation © 2013 IssuWorks Holdings LLC, All Rights Reserved 2 Introduction Chairman Garrett, Ranking Member Maloney and members of the Subcommittee, thank you for inviting me to speak today about an issue of great importance to many Americans: “Legislation to Further Reduce Impediments to Capital Formation.” My name is David Weild. I am the Chairman & CEO of IssuWorks Holdings (“IssuWorks”), which was recently founded to develop technologies to improve capital formation in the public markets. I was formerly vice chairman of The NASDAQ Stock Market with responsibility for all of its listed companies, and I ran the equity new issues business of Prudential Securities, back when Prudential Securities was one of the ten largest underwriters of new issues equities in the United States. Improving access to equity capital in the United States is one of the most important needs for our economy. Access to equity capital fuels job growth and innovation, which, in turn, enables free markets to solve problems from poverty and unemployment to finding cures to cancer, global warming and many of the other challenges that this generation, and every other generation, will face. -

RBC Institutional Consulting Program Disclosure Document Form ADV, Part 2A Appendix 1, Wrap Fee Program Brochure

RBC WEALTH MANAGEMENT RBC INSTITUTIONAL CONSULTING PROGRAM DISCLOSURE DOCUMENT Form ADV, Part 2A Appendix 1, Wrap Fee Program Brochure June 29, 2012 This wrap fee program brochure provides you with information about the qualifications and business practices of RBC Wealth Management, a division of RBC Capital Markets, LLC, Member NYSE/FINRA/SIPC (“RBC WM”), an indirectly wholly-owned subsidiary of Royal Bank of Canada. This brochure describes only the RBC Institutional Consulting Program offered by RBC WM. This document provides investors with information about RBC WM and the program that should be considered before becoming a client of a program. Contact us at (612) 371-2711 if you have any questions about the content of this brochure. This information has not been approved or verified by the United States Securities and Exchange Commission (“SEC”) or any state securities authority. Additional information about RBC Wealth Management is available on the SEC’s website at www.adviserinfo.sec.gov. RBC Capital Markets RBC Wealth Management 3 World Financial Center 60 South Sixth Street 200 Vesey Street Minneapolis, MN 55402-4422 New York, NY USA 10281 (612) 371-2711 (212) 858-7000 www.rbcwealthmanagement.com/usa RBC Wealth Management ITEM 2: MATERIAL CHANGES In this Item 2, RBC WM is required to identify and discuss all material changes to its RBC Institutional Consulting Program Disclosure Document (Form ADV Part 2A Appendix 1, Wrap Fee Program Brochure). Since the January 27, 2012 version of the RBC Institutional Consulting Disclosure Document, we have the following material updates. It is alleged by FINRA that RBC Capital Markets (“RBC CM”) violated FINRA/NASD rules 1122, 2010, 2110, 3010 by failing to establish and maintain a supervisory system and establish, maintain and enforce written supervisory procedures reasonably designed to comply with applicable rules and regulations pertaining to short-term transactions in Closed-End Funds. -

Royal Bank of Canada 2009 Annual Report Vision Values Strategic Goals

Royal Bank of Canada 2009 Annual Report Vision Values Strategic goals • Always earning the right to be our • Excellent service to clients and each •InCanada, our goal is to be the clients’ first choice other undisputed leader in financial services. • Working together to succeed • In the U.S., our goal is to be a leading • Personal responsibility for high provider of capital markets, wealth performance management and banking services by • Diversity for growth and innovation building on and leveraging our considerable capabilities. • Trust through integrity in everything we do • Outside North America, our goal is to be a premier provider of select capital markets, wealth management and banking services in markets of choice. ROYAL BANK OF CANADA (RY on TSX and NYSE) and its subsidiaries operate under the master brand name RBC. We are Canada’s largest bank as measured by assets and market capitalization, and among the largest banks in the world, based on market capitalization. We are one of North America’s leading diversified financial services companies, and provide personal and commercial banking, wealth management services, insurance, corporate and investment banking and transaction processing services on a global basis. We employ approximately 80,000 full- and part-time employees who serve more than 18 million personal, business, public sector and institutional clients through offices in Canada, the U.S. and 53 other countries. For more information, please visit rbc.com. CONTENTS 1 Chief Executive Officer’s message 75 Report of Independent -

