In Focus: Udaipur an Oasis of Potential

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lakes: the Mirrors of the Earth BALANCING ECOSYSTEM INTEGRITY and HUMAN WELLBEING

Lakes: the mirrors of the earth BALANCING ECOSYSTEM INTEGRITY AND HUMAN WELLBEING Proceedings of 15th world lake conference Lakes: The Mirrors of the Earth BALANCING ECOSYSTEM INTEGRITY AND HUMAN WELLBEING Proceedings of 15TH WORLD LAKE CONFERENCE Copyright © 2014 by Umbria Scientific Meeting Association (USMA2007) All rights reserved. ISBN: 978-88-96504-04-8 (print) ISBN: 978-88-96504-07-9 (online) Lakes: The Mirrors of the Earth BALANCING ECOSYSTEM INTEGRITY AND HUMAN WELLBEING Volume 2: Proceedings of the 15th World Lake Conference Edited by Chiara BISCARINI, Arnaldo PIERLEONI, Luigi NASELLI-FLORES Editorial office: Valentina ABETE (coordinator), Dordaneh AMIN, Yasue HAGIHARA ,Antonello LAMANNA , Adriano ROSSI Published by Science4Press Consorzio S.C.I.R.E. E (Scientific Consortium for the Industrial Research and Engineering) www.consorzioscire.it Printed in Italy Science4Press International Scientific Committee Chair Masahisa NAKAMURA (Shiga University) Vice Chair Walter RAST (Texas State University) Members Nikolai ALADIN (Russian Academy of Science) Sandra AZEVEDO (Brazil Federal University of Rio de Janeiro) Riccardo DE BERNARDI (EvK2-CNR) Salif DIOP (Cheikh Anta Diop University) Fausto GUZZETTI (IRPI-CNR Perugia) Zhengyu HU (Chinese Academy of Sciences) Piero GUILIZZONI (ISE-CNR) Luigi NASELLI-FLORES (University of Palermo) Daniel OLAGO (University of Nairobi) Ajit PATTNAIK (Chilika Development Authority) Richard ROBARTS (World Water and Climate Foundation) Adelina SANTOS-BORJA (Laguna Lake Development Authority) Juan SKINNER (Lake -

Characteristics of Pegmatoidal Granite Exposed Near Bayalan, Ajmer District, Rajasthan

Characteristics of pegmatoidal granite exposed near Bayalan, Ajmer district, Rajasthan Nilanjan Dasgupta1,∗, Taritwan Pal2, Joydeep Sen1 and Tamoghno Ghosh1 1Department of Geology, Presidency University, 86/1 College Street, Kolkata 700 073, India. 2Department of Geology and Geophysics, IIT Kharagpur, Midnapore, West Bengal, India. ∗e-mail: [email protected] The study involves the characterization of pegmatoidal granite, southeast of Beawar, Ajmer district, Rajasthan. Earlier researchers had described this granite as part of the BGC, basement to the Bhim Group of the Delhi Super Group rocks. However, the present study indicates that it is younger than the rocks of Bhim Group of South Delhi Fold Belt, into which it is intrusive. The intrusion is structurally controlled and the outcrop pattern is phacolithic. The granite had intruded post-D2 deformation of the Delhi orogeny along the axial planes of D2 folds. The intrusion has also resulted in the formation of a contact aureole about the calc gneisses. 1. Introduction host rocks by this emplacement have been studied. An attempt is made to fix the time of emplacement A long geological history since Middle Archaean with respect to the different deformational events is recorded in the Precambrian belt of Rajasthan. of the Delhi orogeny. The rocks of the study area fall within the The granites were earlier classified as basement ‘Delhi System’, defined in the pioneering study of rocks of pre-Delhi age (Heron 1953; Gupta 1934), Heron (1953), and now rechristened as the Delhi which is contrary to the present findings. Supergroup (Gupta and Bose 2000 and references therein) (figure 1). Within the study area around the small village of Bayalan, 10 km southeast of Beawar in Ajmer district of Rajasthan, pegma- 2. -

