INVESTGAME Weekly News Digest

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

32 Anni Di Metroid,Moonlighter,Dusty Rooms

Il gaming estivo di un musicista ramingo La vita del musicista, d’estate, è la più bella che ci sia: fare chilometri e chilometri con l’auto piena a tappo di strumenti, casse e costosissime apparecchiature per poi ripercorere le strade a ritroso in tarda notte; quando la musica finisce, le vie sono vuote e la gente esausta torna a casa. Ogni sera un luogo diverso, gente diversa e mangiare diverso, notti fatte di scoperte, conoscenze e, talvolta, anche assurdi imprevisti. Tuttavia, per un giocatore quel tempo investito in musica si traduce anche nel dover mettere da parte la propria console e nel giocare quando il tempo lo permette, nelle rare serate quando nessun pub, bar, chiosco o comune richiede la presenza della propria band; ci si sveglia tardi per la stanchezza della sera prima, ci si prende un caffè, si va a pranzare poco dopo e presto bisogna fare una doccia perchè la prossima serata è ormai a un paio d’ore. La console rimane impolverata accanto allo scaffale e la pila di giochi che hai comprato rimane lì, in attesa che tu possa prendere il controller e passare delle sane ore di gaming. Quando finalmente il calendario non segna un impegno della tua band, ci si chiude in camera, si regola il condizionatore a 18°, si mette il cellulare in modalità silenzioso e via, soli con l’avventura del momento e il caldo afoso fuori, fino a quando il sole non si fa color porpora; dopo tante serate passate a suonare per il divertimento dei clienti in un locale, del tempo per noi stessi in cui goderci quel gioco compato a inizio estate e che fino a quel momento non si è riusciti a giocare. -

The BG News September 18, 2017

Bowling Green State University ScholarWorks@BGSU BG News (Student Newspaper) University Publications 9-18-2017 The BG News September 18, 2017 Bowling Green State University Follow this and additional works at: https://scholarworks.bgsu.edu/bg-news Recommended Citation State University, Bowling Green, "The BG News September 18, 2017" (2017). BG News (Student Newspaper). 8991. https://scholarworks.bgsu.edu/bg-news/8991 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Book is brought to you for free and open access by the University Publications at ScholarWorks@BGSU. It has been accepted for inclusion in BG News (Student Newspaper) by an authorized administrator of ScholarWorks@BGSU. No Sleep for BG bg Rapper 21 Savage headlined the #NoSleepBG news An independent student press serving concert this weekend. | Page 6 the campus and surrounding community, ESTABLISHED 1920 Bowling Green State University Monday September 18, 2017 Volume 97, Issue 11 Facing climate change denial, fake news PAGE 4 Mens soccer loses winning streak PAGE 8 Impact of heroin and opiates in BG PAGE 11 PHOTO PROVIDED BY KEVIN MENSAH t we get it. [email protected] COLLEGE www.bgsu.edu/sls 419-372-2951 STUDENT LEGAL SERVICES HAPPENS REAL LAWYERS | REAL RESULTS Immigration experts talk DACA, travel ban Paul Garbarino be processed or accepted. DACA issuances and Mollo also pointed out a common miscon- City Editor work permits that expire between Sept. 5, 2017, ception that immigrants who are removed from Anyone who wants to have their voice heard and March 8, 2018, must be submitted for re- the DACA program will simply self-deport, citing on these policies can reach out to Sens. -

