Robert G. Elliott's Financial News I

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indie Mixtape 20 Q&A Is with Proper., Who Can Sing All the Words to Every Kanye and Say Anything Album (Even the Bad Ones)

:: View email as a web page :: Chuck Klosterman once observed that every straight American man “has at least one transitionary period in his life when he believes Led Zeppelin is the only good band that ever existed.” Typically, this “Zeppelin phase” occurs in one’s teens, when a band that sings lasciviously about squeezing lemons while contemplating hobbits aligns with the surging hormones of the listener. But what about when you hit your early 30s? Is there a band that corresponds with graying beards and an encroaching sense of mortality? We believe, based on anecdotal evidence, that this band is the Grateful Dead. So many people who weren’t Dead fans when Jerry Garcia was alive have come to embrace the band, including many people in the indie-rock community, whether it’s Ezra Koenig of Vampire Weekend, Jim James of My Morning Jacket, or scores of others. Check out this piece on why the Dead is so popular now, even as the 25th anniversary of Garcia’s death looms, and let us know why you like them on Twitter. -- Steven Hyden, Uproxx Cultural Critic and author of This Isn't Happening: Radiohead's "Kid A" And The Beginning Of The 21st Century PS: Was this email forwarded to you? Join the band here. In case you missed it... Our YouTube channel just added a swath official music videos from Tori Amos and Faith No More. After a handful of delays, we now have an official release date for the new album from The Killers, as well as a new song. -

“Grunge Killed Glam Metal” Narrative by Holly Johnson

The Interplay of Authority, Masculinity, and Signification in the “Grunge Killed Glam Metal” Narrative by Holly Johnson A thesis submitted to the Faculty of Graduate and Postdoctoral Affairs in partial fulfillment of the requirements for the degree of Master of Arts in Music and Culture Carleton University Ottawa, Ontario © 2014, Holly Johnson ii Abstract This thesis will deconstruct the "grunge killed '80s metal” narrative, to reveal the idealization by certain critics and musicians of that which is deemed to be authentic, honest, and natural subculture. The central theme is an analysis of the conflicting masculinities of glam metal and grunge music, and how these gender roles are developed and reproduced. I will also demonstrate how, although the idealized authentic subculture is positioned in opposition to the mainstream, it does not in actuality exist outside of the system of commercialism. The problematic nature of this idealization will be examined with regard to the layers of complexity involved in popular rock music genre evolution, involving the inevitable progression from a subculture to the mainstream that occurred with both glam metal and grunge. I will illustrate the ways in which the process of signification functions within rock music to construct masculinities and within subcultures to negotiate authenticity. iii Acknowledgements I would like to thank firstly my academic advisor Dr. William Echard for his continued patience with me during the thesis writing process and for his invaluable guidance. I also would like to send a big thank you to Dr. James Deaville, the head of Music and Culture program, who has given me much assistance along the way. -

Foo Fighters ‘All My Life’

Tracks Foo Fighters ‘All My Life’ Foo Fighters SONG TITLE: ALL MY LIFE ALBUM: ONE BY ONE RELEASED: 2002 LABEL: RCA GENRE: ROCK PERSONNEL: DAVE GROHL (GTR + VOX) CHRIS SHIFLET (GTR) NATE MENDEL (BASS) TAYLOR HAWKINS (DRUMS) UK CHART PEAK: 1 US CHART PEAK: 43 BACKGROUND INFO NOTES ‘All My Life’ is the last single off the Grammy Texan Taylor Hawkins started his career as a Award winning Foo Fighters’ album One by One. drummer-for-hire and before landing the Foo This driving rock performance comes courtesy of Fighters’ gig was, amongst other things, the touring drummer Taylor Hawkins. The track starts with 30 drummer for Alanis Morissette in her Jagged Little seconds of Dave Grohl singing and playing solo guitar Pill period. Grohl originally contacted Hawkins before the rest of the band comes in at breakneck for advice on the best person to fill the drum slot in speed. The drum groove features displaced snare 1997 and was surprised to hear that he was willing hits and other syncopations that give the verses a see- to do the job himself. Hawkins professes himself to saw sense of motion. By contrast, the choruses are be a big fan of Queen’s Roger Taylor and played with straight-ahead rock. him at Live Earth in 2007 along with Chad Smith of the Red Hot Chili Peppers. He also toured as Brian May’s drummer. At one point when the Foo Fighters THE BIGGER PICTURE supported May, he played both the support and headline slots! This album heralds the start of a period of rejuvenation for the Foo Fighters. -

Unscripted Boom (Wall Street Journal 060121)

