HASTOE CAPITAL PLC £75000000 5.60 Per Cent

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HASTOE CAPITAL PLC (Incorporated in England and Wales with Limited Liability Under the Companies Act 2006, Registered Number 7977629) £100,000,000 5.60 Per Cent

HASTOE CAPITAL PLC (Incorporated in England and Wales with limited liability under the Companies Act 2006, registered number 7977629) £100,000,000 5.60 per cent. Secured Bonds due 2042 Issue Price: 99.597 per cent. The £100,000,000 5.60 per cent. Secured Bonds due 2042 (the Bonds) are issued by Hastoe Capital plc (the Issuer). Application has been made to the Financial Services Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 (the UK Listing Authority) for the Bonds to be admitted to the Official List of the UK Listing Authority and to the London Stock Exchange plc (the London Stock Exchange) for the Bonds to be admitted to trading on the London Stock Exchange's regulated market. The London Stock Exchange's regulated market is a regulated market for the purposes of Directive 2004/39/EC (the Markets in Financial Instruments Directive). An investment in the Bonds involves certain risks. For a discussion of these risks see "Risk Factors". Subject as set out below, the net proceeds from the issue of the Bonds will be advanced by the Issuer to Hastoe Housing Association Limited (the Borrower) pursuant to a bond loan agreement between the Borrower and the Issuer to be dated on or around the Issue Date (the Loan Agreement) to be applied in accordance with the Borrower's objects. The Original Commitment (as defined in the Loan Agreement) may be drawn in one or more drawings, each in a principal amount up to an amount which corresponds to the Minimum Value of the NAB Charged Properties multiplied by the Issuer's Security Percentage (each as defined below) (in each case, as at the date of such drawing) less the principal amount of all previous drawings in respect of the Original Commitment. -

MINUTES of the MEETING of TRING TOWN COUNCIL HELD in the COUNCIL CHAMBER, the MARKET HOUSE, HIGH STREET, TRING on MONDAY 23Rd JULY 2018 at 7.30 P.M

- 6649 - MINUTES OF THE MEETING OF TRING TOWN COUNCIL HELD IN THE COUNCIL CHAMBER, THE MARKET HOUSE, HIGH STREET, TRING ON MONDAY 23rd JULY 2018 AT 7.30 p.m. Present: Councillors: Mrs P. Hearn (Chairman) J. Bowden Mrs O. Conway H. Grace S. Hearn M. Hicks P. Hills N. Hollinghurst N. Nutkins Mrs R. Ransley C. Townsend G. Wilkins Also Present: Mr M. Curry, Town Clerk Mrs D. Slade, Deputy Town Clerk 7 Members of the public 19326. TO RECEIVE APOLOGIES FOR ABSENCE None received. 19327. TO MAKE DECLARATIONS OF INTEREST Cllr S Hearn would leave the room when in item 19340 was discussed as a director of Tring Together. Cllr Mrs Conway explained that she would not take part in item 19332 as a member of Dacorum Borough Council’s Development Control Committee. 19328. TO CONFIRM THE MINUTES OF THE ORDINARY COUNCIL MEETING HELD ON 25TH JUNE 2018 RESOLVED: To accept the Minutes and for the Mayor to sign them. 19329. MATTERS OF REPORT FROM THE MINUTES The Clerk reported the following actions All recipients of annual grants have bene asked to present to Council in September or October Letters of thanks had been received from the High Street Baptist Church and the Tring and District Local History and Museum Society for the grants given to them by the Town Council The Mayor announced the winners of the Annual Garden Competition: o Tring UDC Cup - best overall – 66 Grove Road o Trevor Marwood Cup - Small Garden – 18 Henry Street o Coulter Cup - Eight Acres – 82 Eight Acres - 6650 - 19330. -

