Riverpark/Wedgewood Fund (Net-Of-Fees) Declined -7.64%

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Court of Appeals for the Fifth Circuit Fifth Circuit FILED April 12, 2021 No

Case: 20-30418 Document: 00515817174 Page: 1 Date Filed: 04/12/2021 United States Court of Appeals United States Court of Appeals for the Fifth Circuit Fifth Circuit FILED April 12, 2021 No. 20-30418 Lyle W. Cayce Clerk Dennis Perry, Plaintiff—Appellant, versus H. J. Heinz Company Brands, L.L.C.; Kraft Heinz Foods Company, Defendants—Appellees. Appeal from the United States District Court for the Eastern District of Louisiana USDC No. 2:19-CV-280 Before Owen, Chief Judge, and Graves and Ho, Circuit Judges. James E. Graves, Jr., Circuit Judge: Mr. Dennis Perry makes Metchup, which depending on the batch is a blend of either Walmart-brand mayonnaise and ketchup or Walmart-brand mustard and ketchup. Mr. Perry sells Metchup exclusively from the lobby of a nine-room motel adjacent to his used-car dealership in Lacombe, Louisiana. He has registered Metchup as an incontestable trademark. Though he had big plans for Metchup, sales have been slow. Since 2010, Mr. Perry has produced only 50 to 60 bottles of Metchup, which resulted in sales of around $170 and profits of around $50. He owns www.metchup.com but has never Case: 20-30418 Document: 00515817174 Page: 2 Date Filed: 04/12/2021 No. 20-30418 sold Metchup online. For better or worse, the market is not covered in Metchup. Along comes Heinz. It makes Mayochup, which is solely a blend of mayonnaise and ketchup. To promote Mayochup’s United States launch, Heinz held an online naming contest where fans proposed names. A fan submitted Metchup, and Heinz posted a mock-up bottle bearing the name Metchup on its website alongside mock-up bottles for the other proposed names. -

Forthlane Fridays - Guest Bios

Forthlane Fridays - Guest Bios Maria S. Jelescu Dreyfus CHIEF EXECUTIVE OFFICER AND FOUNDER ARDINALL INVESTMENT MANAGEMENT Maria is the Chief Executive Officer and Founder of Ardinall Investment Management, an investment firm focused on energy infrastructure that she started in 2017. Prior to Ardinall Investment Management, Ms. Dreyfus spent 15 years at Goldman Sachs, where she most recently served as a Portfolio Manager and Managing Director in the Goldman Sachs Investment Partners (GSIP) Group. She currently serves as a director on the board of Macquarie Infrastructure Corporation (NYSE: MIC), on the board of CDPQ (one of Canada’s largest pension plans), and on the advisory board of Eni Next (Eni SpA’s corporate venture arm). She also sits on the advisory board of the Center on Global Energy Policy at Columbia University and serves as co-chair of their Women in Energy program. Additionally, Ms. Dreyfus is a member of the MIT Corporation’s Development Committee and sits on the MIT Economics Department’s Visiting Committee. Ms. Dreyfus also serves as a member of the New York State Secure Choice Savings Program Board. Her current and past non-profit board memberships include New America Alliance, Breakthrough New York, and Girls Inc. of NYC. She is a member of the Economic Club of New York and a member of the Milken Institute’s Young Leaders Circle. Ms. Dreyfus has held her CFA since 2004, and holds a dual degree in economics and management science from the Massachusetts Institute of Technology. Daniel Dreyfus CHIEF INVESTMENT OFFICER AND FOUNDER BORNITE CAPITAL Dan serves as the Founder and Chief Investment Officer at Bornite Capital. -

Maybe Warren Buffett Agrees with Bill Gross on Financial Asphyxiation Article

Article SNL Blogs Monday, August 17, 2015 2:18 PM ET Maybe Warren Buffett agrees with Bill Gross on financial asphyxiation By Jeff K. Davis Jeff Davis, CFA, is a veteran bank analyst and SNL Financial contributor. The views and opinions expressed in this piece are those of the author and do not necessarily represent the views of SNL or Mercer Capital, where he is the managing director of the financial institutions group. The financial press tracks Janus Capital Group Inc.'s star fixed-income portfolio manager Bill Gross closely. His Saigon-like helicopter roof departure from Pacific Investment Management Co. LLC (PIMCO) last year has been forgotten. His accomplishments as one of the best fixed-income investors the past four decades are more important than a short, messy chapter in his life. Many have one or two anyway. As a bond manager, Gross is dour compared to equity investors, who usually ask two questions: What's the upside and what's the margin of safety if I am wrong? Plus, equity investors cheer from the rafters for actions that are detrimental to corporate bond holders: buybacks, dividend recaps, debt-financed M&A and spinoffs of profitable units. For bond investors like Gross, what is bad for equities typically is good for bonds. A weaker economy can translate into rising bond prices and declining yields. Rising prices and coupon clipping can generate great total returns, except for our age when only the lower rungs of the high-yield market offer much coupon to clip. With commodity prices in a free fall and credit spreads beginning to widen, the markets' tone has been negative lately. -

