Krause Fund Research Fall 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nysba Spring 2020 | Vol

NYSBA SPRING 2020 | VOL. 31 | NO. 2 Entertainment, Arts and Sports Law Journal A publication of the Entertainment, Arts and Sports Law Section of the New York State Bar Association In This Issue n A Case of “Creative Destruction”: Takeaways from the 5Pointz Graffiti Dispute n The American Actress, the English Duchess, and the Privacy Litigation n The Battle Against the Bots: The Legislative Fight Against Ticket Bots ....and more www.nysba.org/EASL NEW YORK STATE BAR ASSOCIATION In The Arena: A Sports Law Handbook Co-sponsored by the New York State Bar Association and the Entertainment, Arts and Sports Law Section As the world of professional athletics has become more competitive and the issues more complex, so has the need for more reliable representation in the field of sports law. Written by dozens of sports law attorneys and medical professionals, In the Arena: A Sports Law Handbook is a reflection of the multiple issues that face athletes and the attorneys who represent them. Included in this book are chapters on representing professional athletes, NCAA enforcement, advertising, sponsorship, intellectual property rights, doping, concussion-related issues, Title IX and dozens of useful appendices. Table of Contents Intellectual Property Rights and Endorsement Agreements How Trademark Protection Intersects with the Athlete’s EDITORS Right of Publicity Elissa D. Hecker, Esq. Collective Bargaining in the Big Three David Krell, Esq. Agency Law Sports, Torts and Criminal Law PRODUCT INFO AND PRICES 2013 | 539 pages Role of Advertising and Sponsorship in the Business of Sports PN: 4002 (Print) Doping in Sport: A Historical and Current Perspective PN: 4002E (E-Book) Athlete Concussion-Related Issues Non-Members $80 Concussions—From a Neuropsychological and Medical Perspective NYSBA Members $65 In-Arena Giveaways: Sweepstakes Law Basics and Compliance Issues Order multiple titles to take advantage of our low flat Navigating the NCAA Enforcement Process rate shipping charge of $5.95 per order, regardless of the number of items shipped. -

TESIS: Grand Theft Auto IV. Impacto Y Contexto En Los Videojuegos Como

UNIVERSIDAD NACIONAL AUTÓNOMA DE MÉXICO FACULTAD DE ESTUDIOS SUPERIORES ACATLÁN Grand Theft Auto IV. Impacto y contexto en los videojuegos como parte de la cultura de masas Tesis para obtener el título de: Licenciado en Comunicación PRESENTA David Mendieta Velázquez ASESOR DE TESIS Mtro. José C. Botello Hernández UNAM – Dirección General de Bibliotecas Tesis Digitales Restricciones de uso DERECHOS RESERVADOS © PROHIBIDA SU REPRODUCCIÓN TOTAL O PARCIAL Todo el material contenido en esta tesis esta protegido por la Ley Federal del Derecho de Autor (LFDA) de los Estados Unidos Mexicanos (México). El uso de imágenes, fragmentos de videos, y demás material que sea objeto de protección de los derechos de autor, será exclusivamente para fines educativos e informativos y deberá citar la fuente donde la obtuvo mencionando el autor o autores. Cualquier uso distinto como el lucro, reproducción, edición o modificación, será perseguido y sancionado por el respectivo titular de los Derechos de Autor. Grand Theft Auto IV Impacto y contexto en los videojuegos como parte de la cultura de masas Agradecimientos A mis padres. Gracias, papá, por enseñarme valores y por tratar de enseñarme todo lo que sabías para que llegara a ser alguien importante. Sé que desde el cielo estás orgulloso de tu familia. Mamá, gracias por todo el apoyo en todos estos años; sé que tu esfuerzo es enorme y en este trabajo se refleja solo un poco de tus desvelos y preocupaciones. Gracias por todo tu apoyo para la terminación de este trabajo. A Ariadna Pruneda Alcántara. Gracias, mi amor, por toda tu ayuda y comprensión. Tu orientación, opiniones e interés que me has dado para la realización de cualquier proyecto que me he propuesto, así como por ser la motivación para seguir adelante siempre. -

