Petroplus Annual Report 2007 Is Originally Published in English B.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Long-Term Prospects for Northwest European Refining

LONG-TERM PROSPECTS FOR NORTHWEST EUROPEAN REFINING ASYMMETRIC CHANGE: A LOOMING GOVERNMENT DILEMMA? ROBBERT VAN DEN BERGH MICHIEL NIVARD MAURITS KREIJKES CIEP PAPER 2016 | 01 CIEP is affiliated to the Netherlands Institute of International Relations ‘Clingendael’. CIEP acts as an independent forum for governments, non-governmental organizations, the private sector, media, politicians and all others interested in changes and developments in the energy sector. CIEP organizes lectures, seminars, conferences and roundtable discussions. In addition, CIEP members of staff lecture in a variety of courses and training programmes. CIEP’s research, training and activities focus on two themes: • European energy market developments and policy-making; • Geopolitics of energy policy-making and energy markets CIEP is endorsed by the Dutch Ministry of Economic Affairs, the Dutch Ministry of Foreign Affairs, the Dutch Ministry of Infrastructure and the Environment, BP Europe SE- BP Nederland, Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. ('Rabobank'), Delta N.V., ENGIE Energie Nederland N.V., ENGIE E&P Nederland B.V., Eneco Holding N.V., EBN B.V., Essent N.V., Esso Nederland B.V., GasTerra B.V., N.V. Nederlandse Gasunie, Heerema Marine Contractors Nederland B.V., ING Commercial Banking, Nederlandse Aardolie Maatschappij B.V., N.V. NUON Energy, TenneT TSO B.V., Oranje-Nassau Energie B.V., Havenbedrijf Rotterdam N.V., Shell Nederland B.V., TAQA Energy B.V.,Total E&P Nederland B.V., Koninklijke Vopak N.V. and Wintershall Nederland B.V. CIEP Energy -

The DA GHGI Improvement Programme 2009-2010 Industry Sector Task

The DA GHGI Improvement Programme 2009-2010 Industry Sector Task DECC, The Scottish Government, The Welsh Assembly Government and the Northern Ireland Department of the Environment AEAT/ENV/R/2990_3 Issue 1 May 2010 DA GHGI Improvements 2009-2010: Industry Task Restricted – Commercial AEAT/ENV/R/2990_3 Title The DA GHGI Improvement Programme 2009-2010: Industry Sector Task Customer DECC, The Scottish Government, The Welsh Assembly Government and the Northern Ireland Department of the Environment Customer reference NAEI Framework Agreement/DA GHGI Improvement Programme Confidentiality, Crown Copyright copyright and reproduction File reference 45322/2008/CD6774/GT Reference number AEAT/ENV/R/2990_3 /Issue 1 AEA Group 329 Harwell Didcot Oxfordshire OX11 0QJ Tel.: 0870 190 6584 AEA is a business name of AEA Technology plc AEA is certificated to ISO9001 and ISO14001 Authors Name Stuart Sneddon and Glen Thistlethwaite Approved by Name Neil Passant Signature Date 20th May 2010 ii AEA Restricted – Commercial DA GHGI Improvements 2009-2010: Industry Task AEAT/ENV/R/2990_3 Executive Summary This research has been commissioned under the UK and DA GHG inventory improvement programme, and aims to research emissions data for a group of source sectors and specific sites where uncertainties have been identified in the scope and accuracy of available source data. Primarily this research aims to review site-specific data and regulatory information, to resolve differences between GHG data reported across different emission reporting mechanisms. The research has comprised: 1) Data review from different reporting mechanisms (IPPC, EU ETS and EEMS) to identify priority sites (primarily oil & gas terminals, refineries and petrochemicals), i.e. -

Petroplus, Land Part of Area 418. Coryton Refinery, the Manorway, Stanford-Le-Hope

