United States Securities and Exchange Commission Schedule 14A Tegna Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEGNA INC. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Under Rule 14a-12 TEGNA INC. (Exact name of registrant as specified in its charter) STANDARD GENERAL L.P. STANDARD GENERAL MASTER FUND L.P. SOOHYUNG KIM COLLEEN B. BROWN ELLEN MCCLAIN HAIME DEBORAH MCDERMOTT STEPHEN USHER DAVID GLAZEK AMIT THAKRAR DANIEL MALMAN (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Nexstar Broadcasting Group, Inc. Annual Report 2018

Nexstar Broadcasting Group, Inc. Annual Report 2018 Form 10-K (NASDAQ:NXST) Published: March 1st, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2017 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to . Commission File Number: 000-50478 NEXSTAR MEDIA GROUP, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 23-3083125 (State of Organization or Incorporation) (I.R.S. Employer Identification No.) 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062 (Address of Principal Executive Offices) (Zip Code) (972) 373-8800 (Registrant’s Telephone Number, Including Area Code) Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, $0.01 par value per share NASDAQ Global Select Market Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that it was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

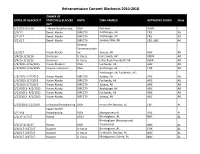

Retrans Blackouts 2010-2018

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

Appendix a Stations Transitioning on June 12

APPENDIX A STATIONS TRANSITIONING ON JUNE 12 DMA CITY ST NETWORK CALLSIGN LICENSEE 1 ABILENE-SWEETWATER SWEETWATER TX ABC/CW (D KTXS-TV BLUESTONE LICENSE HOLDINGS INC. 2 ALBANY GA ALBANY GA NBC WALB WALB LICENSE SUBSIDIARY, LLC 3 ALBANY GA ALBANY GA FOX WFXL BARRINGTON ALBANY LICENSE LLC 4 ALBANY-SCHENECTADY-TROY ADAMS MA ABC WCDC-TV YOUNG BROADCASTING OF ALBANY, INC. 5 ALBANY-SCHENECTADY-TROY ALBANY NY NBC WNYT WNYT-TV, LLC 6 ALBANY-SCHENECTADY-TROY ALBANY NY ABC WTEN YOUNG BROADCASTING OF ALBANY, INC. 7 ALBANY-SCHENECTADY-TROY ALBANY NY FOX WXXA-TV NEWPORT TELEVISION LICENSE LLC 8 ALBANY-SCHENECTADY-TROY PITTSFIELD MA MYTV WNYA VENTURE TECHNOLOGIES GROUP, LLC 9 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CW WCWN FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 10 ALBANY-SCHENECTADY-TROY SCHENECTADY NY CBS WRGB FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. 11 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CW KASY-TV ACME TELEVISION LICENSES OF NEW MEXICO, LLC 12 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM UNIVISION KLUZ-TV ENTRAVISION HOLDINGS, LLC 13 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM PBS KNME-TV REGENTS OF THE UNIV. OF NM & BD.OF EDUC.OF CITY OF ALBUQ.,NM 14 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM ABC KOAT-TV KOAT HEARST-ARGYLE TELEVISION, INC. 15 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM NBC KOB-TV KOB-TV, LLC 16 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM CBS KRQE LIN OF NEW MEXICO, LLC 17 ALBUQUERQUE-SANTA FE ALBUQUERQUE NM TELEFUTURKTFQ-TV TELEFUTURA ALBUQUERQUE LLC 18 ALBUQUERQUE-SANTA FE CARLSBAD NM ABC KOCT KOAT HEARST-ARGYLE TELEVISION, INC. -

