NEWS BRIEF #43 SUNDAY 27 October 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MENA Construction Reinstatement of Coverage

MENA Construction Reinstatement of Coverage Equity | MENA | Construction 18 September 2013 Buy scope over scale, reinstating on GCC contractors Equity Research Faisal AlAzmeh, CFA >> +971 4 425 8217 Reinstating on GCC contractors; DSI stands out as a Buy Research Analyst Merrill Lynch (Dubai) Despite this year’s reacceleration of awards activity, we believe the market is (1) [email protected] overly optimistic on peak-cycle earnings power, and (2) ignoring the risk posed by Ilze Roux >> +27 11 305 5195 stretched receivables. We have an Underperform rating on Arabtec (UAE) and Al- Research Analyst Merrill Lynch (South Africa) Khodari (KSA), but an out-of-consensus Buy on DSI. Perplexingly, the market is [email protected] assuming a strong (and unrealistic) recovery in Arabtec and Al-Khodari’s earnings Macro Research growth while being overly cautious on DSI’s prospects. We believe this provides Jean-Michel Saliba +44 20 7995 8568 an opportunity as DSI’s higher-margin end-to-end solutions business model MENA Economist leaves it well positioned to surprise on the upside. MLI (UK) [email protected] DSI – Buy (PO AED1.55): a premium player at a discount In our view, DSI offers the best exposure to the sector’s reaccelerating activity, which is mirrored in the 70% YTD backlog growth. The company’s experience in Table 1: Reinstated POs and Earnings high-margin end-to-end solutions is likely to allow DSI to increase its exposure to Al-Khodari DSI Arabtec power and rail projects, which have higher margins than civil contracts more U/P Buy U/P common at peers. -

Arabtec and Samsung Engineering Sign Memorandum of Understanding for a New Joint Venture Company

Arabtec and Samsung Engineering sign Memorandum of Understanding for a new Joint Venture Company . New JV Company – Arabtec-Samsung Engineering - will capture growth opportunities in the oil & gas, power and infrastructure sectors . Under the terms of the MoU: o Arabtec and Samsung will have an exclusive relationship throughout MENA in these sectors o Arabtec to own 60% and Samsung Engineering to own 40% -the new company to be incorporated and headquartered in Abu Dhabi o ‘Centre of Excellence’ to be established in Abu Dhabi for training Emirati engineers of the future Abu Dhabi, UAE, 17 April 2013 – Arabtec Holding, a leading construction company in MENA, and Samsung Engineering Co., (Samsung Engineering) , Korea’s first and largest engineering company, announce the signing of a Memorandum of Understanding (MoU) for a new joint venture company (‘JV Company’). The new JV Company will exclusively undertake large-scale projects in oil & gas, power and infrastructure in the Middle East and North Africa (MENA). The JV Company will be called Arabtec-Samsung Engineering, and will be incorporated and headquartered in Abu Dhabi. Arabtec will be a 60% shareholder in the new company with Samsung Engineering holding the remaining 40% interest. The management team of the new JV Company will consist of experienced executives from Samsung Engineering and Arabtec and will be appointed shortly. The JV Company will benefit from Arabtec’s extensive regional network, top tier project managers and skilled workforce along with a proven track-record of delivering technically-complex construction projects in the region as well as Samsung Engineering’s leading market position in oil & gas, power and infrastructure. -

Arabtec Holding PJSC and Its Subsidiaries Condensed

Arabtec Holding PJSC and its subsidiaries Condensed consolidated interim financial information for the six-month period ended 30 June 2019 (Unaudited) Arabtec Holding PJSC and its subsidiaries Pages Report on review of condensed consolidated interim financial information 1 - 3 Condensed consolidated interim statement of financial position 4 Condensed consolidated interim statement of profit or loss 5 Condensed consolidated interim statement of comprehensive income 6 Condensed consolidated interim statement of changes in equity 7 Condensed consolidated interim statement of cash flows 8 - 9 Notes to the condensed consolidated interim financial information 10 - 38 Deloitte & Touche (M.E.) Building 3, Level 6 Emaar Square Downtown Dubai P.O. Box 4254 Dubai United Arab Emirates Tel: +971 (0) 4 376 8888 Fax:+971 (0) 4 376 8899 www.deloitte.com August 17th, 2016 REPORT ON REVIEW OF CONDENSED CONSOLIDATED INTERIM FINANCIAL INFORMATION The Board of Directors Arabtec Holding PJSC and its subsidiaries Dubai United Arab Emirates Introduction We have reviewed the accompanying condensed consolidated interim statement of financial position of Arabtec Holding PJSC (the “Company”) and its subsidiaries (collectively referred to as the “Group”) as at 30 June 2019 and the related condensed consolidated interim statements of profit or loss, comprehensive income, changes in equity and cash flows for the six-month period then ended, including a summary of significant accounting policies and other explanatory information. Management is responsible for the preparation and presentation of this condensed consolidated interim financial information in accordance with International Accounting Standard (IAS) 34 Interim Financial Reporting. Our responsibility is to express a conclusion on this condensed consolidated interim financial information based on our review. -

