Facts & Figures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Arend J Hoogervorst1 B.Sc.(Hons), Mphil., Pr.Sci

Audits & Training Eagle Environmental Arend J Hoogervorst1 B.Sc.(Hons), MPhil., Pr.Sci. Nat., MIEnvSci., C.Env., MIWM Environmental Audits Undertaken, Lectures given, and Training Courses Presented2 A) AUDITS UNDERTAKEN (1991 – Present) (Summary statistics at end of section.) Key ECA - Environmental Compliance Audit EMA - Environmental Management Audit EDDA -Environmental Due Diligence Audit EA- External or Supplier Audit or Verification Audit HSEC – Health, Safety, Environment & Community Audit (SHE) – denotes safety and occupational health issues also dealt with * denotes AJH was lead environmental auditor # denotes AJH was contracted specialist local environmental auditor for overseas environmental consultancy, auditing firm or client + denotes work undertaken as an ICMI-accredited Lead Auditor (Cyanide Code) No of days shown indicates number of actual days on site for audit. [number] denotes number of days involved in audit preparation and report write up. 1991 *2 day [4] ECA - AECI Chlor-Alkali Plastics, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 day [4] ECA - AECI Chlor-Alkali Plastics- Environmental Services, Umbogintwini, KwaZulu-Natal, South Africa. November 1991. *2 Day [4] ECA - Soda Ash Botswana, Sua Pan, Botswana. November 1991. 1992 *2 Day [4] EA - Waste-tech Margolis, hazardous landfill site, Gauteng, South Africa. February 1992. *2 Day [4] EA - Thor Chemicals Mercury Reprocessing Plant, Cato Ridge, KwaZulu-Natal, South Africa. March 1992. 2 Day [4] EMA - AECI Explosives Plant, Modderfontein, Gauteng, South Africa. March 1992. *2 Day [4] EMA - Anikem Water Treatment Chemicals, Umbogintwini, KwaZulu-Natal, South Africa. March 1992. *2 Day [4] EMA - AECI Chlor-Alkali Plastics Operations Services Group, Midland Factory, Sasolburg. March 1992. *2 Day [4] EMA - SA Tioxide factory, Umbogintwini, KwaZulu-Natal, South Africa. -

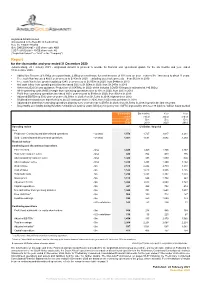

Year End 2020

AngloGold Ashanti Limited (Incorporated in the Republic of South Africa) Reg. No. 1944/017354/06 ISIN: ZAE000043485 – JSE share code: ANG CUSIP: 035128206 – NYSE share code: AU (“AngloGold Ashanti” or “AGA” or the “Company”) Report for the six months and year ended 31 December 2020 Johannesburg, 22 February 2021 - AngloGold Ashanti is pleased to provide its financial and operational update for the six months and year ended 31 December 2020. • Added Ore Reserve of 6.1Moz on a gross basis, 2.6Moz on a net basis, for a net increase of 10% year-on-year - reserve life ∧ increased to about 11 years • Free cash flow increased 485% year-on-year to $743m in 2020 – excluding asset sale proceeds – from $127m in 2019 • Free cash flow before growth capital up 124% year-on-year to $1,003m in 2020, from $448m in 2019 • Net cash inflow from operating activities increased 58% to $1,654m in 2020, from $1,047m in 2019 • Achieved 2020 full year guidance: Production of 3.047Moz in 2020, which includes COVID-19 impacts estimated at 140,000oz • All-in sustaining costs (AISC) margin from continuing operations rose to 40% in 2020, from 28% in 2019 • Profit from continuing operations increased 160% year-on-year to $946m in 2020, from $364m in 2019 • Adjusted EBITDA up 50% year-on-year to $2,593m in 2020, from $1,723m in 2019; highest since 2012 • Dividend increased more than fivefold to 48 US cents per share in 2020, from 9 US cents per share in 2019 • Adjusted net debt from continuing operations down by 62% year-on-year to $597m in 2020, from $1,581m in 2019; -

