The Biotech Growth Trust

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Q1 Pharma Sector Snapshot

SPECIALTY & GENERIC PHARMA Q1 2021 Report Market Commentary – Debt Capital Markets Debt Markets ▪ 2020 saw increased amounts of debt used in buyouts across the board, resulting in the highest debt / EBITDA Median US Buyout Multiples levels since 2014 − The increased use of debt was driven by 2H20 back- end loaded lending activity (primarily 4Q20) as 16.0x 12.7x 14.1x 12.2x 12.0x 11.6x 11.5x certainty around the U.S. election and vaccination 11.1x 10.0x 9.8x 12.0x 9.7x expectations increased 9.4x 8.6x 8.3x 8.2x 7.5x 7.8x 5.2x 6.7x 5.7x 5.6x ▪ 8.0x 5.9x As the effects of COVID now begin to diminish, debt 5.4x 4.4x 4.1x 3.7x 4.6x 4.3x 3.8x markets have seemingly recovered, signaling that 3.6x lenders have become increasingly comfortable with 4.0x 4.3x 6.9x 6.5x 6.3x 6.0x 5.9x 5.7x 5.7x 5.7x 5.7x 5.6x 5.3x 4.5x 4.4x macroeconomic and company-specific fundamentals 4.3x 0.0x 3.2x − With increased confidence, lenders are currently looking to provide strong leverage for high-quality assets, particularly ones that have proven their Debt/EBITDA Equity/EBITDA EV/EBITDA stability through the recent market downturn Source: PitchBook ▪ The spread on U.S. high-yield debt has returned to pre- Historical US High Yield Debt Effective Yield COVID levels − 4.22% current effective yield compared with a 12.0% 11.4% 11.38% effective yield on March 23, 2020 (peak of the pandemic) 9.0% ▪ We expect increased activity by lenders in 2021 due to: 6.0% 4.2% − Pent-up demand in M&A activity driven by the impact of COVID 3.0% − Limited Partner agreements and investor -

Fidelity® Select Portfolio® Pharmaceuticals Portfolio

Quarterly Holdings Report for Fidelity® Select Portfolio® Pharmaceuticals Portfolio November 30, 2020 PHR-QTLY-0121 1.810707.116 Schedule of Investments November 30, 2020 (Unaudited) Showing Percentage of Net Assets Common Stocks – 98.3% Shares Value Shares Value Biotechnology – 17.6% Bausch Health Cos., Inc. (Canada) (a) 535,300 $ 9,937,694 Biotechnology – 17.6% Bristol‑Myers Squibb Co. 1,295,680 80,850,432 Acceleron Pharma, Inc. (a) 128,800 $ 15,207,416 Catalent, Inc. (a) 75,400 7,248,956 Amgen, Inc. 137,400 30,508,296 Elanco Animal Health, Inc. (a) 172,400 5,273,716 Argenx SE (a) 17,400 4,983,924 Eli Lilly & Co. 416,961 60,730,370 Ascendis Pharma A/S sponsored ADR (a) 51,300 8,655,849 GlaxoSmithKline PLC sponsored ADR 348,300 12,813,957 Atea Pharmaceuticals, Inc. 39,800 1,326,136 Harmony Biosciences Holdings, Inc. 133,077 5,467,801 Athenex, Inc. (a) (b) 166,800 2,273,484 Horizon Therapeutics PLC (a) 316,100 22,262,923 BioNTech SE ADR (a) (b) 50,148 6,230,388 Intra‑Cellular Therapies, Inc. (a) 107,000 2,529,480 Blueprint Medicines Corp. (a) 80,300 8,678,824 Johnson & Johnson 337,850 48,880,138 ChemoCentryx, Inc. (a) 6,400 352,960 Merck & Co., Inc. 515,936 41,476,095 Galapagos Genomics NV sponsored ADR (a) 36,900 4,524,309 Nektar Therapeutics (a) (b) 368,233 6,035,339 Generation Bio Co. (b) 16,738 807,106 Novartis AG sponsored ADR 441,496 40,101,082 Generation Bio Co. -

