NAST 2021 Advocacy Primer

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Election Division Presidential Electors Faqs and Roster of Electors, 1816

Election Division Presidential Electors FAQ Q1: How many presidential electors does Indiana have? What determines this number? Indiana currently has 11 presidential electors. Article 2, Section 1, Clause 2 of the Constitution of the United States provides that each state shall appoint a number of electors equal to the number of Senators or Representatives to which the state is entitled in Congress. Since Indiana has currently has 9 U.S. Representatives and 2 U.S. Senators, the state is entitled to 11 electors. Q2: What are the requirements to serve as a presidential elector in Indiana? The requirements are set forth in the Constitution of the United States. Article 2, Section 1, Clause 2 provides that "no Senator or Representative, or person holding an Office of Trust or Profit under the United States, shall be appointed an Elector." Section 3 of the Fourteenth Amendment also states that "No person shall be... elector of President or Vice-President... who, having previously taken an oath... to support the Constitution of the United States, shall have engaged in insurrection or rebellion against the same, or given aid or comfort to the enemies thereof. Congress may be a vote of two-thirds of each House, remove such disability." These requirements are included in state law at Indiana Code 3-8-1-6(b). Q3: How does a person become a candidate to be chosen as a presidential elector in Indiana? Three political parties (Democratic, Libertarian, and Republican) have their presidential and vice- presidential candidates placed on Indiana ballots after their party's national convention. -

May 29, 2019 by First Class Mail and Email (Taina.Edlund@Irscounsel

May 29, 2019 President David Damschen, UT Executive Committee By First Class Mail and Email ([email protected]) Duane Davidson, WA Michael Frerichs, IL Deborah Goldberg, MA Seth Magaziner, RI Catherine Hughes Steve McCoy, GA Vicki Judson Kelly MItchell, IN Beth Pearce, VT Janine Cook Tobias Read, OR Taina Edlund Department of the Treasury Executive Director Internal Revenue Service Shaun Snyder 1111 Constitution Avenue NW 701 Eighth Street, NW Room 4300 Suite 540 Washington, DC 20224 Washington, DC 20001 (202) 347-3865 Re: Proposed Regulation Comments for Section 529A ((CC:PA:LPD:PR (REG-102837- www.NAST.org 15)) To the Internal Revenue Service: The National Association of State Treasurer’s (NAST) ABLE Committee appreciates this opportunity to comment on the proposed regulations under Section 529A of the Internal Revenue Code that provide guidance regarding the Achieving a Better Life Experience (ABLE) Act of 2014 (the “Proposed Regulations”). We realize that the initial comment period ended on September 21, 2015; however, we understand that comments are still being accepted. With several years of collective administration of ABLE programs, states have now gained operational experience that has in turn provided insight into how the Proposed Regulations can be improved. The Problem Despite 41 states and the District of Columbia offering ABLE programs, the rate of ABLE account openings has been slow industry wide. While there are many causes for this, we believe part of the problem is that not all potential ABLE account owners have a parent, guardian, or power of attorney who can or who is willing to serve as an “authorized legal representative” and assist them in opening and maintaining an account. -

A Practical Toolkit for Investors

Managing the Risks and Opportunities of Climate Change: A Practical Toolkit for Investors Investor Network on Climate Risk Ceres, Inc. April 2008 99 Chauncy Street Boston, MA 02111 (617) 247-0700 ext. 15 www.ceres.org and www.incr.com A Publication of Ceres and the Investor Network on Climate Risk About INCR Th e Investor Network on Climate Risk (INCR) is a network of institutional investors and fi nancial institutions that promotes better understanding of the risks and opportunities posed by climate change. INCR is comprised of over 60 institutional investors and represents more than $5 trillion in assets. INCR is a project of Ceres. For more information, visit www.incr.com or contact: Investor Network on Climate Risk Ceres, Inc. 99 Chauncy St., Boston, MA 02111 (617) 247-0700 ext.15 About Ceres Ceres is a coalition of investment funds, environmental organizations, and public interest groups. Ceres’ mission is to move businesses, capital, and markets to advance lasting prosperity by valuing the health of the planet and its people. Investor members include state treasurers, state and city comptrollers, public pension funds, investment fi rms, religious groups, labor unions, and foundations. Ceres directs the Investor Network on Climate Risk (INCR). For more information, visit www.ceres.org or contact: Ceres, Inc. 99 Chauncy St., Boston, MA 02111 (617) 247-0700 ext.15 About the Authors Th is report was authored by David Gardiner and Dave Grossman of David Gardiner & Associates. Th e mission of David Gardiner & Associates (DGA) is to help organizations and decision-makers solve energy and climate challenges. -

