Geyser Kerasotes Showplace

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 30, 2010 or ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-33296 NATIONAL CINEMEDIA, INC. (Exact name of registrant as specified in its charter) Delaware 20-5665602 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 9110 East Nichols Avenue, Suite 200 Centennial, Colorado 80112-3405 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (303) 792-3600 Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.01 per share The NASDAQ Stock Market LLC (Title of each class) (Name of each exchange on which registered) Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ‘ No Í Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No Í Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Cinema Seating

Cinema Seating irwin seating company The Irwin Difference People, Products & Services For over 100 years, Irwin Seating Company’s sole focus has been on meeting our customers’ needs for public seating solutions. We achieve this through innovative design, by manufacturing the industry’s most durable products and by providing unmatched ser- vice before, during, and after the installation of a project. Everyone at Irwin Seating is focused on quality, continuous improvement and customer satisfaction. This commitment is what the Irwin Difference is all about and why we are the world’s leading sup- plier for theatre-style seating. Cinemark Theatres - Hayward, California We start by asking the right ques- tions and listening to our custom- ers’ needs to understand their requirements for a successful project. We provide engineering services for seating layouts and custom chair design to create unique solutions that help our customers with their distinct identities. We recognize the importance of long term value and understand seating must be reliable, easy to maintain, stylish, and com- fortable. This is accomplished through thorough engineering and comprehensive testing, the use of superior materials, includ- Century Theatres - Las Vegas, Nevada ing impact resistant plastics, seat lift mechanisms that are virtually maintenance free and fabrics that pass the industry’s most rigorous tests. Recognizing that value is achieved over time we provide unparalleled parts service to help you keep chairs in service. Talk with your Irwin Seating Company representative today and experi- ence the Irwin Difference. Marcus Theatres, Majestic Cinema - Brookfield, Wisconsin Right: Kerasotes Theatres, Roosevelt Collection - Chicago, Illinois Flip-Up Arm Platform Rocker Platform Available with: Available with: • fixed or articulating backs • all Signature back upholstery styles and 38”, 41” and 44” heights • all Signature back upholstery styles and 38”, 41” and 44” heights • all No. -

Copertina Rev01.Tif

IL CINEMA DIGITALE NEL MONDO NEL 2006 DIGITAL CINEMA WORLDWIDE IN 2006 LE CINÉMA NUMÉRIQUE DANS LE MONDE EN 2006 EL CINE DIGITAL EN EL MUNDO EN 2006 269 270 Annuario Statistico del Cinema Europeo • European Cinema Yearbook • Les Chiffres Clefs du Cinéma Européen • Anuario Estadístico del Cine Europeo I cinema digitali (al dicembre 2006) Digital cinemas (as at December 2006) Les cinémas numériques (en décembre 2006) 1) E: Esercente - Exhibitor - Exploitant - Exhibidor Los cines digitales (hasta diciembre de 2006) Paese Complesso Città Società Schermi Tecnologia Proiettore Proprietario del proiettore Modello proiettore Risoluzione proiettore Server Country Site Town Company Screens Technology Projector Projector’s owner 1 Projector's type Projector's resolution Server Pays Etablissement Ville Société Écrans Technologie Projecteur Propriétaire du projecteur Modèle du projecteur Résolution du projecteu Serveur País Complejo Ciudad Sociedad Pantallas Tecnología Proyector Propietario del proyector Modelo del proyector Resolución del proyector Servidor A Cineplexx Graz Graz Cineplexx 2 DLP Cinema Christie . CP2000 Series 2K XDC A Cineplexx Hohenems Hohenems Cineplexx 1 DLP Cinema Barco DP100 2K XDC A Metropol Kino Innsbruck Innsbruck Ferdinand Purner Lichtspiele 2 DLP Cinema Christie . CP2000 Series 2K XDC A Cineplexx Innsbruck Innsbruck Cineplexx 1 DLP Cinema Barco . DP100 2K XDC A Cineplexx Linz Linz Cineplexx 2 DLP Cinema Barco . DP100 2K XDC A Hollywood Megaplex Pasching Kinobetriebs GMBH 2 DLP Cinema Christie . CP2000 Series 2K XDC A Star Movie Regau Regau Star Movie Betriebs GmbH 2 DLP Cinema Christie CP2000 Series 2K XDC A Cineplexx Airport Salzburg Wals Himmelreich Cineplexx 1 DLP Cinema Barco . DP100 2K XDC A Cineplexx Wienerberg Wien Cineplexx 2 DLP Cinema Barco . -

