Barwa Investor Presentation 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Highlights of Qatar; Places to Visit, Things to Do, Where to Eat?

Highlights of Qatar; Places to visit, things to do, where to eat? There are a number of attractions and activities within easy reach of the Marriott Marquis Hotel: we are highlighting some here for your convenience. During the conference, you may also ask our volunteers who will be around to make your visit most memorable. Looking forward to welcoming you in Qatar, Ilham Al-Qaradawi; 9ICI Chair Hotspots and Highlights Doha Corniche (10 minutes) A seven-kilometre long waterfront promenade around Doha Bay, the Corniche offers spectacular views of the city, from the dramatic high-rise towers of the central business district to the bold shapes of the Museum of Islamic Art. Traditional wooden dhows lining the Bay evoke echoes of Qatar’s great seafaring past. The Corniche provides a green, vehicle-free pedestrian space in the heart of the capital. Katara (10 minutes) An innovative interpretation of the region’s architectural heritage, this purpose- built development’s impressive theatres, galleries and performance venues stage a lively year-round programme of concerts, shows and exhibitions. Among Katara’s recreational attractions are a wide choice of dining options, including top class restaurants offering a variety of cuisines, and a spacious, well- maintained public beach with water sports. The Pearl (10 minutes) The Pearl-Qatar is a man-made island off the West Bay coast featuring Mediterranean-style yacht-lined marinas, residential towers, villas and hotels, as well as luxury shopping at top brand name boutiques and showrooms. A popular dining spot, its waterfront promenades are lined with cafes and restaurants serving every taste – from a refreshing ice cream to a five-star dining experience. -

1 Population 2019 السكان

!_ اﻻحصاءات السكانية واﻻجتماعية FIRST SECTION POPULATION AND SOCIAL STATISTICS !+ الســكان CHAPTER I POPULATION السكان POPULATION يعتﺮ حجم السكان وتوزيعاته املختلفة وال يعكسها Population size and its distribution as reflected by age and sex structures and geographical الﺮكيب النوي والعمري والتوزيع الجغراي من أهم البيانات distribution, are essential data for the setting up of اﻻحصائية ال يعتمد علا ي التخطيط للتنمية .socio - economic development plans اﻻقتصادية واﻻجتماعية . يحتوى هذا الفصل عى بيانات تتعلق بحجم وتوزيع السكان This Chapter contains data related to size and distribution of population by age groups, sex as well حسب ا ل ن وع وفئات العمر بكل بلدية وكذلك الكثافة as population density per zone and municipality as السكانية لكل بلدية ومنطقة كما عكسا نتائج التعداد ,given by The Simplified Census of Population Housing & Establishments, April 2015. املبسط للسكان واملساكن واملنشآت، أبريل ٢٠١٥ The source of information presented in this chapter مصدر بيانات هذا الفصل التعداد املبسط للسكان is The Simplified Population, Housing & واملساكن واملنشآت، أبريل ٢٠١٥ مقارنة مع بيانات تعداد Establishments Census, April 2015 in comparison ٢٠١٠ with population census 2010 تقدير عدد السكان حسب النوع في منتصف اﻷعوام ١٩٨٦ - ٢٠١٩ POPULATION ESTIMATES BY GENDER AS OF Mid-Year (1986 - 2019) جدول رقم (٥) (TABLE (5 النوع Gender ذكور إناث المجموع Total Females Males السنوات Years ١٩٨٦* 247,852 121,227 369,079 *1986 ١٩٨٦ 250,328 123,067 373,395 1986 ١٩٨٧ 256,844 127,006 383,850 1987 ١٩٨٨ 263,958 131,251 395,209 1988 ١٩٨٩ 271,685 135,886 407,571 1989 ١٩٩٠ 279,800 -