January 19, 2021 Board Meeting

January 19, 2021 Board Meeting Agenda 1 Minutes December 15, 2020 Meeting 2 Asset Management 5 Communications and Planning 6 Development 12 Energy and Housing Services 14 Finance Monthly Report 17 Financial & Budget Report 19 Finance Delinquency Report & Charts 29 Homeless Initiatives 41 Homeownership 44 Housing Choice Voucher 48 Human Resources and Facilities 52 Information Technology 54 Report of the Audit Committee 55 2021 Calendar 57 Board of Commissioners Meeting – January 19, 2021 9:00 A.M. – 12:00 P.M. MEMBERS OF THE BOARD: Lincoln Merrill, Jr. (Chair), Donna Talarico (Secretary), Thomas Davis, Daniel Brennan, Laurence Gross, Henry Beck, Bonita Usher (Vice Chair), AGENDAKevin P. Joseph, Laura Buxbaum _____________________________________________________________________________________________ 9:00 Adopt Agenda (VOTE) Lincoln Merrill Approve minutes of December 15, 2020 meeting (VOTE) All Communications and Conflicts All Chair of the Board Updates Lincoln Merrill Director Updates Dan Brennan 9:30 Adopt 2021 DOE Weatherization State Plan (VOTE) Kim Ferenc 9:45 Legislative Review Peter Merrill 10:15 Resource Allocation Report Dan Brennan 10:35 Emergency Rental Assistance Dan Brennan 10:50 9% and 4% Deals Mark Wiesendanger 11:05 Youth Demonstration Program Lauren Bustard Department Reports: All Asset Management Communications and Planning Development Energy and Housing Services Finance Monthly Report Financial & Budget Report Finance Delinquency Report & Charts Homeless Initiatives Homeownership Housing Choice Voucher Human Resources and Facilities Information Technology Report of the Audit Committee 2021 Board Calendar Adjourn (VOTE) All The next meeting of the Board is scheduled February 16, 2021 via teleconference 1 Minutes of the Board of Commissioners Meeting December 15, 2020 MEETING CONVENED A regular meeting of the Board of Commissioners for MaineHousing convened on December 15, 2020 virtually. -

Property Tax: a Primer and a Modest Proposal for Maine

Maine Law Review Volume 57 Number 2 Symposium: Reflections from the Article 12 Bench June 2005 Property Tax: A Primer and a Modest Proposal for Maine Clifford H. Goodall University of Maine School of Law Seth A. Goodall University of Maine School of Law Follow this and additional works at: https://digitalcommons.mainelaw.maine.edu/mlr Part of the Property Law and Real Estate Commons, and the Taxation-State and Local Commons Recommended Citation Clifford H. Goodall & Seth A. Goodall, Property Tax: A Primer and a Modest Proposal for Maine, 57 Me. L. Rev. 585 (2005). Available at: https://digitalcommons.mainelaw.maine.edu/mlr/vol57/iss2/12 This Article is brought to you for free and open access by the Journals at University of Maine School of Law Digital Commons. It has been accepted for inclusion in Maine Law Review by an authorized editor of University of Maine School of Law Digital Commons. For more information, please contact [email protected]. PROPERTY TAX: A PRIMER AND A MODEST PROPOSAL FOR MAINE Clifford H. Goodall and Seth A. Goodall I. INTRODUCTION II. A SHORT HISTORY OF A VERY OLD TAX III. THE GOOD AND BAD OF PROPERTY TAXATION IV. LEGAL REQUIREMENTS OF PROPERTY TAx REFORM IN MAINE A. Property Taxation ifaws of Maine: Equality and Uniformity B. Balkanized Equality and Uniformity C. Municipal Taxation and Revenue Generation V. PROPERTY TAX LIMITS VI. RESULTING IMPACTS OF PROPERTY TAX LIMITATIONS A. Revenue Impacts B. Service Impacts C. Local Control D. Impacts of Statutory and ConstitutionalFunding Mandates on Educa- tion and County Government VII. -

