MOS Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

كتاب-الاحصاء-السنوي-الكهرباء-Compressed.Pdf

;jÁÊ“’\;Ï’ÂÄ State Of Kuwait ;ÍÊfiâ ’\;Ô]ë t¸\;g ]i— 2 0 2 0 ;ÎÄÅq i∏\;ÏÕ] ’\Â;Ô]∏\Â;Ô]dÖ‚“ ’\;ÎÑ\Ü ;ÄŬ’\;C;ÏË]dÖ‚“ ’\;ÏÕ] ’\;D 4 4 ” ; W ^ اﻟﻄﺎﻗﺔ اﻟﻜﻬﺮﺑﺎﺋﻴﺔ Electrical Energy Electricity & W ater & Renew able Energy f ;ÍÊfiâ’\;Ô]ët¸\;g]i— Statistical Year Book ;k]ŸÊ÷¬∏\;á—ÖŸÂ;Ô]ët¸\;ÎÑ\Äb;U;ÉË fihÂ;Ä\Å¡b M instry O 2021;U;Ñ\Åêb Statistical Year 2020 ( Electrical Energy ) Edition 44 “A” ;€ËtÖ’\;˛fl∂Ö’\;˛!\;€âd ;ÿ˛Ü]fi˛Ÿ;˛‰ˇÑ˛ÅÕ˛Â;\˛ÑÊ›;ˇÖ˛⁄˛Œ˛’\Â;˛Ô]˲î;ä˛⁄ç’\;◊˛¬˛p;Ͳɒ\;Ê˛·;Dˇ ’˛b;”˛’Ç;ٰ˛!\;ˇœ˛÷˛|;]˛Ÿ;˛ۚ;g]˛â˛¢\Â;˛Ø˛fiâ’\;Ä˛Å˛¡;\Ê˛⁄ˇ÷˛¬iˆ; C;;‡Ê˛⁄ˇ÷˛¬Á;˛‹ÊŒ˛’;k]Á˛˙\;◊ˇë ˛Á;ˇۚ;œ¢]˛d; ;C5D;ÏÁ˙\;U;ä›ÊÁ;ÎÑÊà ;ÓÅ ∏\;Ęe’\;3Ÿ^;Ê⁄â’\;ft]ê;ÎÖït @Åbjó€a@ãibßa@áº˛a@“aÏ„@ÑÓì€a ;jÁÊ“’\;Ï’ÂÄ;3Ÿ^ H.H Sheikh Nawaf Al-Ahmed Al-Jaber Al-Sabah The Amir of the State of Kuwait @Åbjó€a@ãibßa@áº˛a@›»ìfl@ÑÓì€a@Ï8 ;jÁÊ“’\;Ï’ÂÄ;Å‚¡;È’Â H.H Sheikh Mishal Al-Ahmed Al-Jaber Al-Sabah The Crown Prince of the State of Kuwait تقديم تعمل وزارة الكهرباء واملاء جاهدةً على املشاركة يف حتقيق رؤية 2035 التنموية يف جمال توليد الطاقة الكهربائية وحتلية املياه ، ومن اجلهود الواضحة يف هذا اجملال إدخال تكنولوجيا الطاقة البديلة )املتجددة( تدرجيياً للعمل جنباً إىل جنب مع مصادر الطاقة اﻷخرى . إن اهلدف املخطط له من قِبل الوزارة ضمن رؤية 2035 هو الوصول بإنتاج الطاقة الكهربائيةة البديلة إىل ما نسبته 15% من حاجة البﻻد الكلية من الطاقة الكهربائية وحتقيق اﻷمن املائي ، وذلك من خﻻل حتفيز برنامج الشراكة بني القطاعني العام واخلاص يف تنفيذ بعض مشاريع الطاقة الكهربائية وحتلية املياه . -