12/31/20 at 0.06% Due 01/04/21 $ 969,572 969,572 Barclays Capital, Inc

Biotechnology Fund SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2020 Shares Value COMMON STOCKS† - 99.6% Biotechnology - 72.9% Amgen, Inc. 46,124 $ 10,604,830 Gilead Sciences, Inc. 137,327 8,000,671 Vertex Pharmaceuticals, Inc.* 30,030 7,097,290 Illumina, Inc.* 18,293 6,768,410 Regeneron Pharmaceuticals, Inc.* 13,496 6,520,053 Biogen, Inc.* 22,700 5,558,322 Moderna, Inc.* 49,814 5,204,069 Corteva, Inc. 125,161 4,846,234 Alexion Pharmaceuticals, Inc.* 30,030 4,691,887 Seagen, Inc.* 26,529 4,646,289 Exact Sciences Corp.* 31,204 4,134,218 Incyte Corp.* 44,634 3,882,265 Bio-Rad Laboratories, Inc. — Class A* 6,450 3,759,963 BioMarin Pharmaceutical, Inc.* 38,909 3,411,930 Alnylam Pharmaceuticals, Inc.* 25,838 3,358,165 Guardant Health, Inc.* 25,656 3,306,545 Mirati Therapeutics, Inc.* 13,253 2,910,889 Ionis Pharmaceuticals, Inc.* 48,279 2,729,695 ACADIA Pharmaceuticals, Inc.* 49,103 2,625,046 CRISPR Therapeutics AG* 16,740 2,563,061 BeiGene Ltd. ADR* 9,710 2,508,967 Acceleron Pharma, Inc.* 18,632 2,383,778 Iovance Biotherapeutics, Inc.* 50,194 2,329,002 Arrowhead Pharmaceuticals, Inc.* 30,137 2,312,412 United Therapeutics Corp.* 15,148 2,299,315 BioNTech SE ADR*,1 27,800 2,266,256 Ultragenyx Pharmaceutical, Inc.* 16,339 2,261,808 Twist Bioscience Corp.* 15,850 2,239,446 Exelixis, Inc.* 111,104 2,229,857 Novavax, Inc.*,1 19,860 2,214,589 Amicus Therapeutics, Inc.* 95,070 2,195,166 Halozyme Therapeutics, Inc.* 50,560 2,159,418 Blueprint Medicines Corp.* 18,770 2,105,056 Fate Therapeutics, Inc.* 23,040 2,095,027 Sage Therapeutics, Inc.* 23,286 2,014,472 Biohaven Pharmaceutical Holding Company Ltd.* 22,920 1,964,473 Arena Pharmaceuticals, Inc.* 25,260 1,940,726 ChemoCentryx, Inc.* 30,270 1,874,318 PTC Therapeutics, Inc.* 29,928 1,826,506 Emergent BioSolutions, Inc.* 20,360 1,824,256 Bluebird Bio, Inc.* 36,415 1,575,677 Global Blood Therapeutics, Inc.* 34,845 1,509,137 Inovio Pharmaceuticals, Inc.*,1 125,840 1,113,684 Total Biotechnology 143,863,178 Pharmaceuticals - 17.5% AbbVie, Inc. -