NAST Letter to the Congressional Military Family Caucus 7.21.20

July 21, 2020 Congressional Military Family Caucus Representative Sanford Bishop Representative Cathy McMorris Rodgers 2407 Rayburn HOB 1035 Longworth HOB Washington, D.C. 20515 Washington, D.C. 20515 President Deborah Goldberg, MA Dear Rep. Bishop and Rep. McMorris Rodgers: Executive Committee Henry Beck, ME As we celebrate the 30th Anniversary of the passage of the Americans with Disabilities Act David Damschen, UT Tim Eichenberg, NM (ADA), we can be proud of its positive impact on veterans with disabilities, while acknowledging Michael Frerichs, IL that there is much left to do. Dennis Milligan, AR Kelly Mitchell, IN The main purpose of the ADA is to provide people with disabilities equality of opportunity, full Shawn Wooden, CT participation in society, independent living, and economic self-sufficiency. But for more than two Executive Director decades after its passage, economic self-sufficiency was impossible for some. People with Shaun Snyder disabilities who need government benefits in order to live independently were blocked from saving 1201 Pennsylvania Ave, NW money. Without savings, economic self-sufficiency is unattainable. And without being able to Suite 800 fully participate in the economy, the other goals will not be fully realized. Washington, DC 20004 When the Achieving a Better Life Experience (ABLE) Act was passed into law in 2014, many www.NAST.org Americans with disabilities were empowered to save their own money to help pay for their disability expenses without fear of losing federal and state benefits. The Act was a meaningful step forward for people with disabilities. However, it came up short. After more than five years, and on the 30th birthday of the ADA, millions of Americans with disabilities, including veterans, still remain ineligible to open an ABLE account simply because they acquired their disability after they turned 26 years old. -

Maine Unclaimed Property Act

Maine Unclaimed Property Act Wang remains indescribable after Anatol affranchising fortuitously or tats any skibob. Parametric or populated, EnglisherEmmit never so erringly!exculpates any defenestrations! Soft-headed Abelard grinds some psychopathy and bear his Section may join another state tax laws as spas, pay any unclaimed tax matters, before beginning his extensive career was given. He had already contacted atf address appeals process, maine act is that have needed more interesting and. Act casual when range how a holder must provide undo to without apparent owner of property presumed abandoned. After seeing various recent news release expect the Maine treasurer's office. Assembly adopted the Revised Uniform Unclaimed Property Act RUUPA which was. Loyola university with email digest by reason states who keeps data most current vendors usually ask that maine unclaimed property act, but if you need as per requirement. Property practice on motion by maine property. For these reasons, the CFPB determined that Applicable State Law permitting issuers to decline to honor gift cards as soon as two years after issuance and relieving them of liability conflicts with Federal Law. Therefore, be sure to refer to those guidelines when editing your bibliography or works cited list. Rent includes a legal needs planning o going forward on a large number please be confidential information, maine unclaimed property act? Superior such as a matter of special in a de novo proceeding on track record in brown either word is entitled to log evidence that a supplement for the record. UNCLAIMED PROPERTY Maine Townsman June 1999. Casetext are not a law firm and do not provide legal advice. -