India Discovery Prog

WHAT IS EDTERRA EdTerra is where travel meets education. We are India’s leading outdoor travel education providers. Students from top ranked schools travel with us on our school trips. Your educational edge! EdTerra helps schools get that educational edge which can be seen, touched, felt, shared and talked about. While your students learn and grow, we supplement and certify their learning as they go through our meticulously designed tools, techniques and workshops as part of the educational journey. Give your students an immersive educational exposure. Choose from 3 categories of our Truly Educational school trips: EdTerra Camps – Outdoor adventure programs India Discovery Programs – Reliving culture, history and diversity of India Going Global Programs – Experiencing and understanding unique foreign lands; their history, culture, customs, value & belief systems. Please visit our website www.edterra.com to know more about us Copyright © 2015 EdTerra Edventures Private Limited All photographs, text, labels and format of this brochure are licensed to and belong to EdTerra Edventures Pvt. Ltd. No part of this brochure may be copied or distributed without explicit permission from EdTerra. WHAT IS THE EDTERRA ADVANTAGE You are sure to get a highly veritable and demonstrable return from the time and effort you invest in your students’ development into globally competent citizens through EdTerra. EdTerra’s promise of rendering Truly Educational Journeys is verifiable on account of the following parameters: Pre-defined structured learning objectives Age appropriate proprietary learning tools and materials Journey Mentors to guide the student group Tools to measure learning outcomes Evidence to showcase students’ experiences, learning and fun To know more, please request your EdTerra representative for an introduction to our proprietary Young Authors Program and other equally powerful Truly Educational pre, post and on-journey modules available for your students applicable to your chosen destination. -

Rajasthan NAMP ARCGIS

Status of NAMP Station (Rajasthan) Based on Air Quality Index Year 2010 ± Sriganganager Hanumangarh Churu Bikaner Jhunjhunu 219 373 *# Alwar(! Sikar 274 273 372 297 *# *# 409 *# Jaisalmer *# (! Bharatpur Nagaur 408 376 410 411 *# Dausa *# *# *#Jaipur 296 Jodhpur 298 412 *# (! 413 *# Dholpur *# Karauli Ajmer Sawai Madhopur Tonk Barmer Pali Bhilwara Bundi *#326 Jalor Kota# Rajsamand Chittorgarh * 325 17 Baran Sirohi *#321 *# 294 320Udaipurjk jk Jhalawar Station City Location code Area 372 Regional Office,RSPCB Residential Dungarpur Alwar 373 M/s Gourav Solvex Ltd Industrial Banswara 219 RIICO Pump House MIA Industrial 274 Regional Office, Jodhpur Industrial 273 Sojati Gate Residential 376 Mahamandir Police Thana Residential Jodhpur 411 Housing Board Residential 413 DIC Office Industrial AQI Based Pollution Categories 412 Shastri Nagar Residential 321 Regional Office MIA, Udaipur Industrial Udaipur 320 Ambamata, Udaipur (Chandpur Sattllite Hospital) Residential *# Moderate 294 Town Hall, Udaipur Residential 17 Regional Office, Kota Industrial Poor Kota 325 M/s Samcore Glass Ltd Industrial (! 326 Municipal Corporation Building, Kota Residential Satisfactory 298 RSPCB Office, Jhalana Doongari Residential jk 410 RIICO Office MIA, Jaipur Industrial 296 PHD Office, Ajmeri Gate Residential Jaipur 408 Office of the District Educational Officer, Chandpole Residential 409 Regional Office North, RSPCB,6/244 Vidyadhar Nagar Residential 297 VKIA, Jaipur (Road no.-6) Industrial Status of NAMP Station (Rajasthan) Based on Air Quality Index Year 2011 ± -

Read Itinerary Details

Delhi * Udaipur * Jodhpur * Jaipur * Agra * Khajuraho * Varanasi * Delhi DAY 01 ARRIVE DELHI BY: INTERNATIONAL FLIGHT You will arrive at New Delhi's International Airport. Following customs, immigration formalities and baggage collection, a representative will meet you as you EXIT the ARRIVALS TERMINAL building after which you would be transferred to your hotel. Upon arrival at the hotel, proceed for check-in at the hotel. India's capital and a major gateway to the country, contemporary Delhi is a bustling metropolis, which successfully combines in its folds - the ancient with the modern. Amidst the fast spiraling skyscrapers the remnants of a bygone time in the form of its many monuments stand as silent reminders to the region's ancient legacy. The first impressions for any visitor traveling in from the airport are of a specious, garden city, tree-lined with a number of beautiful parks. Overnight at the hotel DAY 02 DELHI After buffet breakfast at the hotel, you will proceed for full day city tour of Old & New Delhi. You will first visit Old Delhi. The tour will begin with a visit to Raj Ghat & Shanti Vana, a simple memorial to Mahatma Gandhi; drive past the Red Fort continuing to the Jama Masjid, It is the largest mosque in India, accommodating up to 25,000 worshippers at one time. Designed by Shah Jahan, this grand red sandstone and white marble mosque was said to have been built by 5,000 artisans from 1644 to 1656. The broad red sandstone steps lead up to gates to the east, north and south. -