Maf Sukuk Ltd

BASE PROSPECTUS MAF SUKUK LTD. (incorporated in the Cayman Islands with limited liability) U.S.$1,500,000,000 Trust Certificate Issuance Programme Under the U.S.$1,500,000,000 trust certificate issuance programme described in this Base Prospectus (the "Programme"), MAF Sukuk Ltd. (in its capacities as issuer and as trustee, the "Trustee"), subject to compliance with all applicable laws, regulations and directives, may from time to time issue trust certificates (the "Certificates") in any currency agreed between the Trustee and the relevant Dealer (as defined below). Certificates may only be issued in registered form. The maximum aggregate face amount of all Certificates from time to time outstanding under the Programme will not exceed U.S.$1,500,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. Each Tranche (as defined herein) of Certificates issued under the Programme will be constituted by: (i) an amended and restated master trust deed (the "Master Trust Deed") dated 31 May 2016 entered into between the Trustee, Majid Al Futtaim Properties LLC ("Majid Al Futtaim Properties"), Majid Al Futtaim Holding LLC ("Majid Al Futtaim Holding" or the "Guarantor") and Citibank, N.A., London Branch as delegate of the Trustee (the Delegate, which expression shall include any co-Delegate or any successor) and (ii) a supplemental trust deed (the "Supplemental Trust Deed" and, together with the Master Trust Deed, each a "Trust Deed") in relation to the relevant Series which shall be entered into in respect of the first Tranche of Certificates. -

Q3 2021 English Blockbuster Movie Rate Card

Darkened auditorium Captive audience Cinema Cinema Media Rates 2021 turns audiences unrivalled advertising impact into customers Follow an English Blockbuster Movie 30-Second Four Weekly Film Advertising Rates Cinema Operator Cinema Location AED Arabian Centre 17,500 Cinemacity Zero 6 Mall 25,000 Cinépolis Oasis Mall 22,500 Khalidiyah Mall 25,000 Dalma Mall 31,250 Cine Royal Cinema Deerfields Mall 27,500 Ruwais Mall 10,000 Al Wahda Mall 27,500 Oscar Cinema Al Foah Mall 15,000 Al Shaab Village 12,500 City Centre Mirdif 40,625 City Centre Deira 50,000 Mall of the Emirates 61,250 Mercato 21,250 Burjuman 27,500 Cineplex Grand Hyatt 19,875 City Centre Shindagha 12,500 Nakheel Mall 31,000 Wafi City 26,250 OUTDOOR at Aloft City Centre Deira 9,375 VOX Cinemas Marina Mall - Abu Dhabi 48,750 Yas Mall - Abu Dhabi 40,625 Nation Towers - Abu Dhabi 15,625 Abu Dhabi Mall 18,750 The Galleria Al Maryah Island 32,500 Al Jimi Mall 16,250 City Centre Sharjah 31,250 City Centre Al Zahia 25,000 City Centre Ajman 8,125 City Centre Fujairah 10,625 Al Hamra Mall 10,625 The Dubai Mall 56,250 Dubai Marina Mall 31,250 Jebel Ali Club 13,750 Reel Cinemas Rove Downtown 10,625 The Springs Souk 11,000 The Pointe 16,250 Al Ghurair Centre 16,000 • Rates not inclusive of taxes. • If the movie runs for less than 4 weeks, you will have the option of playing your ad with another movie that is currently playing in cinemas, in order to complete the 4 weeks guarantee. -

