Bennelong Kardinia Absolute Return Fund Monthly Performance Report As at 30 September 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code Security Description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LI

15-Jun-16 Australian Dividend Index Trust NTA & Allotment Notice The manager of the Australian Dividend Index Trust advises that as at close of business on 14 June 2016 a total of Nil units has been redeemed or allotted since 13 June 2016. The total number of units on issue on that day was 39,290,493. The asset backing for each ASD unit at close of business (Sydney) on 14 June 2016 was $1.49373 (NTA is net of applicable tax liability). The tracking difference was 2.35% Please note Basket applications and redemptions will be unavailable from Wednesday 15 June to Wednesday 29 June. Basket applications and redemptions will resume on Thursday 30 June. The following companies are currently in the Fund: Code Security description AAD ARDENT LEISURE GROUP ABC ADELAIDE BRIGHTON AGL AGL ENERGY LTD AHG AUTOMOTIVE HOLDINGS G AMP AMP LIMITED ANZ AUSTRALIA AND NEW ZEA APA APA GROUP AST AUSNET SERVICES ASX ASX LIMITED BEN BENDIGO AND ADELAIDE BOQ BANK OF QUEENSLAND CBA COMMONWEALTH BANK OF CGF CHALLENGER LIMITED CIM CIMIC GROUP LIMITED O CSR CSR LIMITED DOW DOWNER EDI LIMITED DUE DUET GROUP FLT FLIGHT CENTRE TRAVEL FXJ FAIRFAX MEDIA LTD FXL FLEXIGROUP LIMITED GEM G8 EDUCATION ORD GMA GENWORTH MORTGAGE INS HVN HARVEY NORMAN HOLDING IAG INSURANCE AUSTRALIA G IFL IOOF HOLDINGS LTD JBH JB HI-FI LIMITED LLC LENDLEASE CORPORATION MMS MCMILLAN SHAKESPEARE MQG MACQUARIE GROUP LTD NAB NATIONAL AUSTRALIA BA NVT NAVITAS LIMITED ORI ORICA LIMITED PPT PERPETUAL TRUSTEES AU PTM PLATINUM ASSET MANAGE RFG RETAIL FOOD GROUP RIO RIO TINTO LIMITED SHL SONIC HEALTHCARE LTD SKI SPARK INFRASTRUCTURE SPK SPARK NEW ZEALAND LIM SPO SPOTLESS GROUP HOLDIN SUL SUPER RETAIL GROUP LI SUN SUNCORP GROUP LTD SVW SEVEN GROUP HOLDINGS SYD SYDNEY AIRPORT UNITS TCL TRANSURBAN GROUP (ORD TLS TELSTRA CORPORATION L WBC WESTPAC BANKING CORP WES WESFARMERS LIMITED WOW WOOLWORTHS LIMITED WPL WOODSIDE PETROLEUM LT For further information please contact: Smartshares Limited 0800 80 87 80 [email protected]. -