AMC Entertainment® and Kerasotes Theatres Announce Entry Into Definitive Agreement

AMC Entertainment® And Kerasotes Theatres Announce Entry Into Definitive Agreement Kansas City, Mo. (Jan. 19, 2010) - AMC Entertainment Inc. ("AMC"), and Kerasotes Showplace Theatres, LLC ("Kerasotes"), two leading theatrical exhibition and entertainment companies in the U.S., announced today that they have entered into a definitive agreement pursuant to which AMC will acquire substantially all of the assets of Kerasotes. Kerasotes owns 96 theatres and 973 screens in mid-sized, suburban and metropolitan markets, primarily in the Midwest. More than three quarters of the Kerasotes theatres feature stadium seating and almost 90 percent have been newly built since 1994. Following the consummation of the proposed transaction, Tony and Dean Kerasotes will retain and operate their two new ICON concept theatres in Minneapolis, MN and Chicago, IL; and one Showplace theatre in Secaucus, NJ. Kerasotes is currently owned by the Kerasotes family and Providence Equity Partners. "Combining Kerasotes' highly-regarded assets and operations with our own is a natural way for us to continue re-defining the future of our industry," said Gerry Lopez, AMC CEO and president. "With almost 200 years in the exhibition business between us, our collective experiences and our complementary geographic footprints will allow us to maintain the reputation for excellence and leadership that is part of each company's culture." "Our team has delivered a consistent, high quality experience for customers, and we have appreciated Providence's partnership over the last six years in helping Kerasotes grow into the sixth largest motion picture exhibition company in North America" said Tony Kerasotes, Chief Executive Officer. "We expect these theatres will be a strong addition to the AMC theatre circuit, and look forward to successfully completing the transaction with AMC and to beginning our next chapter." Completion of the acquisition is subject to the satisfaction of customary closing conditions for transactions of this type, including Department of Justice antitrust approval. -

25 3.75% Grocery Acme (Jewel Foods Gift Card $100)

Industry Name Value Percent Grocery Acme (Jewel Foods Gift Card $25) 25 3.75% Grocery Acme (Jewel Foods Gift Card $100) 100 3.75% Grocery Albertsons (Jewel Foods Gift Card $25) 25 3.75% Grocery Albertsons (Jewel Foods Gift Card $100) 100 3.75% Grocery Angelo Caputo's $25 25 3.00% Grocery Angelo Caputos $100 100 3.00% Grocery Cub (Jewel Foods Gift Card $25) 25 3.75% Grocery Cub (Jewel Foods Gift Card $100) 100 3.75% Grocery Farm Fresh (Jewel Foods Gift Card $25) 25 3.75% Grocery Farm Fresh (Jewel Foods Gift Card $100) 100 3.75% Grocery Garden Fresh $20 20 3.75% Grocery Gordon Food Service $100 100 3.00% Grocery Gordon Food Service $25 25 3.00% Grocery Heinen's $25 25 3.75% Grocery Heinen's $50 50 3.75% Grocery Honey Baked Ham $25 25 7.50% Grocery Hornbachers (Jewel Foods Gift Card $25) 25 3.75% Grocery Hornbachers (Jewel Foods Gift Card $100) 100 3.75% Grocery Jewel Foods Gift Card $100 100 3.75% Grocery Jewel Foods Gift Card $25 25 3.75% Grocery Jewel Foods Gift Card $50 50 3.75% Grocery Joe Caputo & Sons $25 25 3.75% Grocery Marianos Fresh Market $100 100 3.75% Grocery Marianos Fresh Market $50 50 3.75% Grocery Marianos Fresh Market $25 25 3.75% Grocery Meijer $100 100 3.00% Grocery Meijer $25 25 3.00% Grocery Pete's Fresh Market $20 20 3.75% Grocery Safeway $100 100 3.75% Grocery Safeway $25 25 3.75% Grocery Safeway $50 50 3.75% Grocery Sam's Club (Walmart $25) 25 2.63% Grocery Sam's Club (Walmart $50) 50 2.63% Grocery Sam's Club (Walmart $100) 100 2.63% Grocery Shaws/Star Market (Jewel Foods Gift Card $25) 25 3.75% Grocery Shaws/Star Market (Jewel Foods Gift Card $100) 100 3.75% Grocery Shop N Save St. -

