Hanwha Profile 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

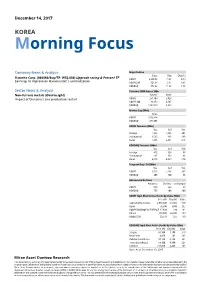

KOREA Morning Focus

December 14, 2017 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Hanwha Corp. (000880/Buy/TP: W56,000) Upgrade rating & Present TP ' KOSPI 2,480.55 19.55 0.79 Earnings to improve on Hanwha E&C s normalization KOSPI 200 326.18 2.11 0.65 KOSDAQ 772.22 11.82 1.55 Sector News & Analysis Turnover ('000 shares, Wbn) Non-ferrous metals (Overweight) Volume Value Impact of Glencore’s zinc production restart KOSPI 251,104 5,028 KOSPI 200 89,459 4,107 KOSDAQ 1,131,049 5,394 Market Cap (Wbn) Value KOSPI 1,613,324 KOSDAQ 274,605 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,443 1,648 -205 Institutional 1,585 886 698 Retail 1,945 2,461 -515 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 412 324 88 Institutional 285 192 93 Retail 4,695 4,869 -174 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,513 1,206 307 KOSDAQ 206 120 86 Advances & Declines Advances Declines Unchanged KOSPI 566 244 67 KOSDAQ 733 408 100 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,566,000 -39,000 570 Hynix 76,800 -1,000 265 KODEX KOSDAQ150 LEVERAGE 17,680 280 191 NCsoft 488,000 22,000 189 KODEX 200 32,670 255 160 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 89,100 1,100 319 New Pride 4,850 145 263 Celltrion Healthcare 93,100 6,100 231 TissueGene(Reg.S) 54,100 4,300 225 Celltrion 210,000 4,400 205 Note: As of December 13, 2017 Mirae Asset Daewoo Research Hanwha Corp. -

STOXX Asia 100 Last Updated: 03.07.2017

STOXX Asia 100 Last Updated: 03.07.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 256.2 1 1 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 128.5 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.6 3 3 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 83.5 4 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 77.2 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 61.7 6 7 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 58.7 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 58.2 8 6 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 52.6 9 12 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 52.0 10 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 48.3 11 15 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 45.4 12 13 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 43.3 13 14 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 42.3 14 17 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 42.2 15 16 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.1 16 19 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

FIRST TRUST EXCHANGE-TRADED ALPHADEX FUND II Form NPORT

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-05-21 | Period of Report: 2021-03-31 SEC Accession No. 0001145549-21-027287 (HTML Version on secdatabase.com) FILER FIRST TRUST EXCHANGE-TRADED ALPHADEX FUND II Mailing Address Business Address 120 EAST LIBERTY DRIVE, 120 EAST LIBERTY DRIVE, CIK:1510337| IRS No.: 000000000 | State of Incorp.:MA SUITE 400 SUITE 400 Type: NPORT-P | Act: 40 | File No.: 811-22519 | Film No.: 21945692 WHEATON IL 60187 WHEATON IL 60187 630-765-8000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document First Trust Asia Pacific ex-Japan AlphaDEX® Fund (FPA) Portfolio of Investments March 31, 2021 (Unaudited) Shares Description Value Shares Description Value COMMON STOCKS (a) – 97.0% Hong Kong (Continued) Australia – 19.4% 21,818 New World Development Co. 3,640 Afterpay Ltd. (b) $ 280,623 Ltd. $ 112,821 26,726 AGL Energy Ltd. 195,892 87,182 PCCW Ltd. 49,119 23,714 ALS Ltd. 174,356 9,818 Power Assets Holdings Ltd. 57,968 3,925 Ansell Ltd. 116,984 12,331 Sun Hung Kai Properties Ltd. 186,850 2,429 Aristocrat Leisure Ltd. 63,374 15,772 Techtronic Industries Co., Ltd. 269,829 34,260 Aurizon Holdings Ltd. 101,486 854,442 2,045 BHP Group Ltd. 70,364 New Zealand – 0.7% 5,733 BlueScope Steel Ltd. 84,260 1,445 Xero Ltd. (b) 138,873 31,931 Boral Ltd. (b) 133,150 Singapore – 7.6% 2,757 Domino’s Pizza Enterprises Ltd. 201,555 105,200 CapitaLand Ltd. -