Horizon Pharma Plc 2018 Irish Statutory Accounts

Horizon Pharma plc 2018 Irish Statutory Accounts (“Irish Annual Report”) CONTENTS Page DIRECTORS AND OTHER INFORMATION 2 DIRECTORS' REPORT 3 – 69 INDEPENDENT AUDITOR’S REPORT 70 – 75 CONSOLIDATED PROFIT AND LOSS ACCOUNT 76 CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS 77 CONSOLIDATED BALANCE SHEET 78 – 79 CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY 80 CONSOLIDATED STATEMENT OF CASH FLOWS 81 – 82 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 83 – 142 PARENT COMPANY FINANCIAL STATEMENTS 143 – 153 DIRECTORS AND OTHER INFORMATION Board of Directors at December 31, 2018 Timothy P. Walbert Michael Grey William F. Daniel Jeff Himawan, Ph.D. Ronald Pauli Gino Santini James Shannon, M.D. H. Thomas Watkins Pascale Witz Secretary and Registered Office Anne-Marie Dempsey Connaught House 1st Floor 1 Burlington Road Dublin 4 D04 C5Y6 Ireland Registered Number: 507678 Auditor PricewaterhouseCoopers Chartered Accountants and Statutory Audit Firm One Spencer Dock North Wall Quay Dublin 1 D01 X9R7 Ireland Solicitor Matheson 70 Sir John Rogerson’s Quay Grand Canal Dock Dublin 2 D02 R296 Ireland 2 DIRECTORS’ REPORT The directors present their report and the audited financial statements of the Company (as defined below) for the financial year ended December 31, 2018. Basis of Presentation The Company is a public limited company formed under the laws of Ireland. The Company operates through a number of international and U.S. subsidiaries with principal business purposes to either perform research and development or manufacturing operations, serve as distributors -

Biopharma Leaders Join Trump and Thunberg in Davos

No. 3989 January 31, 2020 again a key theme at Davos, and many biopharma executives are joining the con- versation this year. These include Werner Baumann, CEO of Bayer, who spoke on a panel on 21 Janu- ary about ‘When Humankind Overrides Evolution,’ focusing on gene-editing tech- nologies for use in agriculture, food and medicine. Meanwhile Takeda CEO Chris- tophe Weber joins a discussion on shap- ing the future of health and healthcare systems on 22 January. Speaking on the gene-editing panel, Baumann said there was “less and less trust in society for the advances of tech- nology,” adding that “the only way to get beyond it is that we do a better job in terms of explaining what we are doing.” Bayer is working with CRISPR Thera- peutics on CRISPR/Cas9 gene-editing in hemophilia, ophthalmology and autoim- Biopharma Leaders Join Trump mune diseases, but also has a major stake in genetically modified seeds via its Mon- And Thunberg In Davos santo division. He called for absolute transparency ANDREW MCCONAGHIE [email protected] from corporations and governments on gene-editing technology, but also decried fter focusing on the year ahead tive to plant 1 trillion trees, an effort aimed the previous “insane dominance” that anti- in biopharma business at the J.P. at soaking up rising levels of carbon diox- GM crop campaigners have been allowed AMorgan conference in San Fran- ide in the atmosphere. to wield. cisco last week, the sector’s attention has 17-year-old environmental campaigner Others taking part include Stéphane switched to the World Economic Forum in Greta Thunberg made her own address to Bancel, Moderna Therapeutics’ chief exec- Davos, Switzerland from 21-24 January. -

