Health Savings Account

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Extensions of Remarks E 2063 EXTENSIONS of REMARKS

October 30, 1995 CONGRESSIONAL RECORD Ð Extensions of Remarks E 2063 EXTENSIONS OF REMARKS THE NEW MEDICARE a more limited choice of health care providers. torial by Thomas Friedman in the New York Beneficiaries would get detailed information in Times. Mr. Friedman summarizes portions of HON. VERNON J. EHLERS the mail each year about types of plans avail- the World Bank study which show that in 1960 OF MICHIGAN able in their area. the Middle East had a per capita income high- Three, medical savings accounts: Bene- IN THE HOUSE OF REPRESENTATIVES er than Asia, but in 1990, even with oil wealth, ficiaries could also choose coverage through a the Middle East per-capita income had only Monday, October 30, 1995 medical savings account [MSA]. This option doubled while that of Asia had more than Mr. EHLERS. Mr. Speaker, after months of would require beneficiaries to choose a high- quadrupled. Economic reform, privatization, debate and thousands of meetings across the deductible insurance policy paid by Medicare. and development have eluded the Middle East country, the House passed the Medicare Pres- The savings achieved through this policy will to a larger extent. ervation Act [MPA] on October 19. Crafting the be placed in an individual MSA, which will be These problems are acute in Egypt. The legislation, which generated strong feelings on used to pay for health care expenses within need for economic restructuring is enormous. all sides of the issue, was by no means an the deductible, or to purchase long-term care Egypt and the entire Middle East region will easy task. -

Palau Along a Path of Sustainability, While Also Ensuring That No One Is Left Behind

0 FOREWORD I am pleased to present our first Voluntary National Review on the SDGs. This Review is yet another important benchmark in our ongoing commitment to transform Palau along a path of sustainability, while also ensuring that no one is left behind. This journey towards a sustainable future is not one for gov- ernment alone, nor a single nation, but for us all. Given the SDG’s inherent inter-linkages, we acknowledge that our challenges are also interrelated, and thus so too must be our solutions. The accelerated pace of global change we see today makes it particularly diffi- cult for small island nations, like Palau, to keep up, let alone achieve sustaina- ble development. Despite this challenge, we firmly believe that we can achieve a sustainable future for Palau. Our conviction stems from our certainty that we can confront our challenges by combining our lessons from the past with new information and modern technology and use them to guide us to stay the right course along our path to the future. Just as important, we are also confi- dent in this endeavor because we can also find solutions amongst each other. Over the past three years, Palau has systematically pursued a rigorous process of assessing our Pathways to 2030. Eight inter-sector working groups, led by government ministries, but including representatives from civil society, and semi-private organizations, have prepared this initial Voluntary National Review. The groups have selected an initial set of 95 SDG global targets and associated indicators that collectively constitute our initial National SDG Framework. -

HSA) Provision in the Medicare Bill Was Signed Into Law by President Bush on December 8, 2003 and Goes Into Effect January 1, 2004

HEALTH SAVINGS ACCOUNTS BY GREG SCANDLEN December 17, 2003 The new Health Savings Accounts (HSA) provision in the Medicare bill was signed into law by President Bush on December 8, 2003 and goes into effect January 1, 2004. All 250 million non-elderly Americans will now have access to a Medical Savings Account (MSA), and one that is far more attractive than the Archer MSAs that were enacted in 1996. Account holders must have a qualified insurance plan, but the insurance requirements have been opened up considerably. Allowable deductibles have been lowered to $1,000 for an individual and $2,000 for a family. The maximum deductible requirement has been replaced by maximum out-of-pocket limits of $5,000 and $10,000 for individuals and families. These limits include deductibles and coinsurance for “in-network” providers. There is no restriction on the stop-loss limits for outof- network services. These amounts will be adjusted annually for cost of living increases. Preventive care services may be covered on a first-dollar basis. That is, deductibles will not have to apply to services as defined by section 1871 of the Social Security Act. Annual contributions to the HSA are limited to 100% of the deductible up to a maximum of $2,600 for an individual or $5,150 for a family. Account holders aged 55 and up may make additional contributions of $500 in 2004, increasing by $100 each year until it reaches $1,000 in 2009. Health Issues A not-for-profit health and tax policy research organization 2 Such contributions may be made by any combination of employer and individual. -

Chase Health Savings Account (HSA)

