RITES Limited Corporate Presentation November 2019 Disclaimer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important Days in February

INSIDE STORY IMPORTANT DAYS IN JANUARY January 09 NRI Day (Pravasi Bharatiya Divas) CAA-2019 3 Miss Universe and Miss World-2019 4 January 10 World Hindi Day First Chief of Defence Staff 5 January 12 National Youth Day Sports Person of the Year-2019 5 January 15 Indian Army Day National News 6 January 24 National Girl Child Day International News 11 January 25 National Voters Day 500+ G.K. One Liner Questions 15 January 27 World Leprosy Day (Every last GS Special 31 Sunday) Awards 32 New Appointments 36 IMPORTANT DAYS IN FEBRUARY Sports 40 February 02 World Wetlands Day Banking & Financial Awareness 45 February 04 World Cancer Day Defence & Technology 47 February 10 National De-worming Day Study Notes 49 February 12 National Productivity Day Tricky Questions 59 February 13 World Radio Day IBPS Clerk (Mains) - Practice Test Paper 70 February 20 World Day of Social Justice SSC CGL (Tier-I) - Practice Test Paper 95 SSC CHSL (Tier-I) - Practice Test Paper 104 February 21 International Mother Language IBPS SO AFO (Mains) - Memory Based Paper 110 Day February 28 National Science Day IMPORTANT RATES (31-12-2019) Repo Rate 5.15% Reverse Repo Rate 4.90% Marginal Standing Facility Rate 5.40% Statutory Liquidity Ratio 18.50% Cash Reserve Ratio 4% Bank Rate 5.40% New Batches Starting for SSC CHSL : 13th & 16th Jan 2020 RBI ASSISTANT : 13th Jan. 2020 For Admission Contact : IBT Nearest Center or Call - 9696960029 ...for abundant practice download Makemyexam app IBT: How much time did you use to Name: Karan Bhagat devote for the preparation of the exam? Fathers Name: Haqeeqat Rai Karan: Sir, I never made a hard and fast Education: B.Sc (Non-Medical) rule for myself to study for a fixed no. -

Final Shareholders List

Folio DP ID Client ID First Named Shareholder Address Line 1 Address Line 2 Address Line 3 Address Line 4 PIN Shares 118792 GOVIND MOHANLAL BHATIA P O BOX NO 755 SHARJAH U A E 000000 3780 000290 AMRIT LAL MADAN 105,PARKS ROAD, DENVILLE, N.J.07834 TEL:973-627-3967 000000 435 162518 RADHA MANUCHA 2,TIPPETT ROAD, TORONTO ONTARIO, CANADA M3H 2V2 000000 1867 001495 GEORGE A TERRETT C/O BURMA OIL CO (1954) LTD 604,MERCHAN P B -1049.RANGOON 000000 210 188740 RAMESH KUMAR KEJRIWAL 1434,VIAN AVENUE HEWLETT NEWYORK, U S A 000000 375 118672 SARITA KUKREJA 6A,STATION TERRACE, LYNFIELD,AUCKLAND, NEW ZEALAND TEL:6496272877 000000 1890 118605 FELIX JOAQUIM FAUSTINO FERNANDES P O BOX 11052 AL-FUTTAIM TOYOTA-NPDC RASHIDIA DUBAI 000000 750 099084 TUSHAR SHANTARAM PATKAR FINANCE & ADMINISTRATION MANAGER, C/O.HASCO & SHELL MARKETING, P.B.19440,HADDA,SANAA, REPUBLIC OF YEMEN 000000 367 118801 BHAGWAN VIROOMAL GWALANI P O BOX 5689 DUBAI U A E 000000 630 002449 SAT PAUL BHALLA A 316 NORTH OF MEDICAL ENCLAVE NEW DELHI 000000 210 118804 MUKESH SHANTILAL SHAH C/O SAHIL ENTERPRISE P O BOX 7363 MATRAH SULTANATE OF OMAN 000000 1680 071262 JATINDER LABANA C/O CAPT K S LAMANA 197 INDEPENDENT FIELD WORKSHOP C/O 56 A P O 000000 135 118573 BHOGI MOHANLAL RATHOD P O BOX 397 SHARJAH U A E 000000 367 038806 BIBHASH CHANDRA DEB D D M S HQ 1 CORPS C/O 56 A P O 000000 37 048511 ATUL CHANDRA PANDE 3974 EDMONTON COURT ANN ARBOR,ML 48103 U S A 000000 157 100436 LAXMI GRANDHI C/O MR RANGA RAO GRANDHI ASST EX ENGINEER POWER HOUSE CONSTRUCTION DIVISION CHUKHA HYDEL PROJECT 000000 270 118571 IYER KRISHNAN C/O CALEB-BRETT (UAE) PVT LTD P O BOX 97 SHARJAH U A E 000000 97 118557 BHARATKUMAR B SHUKLA 6204,N HOYNE AVENUE APARTMENT 1A CHICAGA IL 60659 U.S.A. -

