“Deltic's Diversity of Assets Helps Create Consistent Shareholder Value

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Murphy Oil Corporation

UNITED STATES SECURITIESSTATES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 201 6 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES For the transition period from to Commission file number 1-8590 MURPHY OIL CORPORATION (Exact name of registrant as specified in its charter) Delaware 71-0361522 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 3 00 Peach Street, P.O. Box 7000, El Dorado, Arkansas 71731-7000 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (870) 862-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $1.00 Par Value New York Stock Exchange Series A Participating Cumulative New York Stock Exchange Preferred Stock Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act . Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act . Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Country and City Codes

We hope this information will be useful to you in your travels! The information is believed to be reliable and up to date as of the time of publication. However, no warranties are made as to its reliability or accuracy. Check with Full Service Network Customer Service or your operator for official information before you travel. Country and City Codes Afghanistan country code: 93 Albania country code: 355 city codes: Durres 52, Elbassan 545, Korce 824, Shkoder 224 Algeria country code: 213 city codes: Adrar 7, Ain Defla 3, Bejaia 5, Guerrar 9 American Samoa country code: 684 city codes: City codes not required. All points 7 digits. Andorra country code: 376 city codes: City codes not required. All points 6 digits. Angola country code: 244 Anguilla country code: 264 Antarctica Casey Base country code: 672 Antarctica Scott Base country code: 672 Antigua (including Barbuda) country code: 268 city codes: City codes not required. * Footnote: You should not dial the 011 prefix when calling this country from North America. Use the country code just like an Area Code in the U.S. Argentina country code: 54 city codes: Azul 281, Bahia Blanca 91, Buenos Aires 11, Chilvilcoy 341, Comodoro Rivadavia 967, Cordoba 51, Corrientes 783, La Plata 21, Las Flores 224, Mar Del Plata 23, Mendoza 61, Merio 220, Moreno 228, Posadas 752, Resistencia 722, Rio Cuarto 586, Rosario 41, San Juan 64, San Rafael 627, Santa Fe 42, Tandil 293, Villa Maria 531 Armenia country code: 374 city codes: City codes not required. Aruba country code: 297 city codes: All points 8 plus 5 digits The Ascension Islands country code: 247 city codes: City codes not required. -

2020-2021 Catalog

TABLE OF CONTENTS COLLEGE CALENDAR 2 GENERAL INFORMATION 5 ADMISSIONS & REGISTRATION 8 FINANCIAL INFORMATION 16 STUDENT SERVICES 21 STUDENT FINANCIAL ASSISTANCE 31 STUDENT ACTIVITIES 40 ACADEMIC POLICIES & INFORMATION 42 ACADEMIC DEGREES & CERTIFICATES 56 SPECIAL COLLEGE PROGRAMS 129 COURSE DESCRIPTIONS 133 COLLEGE FACULTY & STAFF 157 COLLEGE TELEPHONE DIRECTORY 166 Revised: 10/30/19 COLLEGE CALENDAR FALL SEMESTER (August 19-November 24, 2020) Advising/Registration ...................................................................................................................................................... August 10-13 (Mon.-Thurs.) Adjunct Faculty Orientation ............................................................................................................................................................ August 11 (Tues.) Faculty Report ................................................................................................................................................................................. August 12 (Wed.) *Camden Aviation Classes Begin ................................................................................................................................................... August 12 (Wed.) Fall Convocation ................................................................................................................................................................................ August 14 (Fri.) *Cosmetology Classes Begin ......................................................................................................................................................... -

Overall Statistics for Arkansas State (All Games Sorted by Batting Avg)

A-STATE BASEBALL Table of Contents Introduction This Is A-State Table of Contents/Quickfacts.......................................1-2 Tomlinson Stadium.....................................................86-87 Media Information................................................................3 Welcome to A-State............................................................88 A-State Administration.....................................................89 Season Preview A-State Chancellor Dr. Tim Hudson.............................90 Season Preview..................................................................4-6 A-State Director of Athletics Terry Mohajir.............91 Roster .........................................................................................7 Athletic Facilities ................................................................92 Jonesboro...............................................................................93 Meet The Team Staff Directory......................................................................94 Head Coach Tommy Raffo..............................................8-9 Assistant Coaches........................................................10-11 Volunteer Assistant Coach..............................................12 Player Profiles...............................................................13-39 Credits Review The 2014 A-State Baseball media guide has been 2013 Statistics ..............................................................40-42 compiled for use by the media, prospective students -

