Building the #1 Bank in Europe on Solid Fundamentals and Values

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report

Annual Report 2006–2007 Group of Thirty 30 Group of Thirty, Washington, DC Copies of this paper are available from: Group of Thirty 1726 M Street, N.W., Suite 200 Washington, DC 20036 Tel.: (202) 331-2472, Fax (202) 785-9423 E-mail: [email protected] WWW: http://www.group30.org Annual Report 2006–2007 Published by Group of Thirty© Washington, DC 2008 Table of Contents I. Introduction ..................................................................................... 5 II. The Group of Thirty Membership ................................................... 7 III. The Work of the Group of Thirty in FY2006 and FY2007 ........... 13 Plenary Sessions .......................................................................... 13 International Banking Seminars ................................................. 13 Study Group Activities ................................................................ 14 Publications ................................................................................. 16 IV. The Finances of the Group .......................................................... 19 Annex 1. Past Membership of the Group of Thirty .......................... 31 Annex 2. Schedule of Meetings and Seminars: .............................. 33 Annex 3. International Banking Seminars ...................................... 35 Annex 4. Plenary Sessions ............................................................... 37 Annex 5. The Group of Thirty (G30) Study on Reinsurance and International Financial Markets ............................................ -

20171121 Instantpayments PR

PRESS RELEASE Gruppo Banca Sella, Intesa Sanpaolo and UniCredit go live with instant payments The three banking groups are the first in Italy to provide SEPA Instant Credit Transfers via EBA Clearing’s RT1 system to their customers Milan, November 21 2017 - Instant transfer payments in euro have arrived in Italy. Gruppo Banca Sella , Intesa Sanpaolo and UniCredit are the first banks in Italy to make the payment service based on the European Payments Council’s new SEPA Instant Credit Transfer (SCT Inst) scheme available to their customers. Starting from today, the launch date of the scheme, all three banks use EBA Clearing 's RT1 system, the first pan-European platform for real-time payments in euro. The RT1 system has been developed by EBA Clearing with the support of 39 funding banks from across Europe, including Gruppo Banca Sella, Intesa Sanpaolo and UniCredit. The three Italian banks are therefore among the first in Europe to implement this new payment instrument, which immediately allows for instant transfer payments to be received from counterparties across the entire Single Euro Payments Area. Sending payments will be gradually implemented in the next few months , in accordance with the programmes of each of the member banks. The instant transfer instrument allows payments in euro to be processed within seconds, so that the payment amount is immediately available to the beneficiary. Transfers can be done at any time, every day (including Saturdays and holidays), 24 hours a day, and the crediting of the beneficiary's account is immediate. The maximum amount per transfer is currently 15,000 euro. -

Intesa Sanpaolo Spa

EMEA Issuer Profile 11 February 2021 Intesa Sanpaolo SpA Senior Outlook Unsecured William Hahn Moody’s Baa1 Negative Credit Research +44 20 7597 8355 S&P BBB Negative [email protected] Fitch BBB- Stable Source: Moody’s, S&P and Fitch Background and ownership Intesa Sanpaolo SpA (‘ISP’) was formed through the merger of Banca Intesa and Intesa – Key Data Sanpaolo IMI in January 2007. In 2018, Intesa announced its intention to merge with its investment-banking subsidiary Banca IMI by incorporation, which was completed in July FY20 2020. In keeping with the bank’s articulated growth strategy, Intesa made a bid for Total Assets (€bn) 1,002 domestic rival and Italy’s fifth largest bank, UBI Banca, in early 2020 and acquired full control in late-July 2020. The merger into the parent company is expected to be finalised Loan Book (€bn) 461.5 by 2Q21. With total assets of €1tr at end-2020, Intesa has become the largest banking group in Italy, ahead of the more internationally active UniCredit group. Loans to Deposits (%) 87.9 Cost to Income (%) 52.2 ISP’s activities are predominantly domestically focused where it is the market leader in retail banking, corporate banking and wealth management, with domestic market shares Net Profit (€m) 3,277 (incl. UBI) of 21% in customer loans, 22% in deposits, 25% in asset management and 24% in pension funds. ISP has also developed a sound retail banking presence in Central LCR (%) >100 and Eastern Europe (CEE) and the Middle East and North Africa (MENA) with total assets FL CET1 (%) 15.4 and lending activities making up 6% and 8.4% of the group’s total respectively. -

