Liste Des Acheteurs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report Name:Retail Foods Bulgaria

Voluntary Report – Voluntary - Public Distribution Date: March 20,2020 Report Number: BU2020-0011 Report Name: Retail Foods Bulgaria Country: Bulgaria Post: Sofia Report Category: Retail Foods Prepared By: Alexander Todorov Approved By: Jonn Slette Report Highlights: Consistent growth in Bulgaria’s food and beverage retail market is driven by increased consumer confidence, declining unemployment, and growing incomes. The total number of retail outlets in Bulgaria in 2019 was 41,306. Modern retail food and beverage sales in 2019 grew by nearly five percent over 2018, and accounted for 55 percent of total food retail in value terms. U.S. exports with strong sales potential in Bulgaria’s food and beverage retail sector are distilled spirits, tree nuts, dried fruits, wine, snacks and cereals, beef meat, fish and seafood, sauces, spices, and pulses. THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Market Fact Sheet: Bulgaria Executive Summary Since 2016, annual Bulgarian GDP growth has Food Retail Industry been over three percent. Exports generate Bulgarian food retail sales reached $6.85 billion in almost 49 percent of Bulgaria’s GDP and are a pillar 2019. Modern retail sales accounted for of the economy. EU Member States are Bulgaria’s $3.77 billion (55 percent) and $3.08 billion in primary trading partners, although there is wide traditional channel. Total retail outlets were 41,306. variation in the balances of trade. In 2019, Bulgaria Food and beverage retail grew in 2019 on improved had a trade deficit in goods of about €1.72 billion consumer confidence and a better labor market. -

Between West and East People of the Globular Amphora Culture in Eastern Europe: 2950-2350 Bc

BETWEEN WEST AND EAST PEOPLE OF THE GLOBULAR AMPHORA CULTURE IN EASTERN EUROPE: 2950-2350 BC Marzena Szmyt V O L U M E 8 • 2010 BALTIC-PONTIC STUDIES 61-809 Poznań (Poland) Św. Marcin 78 Tel. (061) 8536709 ext. 147, Fax (061) 8533373 EDITOR Aleksander Kośko EDITORIAL COMMITEE Sophia S. Berezanskaya (Kiev), Aleksandra Cofta-Broniewska (Poznań), Mikhail Charniauski (Minsk), Lucyna Domańska (Łódź), Viktor I. Klochko (Kiev), Jan Machnik (Kraków), Valentin V. Otroshchenko (Kiev), Petro Tolochko (Kiev) SECRETARY Marzena Szmyt Second Edition ADAM MICKIEWICZ UNIVERSITY INSTITUTE OF EASTERN STUDIES INSTITUTE OF PREHISTORY Poznań 2010 ISBN 83-86094-07-9 (print:1999) ISBN 978-83-86094-15-8 (CD-ROM) ISSN 1231-0344 BETWEEN WEST AND EAST PEOPLE OF THE GLOBULAR AMPHORA CULTURE IN EASTERN EUROPE: 2950-2350 BC Marzena Szmyt Translated by John Comber and Piotr T. Żebrowski V O L U M E 8 • 2010 c Copyright by B-PS and Author All rights reserved Cover Design: Eugeniusz Skorwider Linguistic consultation: John Comber Prepared in Poland Computer typeset by PSO Sp. z o.o. w Poznaniu CONTENTS Editor’s Foreword5 Introduction7 I SPACE. Settlement of the Globular Amphora Culture on the Territory of Eastern Europe 16 I.1 Classification of sources . 16 I.2 Characteristics of complexes of Globular Amphora culture traits . 18 I.2.1 Complexes of class I . 18 I.2.2 Complexes of class II . 34 I.3 Range of complexes of Globular Amphora culture traits . 36 I.4 Spatial distinction between complexes of Globular Amphora culture traits. The eastern group and its indicators . 42 I.5 Spatial relations of the eastern and centralGlobular Amphora culture groups . -

