Pointed out in Our Last Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Proxy Vote Record

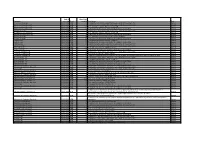

Company Name Ticker Country Meeting DateProposal Text Vote Instruction Abcam Plc ABC United Kingdom 04-Dec-20 Accept Financial Statements and Statutory Reports For Abcam Plc ABC United Kingdom 04-Dec-20 Approve Remuneration Report For Abcam Plc ABC United Kingdom 04-Dec-20 Reappoint PricewaterhouseCoopers LLP as Auditors For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise the Audit and Risk Committee to Fix Remuneration of Auditors For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Peter Allen as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Alan Hirzel as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Elect Michael Baldock as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Louise Patten as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Mara Aspinall as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Giles Kerr as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity without Pre-emptive Rights For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity without Pre-emptive Rights in Connection with an Acquisition or Other Capital Investment For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Market Purchase of Ordinary Shares For Abcam Plc ABC United Kingdom 04-Dec-20 Accept Financial Statements and Statutory Reports For Abcam Plc ABC United Kingdom 04-Dec-20 Approve Remuneration Report For Abcam Plc ABC United Kingdom 04-Dec-20 Reappoint PricewaterhouseCoopers LLP as Auditors -

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Data Standards Manual Summary of Changes

October 2019 Visa Public gfgfghfghdfghdfghdfghfghffgfghfghdfghfg This document is a supplement of the Visa Core Rules and Visa Product and Service Rules. In the event of any conflict between any content in this document, any document referenced herein, any exhibit to this document, or any communications concerning this document, and any content in the Visa Core Rules and Visa Product and Service Rules, the Visa Core Rules and Visa Product and Service Rules shall govern and control. Merchant Data Standards Manual Summary of Changes Visa Merchant Data Standards Manual – Summary of Changes for this Edition This is a global document and should be used by members in all Visa Regions. In this edition, details have been added to the descriptions of the following MCCs in order to facilitate easier merchant designation and classification: • MCC 5541 Service Stations with or without Ancillary Services has been updated to include all engine fuel types, not just automotive • MCC 5542 Automated Fuel Dispensers has been updated to include all engine fuel types, not just automotive • MCC 5812 Eating Places, Restaurants & 5814 Fast Food Restaurants have been updated to include greater detail in order to facilitate easier segmentation • MCC 5967 Direct Marketing – Inbound Telemarketing Merchants has been updated to include adult content • MCC 6540 Non-Financial Institutions – Stored Value Card Purchase/Load has been updated to clarify that it does not apply to Staged Digital Wallet Operators (SDWO) • MCC 8398 Charitable Social Service Organizations has -

Fund Fact Sheet

Franklin Templeton Funds GB00B3ZGH246 FTF Franklin UK Mid Cap Fund - A 31 July 2021 (inc) Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund GBP Performance over 5 Years in Share Class Currency (%) Total Net Assets (GBP) 1.16 billion FTF Franklin UK Mid Cap Fund A (inc) FTSE 250 ex-Investment Trusts Index Fund Inception Date 17.10.2011 180 Number of Issuers 36 Benchmark FTSE 250 ex-Investment 160 Trusts Index IA Sector UK All Companies 140 ISA Status Yes 120 Summary of Investment Objective The Fund aims to grow in value by more than the FTSE 250 100 (ex-Investment Trusts) Index, from a combination of income and investment growth over a three to five-year period after all fees and costs are deducted. 80 07/16 01/17 07/17 01/18 07/18 01/19 07/19 01/20 07/20 01/21 07/21 Fund Management Discrete Annual Performance in Share Class Currency (%) Richard Bullas: United Kingdom 07/20 07/19 07/18 07/17 07/16 Mark Hall: United Kingdom 07/21 07/20 07/19 07/18 07/17 Dan Green, CFA: United Kingdom A (inc) 36.52 -12.79 -1.25 9.89 23.81 Marcus Tregoning: United Kingdom Benchmark in GBP 42.85 -15.10 -4.98 8.39 17.21 Ratings - A (inc) Performance in Share Class Currency (%) Cumulative Annualised Overall Morningstar Rating™: Since Since Asset Allocation 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (inc) 4.45 5.93 20.14 16.83 36.52 17.58 59.90 821.63 5.55 9.84 10.60 Benchmark in GBP 3.24 3.01 16.86 15.60 42.85 15.25 46.41 622.69 4.84 7.92 9.38 Prior to 7 August 2021, the Fund was named Franklin UK Mid Cap Fund. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Notice of Annual General Meeting 24 July 2018 at 1.00 P.M