Anglogold Ashanti Holdings Plc Anglogold Ashanti Limited

Use these links to rapidly review the document TABLE OF CONTENTS Prospectus Supplement TABLE OF CONTENTS TABLE OF CONTENTS 3 Table of Contents Filed pursuant to Rule 424(b)(5) Registration Nos. 333-182712 and 333-182712-02 CALCULATION OF REGISTRATION FEE Amount of Registration Title of Each Class of Aggregate Securities to be Registered Offering Price Fee (1) 5.125% Notes due 2022 of AngloGold Ashanti Holdings plc $750,000,000 $85,950 Guarantee of AngloGold Ashanti Limited in connection with the 5.125% Notes due 2022 (2) — — (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933. (2) Pursuant to Rule 457(n) under the Securities Act of 1933, no separate fee is payable with respect to the guarantee of AngloGold Ashanti Limited in connection with the guaranteed debt securities. Prospectus Supplement to Prospectus dated July 17, 2012 GRAPHIC AngloGold Ashanti Holdings plc $750,000,000 5.125% notes due 2022 Fully and Unconditionally Guaranteed by AngloGold Ashanti Limited The 5.125% notes due 2022, or the "notes", will bear interest at a rate of 5.125% per year. AngloGold Ashanti Holdings plc, or "Holdings", will pay interest on the notes each February 1 and August 1, commencing on February 1, 2013. Unless Holdings redeems the notes earlier, the notes will mature on August 1, 2022. The notes will rank equally with Holdings' senior, unsecured debt obligations and the guarantee will rank equally with all other senior, unsecured debt obligations of AngloGold Ashanti Limited. Holdings may redeem some or all of the notes at any time and from time to time at the redemption price determined in the manner described in this prospectus supplement. -

Building a Sustainably Profitable Business

2008 Annual Report2008 Annual profitable business profitable Building a sustainably Randgold Resources | Annual Report 2008 | Building a sustainably profitable business www.randgoldresources.com Shareholders’ diary Randgold Resources is an African-focused gold mining and 800 exploration business with primary listings on the London Stock Exchange and Nasdaq. 600 400 Financial year end 31 December Annual general meeting Tuesday 5 May 2009 Major discoveries to date include the 7.5 million ounce Morila deposit in southern Mali, the 200 +7 million ounce Yalea deposit at Loulo in western Mali and the +4 million ounce Tongon deposit in the Côte d’Ivoire. Randgold Resources financed and built the Morila mine which Announcement of quarterly results 0 since October 2000 has produced more than 5 million ounces of gold and distributed more First quarter Thursday 7 May 2009 than US$1.3 billion to stakeholders. It also financed and built the Loulo project which started Second quarter Tuesday 4 August 2009 as two open pit mines in November 2005. Since then, an underground mine has been Third quarter Tuesday 10 November 2009 developed at the Yalea deposit and a second underground operation is planned for the Gara Year end and fourth quarter Monday 8 February 2010 deposit. First gold production from the company’s new Tongon project is scheduled for the fourth quarter of 2010. Stock exchange Ticker symbol Randgold Resources has an extensive portfolio of organic growth prospects, constantly replenished by intensive exploration programmes in Mali, Senegal, Burkina Faso, Côte Ticker symbols d’Ivoire, Ghana and Tanzania. Its advanced targets include the significant new Massawa London Stock Exchange (ords) RRS discovery in Senegal, currently at scoping study stage. -