Five Alumni of H.J. Heinz Board of Directors Send Letter to Procter & Gamble Directors

FIVE ALUMNI OF H.J. HEINZ BOARD OF DIRECTORS SEND LETTER TO PROCTER & GAMBLE DIRECTORS Describe How Nelson Peltz Won Them Over as a Heinz Director After a Hard-Fought Proxy Contest Underscore Nelson Peltz’s Long-Term Focus and Contributions Made to Heinz Board September 27, 2017—Five Alumni of the H.J. Heinz Company (“Heinz”) Board of Directors today sent a letter to Directors of The Procter & Gamble Company (NYSE: PG) (“P&G”), reflecting on their positive experience working with Nelson Peltz in the Heinz boardroom. Following Heinz’s hard-fought 2006 proxy contest against Trian Fund Management, L.P. (“Trian”), the Alumni of the Heinz Board found Nelson Peltz to be a valuable, constructive and collegial director with a focus on delivering long-term value to Heinz shareholders. The five signatories of the letter are former Heinz directors Charles E. Bunch, Thomas J. Usher, Dennis Reilley, John G. Drosdick and Dean R. O’Hare – all of whom were members of the Heinz Board for the entirety of Nelson Peltz’s tenure on the Board from 2006 through 2013. Dear Procter & Gamble Directors, In 2006, Nelson Peltz joined the Board of H.J. Heinz Company following a long and hard-fought proxy contest. Like you, many of us had feared that Nelson’s presence would disrupt the effectiveness of our Board process and derail the execution of our strategy. However, just the opposite proved true. The following are some reflections on our experience with Nelson as a Heinz Director: Nelson was a valued member of the Heinz board. -

Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278E)

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No. (3209-0001) (March 2014) Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information Shanahan, Patrick Michael Deputy Secretary of Defense, Department of Defense Other Federal Government Positions Held During the Preceding 12 Months: None Names of Congressional Committees Considering Nomination: ● Committee on Armed Services Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge. /s/ Shanahan, Patrick Michael [electronically signed on 04/08/2017 by Shanahan, Patrick Michael in Integrity.gov] Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to any comments below). /s/ Vetter, Ruth, Certifying Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] Other review conducted by /s/ Vetter, Ruth, Ethics Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] U.S. Office of Government Ethics Certification /s/ Apol, David, Certifying Official [electronically signed on 06/08/2017 by Apol, David in Integrity.gov] 1. Filer's Positions Held Outside United States Government # ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO TYPE 1 The Boeing Company Chicago, Illinois Corporation Senior Vice 3/1986 Present President 2 The University of Washington Seattle, -

Business Analytics

NICK, ’20 Business Analytics Business Analytics Experiential Learning SAMPLE COURSES: Throughout their undergraduate careers, students work in small teams to solve real-world problems from local companies. • BALT 3330: Database Structures and Queries Students get a briefing from company executives on the problem • BALT 4320: Data and Text Mining and work all semester on the project scope and deliverables. At • FINA 4330: Predictive Analytics the end of the semester, the student teams present the results to the company. • BALT 4350: Web Intelligence and Analytics Hackathon Benedictine hosts an annual Hackathon for current BenU students SIMILAR MAJORS: along with students from local community colleges. The event Finance, Marketing, Data Science offers students a chance to work collaboratively in small teams on an analytics and Big Data project. A more recent Hackathon was sponsored by IBM and teams explored Chicago crime data for their project. BUSINESS ANALYTICS ALUMNI Communication Skills Our alumni have built successful careers at Zurich All business analytics students have project-based classes which Insurance, Northwestern, Conversant, CDW, allow them to gain practical and valuable experience as well as Morningstar, UniFirst Corporation, Nicor Gas, learn how to communicate their findings effectively. Students Invesco, Ace Hardware, Dial America, Kraft Heinz learn how to present technical results through written and oral Company, FedEx, Crowe, First Midwest Bank, presentations. These skills are essential in a dynamic business and Chamberlain Group – just to name a few. world and are highly sought-after by employers. WHY STUDY BUSINESS ANALYTICS AT BENEDICTINE? The growing field of analytics is transforming the way companies do business. Analytics can help improve managerial and organizational decision making by transforming data into actions and business insights. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