Annual Report 2016

annual report 2016 # HEMA annual report 2016 HEMA B.V. annual report 2016 This annual report is adopted by the general meeting of shareholders April 13, 2017. Registration number Chamber of Commerce (‘Kamer van Koophandel’) 34215639. MILESTONES #’s 1 th HEMA celebrated its 90th birthday. 90 On 4 November 1926, the ‘Hollandsche Eenheidsprijzen Maatschappij Amsterdam’ (Dutch Standard Prices Company Amsterdam), was founded. HEMA celebrated the 90-year birthday milestone with employees and customers. contents introduction 5 financial highlights 2008 – 2016 7 message to our stakeholders 11 report from the management board 15 milestones of 2016 17 financial results 20 outlook 2017 31 report from the supervisory board 33 #’s corporate governance 39 financial statements 43 consolidated income statement 44 th consolidated statement of comprehensive income 45 consolidated statement of financial position 46 90 consolidated statement of changes in equity 47 consolidated statement of cash flow 48 notes to the consolidated financial statements 50 company financial statements 97 birthday company income statement 98 company balance sheet 99 notes to the company financial statements 100 other information 111 independent auditor’s report 111 cautionary notice 117 definitions 118 contact information 119 3 MILESTONES 2 five HEMA selected five pilot stores pilot to test its international store concept in the Netherlands. The international store concept that HEMA developed for cities such as Barcelona, Paris and London has proven to be so popular with stores customers that HEMA has decided to introduce the concept in the Netherlands as well. Nether lands introduction about HEMA HEMA B.V. (‘HEMA’ or the ‘Company’) is a general merchandise retailer active in the Netherlands, Belgium, Luxembourg, France, Germany, Spain and the United Kingdom. -

Prospectus English

Ontex Group NV Korte Keppestraat 21/31, 9320 Erembodegem (Aalst), Belgium Offering of Ordinary Shares (including approximately €325 million of Newly Issued Ordinary Shares (representing a maximum of 19,696,969 Shares based on the low end of the Price Range) and up to 7,000,000 Existing Ordinary Shares) Listing of all Shares on Euronext Brussels This prospectus (the “Prospectus”) relates to the offering (the “Offering”) (i) by Ontex Group NV (the “Company”), a limited liability company organized under the laws of Belgium, of such number of newly issued ordinary shares, with no nominal value, of the Company (the “Shares”) as is necessary to raise gross proceeds of approximately €325 million (the “Primary Tranche”) (representing a maximum of 19,696,969 Shares based on the low end of the Price Range) and (ii) by Whitehaven B S.à r.l. (“Whitehaven B”), an investment vehicle ultimately owned by funds advised by affiliates of TPG Global, LLC (“TPG”) and funds advised by affiliates of The Goldman Sachs Group, Inc. (“GSCP”) and certain members of the previous and current executive management team of the Company (together, the “Selling Shareholders”), of up to 7,000,000 existing Shares (the “Secondary Tranche”). The Shares being offered by the Company and the Selling Shareholders are herein referred to as the “Offer Shares.” The Offering consists of (i) an initial public offering to retail and institutional investors in Belgium (the “Belgian Offering”); (ii) a private placement in the United States to persons who are reasonably believed to be “qualified institutional buyers” or “QIBs” (as defined in Rule 144A (“Rule 144A”) under the U.S. -

Treazure Pim Cloud Services Server Promotion Engine

Product overview 2018 © Copyright All rights to information (text, images etc.) based at Cow Hills Retail BV Total or partial acquisition, duplication electronic, mechanical, photocopying, recording, or by any other means and / or commercial use of this information is not permitted without written consent by the management of Cow Hills Retail BV. Overview Cow Hills Retail and The Retail Online Suite Cow Hills Retail is a leading software company and provider of Point of Sale (POS) software in Europe, with a variety of tier 1 customers including HEMA, Hunkemöller, Rituals, La Place and Zeeman. The Retail Online Suite is entirely based on Microsoft technology (C#, .Net, SQL) and designed for large retail chains in all kinds of vertical retail markets, like fashion, food, consumer durables, household appliances, shoes, sports & department stores. The Value Proposition The Retail Online Suite is a modern, tier one Point-of-Sale solution that considerably improves the customer engagement experience of leading international and centrally managed retail chains. It significantly reduces cost while at the same time bringing the flexibility to quickly respond to business changes. Designed for multi-currency and multi- language support. Our Customers 20 Retailers / 25.000 POS systems / >>1.500.000.000 !! transactions each Year (only HEMA >250.000.000) 2008 - 2010 2011 - 2012 2013 - 2014 2015 - 2016 2017 - 2018 International Focus Live Austria Belgium Botswana In progress Denmark Albania France Croatia Germany Czech Republik Luxembourg Greece Norway -