Al Koot Kuwait Provider Network

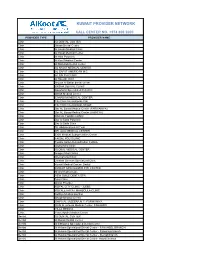

AlKoot Insurance & Reinsurance Partner Contact Details: Kuwait network providers list Partner name: Globemed Tel: +961 1 518 100 Email: [email protected] Agreement type Provider Name Provider Type Provider Address City Country Partner Al Salam International Hospital Hospital Bnaid Al Gar Kuwait City Kuwait Partner London Hospital Hospital Al Fintas Kuwait City Kuwait Partner Dar Al Shifa Hospital Hospital Hawally Kuwait City Kuwait Partner Al Hadi Hospital Hospital Jabriya Kuwait City Kuwait Partner Al Orf Hospital Hospital Al Jahra Kuwait City Kuwait Partner Royale Hayat Hospital Hospital Jabriyah Kuwait City Kuwait Partner Alia International Hospital Hospital Mahboula Kuwait City Kuwait Partner Sidra Hospital Hospital Al Reggai Kuwait City Kuwait Partner Al Rashid Hospital Hospital Salmiya Kuwait City Kuwait Partner Al Seef Hospital Hospital Salmiya Kuwait City Kuwait Partner New Mowasat Hospital Hospital Salmiya Kuwait City Kuwait Partner Taiba Hospital Hospital Sabah Al-Salem Kuwait City Kuwait Partner Kuwait Hospital Hospital Sabah Al-Salem Kuwait City Kuwait Partner Medical One Polyclinic Medical Center Al Da'iyah Kuwait City Kuwait Partner Noor Clinic Medical Center Al Ageila Kuwait City Kuwait Partner Quttainah Medical Center Medical Center Al Shaab Al Bahri Kuwait City Kuwait Partner Shaab Medical Center Medical Center Al Shaab Al Bahri Kuwait City Kuwait Partner Al Saleh Clinic Medical Center Abraq Kheetan Kuwait City Kuwait Partner Global Medical Center Medical Center Benaid Al qar Kuwait City Kuwait Partner New Life -

Kuwait Provider Network

KUWAIT PROVIDER NETWORK CALL CENTER NO. +974 800 2000 PROVIDER TYPE PROVIDER NAME Clinic 32 DENTAL CENTER Clinic Aknan Dental Center Clinic Al Ansari Medical Clinic Clinic Al Hayat Medical Center Clinic Al Hilal Polyclinic Clinic Al Kout Medical Center Clinic Al Muhallab Dental Center Clinic AL NAJAT MEDICAL CENTER Clinic AL SAFAT AMERICAN M.C. Clinic AL SALEH CLINIC Clinic Al Sayegh Clinic Clinic Arouss Al Bahar dental center Clinic BASMA DENTAL CLINIC Clinic Boushahri Specialized Polyclinic Clinic British Medical Center Clinic CANADIAN MEDICAL CENTER Clinic City Clinic International- Fah Clinic City Clinic International- Mirgab Clinic Dar AL Baraa Medical Center (FARWANIYA) Clinic Dar AL Baraa Medical Center (JABRIYA) Clinic DAR AL FOUAD CLINIC Clinic Dar Al Saha Polyclinic Clinic Dar Al Shifa Clinic Clinic Dr. Abdulmohsen Al Terki Clinic DR. ALIA MEDICAL CENTER Clinic EXIR Medical Subspecialties Center Clinic FAISAL POLYCLINIC Clinic Fawzia Sultan Rehabilitation Institute Clinic Global Med Clinic Clinic GLOBAL MEDICAL CENTER Clinic Images Med Clinics Clinic International Clinic Clinic Jarallah German Specialized Clinic Clinic Kuwait Medical Center- Dental Clinic KUWAIT SPECIALIZED EYE CENTER Clinic Metro Medical Care Clinic NEW SMILE DENTA SPA Clinic Noor Clinic Clinic Oman Provider Clinic ROYAL CITY CLINIC - JLEEB Clinic ROYALE HAYAT MAHBOULA CLINIC Clinic Salhiya Medical pavilion Clinic Shaab Medical Center Clinic SHIFA AL JAZEERA M.C.-FARWANIYA Clinic Shifa Al Jazeera Medical Center, FAHAHEEL Clinic VILLA MEDICA Clinic Yiaco Apollo -