MURPHY OIL CORPORATION (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES For the transition period from to Commission file number 1-8590 MURPHY OIL CORPORATION (Exact name of registrant as specified in its charter) Delaware 71 -0361522 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification Number) 200 Peach Street, P.O. Box 7000, El Dorado, Arkansas 71731 -7000 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (870) 862-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $1.00 Par Value New York Stock Exchange Series A Participating Cumulative New York Stock Exchange Preferred Stock Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act . Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act . Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

MURPHY OIL CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-8590 MURPHY OIL CORPORATION (Exact name of registrant as specified in its charter) Delaware 71 -0361522 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 200 Peach Street, P.O. Box 7000, El Dorado, Arkansas 71731 -7000 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (870) 862-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $1.00 Par Value New York Stock Exchange Series A Participating Cumulative New York Stock Exchange Preferred Stock Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Murphy Oil Corporation Annual Report 2018

Murphy Oil Corporation Annual Report 2018 Form 10-K (NYSE:MUR) Published: February 26th, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 201 7 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES For the transition period from to Commission file number 1-8590 MURPHY OIL CORPORATION (Exact name of registrant as specified in its charter) Delaware 71-0361522 (State or other jurisdiction of incorporation or (I.R.S. Employer Identification Number) organization) 300 Peach Street, P.O. Box 7000, El Dorado, Arkansas 71731-7000 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (870) 862-6411 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $1.00 Par Value New York Stock Exchange Series A Participating Cumulative New York Stock Exchange Preferred Stock Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section1 3 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

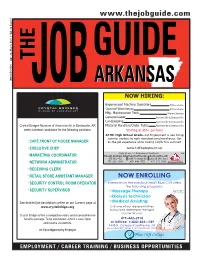

NOW HIRING: Experienced Machine Operators All Locations General Warehouse All Locations Mfg

www.thejobguide.com THE GUIDE (800) 654-9776 Apr 22–May 5, 2011 Vol. 23 Issue 8 ARKANSASARKANSAS JOB NOW HIRING: Experienced Machine Operators All Locations General Warehouse All Locations Mfg. Maintenance Tech. Siloam Springs General Labor Fayetteville & Bentonville Landscaping Fayetteville & Bentonville Crystal Bridges Museum of American Art in Bentonville, AR Material Handlers/Order Puller Fayetteville & Bentonville seeks talented candidates for the following positions: Starting at $10+ per hour ATTN: High School Grads—1st Employment is now hiring summer workers to work manufacturing/warehouse. Get CAFÉ FRONT OF HOUSE MANAGER on-the-job experience while making $10/hr this summer! EXECUTIVE CHEF www.1stEmployment.net Apply at any 1st Employment location!! EOE MARKETING COORDINATOR Siloam Springs, AR Fayetteville, AR Bentonville, AR 975 Hwy 412 3996 Frontage Rd 1003 SE 14th Ste 1 NETWORK ADMINISTRATOR 479–238–8989 479–444–7671 479–273–9992 RECEIVING CLERK RETAIL STORE ASSISTANT MANAGER NOW ENROLLING SECURITY CONTROL ROOM OPERATOR Interested in the medical field? Blue Cliff offers the following programs: SECURITY SUPERVISOR ~Massage Therapy ~Dialysis Technician See detailed job descriptions online on our Careers page at ~Medical Assisting www.crystalbridges.org Call one of our representatives today and determine the right course for you! Crystal Bridges offers a competitive salary and a comprehensive benefits package. To be considered, submit a cover letter 479–442–2914 and resume via website. or toll free: 1–800–863–1749 3448 N. College~Fayetteville, AR www.bluecliffcollege.com/fayetteville.shtml An Equal Opportunity Employer EMPLOYMENT / CAREER TRAINING / BUSINESS OPPORTUNITIES Check out NWA’s Newest Cosmetology School! Specialists in the Evaluations of Consumer Products since 1952 PRODUCTION SUPERVISOR Start your NEW Career 1–2 years previous supervisory experience required. -