Chinatown Wars Kevin George

International Journal of English Literature and Social Sciences, 5(2) Mar-Apr 2020 |Available online: https://ijels.com/ The Dark Side of GTA: Chinatown Wars Kevin George Department of English, K.E College, Mannanam, Kerala, India Abstract—Released way back in 2009, Grand Theft Auto: Chinatown Wars is an action-adventure videogame, developed for a console meant for teenagers. However, the videogame drew flak for its inclusion of certain controversial mini-games and missions involving drugs like cocaine and heroin. This short essay/review will focus on the corruptive influence of something as trivial as a videogame and how it works insidiously as a lure to a world of crime, which young minds find irresistible. Keywords—Addiction,Arson, Delusions of power,Drug-dealing, GTA: Chinatown Wars. INTRODUCTION adolescent innocence as portrayed in his novel The Lord of I was having a hard time coming to terms with the the Flies. ‘Influence’ plays a big role and so does the quarantine in India (and the world over). Usually, I would milieu. The pandemic (COVID19) which is wreaking find solace in reading philosophy and literature or I would havoc on our planet has made their lives insular and more binge on my favourite films or series. But, the headlines susceptible to ‘influence’ (at least for now) and things and podcasts made sure that my usual sangfroid was kept aren’t much different (from the novel). The teenagers who at bay. My penchant for etymology compels me to spent hours playing games like GTA: Chinatown Wars, (I mention the origins of the word ‘sangfroid’. -

Sites of Play: Locating Gameplace in Red Dead Redemption 2

Sites of Play: Locating Gameplace in Red Dead Redemption 2 Andrew Westerside University of Lincoln Brayford Pool, LN6 7TS United Kingdom [email protected] Jussi Holopainen University of Lincoln Brayford Pool, LN6 7TS United Kingdom [email protected] ABSTRACT In Video Game Spaces (2009), Michael Nitsche proposes three indicators of ‘placeness’ in video games: identity, self-motivated and self-organised action, and traces of memory (191-201). We read this notion of placeness as closely aligned to, or overlapping with, the understandings of place and site articulated in theatre and performance research as site-specific performance. Here, we articulate the ideas (and analyse the experiences) of placeness and sitedness in Rockstar Games’ Red Dead Redemption 2 (RDR2) through an analytical conversation between performance studies and games design research with a human-computer interaction bias. Through a close- reading of gameplay experiences (Bizzocchi and Tanenbaum, 2011), we individually experienced over 30 hours of RDR2 gameplay while taking notes, recording, and capturing screenshots. During our individual analyses, we met periodically to compare notes, discuss notable game moments and share analytical insights. At this intersection of game research and performance research, we ask to what extent the theoretical articulations of aesthetic/affective experience in physical, corporeal and material spaces can develop – and further nuance – our understanding of how place is experienced (and thus designed) in contemporary videogames. In doing so, we propose the term gameplace as a means of articulating what this article will define as the affective relationship between place, experience and play. Keywords Place, space, placeness, gameworld, gameplay, performance research, phenomenology INTRODUCTION Site-Specific Performance For scholars and practitioners in the discipline, site-specific performance refers to ‘performance conceived on the basis of a place in the real world (ergo, outside the established theatre)’ (Pavis, 1998, p.337). -

Pdf (Accessed 2.10.14)