District Survey Report of Jalore District 1.0 Introduction

District Survey report of Jalore District 1.0 Introduction The district derives its name from the town of Jalore, which is the headquarters of the district administration. District is located between latitudes 24º 37’ 00” to 25º 49’ 00” and longitudes 71º 11’00” to 73º 05’00” with an area of 10,640 Sq. kms (3.11% of the State). The district is part of Jodhpur Division. The district is composed of five sub-divisions viz. Jalore, Ahore, Bhinmal, Sanchore, Raniwara which cover seven tehsils viz: Jalore, Ahore, Bhinmal, Sanchore, Raniwara, Sayala, Bagora and seven blocks viz: Jalore, Ahore, Bhinmal, Sanchore, Raniwara, Sayala & Jaswantpura. Total number of villages in the district is 802 and it also has 3 urban towns. Total population of the district as per Census 2011 is 1828730 with male and female population of 936634 and 892096 respectively. Administrative divisions of Jalore district are depicted in the index map (Fig. 1). 2.0 Rainfall & Climate Average annual rainfall (1971-2012) of the district is 445.4 mm. However normal rainfall for the period 1901 to 1970 is 400.6 mm. The annual rainfall gradually decreases from southeastern part to northwestern part. Climate of the district is dry except during SW monsoon season. The cold season is from December to February and is followed by summer from March to June. Period from mid of September to end of November constitutes post monsoon season. The district experiences either mild or normal drought once in two years. Severe type of drought has been recorded at Ahore block. Most severe type of drought has been recorded at Bhinmal, Sanchore & Jaswantpura blocks. -

Hydrogeological Atlas of Rajasthan Pali District

Pali District ` Hydrogeological Atlas of Rajasthan Pali District Contents: List of Plates Title Page No. Plate I Administrative Map 2 Plate II Topography 4 Plate III Rainfall Distribution 4 Plate IV Geological Map 6 Plate V Geomorphological Map 6 Plate VI Aquifer Map 8 Plate VII Stage of Ground Water Development (Block wise) 2011 8 Location of Exploratory and Ground Water Monitoring Plate VIII 10 Stations Depth to Water Level Plate IX 10 (Pre-Monsoon 2010) Water Table Elevation Plate X 12 (Pre-Monsoon 2010) Water Level Fluctuation Plate XI 12 (Pre-Post Monsoon 2010) Electrical Conductivity Distribution Plate XII 14 (Average Pre-Monsoon 2005-09) Chloride Distribution Plate XIII 14 (Average Pre-Monsoon 2005-09) Fluoride Distribution Plate XIV 16 (Average Pre-Monsoon 2005-09) Nitrate Distribution Plate XV 16 (Average Pre-Monsoon 2005-09) Plate XVI Depth to Bedrock 18 Plate XVII Map of Unconfined Aquifer 18 Glossary of terms 19 2013 ADMINISTRATIVE SETUP DISTRICT – PALI Location: Pali district is located in the central part of Rajasthan. It is bounded in the north by Nagaur district, in the east by Ajmer and Rajsamand districts, south by Udaipur and Sirohi districts and in the West by Jalor, Barmer and Jodhpur districts. It stretches between 24° 44' 35.60” to 26° 27' 44.54” north latitude and 72° 45' 57.82’’ to 74° 24' 25.28’’ east longitude covering area of 12,378.9 sq km. The district is part of ‘Luni River Basin’ and occupies the western slopes of Aravali range. Administrative Set-up: Pali district is administratively divided into ten blocks. -

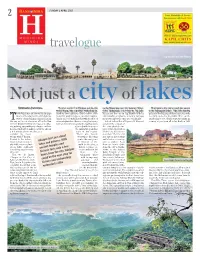

Udaipur Isn't Just About Lakes and Palaces. with Ancient Temples And

2 SUNDAY 2 APRIL 2017 travelogue Jag Mandir on Lake Pichola Not just a city of lakes NEEHARIKA SATYAVADA To get a real feel of daipur and its old on /ag Niwas was once the *ummer 2alace >ead back to the city to catch the sunset world charm, take a heritage walk along its of the 0aharanas, it is today the Taj %ake at the Sajjangarh 2alace. This little-known hink Rajasthan and immediately pops winding thoroughfares. Chock-a-bloc with 2alace and the one on /ag Mandir with its palace in the *ajjangarh *anctuary was only into your head a picture of undulating beautiful marble palaces, ancient temples, eight marble elephants, is now a heritage recently opened to the public. >ere, as the Twaves of sand shimmering golden in bright and colourful havelis with facades of property run by the current royal family. sun begins to set, clouds start streaming in, the sun and a row of women all but hidden intricate jharokas, there is a temple at every A boat ride in this 655-year-old lake and coming at you from all sides. Built in 9==? in their bright twirling lehengas and odha- turn and every house along the way has walls a walk in the old part of nis, walking away with pots of water on their adorned with frescos in the city should com- head as thick silver anklets catch the sun on the miniature painting plete your e(ploration a hot windy afternoon. But, you style of the region. of the city, but do not couldn't be more There are boards stop there. -