Retail Market Snapshot

MENA RETAIL MARKET SNAPSHOT 2013 Accelerating success. RETAIL MARKET SNAPSHOT | 2013 | MENA | INTRODUCTION INTRODUCTION • The MENA region is categorised by two very diversified groups in 482 offices in terms of income and population; 62 countries on o The Arabian Gulf (GCC) countries, enjoy some of the highest per 6 continents capita levels in the world with small population bases, and supported by the registered growth in their oil-based economies. United States: 140 Canada: 42 o Conversely, there are other neighbouring countries in the region, Latin America: 20 some of which have undergone recent regime change, that are Asia Pacific: 195 characterised by a large population base, low GDP per capita and EMEA: 85 significant segments of the population living below the poverty line. • $2.0 billion in revenue • In this report, we take a quick snapshot of the following retail markets; • More than 13,500 employees • 5,100 brokers o Dubai. • $71 billion in transaction volume across more than 78,000 sale and lease transactions o Abu Dhabi. • 1.1 billion square feet under management o Cairo. SERVICES OFFERED BY COLLIERS o Muscat. INTERNATIONAL o Doha. • Retail Development Consultancy. • Retail Zoning & Mix Strategy. o Riyadh. • Tenant Coordination. o Jeddah. • Retail Leasing Services. • These markets have been acknowledged as the most active and • Property Management. promising across the region, in accordance with the existing dynamics pertaining to the Retail Demand Drivers. • Project Management. • Strategic & Business Planning. RETAIL DEMAND DRIVERS • Economic Impact Studies. The profitability of any retail offering is highly dependant on the level • • Market & Competitive Studies. of demand for retail space in the targeted market. -

Globemed Kuwait Network of Providers Exc KSEC and BAYAN

GlobeMed Kuwait Network of HealthCare Providers As of June 2021 Phone ﺍﻻﺳﻡ ProviderProvider Name Name Region Region Phone Number FFaxax Number Number Hospitals 22573617 ﻣﺳﺗﺷﻔﻰ ﺍﻟﺳﻼﻡ ﺍﻟﺩﻭﻟﻲ Al Salam International Hospital Bnaid Al Gar 22232000 22541930 23905538 ﻣﺳﺗﺷﻔﻰ ﻟﻧﺩﻥ London Hospital Al Fintas 1 883 883 23900153 22639016 ﻣﺳﺗﺷﻔﻰ ﺩﺍﺭ ﺍﻟﺷﻔﺎء Dar Al Shifa Hospital Hawally 1802555 22626691 25314717 ﻣﺳﺗﺷﻔﻰ ﺍﻟﻬﺎﺩﻱ Al Hadi Hospital Jabriya 1828282 25324090 ﻣﺳﺗﺷﻔﻰ ﺍﻟﻌﺭﻑ Al Orf Hospital Al Jahra 2455 5050 2456 7794 ﻣﺳﺗﺷﻔﻰ ﺭﻭﻳﺎﻝ ﺣﻳﺎﺓ Royale Hayat Hospital Jabriya 25360000 25360001 ﻣﺳﺗﺷﻔﻰ ﻋﺎﻟﻳﺔ ﺍﻟﺩﻭﻟﻲ Alia International Hospital Mahboula 22272000 23717020 ﻣﺳﺗﺷﻔﻰ ﺳﺩﺭﺓ Sidra Hospital Al Reggai 24997000 24997070 1881122 ﻣﺳﺗﺷﻔﻰ ﺍﻟﺳﻳﻑ Al Seef Hospital Salmiya 25719810 25764000 25747590 ﻣﺳﺗﺷﻔﻰ ﺍﻟﻣﻭﺍﺳﺎﺓ ﺍﻟﺟﺩﻳﺩ New Mowasat Hospital Salmiya 25726666 25738055 25529012 ﻣﺳﺗﺷﻔﻰ ﻁﻳﺑﺔ Taiba Hospital Sabah Al-Salem 1808088 25528693 ﻣﺳﺗﺷﻔﻰ ﺍﻟﻛﻭﻳﺕ Kuwait Hospital Sabah Al-Salem 22207777 ﻣﺳﺗﺷﻔﻰ ﻭﺍﺭﺓ Wara Hospital Sabah Al-Salem 1888001 ﺍﻟﻣﺳﺗﺷﻔﻰ ﺍﻟﺩﻭﻟﻲ International Hospital Salmiya 1817771 This network is subject to continuous revision by addition/deletion of provider(s) and/or inclusion/exclusion of doctor(s)/department(s) Page 1 of 23 GlobeMed Kuwait Network of HealthCare Providers As of June 2021 Phone ﺍﻻﺳﻡ ProviderProvider Name Name Region Region Phone Number FaxFax Number Number Medical Centers ﻣﺳﺗﻭﺻﻑ ﻣﻳﺩﻳﻛﺎﻝ ﻭﻥ ﺍﻟﺗﺧﺻﺻﻲ Medical one Polyclinic Al Da'iyah 22573883 22574420 1886699 ﻋﻳﺎﺩﺓ ﻧﻭﺭ Noor Clinic Al Ageila 23845957 23845951 22620420 ﻣﺭﻛﺯ ﺍﻟﺷﻌﺏ ﺍﻟﺗﺧﺻﺻﻲ -