Chase Health Savings Account (HSA) 2006 Group Participant HSA Enrollment Package This HSA Enrollment Package (the “Enrollment Package”) is for the Chase HSA that is provided by JPMorgan Chase Bank, N.A. By completing and signing the attached Enrollment Form and Adoption Agreement, you are selecting JPMorgan Chase Bank, N.A. (“Chase”) as your Health Savings Account (“HSA”) custodian and are requesting Chase to open an HSA on your behalf. As the custodian of your HSA, Chase will manage your account and safeguard your HSA funds. Instructions processed within one week of enrollment or within 7-10 days after To expedite the enrollment process, please follow these steps: your Chase HSA has been opened and your identification has been verified. The recurring EFT monthly withdrawal will start 1. Use black ink only. Do not use pencil. If you make an error, approximately 30 days from your HSA account open date. Chase may strike through it, and place your initials next to the correction. for business reasons modify the date of the EFT monthly withdrawal 2. Read the eligibility questions carefully. by increasing the number of days between monthly withdrawals. 3. Complete sections 1 through 4, and sign where indicated. Are You Eligible? 4. Sign the Enrollment Form and Adoption Agreement on page 6, It is the responsibility of the individual participant to ensure they are and the Optional Beneficiary Designation Form that is part of eligible for an HSA. To be eligible to open an HSA, you must satisfy this Enrollment Package. Please make a copy of this Enrollment all of the following conditions established by law: Package for your records. -

Contemporary Economic Issues Part I

Contemporary Economic Issues Part I Professor Timothy Taylor THE TEACHING COMPANY ® Timothy Taylor Managing Editor, Journal of Economic Perspectives Macalester College Timothy Taylor is managing editor of the Journal of Economic Perspectives, an academic journal published quarterly by the American Economic Association. The purpose of the journal is to encourage communication and cross-fertilization across the many fields of economics. Taylor received his Bachelor of Arts degree from Haverford College in 1982, and a Master's degree in Economics from Stanford University in 1984. He then worked as an editorial writer for the San Jose Mercury News for two years, before taking the job of starting the Journal of Economic Perspectives in 1986. He has taught introductory economics in a number of contexts. At Stanford University and the University of Minnesota, he taught large lecture courses of 300-500 students. At Stanford, he was winner of the award for excellent teaching in a large class given by the Associated Students of Stanford University in 1992. Since moving to the University of Minnesota in 1994, he has been named a Distinguished Lecturer by the Department of Economics in 1996, and voted Teacher of the Year by the Master's degree students at the Hubert H. Humphrey Institute of Public Affairs in 1997. He has also been a guest speaker for groups of teachers of high school economics, visiting diplomats from Eastern Europe, radio talk shows, and community groups. From 1989 to 1997, Tim wrote an economics opinion column for the San Jose Mercury News; many of his columns were disseminated nationally over the Knight-Ridder-Tribune wire. -

Classification of Health Care Financing Schemes (ICHA-HF)

A System of Health Accounts 2011 © OECD, European Union, World Health Organization PART I Chapter 7 Classification of Health Care Financing Schemes (ICHA-HF) 153 I.7. CLASSIFICATION OF HEALTH CARE FINANCING SCHEMES (ICHA-HF) Introduction This chapter presents a summary of the conceptual accounting framework for health financing and of one of its main components, the new classification of health care financing schemes (ICHA-HF). This summary also serves as an introduction to Chapter 8, in which the classification of revenue of financing schemes (ICHA-FS) is presented. Furthermore, in SHA 2011 the accounting framework for health care financing also encompasses the concept of institutional units of health financing and the related classification of financing agents (ICHA-FA) as a tool for a more detailed national analysis (see Annex D). The three classifications together provide the tools to account comprehensively for health care financing and describe the flow of financial resources in the health system. This introduction therefore provides a brief definition of all the key concepts and highlights their relationships. The relevance of the particular classifications and cross-tabulations may vary for countries that differ in the organisational structure and level of resources of their health care systems, as well as in their level of economic development and their dependency on foreign resources. This chapter is concerned with the financing of the final consumption of health care goods and services; Chapter 11 discusses the financing of fixed capital formation. As to the main functions of health financing, Chapter 7 focuses on accounting tools for the allocation of resources; while Chapter 8 focuses on accounting tools for revenue-raising. -

Financing Health Care in the European Region

Financing health care in the European Union Th e European Observatory on Health Systems and Policies supports and promotes evidence- based health policy-making through comprehensive and rigorous analysis of health systems in Europe. It brings together a wide range of policy-makers, academics and practitioners to analyse trends in health reform, drawing on experience from across Europe to illuminate policy issues. Th e European Observatory on Health Systems and Policies is a partnership between the World Health Organization Regional Offi ce for Europe, the Governments of Belgium, Finland, Norway, Slovenia, Spain and Sweden, the Veneto Region of Italy, the European Investment Bank, the World Bank, the London School of Economics and Political Science and the London School of Hygiene & Tropical Medicine. Financing health care in the European Union Challenges and policy responses Sarah Thomson Thomas Foubister Elias Mossialos This study was requested and fi nanced by the European Parliament’s Committee on Employment and Social Affairs (EMPL). Keywords: FINANCING, HEALTH DELIVERY OF HEALTH CARE – economics HEALTH CARE COSTS HEALTH CARE REFORM EUROPEAN UNION © World Health Organization 2009, on behalf of the European Observatory on Health Systems and Policies All rights reserved. Th e European Observatory on Health Systems and Policies welcomes requests for permission to reproduce or translate its publications, in part or in full. Address requests about publications to: Publications, WHO Regional Offi ce for Europe, Scherfi gsvej 8, DK-2100 Copenhagen Ø, Denmark Alternatively, complete an online request form for documentation, health information, or for permission to quote or translate, on the Regional Offi ce web site (http://www.euro.who.int/pubrequest). -