Brief for Respondents

No. 10-1293 In the Morris Tyler Moot Court of Appeals at Yale FEDERAL COMMUNICATIONS COMMISSION, ET AL., PETITIONERS v. FOX TELEVISION STATIONS, INC., ET AL., RESPONDENTS FEDERAL COMMUNICATIONS COMMISSION AND UNITED STATES OF AMERICA, PETITIONERS v. ABC, INC., ET AL., RESPONDENTS ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE SECOND CIRCUIT BRIEF FOR THE RESPONDENTS LEWIS BOLLARD JONATHAN SIEGEL Counsel for Respondents The Yale Law School 127 Wall Street New Haven, CT 06511 (203) 432–4992 QUESTIONS PRESENTED The FCC forbids the broadcasting of indecent speech, defined “as material that, in context, depicts or describes sexual or excretory activities or organs in terms patently offensive as measured by contemporary community standards for the broadcast medium.” J.A. 49. The questions presented are: 1. Whether the FCC’s definition of indecency violates the Fifth Amendment because it is impermissibly vague. 2. Whether the FCC’s ban on indecency violates the First Amendment because it is not narrowly tailored and because it does not require scienter for liability. i PARTIES TO THE PROCEEDINGS Petitioners are the Federal Communications Commission and the United States of America. Respondents who were petitioners in the court of appeals in Fox Television Stations, Inc. v. FCC are: Fox Television Stations, Inc., CBS Broadcasting Inc., WLS Television, Inc., KTRK Television, Inc., KMBC Hearst-Argyle Television, Inc., and ABC Inc. Respondents who were intervenors in the court of appeals in Fox Television Stations, Inc. v. FCC are: NBC Universal, Inc., NBC Telemundo License Co., NBC Television Affiliates, FBC Television Affiliates Association, CBS Television Network Affiliates, Center for the Creative Community, Inc., doing business as Center for Creative Voices in Media, Inc., and ABC Television Affiliates Association. -

Acquisition of Tribune Media Company

Acquisition of Tribune Media Company Enhancing Nexstar’s Position as North America’s Leading Local Media Company December 3, 2018 Disclaimer Forward-Looking Statements This Presentation includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words "guidance," "believes," "expects," "anticipates," "could," or similar expressions. For these statements, Nexstar Media and Tribune Media claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation, concerning, among other things, the ultimate outcome, benefits and cost savings of any possible transaction between Nexstar Media and Tribune Media and timing thereof, and future financial performance, including changes in net revenue, cash flow and operating expenses, involve risks and uncertainties, and are subject to change based on various important factors, including the timing of and any potential delay in consummating the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied and the transaction may not close; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated, the risk of the occurrence of any -

Nexstar Media Group Stations(1)

Nexstar Media Group Stations(1) Full Full Full Market Power Primary Market Power Primary Market Power Primary Rank Market Stations Affiliation Rank Market Stations Affiliation Rank Market Stations Affiliation 2 Los Angeles, CA KTLA The CW 57 Mobile, AL WKRG CBS 111 Springfield, MA WWLP NBC 3 Chicago, IL WGN Independent WFNA The CW 112 Lansing, MI WLAJ ABC 4 Philadelphia, PA WPHL MNTV 59 Albany, NY WTEN ABC WLNS CBS 5 Dallas, TX KDAF The CW WXXA FOX 113 Sioux Falls, SD KELO CBS 6 San Francisco, CA KRON MNTV 60 Wilkes Barre, PA WBRE NBC KDLO CBS 7 DC/Hagerstown, WDVM(2) Independent WYOU CBS KPLO CBS MD WDCW The CW 61 Knoxville, TN WATE ABC 114 Tyler-Longview, TX KETK NBC 8 Houston, TX KIAH The CW 62 Little Rock, AR KARK NBC KFXK FOX 12 Tampa, FL WFLA NBC KARZ MNTV 115 Youngstown, OH WYTV ABC WTTA MNTV KLRT FOX WKBN CBS 13 Seattle, WA KCPQ(3) FOX KASN The CW 120 Peoria, IL WMBD CBS KZJO MNTV 63 Dayton, OH WDTN NBC WYZZ FOX 17 Denver, CO KDVR FOX WBDT The CW 123 Lafayette, LA KLFY CBS KWGN The CW 66 Honolulu, HI KHON FOX 125 Bakersfield, CA KGET NBC KFCT FOX KHAW FOX 129 La Crosse, WI WLAX FOX 19 Cleveland, OH WJW FOX KAII FOX WEUX FOX 20 Sacramento, CA KTXL FOX KGMD MNTV 130 Columbus, GA WRBL CBS 22 Portland, OR KOIN CBS KGMV MNTV 132 Amarillo, TX KAMR NBC KRCW The CW KHII MNTV KCIT FOX 23 St. Louis, MO KPLR The CW 67 Green Bay, WI WFRV CBS 138 Rockford, IL WQRF FOX KTVI FOX 68 Des Moines, IA WHO NBC WTVO ABC 25 Indianapolis, IN WTTV CBS 69 Roanoke, VA WFXR FOX 140 Monroe, AR KARD FOX WTTK CBS WWCW The CW WXIN FOX KTVE NBC 72 Wichita, KS -