Cerimã³nia Partida Regresso.Xlsx

Date: 2020-02-21 Time: 09:00 Subject: CoC COMMUNICATION No: 1 Document No: 3:1 From: The Clerk of the Course To: All competitors / crew members Number of pages: 4 Attachments: 1 Notes: FIA SR = 2020 FIA Cross-Country Rally Sporting Regulations QCCR SR = 2020 Manateq Qatar Cross-Country Rally Supplementary Regulations 1. TIMECARD 0 At the reception of administrative checks each crew will receive a timecard which must be used for the following controls: • Administrative checks • Scrutineering • Ceremonial Start holding area IN • Rally Start holding area IN 2. ON-BOARD CAMERAS See article 11 of FIA SR. Competitors wishing to use a camera must supply the following information to the Organizer, in writing, during administrative checks: • Car number • Competitor’s name • Competitor’s address • Use of footage All camera positions and mountings used must be shown and approved during pre-event scrutineering. It is forbidden to mount cameras on the outside of the car. 3. ELECTRONIC EQUIPMENT See article 9 of FIA SR. Any numbers of telephones, mobile phones or satellite phones carried on board must be given to the Organiser during the administrative checks. 4. EQUIPMENT OF THE VEHICLES / “SOS/OK” sign Each competing vehicle shall carry a red “SOS” sign and on the reverse a green “OK” sign measuring at least 42 cm x 29.7 cm (A3). The sign must be placed in the vehicle and be readily accessible for both drivers. (article 48.2.5 of FIA SR). 5. CEREMONIAL START HOLDING AREA (Saturday / Souq Waqif) See article 10.2 of QCCR SR. Rally cars must enter the holding area at Souq Waqif during the time window shown in the rally programme (18.15/18.45h). -

THE QATAR GEOLOGIC MAPPING PROJECT Randall C

LINKING GEOLOGY AND GEOTECHNICAL ENGINEERING IN KARST: THE QATAR GEOLOGIC MAPPING PROJECT Randall C. Orndorff U.S. Geological Survey, 12201 Sunrise Valley Drive, Reston, Virginia, 20192, USA, [email protected] Michael A. Knight Gannett Fleming, Inc., P.O. Box 67100, Harrisburg, Pennsylvania, 17106, USA, [email protected] Joseph T. Krupansky Gannett Fleming, Inc., 1010 Adams Avenue, Audubon, Pennsylvania, 19403, USA, [email protected] Khaled M. Al-Akhras Ministry of Municipality and Environment, Doha, Qatar, [email protected] Robert G. Stamm U.S. Geological Survey, 12201 Sunrise Valley Drive, Reston, Virginia, 20192, USA, [email protected] Umi Salmah Abdul Samad Ministry of Municipality and Environment, Doha, Qatar, [email protected] Elalim Ahmed Ministry of Municipality and Environment, Doha, Qatar, [email protected] Abstract During a time of expanding population and aging urban Introduction infrastructure, it is critical to have accurate geotechnical Currently, the State of Qatar does not have adequate and geological information to enable adequate design geologic maps at regional and local scales with detailed and make appropriate provisions for construction. This descriptions, proper base maps, GIS, and digital geoda- is especially important in karst terrains that are prone to tabases to adequately support future development. To sinkhole hazards and groundwater quantity and quality better understand the region’s geological and geotech- issues. The State of Qatar in the Middle East, a country nical conditions influencing long term sustainability of underlain by carbonate and evaporite rocks and having future development, the Infrastructure Planning Depart- abundant karst features, has recognized the significance ment (IPD) of the Ministry of Municipality and Environ- of reliable and accurate geological and geotechnical ment (MME) of the State of Qatar has commenced the information and has undertaken a project to develop a Qatar Geologic Mapping Project (QGMP). -

Annual Report 2016

ANNUAL REPORT 2016 CONTENTS 3 - 8 BOARD OF DIRECTORS 9 - 10 BOARD OF DIRECTORS REPORT 11 SHARI’A SUPVERVISORY BOARD REPORT 13 - 14 MESSAGE FROM THE GROUP CHIEF EXECUTIVE OFFICER 15 - 16 FINANCIAL HIGHLIGHTS 17 - 18 COMPANY VISION AND STRATEGY 19 CORPORATE GOVERNANCE 21 BARWA REAL ESTATE GROUP 23 - 34 REAL ESTATE PROJECTS IN QATAR 35-36 AL AQARIA REAL ESTATE PROJECTS 37 - 38 INTERNATIONAL INVESTMENTS 39 INDEPENDENT SUBSIDIARIES 40 HELPING PEOPLE FIND THEIR DREAMS 41-42 COMMITMENT TO COMMUNITY 43 OUR EMPLOYEES 1 H.H. SHEIKH TAMIM BIN HAMAD AL THANI THE EMIR OF THE STATE OF QATAR 2 H.H. SHEIKH HAMAD BIN KHALIFA AL THANI THE FATHER EMIR 3 BOARD OF DIRECTORS HIS EXCELLENCY MR. SALAH BIN GHANEM BIN NASSER AL ALI CHAIRMAN OF THE BOARD OF DIRECTORS H.E. Mr. Salah Bin Ghanem Bin was appointed as a consultant in the Nasser Al Ali was appointed as Qatar’s office of the Heir Apparent till 2013. Minister of Sports and Culture on He was also appointed as the General January 27th, 2016 after more than Manager of the Sheikh Jasim Bin two years as Minister of Youth and Mahmoud Bin Thani Foundation Sports. His Excellency held a number for Social Care; a private institute of public positions such as Chief of for public interest established by the State Audit Bureau between His Highness The Father Emir 2006 and 2011, during which Sheikh Hamad Bin Khalifa Al H.E participated in developing a Thani. In 2012, H.E. participated in strategic plan for the Bureau aimed the launch of Al Rayyan TV with a at assisting in achieving sustainable mission to support the renaissance development for the Qatari society of Qatar, consolidate its national and to strengthen accountability. -