Review of Annual Reports 2010 of Euronext Brussels Listed Companies 2 Grant Thornton Corporate Governance Review

Corporate Governance Review Review of Annual Reports 2010 of Euronext Brussels listed companies 2 Grant Thornton Corporate Governance Review Contents Contents 3 Foreword 5 Executive summary 7 PART I - Legally binding provisions 11 1. Corporate Governance Statement 12 2. Remuneration committee 17 3. Remuneration report 19 4. Audit committee – Legal requirements 22 PART II - Results corporate governance code 25 5. Board of directors 26 6. Independence 28 7. Nomination committee 30 8. Audit committee – Code requirements 32 Appendix A - Survey methodology 37 Appendix B - List of companies 39 3 4 Grant Thornton Corporate Governance Review Foreword We are pleased to present the Another key factor in the corporate governance debate is the interest of the European Commission second annual publication in Grant and the impact this will have on corporate governance Thornton’s series of reviews of the legislation. The European Commission released a corporate governance disclosures consultation paper on an EU corporate governance of Belgian companies quoted on framework and is seeking submissions from interested parties. We may, therefore, see a single EU-wide the Euronext stock exchange. The corporate governance framework in the not so distant review examines the extent to which future. companies comply with regulatory Corporate governance is fundamentally about requirements. ensuring that key stakeholders, including the public, can have confidence in how business is conducted and This year’s report arrives at a time of turmoil for results are disclosed by public interest entities such Belgian listed companies. While the Belgian banking as listed companies, financial institutions and public sector was struggling for survival and stock markets sector organisations. -

Literatures a Color

Study on the social enterprises ecosystem in Emilia-Romagna RaiSE Enhancing social enterprises competitiveness through improved business support policies This publication only reflects the author’s views. The programme authorities are not liable for any use that may be made of the information contained therein Contents Summary 1. Definition and Criteria in the regional context 2. Characteristics and development of social enterprises 3. Needs assessment and main challenges for scaling social enterprises 4. Ecosystem of business support tools and instruments 5. Gap analysis and policy recommendations Annex 1 Interview Grid Annex 2 Summary of the Interviews Bibliography Sitography – enterprises involved in the mapping 1 SUMMARY This research project was carried out within the framework of the European RaiSE Interreg Europe project, whose objective is to improve regional policy instruments for the competitiveness and sustainability of social enterprises. The development agencies involved in the project - from Emilia-Romagna, Catalonia, Ireland, Scotland, Hungary (Budapest) and Orebro (Sweden) - mapped the economy and social entrepreneurship ecosystems in their respective regional contexts, bringing out a highly varied and interesting scenario. ERVET internal working group, in charge of mapping and analysing the needs of the Emilia-Romagna social cooperatives and enterprises, involved the regional project stakeholders (Emilia-Romagna Region, Legacoop, Confcooperative, AGCI, Forum del Terzo Settore, Aster, ANCI). These contributed to identifying the survey sample whilest AICCON (Italian Association for the Promotion of the Culture of Cooperation and Non Profit) supported the work from the scientific point of view. Chapter 1 of the research report outlines the framework for social enterprises starting from the definition given by the European Commission and describes the social economy context in Emilia-Romagna. -

Formación De Pan Creativa Creative Bread Shaping English Version Starts on Page 32 La Mezcla Ideal Para Obtener El Éxito