Annual Report 2014 Contents

#LOVEBOQ ANNUAL REPORT 2014 CONTENTS DIRECTORS’ REPORT 2 DIRECTORS’ DETAILS 2 OPERATING AND FINANCIAL REVIEW 5 PERFORMANCE REMUNERATION REPORT 12 INTRODUCTORY MESSAGE 12 REMUNERATION REPORT 12 LEAD AUDITOR’S INDEPENDENCE DECLARATION 36 CORPORATE GOVERNANCE 37 SNAPSHOT FINANCIAL REPORT 47 INCOME STATEMENTS 47 STATEMENTS OF COMPREHENSIVE INCOME 48 BALANCE SHEETS 49 STATEMENTS OF CHANGES IN EQUITY 50 STATEMENTS OF CASH FLOWS 54 NOTES TO THE FINANCIAL STATEMENTS 55 OTHER INFORMATION 113 DIRECTORS’ DECLARATION 113 INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS 114 SHAREHOLDING DETAILS 116 SHAREHOLDER INFORMATION 119 PERFORMANCE SNAPSHOT STATUTORY NETafter PROFITtax EARNINGS PER SHARE cash basic up up 5m to . to $260 89.5c CASH EARNINGS after tax DIVIDEND PERfull SHAREyear ordinary up up to $301.2m to 66c 1 Bank of Queensland Limited and its Controlled Entities A.B.N. 32 009 656 740. DIRECTORS’ REPORT Year Ended 31 August 2014 The Directors’ present their report together with the financial report of Bank of Queensland Limited (“the Bank”) and of the Consolidated Entity, being the Bank and its controlled entities for the year ended 31 August 2014 and the independent auditor’s report thereon. DIRECTORS’ DETAILS The Directors of the Bank at any time during or since the end of the financial year are: Name, qualifications and independence status Age Experience, special responsibilities and other Directorships Roger Davis 62 Mr Davis was appointed Chairman on 28 May 2013 and has been a Director since August B.Econ. (Hons), 2008. He has 32 years’ experience in banking and investment banking in Australia, the US and Master of Philosophy Japan. -

For Personal Use Only Use Personal For

ADDRESS CONTACT DETAILS UNIT REGISTRY Level 16 Telephone +61 2 9409 3670 c/- Link Market Services Limited 61 Lavender Street Investor Services 1800 ARDENT Level 12, 680 George Street Milsons Point NSW 2061 Fax +61 2 9409 3679 Sydney NSW 2000 AUSTRALIA www.ardentleisure.com Locked Bag A14 Sydney South NSW 1235 Telephone 1300 720 560 [email protected] ASX RELEASE 13 June 2012 The Manager Company Notices Section ASX Limited 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam MORGAN STANLEY CONFERENCE PRESENTATION Please find attached for release to the market a presentation to be given by Mr Greg Shaw today at the Morgan Stanley Emerging Companies Conference. Yours faithfully Alan Shedden Company Secretary Ardent Leisure Group is a specialist operator of leisure and entertainment assets across Australia, New Zealand and the United States. The Group operates Dreamworld, WhiteWater World, SkyPoint, d’Albora Marinas, AMF and Kingpin bowling centres and Goodlife fitness centres across Australia and New Zealand. The Group also operates the Main Event family entertainment centres in the United States. For further information on the Group’s activities please visit our website at www.ardentleisure.com.au For personal use only Ardent Leisure Group Comprising Ardent Leisure Trust ARSN 093 193 438 (Manager: Ardent Leisure Management Limited ABN 36 079 630 676, AFS Licence No. 247010) and Ardent Leisure Limited ABN 22 104 529 106 Morgan Stanley 2012 Emerging Companies Conference For personal use only Ardent Leisure Profile ― Ardent Leisure is one of Australia’s largest specialist operators of leisure and entertainment assets. ― Occupies dominant positions in a range of affordable leisure sectors: Sector Businesses Number Theme parks Dreamworld, WhiteWater World, and SkyPoint 3 Bowling AMF and Kingpin 49 Health Clubs Goodlife Health Clubs 45 Family Entertainment Centres Main Event USA 10 Marinas D’Albora Marinas 7 ― Resilient earning streams from diverse affordable leisure product range which For personal use only appeals to price conscious consumer. -