Geometry and Genesis of the Giant Obuasi Gold Deposit, Ghana

Geometry and genesis of the giant Obuasi gold deposit, Ghana Denis Fougerouse, BSc, MSc This thesis is presented for the degree of Doctor of Philosophy. Centre for Exploration Targeting School of Earth and Environment The University of Western Australia July 2015 Supervisors: Dr Steven Micklethwaite Dr Stanislav Ulrich Dr John M Miller Professor T Campbell McCuaig ii "It never gets easier, you just go faster" Gregory James LeMond iv Abstract Abstract The supergiant Obuasi gold deposit is the largest deposit hosted in the Paleoproterozoic Birimian terranes of West Africa (62 Moz, cumulative past production and resources). The deposit is hosted in Kumasi Group sedimentary rocks composed of carbonaceous phyllites, slates, psammites, and volcaniclastic rocks intruded by different generations of felsic dykes and granites. In this study, the deformation history of the Obuasi district was re-evaluated and a three stage sequence defined based on observations from the regional to microscopic scale. The D1Ob stage is weakly recorded in the sedimentary rocks as a layer-parallel fabric. The D2Ob event is the main deformation stage and corresponds to a NW-SE shortening, involving tight to isoclinal folding, a pervasive subvertical S2Ob cleavage striking NE, as well as intense sub-horizontal stretching. Finally, a N-S shortening event (D3Ob) formed an ENE-striking, variably dipping S3Ob crenulation cleavage. Three ore bodies characteristic of the three main parallel mineralised trends were studied in details: the Anyankyerem in the Binsere trend; the Sibi deposit in the Gyabunsu trend, and the Obuasi deposit in the main trend. In the Obuasi deposit, two distinct styles of gold mineralisation occur; (1) gold-bearing sulphides, dominantly arsenopyrite, disseminated in metasedimentary rocks and (2) native gold hosted in quartz veins up to 25 m wide. -

Randgold Resources

Randgold Resources Randgold Resources is a gold mining business operating mainly in Mali. Headquartered in Jersey, Randgold Resources Channel Islands, it is listed on the London and the NASDAQ stock exchanges. Its London-traded shares are a constituent of the FTSE 100 Index and its NASDAQ-traded shares are a constituent of the NASDAQ-100 index. Type Public Traded as LSE: RRS (http://w Contents ww.londonstockexc hange.com/exchan History ge/searchengine/s Operations earch.html?q=RRS) References NASDAQ: GOLD (ht tps://www.nasdaq. External links com/symbol/gold) FTSE 100 Component History Industry Mining The company was established in 1995 and was first listed on the London Stock Exchange in 1997. In 2000 it Founded 1995 commissioned the Morila mine and in 2005 commissioned the Loulo mine.[3] Headquarters Saint Helier, Jersey Key people Christopher Operations Coleman, Chairman Mark Bristow, CEO The company's activities are concentrated on the following mines: Revenue $1,280.2 million Morila gold mine, Mali (2017)[1] Loulo-Gounkoto mine complex, Mali Operating $477.9 million Tongon Mine, Côte d'Ivoire income (2017)[1] Kibali Gold Mine, Democratic Republic of Congo (DRC) Net income $335.0 million Additional projects are Massawa in Senegal but exploration operations are predominantly undertaken in (2017)[1] Mali and the Democratic Republic of Congo. Although registered in Saint Helier, Jersey, Mark Bristow, the Number of 11,659 (2016)[2] CEO, operates mainly out of offices in London, England and the administrative functions are based in employees Johannesburg, South Africa. Bristow has urged caution about investing in South Africa while the present Website www [4] regime there remains in government. -

Modelling the Optimum Interface Between Open Pit and Underground Mining for Gold Mines

MODELLING THE OPTIMUM INTERFACE BETWEEN OPEN PIT AND UNDERGROUND MINING FOR GOLD MINES Seth Opoku A thesis submitted to the Faculty of Engineering and the Built Environment, University of the Witwatersrand, Johannesburg, in fulfilment of the requirements for the degree of Doctor of Philosophy. Johannesburg 2013 DECLARATION I declare that this thesis is my own unaided work. Where use was made of the work of others, it was duly acknowledged. It is being submitted for the Degree of Doctor of Philosophy in the University of the Witwatersrand, Johannesburg. It has not been submitted before in any form for any degree or examination at any other university. Signed …………………………….. (Seth Opoku) This……………….day of……………..………2013 i ABSTRACT The open pit to underground transition problem involves the decision of when, how and at what depth to transition from open pit (OP) to underground (UG). However, the current criteria guiding the process of the OP – UG transition are not well defined and documented as most mines rely on their project feasibility teams’ experiences. In addition, the methodologies used to address this problem have been based on deterministic approaches. The deterministic approaches cannot address the practicalities that mining companies face during decision-making, such as uncertainties in the geological models and optimisation parameters, thus rendering deterministic solutions inadequate. In order to address these shortcomings, this research reviewed the OP – UG transition problem from a stochastic or probabilistic perspective. To address the uncertainties in the geological models, simulated models were generated and used. In this study, transition indicators used for the OP - UG transition were Net Present Value (NPV), ratio of price to cost per ounce of gold, stripping ratio, processed ounces and average grade at the run of mine pad. -