Marketer1 Year of Initial Investment Investment

YEAR OF INITIAL INVESTMENT COUNTERPARTY PRODUCT(S) MARKETER1 INVESTMENT VEHICLE Artes Medical, Inc. Bellafill, Puregraft, HD PRP Artes Medical, Inc. 2008 HCR 1 Vertex Pharmaceuticals, Inc. Lexiva ViiV Healthcare UK Limited 2008 HCR 1 Dyax Corp. Phage display platform Multiple 2008 HCR 1, SMA Undisclosed Sanctura, Sanctura XR Allergan, Inc. 2008 HCR 1 Shore Therapuetics, Inc. Fenoglide Sciele Pharma, Inc. 2008 HCR 1 Undisclosed Oracea, Sanctura XR Galderma S.A. / Allergan, Inc. 2008 HCR 1, HCR 2 AEterna Zentaris, Inc. Cetrotide Merck Serono S.A. 2008 HCR 1 NeurogesX, Inc. Qutenza Astellas Pharma Inc. 2010 HCR 1 Undisclosed Undisclosed vaccine Undisclosed 2010 HCR 1 Undisclosed Myozyme Genzyme Corp. / Sanofi-Aventis U.S. LLC 2011 HCR 1 Inventor (undisclosed) Krystexxa Savient Pharmaceuticals, Inc. 2011 HCR 1 Undisclosed Undisclosed vaccine Undisclosed 2010 HCR 2 Zogenix, Inc. Sumavel Dosepro, Zohydro Zogenix, Inc. 2011 HCR 2 AcuFocus, Inc. Kamra Inlay, IOL AcuFocus, Inc. 2011 HCR 2 Inventor Cervarix GlaxoSmithKline plc 2011 HCR 2 Stereotaxis, Inc. RMT Ablation Catheters Biosense Webster, Inc. 2011 HCR 2 Helomics Corporation ChemoFx, GeneFx Lung, GeneFx Colon, BioSpeciFx Helomics Corporation 2012 HCR 2 Raptor Pharmacuetical Corp. Procysbi Raptor Pharmacuetical Corp. 2012 HCR 2, SMA Undisclosed Undisclosed Undisclosed 2012 HCR 2 Nuron Biotech, Inc. Meningitec, HibTITER Nuron Biotech, Inc. 2012 HCR 2 Medigene AG Eligard Astellas Pharma Inc. 2012 HCR 2 Undisclosed Lyrica Pfizer, Inc. 2012 HCR 2, SMA Ironwood Pharmaceuticals, Inc. Linzess Allergan, Inc. 2012 SMA TearScience, Inc. LipiView, LipiFlow TearScience, Inc. 2013 HCR 2 Undisclosed Inavir Daiichi Sankyo Company, Limited 2013 HCR 2 Undisclosed Benlysta GlaxoSmithKline plc 2013 HCR 2 Suneva Medical, Inc. -

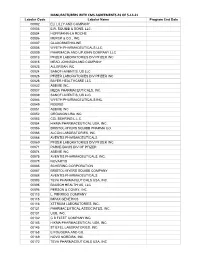

MANUFACTURERS with CMS AGREEMENTS AS of 5-14-21 Labeler Code Labeler Name Program End Date 00002 ELI LILLY and COMPANY 00003 E.R

MANUFACTURERS WITH CMS AGREEMENTS AS OF 5-14-21 Labeler Code Labeler Name Program End Date 00002 ELI LILLY AND COMPANY 00003 E.R. SQUIBB & SONS, LLC. 00004 HOFFMANN-LA ROCHE 00006 MERCK & CO., INC. 00007 GLAXOSMITHKLINE 00008 WYETH PHARMACEUTICALS LLC, 00009 PHARMACIA AND UPJOHN COMPANY LLC 00013 PFIZER LABORATORIES DIV PFIZER INC 00015 MEAD JOHNSON AND COMPANY 00023 ALLERGAN INC 00024 SANOFI-AVENTIS, US LLC 00025 PFIZER LABORATORIES DIV PFIZER INC 00026 BAYER HEALTHCARE LLC 00032 ABBVIE INC. 00037 MEDA PHARMACEUTICALS, INC. 00039 SANOFI-AVENTIS, US LLC 00046 WYETH PHARMACEUTICALS INC. 00049 ROERIG 00051 ABBVIE INC 00052 ORGANON USA INC. 00053 CSL BEHRING L.L.C. 00054 HIKMA PHARMACEUTICAL USA, INC. 00056 BRISTOL-MYERS SQUIBB PHARMA CO. 00065 ALCON LABORATORIES, INC. 00068 AVENTIS PHARMACEUTICALS 00069 PFIZER LABORATORIES DIV PFIZER INC 00071 PARKE-DAVIS DIV OF PFIZER 00074 ABBVIE INC 00075 AVENTIS PHARMACEUTICALS, INC. 00078 NOVARTIS 00085 SCHERING CORPORATION 00087 BRISTOL-MYERS SQUIBB COMPANY 00088 AVENTIS PHARMACEUTICALS 00093 TEVA PHARMACEUTICALS USA, INC. 00095 BAUSCH HEALTH US, LLC 00096 PERSON & COVEY, INC. 00113 L. PERRIGO COMPANY 00115 IMPAX GENERICS 00116 XTTRIUM LABORATORIES, INC. 00121 PHARMACEUTICAL ASSOCIATES, INC. 00131 UCB, INC. 00132 C B FLEET COMPANY INC 00143 HIKMA PHARMACEUTICAL USA, INC. 00145 STIEFEL LABORATORIES, INC, 00168 E FOUGERA AND CO. 00169 NOVO NORDISK, INC. 00172 TEVA PHARMACEUTICALS USA, INC Labeler Code Labeler Name Program End Date 00173 GLAXOSMITHKLINE 00178 MISSION PHARMACAL COMPANY 00185 EON LABS, INC. 00186 ASTRAZENECA PHARMACEUTICALS LP 00187 BAUSCH HEALTH US, LLC. 00206 WYETH PHARMACEUTICALS LLC, 00224 KONSYL PHARMACEUTICALS, INC. 00225 B. F. ASCHER AND COMPANY, INC. 00228 ACTAVIS PHARMA, INC. -