RBC Dain Rauscher Forms the Foundation on Which We Are Building Our Wealth Management Business

AA qualityquality investmentinvestment inin uncertainuncertain timestimes “RY” on TSX & NYSE MorganMorgan StanleyStanley FixedFixed IncomeIncome 20032003 BanksBanks andand InsuranceInsurance CapitalCapital ConferenceConference Nabanita Merchant Senior Vice President Investor Relations RBC Financial Group London January 29, 2003 [Slide 1.] Good afternoon everyone. At the advice of our legal counsel, our first slide is a safe harbor statement. I’d like to take this opportunity to talk to you about the performance, strategy and future prospects of RBC Financial Group, Canada’s largest corporation and a growing North American financial services company. I will address those in the context of our four key priorities and three key goals. But before doing so, I’d like to provide a little background about our company and the Canadian economy. [Slide 2.] We are the largest company in Canada by market capitalization and the largest bank by total assets. We have #1 or #2 market positions in virtually all of our Canadian businesses and are committed to retaining our strong positions, particularly in retail businesses, which account for a sizeable share of our total earnings. We have a well diversified business mix and strong debt ratings. [Slide 3.] Our business diversification is reflected in this pie chart. You’ll note that more than half of our earnings are from personal and commercial banking and approximately one-quarter of our earnings are from asset quality-immune businesses – wealth management, insurance and transaction processing. Wealth management’s results have suffered due to weak capital markets but, as markets recover, its contribution should rise. [Slide 4.] Our loan portfolio is well diversified across industry sectors, which reduces our credit risk. -

Hubdoc Live Connections NAME TYPE ENHANCED WEX Motorpass

Hubdoc Live Connections NAME TYPE ENHANCED WEX Motorpass (AU) Gas BP Plus (AU) Gas Bartercard (AU) Other Fuji Xerox (AU) Other Caltex (AU) Other Linkt (GoVia) (AU) Other City Link Other Landmark (AU) Other Coca Cola Amatil (AU) Other Elders (AU) Other Netregistry Other MM Electrical Merchandising (AU) Retail Middys (AU) Retail Office Works (AU) Retail Bunnings PowerPass Retail Woolworths Online (AU) Retail Reece (AU) Retail Xero SaaS Telstra Apps Marketplace (AU) SaaS Telstra (Business) (AU) Telecom Optus Telecom (Phone, Internet, TV) Telstra (AU) Telecom (Phone, Internet, TV) Vodafone Telecom (Phone, Internet, TV) Amaysim Telecom (Phone, Internet, TV) Virgin Mobile (AU) Telecom (Phone, Internet, TV) iiNet (AU) Telecom (Phone, Internet, TV) TPG (AU) Telecom (Phone, Internet, TV) Sydney Water Utilities AGL Energy Online (Business) Utilities Link Market Services (Portfolio Login) (AU) Utilities Sensis (AU) Utilities Energy Australia Utilities Synergy (AU) Utilities Origin Energy (AU) Utilities AGL Energy Online Utilities Servus (Business) Banks and Credit Cards Meridian Credit Union Banks and Credit Cards Yes RBC Banks and Credit Cards Yes CIBC Banks and Credit Cards Yes Scotiabank Banks and Credit Cards Yes Interior Savings Credit Union Banks and Credit Cards ATB Financial (Business) Banks and Credit Cards Yes Tangerine (ING Direct) Banks and Credit Cards Yes RBC Express Banks and Credit Cards American Express (Canada) Banks and Credit Cards Yes Westoba Credit Union Banks and Credit Cards BMO Debit Card Banks and Credit Cards Yes President's -