From Prince Harry to the Kardashians, Real Stories Are Hollywood’s Rising Stars WarnerMedia-Discovery merger among many high-profile moves bolstering streaming services’ offerings of reality TV and documentaries Kris Jenner, with short hair in black, and daughters Kim, Khloe and Kourtney Kardashian accepting the Reality Show of 2019 People's Choice award. PHOTO: NBCU PHOTO BANK VIA GETTY IMAGES By R.T. Watson, May 30, 2021 8:00 am ET Stories starring real people are attracting some of the world’s biggest celebrities, from the Obamas to Kim Kardashian, as nonfiction programming has become essential to companies aiming to build streaming services. 1 Unscripted shows and documentary projects tend to be cheaper to make than their scripted counterparts, offering the potential for bigger profits if they become popular. According to market-research company Reelgood, the cumulative number of reality TV shows offered on streaming services nearly doubled in the first quarter of this year when compared with 2020. AT&T Inc. T -0.65% placed a premium on this type of entertainment in its recent deal to merge WarnerMedia with Discovery Inc., DISCB 0.22% a big player in unscripted programming known for its top-rated reality franchise “90 Day Fiancé” and others, such as “Fixer Upper.” Discovery Chief Executive David Zaslav said after the deal was announced that combining his company’s expertise in unscripted productions with WarnerMedia’s prowess in scripted shows will be explosive. Chip and Joanna Gaines get ready for another season of ‘Fixer Upper.’ PHOTO: LISA PETROLE/MAGNOLIA NETWORK/ASSOCIATED PRESS In addition, the Kardashians are putting out a new show on Walt Disney Co. -

Statement of the Department of Justice on the Closing of the Antitrust Division’S Review of the ASCAP and BMI Consent Decrees

DEPARTMENT OF JUSTICE Statement of the Department of Justice on the Closing of the Antitrust Division’s Review of the ASCAP and BMI Consent Decrees Washington, D.C. August 4, 2016 The American Society of Composers, Authors and Publishers (ASCAP) and Broadcast Music, Inc. (BMI) are “performing rights organizations” (PROs). PROs provide licenses to users such as bar owners, television and radio stations, and internet music distributors that allow them to publicly perform the musical works of the PROs’ thousands of songwriter and music publisher members. These “blanket licenses” enable music users to immediately obtain access to millions of songs without resorting to individualized licensing determinations or negotiations. But because a blanket license provides at a single price the rights to play many separately owned and competing songs – a practice that risks lessening competition – ASCAP and BMI have long raised antitrust concerns. ASCAP and BMI are subject to consent decrees that resolved antitrust lawsuits brought by the United States in 1941 alleging that each organization had unlawfully exercised market power acquired through the aggregation of public performance rights in violation of Section 1 of the Sherman Act, 15 U.S.C. § 1. The consent decrees seek to prevent the anticompetitive exercise of market power while preserving the transformative benefits of blanket licensing. In the decades since the ASCAP and BMI consent decrees were entered, industry participants have benefited from the “unplanned, rapid and indemnified access” to the vast repertories of songs that each PRO’s blanket licenses make available. Broadcast Music, Inc. v. CBS, Inc., 441 U.S. 1, 20 (1979). -

Behind the Music

Q&A BEHIND THE MUSIC It’s crazy to think that this year marks the 20th Anniversary of Kurt Cobain’s passing – a true game-changer in our industry, and a man who, in many ways, revolutionised music, inadvertently spawning a whole new scene. Nevermind is a seminal record, and its success was the catalyst for record labels’ mission impossible, the search for ‘the next Nirvana’. Although he might not have known it at the time, those 16 days recording Nevermind would change Butch Vig’s career forever. It paved the way for a remarkable musical journey, the production of a string of hit records for supergroups such as The Smashing Pumpkins, The Foo Fighters, and many more... Not to mention Garbage, Vig’s own band, which has enjoyed more than 17 million record sales over the last two decades. This legend of the game reveals some of his trade secrets, and shares some fond, unforgettable memories... Your career speaks for itself, but first up, how did it all begin for you? Well, I played in bands in high school in a small town in Wisconsin, and then I went to University in Madison. I started getting into the local music scene, and joined a band, which was sort of a power pop, new wave band called Spooner; and Duke [Erikson] from Garbage was the guitarist and lead singer at the time. I also got a degree in film, and ended up doing a lot of music for film; a lot of synth, and abstract music, and that’s where I kind of got the recording bug. -