Appendix B - Product Name Sorted by Applicant

JUNE 2021 - APPROVED DRUG PRODUCT LIST B - 1 APPENDIX B - PRODUCT NAME SORTED BY APPLICANT ** 3 ** 3D IMAGING DRUG * 3D IMAGING DRUG DESIGN AND DEVELOPMENT LLC AMMONIA N 13, AMMONIA N-13 FLUDEOXYGLUCOSE F18, FLUDEOXYGLUCOSE F-18 SODIUM FLUORIDE F-18, SODIUM FLUORIDE F-18 3M * 3M CO PERIDEX, CHLORHEXIDINE GLUCONATE * 3M HEALTH CARE INC AVAGARD, ALCOHOL (OTC) DURAPREP, IODINE POVACRYLEX (OTC) 3M HEALTH CARE * 3M HEALTH CARE INFECTION PREVENTION DIV SOLUPREP, CHLORHEXIDINE GLUCONATE (OTC) ** 6 ** 60 DEGREES PHARMS * 60 DEGREES PHARMACEUTICALS LLC ARAKODA, TAFENOQUINE SUCCINATE ** A ** AAA USA INC * ADVANCED ACCELERATOR APPLICATIONS USA INC LUTATHERA, LUTETIUM DOTATATE LU-177 NETSPOT, GALLIUM DOTATATE GA-68 AAIPHARMA LLC * AAIPHARMA LLC AZASAN, AZATHIOPRINE ABBVIE * ABBVIE INC ANDROGEL, TESTOSTERONE CYCLOSPORINE, CYCLOSPORINE DEPAKOTE ER, DIVALPROEX SODIUM DEPAKOTE, DIVALPROEX SODIUM GENGRAF, CYCLOSPORINE K-TAB, POTASSIUM CHLORIDE KALETRA, LOPINAVIR NIASPAN, NIACIN NIMBEX PRESERVATIVE FREE, CISATRACURIUM BESYLATE NIMBEX, CISATRACURIUM BESYLATE NORVIR, RITONAVIR SYNTHROID, LEVOTHYROXINE SODIUM ** TARKA, TRANDOLAPRIL TRICOR, FENOFIBRATE TRILIPIX, CHOLINE FENOFIBRATE ULTANE, SEVOFLURANE ZEMPLAR, PARICALCITOL ABBVIE ENDOCRINE * ABBVIE ENDOCRINE INC LUPANETA PACK, LEUPROLIDE ACETATE ABBVIE ENDOCRINE INC * ABBVIE ENDOCRINE INC LUPRON DEPOT, LEUPROLIDE ACETATE LUPRON DEPOT-PED KIT, LEUPROLIDE ACETATE ABBVIE INC * ABBVIE INC DUOPA, CARBIDOPA MAVYRET, GLECAPREVIR NORVIR, RITONAVIR ORIAHNN (COPACKAGED), ELAGOLIX SODIUM,ESTRADIOL,NORETHINDRONE ACETATE -