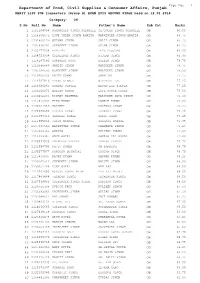

Visual Foxpro

Page No: 1 Department of Food, Civil Supplies & Consumer Affairs, Punjab MERIT LIST FOR Inspectors (Group B) EXAM 2013 SECOND STAGE held on 12.01.2014 Category: OH S.No Roll No Name Father's NameSub Cat Marks 1 1101104698 RAMANDEEP SINGH SHERGILL TEJINDER SINGH SHERGILLOH 90.50 2 1114569575 LOVE INDER SINGH BHATIA HARWINDER SINGH BHATIAOH 86.75 3 2131860129 GURNAM SINGH DALIP SINGH OH 85.75 4 1107636492 SUKHJEET SINGH SUCHA SINGH OH 84.25 5 2135177038 PRATIMA INDU BHUSHAN OH 83.00 6 1104723038 GULKEERAT SINGH NISHAN SINGH OH 82.00 7 1118187140 HARPREET KAUR BALBIR SINGH OH 79.75 8 1110046889 SANDIP SINGH NARINDER SINGHOH 78.75 9 1105124693 ASHPREET SINGH NARINDER SINGHOH 78.00 10 2119200436 RAJIV KUMAR SHAM LAL OH 77.75 11 1114267816 HARSH SINGLA GIRDHARI LAL OH 77.25 12 1118389260 RAKESH SINGLA MADAN LAL SINGLAOH 77.25 13 1100100076 GOBIND KUMAR LATE PURAN CHANDOH 76.50 14 2130252235 RISHAV WADHERA NARINDER PAUL SINGHOH 75.00 15 1115875891 HINU KUMAR RAMESH KUMAR OH 74.00 16 1108037969 HARDEEP DARBARA SINGH OH 73.25 17 2128946385 HARDEV SINGH JASWANT SINGH OH 73.25 18 2131357319 SANDEEP KUMAR SURAJ BHAN OH 73.25 19 1111855032 JATIN MANGAL SUBHASH MANGALOH 71.75 20 2137590563 BACHITTAR SINGH CHAMKAUR SINGHOH 71.25 21 1107033765 AMBIKA KULDEEP KUMAR OH 71.00 22 1113463367 ANJU GOYAL SHEESH PAL GOYALOH 71.00 23 2125631935 AMANDEEP KAKKAR RAMESH KAKKAR OH 70.75 24 2131558749 RAJIV KUMAR OM PARKASH OH 69.75 25 2135277577 KANCHAN BHANDARI CHATAR SINGH OH 69.75 26 1113463007 RAJAT KUMAR SARWAN KUMAR OH 69.25 27 1100702514 SUKHDEEP SINGH BALVIR SINGH OH 69.00 28 2130051706 DONY GOYAL HEM RAJ OH 69.00 29 1113261695 MUKESH KUMAR MAINI DEV RAJ MAINI OH 68.50 30 1117483484 JAGROOP SINGH JASWINDER SINGHOH 68.50 31 2127539903 TALWINDER SINGH SIDHU DARSHAN SINGH OH 68.00 32 2129750308 GURJOT KAUR KULDEEP SINGH OH 67.50 33 2136383062 RAJWINDER SINGH GULZAR SINGH OH 67.50 34 2137389613 DAL CHAND JAIT KANWAR OH 67.25 35 1100803134 VISHAL VIJ SH. -