Dave Grohl's Growth Mindset

! Handout 2 - Dave Grohl’s Growth Mindset To some, Dave Grohl is the drummer from the groundbreaking Seattle “Grunge” band Nirvana. Other music fans likely know him as the guitarist, vocalist, frontman, and songwriter of the arena- filling band, Foo Fighters. Still others that have seen Grohl on the HBO series Sonic Highways or the documentary Sound City may recognize him as a music historian and film director. The truth is that Dave Grohl is all of the above. Thinking back to his childhood during an episode of the Sonic Highways series, Grohl remembers his artistic “light bulb” turning on during a family vacation to Chicago. Grohl, only twelve at the time, accompanied a cousin to a local Punk concert. It was awesome. He left the show inspired, asking himself, “why can’t I do this?” Then, he realized he could. Once home in Springfield, VA, a Beltway suburb about thirteen miles from the White House, the young Grohl tapped into D.C.’s thriving Punk scene. He befriended members of the local music community such as Ian MacKaye, a go-getter who played bass in Teen Idles, sang in Minor Threat, and later handled guitar and vocals in Fugazi, all while co-founding the Dischord Records label. In the mid and late 1980s, the major record labels, radio, and MTV--basically all the national tastemakers--were mostly focused on Glam Rock, Synth Pop, and Michael Jackson. D.C. Punk wasn’t even on their radar. But, rather than get discouraged or bitter about the lack of outside investment, many in the D.C. -

Contradictionary Lies: a Play Not About Kurt Cobain Katie

CONTRADICTIONARY LIES: A PLAY NOT ABOUT KURT COBAIN KATIE WALLACE Bachelor of Arts in English/Dramatic Arts Cleveland State University May 2012 Master of Arts in English Cleveland State University May 2015 submitted in partial fulfillment of requirements for the degree MASTER OF FINE ARTS IN CREATIVE WRITING at the NORTHEAST OHIO MFA and CLEVELAND STATE UNIVERSITY May 2018 We hereby approve this thesis For KATIE WALLACE Candidate for the MASTER OF FINE ARTS IN CREATIVE WRITING degree For the department of English, the Northeast Ohio MFA Program And CLEVELAND STATE UNIVERSITY’S College of Graduate Studies by ________________________________________________________________ Thesis Chairperson, Imad Rahman ____________________________________________________ Department and date _________________________________________________________________ Eric Wasserman _____________________________________________________ Department and date ________________________________________________________________ Michael Geither ____________________________________________________ Department and date Student’s date of defense April 19, 2018 CONTRADICTIONARY LIES: A PLAY NOT ABOUT KURT COBAIN KATIE WALLACE ABSTRACT Contradictionary Lies: A Play Not About Kurt Cobain is a one-act play that follows failed rocker Jimbo as he deals with aging, his divorce, and disappointment. As he and his estranged wife Kelly divvy up their belongings and ultimately their memories, Jimbo is visited by his guardian angel, the ghost of dead rock star Kurt Cobain. Part dark comedy, -

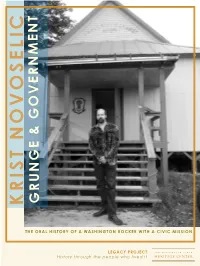

Krist Novoselic

OVERNMENT G & E GRUNG KRIST NOVOSELIC THE ORAL HISTORY OF A WASHINGTON ROCKER WITH A CIVIC MISSION LEGACY PROJECT History through the people who lived it Krist Novoselic Research by John Hughes and Lori Larson Transcripti on by Lori Larson Interviews by John Hughes October 14, 2008 John Hughes: This is October 14, 2008. I’m John Hughes, Chief Oral Historian for the Washington State Legacy Project, with the Offi ce of the Secretary of State. We’re in Deep River, Wash., at the home of Krist Novoselic, a 1984 graduate of Aberdeen High School; a founding member of the band Nirvana with his good friend Kurt Cobain; politi cal acti vist, chairman of the Wahkiakum County Democrati c Party, author, fi lmmaker, photographer, blogger, part-ti me radio host, While doing reseach at the State Archives in 2005, Novoselic volunteer disc jockey, worthy master of the Grays points to Grays River in Wahkiakum County, where he lives. Courtesy Washington State Archives River Grange, gentleman farmer, private pilot, former commercial painter, ex-fast food worker, proud son of Croati a, and an amateur Volkswagen mechanic. Does that prett y well cover it, Krist? Novoselic: And chairman of FairVote to change our democracy. Hughes: You know if you ever decide to run for politi cal offi ce, your life is prett y much an open book. And half of it’s on YouTube, like when you tried for the Guinness Book of World Records bass toss on stage with Nirvana and it hits you on the head, and then Kurt (Cobain) kicked you in the butt . -