Initial Public Offerings 2018 Second Edition

Initial Public Offerings 2018 Second Edition Contributing Editors: Ilir Mujalovic & Harald Halbhuber With contributions by: CONTENTS Preface Ilir Mujalovic & Harald Halbhuber, Shearman & Sterling LLP Foreword Sean C. Davy, The Securities Industry and Financial Markets Association (SIFMA) 1 General chapters Paving the road for SMEs’ access to public equity markets Cédric Pacheco, Association for Financial Markets in Europe (AFME) 7 Going public in the USA: An overview of the regulatory framework and capital markets process for IPOs Ilir Mujalovic, Harald Halbhuber & Rupa Briggs, Shearman & Sterling LLP 14 An overview of structuring and governance considerations for Initial Public Offerings in the USA, Stacy J. Kanter & Michael J. Hong, Skadden, Arps, Slate, Meagher & Flom LLP and Affiliates 30 Trends shaping an evolving IPO market, Pippa Bond, Daniel Forman & Lily Desmond, Proskauer Rose LLP 40 Country chapters Australia Daniel Scotti & Nicole Sloggett, MinterEllison 56 Bermuda David Cooke & Edward Rance, Conyers Dill & Pearman Limited 68 Brazil Fernando Zorzo, Pinheiro Neto Advogados 75 British Virgin Matthew Gilbert, Greg Knowles & Richard May, Maples and Calder 86 Islands Cayman Islands Suzanne Correy & Daniel Lee, Maples and Calder 93 China Shiwei Zhang, Zhong Lun Law Firm 102 Denmark Rikke Schiøtt Petersen, Chantal Pernille Patel & Mads Robert Bording Jensen, Gorrissen Federspiel Private Limited Partnership 111 Finland Tarja Wist, Maria Pajuniemi & Emilia Saloranta, Waselius & Wist 121 France Jérôme Lombard-Platet & Gacia Kazandjian, DS Avocats 130 Germany Dr. Achim Herfs & Dr. Anna Schwander, Kirkland & Ellis International LLP 143 Hong Kong Angel Wong & Agatha Chun, ONC Lawyers 154 India Venkatesh Vijayaraghavan, Juhi Singh & Pratichi Mishra, S&R Associates 165 Ireland Matthew Cole, A&L Goodbody 177 Italy Marco Lantelme, BSVA Studio Legale Associato 187 Japan Kagayaki Funakoshi & Shunsuke Aoki, Anderson Mori & Tomotsune 199 Mexico Ricardo Maldonado, Patricio Trad & Manuel Echave, Mijares, Angoitia, Cortés y Fuentes, S.C. -

Initiation of Coverage Report

Research Department Initiation of Coverage Report 20 September 2007 Arabtec Holding PJSC Buy Something To Build On General Information Summary RIC ARTC.DU Strong local presence and a healthy backlog Bloomberg code ARTC UH Arabtec Holding, formerly Arab Technical Construction Company, was established in Dubai Market cap AED3,588 mil in 2004 with the principal objective of investing in the construction sector through the Shares outstanding 598 mil acquisition of contracting and related companies in the UAE and the MENA region. In Enterprise value AED3,661 mil August 2004, the company offered 55.0% of its shares in an IPO that was oversubscribed Net debt AED73.3 mil 74 times. The company listed its shares on the Dubai Financial Market (DFM) on January Free float 55.0% 4, 2005. Arabtec’s local outstanding backlog stood at around AED16.2 billion by the end of July 2007, including all local and international activities. Valuation Geographical expansion on the rise Target price AED7.60 Arabtec Holding is undertaking an aggressive regional expansion plan, mainly targeting Market price AED6.00 Asian and Middle Eastern markets. Arabtec Holding was able to secure contracts in Qatar, Upside potential 26.67% Pakistan, and Mauritius through the establishment of new subsidiaries and joint ventures in the field of construction and related works as well as the manufacture and Share Price Information transportation of ready mix. Arabtec’s share in regional joint venture projects reached a Absolute *Relative value of AED2.3 billion as of 1H07, with more expected project awards in the pipeline. YTD ∆ 30.9% 28.6% 1H07: Robust growth 1M ∆ 3.8% 1.4% Arabtec Holding released 1H07 results posting a net income of AED173.4 million, up 3M ∆ 0.3% 6.5% 52.7% from AED113.6 million in 1H06, due to a 25.1% YoY increase in revenues on the 12M ∆ 39.9% 52.9% back of recording more construction contracts as well as the acquisition of new Av. -