Chilterns Walking Festival Autumn – Proof 4 Online.Indd

15 OCTOBER – 1 NOVEMBER 2020 Chilterns Walking Festival visitchilterns.co.uk/walkingfestival BOOK ONLINE Welcome to the 7th Chilterns Walking Festival KEY From Hitchin in Hertfordshire to Goring in Oxfordshire, the Chilterns Walking Festival F F Free event 1 Difficulty2 F 3 14 25 Dogs3 on lead4 5 1 2 3 4 5 Range: 1 – 5 welcome provides over 50 opportunities to enjoy beech 1 = easy woodlands, nature reserves, family walks F F FamilyF 1 Near2 public31 4 2 53Accessible1 4 2 5 3 4 5 friendly and much more, all in the expert care of a transport knowledgeable guide. Covid-19 – Keeping you safe HEALTH & WELLBEING BOOK ONLINE All Chilterns Walking Festival walks and events events will be risk assessed and Covid-19 TASTER sessions Further information and booking safety precautions adhered to, including and outdoor learning please visit our website maintaining a 2 metre social distance and www.visitchilterns.co.uk/walkingfestival limiting numbers. WALKS for ALL where you will also find full details of all Booking is essential for all events and events, including information on walk grades, participants will be asked to provide suitability for children and dogs, booking telephone and email details for purposes guidance etc. of contact tracing. For further information see here. www.visitchilterns.co.uk/walkingfest BOOK ONLINE www.visitchilterns.co.uk/walkingfest Routes to the Past: Chinnor Woodland walks from Nettlebed Here, furtherRusty, images Knights, will be displayed Mosquitos providing and a moreperfect ... spot for a picnic and a continuing journey along the Chess Valley. Thursday 15 10am 4 miles Walk (0009) Saturday 17 10am 9 miles Walk (1001) Saturday 17 10.15am 3 miles Walk (0001) Join Community Heritage Officer Sam Johansen for a walk taking You can choose a morning walk, an afternoon walk, or both. -

Pitstone Guide 2016/17

Pitstone Guide 2016/17 CONTENTS Page 3 Welcome to the Pitstone Guide 4 Pitstone’s History 5 Pitstone Today 6-11 Places of Interest to Visit 12-15 Churches and Church Services 16-19 Activity Venues 20-23 Eating and Drinking—cafes, pubs, restaurants and take aways 24-26 Charities Benefitting Parishioners 27 Help with Transport 28-29, 32-33 Biographies of Famous Pitstone Residents 30-31 Village Map 34-44 A-Z of Sports, Activities and Clubs 45-49 Local Walks 50-51 Easy Cycle Routes 52-53 Volunteering Opportunities 54-57 General Information 58 Pitstone Parish Council Services and Key Projects 59 Your Local Council Published October 2013 2 WELCOME TO THE PITSTONE GUIDE Welcome to the second edition of the Pitstone Guide. The parish council is very proud of our rural parish, set within some of the most beautiful countryside in England and we hope you are too. We have a dynamic and growing community of approximately 3,000 residents, with lots for everyone to get involved in and plenty of opportunities for you to broaden your skills or volunteer some time. Inside this guide, you will find details of all the local venues, clubs and associations - you will probably be surprised at the extent of activities available within our community, or just a short distance away. There are also local walks and cycle rides that will let you take in some of the breathtaking views. The parish and the surrounding area is steeped in fascinating history and there are plenty of opportunities for you to experience this. -

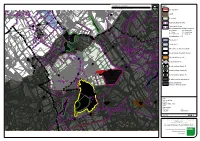

918.1 02 Designations

1:25,000 at A3 - kilometres: KEY 0 0.5 1 2 north O C A 145m Site boundary D O M N 120m Issues BP A A RO FB Manor S AD E 119m L D T UKE 93m E 120m R S Farm 120m TR 24 LA W C WI N W E AY HITH 145m 91m CHURCH E ILL B L 180m N Cowhill Spring Aspen's Path BOL Astrope G Path E Track R Lower End Farm W A A FB Issues RW V CK Path 125m I Harvington 135m Track 125m Track E 97m Church Drain Path TR 23 Gubblecote Drain Park 180m R Allot TR 28 R Astrope Path D Moat B489 D End B488 House Gdns 100m CHURCH ROAD 150m TUNNEL W H E C 85m Allot FB 120m Path V Path Moat 125m ER C H 145m 180m 243m 125m U 125m V Gdns B489 R IC Path TR 54 Path Allot CH Path Eriegh AR B488 Path R A Car Path Path Path L D L O G Path Path O ON Gdns A Manor E Path A QUARRY R D Track AONB OAD PW TR 52Astrope N O R Park Manor Farm G G O 185m PIS/8/1 R PW A Folly Path Track Path D 155m FB TR 22 M N 100m M 238m Puttenham A O A 130m 184m 245m 87m R S T R 150m TR 25 125m Court Astrope S T FB White Farm Moat O Astrope Path N Potash Farm LANE 135m Cottage TR 53 90m R College Moat OA SHIP Costello Drain Brook's Statnalls Brook's PIS/7/1 Farm Gubblecote FB Farm D 150m 220m Farm 133m Wood Statnalls Clipper Down Track 240m Cottage Ivinghoe Common 102m 137m Wood Grange Potash Dover TR 20 B Path 85m Track 230m Farm Bungalows 86m 140m 192m Castle Path Track 135m Workings Chalk (dis) Pit 235m Path ASTROPE o Green Belt 93m Path PIS/13/1 Dover TR 26 TR 27 195m PIS/12(BW)/1 95m 110m Track Track Puttenham House r 100m 225m Track 190m o 130m 175m LANE Path 180m TR 18 Gurney's Marsworth Path 115m War -