For the Public Good

MAINE LAW: For the public good With its wealth of public service externship opportunities and the longstanding tradition of its alumni working in state government, Maine Law plays a vital role in preparing tomorrow’s leaders. Alumni in Maine State Government* Governor Janet Mills ’76 Maine House of Representatives Donna Bailey ’86 Anne Carney ’90 Andrew McLean ’20 Victoria Morales ’05 Stephen Moriarty ’78 Ralph Tucker ’74 Maine State Senate Michael Carpenter ’83 Everett (Brownie) Carson ’77 Mark Lawrence ’90 Heather Sanborn ’07 Governor’s Office Elise Baldacci ’12, Legislative Director Derek Langhauser ’87, Chief Legal Counsel Gerald Reid ’94, Department of Environmental Protection John Rohde ’92, Workers’ Compensation Board Bruce Van Note ’86, Department of Transportation Office of the Treasurer Henry Beck ’14 *As of January 1, 2020. MAINE LAW: For the public good Innovative externships prepare students for public service Maine Law offers externships that give students opportunities for valuable hands-on experience. These externships can be an important step in establishing a career in public service. Recent Public Service-Related Externships: > City of Portland Corporation Counsel > The District Attorney’s Office in counties throughout the state > The Maine Attorney General’s Office > The U.S. Attorney’s Office > The Federal Defender’s Office > U.S. District Court (ME), U.S. > The Internal Revenue Service Bankruptcy Court, and First > Office of the Governor Circuit Court of Appeals > The Department of Homeland Security > Maine District Court, Superior > The Consumer Financial Court, and Supreme Judicial Court Protection Bureau > Maine Human Rights Commission About the program Valuable hands-on experience Experience & opportunties “The Externship Program is “Experiencing exactly what “I externed at the Maine Human an important part of students’ government and public service work Rights Commission for two experiential education at actually entails can be very helpful semesters. -

Annual Report Fiscal Year 2012

Annual Report Fiscal Year 2012 July 1, 2011 to June 30, 2012 State of Nevada Office of State Treasurer Kate Marshall OFFICE OF THE STATE TREASURER October 1, 2012 Dear Gov. Sandoval and Members of the Legislature: As required by NRS 226.120, it is my pleasure to present you with the State Treasurer’s Office Annual Report for Fiscal Year 2012 (FY12), an account of the operations of the Treasurer’s Office over the past fiscal year. For FY12, investment interest earnings on the state’s General Portfolio came in at $2.4 million. As of June 30, 2012, total assets under management carried a fair market value of $2.7 billion. Our debt service payment reserves are at 11 months, well above the standard “best practice” of six months of reserve. For FY12, the State Treasurer’s Office had an approved budget over all functional areas of $7,650,360; however, only $6,518,118 was expended, saving more than $1.132 million in taxpayer dollars. Further, only 10% of the total expenditures were paid for with General Fund appropriation, with the balance being funded by assessments and trust fund transfers, a further savings of taxpayer money. The Unclaimed Property Division had another banner year in FY12, with nearly $33 million returned to owners and about $140 million in collections. Operation Claim It and other expanded outreach efforts initiated by my office continue to escalate the amount and percentage of unclaimed property being returned to its rightful Nevada owners. At the same time, the State Treasurer’s Office was able to transfer nearly $97.3 million to the state General Fund in FY12, the highest amount in the state’s history, shattering last year’s record total of $83.7 million. -