2Nd June, 2008.Pmd

Overseas Information Overseas Market Information UAE DANA GAS coming up with 19 New Drilling Units in Egypt UAE-based Dana Gas is planning to step up its drilling unit in Egypt for doubling its natural gas reserves in the North African segment. Dana Gas, which relies on Egypt for its major revenue said it planned to spend more than $ 170 million for drilling 19 new wells in Egypt before the end of the year, compared with 10 wells with investments of $ 56 million in 2007. Egypt holds Africa’s third-largest natural gas reserves after Algeria and Nigeria. The gas sector in Egypt is expanding rapidly. This exploration and development programme could potentially double the size of Egypt’s reserves. Also, the said firm is investing about $ 500 million in Egypt and Iraq’s Kurdish region this year to boost natural gas output. The firm posted a near 15 per cent rise in fourth-quarter revenue compared with the third quarter on higher production from its Egyptian gas operations and higher prices. Earlier in November 2006, Dana Gas started its operation in the Egyptian Sector after its acquisition of Canada’s “Centurion International” for an amount of C$ 1.15 billion (US$ 1.13 billion). Apart from Dana Gas, similar firms from Abu Dhabi would develop 15 exploration wells and four development wells at the Komombo concession in Upper Egypt and two concessions in the Nile Delta. Five of the wells at the Sidi Salem Formation would target depths of 4,000 metres (13,120 ft). Dana Gas P.O. -

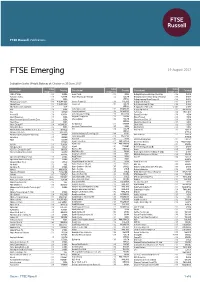

FTSE Emerging

FTSE Russell Publications 19 August 2017 FTSE Emerging Indicative Index Weight Data as at Closing on 30 June 2017 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 3SBio (P Chip) 0.03 CHINA Asian Paints 0.13 INDIA Beijing Enterprises Holdings (Red Chip) 0.06 CHINA Aamal Co. Q.S.C. 0.01 QATAR Aspen Pharmacare Holdings 0.2 SOUTH Beijing Enterprises Water Group (Red Chip) 0.08 CHINA ABB India 0.03 INDIA AFRICA Beijing Jingneng Clean Energy (H) 0.02 CHINA Aboitiz Equity Ventures 0.09 PHILIPPINES Asseco Poland SA 0.03 POLAND Beijing North Star (H) 0.01 CHINA Aboitiz Power 0.03 PHILIPPINES Assore Ltd 0.01 SOUTH Belle International (P Chip) 0.12 CHINA Abu Dhabi Commercial Bank 0.1 UAE AFRICA Bengang Steel Plates (B) <0.005 CHINA ACC 0.03 INDIA Astra Agro Lestari 0.01 INDONESIA Berjaya Sports Toto 0.01 MALAYSIA Acer 0.04 TAIWAN Astra International 0.35 INDONESIA Berli Jucker 0.04 THAILAND Acron JSC 0.01 RUSSIA Astro Malaysia Holdings 0.03 MALAYSIA Bharat Electronics 0.04 INDIA Adani Enterprises 0.01 INDIA Asustek Computer Inc 0.17 TAIWAN Bharat Forge-A 0.04 INDIA Adani Ports and Special Economic Zone 0.12 INDIA Attacq Limited 0.02 SOUTH Bharat Heavy Elect .LS 0.03 INDIA AFRICA Adani Power 0.01 INDIA Bharat Petroleum Corp 0.17 INDIA AU Optronics 0.11 TAIWAN Adaro Energy PT 0.04 INDONESIA Bharti Airtel 0.2 INDIA Aurobindo Pharmaceuticals 0.07 INDIA Aditya Birla Nuvo 0.02 INDIA Bharti Infratel 0.08 INDIA AVI 0.06 SOUTH Administradora Fibra Danhos S.A. -