09Esumbbmediaguide.Pdf

2004 Regional Tournament 2007 Regional Tournament TV AND RADIO ROSTER #1 Jordan Stout #3 Jarivs Nichols #11 Taylor Euler #12 Robert Moores #15 Tim Niles 6-2 Jr. G 6-3 Sr. G 5-10 Fr. G 6-2 Sr. G 5-11 Sr. G Madison, Kansas Carol Strean, Ill. Emporia, Kansas Chicago, Illinois Brooklyn, New York #20 Matt Nelson #21 Dustin Andrews #22 Matt Boswell #24 Lamar Wilbern #31 Jeremiah Box 6-6 Jr. F 6-3 Sr. G 6-6 Jr. G 6-2 Sr. G 6-5 Sr. G/F Topeka, Kan. Lee’s Summit, Mo. Wichita, Kan. Milwaukee, Wisconsin Rockford, Illinois #33 Danny McEvoy #35 Abe Barnes #40 Doug Moore #50 Adam Holthaus 6-4 Sr. F 6-6 Fr. F 6-7 Sr. C 6-7 Jr. F Leavenworth, Kan. McKinney, Texas Wichita, Kansas Topeka, Kansas David Moe Wesley Book Austin Klumpe Ryan Thomas Gary Lenoir Head Coach Assistant Coach Graduate Assistant Student Assistant Student Assistant IFC TABLE OF CONTENTS TABLE OF CONTENTS GENERAL INFORMATION Location ......................................................................................................Emporia, Kan. General Information . I. FC-1 Founded ....................................................................................................................1863 Media Roster . IFC Contents ............................1 Affiliation ...............................................................................................................NCAA II University Quick Facts . .1 Conference ..........................................Mid-America Intercollegiate Athletics Association Enrollment ................................................................................................................6,528 -

Kelsey Ponder Claim Souri for Two Seasons

TABLE OF CONTENTS INTRODUCTION HISTORY Table of Contents 1 Individual Awards & Honors 63 Quick Facts 2 Off the Field 64 Conference Tournament 65 COACHES AND STAFF Hall of Honor 66-69 Head Coach Brian Dooley 3-5 Assistant Coach Shannon Washington 6 MEDIA Assistant Coach Daniel O’Hare 7 A-State Soccer Park 70 Locker Room 71 2018 RED WOLVES Academics Commitment 72 Roster 8 Athletics Facilities 73 Returning Players 9-29 Arkansas State University 74-75 Newcomers 30-33 Jonesboro 76 ASU Administration 77 2017 REVIEW ASU System President Dr. Charles Welch 78 Final Notebook 34 A-State Chancellor Dr. Kelly Damphousse 79 Results 35 Director of Athletics Terry Mohajir 80-82 Box Scores 36-40 Athletics Department Directory 83 Season Stats 41 Media Relations 84 Sun Belt Conference Stats 42 Media Outlets 85 Team Compairison 43 CREDITS Team Highs and Lows 44 The 2018 Arkansas State Soccer Media Guide is a production Sun Belt Conference Recap 45 of the A-State Athletics Media Relations Office. Written, compiled and edited by Assistant Director of Media Relations, Chris Graddy. Cover design by Arkansas State University Media Services. Editorial assistance from Media Relations Director RECORDS Jerry Scott and Assistant Directors Mark Taylor and Dennen Cuthbertson. Photos courtesy of Travis Clayton, Hannah Dolle, Scoring 46-47 Sun Belt Conference and A-State Media Relations Office. Shot 48 Goalkeeping 49-50 Miscellaneous 51 Coaches 52 Yearly Statistics 53-54 Yearly Results 55 Year-by-Year 56-58 All-Time Results 59 All-Time Letterwinners 60-62 2018 ARKANSAS STATE WOMEN'S SOCCER REFERENCE GUIDE 1 UNIVERSITY QUICK FACTS UNIVERSITY INFORMATION 2017 SCHEDULE Location Jonesboro, Ark. -