893780-SHH 2015 Annual Report.Indd

ANNUAL REPORT 2015 “It is the small things children’s wellbeing and safety while they may be at work. The rural setting of our residential camp uniquely offers opportunities that matter the most.” to be continuously active and to learn about environmental stewardship. The positive influence of friendships built during Staff and volunteers typically these experiences can have a say this when asked what helps lifelong impact. our members have fun and learn new things when they Empowering all youth, especially those who need us most, is a come to Sarah Heinz House BIG mission. But we know it is achievable by doing many small each day. things exceedingly well. The small things which cause them to joyfully come through our door each day to be part of activities It can start with a simple hug to that improve their fitness and health, deepen learning and build say hello, a spontaneous 30 second chat in a hallway to convey new friendships. how special a child really is, or the longer discussion at the table during the nightly dinner to simply listen to what’s on their Sarah Heinz House is extremely proud of our team of innovative minds. Encouragement and recognition are also given during employees, amazing volunteers and seasonal staff whose individual and group projects or fitness activities so our kids find collective talents and care for our youth resulted in over 100 a way to push themselves to new levels of achievement. different after school programs and 8 weeks of summer camp for 1,800 youth in 2015. -

Warren Buffett Trip

Warren Buffett Trip Omaha, Nebraska January 2018 Letter from Smart Woman Securities National Meeting with Warren Buffett on January 12th was an honor and a privilege that SWS members will treasure for a lifetime! During the 2 ½ hour Q&A session, we intently listened to Mr. Buffett as he educated us on business, provided advice on rela- tionships and shared meaningful and humorous insights on life and success. He is often referred to as the “Sage of Omaha”, a title earned for being the world’s greatest investor. The definition of a sage is someone characterized by wisdom, prudence and good judgement and Mr. Buffett truly embodies each of these qualities. But the depth of his tremendousness goes far beyond his financial acumen. And because of his generosity with his time, we were able to see and hear for ourselves just how wonderful a person he is. His brilliance, humility, kindness and optimism were evident and inspiring. Our rigorous preparation requirements included readings from The Intelligent Investor, The Making of an American Capital- ist, watching video interviews, dissecting the Annual Shareholder newsletter, and participating in weekly discussion groups. By thoroughly researching companies and studying biographies of the executives that we were meeting, it allowed the students to take full advantage of the opportunity of asking thoughtful questions beyond what anyone could easily access on the internet. All agreed that the preparation allowed them to derive the maximum benefit from the trip. That afternoon was followed by an exclusive dinner at Mr. Buffett’s favorite steakhouse, Gorat’s with our members and SWS Co- founders, Tracy Britt Cool and Teresa Hsiao. -

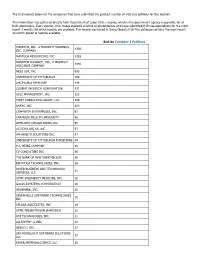

The H1B Records Below List the Companies That Have Submitted the Greatest Number of H1B Visa Petitions for This Location

The H1B records below list the companies that have submitted the greatest number of H1B visa petitions for this location. This information was gathered directly from Department of Labor (DOL) records, which is the government agency responsible for all H1B submissions. Every quarter, DOL makes available a listing of all companies who have submitted H1B visa applications for the most recent 3 months for which records are available. The records contained in Going Global's H1B Plus database contains the most recent 12-month period of records available. Sort by Company | Petitions MASTECH, INC., A MASTECH HOLDINGS, 4339 INC. COMPANY MASTECH RESOURCING, INC. 1393 MASTECH ALLIANCE, INC., A MASTECH 1040 HOLDINGS COMPANY NESS USA, INC. 693 UNIVERSITY OF PITTSBURGH 169 UHCP D/B/A UPMC MEP 144 COGENT INFOTECH CORPORATION 131 SDLC MANAGEMENT, INC. 123 FIRST CONSULTING GROUP, LLC 104 ANSYS, INC. 100 COMPUTER ENTERPRISES, INC. 97 CARNEGIE MELLON UNIVERSITY 96 INTELLECT DESIGN ARENA INC. 95 ACCION LABS US, INC. 63 HM HEALTH SOLUTIONS INC. 57 UNIVERSITY OF PITTSBURGH PHYSICIANS 44 H.J. HEINZ COMPANY 40 CV CONSULTING INC 36 THE BANK OF NEW YORK MELLON 36 INFOYUGA TECHNOLOGIES, INC. 36 BAYER BUSINESS AND TECHNOLOGY 31 SERVICES, LLC UPMC EMERGENCY MEDICINE, INC. 28 GALAX-ESYSTEMS CORPORATION 26 HIGHMARK, INC. 25 SEVEN HILLS SOFTWARE TECHNOLOGIES 25 INC VELAGA ASSOCIATES, INC 24 UPMC PRESBYTERIAN SHADYSIDE 22 DVI TECHNOLOGES, INC. 21 ALLEGHENY CLINIC 20 GENCO I. INC. 17 SRI MOONLIGHT SOFTWARE SOLUTIONS 17 LLC BAYER MATERIALSCIENCE, LLC 16 BAYER HEALTHCARE PHARMACEUTICALS, 16 INC. VISVERO, INC. 16 CYBYTE, INC. 15 BOMBARDIER TRANSPORTATION 15 (HOLDINGS) USA, INC. -