Planning Committee 14 January 2016 Application Reference: 15/00877/FUL Reference: Site: 15/00877/FUL Petroplus, land part of Area 418. Coryton Refinery, The Manorway, Stanford-le-Hope Ward: Proposal: Corringham and Full planning permission for the installation and operation of a Fobbing ground mounted solar photovoltaic array to generate electricity of up to 5MW capacity comprising photovoltaic panels, inverters, security fencing and cameras and other associated infrastructure. Plan Number(s): Reference Name Received 15K62-CV-GS-101 Rev. AB Site Location 21.12.15 15K62-CV-GS-104 Rev. AA Site Plan 21.09.15 15K62-EL-LY-101 Rev. AC Layout 21.12.15 15K62-EL-LY-101 A Rev. AB Layout 21.09.15 15K62-EL-LY-101 B Rev. AB Layout 21.09.15 15K62-EL-LY-101 C Rev. AB Layout 21.09.15 15K62-EL-LY-101 D Rev. AB Layout 21.09.15 15K62-HS-LY-104 Rev. AA CCTV Layout & CCTV Pole Details 21.09.15 15K62-CV-FC-103 Rev. AA Fence & Gate Details 21.09.15 15K62-CV-HS-101 Rev. AA Inverter Housing Elevation 21.09.15 15K06-CV-HS-102 Rev. AA Control Cabin Elevation 21.09.15 15K06-CV-HS-103 Rev. AA Storage Container Elevation 21.09.15 15K62-EL-PA-101 Rev. AA PV Array Elevation 21.09.15 15K62-EL-CR-101 Rev. AA Cable Route & PoC 21.09.15 The application is also accompanied by: Design and Access Statement Environmental Statement, including: - Screening Opinion - Layout of the Development - Landscape and Visual Assessment - Preliminary Ecological Assessment - Botanical Survey - Great Crested Newt Survey - Breeding Bird Survey - Reptile Survey - Water Vole Survey - Invertebrate Survey Planning Committee 14 January 2016 Application Reference: 15/00877/FUL - Flood Risk Assessment - Non-Technical Assessment Planning Statement Applicant: Validated: Sun4Net Limited 22 September 2015 Date of expiry: 12 January 2016 Recommendation: Approve subject to conditions. -

2010 Sustainability Reporting of the World's Largest Petroleum Refining

Bharat Petroleum, BP, Caltex Australia, Calumet Specialty Products, Cepsa, Chevron, China National Petroleum, ConocoPhillips,2010 Sustainability Cosmo Reporting Oil, of the CPC, World's CVR Energy,Largest Eni, Petroleum Exxon Refining Mobil, Companies Formosa Petrochemical, Frontier Oil, Galp Energia, Pacific Sustainability Index Scores: A benchmarking tool for online sustainability reporting GS Holdings, Hess, Hindustan Petroleum, Holly, Idemitsu Kosan, Indian Oil, Israel C o r p . , L u k o i l , M a r a t h o n O i l , M o l Hungarian Oil and Gas, Murphy Oil, Neste Oil, Nippon Mining Holdings, Nippon Oil, OMV Group, PDVSA, Petrobras, Petronas, Petroplus Holdings, PKN Orlen Group, PTT, Reliance Industries, Repsol YPF, Rosneft Oil, Royal Dutch Shell, Showa Shell Sekiyu, Sinopec, SK Holdings, S-Oil, Statoil Hydro, Suncor Energy, Sunoco, Tesoro, TNK-BP Holding, Total,United Refining, J.E. Morhardt, Elgeritte Adidjaja, Gracie Beck, Shae Blood, Leah Bross, William Brown, Carolyn Campbell, Jaclyn T. D'Arcy, Whitney Ellen Dawson, V a l e r o E n e r g y , WKaren de e Wolski, s tKaren e Diaz, r Erin n Franks, R Karina e Gomez, fi nAustin i Prentice n g Hallett, Bukola Jimoh, Eric Robert King, Ryan Dean Chas Kristensen, Danielle L. Manning, Allison Scott, Ashley Scott, Aisha Shaikh, Michael Handler Shoemaker, Jennifer Katelyn Ward, and Kathleen West. Contents The Roberts Environmental Center has been the foremost Topics Page analyst of corporate sustainability reporting for over a Company Rankings 3 decade. We analyze corporate online disclosure using our Lead Analyst’s Commentary 4 Pacific Sustainability Index (PSI) and publish the results Carbon Capture and Storage Trends in the 5 online. -