Notes 1 Introduction: Video Games and Storytelling 1. It must be noted that the term ‘Narratological’ is a rather loose application by the Ludologists and the implications of this are pointed out later in this chapter. 2. Roland Barthes states that the ‘infinity of the signifier refers not to some idea of the ineffable (the unnameable signified) but to that of a playing [ ...] theText is plural’. Source: Barthes, R., 1977. Image, Music, Text, in: Heath,S.(Tran.), Fontana Communications Series. Fontana, London. pp. 158–159. 3.In Gaming Globally: Production, Play, and Place (Huntemann and Aslinger, 2012),theeditors acknowledgethat ‘while gaming maybe global, gaming cultures and practices vary widely depending on the power and voice of var- ious stakeholders’ (p. 27). The paucity of games studies scholarship coming from some of the largest consumers of video games, such as South Korea, China and India, to name a few, is markedly noticeable. The lack of represen- tation of non-Western conceptions of play culture and storytelling traditions is similarly problematic. 4. Chapter 8 will engage with this issue in more detail. 5. ‘(W)reading’ is preferred over the more commonly used neologism ‘wread- ing’toemphasise the supplementarity of the reading and writingprocesses and also to differentiate it from earlier usage that might claim that the two processes are the same thing. 3 (W)Reading the Machinic Game-Narrative 6. For whichhe is criticisedby Hayles (see Chapter 2). 7. Landow respondstothis by rightly stating that Aarseth misreads his original comment where heclaims that ‘the reader whochooses among linksortakes advantage of Storyspace’s hypertext capabilities shares some of the power of theauthor’(Landow, p. -

Take-Two Interactive Software, Inc. Reports First Quarter Fiscal 2009 Financial Results

Take-Two Interactive Software, Inc. Reports First Quarter Fiscal 2009 Financial Results March 10, 2009 4:01 PM ET NEW YORK NEW YORK--(BUSINESS WIRE)--Mar. 10, 2009-- Take-Two Interactive Software, Inc. (NASDAQ: TTWO) today announced financial results for its first fiscal quarter ended January 31, 2009. Net revenue for the first quarter was $256.8 million, compared to $240.4 million for the same quarter of fiscal 2008. First quarter sales were led by Grand Theft Auto IV, Carnival Games, NBA 2K9 and Midnight Club: Los Angeles. Net loss for the first quarter was $50.4 million or $0.66 per share, compared to a net loss of $38.0 million or $0.52 per share in the first quarter of fiscal 2008. The Company’s increased loss for the first quarter compared to the prior year was primarily due to higher marketing, legal, and research and development expenses. The first quarter results include $6.2 million in stock-based compensation expense ($0.08 per share) and $4.9 million in expenses related to unusual legal matters ($0.06 per share). Results for the first quarter of 2008 included $6.1 million in stock-based compensation expense ($0.08 per share) and $1.7 million in expenses related to unusual legal matters and business reorganization costs ($0.02 per share). Non-GAAP net loss was $39.3 million or $0.52 per share in the first quarter, compared to a net loss of $30.3 million or $0.41 per share in the first quarter of 2008. (Please refer to Non-GAAP Financial Measures and reconciliation tables included later in this release for additional information and details on non-GAAP items.) Business Highlights Among the significant recent business developments, Take-Two noted the following: Over 13 million units of Rockstar Games’ Grand Theft Auto IV have been shipped as of January 31, 2009. -

Red Dead Redemption 2 Achieves Entertainment’S Biggest Opening Weekend of All Time

Red Dead Redemption 2 Achieves Entertainment’s Biggest Opening Weekend of All Time October 30, 2018 8:00 AM ET NEW YORK--(BUSINESS WIRE)--Oct. 30, 2018-- Rockstar Games® is proud to announce that the critically acclaimed Red Dead Redemption 2 has achieved the single-biggest opening weekend in the history of entertainment*. With over $725 million in worldwide retail sell-through during its first three days, Red Dead Redemption 2 is the second-highest grossing entertainment launch of all time next to Rockstar Games’ previously released title, Grand Theft Auto V, which achieved over $1 billion in retail sell-through in three days.* This press release features multimedia. View the full release here: https://www.businesswire.com/news/home /20181030005459/en/ Sony Interactive Entertainment (SIE) also confirmed that Red Dead Redemption 2 set new records on the PlayStation Network Rockstar Games® is proud to announce that the critically for highest ever pre-orders, highest day one sales and highest sales acclaimed Red Dead Redemption 2 has achieved the single- biggest opening weekend in the history of entertainment*. for the first three days in market. With over $725 million in worldwide retail sell-through during its first three days, Red Dead Redemption 2 is the Rockstar Games has partnered with SIE to bring PlayStation®4 second-highest grossing entertainment launch of all time next to Rockstar Games' previously released title, Grand Theft Auto players first access to earn select online content in Red Dead V, which achieved over $1 billion in retail sell-through in three Online that is planned to release this November. -