MTS EXAMINATION 2012 Class : X QUESTION PAPER 10

MTS EXAMINATION 2012 Class : X QUESTION PAPER 10 Marks : 100 Register No : Time : 2 hrs General Instructions 1. Candidates are supplied with an OMR Answer Sheet. 2. Answer the questions in the OMR Sheet by shading the appropriate bubble. 3. Shade the bubbles with black ball pen. 4. Each question carries one mark. 5. Use the space provided in the last page for rough work. Read the passage and answer the questions from 1 to 4. He is a lover of languages, fluent in German, French and English and of course, his mothertongue Tamil. Teaching German at the Goethe Institute upto seven days a week and heading the Distant Learning Programme in cooperation with IGNOU, keep him very busy. As if his life wasn’t hectic enough, P Saralathan has translated Franz Kafka’s ‘Letter to the Father’ from the original German text into Tamil. The Tamil translation is entitled ‘Thandaiku’. Saralathan says that he was inspired to translate ‘Letter to the Father’ for the potential of Kafka’s words make us look at the power wielded by Indian parents over their children. In a rare departure from contemporary Indian or Tamil literature, this book explores a son’s pent up remorse towards his father. It is not to say that a son in India cannot feel for his father, but according to Saralathan, it is something that is not really discussed openly in our patriarchal society. 1. What makes Saralathan extremely busy? A. Seven days of teaching at Goethe Institute B. Heading the Distant Learning Programme C. Translation of Kafka’s book into Tamil D. -

JCC NUCLEAR ARMS RACE: INDIA BACKGROUND GUIDE & Letters from the Directors

&MUN IX JCC NUCLEAR ARMS RACE: INDIA BACKGROUND GUIDE & Letters From The Directors Dear Delegates, Welcome to &MUN IX and to the Nuclear Arms Race: India v. Pakistan. My name is Reeves Yanez and I will be the coordinating crisis director. I am a Junior at William & Mary majoring in Kinesiology with a concentration in Public Health. I have done MUN since middle school and since I have become increasingly involved, competing as part of W&M’s travel team, staffing our conferences, and serving as the USG for specialized agencies and Director General for our middle school conference, WMIDMUN. Outside of MUN, I love to spend time outside, leading students on backpacking trips through the student rec center. I am beyond excited to see what you all bring to the table as we discuss such an exciting topic with so many possibilities. I would encourage you to use history as a guide as you change the future of the subcontinent, but don’t be constrained by it.. The historical outcome was not perfect and I look forward to the alternate solutions you put forward. I especially value creativity and novel solutions, and plans that account for contingencies will be the most successful. With that being said there may be some sensitive subjects covered in this committee and we have high expectations of delegate conduct. We will not tolerate any racism, sexism, homophobia, transphobia, or any other form of discrimination. I look forward to your exciting plans as you strive to lead your nation to victory. This committee will also be a joint crisis committee, and so you will be actively working against another committee. -

Current Affairs Q&A PDF 2019 Subscribe(Buy)

Current Affairs Q&A PDF Current Affairs Q&A PDF 2019 Contents Current Affairs Q&A – July 2019 .......................................................................................................................... 2 INDIAN AFFAIRS ............................................................................................................................................. 2 INTERANTIONAL AFFAIRS ......................................................................................................................... 78 BANKING & FINANCE ................................................................................................................................ 102 BUSINESS AND ECONOMY ....................................................................................................................... 119 AWARDS AND RECOGNITIONS ............................................................................................................... 136 APPOINTMENTS & RESIGNS .................................................................................................................... 156 ACQUISITIONS AND MERGERS ............................................................................................................... 178 SCIENCE & TECHNOLOGY ....................................................................................................................... 180 ENVIRONMENT ........................................................................................................................................... 194 SPORTS ......................................................................................................................................................... -