December 17, 2020 from During the Press Conference

Qatar-Russia Doha 2030 trade Asian Games volume to inspire rises 200%: next Minister generation Business | 01 Sport | 02 THURSDAY 17 DECEMBER 2020 2 JUMADA I - 1442 VOLUME 25 NUMBER 8474 www.thepeninsula.qa 2 RIYALS 6D$2)5 *6__C_:<T Happy National Day! Doha wins bid to host Asian Games 2030; Riyadh to stage 2034 edition QNA/THE PENINSULA — DOHA Doha won the 2030 Asian Games bid race yesterday after clinching the voting that took We are pleased to host the 2030 Asian Games. Thanks to place on the sidelines of the the Bid Committee and everyone worked with it for their 39th General Assembly of the valued efforts. Just as Doha 2006 was distinguished, Olympic Council of Asia (OCA) Doha 2030 will be a qualitative leap embodying Qatar's in Muscat. sporting mission as a mean for enhancing communication The decision yesterday was and human cultural understanding. announced by OCA President Sheikh Ahmad Al Fahad Al Sabah as the entire Asian sports family watched the proceedings broadcast live on television Doha clinches the bidding race after voting at the 39th General channels and social media plat- Assembly of the Olympic Council of Asia in Muscat. forms right across the continent. “I can now announce... that Chairman of Doha 2030 H E Sheikh Joaan bin Hamad Al Thani the city who had the highest vote thanks H H the Amir, all others who supported the bid file. and will host 2030 is Doha,” said Sheikh Ahmad said yesterday. More than 10,000 athletes from 45 Asian countries gather for “The second hosting city, for the event. -

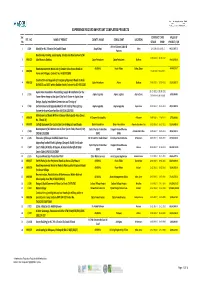

Experience Record Important Completed Projects

EXPERIENCE RECORD IMPORTANT COMPLETED PROJECTS Ser. CONTRACT DATE VALUE OF REF . NO . NAME OF PROJECT CLIENT'S NAME CONSULTANT LOCATION No STRART FINISH PROJECT / QR Artline & James Cubitt & 1 J/149 Masjid for H.E. Ghanim Bin Saad Al Saad Awqaf Dept. Dafna 12‐10‐2011/31‐10‐2012 68,527,487.70 Partners Road works, Parking, Landscaping, Shades and Development of Al‐ 22‐08‐2010 / 21‐06‐2012 2 MRJ/622 Jabel Area in Dukhan. Qatar Petroleum Qatar Petroleum Dukhan 14,428,932.00 Road Improvement Works out of Greater Doha Access Roads to ASHGHAL Road Affairs Doha, Qatar 48,045,328.17 3 MRJ/082 15‐06‐2010 / 13‐06‐2012 Farms and Villages, Contract No. IA 09/10 C89G Construction and Upgrade of Emergency/Approach Roads to Arab 4 MRJ/619 Qatar Petroleum Atkins Dukhan 27‐06‐2010 / 10‐07‐2012 23,583,833.70 D,FNGLCS and JDGS within Dukhan Fields,Contract No.GC‐09112200 Aspire Zone Foundation Dismantling, Supply & Installation for the 01‐01‐2011 / 30‐06‐2011 5 J / 151 Aspire Logistics Aspire Logistics Aspire Zone 6,550,000.00 Tower Flame Image at the Sport City Torch Tower in Aspire Zone Extension to be issued Design, Supply, Installation.Commission and Testing of 6 J / 155 Enchancement and Upgrade Work for the Field of Play Lighting Aspire Logestics Aspire Logestics Aspire Zone 01‐07‐2011 / 25‐11‐2011 28,832,000.00 System for Aspire Zone Facilities (AF/C/AL 1267/10) Maintenance of Roads Within Al Daayen Municipality Area (Zones 7 MRJ/078 Al Daayen Municipality Al Daayen 19‐08‐2009 / 11‐04‐2011 3,799,000.00 No. -