Updating the Statutory Framework for Communications for the Digital Age: Issues for Congress

Updating the Statutory Framework for Communications for the Digital Age: Issues for Congress Charles B. Goldfarb Specialist in Telecommunications Policy September 30, 2013 Congressional Research Service 7-5700 www.crs.gov R43248 Updating the Statutory Framework for Communications for the Digital Age: Issues for Congress Summary The statutory framework for the communications sector largely was enacted prior to the commercial development and deployment of digital technology, Internet Protocol (IP), broadband networks, and online voice, data, and video services. These new technologies have driven changes in market structure throughout the communications sector. Technological spillovers have allowed for the convergence of previously service-specific networks, creating new competitive entry opportunities. But they also have created certain incentives for market consolidation. Firms also have used new technologies to attempt to “invent around” statutory obligations or prohibitions, such as retransmission consent and copyright requirements. In addition, firms have developed new technologies that are attractive to consumers because they allow them to avoid paying for programming or allow them to skip the commercials that accompany video programming, but present a challenge to the traditional business model. The expert agencies charged with implementing the relevant statutes—the Federal Communications Commission (FCC) and the Copyright Office—have had to determine if and how to apply the law to technologies and circumstances that were not considered -

Federal Communications Commission DA 13-2140 Before the Federal

Federal Communications Commission DA 13-2140 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) J. Stewart Bryan III and Media General ) MB Docket No. 13-191 Communications Holdings, LLC ) (Transferor) ) File Nos. BTCCDT-20130703ABQ et al. ) Shareholders of New Young Broadcasting ) Holding Company, Inc., and Its Subsidiaries ) (Transferor) ) ) and ) ) Post-Merger Shareholders of Media General, Inc. ) (Transferee) ) ) For Consent to Transfer Control of Licenses MEMORANDUM OPINION AND ORDER Adopted: November 7, 2013 Released: November 8, 2013 By Chief, Video Division, Media Bureau I. INTRODUCTION 1. The Federal Communications Commission (“Commission”), by the Chief, Video Division, Media Bureau, pursuant to delegated authority, has before it applications seeking consent to the transfer of control of the broadcast television operations of the licensee subsidiaries of New Young Broadcasting Holding Co., Inc. (“Young”) and Media General Communications Holdings, LLC (“Media General”)(collectively “the Applicants”) to a new post-merger entity, which in the applications has been referred to as Post-Merger Shareholders of Media General, Inc. (hereinafter “Post-Merger Media General”).1 For the reasons set forth below, we grant the applications seeking consent to the transfer of control, as listed in the attached Appendix. We further grant the requested “satellite exemptions,” pursuant to Note 5 of Section 73.3555 of the local television ownership rule2 and “failing” station waiver, pursuant to Note 7 of Section 73.3555 of the local television ownership rule.3 We deny the Informal Objections filed by Spartan-TV, LLC (“Spartan”) and Dish Network, LLC (“Dish”). 1 Applications for Consent to Transfer Control of New Young Broadcasting Holding Co., Inc. -

All Full-Power Television Stations by Dma, Indicating Those Terminating Analog Service Before Or on February 17, 2009

