The Big Five Disruptive Strategies for African Aviation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Annual Report 2004/05

ETHIOPIAN AIRLINES Annual Report 2004-05 WWW.ETHIOPIANAIRLINES.COM ANNUAL REPORT 2004-05 building CONTENTS on the FUTURE Management Board of Ethiopian Airlines .................................. 2 CEO’s Message............................................................................................. 3 Ethiopian Airlines Management Team ......................................... 4 Embarking on a long-range reform I. Investing for the future Continent .................................... 5 II. Continuous Change .............................................................. 5 III. Operations Review ............................................................... 5 IV. Measures to Enhance Profitability .................................. 7 V. Human Resource Development ....................................... 10 VI. Fleet Planning and Financing .......................................... 11 VII. Information Systems .......................................................... 11 VIII. Tourism Promotion ............................................................ 11 IX. Corporate Social Responsibility (CSR) Measures ....... 12 Finance ............................................................................................................. 13 Auditors Report and Financial Statements ................................ 22 Domestic Route Map .............................................................................. 40 Ethiopian Airlines Offices ...................................................................... 41 International Route Map ...................................................................... -

Genesis Analytics 2016 Quantifying the Economic Contribution Of

Quantifying the Economic Contribution of Emirates to South Africa A report prepared by Genesis Analytics June 2016 © Genesis Analytics 2016 Document Reference: Quantifying the Economic Contribution of Emirates to South Africa, Final Date: June 2016 Contact Information Genesis Analytics (Pty) Ltd Office 3, 50 Sixth Road Hyde Park, 2196, Johannesburg South Africa Tel: +27 (0) 11 994 7000 Fax: +27 (0) 11 994 7099 www.genesis-analytics.com Authors Ryan Short Mbongeni Ndlovu Tshediso Matake Dirk van Seventer With thanks to Annabelle Ong and Chris Cuttle Contact Person Ryan Short [email protected] +27 (0) 11 994 7000 ii Table of Contents EXECUTIVE SUMMARY .............................................................................. VI 1. INTRODUCTION ..................................................................................... 1 1.1. Background and purpose ........................................................................ 1 1.2. Report structure ...................................................................................... 2 2. ABOUT EMIRATES ................................................................................. 3 3. OVERVIEW OF EMIRATES GROUP IN SOUTH AFRICA ..................... 4 4. A FRAMEWORK FOR MEASURING CONTRIBUTION ......................... 6 5. ENABLED CONTRIBUTION ................................................................... 9 5.1. The economic benefits of air connectivity ............................................... 9 5.2. The connectivity benefits of Emirates ..................................................... -

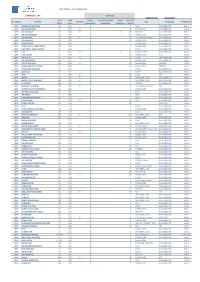

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

336 Partners Available for Ticketing in Iran

336 partners available for ticketing in Iran Please always use Quick Check on www.hahnair.com/quickcheck prior to ticketing HR-169 partner 9K Cape Air CC CM Airlines HF Air Côte d'Ivoire LM Loganair 9N Tropic Air CG PNG Air HM Air Seychelles LO LOT 9U Air Moldova CI China Airlines HO Juneyao Airlines LP LATAM Airlines Peru 0B Blue Air 9V Avior Airlines CM COPA Airlines HR Hahn Air Lines LR Lacsa 2D Dynamic Airways 9W Jet Airways CU Cubana de Aviacion HU Hainan Airlines LX Swiss International Airlines 2I Star Perú A3 Aegean Airlines CX Cathay Pacific HX Hong Kong Airlines M9 Motor Sich Airlines 2J Air Burkina A9 Georgian Airways CZ China Southern Airlines HY Uzbekistan Airways ME Middle East Airlines 2K Avianca Ecuador AD Azul Linhas Aereas Brasile… D2 Severstal Aircompany HZ Aurora Airlines MF Xiamen Airlines 2L Helvetic Airways AE Mandarin Airlines DE Condor IE Solomon Airlines MH Malaysia Airlines 2M Maya Island Air AH Air Algerie DV SCAT Airlines IG Meridiana fly MI SilkAir 2N Nextjet AI Air India E7 Equaflight IZ Arkia Israel Airlines MK Air Mauritius 3M Silver Airways AM AEROMEXICO EI Aer Lingus J2 Azerbaijan Airlines (Azal) MN kulula 3S Air Antilles AR Aerolineas Argentinas EK Emirates J8 Berjaya Air MR Hunnu Air 3U Sichuan Airlines AS Alaska Airlines EL Ellinair JD Beijing Capital Airlines MS EGYPTAIR 4M LATAM Airlines Argentina AT Royal Air Maroc EN Air Dolomiti JF Jet Asia Airways MT Thomas Cook Airlines 4O Interjet AV AVIANCA EQ TAME JJ LATAM Airlines Brasil MU China Eastern Airlines 4V BVI Airways AY Finnair ET Ethiopian Airlines -