Arabtec Holding Company UAE Construction Sector

Arabtec Holding Company UAE Construction Sector Initiation of Coverage August 15, 2006 Building a Nation STRONG BUY • Arabtec Holding PJSC formerly known as Arab Technical Construction Com- pany (ATCC) was established as a special purpose vehicle to facilitate a strat- Target Price (AED) 5.0 egy of investment in the construction sector, and capitalization on an ongoing boom, through acquisition of stakes in existing companies within the U.A.E. Recent Price (AED) 4.0 Following inauguration in 2004, the decision was taken to acquire Arabtec (ATCC), a leading construction company within the UAE, sporting over 30 Upside Potential 25% years of experience and contacts, for a total consideration of AED400 million. Investment Grade Growth • The construction sector boom in the UAE commenced in the late 1970s in Previous Target (AED) NA response primarily to massive population growth. The latter continues to prove a primary growth engine, with the sector kicking off on a new aggres- sive growth phase in 2003, fuelled by both an oil price driven explosion of Share Data liquidity and legislative reform permitting expatriate freehold rights. To date, Exchange Rate AED3.67/US$ developmental based projects, officially announced in the UAE, are estimated to be worth ca.US$340.8 billion of which the construction segment captures a Reuters Code ARTC.DU bulk 78%, equivalent to US$266.7 billion. Arabtec is estimated to enjoy a ca. Most Recent Shares (000) 520,000 3.5% share of this market. Par Value/share AED1 • We have calculated the company’s current backlog at an impressive ca. Financial Year December AED6.86 billion spread across 16 projects, all of which are situated in Dubai, with the exception of the Abu Dhabi Investment Authority– ADIA headquar- Mkt. -

International Petroleum Investment Company PJSC and Its Subsidiaries

International Petroleum Investment Company PJSC and its subsidiaries BOARD OF DIRECTORS’ REPORT AND CONSOLIDATED FINANCIAL STATEMENTS 31 DECEMBER 2015 International Petroleum Investment Company PJSC and its subsidiaries BOARD OF DIRECTORS’ REPORT 31 DECEMBER 2015 International Petroleum Investment Company PJSC and its subsidiaries BOARD OF DIRECTORS’ REPORT For the year ended 31 December 2015 The Board of Directors presents the consolidated financial statements of International Petroleum Investment Company PJSC (IPIC or the Company) and its subsidiaries (the Group) for the year ended 31 December 2015. Activities IPIC is a public joint stock company established on 29 May 1984 in Abu Dhabi, United Arab Emirates (“UAE”) by Emiri Decree No 3/1984 (subsequently replaced by Emiri Decree No 2/1986) and is wholly owned by the Government of the Emirate of Abu Dhabi. The Company’s registered head office is P.O. Box 7528, Abu Dhabi, UAE. The principal activity of the Company is to invest, on a long-term basis, in overseas energy and energy-related assets and to undertake infrastructure projects. At year-end, the Company has direct and indirect equity interests in various subsidiaries across the world: 64% interest in Borealis AG (“Borealis”) based in Austria, 100% interest in Nova Chemicals Corporation (“Nova”) based in Canada, 100% interest in Compañía Española de Petróleos SA (“CEPSA”) based in Spain and 98.46% interest in Aabar Investments PJS (“Aabar”) based in UAE. Aabar is a diversified investment company with investments across a broad range of sectors including aerospace, construction, commodities, financial services and real estate. Further, Aabar has direct and indirect equity interests in various subsidiaries across the world: 100% interest in Falcon Private Bank (“Falcon Bank”) based in Switzerland, 70% in Palm Assets based in Morocco and 36.11% interest in Arabtec Holding PJSC (“Arabtec”) based in UAE. -