It's Personal

SIMON PUGH & PETER WOODS QLM Label Makers BOQ Business Banking customers It’s personal LYNNE POWER BOQ Owner-Manager KATIE KOCHANSKI Daisy Hill branch BOQ customer since age 7 Shareholder Review 2010 BOQ SHR 2010 FA - PRINT.indd 2 21/10/10 11:30 AM JONAH & AMBER Community members SHIRLEY KOLPAK Shareholder It’s personal BOQ SHR 2010 FA - PRINT.indd 3 21/10/10 11:30 AM CONTENTS 1 Operational overview 3 Acquisitions 4 Financial highlights 7 Chairman’s report 11 Managing Director’s report 15 Community 17 Customers 17 Environment 18 Employees 19 Executive team 21 Your Board 25 Remuneration overview 26 Financial calender BOQ SHR 2010 FA - PRINT.indd 4 21/10/10 11:30 AM BRAND RELAUNCH In February 2010, BOQ launched At BOQ, most of our branches are run by local a new brand promise: Owner-Managers. This means they’re running your own personal bank a small business, so they get what it means to The new brand was the culmination of deliver personal service. So we really can deliver an 18 month “inside out” brand review, on our promise of being your own personal bank. where both staff and customers helped The brand relaunch also represented the to really define what makes BOQ different perfect moment in time to reintroduce ourselves to the other banks. The overwhelming as BOQ, rather than the state-centric name of response was that for us, it’s personal. Bank of Queensland. Over the past decade, we have expanded right across Australia. And it all started with this simple question. -

Betashares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security

BetaShares Portfolio Holdings ETF Name BETASHARES FTSE RAFI AUSTRALIA 200 ETF ETF ASX Code QOZ Date: 6/09/2016 Security/Code Security Name Weighting # securities Market value BHP BHP BILLITON LTD 9.13% 385,882 $ 7,848,840 CBA COMMONWEALTH BANK OF AUSTRAL 7.49% 89,038 $ 6,438,338 ANZ AUST AND NZ BANKING GROUP 7.39% 233,137 $ 6,352,983 WBC WESTPAC BANKING CORP 7.13% 206,613 $ 6,130,208 NAB NATIONAL AUSTRALIA BANK LTD 6.63% 206,485 $ 5,703,116 WES WESFARMERS LTD 4.17% 84,121 $ 3,583,555 WOW WOOLWORTHS LTD 3.73% 133,217 $ 3,203,869 RIO RIO TINTO LTD 2.12% 37,909 $ 1,823,423 SUN SUNCORP-METWAY LTD 2.09% 139,200 $ 1,794,288 WPL WOODSIDE PETROLEUM LTD 1.76% 53,115 $ 1,514,309 ORG ORIGIN ENERGY LTD 1.69% 276,343 $ 1,450,801 MQG MACQUARIE GROUP LTD 1.66% 17,366 $ 1,426,443 TLS TELSTRA CORP LTD 1.61% 269,524 $ 1,388,049 AMP AMP LTD 1.50% 240,024 $ 1,286,529 QBE QBE INSURANCE GROUP LTD 1.46% 127,707 $ 1,259,191 FMG FORTESCUE METALS GROUP LTD 1.46% 249,258 $ 1,251,275 SCG SCENTRE GROUP 1.01% 176,862 $ 866,624 IAG INSURANCE AUSTRALIA GROUP 1.00% 152,729 $ 858,337 WOR WORLEYPARSONS LTD 0.91% 96,847 $ 785,429 STO SANTOS LTD 0.90% 175,609 $ 777,948 AMC AMCOR LIMITED 0.90% 47,631 $ 774,004 CTX CALTEX AUSTRALIA LTD 0.85% 21,632 $ 733,108 FBU FLETCHER BUILDING LTD 0.84% 70,092 $ 724,751 AGL AGL ENERGY LTD 0.80% 37,247 $ 690,932 SGP STOCKLAND 0.78% 138,071 $ 666,883 CSL CSL LTD 0.77% 6,338 $ 664,983 LLC LEND LEASE GROUP 0.74% 44,545 $ 633,875 NCM NEWCREST MINING LTD 0.72% 26,978 $ 622,382 ORI ORICA LTD 0.71% 42,615 $ 609,821 MTS METCASH LTD 0.65% 265,979 -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Factsheet Templates