Guide 2020 Games from Spain

GUIDE GAMES 2020 FROM SPAIN Message from the CEO of ICEX Spain Trade and Investment Dear reader, We are proud to present the new edition of our “Guide to Games from Spain”, a publication which provides a complete picture of Spain’s videogame industry and highlights its values and its talent. This publication is your ultimate guide to the industry, with companies of various sizes and profiles, including developers, publishers and services providers with active projects in 2020. GAMES Games from Spain is the umbrella brand created and supported by ICEX Spain Trade and Investment to promote the Spanish videogame industry around the globe. You are cordially invited to visit us at our stands at leading global events, such us Game Con- nection America or Gamescom, to see how Spanish videogames are playing in the best global production league. Looking forward to seeing you soon, ICEX María Peña SPAIN TRADE AND INVESTMENT ICT AND DIGITAL CONTENT DEPARTMENT +34 913 491 871 [email protected] www.icex.es GOBIERNO MINISTERIO DE ESPAÑA DE INDUSTRIA, COMERCIO Y TURISMO EUROPEAN REGIONAL DEVELOPMENT FUND A WAY TO MAKE EUROPE GENERAL INDEX ICEX | DISCOVER GAMES FROM SPAIN 6 SPANISH VIDEOGAME INDUSTRY IN FIGURES 8 INDEX 10 DEVELOPERS 18 PUBLISHERS 262 SERVICES 288 DISCOVER www.gamesfromspain.com GAMES FROM SPAIN Silvia Barraclough Head of Videogames Animation and VR/AR ICEX, Spain Trade and Investment in collaboration with [email protected] DEV, the Spanish association for the development and +34 913 491 871 publication of games and entertainment software, is proud to present its Guide to Games from Spain 2020, the perfect way to discover Spanish games and com- panies at a glance. -

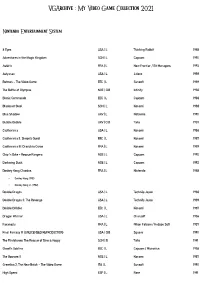

Vgarchive : My Video Game Collection 2021

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs. -

Un Grand Classique De Metroid Est De Retour Dans Un Remake Intégral !

METROID SAMUS RETURNS Informations générales Plateforme : consoles de la famille Nintendo 3DS Genre: plateforme‐action à défilement latéral Nombre de joueurs : 1‐2 Date de sortie : 15 septembre 2017 PEGI : TBC Développeur : MercurySteam Entertainment/Nintendo Editeur : Nintendo UN GRAND CLASSIQUE DE METROID EST DE RETOUR DANS UN REMAKE INTÉGRAL ! Présentation : Incarnez la chasseuse de primes Samus Aran et bravez les territoires hostiles d'une planète inconnue grouillant de créatures malveillantes. Votre mission ? Anéantir la menace métroïde dans cette refonte magistrale d'une aventure sortie en 1991 sur Game Boy. Les capacités de Samus Aran se sont étoffées de nouvelles attaques et de compétences qui l'aideront à affronter les dangers mortels qui l'attendent. Idéal pour découvrir la franchise Metroid, ce jeu de plateforme-action intense à défilement latéral est aussi un excellent épisode à redécouvrir pour tous les fans ! Caractéristiques : Explorez un environnement alien inconnu : la Fédération Galactique a missionné Samus, Chasseuse de l’espace, pour rapatrier le vaisseau contenant les secrets des Metroids de la planète SR388, des formes de vie inconnues. Le vaisseau s’est échoué sur Zébes après un assaut de Pirates de l’espace, Samus doit explorer, se défendre et éliminer ses ennemis. Le jeu regorge de secrets et si vous en découvrez suffisamment, vous commencerez peut-être à percer le mystère de la planète SR388. Et comme toujours attention aux coulées de lave ! Un jeu iconique complètement revisité : ce jeu de plateforme-action intense à défilement latéral propose de magnifiques environnements en 3D ainsi qu'une palette de couleurs riche et particulièrement immersive. Vous pourrez parcourir ces espaces en courant, en sautant en boule morphing ou vous tractant avec votre grappin au-dessus du vide. -