PANADERÍA SUPPLEMENT TO BAKE JUNIO 2019 Formación de Pan Creativa Creative Bread Shaping English version starts on page 32 La mezcla ideal para obtener el éxito El manejo de una panadería no tiene que Los ojos de buey, duraznos y guayabas destacadas ser laboriosa ni difícil. Con la calidad y a continuación fueron hechos con la mezcla Trigal conveniencia de la línea de mezclas auténticas Dorado® Guayaba Mix – sólo necesitas agregar de Trigal Dorado® ahorras tiempo, mano de agua y huevos, ¡así de fácil! La línea de mezclas obra y costos de ingredientes mientras que auténticas de Trigal Dorado incluye: continúas ofreciendo los sabores auténticos que los clientes desean. ~ Bizcocho Mix ~ Pan Fino Mix ~ Galleta & Polvorón Mix ~ Mantecada Mix ~ Bolillo Mix Para obtener una lista ~ Danés Mix de ingredientes Trigal Dorado, escanea el ~ Puerquito Mix código QR. ~ Tres Leches Cake Mix Disponible de tu proveedor de panadería completa www.yourbakemark.com CARTA DE INTRODUCCIÓN CONTENIDO La version en Inglés comienza en la pagina 32 06 10 14 CONTENIDO DESTAQUE SU CREATIVIDAD 6 PAN Y HORNEO a creatividad es la mejor amiga de las innovaciones en la formación de pan has- 10 PASTELES Y DECORACIONES un panadero. La industria panadera ta los diseños creativos de pastel y repostería 14 LA MAGIA DE Les un comercio físicamente exigente que son dignos de publicarse en los medios LOS MEDIOS SOCIALES que requiere trabajo duro para tener éxito. sociales (y que captan la atención de sus Pero la creatividad es lo que trae la inno- clientes leales), este número está dedicado a 20 PERFILES DE PANADERÍAS vación a la luz. -

BIZCOCHOS CASEROS 17 Recetas Para Chuparse Los Dedos

BIZCOCHOS CASEROS 17 recetas para chuparse los dedos ÍNDICE Índice 1 Introducción 3 Bizcocho de almendra 4 Bizcocho vegano 7 Banana bread en tarro 10 Bizcocho genovés 12 Brazo decorado 15 Plancha de bizcocho 18 Bizcocho de chocolate 20 Bizcocho marmolado 22 Bizcocho de yogur 25 Bizcocho con manzanas 27 Bundt de ron con frutas 30 Bundt de jengibre y cerveza 32 BIZCOCHOS CASEROS | MARIALUNARILLOS.COM 1 Christmas Fruit Cake 35 Angel Food Cake 37 Minibundts de calabaza 39 Pastel de castañas 41 Bizcocho de calabacín 44 BIZCOCHOS CASEROS | MARIALUNARILLOS.COM 2 INTRODUCCIÓN E l bizcocho es un clásico en muchas casas y probablemente uno de los dulces tradicionales que más se repiten día a día en cada hogar. Es por ello que es de las primeras preparaciones básicas que se enseñan y se aprenden a elaborar. En María Lunarillos nos encantan los bizcochos y en este e-book hemos querido recopilar nuestras mejores 17 recetas de bizcochos caseros para todos los gustos. ¡Deseamos que lo disfrutes! Con cariño, el equipo de María Lunarillos. © 2015. María Lunarillos S.L. Todos los derechos reservados. BIZCOCHOS CASEROS | MARIALUNARILLOS.COM 3 BIZCOCHO DE ALMENDRA 12BIZCOCHOS RECETAS IMPRESCINDIBLES CASEROS | MARIALUNARILLOS.COM PARA PASCUA 24 BIZCOCHO DE ALMENDRA Miriam García ■ 250 g de almendras crudas ■ 6 huevos medianos ■ 150 g de fécula de patata ■ 220 g de azúcar ■ 15 g de levadura química ■ Una pizca de sal 1. Empezamos por triturar las almendras. Siempre os vamos a recomendar triturarlas en casa si tenéis esa posibilidad, es mejor que usar almendra ya triturada, ganaremos en sabor. -