Deltic Timber Corporation 2012 Annual Report 1 Highlights

Deltic Timber Corporation 2012 Annual Report 1 Highlights 2 To Our Shareholders 4 Woodlands 6 Mills 8 Real Estate 10 Financial Review 11 Statistical Summary 12 Directors and Officers Form 10-K IBC Corporation Information Financial (Thousands of dollars, except per-share amounts) For the Year 2012 2011 2010 Deltic Timber Corporation is Net sales $ 140,908 121,847 141,623 a vertically integrated natural Operating income $ 17,132 7,459 17,909 Net income $ 9,235 2,659 12,397 resources company focused Earnings per common share $ 0.73 0.21 0.99 Net cash provided by on the efficient and operating activities $ 24,082 14,639 28,898 environmentally responsible Capital expenditures $ 24,034 15,697 15,568 management of its land At Year-End holdings. The Company Working capital $ 5,566 3,618 2,520 Total assets $ 353,209 341,870 343,273 owns 453,200 acres of Long-term debt $ 63,000 64,000 65,611 timberland, operates two Stockholders’ equity $ 232,230 227,123 230,011 Common shares sawmills, and is engaged in outstanding (thousands) 12,672 12,606 12,505 real estate development. Headquartered in Operating El Dorado, Arkansas, the Pine sawtimber harvested Company’s operations are from fee land (tons) 606,879 606,311 609,867 Pine sawtimber located primarily in Arkansas sales price (per ton) $ 22 23 27 Lumber sales (MBF) 272,875 254,291 270,834 and north Louisiana. Lumber sales price (per MBF) $ 309 254 290 Residential lot sales (lots) 50 31 28 Residential lot sales price (per lot) $ 69,600 63,500 81,400 Commercial acreage sales (acres) – 27.4 19.0 Commercial acreage sales price (per acre) $ – 116,700 334,000 To Our Shareholders With an improving housing environment, Deltic created additional shareholder value with its strategic vertical integration of land-based and manufacturing assets. -

Deltic Timber Corporation Waldo Mill Permit No. AR0047953 NPDES Application for Renewal

Deltic Timber Corporation Waldo Mill Permit No. AR0047953 NPDES Application for Renewal August 1, 2014 Renewal Application for NPDES Permit No. AR0047953 Prepared for: Deltic Timber Corporation Waldo Mill 1720 Highway 82 West P.O. Box 409 Waldo, AR 71770 Prepared by: GBMc & Associates 219 Brown Lane Bryant, AR 72022 August 1, 2014 CONTENTS Application Summary Form 1 Area Maps FEMA Map Water Supply Sources Process Flow Diagrams Form 2C Form 2F Site Drainage Map DMR Summary Data Laboratory Analytical Results Annual Report Certificates of Good Standing (Arkansas and Delaware) August 1, 2014 i APPLICATION SUMMARY The Deltic Timber Corporation Waldo Mill located in Columbia County, Arkansas, is a wood products facility that specializes in producing dimension size lumber while following requirements set forth by Arkansas Department of Environmental Quality (ADEQ). This application package includes a Form 1, 2C, 2F, and other pertinent information necessary to complete the application process for renewal under NPDES permit number AR0047953. August 1, 2014 Arkansas Department of Environmental Quality NPDES PERMIT APPLICATION FORM 1 INSTRUCTIONS: 1. This form should be typed or printed in ink. If insufficient space is available to address any item please continue on an attached sheet of paper. 2. Please complete the following Section (s): Sections A B C D E F G H I POTW X X X X X Industrial User X X X X X X X X Construction Permit Only X X * X X X Modification X X X X X * * X X All Other Applicants X X X X X X * As necessary 3. If you need help on SIC or NAICS go to www.osha.gov/oshstats/sicser.html 4.