TFG Alejandro Quesada

UNIVERSIDAD AUTONOMA DE MADRID ESCUELA POLITECNICA SUPERIOR Grado en Ingeniería Informática TRABAJO FIN DE GRADO Desarrollo de un videojuego a presentar en la segunda edición de concurso nacional de videojuegos indies Alejandro Quesada López Tutor: Carlos Aguirre Maeso Junio de 2019 Desarrollo de un videojuego a presentar en la segunda edición de concurso nacional de videojuegos indies AUTOR: Alejandro Quesada López TUTOR: Carlos Aguirre Maeso Departamento de Ingeniería Informática Escuela Politécnica Superior Universidad Autónoma de Madrid Junio de 2019 Resumen Este Trabajo de Fin de Grado detalla los pasos seguidos durante la planificación y el desarrollo de Prismatica, un videojuego indie de acción y exploración lateral 2D para un jugador, que utiliza como motor la versión personal de Unity 2018. El objetivo final del proyecto es construir un videojuego completo para PC, que cumpla con la mayoría de los estándares de calidad esperables en cualquier videojuego indie profesional moderno, con el fin de presentarlo a competiciones de videojuegos indies. Todos los elementos que forman parte del apartado visual del videojuego son originales y han sido creados y animados expresamente para el proyecto. El videojuego se basa en la exploración de un mundo compuesto por distintas zonas interconectadas, en las que el jugador deberá buscar secretos, resolver puzles y derrotar enemigos utilizando diferentes habilidades. Según avance por diferentes regiones sin color, encontrará diversas mejoras y nuevas habilidades, conocidas como HEXes, que abrirán nuevas opciones de combate y exploración. El uso de HEXes de distintos colores puede afectar al mundo y sus elementos de diferentes formas, y constituye una de las características principales del título. -

PRESS RELEASE Deadlight: Director's Cut out Now for PS4

AUTHOR: TEQUILA WORKS PROJECT: Deadlight: Director’s Cut PRESS RELEASE Planegg, June 21st2016 Press Contact Deep Silver Jennifer Willis A division of Koch Media GmbH Tel: +49 89 24245-193 Lochhamerstr. 9 Fax: +49 89 24245-3193 82152 Planegg [email protected] Deadlight: Director’s Cut Out Now for PS4, Xbox One & PC - Annihilate or evade, survival is what it’s all about – Munich, June 21 – The survival horror platformer Deadlight: Director’s Cut, isavailable today for PlayStation®4, Xbox One, the all-in-one games and entertainment system from Microsoft and PCon both Digital and Retail at 19.99€, £15.99, $19.99. With the brand-new Survival Arena Mode which offers interactive defenses and novel weapons, all players can enjoy an even more intense struggle against the horde. In addition, the PS4 and Xbox One versions now also encompass the Nightmare Mode, revealing an alternative ending upon completion of thegame. Playing as Randall Wayne, who is in search of his family in the ruins of a ‘1986’ Seattle, players will solve puzzles and overcome environmental hazards in this tense 2D platformer. As resources such as weapons and ammunition are scarce, diving into battle isn’t always the best solution. The choice between sneaking past zombies or annihilating them with melee combat and weapons will be crucial to prevail. Enhancements to Deadlight: Director’s Cut also entail superior controls, improved animations and running at 1080p on all platforms. Additionally available are the original Developer Diaries, which also present an in depth insight to the Deadlight series, as well as the new digital art book. -