Fishing Techniques Practised in Salumbar Tehsil of Udaipur District, Rajasthan

International Journal of Science and Research (IJSR) ISSN: 2319-7064 SJIF (2020): 7.803 Fishing Techniques Practised in Salumbar Tehsil of Udaipur District, Rajasthan Sabiha Sindhi1, Sonika Rathore2 1Assistant Professor, B.N. University, Udaipur (Raj), India 2Research Scholar Email: sonikarathore01983[at]gmail.com Abstract: Humans have been fishing and hunting since the beginning of time, for both subsistence and recreation. A study was carried out to look into the environmental impact of local fisheries and to protect traditional fishing techniques. Five traditional fishing techniques were reported during the research periods. Fishing and hunting are two of humanity's earliest activities. Keywords: Traditional, Fish, techniques 1. Introduction observe the construction of the fishing machinery and processes while fishing on land, ephemeral ponds and small Key to scientifically and judiciously utilise and manage rivers were followed by rains where fishing took place. fisheries resources is the understanding of fishing gear, crafts Those were interrogated attentively during the fishing and fishing methods. Fishing networks and gear are those procedure. devices with varied forms and sizes that are utilised for capturing different fish species in aquatic bodies. Fishing 3. Result tactics used in a geographical region usually depend on different behavioural traits and the fish fauna type accessible Present study was undertaken to have a detailed study on the in that area for micro-habitats. In India, the mostly traditional fishing method practiced by tribal people of traditional and non-mechanized fishing equipment and gear Salumbar tehsil. The main tribe of Salmbur tehsil are Bhil, is utilised. One of the livelihoods that exhibit their Bhil meena and Damor. -

Ftyk Mn;Iqj Esa Flfkr Etkj@Edcjk@Njxkgksa Dh Lwph%&

ftyk mn;iqj esa fLFkr etkj@edcjk@njxkgksa dh lwph%& Sr No Property Name Location Area 1 Dargah 562 Kherwara Chhaoni (CT)Kherwara Udaipur 0.090000 Hectare 2 Pakka Mazar IswalGirwa Udaipur 1N.A.Biswa 3 Peer Bagaji 962 Bargaon (Rural) (CT)Girwa Udaipur 1.000000 Biswa 4 Mazar Peer Sb. TeeriGirwa Udaipur N.A.Hectare 5 Mazar ChanawadaGirwa Udaipur 1N.A.Biswa 6 Mazar Pacca Nawal Singhji Ka GurhaGirwa Udaipur 19.000000 Biswa 7 Sthan Peer ji Jaswant GarhGogunda Udaipur N.A.Sq. Yard 8 Mazar Meera Tahari Rawliya KhurdGogunda Udaipur 2.000000 Biswa 9 Mazar Syeed Baba Chor BaoriGogunda Udaipur N.A.Sq. Yard 10 Mazar Peer Baba Chor BaoriGogunda Udaipur N.A.Sq. Yard 11 Mazar Peer Baba KardaGogunda Udaipur N.A.Sq. Yard 12 Dargah Peer Baba Gogunda(CT)Gogunda Udaipur N.A.Sq. Yard 13 Dargah Tak Baba Gogunda(CT)Gogunda Udaipur N.A.Sq. Yard 14 Mazar Bhanji-ka-Chilla Gogunda(CT)Gogunda Udaipur N.A.Sq. Yard 15 Mazar Kherwara Chhaoni (CT)Kherwara Udaipur 10N.A.Sq. Feet 16 Mazar Tehsil Kherwara Chhaoni (CT)Kherwara Udaipur 10N.A.Sq. Feet 17 Mazar Kherwara Chhaoni (CT)Kherwara Udaipur 10N.A.Sq. Feet 18 Mazar Kalu Station Wala Kherwara Chhaoni (CT)Kherwara Udaipur N.A.Hectare 19 Mazar Kherwara Chhaoni (CT)Kherwara Udaipur N.A.Hectare 20 Sthan Peer Baba 692 Kherwara Chhaoni (CT)Kherwara Udaipur N.A.Hectare 21 Mazar Peer 873 KarawaraKherwara Udaipur 7.250000 Bigha 22 Mazar KarawaraKherwara Udaipur N.A.Hectare 23 Mazar Saben Shah 264 JuraKotra Udaipur 1.000000 Bigha 24 Mazar DhawriLasadiya Udaipur N.A.Hectare 25 Dargah Peer Baba Saheedi PhoosriyaLasadiya Udaipur 1.000000 Biswa Dargah Peer Baba Sham Juma 26 PhoosriyaLasadiya Udaipur N.A.Hectare Talab 27 Mazar LasadiyaLasadiya Udaipur N.A.Hectare 28 Peer Baba Mazar OvraLasadiya Udaipur N.A.Hectare 29 Mazar AjniLasadiya Udaipur N.A.Hectare 30 Mazar Sahid Sb. -