Global Vs. Local-The Hungarian Retail Wars

Journal of Business and Retail Management Research (JBRMR) October 2015 Global Vs. Local-The Hungarian Retail Wars Charles S. Mayer Reza M. Bakhshandeh Central European University, Budapest, Hungary Key Words MNE’s, SME’s, Hungary, FMCG Retailing, Cooperatives, Rivalry Abstract In this paper we explore the impact of the ivasion of large global retailers into the Hungarian FMCG space. As well as giving the historical evolution of the market, we also show a recipe on how the local SME’s can cope with the foreign competition. “If you can’t beat them, at least emulate them well.” 1. Introduction Our research started with a casual observation. There seemed to be too many FMCG (Fast Moving Consumer Goods) stores in Hungary, compared to the population size, and the purchasing power. What was the reason for this proliferation, and what outcomes could be expected from it? Would the winners necessarily be the MNE’s, and the losers the local SME’S? These were the questions that focused our research for this paper. With the opening of the CEE to the West, large multinational retailers moved quickly into the region. This was particularly true for the extended food retailing sector (FMCG’s). Hungary, being very central, and having had good economic relations with the West in the past, was one of the more attractive markets to enter. We will follow the entry of one such multinational, Delhaize (Match), in detail. At the same time, we will note how two independent local chains, CBA and COOP were able to respond to the threat of the invasion of the multinationals. -

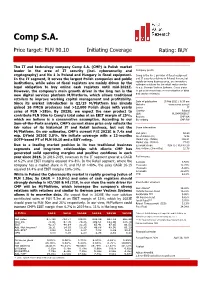

Initiating Coverage Rating: BUY

Comp S.A. Price target: PLN 90.10 Initiating Coverage Rating: BUY The IT and technology company Comp S.A. (CMP) is Polish market leader in the area of IT security (incl. cybersecurity and Company profile cryptography) and No 1 in Poland and Hungary in fiscal equipment. Comp is the No 1 provider of fiscal equipment and IT security solutions in Poland. A new, but In the IT segment, it serves the largest Polish companies and public rapidly growing business area, are innovative institutions, while sales of fiscal registers are mainly driven by the software solutions for the retail sector similar legal obligation to buy online cash registers until mid-2021E. to e.g. German Vectron Systems. Comp plans However, the company’s main growth driver in the long run is the to put a stronger focus on monetisation of data and service revenues. new digital services platform M/Platform, which allows traditional retailers to improve working capital management and profitability. Date of publication 15 Feb 2021 / 6:30 am Since its market introduction in Q2/19 M/Platform has already Website www.comp.com.pl gained 16 FMCG producers and >12,000 Polish shops with yearly Sector IT sales of PLN >18bn. By 2023E, we expect the new product to Country Poland ISIN PLCMP0000017 contribute PLN 90m to Comp’s total sales at an EBIT margin of 25%, Reuters CMP.WA which we believe is a conservative assumption. According to our Bloomberg CMP PW Sum-of-the-Parts analysis, CMP’s current share price only reflects the fair value of its historical IT and Retail business, but not the Share information M/Platform. -

Elia Group Full Year 2020 Results

Elia Group Full Year 2020 Results Wednesday, 3rd March 2021 Transcript produced by Global Lingo London – 020 7870 7100 www.global-lingo.com Elia Group Full Year 2020 Results Wednesday, 3rd March 2021 Elia Group Full Year 2020 Results Marleen Vanhecke: Good morning, ladies and gentlemen. Thank you for participating in our livestreamed event, which is being broadcast from a corona-proof studio in Brussels. It would have been nicer to meet you in person, of course, but the lockdown measures have forced us to present our full year results in another format. The setup is different, but we will keep you just as informed as we normally would. What hasn't changed are today's speakers. Elia Group is represented by Catherine Vandenborre, CFO, and by Chris Peeters, CEO, both in good health, as you can see. Today's programme is as follows. First, we will give you an overview of the headlines from 2020. We will talk with Chris Peeters about the acceleration of the energy transition and how Elia Group is managing it. Catherine Vandenborre will then present the financial results. And finally, we will present our conclusion and an outlook on the years to come. Before we start, I would like to present a disclaimer for today's presentation as mentioned on the title page. You must read the disclaimer before we can continue. I suppose you have all done it by now. Am I right? So let's immediately go to the first question for Chris. Marleen Vanhecke: Chris, looking back at 2020, it's impossible to avoid the corona crisis, of course.