Analyzing the Design of Game Cartography Interfaces

Making Maps Available for Play: Analyzing the Design of Game Cartography Interfaces Z O. TOUPS, New Mexico State University NICOLAS LALONE, University of Nebraska Omaha SULTAN A. ALHARTHI and HITESH NIDHI SHARMA, New Mexico State University ANDREW M. WEBB, Inria, Université Paris-Saclay Maps in video games have grown into complex interactive systems alongside video games themselves. What map systems have done and currently do have not been cataloged or evaluated. We trace the history of game map interfaces from their paper-based inspiration to their current smart phone-like appearance. Read- 30 only map interfaces enable players to consume maps, which is sufficient for wayfinding. Game cartography interfaces enable players to persistently modify maps, expanding the range of activity to support planning and coordination. We employ thematic analysis on game cartography interfaces, contributing a near-exhaustive catalog of games featuring such interfaces, a set of properties to describe and design such interfaces, a collection of play activities that relate to cartography, and a framework to identify what properties promote the activities. We expect that designers will find the contributions enable them to promote desired play experiences through game map interface design. CCS Concepts: • Human-centered computing → HCI theory, concepts and models; Interaction design theory, concepts and paradigms;•Information systems → Collaborative and social comput- ing systems and tools; Geographic information systems; Massively multiplayer online games; Location based services; Additional Key Words and Phrases: Game design, cartography, maps ACM Reference format: Z O. Toups, Nicolas LaLone, Sultan A. Alharthi, Hitesh Nidhi Sharma, and Andrew M. Webb. 2019. Making Maps Available for Play: Analyzing the Design of Game Cartography Interfaces. -

Subtle and Challenging Gaze-Based Player Guidance in Exploration Games

Multimodal Technologies and Interaction Article gEYEded: Subtle and Challenging Gaze-Based Player Guidance in Exploration Games Michael Lankes 1,* , Andreas Haslinger 1 and Christian Wolff 2 1 Department of Digital Media, University of Applied Sciences Upper Austria, 4232 Hagenberg, Austria 2 Department of Media Informatics, University of Regensburg, 93053 Regensburg, Germany * Correspondence: [email protected]; Tel.: +43-50-8042-2133 Received: 9 July 2019; Accepted: 19 August 2019; Published: 22 August 2019 Abstract: This paper investigates the effects of gaze-based player guidance on the perceived game experience, performance, and challenge in a first-person exploration game. In contrast to existing research, the proposed approach takes the game context into account by providing players not only with guidance but also granting them an engaging game experience with a focus on exploration. This is achieved by incorporating gaze-sensitive areas that indicate the location of relevant game objects. A comparative study was carried out to validate our concept and to examine if a game supported with a gaze guidance feature triggers a more immersive game experience in comparison to a crosshair guidance version and a solution without any guidance support. In general, our study findings reveal a more positive impact of the gaze-based guidance approach on the experience and performance in comparison to the other two conditions. However, subjects had a similar impression concerning the game challenge in all conditions. Keywords: player guidance; gaze-based interactions; feedback types; game experience 1. Introduction Gaze-based interactions have found their way into the games domain (e.g., [1–10]): Top-level “AAA games”, such as Far Cry 5 [11] or Assassin’s Creed Odyssey [12], support eye-tracking devices with the aim to provide players a more intuitive form of game interaction [13]. -

News Release

Un Metroid “made in Spain” y Mario & Luigi: Superstar Saga + Secuaces de Bowser completan la primera jornada de anuncios de Nintendo en el E3 Además, el Nintendo Treehouse: Live at E3 muestra nuevas imágenes de partida de Fire Emblem Warriors y Super Mario Odyssey Los Ángeles, 14 de junio de 2017.– Tras los anuncios del Nintendo Spotlight, emitido en la mañana del martes (horario de Los Ángeles) Nintendo aprovechó la primera jornada de la feria E3 para seguir ofreciendo detalles sobre sus juegos, mostrar partidas en profundidad de una variedad de juegos para Nintendo Switch y la familia de consolas Nintendo 3DS y anunciar nuevos títulos durante la emisión del programa en directo “Nintendo Treehouse: Live at E3”. Además del anuncio del nuevo Metroid: Samus Returns, que está siendo desarrollado en colaboración con el estudio español MercurySteam, la compañía también anunció un remake de un clásico Mario & Luigi. El “Nintendo Treehouse: Live at E3” arrancó justo después de terminar la emisión del Nintendo Spotlight, con un contenido de excepción: partida inédita de Super Mario Odyssey de la mano de miembros del equipo de Nintendo Treehouse, que mostraron en directo un área exclusiva del juego a la que no se puede acceder desde la demo disponible en el stand de la compañía en la feria. La presentación reveló nuevas mecánicas de juego, nuevos objetivos que capturar y nuevas maneras de interactuar con el entorno. Este exuberante y arbolado reino mostró algunas de las sorpresas que aguardarán a los jugadores en Super Mario Odyssey, disponible para Nintendo Switch el 27 de octubre. -