Hastoe Cross Cottage

HASTOE CROSS COTTAGE CHURCH LANE | HASTOE | TRING | HERTFORDSHIRE | HP23 6LU HASTOE CROSS COTTAGE CHURCH LANE | HASTOE | TRING | HERTFORDSHIRE HP23 6LU Mileages approx. Tring - 1.8 miles, Tring Station - 3.2 miles with direct line to London Euston from 30 minutes, Berkhamsted - 6.5 miles, Amersham - 8.7 miles, A41 bypass - 3.8 miles, M25 junction 20 – 16 miles, London Luton Airport 15.6 miles A Wonderful period country house with about 37 acres and extensive range of barns THE PROPERTY RECEPTION HALL | GARDEN ROOM | DINING ROOM | KITCHEN/BREAKFAST ROOM | SITTING ROOM | MORNING ROOM | OFFICE/HOME STUDY | UTILITY ROOM | CLOAKROOM | PRINCIPAL BEDROOM | BEDROOM WITH EN SUITE THREE FURTHER BEDROOMS | TWO BATHROOMS OUTSIDE/OUTBUILDINGS WONDERFUL MATURE PRIVATE GARDENS | LONG GRAVEL DRIVEWAY WITH TURNING CIRCLE | PARTY/SNOOKER BARN FIVE STABLES AND TACK ROOM | GARDEN STORES | GARAGE BARN PROVIDING SPACE FOR AT LEAST FOUR CARS | DOG KENNEL AND OPEN BAY STORAGE | TWO EXTENSIVE DETACHED STORAGE BARNS LAND FOUR ENCLOSED PASTURE GRAZING FIELDS | ONE WITH SPECTACULAR FAR REACHING VIEWS ACROSS THE CHILTERN HILLS IN ALL ABOUT 37.16 ACRES | 15.039 HECTARES SAVILLS SAVILLS SAVILLS HARPENDEN AMERSHAM COUNTRY HOUSE DEPARTMENT [email protected] [email protected] [email protected] 01582 465000 01494 787 785 0207 4998644 The Property Outside Hastoe Cross Cottage is a delightful Grade II The property is approached through electronically operated gates listed period house situated on the Herts/Bucks and over a long gravel driveway which takes you down to the border and within an Area of Outstanding house to a lovely turning circle. Attractive lawned front gardens Natural Beauty. Located towards the northern flank the driveway and feature numerous shrubs and trees. -