2020 Annual Report on Form 10-K Are Available At

TOTAL REVENUES NON-GAAP ADJUSTED NET NET CASH PROVIDED BY $ in millions INCOME PER DILUTED SHARE1,2 OPERATING ACTIVITIES (audited) (unaudited) $ in millions (unaudited) $2,364 $900 $2,162 $799 $1,891 $776 $15.38 $693 $1,619 $13.54 $12.46 $9.59 2017 2018 2019 2020 2017 2018 2019 2020 2017 2018 2019 2020 13.4% 3 YEAR CAGR 9.1% 3 YEAR CAGR 9.1% 3 YEAR CAGR NOTICE OF 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 29, 2021 Dear Shareholder: Whether or not you expect to The 2021 annual general meeting of shareholders (the “annual meeting”) of Jazz attend the meeting, please vote as Pharmaceuticals plc, a public limited company formed under the laws of Ireland (the “company”), soon as possible. You may vote will be held on Thursday, July 29, 2021, at 3:00 p.m. local time at our corporate headquarters your shares: Proxy located at Fifth Floor, Waterloo Exchange, Waterloo Road, Dublin 4, Ireland, for the following purposes: 1. To elect by separate resolutions each of the four nominees for director named in the Over the Telephone accompanying proxy statement (the “proxy statement”) to hold office until the 2024 annual 1-800-690-6903 meeting of shareholders (Proposal 1). Via the Internet 2. To ratify, on a non-binding advisory basis, the appointment of KPMG, Dublin, or KPMG, as www.proxyvote.com the independent auditors of the company for the fiscal year ending December 31, 2021 and to authorize, in a binding vote, the board of directors, acting through the audit committee, to determine the independent auditors’ remuneration (Proposal 2). -

Horizon Therapeutics Plc 2020 Irish Statutory Accounts

Horizon Therapeutics plc 2020 Irish Statutory Accounts (“Irish Annual Report”) CONTENTS Page DIRECTORS AND OTHER INFORMATION 2 DIRECTORS' REPORT 3 – 87 INDEPENDENT AUDITOR’S REPORT 88 – 94 CONSOLIDATED PROFIT AND LOSS ACCOUNT 95 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 96 CONSOLIDATED BALANCE SHEET 97 – 98 CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY 99 CONSOLIDATED STATEMENT OF CASH FLOWS 100 – 101 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 102 – 155 PARENT COMPANY FINANCIAL STATEMENTS 156 – 168 DIRECTORS AND OTHER INFORMATION Board of Directors at December 31, 2020 Timothy Walbert Michael Grey William F. Daniel Jeff Himawan, Ph.D. Susan Mahony, Ph.D. Gino Santini James Shannon, M.D. H. Thomas Watkins Pascale Witz Secretary and Registered Office Jennifer Lee Connaught House 1st Floor 1 Burlington Road Dublin 4 D04 C5Y6 Ireland Registered Number: 507678 Auditor PricewaterhouseCoopers Chartered Accountants and Statutory Audit Firm One Spencer Dock North Wall Quay Dublin 1 D01 X9R7 Ireland Solicitor Matheson 70 Sir John Rogerson’s Quay Grand Canal Dock Dublin 2 D02 R296 Ireland 2 DIRECTORS’ REPORT The directors present their report and the audited financial statements of the Company (as defined below) for the financial year ended December 31, 2020. Basis of Presentation The Company is a public limited company formed under the laws of Ireland. The Company operates through a number of international and U.S. subsidiaries with principal business purposes to either perform research and development or manufacturing operations, serve -