TAKARÉK SZÁRMAZTATOTT BEFEKTETÉSI ALAP Tájékoztató És Kezelési Szabályzat

DIÓFA ALAPKEZELŐ ZRT. TAKARÉK SZÁRMAZTATOTT BEFEKTETÉSI ALAP Tájékoztató és Kezelési Szabályzat Közzététel időpontja: 2018. május. 2. Hatálybalépés időpontja: 2018. június 1. Tartalom Tájékoztató ...................................................................................................................................... 11 A Tájékoztatóban és Kezelési Szabályzatban használt fogalmak, rövidítések ...................................................11 I. A befektetési alapra vonatkozó információk .................................................................................................20 1. A befektetési alap alapadatai .............................................................................................................................20 1.1. A befektetési alap neve ..............................................................................................................................20 1.2. A befektetési alap rövid neve ....................................................................................................................20 1.3. A befektetési alap székhelye ......................................................................................................................20 1.4. A befektetési alapkezelő neve ...................................................................................................................20 1.5. A letétkezelő neve .......................................................................................................................................20 1.6. A forgalmazó -

Intesa Sanpaolo Innovates Banking with New Services Supported by Advanced Technology

Intesa Sanpaolo Financial Services Intesa Sanpaolo innovates banking with new services supported by advanced technology Intesa Sanpaolo is the banking group formed The bank created a roadmap to move Intesa Sanpaolo: by the merger of Banca Intesa and Sanpaolo away from its old banking model—a Size: More than 93,000 employees IMI bringing together two major Italian proprietary UNIX environment—to converged banks with shared values to increase their infrastructure and open systems. The Industry: Financial services opportunities for growth, enhance service new platform needed the performance Location: Turin, Italy for retail customers, significantly support and simplicity to respond to new market the development of businesses and make demands as well as cost and regulatory an important contribution to the country’s pressures. The solution also had to be Solutions growth. Intesa Sanpaolo has focused on scalable, because the bank is constantly • Flexible infrastructure expands opportunities for profitable growth through adding new services. quickly to support new services continuously evolving online services. And that means developing a new banking model Intesa Sanpaolo collaborated with Cisco for • Virtualized environment reduces to reduce infrastructure costs and improve a simplified platform that supports innovation costs, power, and footprint while time to market for new applications. and growth by delivering new application increasing performance environments in minutes and at far lower cost. • New cloud, analytics, and big data Challenge: Growth Through New Services The role of technology in financial services Embracing New Speeds services drive business growth ® is changing. Banks that are able to bring With Cisco UCS servers and Cisco new services to market quickly capture the management tools, the Intesa Sanpaolo most market share. -

Bad Bank Resolutions and Bank Lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi

BIS Working Papers No 837 Bad bank resolutions and bank lending by Michael Brei, Leonardo Gambacorta, Marcella Lucchetta and Bruno Maria Parigi Monetary and Economic Department January 2020 JEL classification: E44, G01, G21 Keywords: bad banks, resolutions, lending, non-performing loans, rescue packages, recapitalisations BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The papers are on subjects of topical interest and are technical in character. The views expressed in them are those of their authors and not necessarily the views of the BIS. This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2020. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1020-0959 (print) ISSN 1682-7678 (online) Bad bank resolutions and bank lending Michael Brei∗, Leonardo Gambacorta♦, Marcella Lucchetta♠ and Bruno Maria Parigi♣ Abstract The paper investigates whether impaired asset segregation tools, otherwise known as bad banks, and recapitalisation lead to a recovery in the originating banks’ lending and a reduction in non-performing loans (NPLs). Results are based on a novel data set covering 135 banks from 15 European banking systems over the period 2000–16. The main finding is that bad bank segregations are effective in cleaning up balance sheets and promoting bank lending only if they combine recapitalisation with asset segregation. Used in isolation, neither tool will suffice to spur lending and reduce future NPLs. Exploiting the heterogeneity in asset segregation events, we find that asset segregation is more effective when: (i) asset purchases are funded privately; (ii) smaller shares of the originating bank’s assets are segregated; and (iii) asset segregation occurs in countries with more efficient legal systems. -