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Download Ethiopian Fact Sheet April 2017

VICTORIA FALLS Ethiopian Airlines Factsheet - April 2017 OSLO ANTANANARIVO Overview Ethiopian Airlines (Ethiopian) is the leading and most profitable airline in Africa. In 2014 IATA ranked Ethiopian as the largest airline in Africa in revenue and profit. Over the past seven decades, Ethiopian has been a pioneer of African aviation as an aircraft technology leader. It all started with a military surplus C-47, leading the way with the first Jet service in the continent in the early 60’s to the first B-767 in the mid 80’s, to the first African B-787 Dreamliner in 2012 and the first African Airbus A-350 in 2016. Ethiopian joined Star Alliance, the world’s largest Airline network, in December 2011. Ethiopian is currently implementing a 15-year strategic plan called Vision 2025 that will see it become the leading airline group in Africa with seven strategic business units. Ethiopian is a multi-award winning airline, including SKYTRAX and Passenger Choice Awards in 2015, and has been registering an average growth of 25% per annum for the past ten years. Ethiopian Background Information Founded E December 21, 1945 Starting date of operation E April 08, 1946 Ownership E Government of Ethiopia (100%) Head Office E Bole International Airport, P.O. Box 1755 Addis Ababa, Ethiopia Fax: (+ 251)11661 1474 Reservations E Tel: (+251) 11 665 6666 Website E http://www.ethiopianairlines.com Group Chief Executive Officer E Mr. Tewolde GebreMariam Fleet Summary Aircraft Inventory: 87 Fleet on order: 47 Average age of aircraft: 5 years Passenger aircraft Airbus -

(AIM: FJET) Final Results for the Year to 31 December 2016 30 May 2017 Fa

fastjet Plc ("fastjet" or the “Company”) (AIM: FJET) Final results for the year to 31 December 2016 30 May 2017 fastjet, the low-cost African airline, announces its audited final results for the year ended 31 December 2016. The table below shows the financial performance of the fastjet Group’s continuing activities. 2016 2015 US$ US$ Revenue 68.5m 65.1m Group Operating loss (63.9)m (37.9)m Loss from continuing activities before tax (65.8)m (35.9)m Loss from continuing activities after tax (66.0)m (36.2)m Profit/(loss) from discontinued activities after tax 18.0m 14.3m Loss for the year after tax (48.0)m (21.9)m Loss per share from continuing activities (0.84) (0.71) Cash balance at year end 3.6m 28.9m Strategic highlights ● Nico Bezuidenhout appointed CEO on 1 August 2016. ● Stabilisation Plan initiated comprising: o Major cost reductions o Fleet transition to smaller aircraft o Head office relocation to Johannesburg o Revenue initiatives including route rationalisation ● Successful capital fundraising of approximately US$20.0m before expenses in August 2016 ● Strategic and operational partnership with Solenta Aviation Holdings concluded in January 2017 providing 3 E145 aircraft at reduced lease rates and Solenta acquiring a 28% shareholding in fastjet. ● Additional capital raise of approximately US$28.8m before expenses in January 2017, reflecting optimism in the strategic outlook for fastjet Operational highlights ● Named Africa’s Leading Low-Cost Airline 2016 at the World Travel Awards ● Revenues increased by 5% to US$68.5m (2015: -

Aviation Rankings' Misjudgment: Inspiration of Egypt Air and Cairo International Airport Cases