MINING in AFRICA a Legal Overview

MINING IN AFRICA A Legal Overview www.dlapiper.com | 01 CONTENTS Introduction ............................................................................................................................................................. 04 Algeria ........................................................................................................................................................................ 06 Angola ........................................................................................................................................................................ 08 Botswana ...................................................................................................................................................................10 Burkina Faso ..............................................................................................................................................................12 Democratic Republic of Congo ............................................................................................................................14 Egypt ...........................................................................................................................................................................16 Gabon .........................................................................................................................................................................19 Ghana ..........................................................................................................................................................................21 -

2017 Annual Report

RANDGOLD & EXPLORATION COMPANY LIMITED Randgold & Exploration Company Limited Annual Report 2017 The board of Randgold & Exploration Company Limited (R&E) remains focused on the recovery of claims relating to assets allegedly misappropriated from it and frauds perpetrated against R&E, while simultaneously safeguarding the company’s existing asset base. 2 ANNUAL REPORT 2017 RANDGOLD & EXPLORATION COMPANY LIMITED RANDGOLD & EXPLORATION COMPANY LIMITED ANNUAL REPORT 2017 1 Corporate information 2 – 3 Forward-looking statements 4 Group structure 5 Report of the chairman and the chief executive officer 6 – 7 Report of the financial director 8 – 9 Corporate governance report 10 – 31 Curricula vitae 32 – 33 Legal report 34 – 40 Prospecting rights 41 Annual financial statements – group 42 – 77 Annual financial statements – company 78 – 88 Shareholder analysis tables 89 – 90 Notice of annual general meeting 91 – 96 Form of proxy 97 – 98 Contents 2 ANNUAL REPORT 2017 RANDGOLD & EXPLORATION COMPANY LIMITED RANDGOLD & EXPLORATION COMPANY LIMITED ANNUAL REPORT 2017 1 Corporate information RANDGOLD & EXPLORATION COMPANY LIMITED (R&E) (Registration number 1992/005642/06) Company Secretary Van Zyl Botha CA(SA) Suite 25, Third floor, Katherine & West Building 114 West Street, Sandown Sandton, 2196 Postal address PO Box 202, Stellenbosch, 7600 Telephone: +27 71 580 3739 Facsimile: +27 86 235 9863 Website: www.randgoldexp.co.za Registered office Suite 25, Third floor, Katherine & West Building 114 West Street, Sandown Sandton, 2196 SOUTH AFRICAN TRANSFER -

Hidden Treasure? in Search of Mali’S Gold-Mining Revenues a C I R E M a M a F X O / F F O L E T T E R B

Hidden Treasure? In search of Mali’s gold-mining revenues A C I R E M A M A F X O / F F O L E T T E R B Authors Rani Parker (Ph.D., George Washington University) is founder of Business-Community Synergies, a development economist, and a leading authority on corporate-community engagement. Parker has 20 years' experience in international development, including consultancies with organizations such as CARE, the UN Children’s Fund (UNICEF), the UN Development Program (UNDP), and multi- national companies in the energy and extractive industries. Fred Wood (Ph.D., University of London) is an internationally recognized expert on early childhood and youth development. For 12 years, Dr. Wood served as director of education for Save the Children. His consulting projects have included Save the Children, UNICEF, and the World Bank. FRONT COVER: Niama Makalu, 22, and her nephew, Amidou Dembelle, working in a field of groundnuts against the backdrop of a waste dump area for the Sadiola Hill Gold Mine in Mali. Their families were among the many people displaced when mining began in the area in the mid-1990s. Makalu, who is married to the chief of Sadiola, is now—like many others—forced to cultivate food for her family on land in close proximity to mine waste. What’s more, since the Sadiola Hill Mine now occupies much of the area’s former agricultural land, local people have no viable alternatives to farming on these few remaining sites. Above: Sign and fence on the border of the Sadiola Hill Mine, barring trespassers from land that has been conceded to the mining company. -