April 12Th 2021 Cleansing Statement

NEXI S.P.A. Corso Sempione 55 20149, Milan Italy PRESS RELEASE Milan (Italy)—April 12, 2021 Nexi S.p.A., a società per azioni incorporated under the laws of Italy (“Nexi” or the “Issuer”), announced today that it it intends to offer approximately €2,100 million in aggregate principal amount of unsecured Senior Notes consisting of Senior Notes due 2026 and Senior Notes due 2029 (collectively, the “Notes”). In connection with the offering of the Notes, the Issuer disclosed certain information, including certain pro forma financial information and non-GAAP financial information of the Issuer, Nets Topco 2 S.à r.l. and its subsidiaries and SIA S.p.A. and its subsidiaries as of and for the years ended December 31, 2020 and 2019, to prospective holders of the Notes. A copy of such information is hereby disclosed to the Issuer’s shareholders and to the holders of the Issuer’s existing indebtedness and is attached hereto as Exhibit A (the “Information Release”). The Notes will be offered only to non-U.S. persons outside the United States in connection with offshore transactions complying with Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”). The Notes have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities or blue sky laws and foreign securities laws. **************** This announcement contains information that prior to its disclosure may have constituted inside information under European Union Regulation 596/2014 on market abuse. -

INTESA SANPAOLO BANK IRELAND P.L.C

INFORMATION MEMORANDUM 24 March 20 2 1 INTESA SANPAOLO BANK IRELAND p.l.c. ( as Issuer in respect of Euro - Commercial Paper and Certificate of Deposit ) INTESA SANPAOLO BANK LUXEMBOURG, SOCIÉTÉ ANONYME ( as Issuer in respect of Euro - Commercial Paper and Certificate of Deposit ) INTESA SANPAOLO S.p.A. ( as Issuer in respect of Commercial Paper ( Cambiali Finanziarie ) and , in respect of Euro - Commercial Paper and Certificate of Deposit issued by Intesa Sanp a olo Bank Ireland p.l.c. and Intesa Sa npaolo bank Luxembourg S.A., as Guarantor) €30,000,000,000 GUARANTEED EURO - COMMERCIAL PAPER AND CERTIF I CATE OF DEPOSIT AND COMMERCIAL PAPER ( Cambiali Finanziarie ) PROGRAMME Name of the Programme Intesa Sanpaolo Bank Ireland p.l.c. Intesa Sanpaolo Bank Luxembourg, société anonyme and Intesa Sanpaolo S.p.A. Guaranteed Euro - Commercial Paper and Certificate of Deposit and Commercial Paper ( Cambiali Finanziarie ) Programme Type of the Programme Multi - Issuer Global Guaranteed Euro - Commercial Paper and Certificate of Deposit and Commercial Paper ( Cambiali Finanziarie ) Programme Maximum Amount of the €30,000,000,000 Programme Guarantor Intesa Sanpaolo S.p.A. ( in re spect of Euro - Commercial Paper and Certificate of Deposit issued by Intesa Sanp a olo Ba nk Ireland p.l.c. and Intesa Sa npaolo Bank Luxembourg S.A.) Rating(s) Rated Moody's Investors Service Espaňa S.A. (Moody's) S&P Global Ratings Europe Limited ( S&P ) Fitch Ratings Ireland Limited (Fitch) DBRS Ratings GmbH (DBRS) Arrangers Intesa Sanpaolo Bank Ireland p.l.c. Intesa Sanpaolo S.p.A. Issuing and Paying Agent The Bank of New York Mellon , London Branch Dealers Barclays 0050829 - 0000304 UKO2: 2001430388.39 1 BofA Securities Citigroup Credit Suisse Goldman Sachs International ING Intesa Sanpaolo S.p.A. -

1Q20 Results

1Q20 Results Alessandro Foti, CEO and General Manager Milan, June 2020 Disclaimer This Presentation may contain written and oral “forward-looking statements”, which includes all statements that do not relate solely to historical or current facts and which are therefore inherently uncertain. All forward-looking statements rely on a number of assumptions, expectations, projections and provisional data concerning future events and are subject to a number of uncertainties and other factors, many of which are outside the control of FinecoBank S.p.A. (the “Company”). There are a variety of factors that may cause actual results and performance to be materially different from the explicit or implicit contents of any forward-looking statements and thus, such forward-looking statements are not a reliable indicator of future performance. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable law. The information and opinions contained in this Presentation are provided as at the date hereof and are subject to change without notice. Neither this Presentation nor any part of it nor the fact of its distribution may form the basis of, or be relied on or in connection with, any contract or investment decision. The information, statements and opinions contained in this Presentation are for information purposes only and do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of an offer to purchase or subscribe for securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments. -