Energy Risk Management

ENERGY RISK MANAGEMENT Howard Rennell, Pat Shigueta, & Karen Palladino (212) 624-1132 (888) 885-6100 www.e-windham.com ENERGY MARKET REPORT FOR MAY 7, 2009 Qatar’s Oil Minister Market Watch Abdullah bin The US Labor Department said initial claims for state unemployment benefits fell by 34,000 to 601,000 in the week ending May 2nd. It is the fourth decline in five weeks. The four week average Hamad Al fell by 14,750 to 623,500, the lowest level since mid-February. According to the report, continuing Attiyah said unemployment claims increased by 56,000 to a record high of 6,351,000. The unemployment rate OPEC will for workers with unemployment insurance increased 0.1% to 4.8%, a 26 year high. Meanwhile, the discuss how to Labor Department reported that non-farm business productivity in the first quarter increased 0.8% deal with oil at an annual rate. It is more than double the 0.3% increase economists had expected. Productivity market fell by 0.6% in the fourth quarter of 2008. Unit labor costs increased 3.3% last quarter at an annual speculators at rate. its next meeting. He declined to The Baltic Exchange’s main sea freight index, which gauges the cost of shipping resources comment on including iron ore, cement, grain, coal and fertilizer, increased 6.25% on Thursday to 2,194 points due to continued Chinese demand for iron ore and other commodities. whether or not OPEC members According to an Industry Economic & Ratings Outlook, the collapse of crude and natural gas are likely to cut prices will make 2009 difficult for the exploration and production sector, particularly for or hold their speculative grade companies. -

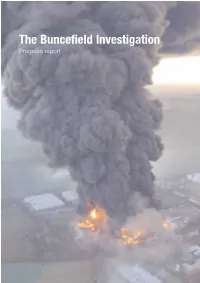

The Buncefield Investigation Progress Report the Buncefield Investigation

The Buncefield Investigation Progress report The Buncefield Investigation Contents Foreword 3 Part 1 The Investigation so far 4 1.1 The incident 4 1.2 What is known about the explosions and fire 9 1.3 The continuing Investigation 12 1.4 Review of HSE/EA roles in regulating activities at Buncefield 14 1.5 Major Incident Investigation Board 15 Part 2 Background 16 2.1 Site description 16 2.2 Regulation of high-hazard sites 19 Annexes 1 Background to the COMAH Regulations 21 2 HSE’s current approach to land use planning 22 3 Investigation terms of reference 25 4 Major Incident Investigation organogram 26 5 Further information 27 Glossary 28 Photographs are courtesy of the Chiltern Air Support Unit and Hertfordshire County Council 2 The Buncefield Investigation Foreword At the first meeting of the Major Incident Investigation Board (MIIB) on 24 January I was asked to prepare, for the second (10 February) meeting, a progress report on the Buncefield Major Incident Investigation by the Health and Safety Executive (HSE) and the Environment Agency (EA). This was to bring together relevant background material and to cover progress with the investigation and such facts as have been established to this point. The MIIB said that this progress report would not constitute the ‘initial report’ required by Terms of Reference 6, since some of the main facts have yet to be established. This progress report is a stepping stone towards the initial report. The report describes the incident and the nature of the site and surrounding communities and the initial responses by EA and HSE. -