Take-Two Interactive Software Annual Report 2020

Take-Two Interactive Software Annual Report 2020 Form 10-K (NASDAQ:TTWO) Published: May 22nd, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended March 31, 2020 OR ☐ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the transition period from to . Commission file number 001-34003 TAKE-TWO INTERACTIVE SOFTWARE, INC. (Exact name of registrant as specified in its charter) Delaware 51-0350842 (State or Other Jurisdiction of (I.R.S. Employer Incorporation or Organization) Identification No.) 110 West 44th Street New York, New York 10036 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (646) 536-2842 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of each exchange on which registered Common Stock, $.01 par value TTWO NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

List of Western-Themed Games

List of Western-Themed Games Key action (A) adventure (ADV) card game (C) duel (D) first-person shooter (FPS) laser disc/multimedia (LD) other (O) pinball (PB) platform (PL) puzzle (PUZ) real-time strategy/manager (RTS) role-playing game (RPG) strategy/wargame (S) target shooting/reaction (TS) Year Games 1939 Buckaroo (PB), Ride “M” Cowboy (PB) 1941 Texas Mustang (PB) 1945 Wagon Wheels (PB) 1946 Dynamite (PB) 1947 Broncho (PB), Ranger (PB) 1948 Round Up (PB) 1949 Oklahoma (PB), Tumbleweed (PB), Utah (PB) 1950 Buffalo Bill (PB), Six Shooter (TS) 1954 Stage Coach (PB) 1955 Smoke Signal (PB), Southern Belle (PB), Wild West Gallery (TS) 1957 Arrow Head (PB) 1959 Gunsmoke (TS) 1960 Pony Express (TS), Texan (PB), Wagon Train (PB) 1961 Double Barrel (PB), Indian Scout (TS), Mr. Quick Draw (TS), Mr. Top Gun (TS), Wild West (TS) 1962 Arrowhead (PB), Flipper Cowboy (PB) 1963 Bronco (PB), Texas Ranger Gatling Gun (TS) WiderScreen 1/2015: Villin lännen uudet visiot – New Visions of the Wild West 1964 Bonanza (PB), Championship Fast Draw (TS) 1965 Buckaroo (PB) 1966 Six Shooter (PB) 1967 Rifleman (TS), Wild West Rifle Gallery (TS) 1968 Civil War (S), Dogies (PB), Gun Smoke (PB), Stage Coach (PB) 1969 Lariat (PB) 1970 Bonanza (TS), Cowboy (PB), Gun Fight (D), White Lightning (TS) 1971 Gold Rush (PB), Lawman (PB) 1972 Rodeo Shooting Gallery (TS), Texas Ranger (PB) 1974 Big Indian (PB), Cowboy (A), Wild Gunman (TS) 1975 El Dorado (PB), Fast Draw (PB), Gun Fight [Western Gun] (D) 1976 Cherokee (PB), Outlaw (TS), Plinker’s Canyon (TS), Top -