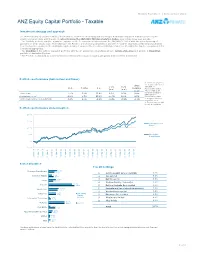

Monthly Fact Sheet | 31 December 2019 ANZ Equity Capital Portfolio - Taxable Investment strategy and approach 3610 The Australian Equity Capital Portfolio (‘the Portfolio’) focuses on identifying and investing in Australian companies that willprovide capital growth to shareholders with the aim of outperforming the S&P/ASX 300 Accumulation Index, over rolling three year periods. - The Portfolio seeks to combine a passive exposure to the 20 companies that comprise the S&P/ASX 20 Index with two actively managed portfolios of 10-20 stocks each. The holdings in the Portfolio are generally comprised of between 40 and 50 securities, predominantly selected from the top 300 equities in the Australian equities market. However the Investment Manager many invest outside the top 300 companies if it is considered appropriate. -Theblending of the actively managed portfolios with the 20 passively held positions aims to reduce style bias and provide a diversified portfolio of Australian Equities. - The Portfolio is designed as a core investment offering with a focus on quality companies and long-term investment. #N/A Portfolio performance (before fees and taxes) 31/10/2008 31/10/2008 1 3 12 36 60 Since 1. Before 14 July 2017, Since the benchmark refers to 3 yrs 5 yrs S&P/ASX 100 1mth 3 mths 1 yr inception (p.a.) (p.a.) Accumulation Index . (p.a.)2 After 14 July 2017, benchmark refers to 1 Total return -1.7% 2.7% 22.6% 9.0% 8.0% 8.5% S&P/ ASX 300 1 1 Benchmark return -2.0% 0.7% 23.8% 10.4% 9.0% 9.6% Accumulation Index. -

Ardent Leisure Group Limited FY19 Results Presentation

Ardent Leisure Group Limited FY19 Results Presentation August 2019 0 Disclaimer This information has been prepared for general information purposes only, is not general financial product advice and has been prepared by Ardent Leisure Group Limited (ABN 51 628 881 603) (ALG), without taking into account any potential investors’ personal objectives, financial situation or needs. Past performance information provided in this presentation may not be a reliable indication of future performance. Due care and attention has been exercised in the preparation of forecast information, however, forecasts, by their very nature, are subject to uncertainty and contingencies many of which are outside the control of ALG. Actual results may vary from forecasts and any variation may be materially positive or negative. ALG does not provide assurances in respect of the obligations of any controlled entities. The information in this presentation is provided in summary form and is therefore not necessarily complete. The information contained herein is current as at the date of this presentation unless specified otherwise. 1 FY19 Group Overview 2 Key messages ▪ Revenue and EBITDA (before Specific Items) from continuing businesses were up 14.4% and 15.7% respectively over the prior year ▪ Main Event revenue in USD grew 7.9% reflecting contributions from centres opened in FY18 and FY19. Constant centre revenue decreased by 1.0% on a like-for-like basis1 ▪ Main Event aims to return EBITDA margins in excess of 20%2 over the medium term ▪ Theme Parks revenue was broadly in line with pcp. Attendance was adversely impacted by the Coronial Inquest hearings held during 1H19, along with the opening of Sky Voyager taking longer than anticipated. -