Hanwha Solutions Green Financing Framework

CONFIDENTIAL Hanwha Solutions Green Financing Framework March 2021 1. Background of Hanwha Solutions Hanwha Solutions (the “Company”) is a newly formed corporation with the merger of Hanwha Chemical, Hanwha Q CELLS, and Hanwha Advanced Materials in January 2020, with the goal to create a global chemical, materials and energy company that will lead the global eco-friendly energy market and high-value added materials industry. The Company operates in three business areas: chemicals, total energy solutions, and advanced materials. The Company’s solar voltaic division, a part of its total energy solutions, makes up the largest segment of its operations. (Q CELLS made up 37.4% of the Company’s revenue in FY2019) Hanwha Solutions’ subsidiaries include Hanwha Q CELLS Malaysia within Hanwha Q CELLS, which focuses on photovoltaic module production for solar power generation. Hanwha Q CELLS Malaysia became part of the Company after the acquisition of Q.CELLS, a leading German solar company, in 20121, which included Q.CELLS production facilities in Germany and Malaysia. The Company is an affiliate of the Hanwha Group (the “Group”), a Fortune Global 500 firm and the 7th largest conglomerate in South Korea with primary businesses in the chemical, aerospace, mechatronics, solar energy and finance sectors. 1.1 Hanwha Solutions’ Q CELLS Division2 Hanwha Solutions’ Q CELLS Division (the “Q CELLS Division”) is a total energy solutions provider worldwide. The Q CELLS Division business scope ranges from the midstream of cells and modules to downstream solar solutions for residential, commercial, and industrial buildings, as well as for large solar power plants. The Q CELLS Division has a global cell and module production capacity of 9.0 GW per year and 10.7 GW per year, respectively (as of YE2019). -

Samsung C&T Corporation and Subsidiaries

Samsung C&T Corporation and Subsidiaries Consolidated Interim Financial Statements September 30, 2017 and 2016 Samsung C&T Corporation and Subsidiaries Index September 30, 2017 and 2016 Pages Report on Review of Interim Financial Statements ………………………............................... 1 - 5 Consolidated Interim Financial Statements Consolidated Interim Statements of Financial Position …………………………………………….. 6 - 8 Consolidated Interim Statements of Comprehensive Income....................................................... 9 - 10 Consolidated Interim Statements of Changes in Equity..............................…………................... 11 - 12 Consolidated Interim Statements of Cash Flows…………………………………………………….. 13 - 14 Notes to the Consolidated Interim Financial Statements....................................……....……....... 15 - 102 Report on Review of Interim Financial Statements (English Translation of a Report Originally Issued in Korean) To the Shareholders and Board of Directors of Samsung C&T Corporation Reviewed Financial Statements We have reviewed the accompanying consolidated interim financial statements of Samsung C&T Corporation (the Company) and its subsidiaries (collectively referred to as the “Group”). These financial statements consist of the consolidated interim statement of financial position of the Group as at September 30, 2017, and the related consolidated interim statements of comprehensive income for the three-month and nine-months periods ended September 30, 2017 and 2016, and consolidated interim statements of changes in equity -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares ESG Aware MSCI EM ETF | ESGE | NASDAQ • iShares MSCI Emerging Markets ex China ETF | EMXC | NASDAQ • iShares MSCI Emerging Markets Min Vol Factor ETF | EEMV | Cboe BZX • iShares MSCI Emerging Markets Multifactor ETF | EMGF | Cboe BZX • iShares MSCI Global Min Vol Factor ETF | ACWV | Cboe BZX Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. -