2019 Annual Report

TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT ANNUAL INC. 2019 SOFTWARE, INTERACTIVE TAKE-TWO TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT Generated significant cash flow and ended the fiscal year with $1.57$1.57 BILLIONBILLION in cash and short-term investments Delivered total Net Bookings of Net Bookings from recurrent $2.93$2.93 BILLIONBILLION consumer spending grew 47% year-over-year increase 20%20% to a new record and accounted for units sold-in 39% 2424 MILLIONMILLIONto date 39% of total Net Bookings Tied with Grand Theft Auto V as the highest-rated game on PlayStation 4 and Xbox One with 97 Metacritic score One of the most critically-acclaimed and commercially successful video games of all time with nearly units sold-in 110110 MILLIONMILLIONto date Digitally-delivered Net Bookings grew Employees working in game development and 19 studios 33%33% 3,4003,400 around the world and accounted for Sold-in over 9 million units and expect lifetime Net Bookings 62%62% to be the highest ever for a 2K sports title of total Net Bookings TAKE-TWO INTERACTIVE SOFTWARE, INC. 2019 ANNUAL REPORT DEAR SHAREHOLDERS, Fiscal 2019 was a stellar year for Take-Two, highlighted by record Net Bookings, which exceeded our outlook at the start of the year, driven by the record-breaking launch of Red Dead Redemption 2, the outstanding performance of NBA 2K, and better-than- expected results from Grand Theft Auto Online and Grand Theft Auto V. Net revenue grew 49% to $2.7 billion, Net Bookings grew 47% to $2.9 billion, and we generated significant earnings growth. -

NFL 2K Is a One- to Four-Player Game

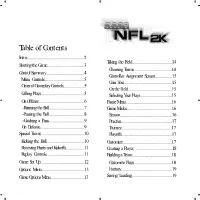

2KFootballV4 2/25/00 11:50 AM Page 1 Table of Contents Intro........................................................2 Taking the Field.......................................14 Starting the Game....................................3 Choosing Teams.....................................14 Control Summary.....................................4 Controller Assignment Screen.................15 Menu Controls.......................................5 Coin Toss...............................................15 General Gameplay Controls....................5 On the Field...........................................15 Calling Plays..........................................5 Selecting Your Plays...............................15 On Offense............................................6 Pause Menu.............................................16 -Running the Ball..................................7 Game Modes............................................16 -Passing the Ball...................................8 Season..................................................16 -Catching a Pass...................................9 Practice.................................................17 On Defense...........................................9 Tourney.................................................17 Special Teams ........................................10 Playoffs.................................................17 Kicking the Ball.....................................10 Customize................................................17 Receiving Punts and Kickoffs..................11 -

Recommending Games to Adults with Autism Spectrum Disorder(ASD) for Skill Enhancement Using Minecraft

Brigham Young University BYU ScholarsArchive Theses and Dissertations 2019-11-01 Recommending Games to Adults with Autism Spectrum Disorder(ASD) for Skill Enhancement Using Minecraft Alisha Banskota Brigham Young University Follow this and additional works at: https://scholarsarchive.byu.edu/etd Part of the Physical Sciences and Mathematics Commons BYU ScholarsArchive Citation Banskota, Alisha, "Recommending Games to Adults with Autism Spectrum Disorder(ASD) for Skill Enhancement Using Minecraft" (2019). Theses and Dissertations. 7734. https://scholarsarchive.byu.edu/etd/7734 This Thesis is brought to you for free and open access by BYU ScholarsArchive. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of BYU ScholarsArchive. For more information, please contact [email protected], [email protected]. Recommending Games to Adults with Autism Spectrum Disorder (ASD) for Skill Enhancement Using Minecraft Alisha Banskota A thesis submitted to the faculty of Brigham Young University in partial fulfillment of the requirements for the degree of Master of Science Yiu-Kai Dennis Ng, Chair Seth Holladay Daniel Zappala Department of Computer Science Brigham Young University Copyright c 2019 Alisha Banskota All Rights Reserved ABSTRACT Recommending Games to Adults with Autism Spectrum Disorder (ASD) for Skill Enhancement Using Minecraft Alisha Banskota Department of Computer Science, BYU Master of Science Autism spectrum disorder (ASD) is a long-standing mental condition characterized by hindered mental growth and development. In 2018, 168 out of 10,000 children are said to be affected with Autism in the USA. As these children move to adulthood, they have difficulty in communicating with others, expressing themselves, maintaining eye contact, developing a well-functioning motor skill or sensory sensitivity, and paying attention for longer period.