Thurrock Council

Third Round Updating and Screening Assessment for Thurrock Council June 2006 Third Round Updating and Screening Assessment Thurrock Council Acknowledgements The assistance of Dheshnee Nadar and Mark Gentry from Thurrock Council is gratefully acknowledged in the production of this report. 2 Environmental Research Group, King’s College London Thurrock Council Third Round Updating and Screening Assessment Executive Summary The role of the local authority review and assessment process is to identify areas where it is considered that the government’s air quality objectives will be exceeded. The Thurrock Council has previously undertaken the earlier rounds of review and assessment (R&A) of local air quality management and identified areas where the objectives are exceeded and where there is relevant public exposure. As a consequence, it has designated Air Quality Management Areas (AQMAs) across its area. This report concerns the third round Updating and Screening Assessment. Local authorities are required to review and assess air quality against the objectives in the Air Quality Regulations 2000 and the amendment regulations as part of a rolling three-year cycle ending in 2010. The air quality objectives to be assessed are for the following seven pollutants: carbon monoxide, benzene, 1,3- butadiene, lead, nitrogen dioxide, sulphur dioxide and particles (PM10). This report provides a new assessment to identify those matters that have changed since the last review and assessment, and which might lead to a risk of the objective being exceeded. The report follows the prescribed guidance given in technical guidance LAQM. TG (03) and the additional advice provided by DEFRA (as Frequently Asked Questions) for the purposes of this round of R&A. -

The Mineral Industry of the United Kingdom in 2010

2010 Minerals Yearbook UNITED KINGDOM U.S. Department of the Interior October 2012 U.S. Geological Survey THE MINERAL INDUSTRY OF THE UNITED KINGDOM By Alberto Alexander Perez In 2010, the United Kingdom’s economy was ranked second to restrictions on their size and the payment of a royalty on the after Germany’s within the European Union (EU) in terms of amount of coal produced. the gross domestic product (GDP) based on purchasing power Most other mineral rights in England, Scotland, and Wales are parity. The United Kingdom’s GDP, in 2010 dollars, was privately owned with the exceptions of gold and silver, which are $2.173 trillion, which was a 1.3% increase compared with that vested in the Royal Family. A different situation regarding mineral of 2009. The country’s heavy industry, which was composed rights applies to Northern Ireland where, under the Mineral of companies that produced automotive and aviation products, Development Act (Northern Ireland), 1969, the rights to work chemicals, and machine tools, among others, relied heavily minerals and to license others to do so are vested in the state. on imported metal ores and concentrates, as well as on some The Government of the United Kingdom had ratified the industrial minerals and mineral fuels. The mineral fuels sector, Kyoto Protocol. The EU, however, decided to meet Kyoto which included coal, natural gas, and petroleum, formed a requirements as a whole, rather than as individual signatories, significant segment of the United Kingdom’s mineral industry. with each member state given a different emissions target by the In 2009, the country accounted for about 1.3% of the world’s EU (British Geological Survey, 2010a). -

Port Trades Origins and Destinations Report

London is the UK’s most diverse port in terms of cargoes handled. The following case studies of terminal operators participating in PLA research demonstrates some of the variety of locations and cargoes handled. North Sea Jetty is the larger of Brett Aggregates Group’s two facilities on ț the Thames. It handles some one The Port of London plays an The river is an important route for onward and a quarter million tonnes of sand distribution of goods by water, handling and gravel a year, principally from essential role as a transport hub newly consented dredging grounds two to three million tonnes of goods annually. nationally, for the South East region in the Eastern English Channel and established licences in the North and locally within London, Essex Sea and around the Isle of White. and Kent. Each year the Port The Thames: Just under half of the terminal’s throughput is used on site in ț Accounted for 77% of all sea-dredged aggregates block making, concrete production and bagging. handles in excess of 50 million moved in UK waterways in 2006. A further quarter leaves the site from dedicated rail sidings for tonnes of cargo. depots in South and West London; the remaining quarter is transported by road to concrete plants and other sites in the Economic impact South East. This report summarises the findings Earlier research has concluded that the Port of The company is investing in new conveyors at the site, both to Cobelfret Ferries operates a three of research commissioned by the increase the rate of discharge from dredgers and to load vessels London makes a major economic contribution to the times weekday ro-ro service for for transhipment upstream. -