ALL FULL-POWER TELEVISION STATIONS BY DMA, INDICATING THOSE TERMINATING ANALOG SERVICE BEFORE OR ON FEBRUARY 17, 2009. (As of 2/20/09) NITE HARD NITE LITE SHIP PRE ON DMA CITY ST NETWORK CALLSIGN LITE PLUS WVR 2/17 2/17 LICENSEE ABILENE-SWEETWATER ABILENE TX NBC KRBC-TV MISSION BROADCASTING, INC. ABILENE-SWEETWATER ABILENE TX CBS KTAB-TV NEXSTAR BROADCASTING, INC. ABILENE-SWEETWATER ABILENE TX FOX KXVA X SAGE BROADCASTING CORPORATION ABILENE-SWEETWATER SNYDER TX N/A KPCB X PRIME TIME CHRISTIAN BROADCASTING, INC ABILENE-SWEETWATER SWEETWATER TX ABC/CW (DIGITALKTXS-TV ONLY) BLUESTONE LICENSE HOLDINGS INC. ALBANY ALBANY GA NBC WALB WALB LICENSE SUBSIDIARY, LLC ALBANY ALBANY GA FOX WFXL BARRINGTON ALBANY LICENSE LLC ALBANY CORDELE GA IND WSST-TV SUNBELT-SOUTH TELECOMMUNICATIONS LTD ALBANY DAWSON GA PBS WACS-TV X GEORGIA PUBLIC TELECOMMUNICATIONS COMMISSION ALBANY PELHAM GA PBS WABW-TV X GEORGIA PUBLIC TELECOMMUNICATIONS COMMISSION ALBANY VALDOSTA GA CBS WSWG X GRAY TELEVISION LICENSEE, LLC ALBANY-SCHENECTADY-TROY ADAMS MA ABC WCDC-TV YOUNG BROADCASTING OF ALBANY, INC. ALBANY-SCHENECTADY-TROY ALBANY NY NBC WNYT WNYT-TV, LLC ALBANY-SCHENECTADY-TROY ALBANY NY ABC WTEN YOUNG BROADCASTING OF ALBANY, INC. ALBANY-SCHENECTADY-TROY ALBANY NY FOX WXXA-TV NEWPORT TELEVISION LICENSE LLC ALBANY-SCHENECTADY-TROY AMSTERDAM NY N/A WYPX PAXSON ALBANY LICENSE, INC. ALBANY-SCHENECTADY-TROY PITTSFIELD MA MYTV WNYA VENTURE TECHNOLOGIES GROUP, LLC ALBANY-SCHENECTADY-TROY SCHENECTADY NY CW WCWN FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. ALBANY-SCHENECTADY-TROY SCHENECTADY NY PBS WMHT WMHT EDUCATIONAL TELECOMMUNICATIONS ALBANY-SCHENECTADY-TROY SCHENECTADY NY CBS WRGB FREEDOM BROADCASTING OF NEW YORK LICENSEE, L.L.C. -

Schedule 14A (Rule 14A-101)

1 SCHEDULE 14A (RULE 14A-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. ) Filed by the registrant /x/ Filed by a party other than the registrant / / Check the appropriate box: / / Preliminary Proxy Statement / / Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) /x/ Definitive Proxy Statement / / Definitive Additional Materials / / Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 HARTE-HANKS COMMUNICATIONS, INC. -------------------------------------------------------------------------------- (Name of Registrant as Specified in its Charter) -------------------------------------------------------------------------------- (Name of Person(s) Filing Proxy Statement, if other than Registrant) Payment of filing fee (Check the appropriate box): /x/ $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), or 14a-6(j)(2) or Item 22(a)(2) of Schedule 14A. / / $500 per each party to the controversy pursuant to Exchange Act Rule 14a-6(i)(3). / / Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. (1) Title of each class of securities to which transaction applies: -------------------------------------------------------------------------------- (2) Aggregate number of securities to which transactions applies: -------------------------------------------------------------------------------- (3) Per unit price or other underlying value of transaction computed -

Broadcasters in the Internet Age

G.research, LLC November 27, 2018 One Corporate Center Rye, NY 10580-1422 g.research Tel (914) 921-5150 www.gabellisecurities.com Broadcasters in the Internet Age Brett Harriss G.research, LLC 2018 (914) 921-8335 -Please Refer To Important Disclosures On The Last Page Of This Report- G.research, LLC November 27, 2018 One Corporate Center Rye, NY 10580-1422 g.research Tel (914) 921-5150 www.gabellisecurities.com OVERVIEW The television industry is experiencing a tectonic shift of viewership from linear to on-demand viewing. Vertically integrated behemoths like Netflix and Amazon continue to grow with no end in sight. Despite this, we believe there is a place in the media ecosystem for traditional terrestrial broadcast companies. SUMMARY AND OPINION We view the broadcasters as attractive investments. We believe there is the potential for consolidation. On April 20, 2017, the FCC reinstated the Ultra High Frequency (UHF) discount giving broadcasters with UHF stations the ability to add stations without running afoul of the National Ownership Cap. More importantly, the current 39% ownership cap is under review at the FCC. Given the ubiquitous presence of the internet which foster an excess of video options and media voices, we believe the current ownership cap could be viewed as antiquated. Should the FCC substantially change the ownership cap, we would expect consolidation to accelerate. Broadcast consolidation would have the opportunity to deliver substantial synergies to the industry. We would expect both cost reductions and revenue growth, primarily in the form of increased retransmission revenue, to benefit the broadcast stations and networks.