Journal of the Faculty of Tourism and Hotels-University of Sadat City, Vol. 4, Issue (2/1), December, 2020 Aviation Rankings' Misjudgment: Inspiration of Egypt Air and Cairo International Airport Cases 1Farouk Abdelnabi Hassanein Attaalla 1Faculty of Tourism and Hotels, Fayoum University Abstract This study aims to make a comprehensive assessment of the three most popular aviation rankings; Skytrax, AirHelp and TripAdvisor from a critical perspective supported by a global field study conducted in the same methodology as these three rankings have been done. This study is based on the descriptive statistics to analyze field data gathered about EgyptAir and other airlines, Cairo International Airport and other airports and comparing these results with what is published in these three rankings in 2018. The current study reveals that the results of these three global rankings are characterized by shortcomings and lack of value and unfairness. Finally, the study suggests a model for fairness and equity in the rankings of airlines and airports. Keywords: Air Rankings, Egypt Air, Cairo International Airport, Equity. 1- Introduction Through scanning the international airlines and airports rankings for the recent five years from 2013 to 2018, it is found that no understandable and embarrassing absence for Egypt Air (MS) and Cairo International Airport (CAI). However, Arabic airlines and Airports such as Qatar Airways, Emirates Airways, Oman Air, Etihad Airways, Saudia Airlines, Royal Jordanian and Air Maroc, Hamad International Airport and Queen Alia International Airport have occupied different ranks through these years. Their ranks may be one of the top 10 airline and airport positions, while others occupy one of the top 100 airlines and airports in the world. -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Fastjet Plc ("Fastjet" Or the “Company”) (AIM: FJET) Interim Results for The

fastjet Plc ("fastjet" or the “Company”) (AIM: FJET) Interim Results for the six months to 30 June 2018 fastjet, the African value airline for everyone, announces its unaudited Interim Results for the six months to 30 June 2018, together with strategic and operational developments to date in 2018. The table below shows the financial performance highlights of the fastjet Group for the period to 30 June 2018. H1 2018 H1 2017 US$ US$ Revenue 30.1m 21.2m Operating loss (14.6)m (13.2)m Loss per share (HEPS) (0.03) (0.04) Highlights • Revenue growth is driven by capacity and fleet increases year on year following Stabilisation Plan adjustments initiated in 2017; • Successful capital raise of $10m in July 2018 to fund working capital for current operational period; • Recent changes in the competitive landscape in Tanzania have caused the Board to evaluate fastjet’s Tanzanian operations and the consequential financial impact of continued losses in this operation, which could include ceasing operations in country; • The Directors are still encouraged by trading in the Zimbabwean and Mozambique markets, but the headroom of freely usable and available cash resources is minimal and the company’s ability to continue as a going concern remains very sensitive to its future funding requirements; and • Additional funding will be required by the end of October to enable fastjet to continue operating; The Company is currently in active discussions with its major shareholders regarding a potential equity fundraising, in the absence of which the Group is not able to continue trading as a going concern. -

Worldwide Direct Flights File

LCCs: On the verge of making it big in Japan? LCCs: On the verge of making it big in Japan? The announcement that AirAsia plans a return to the Japanese market in 2015 is symptomatic of the changes taking place in Japanese aviation. Low cost carriers (LCCs) have been growing rapidly, stealing market share from the full service carriers (FSCs), and some airports are creating terminals to handle this new type of traffic. After initial scepticism that the Japanese traveller would accept a low cost model in the air, can the same be said for low cost terminals? In this article we look at the evolution of LCCs in Japan and ask what the planners need to be considering now in order to accommodate tomorrow’s airlines. Looking back decades Japan was unusual in Asia in that it fostered competition between national carriers, allowing both ANA and Japan Airlines to create strong market positions. As elsewhere, though, competition is regulated and domestic carriers favoured. While low cost carriers (LCCs) have been given room to breathe in Japan their access to some of the major airports has been restricted, albeit by a lack of slot availability at airports such as Tokyo’s Haneda International Airport. The fostering of a truly competitive Japanese aviation market requires the opportunity for LCCs to thrive and that almost certainly means new airport infrastructure to deliver those much needed slots. State of play In comparison to the wider Asian region, LCCs in Japan are still some way from reaching comparable levels of market share. In October 2014, LCCs accounted for 26% of scheduled airline capacity within Asia; in Japan they have just reached a 17% share of domestic seats and have yet to gain a strong foothold in the international market, with just 9% of seats, or 7.5 million seats annually.