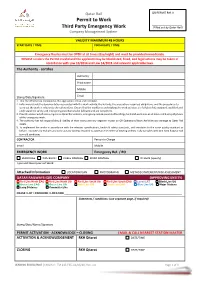

Permit to Work ______Third Party Emergency Work (Filled out by Qatar Rail) Company Management System

Qatar Rail QR-PERMIT Ref. # Permit to Work ____________________ Third Party Emergency Work (Filled out by Qatar Rail) Company Management System VALIDITY MAXIMUM 48 HOURS START DATE / TIME: FINISH DATE / TIME: Emergency Routes must be OPEN at all times (day/night) and must be provided immediately. MISUSE renders the Permit invalid and the applicant may be blacklisted, fined, and legal actions may be taken in accordance with Law 10/2014 and Law 14/2015 and relevant applicable laws. The Authority - certifies Authority Print name Mobile Email Stamp/Date/Signature 1. That the information contained in this application is true and complete. 2. Fully understands the documentation associated with this work activity, the hazards, the precautions required, obligations, and the procedures to carry out the work in relation to the rail interface. Ensure that the workforce undertaking the work activities are fully briefed, equipped, qualified and understand the safety and emergency procedures to be followed and are competent. 3. Provide unobstructed access/egress to Qatar Rail stations, emergency exits & associated buildings, land and work sites at all times and during all phases of the emergency work. 4. The authority has full responsibility & liability of their works and any negative impact on QR Operations/Work Activities and damage to Qatar Rail assets. 5. To implement the works in accordance with the relevant specifications, health & safety standards, and reinstates to the same quality standard as before. Excavate any trial pits and carry out any surveys required to ascertain the extent of existing utilities. Fully complies with QCS 2014 & Qatar Rail terms & conditions. CONTRACTOR Person in Charge Email Mobile EMERGENCY WORK Emergency Ref. -

Coastal Geomorphology of the Qatar Peninsula

_________________________________________________________________________Swansea University E-Theses Coastal geomorphology of the Qatar Peninsula. Alsheeb, Ali I. M How to cite: _________________________________________________________________________ Alsheeb, Ali I. M (1988) Coastal geomorphology of the Qatar Peninsula.. thesis, Swansea University. http://cronfa.swan.ac.uk/Record/cronfa43167 Use policy: _________________________________________________________________________ This item is brought to you by Swansea University. Any person downloading material is agreeing to abide by the terms of the repository licence: copies of full text items may be used or reproduced in any format or medium, without prior permission for personal research or study, educational or non-commercial purposes only. The copyright for any work remains with the original author unless otherwise specified. The full-text must not be sold in any format or medium without the formal permission of the copyright holder. Permission for multiple reproductions should be obtained from the original author. Authors are personally responsible for adhering to copyright and publisher restrictions when uploading content to the repository. Please link to the metadata record in the Swansea University repository, Cronfa (link given in the citation reference above.) http://www.swansea.ac.uk/library/researchsupport/ris-support/ COASTAL GEOMORPHOLOGY OF THE QATAR PENINSULA by Ali I. M. Alsheeb B.Sc Qatar University, Qatar M.A. Pittsburgh University, U.S.A. Thesis submitted for the degree of Doctor of Philosophy in the Department of Geography, Swansea University, University of Wales, May 1988 ProQuest Number: 10821559 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a com plete manuscript and there are missing pages, these will be noted. -

1 Population \307\341\323\337\307\344.Xls

!_ اءات ا وا FIRST SECTION POPULATION AND SOCIAL STATISTICS !+ اــ ن CHAPTER I POPULATION ان POPULATION ان وز ا وا Population size and its distribution as reflected by ا آ%$ ا#" وا ي وا ز اا ا ا age and sex structures and geographical distribution, together with the characteristics ا012 ا / .- ا %% وا,وا+% *( أه related to educational and marital status are ا%8ت ا126% ا 5 "% ا essential date for the setting up of economic and %# 3%4 ا6: 2د واsocial development plans. %" +6 - ى ه=ا ا2> " .%8ت ; .- وز This Chapter contains data related to size and ان $ ا#ع وAت ا .> .5 وآ=@ ا? distribution of population by age qroups, sex as well as popuation density per zone and ا8% > .5 و*#4/ آ " C1 8 ا 5اد ,municipality as given by Census Population ا م ن واآ( وا#HIت، أ. > ٢٠١٠ .Housing & Establishments, April 2010 - ى ا2> أ Lً " .%8ت "( ا- ا %% The Chapter also covers data related to وا,وا+% وز ت ا/ة اI ا#4I وا% education status, marital status and distribution of manpower into economically active and . 4I8 ا: 2د ً .inactive persons و*52ر .%8ت ه=ا ا2> ا 5اد ا م ن واآ( The source of infomation presented in this أ. > ٢٠١٠ */ر8 * .%8ت 5اد ١٩٨٦ و ١٩٩٧ & chapter is the Population, Housing Establishments Census April 2010 in comparison . و ٢٠٠٤ .with population census 1986,1997, 2004 )'&% $د ا "ن 0/ . -,+ ا*$ ام ١٩٨٦ - ٢٠١٣ POPULATION ESTIMATE AS OF MIDDLE 1986 - 2013 ول ر (٥) (TABLE (5 ا ع Gender ذآ ر اث ا ع Total F M ا ات Years ١٩٨٦* 247,852 121,227 369,079 *1986 ١٩٨٦ 250,328 123,067 373,395 1986 ١٩٨٧ 256,844 127,006 383,850 1987 ١٩٨٨ -