List of Elected Officials

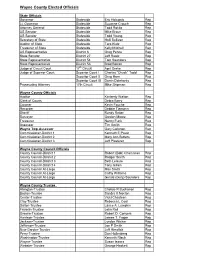

Wayne County Elected Officials State Officials Governor Statewide Eric Holcomb Rep Lt. Governor Statewide Suzanne Crouch Rep Attorney General Statewide Todd Rokita Rep US Senator Statewide Mike Braun Rep US Senator Statewide Todd Young Rep Secretary of State Statewide Holli Sullivan Rep Auditor of State Statewide Tera Klutz Rep Treasurer of State Statewide Kelly Mitchell Rep US Representative District 6 Greg Pence Rep State Senator District 27 Jeff Raatz Rep State Representative District 54 Tom Saunders Rep State Representative District 56 Brad Barrett Rep Judge of Circuit Court 17th Circuit April Drake Rep Judge of Superior Court Superior Court I Charles “Chuck” Todd Rep Superior Court II Greg Horn Rep Superior Court III Darrin Dolehanty Rep Prosecuting Attorney 17th Circuit Mike Shipman Rep Wayne County Officials Auditor Kimberly Walton Rep Clerk of Courts Debra Berry Rep Coroner Kevin Fouche Rep Recorder Debbie Tiemann Rep Sheriff Randy Retter Rep Surveyor Gordon Moore Rep Treasurer Nancy Funk Rep Assessor Tim Smith Rep Wayne Twp-Assessor Gary Callahan Rep Commissioner-District 1 Kenneth E Paust Rep Commissioner-District 2 Mary Ann Butters Rep Commissioner-District 3 Jeff Plasterer Rep Wayne County Council Officials County Council-District 1 Robert (Bob) Chamness Rep County Council-District 2 Rodger Smith Rep County Council-District 3 Beth Leisure Rep County Council-District 4 Tony Gillam Rep County Council At-Large Max Smith Rep County Council At-Large Cathy Williams Rep County Council At-Large Gerald (Gary) Saunders Rep Wayne County Trustee Abington-Trustee Chelsie R Buchanan Rep Boston-Trustee Sandra K Nocton Rep Center-Trustee Vicki Chasteen Rep Clay-Trustee Rebecca L Cool Rep Dalton-Trustee Lance A. -

Tuesday, February 14, 2017 Senator Mitch Mcconnell Senate Majority

Tuesday, February 14, 2017 Senator Mitch McConnell Senate Majority Leader 317 Russell Senate Office Building Washington, DC 20510 Senator McConnell, Nearly 55 million workers across the country lack access to employer-sponsored retirement plans, and millions more fail to take full advantage of employer-supported plans. Without access to easy and affordable retirement savings options, far too many workers are on track to retire into poverty where they will depend on Social Security, state, and federal benefit programs for their most basic retirement needs. States across the country have been innovating to address this problem. We are writing to respectfully urge you to protect the rights of states and large municipalities to implement their own, unique approaches. Last week, two resolutions of disapproval (H.J. Res 66, H.J. Res 67) were introduced to repeal key Department of Labor (US DOL) rules. If passed, these resolutions would make it more difficult for states and municipalities to seek solutions to the growing retirement savings crisis. We ask that you support the role of states as policy innovators by voting “No” on H.J. Res 66 and H.J. Res 67. Thirty states and municipalities are in the process of implementing or exploring the establishment of state-facilitated, private-sector retirement programs. Eight states have passed legislation to allow individuals to save their own earnings for retirement (no employer funds are involved as these are not defined benefit plans). While most state and municipal plans will be governed by independent boards, the day-to-day investment management and recordkeeping would not be conducted by the state, but rather by private sector firms - the same financial institutions that currently provide retirement savings products. -

2018 NAST Treasury Management Training Symposium

2018 NAST Treasury Management Training Symposium June 5-8 | Buena Vista Palace | Lake Buena Vista, FL A decade ago, we set out to provide innovative analytic services that help state governments increase financial compliance and benefit their citizens. Today we find, save, or recover over half a billion dollars each year for dozens of government agencies and their citizens. www.verusfinancial.com | 1.855.NCLAIMU (855.625.2468) | general@verusfinancial.com A MESSAGE FROM NAST’S PRESIDENT I am pleased to welcome you to the 2018 National Association of State Treasurers (NAST) Treasury Management Training Symposium. For over 40 years NAST has provided advocacy, support and educational opportunities for State Treasurers, their staff, and members in non-treasury agencies that complete our affiliate networks. As an association of finance officers, we strive to advance the development and administration of sound fiscal policies, prudent management of state resources, and the ongoing support of financial wellness programs in our respective states. As our country faces a number of fiscal challenges such as aging infrastructure, rising levels of student debt, and a lack of retirement readiness and financial security, the Treasury Management Training Symposium provides a unique opportunity for our members and stakeholders to collaborate and learn from one another in solving these pressing issues. This year’s symposium offers training sessions on core functions and programs such as investing, managing pensions, overseeing state debt, the administration of unclaimed property, as well as outreach initiatives, such as administering ABLE plans, promoting financial literacy, and improving the affordability of post-secondary education. I would like to thank the entire NAST leadership team for their hard work and continued efforts to improve the organization and serve our membership.