1 PROSPECTUS If You Are in Doubt About the Contents of This

PROSPECTUS If you are in doubt about the contents of this Prospectus, you should consult your stockbroker or other independent financial adviser. ATLANTIS INTERNATIONAL UMBRELLA FUND (an open-ended umbrella unit trust established as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations, 2011 (S.I. 352 of 2011), as amended The Units in Atlantis Japan Opportunities Fund, Atlantis China Healthcare Fund, Atlantis China Fund and Atlantis Asian Fund are admitted to the Official List and to trading on the main securities market of Euronext Dublin. The Directors do not expect that an active secondary market will develop in the Units. Neither the admission of the Units to the Official List and to trading on the main securities market of Euronext Dublin nor the approval of this Prospectus pursuant to the requirements of Euronext Dublin, shall constitute a warranty or representation by Euronext Dublin as to the competence of the service providers to or any other party connected with the Fund, the adequacy of the information contained in the Prospectus and Supplements or the suitability of the Fund for investment purposes. Dated: 19 February, 2021 1 9999278v1 PRELIMINARY The Fund is structured as an umbrella fund and may comprise several portfolios of assets, each a “Sub-Fund” in which units representing one undivided share in the assets of a Sub-Fund (“Units”) are issued. Each Sub-Fund may be further sub-divided, to denote differing characteristics attributable to particular Units, into “classes”. THIS PROSPECTUS MAY ONLY BE ISSUED WITH ONE OR MORE SUPPLEMENTS, EACH CONTAINING INFORMATION RELATING TO A SEPARATE SUB-FUND. -

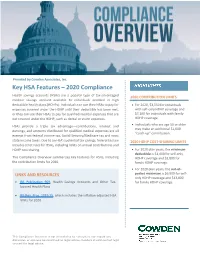

Key HSA Features – 2020 Compliance

Provided by Cowden Associates, Inc. Key HSA Features – 2020 Compliance Health savings accounts (HSAs) are a popular type of tax-advantaged 2020 CONTRIBUTION LIMITS medical savings account available to individuals enrolled in high deductible health plans (HDHPs). Individuals can use their HSAs to pay for For 2020, $3,550 for individuals expenses covered under the HDHP until their deductible has been met, with self-only HDHP coverage and or they can use their HSAs to pay for qualified medical expenses that are $7,100 for individuals with family not covered under the HDHP, such as dental or vision expenses. HDHP coverage. HSAs provide a triple tax advantage—contributions, interest and Individuals who are age 55 or older may make an additional $1,000 earnings, and amounts distributed for qualified medical expenses are all “catch-up” contribution. exempt from federal income tax, Social Security/Medicare tax and most state income taxes. Due to an HSA’s potential tax savings, federal tax law 2020 HDHP COST-SHARING LIMITS includes strict rules for HSAs, including limits on annual contributions and HDHP cost sharing. For 2020 plan years, the minimum deductible is $1,400 for self-only This Compliance Overview summarizes key features for HSAs, including HDHP coverage and $2,800 for the contribution limits for 2020. family HDHP coverage. For 2020 plan years, the out-of- LINKS AND RESOURCES pocket maximum is $6,900 for self- only HDHP coverage and $13,800 IRS Publication 969, Health Savings Accounts and Other Tax- for family HDHP coverage. favored Health Plans. IRS Rev. Proc. 2019-25, which includes the inflation-adjusted HSA limits for 2020. -