The Preqin Quarterly Update: Private Equity

Q1 2013 The Preqin Quarterly Update: Private Equity Content Includes: Fundraising We review the latest fundraising figures, including regional breakdown, time spent on the road, and the largest funds to close in the quarter. Investors We take a look at investor appetite for private equity in the year ahead, including geographies and strategies to be targeted. Buyout Deals We examine private equity buyout deals and exits in Q1 2013 by type, value and region. Venture Capital Deals We provide a breakdown of the latest venture capital deal activity by value, region and stage. Performance We analyze the latest performance data for private equity funds, featuring dry powder figures, IRRs by fund type and vintage and the PrEQIn Private Equity Quarterly Index. alternative assets. intelligent data. The Preqin Quarterly Update: Private Equity, Q1 2013 Download Data Foreword Private equity fundraising in the fi rst quarter of 2013 was relatively robust, with 130 funds closed having raised an aggregate $67.2bn. However, in an increasingly competitive fundraising market – 1,906 funds are in market as of the start of Q2 2013 – many LPs are choosing to invest in funds raised by more established managers. First-time funds that closed in Q1 2013 secured just $4.2bn in aggregate capital, compared to the peak of $31.6bn in Q2 2008. However, Preqin’s interviews with private equity investors in December 2012 reveal that investor attitudes towards fi rst-time fund managers are more positive moving forwards; half of LPs interviewed will consider committing to fi rst-time funds or those managed by spin-off teams in the following 12 months. -

Chicago's Largest Publicly Traded Companies | Crain's Book of Lists

Chicago’s Largest Publicly Traded Companies | Crain’s Book of Lists 2018 Company Website Location Walgreens Boots Alliance Inc. www.walgreensbootsalliance.com Deerfield, IL Boeing Co. www.boeing.com Chicago, IL Archer Daniels Midland Co. www.adm.com Chicago, IL Caterpillar Inc. www.caterpillar.com Peoria, IL United Continental Holdings Inc. www.unitedcontinental-holdings.com Chicago, IL Allstate Corp. www.allstate.com Northbrook, IL Exelon Corp. www.exeloncorp.com Chicago, IL Deere & Co. www.deere.com Moline, IL Kraft Heinz Co. www.kraftheinz-company.com Chicago, IL Mondelez International Inc. www.mondelez-international.com Deerfield, IL Abbvie Inc. www.abbvie.com North Chicago, IL McDonald’s Corp. www.aboutmcdonalds.com Oak Brook, IL US Foods Holding Corp. www.USfoods.com Rosemont, IL Sears Holdings Corp. www.searsholdings.com Hoffman Estates, IL Abbott Laboratories www.abbott.com North Chicago, IL CDW Corp. www.cdw.com Lincolnshire, IL Illinois Tool Works Inc. www.itw.com Glenview, IL Conagra Brands Inc. www.conagrabrands.com Chicago, IL Discover Financial Services Inc. www.discover.com Riverwoods, IL Baxter International Inc. www.baxter.com Deerfield, IL W.W. Grainger Inc. www.grainger.com Lake Forest, IL CNA Financial Corp. www.cna.com Chicago, IL Tenneco Inc. www.tenneco.com Lake Forest, IL LKQ Corp. www.lkqcorp.com Chicago, IL Navistar International Corp. www.navistar.com Lisle, IL Univar Inc. www.univar.com Downers Grove, IL Anixter International Inc. www.anixter.com Glenview, IL R.R. Donnelly & Sons Co. www.rrdonnelly.com Chicago, IL Jones Lang LaSalle Inc. www.jll.com Chicago, IL Dover Corp. www.dovercorporation.com Downers Grove, IL Treehouse Foods Inc.