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

Hanwha Techwin Brochire 2021

Company Overview A global leader in the video surveillance Hanwha Group HQ Golden Tower, Seoul, industry, Hanwha Techwin South Korea 2021 – A year of opportunities This new year will, without doubt, bring many exciting opportunities for manufacturers, such as Hanwha Techwin, to help system integrators and our distribution partners grow their businesses. Over recent years, growth in the sales of security cameras, recording devices and video management software platforms has been fuelled by businesses and organisations recognising the need to take their security to a higher level. As IoT devices have become more popular over the years, managers responsible for security all share the same goals of protecting property, people Top 5 video surveillance and assets against a context of increasingly sophisticated cyber-attacks. trends for 2021 It is therefore not surprising to learn that the global professional The market research reports and feedback from customers video surveillance equipment market is predicted to continue to give weight to predictions as to what the top trends and significantly increase over the coming years, with Berg Insight, a hot topics will be during 2021: leading IoT market research provider, estimating that the number 1. With increased functionality now being included of cameras installed across Europe and North America will grow in edge-based Deep Learning AI solutions, there is from a 2019 total of 183 million, to 420.3 million cameras in 2024. likely to be a large increase in the number of devices As end-users’ expectations rise as to what they can expect to deployed which can process data at the edge. -

Hanwha Profile 2020

Hanwha Profile 2020 A “We engage and listen to our customers to create the solutions they trust us to build.” Contents 02 CHAIRMAN’S MESSAGE 08 BUSINESS HIGHLIGHTS 10 Chemicals & Materials 20 Aerospace & Mechatronics 28 Solar Energy 36 Finance 46 Services & Leisure 54 Construction 62 Hanwha OVERVIEW 64 Hanwha’s Vision, Spirit & Core Values 66 Hanwha Today 68 Milestones 70 Financial Highlights 72 Hanwha BUSINESSES 75 Manufacturing & Construction 93 Finance 99 Services & Leisure 104 CORPORATE SOCIAL RESPONSIBILITY 112 GLOBAL NETWORK & DIRECTORY B 1 Chairman’s Message The world has already moved beyond the Fourth Industrial Revolution. It is now heading toward the next industrial revolution. So are we. At Hanwha, we believe in building trust and strengthening loyalty. Our customers trust us because we’ve earned it over time. In turn, we strengthen our loyalty to the people we serve through contributions to society. Trust and loyalty are in the DNA of every Hanwha employee, motivating us to build for the good of all, amid constant changes and despite them. As a company, our never-ending goal is to improve the lives of everyone we touch. We seek to raise the standards of living and improve the quality of life. We know this is easily said but difficult to attain. And yet, if we persevere, continue to innovate and build for a better tomorrow, the future is ours to imagine. In 2010, Hanwha’s vision of “Quality Growth 2020” was unveiled. Since then, we have made significant strides toward realizing this vision through our expertise and innovations that have grown exponentially across the company’s core businesses. -

2020 Annual Report

AUGUST 31, 2020 2020 Annual Report iShares, Inc. • iShares Core MSCI Emerging Markets ETF | IEMG | NYSE Arca • iShares MSCI BRIC ETF | BKF | NYSE Arca • iShares MSCI Emerging Markets Asia ETF | EEMA | NASDAQ • iShares MSCI Emerging Markets Small-Cap ETF | EEMS | NYSE Arca Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. Ifyou hold accounts throughafinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies ofyour shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds held with your financial intermediary. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by contactingyour financial intermediary. Please note that not all financial intermediaries may offer this service. The Markets in Review Dear Shareholder, The 12-month reporting period as of August 31, 2020 has been a time of sudden changeinglobal financial markets, as the emergence and spread of the coronavirus led to a vast disruption in the global economy and financial markets. -