Single Sector Funds Portfolio Holdings

! Mercer Funds Single Sector Funds Portfolio Holdings December 2020 welcome to brighter Mercer Australian Shares Fund Asset Name 4D MEDICAL LTD ECLIPX GROUP LIMITED OOH MEDIA LIMITED A2 MILK COMPANY ELDERS LTD OPTHEA LIMITED ABACUS PROPERTY GROUP ELECTRO OPTIC SYSTEMS HOLDINGS LTD ORICA LTD ACCENT GROUP LTD ELMO SOFTWARE LIMITED ORIGIN ENERGY LTD ADBRI LTD EMECO HOLDINGS LTD OROCOBRE LTD ADORE BEAUTY GROUP LTD EML PAYMENTS LTD ORORA LTD AFTERPAY LTD ESTIA HEALTH LIMITED OZ MINERALS LTD AGL ENERGY LTD EVENT HOSPITALITY AND ENTERTAINMENT PACT GROUP HOLDINGS LTD ALKANE RESOURCES LTD EVOLUTION MINING LTD PARADIGM BIOPHARMACEUTICALS LTD ALS LIMITED FISHER & PAYKEL HEALTHCARE CORP LTD PENDAL GROUP LTD ALTIUM LTD FLETCHER BUILDING LTD PERENTI GLOBAL LTD ALUMINA LTD FLIGHT CENTRE TRAVEL GROUP LTD PERPETUAL LTD AMA GROUP LTD FORTESCUE METALS GROUP LTD PERSEUS MINING LTD AMCOR PLC FREEDOM FOODS GROUP LIMITED PHOSLOCK ENVIRONMENTAL TECHNOLOGIES AMP LTD G8 EDUCATION LTD PILBARA MINERALS LTD AMPOL LTD GALAXY RESOURCES LTD PINNACLE INVESTMENT MANAGEMENT GRP LTD ANSELL LTD GDI PROPERTY GROUP PLATINUM INVESTMENT MANAGEMENT LTD APA GROUP GENWORTH MORTGAGE INSRNC AUSTRALIA LTD POINTSBET HOLDINGS LTD APPEN LIMITED GOLD ROAD RESOURCES LTD POLYNOVO LIMITED ARB CORPORATION GOODMAN GROUP PTY LTD PREMIER INVESTMENTS LTD ARDENT LEISURE GROUP GPT GROUP PRO MEDICUS LTD ARENA REIT GRAINCORP LTD QANTAS AIRWAYS LTD ARISTOCRAT LEISURE LTD GROWTHPOINT PROPERTIES AUSTRALIA LTD QBE INSURANCE GROUP LTD ASALEO CARE LIMITED GUD HOLDINGS LTD QUBE HOLDINGS LIMITED ASX LTD -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd. -

Ardent Leisure Group Securityholder Booklet Corporatisation and Restructure Proposal 10 October 2018

CONTACT DETAILS REGISTRY Level 8, 60 Miller Street c/- Link Market Services Limited Ardent Leisure Trust North Sydney NSW 2060 Level 12, 680 George Street ARSN 093 193 438 AUSTRALIA Sydney NSW 2000 Ardent Leisure Limited Telephone +61 2 9168 4600 Locked Bag A14 ABN 22 104 529 106 Fax +61 2 9409 3679 Sydney South NSW 1235 Ardent Leisure Management Limited www.ardentleisure.com Telephone 1300 720 560 ABN 36 079 630 676 [email protected] (AFS Licence No. 247010) ASX RELEASE 10 October 2018 ARDENT LEISURE GROUP ANNOUNCES COURT APPROVAL TO DESPATCH SECURITYHOLDER BOOKLET AND CONVENE SCHEME MEETINGS Ardent Leisure Limited and Ardent Leisure Management Limited in its capacity as responsible entity of the Ardent Leisure Trust (together, Ardent Leisure Group) (ASX: AAD) are pleased to announce that the Supreme Court of New South Wales (the Court) has made orders approving the despatch of the securityholder booklet (Securityholder Booklet) in relation to the proposal for the corporatisation of the Ardent Leisure Group which will involve a new company called Ardent Leisure Group Limited (NewCo) becoming the single head entity of the Ardent Leisure Group in place of the current stapled structure (the Proposal). The Court has also ordered that meetings of Ardent Leisure Group securityholders be convened to consider and vote on the Proposal (Scheme Meetings). The implementation of the Proposal remains subject to the satisfaction or waiver (as applicable) of certain conditions precedent. The Proposal requires the approval of Ardent Leisure Group Securityholders at Meetings to be held on: Tuesday, 20 November 2018 from 10.45am (Sydney time) (or as soon thereafter as the AGM has concluded) at The Mint, 10 Macquarie Street, Sydney, NSW 2000 Information relating to the Proposal, including the Notice convening the Scheme Meetings and the Independent Expert's Report, is included in the attached Securityholder Booklet, which has been registered with the Australian Securities and Investments Commission today.