Comcast Reaches Agreement to Acquire Fandango and Announces Plan to Launch Fancast.Com, New National Online Destination

Comcast Reaches Agreement to Acquire Fandango and Announces Plan to Launch Fancast.com, New National Online Destination Comcast Interactive Media Makes Strategic Addition with Fandango, One of Web's Top Movie and Entertainment Sites PHILADELPHIA and LOS ANGELES, April 11 /PRNewswire-FirstCall/ -- Comcast Corporation (Nasdaq: CMCSA, CMCSK), the nation's leading provider of cable, entertainment and communications products and services, today announced that it has reached an agreement to acquire Fandango, the nation's premier destination for movie information, showtimes and ticketing, and one of the Web's top entertainment sites. The company also announced plans to launch Fancast.com, a new national online destination that will enable consumers to search, discover, manage and enjoy their entertainment experience across many devices and channels, including television, computers, DVDs and wireless services. Comcast has a major Internet presence, through Comcast.net, which is now a top 10 site with more than 2.5 billion page views, more than 80 million videos viewed and 15 million unique visitors per month. Comcast will leverage its experience as the nation's largest buyer of video content, serving nearly 25 million cable customers and 11.5 million broadband customers, to expand its existing video-centric websites and create a new online destination, Fancast.com. Fandango, which is a top online brand and destination where millions of people visit every month to learn about movies and purchase theater tickets, will be an integral component of the Fancast user experience. Fandango.com is already a top entertainment site and one of the nation's largest movie sites with between 4 and 5 million unique visitors each month. -

Reproductions Supplied by EDRS Are the Best That Can Be Made from the Original Document

DOCUMENT RESUME ED 480 373 PS 031 482 TITLE Marketing Violent Entertainment to Children: A Twenty-One Month Follow-Up Review of Industry Practices in the Motion Picture, Music Recording and Electronic Game Industries. A Report to Congress. INSTITUTION Federal Trade Commission, Washington, DC. PUB DATE 2002-06-00 NOTE 63p.; For the Six-Month Follow-Up Review, see ED 452 453, and for the One Year Follow-Up Review, see PS 031 481. AVAILABLE FROM Federal Trade Commission, 600 Pennsylvania Avenue, NW, Washington, DC 20580. Tel: 877-FTC-HELP (Toll Free); Web site: http://www.ftc.gov. For full text: http://www.ftc.gov/reports/ violence/mvecrpt0206.pdf. PUB TYPE Reports - Evaluative (142) EDRS PRICE EDRS Price MF01/PC03 Plus Postage. DESCRIPTORS Adolescents; *Advertising; Children; *Compliance (Legal); Federal Regulation; *Film Industry; Influences; Mass Media; *Mass Media Role; Merchandising; Popular Music; Video Games; *Violence IDENTIFIERS Entertainment Industry; Federal Trade Commission; *Music Industry ABSTRACT In a report issued in September 2000, the Federal Trade Commission contended that the motion picture, music recording, and electronic game industries had engaged in widespread marketing of violent movies, music, and games to children inconsistent with their own parental advisories and undermining parents' attempts to make informed decisions about their children's exposure to violent content. This report responds to requests of the Congressional Committees on Appropriations and from 18 representatives by documenting progress regarding advertisement placement in popular teen media and disclosure of rating and labeling information in advertising. The report details findings that there were virtually no ads for R-rated movies in popular teen magazines, with only one ad for an R-rated video advertised in two teen-oriented magazines. -