Bedford Borough Council Housing Strategy 2021-2026

Housing Strategy 2021 -2026 1 Contents 1. Executive Summary 2. Introduction 3. The National Context 4. The Bedford Borough Context 4.1. Strategies and Plans 4.2. Demographic Context – Understanding Our Population 5. Theme 1 – Understanding Housing Needs 5.1. Key Objective 5.2. Data Sources 5.3. Issues for Bedford Borough 5.4. Key Actions 6. Theme 2 – Delivering the Homes Required 6.1. Key Objective 6.2. Data Sources 6.3. Issues for Bedford Borough 6.4. Key Actions 7. Theme 3 - Making Best Use of Existing Housing 7.1. Key Objectives 7.2. Data Sources 7.3. Issues for Bedford Borough 2 7.4. Key Actions 8. Theme 4 - Meeting the Housing Needs of Vulnerable People 8.1. Key Objective 8.2. Data Sources 8.3. Issues for Bedford Borough 8.4. Key Actions 9. Action Plan 3 1. Executive Summary 1.1. All Local Housing Authorities have a responsibility to produce a Housing Strategy which details how they will undertake their strategic housing role. This Strategy sets out Bedford Borough’s housing objectives for the period 2021 – 2026 and how it will deliver them. 1.2. Bedford Borough’s housing objectives must be delivered in the context of the national and local operating environment. There have been significant changes to both since the adoption of the Borough’s Housing Strategy Review 2016 – 2020. 1.3. Significant legislation implemented since the adoption of Housing Strategy 2012 – on which the 2016 – 20 Review was based - includes: The Localism Act 2011, Care Act 2014, The Self-build and Custom Housebuilding Act 2015, Housing and Planning Act 2016 and the Homelessness Reduction Act 2017. -

Laxton-Hastoe-The-Stables-Property

THE STABLES HASTOE FOUR ATTRACTIVE FIVE-BEDROOM HOMES BUILT TO A HIGH SPECIFICATION WITHIN A RARELY AVAILABLE NEW BUILD DEVELOPMENT IN THE GREEN BELT AND AREA OF OUTSTANDING NATURAL BEAUTY. RURAL SETTING EXCLUSIVE CHARM & STYLE The development is located on Hastoe Hill, in the There is a great selection of pubs, restaurants and shops peaceful rural hamlet of Hastoe, within an Area of available including an M&S Food Hall and the highly Outstanding Natural Beauty and in the Green Belt. All acclaimed Akeman pub and restaurant. Tring railway The Stables provides just four luxury new build of the houses benefit from fantastic views across the station (approx 3.2 miles) offers quick and convenient homes in a gated development in a beautiful setting. Chilterns countryside and the location is perfect for access into London Euston in approx 35 mins, with the Each of the homes has a large, flat garden and stone country walks or cycle rides. A41 providing links to the M25 and M1 motorways. patio with views of the countryside beyond, together with additional paddock land which is perfect for In addition to being in such a peaceful and attractive There are many excellent independent and state schools families to enjoy. setting The Stables is located just 1.4 miles from the nearby. Aylesbury is around 9 miles away and boasts a centre of the popular and vibrant market town of Tring. multiplex cinema, shopping centres and a theatre. The development is screened with mature trees adjacent to a quiet rural road, with electric gates providing access to the landscaped paved courtyard area which reflects the heritage of the site as a former riding stable. -

Grim's Ditch, Ivinghoe

GRIM'S DITCH, IVINGHOE JEAN DAVIS AND J. G. EVANS The excavation in 1982 of part of Grim's Ditch in Ivinghoe is described and a drawing of the section is published. Soil and molluscan analyses of samples taken through the deepest part of the ditch suggest that the ditch was dug in open arable country or on the borders of arable and grassland. A long period of extensive grassland is envisaged, followed by renewed cultivation, probably in Iron Age times. Comparison is made with similar samples taken in a nearby coombe in Pitstone. The possible purpose and date of the ditch are discussed and a tentative relationship between historic parishes and prehistoric agrarian management is suggested. The excavation during 1980 of a section of Depth below ditch (Dyke V) forming part of the Chiltern surface (cm) Grim's Ditch complex was described in 0-20 Modern ploughsoil (1). Greyish brown Volume 23 of the Records (Davis, 1981). (10YR 5/2) chalky loam with small Mention was then made of evidence for chalk lumps throughout. another larger ditch running roughly parallel 20-90 Ploughwash (2). As modern ploughsoil but pale brown to light yellowish brown and higher up the hillside, some 36 m to the (10YR 6/3-6/4). south: this second ditch was referred to as 90-110 Ploughwash (2). As above but with Dyke VI (Fig. 1). more coarse chalk. Pale brown to brown (10YR 6/3-5/3). In August 1982, a section was cut through 110-153 Ploughwash (4 and 5). As above but Dyke VI (SP 9540 1534) by members of the with some less stony zones. -