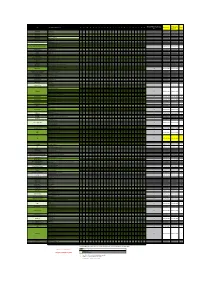

Updated As of 01/06/2017 Changes Highlighted in Yellow

NEW QUARTER TOTAL PDship per Previous Quarter Firm Legal Entity Holding Dealership AT BE BG CZ DE DK ES FI FR GR HU IE IT LV LT NL PL PT RO SE SI SK UK Current Quarter Changes Bank March 2016) ABLV Bank ABLV Bank, AS 1 bank customer bank customer 0 Abanka Vipa Abanka Vipa d.d. 1 bank customer bank customer 0 ABN Amro ABN Amro Bank N.V. 3 bank inter dealer bank inter dealer 0 Alpha Bank Alpha Bank S.A. 1 bank customer bank customer 0 Allianz Group Allianz Bank Bulgaria AD 1 bank customer bank customer 0 Banca IMI Banca IMI S.p.A. 3 bank inter dealer bank inter dealer 0 Banca Transilvania Banca Transilvania 1 bank customer bank customer 0 Banco BPI Banco BPI + 1 bank customer bank customer 0 Banco Comercial Português Millenniumbcp + 1 bank customer bank customer 0 Banco Cooperativo Español Banco Cooperativo Español S.A. + 1 bank customer bank customer 0 Banco Santander S.A. + Banco Santander / Santander Group Santander Global Banking & Markets UK 6 bank inter dealer bank inter dealer 0 Bank Zachodni WBK S.A. Bank Millennium Bank Millennium S.A. 1 bank customer bank customer 0 Bankhaus Lampe Bankhaus Lampe KG 1 bank customer bank customer 0 Bankia Bankia S.A.U. 1 bank customer bank customer 0 Bankinter Bankinter S.A. 1 bank customer bank customer 0 Bank of America Merrill Lynch Merrill Lynch International 9 bank inter dealer bank inter dealer 0 Barclays Barclays Bank PLC + 17 bank inter dealer bank inter dealer 0 Bayerische Landesbank Bayerische Landesbank 1 bank customer bank customer 0 BAWAG P.S.K. -

Digital Transformation of the Retail Payments Ecosystem European Central Bank and Banca D’Italia Joint Conference

Digital transformation of the retail payments ecosystem European Central Bank and Banca d’Italia joint conference 30 November and 1 December 2017 Rome, Italy programme Thursday, 30 November 2017 08:00 Registration and coffee 09:00 Welcome remarks Ignazio Visco, Banca d’Italia Introductory speech Yves Mersch, European Central Bank Topic I – Digital evolution of retail payments 09:45 Panel discussion: Digital evolution of retail payments – a global scan from a central bank perspective Panellists: Veerathai Santiprabhob, Bank of Thailand Reinaldo Le Grazie, Banco Central do Brasil Denis Beau, Banque de France Francois E. Groepe, South African Reserve Bank Moderator: Yves Mersch, European Central Bank 11:00 Coffee break 2 11:30 Keynote speech: The impact of digital innovation on banking and payments Chris Skinner, Fintech commentator and author 12:00 Panel discussion: How to foster innovation and integration in retail payments Panellists: Massimo Cirasino, World Bank Group Luisa Crisigiovanni, Altroconsumo Elie Beyrouthy, American Express Pierre Petit, European Central Bank Javier Santamaría, European Payments Council Moderator: Paolo Marullo Reedtz, Banca d’Italia 13:15 Lunch break 14:30 Academic session: On the way to a digital retail payments ecosystem – drivers and inhibitors Are instant retail payments becoming the new normal? Lola Hernández (co-authors Monika E. Hartmann, Mirjam Plooij and Quentin Vandeweyer), European Central Bank 3 The future of digital retail payments in Europe: a role for central bank issued crypto cash? Ruth Wandhöfer, -

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A.