The Year Walk Ritual in Swedish Folk Tradition

http://www.diva-portal.org Postprint This is the accepted version of a chapter published in Folk Belief and Traditions of the Supernatural. Citation for the original published chapter: Kuusela, T. (2016) "He Met His Own Funeral Procession": The Year Walk Ritual in Swedish Folk Tradition. In: Tommy Kuusela & Giuseppe Maiello (ed.), Folk Belief and Traditions of the Supernatural (pp. 58-91). København: Beewolf Press N.B. When citing this work, cite the original published chapter. Permanent link to this version: http://urn.kb.se/resolve?urn=urn:nbn:se:su:diva-131842 [58] Folk Belief and Traditions of the Supernatural Chapter 3 “He Met His Own Funeral Procession”: The Year Walk Ritual in Swedish Folk Tradition Tommy Kuusela Stockholm University, Sweden Introduction The belief in prophetic signs bound to specific and important dates can be seen all over Europe as early as Medieval times, with weather and harvest divinations being the most common kinds (Cameron 2013: 65-67). In Sweden, one oracular method was a ritual known as year walk, and those who ventured on this perilous journey were known as year walkers. Success meant that the omen-seeker could acquire knowledge of the following year; it was a ritual that sought answers regarding the unbearable uncertainty of being. Year walk (or annual walk) is known in Swedish as årsgång, with regional and lexical variations: ådergång, julagång, ödegång, adergång, dödsgång, sjukyrkegång, and so on. Although the term årsgång has a southern Swedish pattern of distribution (Götaland), similar practices, as well as the same motifs in different types of folk legends, are common and can be found throughout the Nordic countries. -

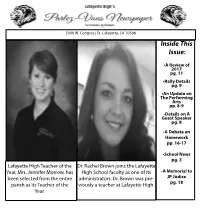

Inside This Issue

3000 W. Congress St. Lafayette, LA 70506 Inside This Issue: •A Review of 2017 pg. 11 •Rally Details pg. 9 •An Update on The Performing Arts pp. 8-9 •Details on A Guest Speaker pg. 8 •A Debate on Homework pp. 16-17 •School News pg. 3 Lafayette High Teacher of the Dr. Rachel Brown joins the Lafayette Year, Mrs. Jennifer Morrow, has High School faculty as one of its •A Memorial to been selected from the entire administrators. Dr. Brown was pre- JP Judice parish as its Teacher of the viously a teacher at Lafayette High. pg. 18 Year. 22 NEWS January 2018 January 2018 NEWS BRIEFS 33 Parlez-Vous Staff A Successful New New Year’s Landry, junior. Editors “Go to chemistry more.” Breanna Gabriel, Quote of the Month Year Resolutions junior. Hannah Primeaux “The new year stands before us, by Hannah Primeaux by Kate Manuel and Gabby Perrin Gabby Perrin Editor-In-Chief Junior Staff Writer and Co-Editor like a chapter in a book, waiting “To read more.” Jordyn Benoit, junior. to be written.” 1.Mrs. Jennifer Morrow has been “To be more adventurous.” Mallory “To stop speeding.” Aubrey Adams, junior. Senior Staff Writer Domingue, senior. Andrew Degeyter -Melody Beattie named Lafayette Parish teacher of the year. “I didn’t make one because I knew I “To not make a New Year’s Resolution.” wouldn’t fulfill it.” Madeline Miller, junior. Sydney Thibodeaux, senior. Junior Staff Writers 2. The Lafayette High Winter Guard Olivia Cart teams recently competed in the season “I’m taking a kickboxing class.” Lauren “Stop cursing, but I already failed Oakes, junior. -

The Piano Lesson

THE PIANO LESSON Synopsis The Piano Lesson is set in Pittsburgh in 1936. Boy Willie has come to his uncle’s house to retrieve a piano that holds significant historical and sentimental value to the family. A battle ensues over the possession of the piano, which carries the legacy and opportunities of the characters and determines the choices they must make. Characters AVERY: Thirty-eight years old, Avery is a preacher who is trying to build up his congregation. He is honest and ambitious, finding himself opportunities in the city that were unavailable to him in rural areas of the South. While fervently religious, he manages to find the time to court Berniece after her husband’s death. BOY WILLIE: Brother to Berniece, Boy Willie is a thirty year old brash, impulsive, and fast-talking man. He has an infectious grin and a boyishness that is apt for his name. His story provides the central conflict for the play in that he plans to sell the family piano in order to buy land that his family worked on as slaves. He feels it’s important he does this in order to avenge his father, who grew up property-less— but not everyone in the family agrees. LYMON: Boy Willie’s long time friend is a twenty-nine year old who speaks little, but when he does with a disarming straight-forwardness. As he flees the law, he makes a plan to begin anew in the North. Eliciting stories from the families past, Lymon proves a vehicle by which we learn about the family.