Tring – Pavis Wood Walk – Draft 3

Tring – Pavis Wood Walk – Draft 3 Here’s the fourth in our series of dog-friendly local walks. This one starts at the highest point in Hertfordshire (801ft or 244m) in Pavis Woods, Hastoe. It’s 3.2 miles or 5.1km long or, for the energetic, an additional 3.5 miles or 5.7 km from Tring. START: At the entry to Pavis, Black and Northill Woods Nature Reserve, at the junction of Shire and Gadmore Lanes, Hastoe. Grid reference: SP 91419 09186. For the more energetic you can walk from the centre of Tring and we have provided directions from Tring High Street / Akeman Street to the start of the short route in Pavis Woods, avoiding most roads. ENDS: Pavis, Black and Northill Woods Nature Reserve entry, at the junction of Shire and Gadmore Lanes, Hastoe. The more energetic can walk back to Tring, following a similar route to their outward journey, where there are a number of refreshment places in the town. DISTANCE: Approximately 3.2 miles (5.1km). Mostly easy but can be muddy in parts. There are two stiles (both with ‘dog holes’ when checked), and one or two fields may have cattle. Approximate height ascended 220 ft (67m). For the more energetic, walking from and returning to Tring High Street, adds about an extra 3.5 miles or 5.7km and an initial steep ascent of about 400ft (122m). There may be some sheep on this longer route. MAP: Ordnance Survey Explorer 181 Chiltern Hills North The shorter route is an easy circular from Pavis, Black and Northill Woods Nature Reserve in Hastoe, the highest point in Hertfordshire. -

Chilterns Ancient Woodland Survey Appendix: Dacorum Borough

Ancient Woodland Inventory for the Chilterns Appendix - Dacorum Borough Chiltern Woodlands CONSERVATION BOARD Project Chiltern District Council WYCOMBE DISTRICT COUNCIL an Area of Outstanding Natural Beauty 1. Introduction his appendix summarises results from the Chilterns Ancient Woodland Survey within Dacorum Borough in the County of Hertfordshire (see map 1 for details). For more information on the project and its methodology, 1 Tplease refer to the main report, which can be downloaded from www.chilternsaonb.org The Chilterns Ancient Woodland Survey area includes parts of Buckinghamshire, Bedfordshire, Hertfordshire and Oxfordshire. The extent of the project area included, but was not confined to, the Chilterns Area of Outstanding Natural Beauty (AONB). 2 The work follows on from previous revisions in the South East. The Chilterns survey was hosted by the Chilterns Conservation Board with support from the Chiltern Woodlands Project, Thames Valley Environmental Records Centre (TVERC) and Surrey Biodiversity Information Centre (SBIC). The work was funded by Buckinghamshire County Council, Chilterns Conservation Board, Chiltern District Council, Dacorum Borough Council, Forestry Commission, Hertfordshire County Council, Natural England and Wycombe District Council. Map 1: Project aims The Survey Area, showing Local Authority areas covered and the Chilterns AONB The primary aim of the County Boundaries survey was to revise and Chilterns AONB update the Ancient Entire Districts Woodland Inventory and Chiltern District to include ancient -

Tring Park and Hastoe Walk

2018 WALK 1 TRING PARK AND HASTOE This circular walk of a little over 4 miles starts and finishes in Tring, just off the A41 in the west of the county. The route takes in the designed landscape of grassland and woodland in Tring Park, then reaches the highest point in Hertfordshire at 803 feet (244 metres) above sea level, before descending the wooded Chilterns scarp to return to Tring. All of the route is within the Chilterns Area of Outstanding Natural Beauty (AONB). Along the way there are far-reaching views, and the route overlooks Green Belt countryside on the edge of Tring which will soon disappear under housing. The route involves a climb through the woodland in Tring Park, then a high-level section along the Ridgeway long-distance path, which offers lovely views. After following a mainly quiet country lane through Hastoe, there is a steep descent down the scarp slope which may be very muddy and slippery for a short distance (you might find walking poles useful here). The final section follows the base of the hill before a final short climb reaches another viewpoint. There are numerous pubs and cafés in Tring, including the Zebra café in Tring Museum. You might like to combine the walk with a visit to the Museum, which houses the collection assembled by Walter Rothschild, begun in the 19th century. It remains the largest private natural history collection ever put together by one person, and is now part of the Natural History Museum. To reach the start of the walk, go into the centre of Tring, then follow signs for Tring Museum in Akeman Street.