A Study of the Outsourcing of Maintenance in UK Petrochemicals

Strategy, flexibility and human resource management: a study of the outsourcing of maintenance in UK petrochemicals by Neil Henry Ritson A thesis submitted in partial fulfilment for the requirements for the degree of PhD (by Published Works) at the University of Central Lancashire March 2008 ate uclan University of Central Lancashire Student Declaration Concurrent registration for two or more academic awards Either *1 declare that while registered as a candidate for the research degree, I have not been a registered candidate or enrolled student for another award of the University or other academic or professional institution or *1 dec1re that for for Material submitted for another award Either *1 declare that no material contained in the thesis has been used in any other submission for an academic award and is solely my own work. or (state award and awarding body and list the material below): Collaboration Where a candidate's research prog9mrrl1s part of a collaborative project, the thesis must indicate in addition clearly the candidate' ividual contribution and the extent of the collaboration. Please state below Signature of Candidate Type of Award Department Part I The Thesis Thesis submitted in partial fulfilment for the Degree of PhD University of Central Lancashire March 2008 Candidate: Neil Henry Ritson Title Strategy, flexibility and human resource management: a study of the outsourcing of maintenance in UK petrochemicals Table of Contents Abstract page 4 Acknowledgements page 5 Preface pages 6-7 Chapter 1 Introduction pages -

Experience in the Oil and Gas Industry “They Go to Great Lengths to Understand Your Industry, Business and Specific Objectives

Experience in the Oil and Gas Industry “They go to great lengths to understand your industry, business and specific objectives . so the advice you get it is fit for purpose. It’s not cookie cutter, and as a client that is extremely valuable.” CLIENT QUOTED IN CHAMBERS UK 2014 NATURAL RESOURCES “Sullivan is our firm of choice – they are terrific, time after time. The work is of a very high quality, and they understand our commercial intentions as well as the legal issues.” CLIENT QUOTED IN CHAMBERS USA 2013 “The partners ‘are detail oriented, efficient and they think strategically’. ‘Their legal expertise is absolutely first rate but equally or more valuable is their general industry/business advice and suggestions on how to tackle issues.” LEGAL 500 LATIN AMERICA 2013 Oil and Gas &C has significant and varied experience advising clients in “Oil & Gas Legal Adviser of the Year” Sthe oil and gas sector. Our depth of understanding of the oil INFRASTRUCTURE JOURNAL 2011 and gas industry means our lawyers’ advice is always orientated towards the achievement of our clients’ business objectives. S&C’s standing in the industry is reflected in the number We provide tailored solutions informed by market knowledge. of major companies it has represented, both directly and in Our multi-disciplinary approach ensures that clients benefit consortia, including: from our industry experience in each of our core practice areas. AEC (Alberta Energy) INPEX Corporation American Energy Kerr-McGee Partners, LP Nigeria LNG Limited OUR OIL AND GAS Upstream BG Group plc INDUSTRIES Nippon Oil Pipelines BHP Billiton Petroleum Oleoducto Central S.A. -

A Lifecycle Assessment of Petroleum Processing Activities in the United Kingdom

From Ground to Gate: A lifecycle assessment of petroleum processing activities in the United Kingdom Reyn OBorn Master in Industrial Ecology Submission date: June 2012 Supervisor: Anders Hammer Strømman, EPT Co-supervisor: Olav Bolland, EPT Norwegian University of Science and Technology Department of Energy and Process Engineering Abstract Petroleum products are an important component of today’s societal energy needs. Petroleum powers everything from the vehicles people rely on, to the ships that carry goods around the world, to the heating of homes in colder climates. The petroleum process chain is complex and the environmental impacts within the process chain are not always well understood. A deeper understanding of where emissions come from along the process chain will help policy makers in the path towards a less carbon intensive society. One of the core processes of the petroleum process chain is refining. Petroleum refining is a complicated process which can have varying crude inputs and varying fuel outputs depending upon the refinery make-up, the crude blend and the market conditions at the time of production. The goal of this paper is to introduce a lifecycle analysis on the UK petroleum refining sector. Where emissions occur along the process chain and which fuels cause the most pollution on a per unit basis will be reported and discussed using lifecycle analysis framework. The refining process is difficult to maneuver around and it can be difficult to discern which processes create which products. The analysis is broadened to understand the refining emissions associated with different fuel types at both a process and country level.