Randgold Resources Annual Report 2006 01 Chairman’S Statement

Value creation is in our DNA ANNUAL REPORT 2006 Mission Randgold Resources’ focus is on the creation of value through the discovery and development of world class gold projects. IFC Corporate profile and mission 01 2006 highlights Corporate profile 02 Chairman’s statement 04 Directors 06 Management Randgold Resources is an African focused gold mining and 08 Chief executive’s report exploration business incorporated in Jersey in the Channel REVIEW OF OPERATIONS Islands in 1995 and listed on the London Stock Exchange in 11 Financial review 1997 and on Nasdaq in 2002. 13 Operations and projects 13 Loulo mine Its discoveries to date include the 7.5 million ounce Morila deposit 24 Morila mine in southern Mali, the +6 million ounce Yalea deposit at Loulo in 29 Tongon project western Mali and the 3 million ounce Tongon deposit in the Côte Annual resource and reserve declaration 31 d’Ivoire. 32 Table of mineral rights 33 Exploration review The company financed and developed the Morila mine which 42 New business was brought into production in October 2000 and to date has 43 Social responsibility 43 Policy statement produced more than 4 million ounces of gold. It also financed 44 Environmental report and developed the Loulo mine, which was officially opened in 44 Human resources report November 2005. Loulo’s gold production is planned to average DIRECTORS’ REPORTS 250 000 ounces per year until 2009, when Yalea underground 47 Corporate governance will start contributing. The underground development will 53 Remuneration committee report significantly extend the mine’s production and life and is expected 59 Directors’ report to average above 350 000 ounces per year during the seven 60 Statement of directors’ responsibilities and year period from 2009 to 2015. -

24 Randgold Resources

WorldReginfo - 91eabbb6-98e3-4f18-932c-032325ccfb6c WorldReginfo - 91eabbb6-98e3-4f18-932c-032325ccfb6c Shareholders’ diary Randgold Resources is an African focused gold mining Financial year end 31 December and exploration company with Annual general meeting Tuesday 3 May 2011 listings on the London Stock Exchange and Nasdaq. ANNOUNCEMENT OF QUARTERLY RESULTS First quarter Thursday 5 May 2011 Second quarter Thursday 4 August 2011 Third quarter Wednesday 2 November 2011 Year end and fourth quarter Monday 6 February 2012 Major discoveries to date include the 7.5 million ounce Morila deposit in southern Mali, the 7 million ounce Yalea deposit and the 5 million ounce Gounkoto deposit, both in western Mali, the 4 million ounce Tongon deposit in the Côte d’Ivoire and the 3 million ounce Massawa deposit in eastern Senegal. Stock exchange Ticker symbol TICKER SYMBOLS Randgold Resources Limited (Randgold) financed and London Stock Exchange (ords) RRS built the Morila mine which since October 2000 has KEY NUMBERS Nasdaq Global Select Market (ADRs) GOLD produced approximately 5.8 million ounces of gold and 31 Dec 31 Dec distributed more than US$1.6 billion to stakeholders. It US$000 2010 2009 also financed and built the Loulo operation which started as two open pit mines in November 2005. Since then, Gold sales* 487 669 434 194 an underground mine has been developed at the Yalea Note that the above dates may be subject to change and should be Total cash costs* 289 043 249 183 confirmed by checking on the website closer to the time. Profit from mining activity* 198 626 185 011 deposit and construction of a second underground Exploration and corporate expenditure 47 178 51 111 operation is underway at the Gara deposit.