'Realty Market Turning More Tenant-Friendly'

After LSE’s sharp rebuff, HKEX begins investor charm offensive PAGE 11 MONDAY, SEPTEMBER 16, 2019 27,219.52 10,394.90 37,384.99 1,499.50 +37.07 PTS -66.75 PTS +280.71 PTS GOLD -0.52% Saudi, Gulf stocks fall after DOW QE SENSEX attacks on Aramco plants PAGE 11 PRICE PERCENTAGE PRICE PERCENTAGE 17.57 BRENT 60.22 -0.26% WTI 54.85 -0.44% SILVER -3.34% Jordan-Qatar QFZA CHAIRMAN MEETS WITH CHINESE DELEGATION Saudi attacks raise Business Council to meet spectre of oil at $100 REUTERS ity amidst ongoing disruption QNA LONDON risks, hoarding, and panic sen- AMMAN timent.” THE oil market will rally by Greg Newman, CO-CEO AMBASSADOR Extraordi- $5-10 per barrel when it opens OF Onyx Commodities expects nary and Plenipotentiary on Monday and may spike to brent futures to open $2 per of Qatar to the Jordan HE as high as $100 per barrel if barrel up and close $7 to $10 Sheikh Saud bin Nasser al Saudi Arabia fails to quickly per barrel higher on Monday. Thani said the Qatari Embas- resume oil supply lost after at- The market could see a re- sy in Jordan was ready to pro- tacks over the weekend, trad- turn to $100 per barrel if the vide all forms of cooperation ers and analysts said. issue cannot be resolved in the to enhance relations between Attacks on two plants at short term, he said. the two countries by conven- the heart of the kingdom’s oil “In the swaps market, ing the Jordanian - Qatari industry on Saturday knocked Dubai timespreads could see a Business Council. -

FOR RENT a Reputable Company Is in Need of the Below Positions Prior Experience in Sign field Is a Must

Gulf Times 1 Monday, August 21, 2017 CLASSIFIED ADVERTISING SITUATION VACANT A well reputed and established business group in QATAR requires Required urgently the following personnel for its growing operations………. ACCOUNTANT Sales Engineer (Power Tools)-(1 No): (With 5 years experience at least Preferably engineering graduate or regular diploma holder having 4-5 years experience in sales of power tools. Candidates with Qatar Driving license are preferred. in Accounting field) Sales Executive (GI Duct)-(2 Nos): DEBTS COLLECTOR Graduate in any discipline with 3-5 years experience in Sales of HVAC Accessories. Candidates with (with 3 years experience in Qatar Driving license are preferred. Debts Collection and Accounting). Team Leader (Retail Sales)-(3 Nos): Candidates must be a graduate with minimum 4 years of experience in similar position of any reputed modern retail electronics outlet. CV to be send to: [email protected] Sr.Store Keeper/Store Keeper-(3 Nos): Graduate or Diploma holder with 4-5 years experience in inventory management preferably home appliances & electronic products. Proficiency in computer literacy is required. Sr. Salesman/Salesman- (5 Nos): Preferably graduate with 3-4 years of experience in sales of consumer durable products. Merchandiser-(5 Nos): Preferably graduate with 3-4 years of experience in sales of consumer durable products in malls, hypermarkets etc. Cashier-(3 Nos): Graduate with 2-3 years experience to handle cash, credit card transactions in retail trading company. Candidate must be proficient in use of computers, POS with sales background. Technician (Air Conditioners, Appliances)-(10 Nos): ITI or TESDA qualified with minimum 5 years of experience in Installation repairs, troubleshooting of air conditioners, home appliances, electronic products.