Model Paper 2019 Rrb Po Mains/Reasoning Ability Q.1-5

MODEL PAPER 2019 RRB PO MAINS/REASONING ABILITY Q.1-5. Study the following information carefully and Q.4. B is related to class 3 in the same way as S is answer the questions given below: related to class 1 based on the given arrangement. Ten persons from different classes viz. 1, 2, 3, 4, To whom amongst the following is C related to, 5, 6, 7, 8, 9 and 10 are sitting in two parallel rows following the same pattern? containing five people each, in such a way that (1) Class 2 (2) Class 10 (3) Class 8 there is an equal distance between adjacent (4) Class 4 (5) Class 5 persons. In row-1 P, Q, R, S and T are seated and Q.5. Who amongst the following faces the person all of them are facing south. In row-2 A, B, C, D from class 3? and E are seated and all of them are facing north. (1) The person from class 6 Therefore, in a given seating arrangement, each (2) T member seated in a row faces another member of the other row. (All the information given above (3) The person from class 8 does not necessarily mean represent the order of (4) The person from class 5 seating as in the final arrangement) (5) E The person from class 5 sits second to left of R. Q.6-10. Study the given information carefully and answer Neither R nor P sit at an extreme end of the line. the following questions. Only two persons sit between the one who faces Ten persons A, B, C, D, E, F, G, H, I and J sitting the person from class 5 and D. -

Part-A-2450 01.Pdf

Regn No Full Name Fathers / Date of Birth Address Qualif Board/University Year of Qualification Date of Regn Status Phone, No. C Husbands Name a n c 1 Tirlochan Singh Sh. Jagat Singh 1929-05-01 411-L, Model Town, Jalandhar City (Pb.) D.H.S. West Bengal-Calcutta June 1954 1974-04-02 Ren Upto July 2017 2 Sh. Ashvini Kumar Sh. Banwari Lal 1915-06-09 Daresi Road, Ludhiana D.H.S. Delhi 1965 1974-06-19 Expired 3 Sh. Gurnam Singh Sh. Lal Singh 1935-05-01 Anardana Chowk, Patiala D.M.S. Bihar-Patna 1962 1975-02-12 Expired 4 Sh. Davendar Singh Sh. Mastan Singh 1921-07-08 Sheranwala Gate, Patiala D.M.S. Calcutta 1954 1982-08-09 Ren Upto July 2012 Virk 5 Sh. Tej Paul Singh Sh. Lakhmi Dass 1944-01-24 5-A, Hgurdwara Shahidan Road, Model Town, D.M.S. Bihar-Patna 1963 1975-02-24 Expired Ludhiana 6 Not allotted 7 Sh. Nirmal Tej Singh Sh. Balbir Singh 1948-11-09 C/o. Sh. Rajeshwar Jain, Railway Road, Karnal B.M.S. Lucknow (U.P.) 1972 1974-05-07 RenFee Not Received Sodhi 8 Sh. Phool Chand Seth Sh. Dev Raj Seth 1941-12-25 V & P.O. Dialpur, Main Bazar, Distt. Jalandhar D.M.S. Bengal-Calcutta 1963 1974-06-12 Ren Upto July 2017 9915561046 9 Sh. Jaswant Singh Sh. Lal Singh 1925-03-14 421-L, Model Town, Ludhiana D.H.S. Delhi 1965 1974-06-19 RenFee Not Received 10 Not allotted 11 Sh. Jaswant Singh Sh. -