Notice of Annual General Meeting 24 July 2018 at 1.00 p.m. (CEST) to be held at World Trade Centre I Route de l’Aéroport 10 1216 Cointrin Geneva, Switzerland THIS NOTICE IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of the proposals referred to in this Notice or as to the action you should take, you should seek advice from a stockbroker, bank manager, solicitor, accountant or other independent professional adviser who is duly authorised under the Financial Services and Markets Act 2000 if you are in the United Kingdom, or another appropriately authorised independent adviser if you are in a territory outside the United Kingdom. If you have sold or otherwise transferred all of your ordinary shares in Wizz Air Holdings Plc please send this Notice, together with the accompanying documents, at once to the relevant purchaser or transferee, or to the stockbroker, bank or agent through whom the sale or transfer was effected for transmission to the relevant purchaser or transferee. A Form of Proxy for use at the Annual General Meeting is enclosed with this Notice. Notes on completing and returning the Form of Proxy can be found in the Form of Proxy and this Notice and should be read carefully before the Form of Proxy is completed. Wizz Air Holdings Plc Notice of Annual General Meeting EU-DOCS\21196750.7 Wizz Air Holdings Plc Company Number: 103356 44 Esplanade, St. Helier JE4 9WG Jersey, Channel Islands 24 May 2018 Dear Shareholder, ANNUAL GENERAL MEETING OF THE COMPANY – 24 JULY 2018 I am pleased to enclose the Notice convening the forthcoming annual general meeting (“AGM”) of Wizz Air Holdings Plc (the “Company”) which will be held at World Trade Centre I, Route de l’Aéroport 10, 1216 Cointrin, Geneva, Switzerland on 24 July 2018 at 1.00 p.m. -

The Importance of Human Motion for Simulation Testing of GNSS

The Importance of Human Motion for Simulation Testing of GNSS Kimon Voutsis, Paul D Groves, University College London, United Kingdom Mark Holbrow, Colin Ford, Spirent Communications plc, United Kingdom BIOGRAPHY ABSTRACT Kimon Voutsis is a PhD student of the Space Geodesy and Human motion is generally considered benign to the Navigation Laboratory (SGNL) at University College performance of global navigation satellite system (GNSS) London (UCL). He is interested in positioning sensors and and other positioning sensors. This study proves that this is navigation systems, human biomechanics and routing not the case, even for typical human behaviour involving models. The aim of his current research is the development GNSS user equipment, e.g. in smartphones. Using of a pedestrian motion model intended for testing the recorded human motion, it is shown that phase-lock loops performance of positioning sensors in a simulation (PLLs) in GNSS receivers are sensitive to jerk dynamics environment. He holds a first-class Bachelor (Hons) in induced by user motion, resulting in carrier cycle slips. Geography from Harokopio University of Athens, Greece and an MSc in Geographic Information Science from UCL. To test the effects of human dynamics on GNSS carrier He has worked for three years in technical analysis and tracking, real human motion profiles were captured. These developing GIS software solutions for the transport profiles comprised typical types of movements using a industry. ([email protected]) mobile phone, e.g. holding, answering and texting, different types of activities, e.g. walking or jogging, as well Dr Paul Groves is a Lecturer (academic faculty member) at as different phone locations on the human body, e.g. -