Generic Pharma – Transaction Comps

November 2019 November 2019 Branded Specialty Pharma – Transaction Comps Announced Geographic Enterprise EV / EV / Date Target Target Description Buyer Location Value LTM Revenue LTM EBITDA LTM Revenue LTM EBITDA Specialty pharmaceutical company focused on IP United Aug-19 Beckley Canopy Health $64.9 NA NA NA NA protected pain and addiction cannabis products Kingdom Naloxone and Epinephrine nasal spray products Aug-19 2 505(b)(2)s from Insys Hikma USA $17.0 NA NA NA NA awaiting FDA approval under 505(b)(2) pathway Specialty pharmaceutical company focused on the Jul-19 Spitfire Pharma Altimmune USA $93.0 NA NA NA NA development of NASH products Large pharmaceuctical company with products across Jun-19 Allergan Abbvie Ireland $84,227.1 $15,712.4 $7,062.2 5.4x 11.9x a range of therapeutic, primarily in the US Branded product for the treatment of chronic dry eye May-19 Xiidra from Takeda Novartis USA $5,300.0 $388.0 NA 13.7x NA disease Specialty pharmaceutical company focused in hospital InvaGen Nov-18 Avenue Therapeutics USA $210.2 NA NA NA NA products Pharmaceuticals Specialty pharmaceutical company focused in Oct-18 Corium International Gurnet Point Capital USA $492.5 $36.5 ($44.0) 13.5x NM transdermal and transmucosal products NextWave Specialty pharmaceutical company focused in Sep-18 Tris Pharma USA NA NA NA NA NA Pharmaceuticals pediatric CNS products Specialty pharmaceutical company focused in opioid Aug-18 Adapt Pharma Emergent BioSolutions Ireland $719.8 NA NA NA NA abuse products Sylvant from Johnson & Branded product for the treatment -

Drug Companies Participating in MED-Project Stewardship Plan (February 9, 2017)

Drug Companies Participating in MED-Project Stewardship Plan (February 9, 2017) Participating Drug Company Parent Drug Company 3M Corporation 3M Corporation 3M Critical and Chronic Care 3M Corporation 3M Drug Delivery Systems 3M Corporation 3M Infection Prevention 3M Corporation 3M Oral Care 3M Corporation AbbVie Inc. AbbVie Inc. ACADIA Pharmaceuticals Inc. ACADIA Pharmaceuticals Inc. Accord Healthcare Inc. Accord Healthcare Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Acorda Therapeutics, Inc. Actavis Generics Teva Pharmaceuticals USA, Inc. Actavis Pharma, Inc. (only for labeler code 52544) Allergan, Inc. Actelion Pharmaceuticals US, Inc. Actelion Pharmaceuticals US, Inc. Advanced Vision Research Inc. d.b.a. Akorn Consumer Health Akorn, Inc. Aegerion Pharmaceuticals, Inc. Aegerion Pharmaceuticals, Inc. Afaxys Inc. Afaxys Inc. Afaxys Pharmaceuticals (a division of Afaxys Inc.) Afaxys Inc. Affordable Pharmaceuticals LLC Braintree Laboratories Inc. Akorn Animal Health, Inc. Akorn, Inc. Akorn, Inc. Akorn, Inc. Akrimax Pharmaceuticals, LLC Akrimax Pharmaceuticals, LLC AKRON COATING & ADHESIVES AKRON COATING & ADHESIVES Alcon Laboratories, Inc. Novartis Group Companies Allergan Sales LLC Allergan, Inc. Allergan USA, Inc. Allergan, Inc. Allergan, Inc. Allergan, Inc. Alva-Amco Pharmacal Companies, Inc. Alva-Amco Pharmacal Companies, Inc. AMAG Pharma USA, Inc. AMAG Pharmaceuticals, Inc. AMAG Pharmaceuticals, Inc. AMAG Pharmaceuticals, Inc. Amarin Corp Amarin Pharma, Inc. Amarin Corp. PLC Amarin Pharma, Inc. Amarin Pharma, Inc. Amarin Pharma, Inc. Amarin Pharmaceuticals Ireland Ltd. Amarin Pharma, Inc. American Regent, Inc. Daiichi Sankyo, Inc. Amerisource Health Services Corporation DBA: American Health Amerisource Health Services Corporation DBA: American Health Packaging Packaging Amgen Inc. Amgen Inc. Amgen USA Amgen Inc. Amneal Pharmaceuticals LLC Amneal Pharmaceuticals LLC Anchen Pharmaceuticals, Inc.