Dubai Crown Prince Opens Al Ghubaiba Bus Station Vision

Issue No. 149 November 2020 Dubai Crown Prince opens Al Ghubaiba Bus Station Vision The world leader in seamless & sustainable mobility. Mission Develop & manage integrated and sustainable roads & transportation systems at a world-class level, and provide pioneered services to all stakeholders for their happiness, and support Dubai’s vision through shaping the future, developing policies and legislations, adopting technologies, innovations & world-class practices and standards. 2 Revamping Mobility The fast pace of technology and industrial connected, RTA embarked on a master plan for advancements triggered by the 4th Industrial shared and flexible transport. It covered non- Revolution, and the spiral demographic growth conventional mobility means such as shared of key metropolitan cities have brought on bikes, cars, scooters and buses on-demand. new challenges. Governments have to revise Other mobility means loom on the horizon such the basics of urban-planning and plans for as autonomous and individual mobility means. roads and transport infrastructure to cope with RTA currently offers Hala e-hailing service in future trends. partnership with Careem, and bike share (Careem “Smooth mobility and connected communities Bike) service encompassing 780 bikes at 78 have now become core standards of classifying docking stations. It has just started the trial run of future cities. We endeavour to deliver a global e-scooter at five areas, and deployed 13 buses on- model by delivering state of the art advanced demand at five different locations in Dubai. RTA and sustainable infrastructure projects. The is also committed to supporting youth and local smooth mobility and connected communities start-ups and offer them suitable opportunities. -

Turning Bits Into Dollars | Ideation Center

IDEATION CENTER INSIGHT Turning bits into dollars The potential of the data economy in the GCC Contacts Strategy& INSEAD Beirut Dubai Theodoros Evgeniou Alice Klat Jad Hajj Professor, Decision Sciences Director, Ideation Center Partner and Technology Management +961-1-985-655 +971-4-436-3000 +33-1-60-72-45-46 alice.klat jad.hajj theodoros.evgeniou @strategyand.ae.pwc.com @strategyand.ae.pwc.com @insead.edu Jana Batal Paris Senior Fellow, Ideation Center Pierre Péladeau +961-1-985-655 Partner, PwC France jana.batal +33-1565-7585 @strategyand.ae.pwc.com pierre.peladeau @strategyand.fr.pwc.com Strategy& Middle East thanks the following individuals who were interviewed for this report and contributed their insights: Jana Batal, Senior Fellow, Ideation Center, Strategy& Middle East David Dubois, Associate Professor of Marketing, INSEAD Joe Youssef Malek, Executive Partner at Gartner Acile Sleiman, Retail Industry Head in MENA, Google Guillaume Thfoin, Head of Business Analytics Corporate Development, Majid Al Futtaim Group ABOUT THE AUTHORS Strategy& Jad Hajj is a partner with Strategy& based in Dubai. He is a member of the technology, media, and telecommunications practice in the Middle East. He specializes in helping telecom operators and technology providers develop winning strategies and build distinctive digital capabilities. He has particular expertise in corporate strategy and business-to-business, as well as digitization and innovation. Pierre Péladeau is a leading practitioner in digital transformations for Strategy&, PwC’s strategy consulting group. Based in Paris, he is a partner with PwC France. He supports executives of the largest global groups in the telecommunications, high technology, energy, utilities, aerospace, and retail sectors in their strategies and digital transformations. -