Welfare: Savings Not Taxation

DISCUSSION PAPER SERIES IZA DP No. 10632 Welfare: Savings not Taxation Sir Roger Douglas Robert MacCulloch MARCH 2017 DISCUSSION PAPER SERIES IZA DP No. 10632 Welfare: Savings not Taxation Sir Roger Douglas Roger Douglas Associates Robert MacCulloch University of Auckland and IZA MARCH 2017 Any opinions expressed in this paper are those of the author(s) and not those of IZA. Research published in this series may include views on policy, but IZA takes no institutional policy positions. The IZA research network is committed to the IZA Guiding Principles of Research Integrity. The IZA Institute of Labor Economics is an independent economic research institute that conducts research in labor economics and offers evidence-based policy advice on labor market issues. Supported by the Deutsche Post Foundation, IZA runs the world’s largest network of economists, whose research aims to provide answers to the global labor market challenges of our time. Our key objective is to build bridges between academic research, policymakers and society. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. IZA – Institute of Labor Economics Schaumburg-Lippe-Straße 5–9 Phone: +49-228-3894-0 53113 Bonn, Germany Email: [email protected] www.iza.org IZA DP No. 10632 MARCH 2017 ABSTRACT Welfare: Savings not Taxation Many nations are seeking to reform their welfare states so that costs to the government can be reduced and the quality of outcomes improved. As a potential way to achieve these aims, there has been a surge of interest in the Singaporean model which features compulsory savings accounts and transparent pricing of health services. -

Us Taxation of Foreign Nationals

US TAXATION OF FOREIGN NATIONALS Be adventurous. Making your tax world easier to travel. SEE ALSO OUR BOOKLET “TAXATION OF US EXPATRIATES” https://www.gtn.com/files/Taxation_of_US_Expatriates.pdf gtn.com C O N T E N T S Introduction 1 1. Residency 3 • Lawful Permanent Resident Test 3 • Substantial Presence Test 5 • Which Test Prevails? 9 • Special Considerations 9 2. Case Study Background 11 3. Income Taxation of Residents 13 • Income Tax Overview 14 • Filing Status 15 • Gross Income 15 • Deductions from Gross Income 16 • Itemized Deductions / Standard Deductions 16 • Exemptions 17 • Tax Credits (Foreign Tax Credit and Other Credits) 18 • Filing Requirements and Procedures 23 4. Sourcing Rules 23 • Personal Services Income 23 • Interest Income 24 • Dividend Income 24 • Rental and Royalty Income 25 • Income from Sale of Personal Property 25 • Income from Sale of Real Property 25 • Partnerships 25 5. Taxation of Nonresidents 25 • Trade or Business Income 26 • Passive Income 29 • Filing Requirements and Procedures 32 6. Dual-Status Taxpayers 33 • Overview 33 • Joint Return Election 37 • Filing Requirements 38 7. Other Taxes and Filing Requirements 39 • General Application of Social Security Tax 39 • Totalization Agreements 40 • Other Benefits 40 • State Income Taxes 41 • Gift and Estate Taxes 41 • Expatriation Tax 43 • Filing Requirement on Departure 43 • Foreign Bank Account Reporting Requirement 44 • Specified Foreign Financial Assets 44 • Form 5471 45 • Passive Foreign Investment Corporation (PFIC) 46 8. Income Tax Treaties 46 9. Other Income Tax Considerations 48 • Exchange Rate Issues 48 • Moving Expenses 49 • Foreign Earned Income and Housing Exclusions 49 • Capital Gains 50 • Dispositions of US Real Property Interests 51 • Sale of Principal Residence 51 • Rental of a Residence 53 • Investments in Foreign Corporations 54 Appendix A. -

Can Asia Provide Models for Tax-Based European Health Systems? a Comparative Study of Singapore and Sweden

Health Economics, Policy and Law (2020), page 1 of 18 doi:10.1017/S1744133120000390 PERSPECTIVE Can Asia provide models for tax-based European health systems? A comparative study of Singapore and Sweden Richard B. Saltman1* , Ming-Jui Yeh2 and Yu Liu1 1Department of Health Policy and Management, Rollins School of Public Health, Emory University, 1518 Clifton Rd NE, Atlanta, GA 30322, USA and 2Department of Health Policy and Management, College of Public Health, National Taiwan University, No. 17, Xuzhou Road, Zhongzheng District, Taipei City, 100, Taiwan *Corresponding author. Email: [email protected] (Received 12 December 2019; revised 12 August 2020; accepted 2 October 2020) Abstract Singapore’s health system generates similar levels of health outcomes as does Sweden’s but for only 4.4% rather than 11.0% of gross domestic product, with Singapore’s resulting health sector savings being re- directed to help fund both long-term care and retirement pensions for its elderly citizens. This paper con- trasts the framework of financial risk-sharing and the configuration and management of health service providers in these two high-income, small-population countries. Two main institutional distinctions emerge from this country case comparison: (1) Key differences exist in the practical configuration of soli- darity for payment of health care services, reflecting differing cultural roots and social expectations, which in turn carry substantial implications for financing long-term care and pensions. (2) Differing arrange- ments exist in the organization of health service institutions, in particular balancing public as against pri- vate sector responsibilities for owning, operating and managing these two countries’ respective hospitals.