The Driving Force in Refractories

The driving force in refractories Annual Report 2018 RHI Magnesita - The driving force in refractories - Annual Report 2018 CONTENTS 02 Strategic Report 102Financial Statements 04 Key financial and operating highlights 104 Consolidated Statement 06 RHI Magnesita at a glance of Financial Position 08 Chairman’s statement 105 Consolidated Statement 10 Market overview of Profit and Loss 14 Our business - 106 Consolidated Statement how we create value of Comprehensive Income 16 Our value chain explained 107 Consolidated Statement 18 Our strategic priorities of Cash Flows 20 CEO’s review 108 Consolidated Statement 22 Innovation of Changes in Equity 26 Operational review 110 Notes to the Consolidated 34 Key performance indicators Financial Statements 2018 36 Financial review 195 Independent Auditor’s Report 42 Risks, viability & internal controls 48 Sustainability Other information 203 Alternative performance measures (“APMs”) 204 Shareholder information 58 Governance 60 Board of Directors 64 Executive Management Team 66 Chairman’s introduction to Corporate Governance 67 Corporate Governance Report 76 Nomination Committee Report 78 Audit & Compliance Committee Report 80 Remuneration Committee Report 84 Directors’ Remuneration Policy 92 Annual Report on Remuneration RHI Magnesita (the “Company” or “Group”) is quoted with a premium listing on the London Stock Exchange (symbol: RHIM) and is a constituent of the FTSE 250 index. For more information please visit: www.rhimagnesita.com RHI MAGNESITA ANNUAL REPORT 2018 We are RHI Magnesita. The driving force. RHI Magnesita is the leading global supplier of high- grade refractory products, systems and solutions. With its high level of geographic diversification, focus on innovation and a vertically integrated value chain, from raw materials to refractory products and full performance-based solutions, RHI Magnesita serves customers around the world. -

Company Date of Meeting Event Resolution

Date of Resolution Company meeting Event number Resolution Vote Henderson Group plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Against Spirent Communications plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Abstain Spirent Communications plc 01/05/2013 AGM 11 To re-appoint as auditors, Ernst & Young LLP Against Spirent Communications plc 01/05/2013 AGM 12 To authorise the directors to determine the auditor's remuneration Against 4imprint Group plc 01/05/2013 AGM 3 To adopt the remuneration report for the year ended 31 December 2012 Abstain Aga Rangemaster Group plc 01/05/2013 AGM 9 To re-appoint as auditors, Ernst & Young LLP Abstain Aga Rangemaster Group plc 01/05/2013 AGM 10 To authorise the directors to determine the auditor's remuneration Abstain 4imprint Group plc 01/05/2013 AGM 10 To re-appoint PricewaterhouseCoopers LLP as auditors Against 4imprint Group plc 01/05/2013 AGM 11 To authorise the directors to determine the auditor's remuneration Against Ladbrokes plc 01/05/2013 AGM 12 To re-appoint as auditors, Ernst & Young LLP Against Ladbrokes plc 01/05/2013 AGM 13 To authorise the directors to determine the auditor's remuneration Against Ladbrokes plc 01/05/2013 AGM 14 To adopt the remuneration report for the year ended 31 December 2012 Against Novae Group plc 01/05/2013 AGM 2 To adopt the remuneration report for the year ended 31 December 2012 Abstain Novae Group plc 01/05/2013 AGM 13 To re-appoint as auditors, KPMG Audit plc Abstain Novae Group -