Annual Report 2019 - 2020 Railway Energy Management Co

RAILWAY ENERGY MANAGEMENT CO. LTD. (A JOINT VENTURE OF INDIAN RAILWAYS AND RITES LIMITED) ANNUAL REPORT 2019 - 2020 RAILWAY ENERGY MANAGEMENT CO. LTD. iv MISSIONANNUAL REPORT 2019 - 2020 EXPLORING BUSINESS OPPORTUNITIES IN GREEN ENERGY, ESPECIALLY IN THE FIELD OF WIND AND SOLAR BY INSTALLING WINDMILLS AND SOLAR PLANTS FOR GENERATING AND SELLING RENEWABLE ENERGY, MAINLY FOR RAILWAYS CONSUMPTION. FACILITATING COST EFFICIENCIES IN THE ENERGY MANAGEMENT FOR RAILWAYS BY POWER PROCUREMENT THROUGH OPEN BIDDING AS WELL AS TRADING THROUGH POWER EXCHANGES. ENTERING UPON THE CONSULTANCY BUSINESS IN ENERGY MANAGEMENT AREA INCLUDING BOTH WIND AND SOLAR ENERGY PROJECTS. CONTENTS BOARD AND MANAGEMENT REPORTS 2 BOARD OF DIRECTORS & KMP 3 CHAIRMAN’S MESSAGE 5 DIRECTORS’ REPORT 18 REPORT ON CORPORATE GOVERNANCE 25 MANAGEMENT DISCUSSION AND ANALYSIS FINANCIAL STATEMENTS 45 INDEPENDENT AUDITORS’ REPORT 50 BALANCE SHEET 51 STATEMENT OF PROFIT & LOSS 52 STATEMENT OF CHANGES IN EQUITY 53 STATEMENT OF CASH FLOWS 55 SIGNIFICANT ACCOUNTING POLICIES 63 NOTES TO ACCOUNTS 88 COMMENTS BY CAG 1 RAILWAY ENERGY MANAGEMENT CO. LTD. BOARD OF DIRECTORS Mr. Rajeev Mehrotra Chairman Mr. Gopi Sureshkumar Mr. Ajeet Kumar Srivastava Mr. Shalabh Goel Mr. Pradeep Kumawat Varadarajan Director Director Independent Director Director (Upto 19.11.2019) Ms. Sheela Koul Mr. Parmod Kumar Narang Mr. Manish Gupta Mr. Anil Ghai Independent Director Director Director Director (From 25.07.2019) (From 01.06.2019) (From 07.08.2020) (Upto 31.05.2019) KEY MANAGERIAL PERSONNEL Mr. Sudhir Kumar Saxena -

Intimation for Director

“GEE—H niece ' @7113me RITES LIMITED FEZZES ‘A’ of Govt. ”r. (m’nggmugwm P, (u, (Schedule Enterprise oflndia) Date : 15.07.2019 T°: To: Listing Department, Corporate Relationship National Stock Exchange of India Department, Limited. 'Exchange Plaza', C-1, Block G, BSE Limited, Rotunda Building, Bandra - Kurla Complex, Bandra (E), P J Towers, Dalal Street, Mumbai - 400 051 Fort, Mumbai - 400 001 Scrip Code- RITES Scrip Code- 541556 Sub: lntimation for Appointment of Independent Directors. Dear Sir/Madam, In accordance with the Regulation 30 read with Part A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015. We would like to inform you that in terms of Ministry of Railway’s order dated 11‘h July, 2019, 2009/PLJ48/1/(Pt.3) received on July 12, 2019, Shri Anil Kumar Goel (DIN : 06727255) and Shri Satish Sareen (DIN : 01874068) have been appointed as Additional Directors (independent Directors) of the company with effect from 12th July, 2019. A brief profile of Mr. Anil Kumar Goel and Mr. Satish Sareen is annexed. It is further confirmed that none of the Directors are related to each other. This is for your information and record. Thanking You, Yours faithfully, For RITES Limited Ash h Srivastava (Company Secretary & Compliance Officer) (Membership No.: FCS: 5325) CIN : L148990L1974GO|007227 W? W: “3331 W #0, 1. 13337—29. 137113—122 001 (W) Corporate Office: RITES Bhawan, No. 1, Sector-29, Surgeon-122 001 (INDIA) WW: wit: W. Hall =r-rr. kWh-110 092. (WWW) Registered Office: SCOPE Minar, Laxmi Nagar, -