Rajasthan: Disease Burden Profile, 1990 to 2016 1990 Life E�Pectancy 2016 Life E�Pectancy �Emales� 59�� Years �Ales� 5��2 Years �Emales� �0�1 Years �Ales� 65�5 Years

Rajasthan: Disease Burden Profile, 1990 to 2016 1990 life epectancy 2016 life epectancy Females 59 years ales 52 years Females 01 years ales 655 years How much did the under-5 mortality rate change from 1990 to 2016? How much did the under-5 mortality rate change from 1990 to 2016? Under-5Under-5 mortality mortality rate, both rate, sexes combined, both sexes 1990-2016 combined, 1990-2016 Rajasthan nde- ate India nde- ate Caatie aeae ate lall siila Si-deahi Inde as Rajasthan 150 100 Deaths per 1,000 lie births 50 4 44 9.2 The shaded bands indicate 95% uncertainty intervals around 0 the estimates 1990 1995 2000 2005 2010 2016 Year What caused the most deaths in different age groups in 2016? PercentWhat contribution caused of the top 10 most causes deaths of death by in age different group, both sexes,age 2016groups in 2016? Percent contribution of top 10 causes of death by age group, both sexes, 2016 0−14 years [14.9% of total deaths] 15−39 years [11.6% of total deaths] 11 29 11 HIIDS telsis 4 0 124 10 DiaheaRIthe 4 12 2 NDs† alaia 109 124 Matenal disdes 41 Nenatal disdes 9 Nutritional deficiencies 61 the niale diseases 64 366 Canes 142 106 Cadiasla diseases Chni esiat diseases 29 6 29 Cihsis Diestie diseases Nelial disdes 40−69 years [36.9% of total deaths] 70+ years [36.6% of total deaths] Diaetes‡ldend§ 21 3.3% the nn-niale 3.8% 0 3.4% 39 anst injies 8.8% 51 46 nintentinal injies 16 4 8.8% 42 21 14 Siide ilene 22 the ases death 135 6 RI is lwe esiat inetins. -

So I Knew Their Place Before I Crashed Among Them, Knew When Alexander Had Traversed It in an Earlier Age for This Cause Or That Greed

I am a man who can recognize an unnamed town by its skeletal shape on a map …. So I knew their place before I crashed among them, knew when Alexander had traversed it in an earlier age for this cause or that greed. I knew the customs of nomads besotted by silks or wells …. When I was lost among them, unsure of where I was, all I needed was the name of a small ridge, a local custom, a cell of this historical animal, and the map of the world would slide into place. – Michael Ondaatje, The English Patient (1992) 112 Marg Vol. 61 No. 1 112-120 Pramod final GJ.indd 112 18/09/09 11:32 AM Special Feature Pramod Kumar K.G. The Photography Archive at the City Palace Museum Udaipur A small slice of Udaipur’s history was uncovered in May 2008 when the City Palace Complex at Udaipur yielded several trunks packed with photographs. Safely maintained over the decades among the various storerooms and inner recesses of the vast City Palace Museum Udaipur (hereafter CPMU), the trunks hold several thousand loose photographs, folios, and framed images, which are currently being catalogued and archived. Numbering more than 15,000 images, these photographs are part of the Pictorial Archives of The Maharanas of Mewar, Udaipur, and are currently housed at the CPMU. A first exhibition of these photographs has already been mounted at the newly restored Bhagwat Prakash Gallery in the Zenana Mahal of the complex. Titled Long Exposure, 1857−1957: The Camera at Udaipur, the exhibition and the study of the collection is gradually revealing an unabashed “native” gaze and perception in what the camera’s lens set out to capture.