Investec W&I – Morning Minutes 16.06.2020

Morning Meeting 16 June 2020 Index +/- % change Currencies +/- 12 month range FTSE 100 6064.7 -40.5 -0.7 £:$ 1.257 0.00 1.15 1.33 FTSE All-Share 3362.1 -17.7 -0.5 Y:$ 107.405 0.07 102.55 112.09 DJ Industrial Average 25763.2 157.6 0.6 E:£ 1.115 0.00 1.07 1.20 S&P 500 3066.6 25.3 0.8 E:$ 1.127 0.00 1.07 1.14 NASDAQ Composite Index 9726.0 137.2 1.4 10 Yr Bond Yld % +/- -3 months -12 months Nikkei Japan 1000 Index 1829.3 -48.5 -2.6 UK 0.19 -0.01 0.38 0.93 Hang Seng Index 23777.0 -524.4 -2.2 US 0.70 0.01 0.95 2.09 EURO STOXX 50 (EUR) 3136.4 -17.3 -0.5 Germany -0.45 -0.02 -0.58 -0.25 Switzerland SMI (PR) 9842.6 46.2 0.5 Price (p) +/- 12 month range France CAC 40 4815.7 -23.5 -0.5 Germany DAX (TR) 11911.4 -37.9 -0.3 Investec plc 165.55 -2.15001 128.8 518.6 Matrix Winners Price +/- % change Sector Winners % change Mkt Wt Bunzl plc 2069.0 185.0 9.8 FTSE All-Share / Support Services - SEC 0.9 5.6 LondonMetric Property Plc 213.2 6.4 3.1 FTSE All-Share / Leisure Goods - SEC 0.85 5.6 Ted Baker PLC 128.3 3.8 3.1 FTSE All-Share / Health Care Equipment & Services - SEC 0.62 1.1 Ashtead Group plc 2417.0 56.0 2.4 FTSE All-Share / Technology Hardware & Equipment - SEC 0.6 0.1 Hikma Pharmaceuticals Plc 2359.0 54.0 2.3 FTSE All-Share / Software & Computer Services - SEC 0.6 1.0 Matrix Losers Price +/- % change Sector Losers % change Mkt Wt Fresnillo PLC 747.6 -46.6 -5.9 FTSE All-Share / Industrial Metals & Mining - SEC -2.1 0.1 Barratt Developments PLC 499.2 -26.6 -5.1 FTSE All-Share / Beverages - SEC -1.8 3.7 Hurricane Energy Plc 6.6 -0.34 -4.9 FTSE All-Share -

The IC Ideas Farm Evidence That These Holdings Are Worthy of Investigation

TIPS IDEAS FARM offered a thorough explanation of the Welcome to the IC Ideas Farm evidence that these holdings are worthy of investigation. Meanwhile, that old favourite ALGY HALL will highlight stocks close to 52-week highs indicator of insider sentiment, director e offer up a lot of investment ideas for and lows. While generally it is a good sign if deals, are being drawn on as inspiration, Wour readers. Over the past 12 months, stocks are near a high and a bad sign if they although this data will continue to appear to improve the idea generation process, we’ve are near a low, sometimes these will also be elsewhere in the magazine. increased our focus on market signals that contrarian indicators of value opportunities Our tips and ideas will also continue to highlight stocks that may be worth further or overvaluation. draw on the screen results published weekly research. These new pages have been put We’re also producing a list of the market’s in our Alpha reports. We hope that by doing together to share this weekly ideas generation, most shorted shares based on disclosures to this we’re adding value for Alpha subscribers as we think readers will be able to gain their the Financial Conduct Authority (FCA). Short with our analysis, while also using the Alpha own valuable insights from the data. These sellers have proved very good at highlight- data to add value for readers that get the pages should also provide context to some of ing troubled companies, such as Carillion, magazine but don’t subscribe to the service. -

Register of Lords' Interests

REGISTER OF LORDS’ INTERESTS _________________ The following Members of the House of Lords have registered relevant interests under the code of conduct: ABERDARE, LORD Category 10: Non-financial interests (a) Director, F.C.M. Limited (recording rights) Category 10: Non-financial interests (c) Trustee, National Library of Wales (interest ceased 31 March 2021) Category 10: Non-financial interests (e) Trustee, Stephen Dodgson Trust (promotes continued awareness/performance of works of composer Stephen Dodgson) Chairman and Trustee, Berlioz Sesquicentenary Committee (music) Director, UK Focused Ultrasound Foundation (charitable company limited by guarantee) Chairman and Trustee, Berlioz Society Trustee, West Wycombe Charitable Trust ADAMS OF CRAIGIELEA, BARONESS Nil No registrable interests ADDINGTON, LORD Category 1: Directorships Chairman, Microlink PC (UK) Ltd (computing and software) Category 10: Non-financial interests (a) Director and Trustee, The Atlas Foundation (registered charity; seeks to improve lives of disadvantaged people across the world) Category 10: Non-financial interests (d) President (formerly Vice President), British Dyslexia Association Category 10: Non-financial interests (e) Vice President, UK Sports Association Vice President, Lakenham Hewitt Rugby Club (interest ceased 30 November 2020) ADEBOWALE, LORD Category 1: Directorships Director, Leadership in Mind Ltd (business activities; certain income from services provided personally by the member is or will be paid to this company; see category 4(a)) Director, Visionable