AND the WINNER IS…21St D.I.C.E. AWARDS CELEBRATES the BEST in VIDEO GAMES

AND THE WINNER IS…21st D.I.C.E. AWARDS CELEBRATES THE BEST IN VIDEO GAMES The Legend of Zelda: Breath of the Wild Takes Top Honor as Game of the Year LAS VEGAS – Feb. 22, 2018 – The Academy of Interactive Arts & Sciences (AIAS), the non-profit organization dedicated to the advancement and recognition of the interactive arts representing its 33,000+ membership base, today held the 21st D.I.C.E. Awards, its annual ceremony that brings together the interactive entertainment industry to honor the year’s biggest achievements in video games. This year’s Game of the Year was awarded to The Legend of Zelda: Breath of the Wild by Nintendo, which takes players on a world of adventure as they travel across vast fields, through forests and over mountain peaks as they discover what has become of the kingdom of Hyrule. The Academy membership honored games in 24 award categories, with The Legend of Zelda: Breath of the Wild receiving four awards, making it the night’s most awarded game. Cuphead earned a total of three awards. Games honored with two awards each included Horizon Zero Dawn, Lone Echo/Echo Arena, PLAYERUNKNOWN’S BATTLEGROUNDS and Snipperclips. Other top honorees were Fire Emblem Heroes for Mobile Game of the Year, Mario Kart 8 Deluxe for Racing Game of the Year, Injustice 2 for Fighting Game of the Year, FIFA 18 for Sports Game of the Year, Snipperclips for the Sprite Award, and PLAYERUNKNOWN’S BATTLEGROUNDS for Outstanding Achievement in Online Gameplay. “Every year, the D.I.C.E. -

Games from Spain”, a Publication Which Provides a Complete Picture of Spain’S Videogame Industry and Highlights Its Values and Its Talent

GUIDE TO 2019 2019 NIPO: 114190486 EUROPEAN UNION NIPO: 114190491 D.L.: M-8502-2019 EUROPEAN REGIONAL DEVELOPMENT A way to make Europe Message from The CEO of ICEX, Spain Trade and Investment. Dear reader, Continuing with our support for the Spanish videogame area, we are proud to present our second edition of the “Guide to Games from Spain”, a publication which provides a complete picture of Spain’s videogame industry and highlights its values and its talent. This publication is your ultimate guide to the industry, introducing you to companies of various sizes and profiles, including developers, publishers and services providers with active projects in 2019. Games from Spain is the umbrella brand created and supported by ICEX, Spain Trade and Investment to promote the videogame industry around the globe. You are cordially invited to visit us at our stands at Game Connection America, Gamescom or Tokyo Game show, among other events, and so to see how Spanish videogames are once again playing in the best global productions league. Looking forward to seeing you soon. Kind regards, María Peña Mateos EUROPEAN UNION EUROPEAN REGIONAL DEVELOPMENT A way to make Europe 4 5 GENERAL INDEX Message from The CEO of ICEX 03 Spanish videogame industry in figures 06 Discover GAMES FROM SPAIN 07 Index Developers 08 Index Publishers 18 Index Services 20 6 7 SPANISH VIDEOGAME INDUSTRY IN FIGURES NUMBER OF GAME DEVELOPMENT Discover NUMBER OF GAME DEVELOPMENT 455 COMPANIES 455 COMPANIES GAMES FROM SPAIN EMPLOYMENT 6.337 persons (direct employment) EMPLOYMENT