STOXX South Korea 200 Last Updated: 01.06.2017

STOXX South Korea 200 Last Updated: 01.06.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 249.7 1 1 KR7000660001 6450267 000660.KS KR00EP SK HYNIX INC KR KRW Y 26.3 2 2 KR7035420009 6560393 035420.KS KR00NY NAVER CORP KR KRW Y 22.1 3 3 KR7005380001 6451055 005380.KS KR004F Hyundai Motor Co KR KRW Y 21.1 4 4 KR7055550008 6397502 055550.KS KR00AL Shinhan Financial Group Co Ltd KR KRW Y 18.6 5 5 KR7105560007 B3DF0Y6 105560.KS KR008J KB Financial Group Inc KR KRW Y 17.8 6 6 KR7005490008 6693233 005490.KS KR003E POSCO KR KRW Y 16.7 7 7 KR7012330007 6449544 012330.KS KR007I Hyundai Mobis KR KRW Y 15.0 8 8 KR7028260008 BSXN8K7 028260.KS KR507N SAMSUNG C&T CORP KR KRW Y 13.0 9 9 KR7017670001 6224871 017670.KS KR048N SK TELECOM KR KRW Y 12.2 10 10 KR7033780008 6175076 033780.KS KR00S3 KT&G Corp KR KRW Y 12.1 11 12 KR7051910008 6346913 051910.KS KR005G LG Chem Ltd KR KRW Y 11.3 12 13 KR7015760002 6495730 015760.KS KR009K Korea Electric Power Corp KR KRW Y 10.6 13 11 KR7034730002 B39Z8L3 034730.KS KR053J SK HOLDINGS KR KRW Y 10.6 14 15 KR7032830002 B12C0T9 032830.KS KR00BM Samsung Life Insurance Co Ltd KR KRW Y 10.5 15 14 KR7086790003 B0RNRF5 086790.KS KR06L2 Hana Financial G KR KRW Y 9.7 16 16 KR7000810002 6155250 000810.KS KR00JU Samsung Fire & Marine Insuranc KR KRW Y 9.4 17 17 KR7090430000 B15SK50 090430.KS KR06O5 Amorepacific KR KRW Y 8.6 18 21 KR7000270009 6490928 000270.KS KR00GR Kia Motors Corp KR KRW -

One-Asia Morning Focus

May 13, 2020 One-Asia Morning Focus Today’s reports NCsoft (036570 KS/Buy/TP: W970,000) Raise TP – Our top global gaming pick for 2020-21; Raise TP Hanwha Aerospace (012450 KS/Buy/TP: W33,000) Lower TP – Stability of defense business to stand out Shinsegae (004170 KS/Buy/TP: W360,000) – 1Q20 review: More leveraged to tailwinds than headwinds Global performance monitor: Two-day change (%) Asia xJPN World EM World DM Korea Japan China Taiwan HK India Indonesia Singapore Thailand Index 0.86 0.47 -0.05 -1.80 0.38 1.23 -0.40 1.24 -0.04 -0.25 0.03 3.12 Growth 0.65 1.12 0.64 -0.76 0.48 1.74 -0.92 1.59 -0.29 0.79 0.21 3.62 Value N/A 0.47 -0.72 -3.07 0.27 0.56 0.15 0.85 0.20 -1.54 -0.16 2.58 Semicon. & equip. 0.85 0.87 0.48 0.41 1.87 0.30 -0.90 -1.98 N/A N/A N/A N/A Tech hardware & equip. 0.24 0.24 0.75 -2.15 0.80 0.12 0.09 1.64 6.94 N/A -1.06 N/A Comm. & prof. services 0.07 0.07 -0.24 1.23 3.42 -0.82 -0.22 N/A -3.99 -1.02 N/A N/A Software & services 0.86 0.74 0.54 -0.41 0.56 -1.03 -0.32 0.94 2.21 N/A -2.18 N/A Media & entertainment 2.78 2.73 0.70 3.97 0.91 0.07 2.06 -0.12 -2.24 N/A -2.24 N/A Consumer goods 1.15 1.00 -0.53 -0.98 1.03 2.15 -0.85 1.09 1.31 1.67 N/A 3.59 Consumer services 0.12 -0.62 -1.17 -4.81 2.26 -1.03 3.82 1.46 -0.03 2.74 0.35 2.49 F&B & tobacco 0.21 -0.03 -0.10 -0.73 1.21 -0.03 -1.92 1.85 1.87 1.94 9.76 5.10 Food & staples retailing 1.17 0.02 0.47 -2.04 1.31 0.72 -0.39 1.25 2.19 N/A 0.99 2.85 Retailing 1.51 1.38 0.95 -4.43 0.39 -1.88 0.13 -0.58 -0.88 -0.50 -0.89 3.91 HH & personal products -0.91 -1.17 -0.17 -2.21 0.99 -0.62