12 KB Jul 28Th, 2013 Exhibition Giant Carmike Cinemas Joins National

THE NATIONAL ASSOCIATION For Immediate Release OF THEATRE OWNERS Exhibition Giant Carmike Cinemas Joins National Association of Theatre Owners NORTH HOLLYWOOD, Calif. (April 23, 2003) – Carmike Cinemas, one of the world’s largest theatre chains with a fleet of 2,262 U.S. screens, has joined the National Association of Theatre Owners (NATO), it was announced today. “Michael Patrick’s Carmike team brings a wealth of knowledge and experience to the table and NATO welcomes their leadership as we confront the many challenges and examine the many opportunities facing exhibition,” said NATO president John Fithian. “With Michael and his talented staff now part of NATO, the exhibition industry has never stood more united.” Carmike CEO Michael Patrick stated “Carmike recognizes the many benefits available to us by becoming active members in NATO and we approach this alliance with extreme optimism knowing that as a represented industry we can successfully address any issue before this organization.” Headquartered in Columbus, Ga., Carmike today ranks among the nation’s three largest cinema chains, with more than 308 cinema sites spread across 35 U.S. states. “Carmike’s joining with NATO represents an enormous milestone for this association, which now counts among its membership every U.S. cinema chain operating more than 200 screens, except one,” said Fithian. With Carmike’s membership, NATO – long the world’s largest trade association for cinema owners – now represents 24 of the 25 largest U.S. cinema chains, including Regal Entertainment Group, Cinemark USA, Loews Cineplex Entertainment, National Amusements, Century Theatres, Kerasotes Theatres, Marcus Theatres, Wallace Theatres, Pacific Theatres, Goodrich Quality Theatres, GKC Theatres, Clearview Cinemas, Caribbean Cinemas, Malco Theatres, Harkins Theatres, Muvico Theatres, Consolidated Theatres, Georgia Theatre Company, Signature Theatres, Eastern Federal, Wehrenberg Theatres, Crown Theatres and Mann Theatres -- as well as more than 500 smaller theatre companies throughout the United States and around the world. -

The Changing Relationship Between Movie Studios and Exhibitors Due to the Rise of Movie Theater Consolidation

Theory and Evidence… The Changing Relationship between Movie Studios & Exhibitors Due to the Rise of Movie Theater Consolidation by Anu R. Ganti An honors thesis submitted in partial fulfillment of the requirements for the degree of Bachelor of Science Undergraduate College Leonard N. Stern School of Business New York University May 2005 Professor Marti G. Subrahmanyam Professor Al Lieberman Faculty Adviser Thesis Advisor 1 Table of Contents INTRODUCTION .......................................................................................................................... 3 PROBLEM STATEMENT .................................................................................................................... 4 HYPOTHESIS .................................................................................................................................... 4 The Transition to Digital Cinema .................................................................................................. 4 On-Screen Cinema Advertising ...................................................................................................... 9 Movie Co-Op Advertising ............................................................................................................. 12 Threats to Movie Theater Chains ................................................................................................ 14 Movie Marketing .......................................................................................................................... 18 Conclusion ................................................................................................................................... -

And Kerasotes Theatres Announce Entry Into Definitive Agreement

MEDIA CONTACTS AMC Entertainment Sun Dee Larson, (816) 480-5861 FOR IMMEDIATE RELEASE [email protected] Kerasotes Showplace Theatres James DeBruzzi, (312) 756-3365 [email protected] AMC ENTERTAINMENT® AND KERASOTES THEATRES ANNOUNCE ENTRY INTO DEFINITIVE AGREEMENT Kansas City, Mo. (Jan. 19, 2010) – AMC Entertainment Inc. (“AMC”), and Kerasotes Showplace Theatres, LLC (“Kerasotes”), two leading theatrical exhibition and entertainment companies in the U.S., announced today that they have entered into a definitive agreement pursuant to which AMC will acquire substantially all of the assets of Kerasotes. Kerasotes owns 96 theatres and 973 screens in mid- sized, suburban and metropolitan markets, primarily in the Midwest. More than three quarters of the Kerasotes theatres feature stadium seating and almost 90 percent have been newly built since 1994. Following the consummation of the proposed transaction, Tony and Dean Kerasotes will retain and operate their two new ICON concept theatres in Minneapolis, MN and Chicago, IL; and one Showplace theatre in Secaucus, NJ. Kerasotes is currently owned by the Kerasotes family and Providence Equity Partners. "Combining Kerasotes’ highly regarded assets and operations with our own is a natural way for us to continue re-defining the future of our industry,” said Gerry Lopez, AMC CEO and president. “With almost 200 years in the exhibition business between us, our collective experiences and our complementary geographic footprints will allow us to maintain the reputation for excellence and leadership that is part of each company’s culture.” “Our team has delivered a consistent, high quality experience for customers, and we have appreciated Providence’s partnership over the last six years in helping Kerasotes grow into the sixth largest motion picture exhibition company in North America,” said Tony Kerasotes, Chief Executive Officer. -