Detail of Registered Travel Agents in Jalandhar District Sr.No

Detail of Registered Travel Agents in Jalandhar District Sr.No. Licence No. Applicant Name and Office Name & Address Home Address Licence Type Licence Issue Date Till Which date Photo Father's Name Licence is Valid 1 2 3 4 5 1 1/MC1/MA Sahil Bhatia S/o Sh. Manoj M/s Om Visa, Shop R/o H.No. 57, Park Avenue, Ladhewali Travel Agency Consultancy Ticekting Agent 04-09-15 03.09.2025 Bhatia No.10, 12, AGI Business Road, Jalandhar Centre, Near BMC Chowk, Garha Road, Jalandhar 2 2/MC1/MA Mr. Bhavnoor Singh Bedi M/s Pyramid E-Services R/o H.No.127, GTB Avenue, Jalandhar Travel Agent Coaching Consultancy Ticekting Agent 10-09-15 19.07.2025 S/o Mr. Jatinder Singh Pvt. Ltd., 6A, Near Old Institution of Bedi Agriculture Office, Garha IELTS Road, Jalandhar 3 3/MC1/MA Mr.Kamalpreet Singh M/S CWC Immigration Sco 26, Ist to 2nd Floor Crystal Plaza, Travel Agency 21-12-15 20-12-20 Khaira S/o Mr. Kar Solution Choti Baradari Pase-1 Garha Road , Jalandhar 4 4/MC1/MA Sh. Rahul Banga S/o Late M/S Shony Travels, 2nd R/o 133, Tower Enclave, Phase-1, Travel Agent Ticketing Agent 21-12-15 17-06-23 Sh. Durga Dass Bhanga Floor, 190-L, Model Town Jalandhar Market, Jalandhar 5 5/MC1/MA Sh.Jaspal Singh S/o Sh. M/S Cann. World Sco-307, 2nd Floor, Prege Chamber , Travel Agency 03-02-16 02-02-21 Mohan Singh Consulbouds opp. Nanrinder Cinema Jalandhar 6 6/MC1/MA Sh. -

Fill???I.II \ Ll Helm RITES\II'7!MI!T(§(?H

‘\ R l I \I' \‘lsdfll iolillux‘, (Iiim \’l\'-III\' IIII IIII‘IIIIIvI) L: I (Jihad/i.t . ) I l‘rII/“II III:fill???I.II \ ll helm RITES\II'7!MI!T(§(?H Date: 30.07.2019 V 7 T6: To: Listing Department, Corporate Relationship National Stock Exchange of India Department, BSE Limited, Rotunda Limited. 'Exchange Plaza', C-1, Block G, Building, P J Towers, Dalal Street, - Bandra - Kurla Complex, Bandra (E), Fort, Mumbai 400 001 7 -400 051 7 W7 7W # Mumbai < Scrip Code- RITES xi Scrip Code-5415?} ,2, 7 Sub: Intimation for Appointment of Independent Directors In accordance with the Regulation 30 read with Part A of Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we would held like to inform you that Board of Directors of the company at its meeting today i.e. July 30, 2019, has inter— alia approved the appointment of Mr. Anil Kumar Goel and Mr. Satish Sareen as Additional Directors (Independent). It is further informed that Mr. Anil Kumar Goel and Mr. Satish Sareen were earlier appointed as Additional Directors (Independent) w.e.f. July 12, 2019 through Resolution by Circulation of Board of Directors. The tenure of the above two Directors came to an end on July 30, 2019 i.e. up to the date of Annual General Meeting as per the provisions of Section 161(1) due to which they are re-appointed again as Additional Directors w.e.f July 30, 2019. A brief profile of Mr. Anil Kumar Goel and Mr. Satish Sareen is annexed.