Europe, Middle East & Africa

September 28, 2007 Europe, Middle East & Africa: Multi-Industry September 28, 2007 Europe, Middle East & Africa: Multi-Industry Initiating coverage in the Middle East: We select our top ten beneficiaries of the boom Geared to infrastructure investment Best buy ideas The Middle East is experiencing an economic Emaar Properties ACTION boom, born out of structural reform and Aldar Properties supported by the strong liquidity effects of high 12-month Potential oil prices, low interest rates and a weak US dollar. Union Properties Price price target up/downside Buy list stocks Equity markets, having overshot in 2005, now Emaar Properties Dh10.70 Dh16.2 51% Arabtec Holding Aldar Properties Dh7.35 Dh14.4 96% look inexpensive relative to mainstream emerging Union Properties Dh3.16 Dh5.9 87% Arabtec Holding Dh6.25 Dh8.6 38% markets. Tabreed Tabreed Dh2.43 Dh3.2 32% Tamweel Dh4.0 Dh7.0 75% We initiate coverage of 30 stocks in the UAE and Tamweel Abu Dhabi Nat'l Hotels Dh5.85 Dh7.6 30% Agility KD1.82 KD2.4 32% Turkey, which provide exposure to the theme of Aramex Dh2.55 Dh3.4 33% Abu Dhabi National Hotels infrastructure development in the region. Our Dubai Financial Market Dh3.14 Dh4.1 31% coverage stocks span sectors including real estate Agility Sell list stocks Union Cement Dh4.74 Dh4.0 -16% development, construction, building materials, National Cement Co Dh9.65 Dh8.0 -17% Aramex RAK White Cement Dh2.14 Dh1.9 -11% utilities, mortgage finance, logistics and Gulf Cement Dh6.45 Dh5.4 -16% transportation. Together, they represent over 80% Dubai Financial Market of the non-financial market cap of the Dubai Financial Market and c.40% of the non-financial Best sell ideas stocks of the Abu Dhabi Securities Market that UAE cement sector: can be purchased by non-GCC entities. -

Arabtec to Increase Its Ownership of Target Engineering Construction Co

أرابــــتــــك الــقـــابـــــضـــــة )ش.م.ع.( Arabtec Holding (PJSC) Arabtec to Increase its Ownership of Target Engineering Construction Co. to 98% Abu Dhabi, UAE, 26th November 2013 – Arabtec Holding, a leading engineering and construction group specialising in complex projects in the Middle East and North Africa region, announced today that it has entered into a definitive agreement to increase its stake in Target Engineering Construction Co. LLC to 98%, with senior management retaining the remaining 2% stake. Established in 1975, Target Engineering is one of the leading single source engineering, procurement and construction (‘EPC’) contractors, focused on the oil & gas, power and marine sectors with operations in the United Arab Emirates, Qatar, the Kingdom of Saudi Arabia and other countries. Arabtec acquired 60% of Target Engineering in 2007, and the acquisition of a further 38% for AED 270 million supports Arabtec’s strategic expansion in EPC in the oil & gas and power sectors. The transaction will be funded by the proceeds from Arabtec Holding’s recent rights issue. This acquisition follows the recent launch of Arabtec Samsung Engineering, a joint venture company that will provide EPC on large-scale multi-billion dollar projects in the oil and gas, power and related infrastructure sectors in the MENA region, which marked a major milestone in Arabtec’s ambitious strategy to expand into the oil and gas sector. The oil and gas sector is a key driver of long-term economic growth in the region, with the top 50 projects currently planned or already under way across the region valued at US$1.56 trillion. -

Arabtec Announces the Retirement Of

أرابــــتــــك الــقـــابـــــضـــــة )ش.م.ع.( Arabtec Holding (PJSC) At a contract value of AED 1.037 billion Arabtec Construction selected to build over 1,500 townhouses for Emaar Properties in Dubai Dubai, UAE, 5th March 2014 – Arabtec Holding PJSC, a leading engineering and construction Group of companies specialising in complex projects in the Middle East and North Africa region, announced today that its subsidiary Arabtec Construction has been awarded a contract to construct over 1,500 townhouses developed by Emaar Properties, the global developer of iconic real estate assets, in Reem, the master- planned community, in Dubai for a total value of AED1.037 billion. The 1,582 townhouses are part of the Mira community, the first phase of Reem, which was launched to strong customer response. The villas come in four different types, covering a total built area of 337,805 sq.m. The villa community is designed by BH.NS Engineering Consultant. Hasan Abdullah Ismaik, Managing Director and CEO of Arabtec Holding, commented: “We are indeed privileged to be selected by Emaar for yet another major residential development. This new project is a quality addition to our long history of cooperation. Emaar’s continued trust in Arabtec is testament to our established strength in delivering major developments on time and with high quality.” Arabtec was engaged in the construction of a number of Emaar’s iconic projects, including Burj Khalifa, the world’s tallest building, The Address Downtown Dubai, Emirates Hills, and the luxury Polo Homes in Arabian Ranches, among others. Ismaik added: “We are pleased to continue our long-time cooperation with Emaar and our mutual contribution to the urban development of the UAE.