BI Movie Magic: Maps, Graphs, and BI Dashboards at AMC Theatres

BI Movie Magic: Maps, Graphs, and BI Dashboards at AMC Theatres Session ID: 10553 Prepared by: Tim Vlamis VP & Analytics Strategist Vlamis Software Solutions [email protected] www.vlamis.com @TimVlamis Agenda: • About AMC • Challenges • Strategy • Journey • Solution Set – Maps – Graphs – BI Dashboards • Next Steps • Questions Vlamis Software Solutions • Vlamis Software founded in 1992 in Kansas City, Missouri • Developed more than 200 Oracle BI and Analytics systems • Specializes in ORACLE-based: • Business Intelligence & Analytics • Data Mining and Predictive Analytics • Data Visualization • Data Warehousing • Expert presenter at major Oracle conferences • www.vlamis.com (blog, papers, newsletters, services) • Co-authors of book “Data Visualization for OBI 11g” • Co-author of book “Oracle Essbase & Oracle OLAP” • Oracle University Partner • Oracle Gold Partner Copyright © 2016, Vlamis Software Solutions, Inc. Tim Vlamis Vice President & Analytics Strategist – 30+ years experience in business modeling and valuation, forecasting, and scenario analyses – Oracle ACE – Instructor for Oracle University’s Data Mining Techniques and Oracle R Enterprise Essentials Courses – Professional Certified Marketer (PCM) from AMA – Adjunct Professor of Business Benedictine College – MBA Kellogg School of Management (Northwestern University) – BA Economics Yale University [email protected] Copyright © 2016, Vlamis Software Solutions, AMC History • 1920 Maurice, Edward and Barney Dubinsky purchase the Regent Theatre in Kansas City, Mo. • 1961 Stanley Durwood becomes CEO of the company and renames it American Multi-cinema. • 1962 AMC opens the world’s first multiplex, the Parkway Twin in Kansas City. • 1981 AMC becomes the first theatre chain to add cupholder armrests. • 1991 Introduces Clip®, a “film strip” character to serve as an ambassador of the brand and its Silence is Golden® program • 1995 AMC opens the world’s first megaplex. -

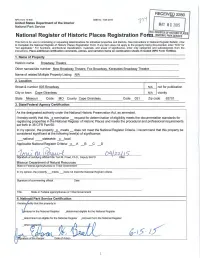

Broadway Theatre Other Names/Site Number New Broadway Theatre, Fox Broadway, Kerasotes Broadway Theatre Name of Related Multiple Property Listing N /A______

RECEIV§Q 2280 NPS Form 10-900 0MB No. 1024-0018 United States Department of the Interior National Park Service MAY OI 2015 NAT. REGISTER OF HISTORIC PLACES National Register of Historic Places Registration Fo NATIONAL PARK SERVICE This form is for use in nominating or requesting determinations for individual properties and districts. See instructions in National Register Bulletin, How to Complete the National Register of Historic Places Registration Form. If any item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, architectural classification, materials, and areas of significance, enter only categories and subcategories from the instructions. Place additional certification comments, entries, and narrative items on continuation sheets if needed (NPS Form 10-900a). 1. Name of Property Historic name Broadway Theatre Other names/site number New Broadway Theatre, Fox Broadway, Kerasotes Broadway Theatre Name of related Multiple Property Listing _N_/A_________________________ _ 2. Location Street & number _8_05_ B_ro_a_d_w_a_y___ ___________________ _N_/_A___, not for publication 0 City or town Cape Girardeau NIA vicinity State Missouri Code MO County Cape Girardeau Code 031 Zip code 63701 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this _xnomination _ request for determination of eligibility meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements set forth in 36 CFR Part 60. In my opinion, the property 2_ meets_ does not meet the National Register Criteria. I recommend that this property be considered significant at the following level(s) of significance: _national __statewide _x_local Applicable National Register Criteria: _x_A _B _C D 6 Missouri Department of Natural Resources State or Federal agency/bureau or Tribal Government In my opinion, the property _meets _does not meet the National Register criteria.