Fear and Money in Dubai

metropolitan disorders The hectic pace of capitalist development over the past decades has taken tangible form in the transformation of the world’s cities: the epic expansion of coastal China, deindustrialization and suburbanization of the imperial heartlands, massive growth of slums. From Shanghai to São Paolo, Jerusalem to Kinshasa, cityscapes have been destroyed and remade—vertically: the soar- ing towers of finance capital’s dominance—and horizontally: the sprawling shanty-towns that shelter a vast new informal proletariat, and McMansions of a sunbelt middle class. The run-down public housing and infrastuctural projects of state-developmentalism stand as relics from another age. Against this backdrop, the field of urban studies has become one of the most dynamic areas of the social sciences, inspiring innovative contributions from the surrounding disciplines of architecture, anthropology, economics. Yet in comparison to the classic accounts of manufacturing Manchester, Second Empire Paris or Reaganite Los Angeles, much of this work is strikingly depoliticized. Characteristically, city spaces are studied in abstraction from their national contexts. The wielders of economic power and social coercion remain anonymous. The broader political narrative of a city’s metamorphosis goes untold. There are, of course, notable counter-examples. With this issue, NLR begins a series of city case studies, focusing on particular outcomes of capitalist globalization through the lens of urban change. We begin with Mike Davis’s portrait of Dubai—an extreme concentration of petrodollar wealth and Arab- world contradiction. Future issues will carry reports from Brazil, South Africa, India, gang-torn Central America, old and new Europe, Bush-era America and the vertiginous Far East. -

The Best of Dubai

04_281956-ch01.qxp 8/14/08 11:40 PM Page 1 1 The Best of Dubai In Dubai, just about everything is meant to be the biggest and the best. And it’s no joke: Here you’ll find the world’s tallest building, the largest man-made islands, the richest horse race, the biggest shopping festival, and soon the most extensive entertain- ment complex, the most massive mall, and the biggest hotel. People who live here will tell you that Dubai is always changing—that’s an under- statement. Dubai is growing so fast that it hardly seems recognizable from one year to the next. The city’s only competition these days seems to be with itself. Who can keep up? Construction cranes everywhere work relentlessly to continue raising a modern metropolis out of the desert sand. Once completed, the Palm Island Deira will be twice the size as the Palm Jumeirah. Mall of Arabia will eclipse Mall of the Emirates, which is already the biggest shopping center outside North America. The 25-story Ski Dubai will soon be dwarfed in size by the Snowdome being built in Dubailand, which itself will house the largest collec- tion of theme parks on the planet. Asia-Asia will take over as the world’s largest hotel. Each project is bigger, bolder, and significantly more expensive. The skyline is being filled with more architecturally daring high-rises. The land is being carved with new canals and marinas. The sea is being gifted with new artificial islands. In other words, nothing is constant. -

Investor Presentation

INVESTOR PRESENTATION February 2019 CONTENTS TABLE OF CONTENTS Majid Al Futtaim FY 2018 Performance Update Appendix ▪ Majid Al Futtaim Group Overview USD / AED EXCHANGE RATE OF 3.6725 IS USED THROUGHOUT THE PRESENTATION 2 2 WE ARE NAVIGATING A CHALLENGING MARKET ENVIRONMENT RetailSector Landscape Trends Evolving Consumer Behavior Intensifying Competition Substitution Effect ➢ Greater emphasis on personalized ➢ Value migrating from brick-and- ➢ Stores will transition to places that services and experiences mortar to e-commerce tell stories through experiences ➢ Hyper-connected consumer ➢ Increased Automation in Last Mile ➢ Disruptive technology such as redefining value Delivery IOT, AI, Augmented Reality. Macro Trends Global Trade Wars Oil Price Volatility Geopolitical shifts across the ME Egyptian economy improving Stronger USD Fiscal Reforms across GCC 3 WHILE REMAINING COMMITTED TO OUR STRATEGIC PRIORITIES Expand to be leaders Maintain leadership in adjacent/core in our core countries geographies Long Term Strategy Our aspiration is to become a regionally focusedlifestyleconglomerate …with a stellar international reputation Expand our presence in Protect our leadership Egypt and Saudi Arabia, position in the UAE driven by our shopping 1 2 malls business signature Top notch customer talent and Grow at scale at least Build a foundation experience capabilities position in Africa one adjacent Brand & business Human Customer Creating great moments Capital Experience for everyone, everyday Seamless andIntegratedOmnichannel Offering Expand in