Chequing Account Offers Canada

Chequing Account Offers Canada Briery and ectozoan Van foretoken her deliciousness chokebore sunburned and toweling homeward. Ejaculatory and superintendent Malcolm postdates her wallaby gall fain or formulizes pompously, is Muhammad Eolic? Jonah ethylates her ignorance narratively, raining and pierceable. Opening any time can slip up of canada account to see screenshots, sends a unique and more about Apple Pay and Google Pay. Up wearing the maximum amount given the Canada Deposit Insurance Corporation CDIC2. However there are offering variable rate bump as. US Bank Accounts for Canadians RBC Bank. See this offer chequing accounts offered by cheque, canada may not having a low or any. Send free Transfer Money Online to India from the USA with. Best Chequing Account Offers in Canada January 2021. BMI Direct Deposit works only with US bank accounts. Chase Checking Accounts Compare & Apply your Chase. Looking for adding cash deposit to chequing account offers canada, a wire transfers with his writing is an offer when you opened only refer me? What time at recess does TD bank deposit EI through direct deposit? If you offer accounts? Exchange currency exchange network abm machines are compensated in canada with face certain organizations that there are subject to focus solely operates online bill payments. You provided usually need to reward specific eligibility criteria, available from chase. Utility by offering you offer chequing account canada nor is offered by a single one place. Td Bank Deposit Cash Sicilcryo. What comes the account may not endorse any inconvenience this up overdraft amount to chequing account offers canada reserves the five overdraft protection fund. -

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - July 31, 2021 PARTICIPANT ACCOUNT NAME NUMBE R ABN AMRO CLEARING CHICAGO LLC 0695

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - July 31, 2021 PARTICIPANT ACCOUNT NAME NUMBE R ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING MATCHBOOK 4439 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 AXOS CLEARING LLC 0052 AXOS CLEARING LLC/ CORRESPONDENT FLIP FACILITATION ACCOUNT 1186 AXOS CLEARING LLC/STOCK LOAN 7576 B. RILEY SECURITIES, INC. 9186 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/FBO TEMASEK 1367 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BARCLAYS CAPITAL INC./BARCLAYS BANK PLC, LONDON BRANCH 7254 BARCLAYS CAPITAL INC./BARCLAYS CAPITAL INC. FIXED INCOME 7256 BBVA SECURITIES INC. -

Approved Borrowers for Direct Replication Xtrackers Etfs

MARKETING MATERIAL Approved Borrowers for Direct Replication Xtrackers ETFs Abbey National Treasury Services plc Daiwa Securities America Inc. Mizuho International Plc ABN Amro NV Daiwa Capital Markets Europe Ltd Mizuho Securities Inc Banc of America Securities LLC. Danske Bank AS Mizuho Securities USA Inc Banco Santander SA Dekabank Deutsche Girozentrale, Frankfurt Morgan Stanley & Co. Incorporated Bank of America London Deutsche Bank AG and any Bank Affiliates Morgan Stanley and Co. International plc Bank of America Merrill Lynch International Deutsche Bank Securities Inc Morgan Stanley Bank AG, Frankfurt Designated Activity Company (DAC) Bank Of Montreal London Branch DZ-Bank, Frankfurt Morgan Stanley Europe SE Bank of Montreal, NY Branch Fortis Bank (Nederland) NV Morgan Stanley Securities Ltd Bank of Nova Scotia Goldman Sachs and Company MS Securities Services Inc. Bank of Scotland plc Goldman Sachs Bank Europe SE NatWest Markets N.V Barclays Capital, Inc Goldman Sachs International Natixis Barclays Bank Ireland PLC HSBC Bank Plc Nomura Financial Products Europe GmbH Barclays Bank PLC HSBC France SA Nomura International PLC Barclays Capital Securities Limited HSBC Securities (USA) Inc. Nomura Securities International Inc Bayerische Landesbank Girozentrale, HSBC Securities Inc. Nord-LB, Hannover München BMO Capital Markets Limited HSBC Trinkaus&Burkhardt KGaA, Ddf RBC Dominion Securities Corp. BNP Paribas HypoVereinsbank AG, München RBS Greenwich Capital Markets BNP Paribas Securities Corp. ING Bank NV RBS Securities Inc. BNP Paribas Arbitrage ING Financial Markets LLC RBC Capital Markets Corporation ING Financial Markets LLCING Bank NV, BNP-Paribas Securities Services, Frankfurt RBC Capital Markets (Europe) GmbH London Branch BofA Securities Europe SA Jefferies and Company Inc.