CU-0548 the Act Provides in Section 503(A) That in Making Determinations With

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Listado De Inmuebles En Venta En La Habana Con 2 O Más Dormitorios, 1 O Más Baños, Precio Desde 5 000 Hasta 20 000 Cuc - Página 1

Detras de la Fachada.COM - El Portal Inmobiliario de los Cubanos Pagina 1 de 13 Listado de Inmuebles en venta en La Habana con 2 o más dormitorios, 1 o más baños, precio desde 5 000 hasta 20 000 cuc - Página 1 1 - Apartamento en venta en Marianao, La Habana Precio de venta: 13 000 CUC 2 dormitorios 2 baños 1 Cocinas Se vende apartamento para llegar y vivir Se vende apartamento en interior muy ventilado y con buena seguridad en la zona del Hospital militar de Marianao. El mismo consta de entrada individual, cocina nueva, dos cuartos con sus respectivos baños y closet de mampostería, salita y patiecito de servicio; placa libre con dos tanques elevados y sus respectivas instalaciones de agua; todas las ventanas y puertas son nuevas y de hierro, y posee instalación de 220V, ideal para parejas con planes de ampliar la familia. Con el apartamento también se traspasan: Refrigerador Haier. Cocina de horno con encendido electrónico. Ollas eléctricas y diversos utensilios de cocina. Juego de cuarto de tubo y colchón nuevos. Ventilador ciclón, entre otras cosas. Interesados comunicarse con el Sr. Miguel al móvil: 55 598976. Dirección: CALLE 122ª Nº2519 INT. E/ AVENIDA 25 Y AVENIDA 27 Municipio: Marianao Provincia: La Habana Datos de contacto Nombre y apellidos: Miguel Teléfono: 55 598976 Horario de contacto: Publicado hace: 10 días y 18 horas Ver la información detallada en: http://www.detrasdelafachada.com/apartamento-2-dormitorios-2-banos-en-venta-calle-122-en-marianao-la-habana-cuba/tzq27mk1utjl137 2 - Casa en venta en Wajay Boyeros, La Habana -

FOREIGN Claikis SETTI.EUENT Cotauissioh of the UNITED STATES Wasmt~'Ro~, D.C, 20579 Claim No.CU-2531 Under the International C

FOREIGN CLAIkIS SETTI.EUENT COtAUISSIOH OF THE UNITED STATES wAsmt~’ro~, D.C, 20579 IN THE’M~TTER 0¥ "mE CLkI~ OF Claim No.CU-2531 CARLOS AMIGUET MARY GENE AMIGUET Decision No.(~U-6197 Under the International Claims Settlement : Act of 1949. as amended Appeal and objections from a Proposed Decision entered May 19, 1971. No hearing reques ted. Hearing on the record held September 30, 1971. FINAL DECISION In its Propose~ Decision the Commission certified a loss to each claimant in the amount of $1116,478.70 for their 1/6 interest in three items of real pro- perty and a i/2 interest incash. Other items of real property, personal fur- nishings and an interest in drugstore businesses were denied for failure to meet the burden of proof. Claima~objec~ed to three items of the Proposed Decision that~were denied and submitted additional evidence in support thereof. The entire record has been reviewed and the Commission now finds as to the parts of the claim to which objections~were raised, as follows: i. ~I~000 square meters of undeveloped land Each claimantwas the owner of a 1/6 interest in 21,000 square meters of undeveloped land at the crossing of Carretera of Guanabacoaand Regla which~was taken by the Government of Cuba on October 14, 1960 pursuant to the Urban Re- form Law. The Commission further finds that at the tfme of loss the land had a value of $105’000.00 and each claimant hereinsuffered a loss in the amount of $17,500.00. -

Reglas De Congo: Palo Monte Mayombe) a Book by Lydia Cabrera an English Translation from the Spanish

THE KONGO RULE: THE PALO MONTE MAYOMBE WISDOM SOCIETY (REGLAS DE CONGO: PALO MONTE MAYOMBE) A BOOK BY LYDIA CABRERA AN ENGLISH TRANSLATION FROM THE SPANISH Donato Fhunsu A dissertation submitted to the faculty of the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of English and Comparative Literature (Comparative Literature). Chapel Hill 2016 Approved by: Inger S. B. Brodey Todd Ramón Ochoa Marsha S. Collins Tanya L. Shields Madeline G. Levine © 2016 Donato Fhunsu ALL RIGHTS RESERVED ii ABSTRACT Donato Fhunsu: The Kongo Rule: The Palo Monte Mayombe Wisdom Society (Reglas de Congo: Palo Monte Mayombe) A Book by Lydia Cabrera An English Translation from the Spanish (Under the direction of Inger S. B. Brodey and Todd Ramón Ochoa) This dissertation is a critical analysis and annotated translation, from Spanish into English, of the book Reglas de Congo: Palo Monte Mayombe, by the Cuban anthropologist, artist, and writer Lydia Cabrera (1899-1991). Cabrera’s text is a hybrid ethnographic book of religion, slave narratives (oral history), and folklore (songs, poetry) that she devoted to a group of Afro-Cubans known as “los Congos de Cuba,” descendants of the Africans who were brought to the Caribbean island of Cuba during the trans-Atlantic Ocean African slave trade from the former Kongo Kingdom, which occupied the present-day southwestern part of Congo-Kinshasa, Congo-Brazzaville, Cabinda, and northern Angola. The Kongo Kingdom had formal contact with Christianity through the Kingdom of Portugal as early as the 1490s. -

Convocatoria Matrícula 20-21 UCMH (Dic)

UNIVERSIDAD DE CIENCIAS MÉDICAS DE LA HABANA La Habana, 20 de noviembre de 2020 “Año 62 de la Revolución” Cro Jefe de Información o Redacción. Estimado Compañero: Le solicitamos analice la posibilidad de divulgar a través de ese órgano la información siguiente: La Universidad de Ciencias Médicas de La Habana realizará del 2 al 19 de diciembre la matrícula del nuevo ingreso correspondiente al curso 2020-2021, sólo Diferidos y Curso Por Encuentro, en las carreras universitarias de: Medicina, Estomatología, Licenciaturas en Rehabilitación en Salud, Bioanálisis Clínico, Nutrición, Higiene y Epidemiología, Sistema de Información en Salud, Imagenología y Radiofísica Médica, Logofonoaudiología y Licenciatura en Enfermería, así como en las carreras de Ciclo Corto Superior de: Enfermería, Análisis Clínico y Medicina Transfusional, Logofonoaudiología, Biofísica médica, Citihistopatología, Electromedicina, Higiene y epidemiología, Nutrición y dietética, Radiología, Prótesis estomatológica, Servicios farmacéuticos, Trabajo social en salud, Terapia ocupacional, Neurofisiología clínica y Vigilancia y lucha antivectorial. La convocatoria precisa que los estudiantes que tienen otorgada la CARRERA DE MEDICINA matricularán en las facultades, en correspondencia con los municipios a los cuales estas atienden. Los Cadetes del MININT matricularán en el ICBP Victoria de Girón. Las Facultades de Estomatología y Victoria de Girón garantizarán la matrícula de aquellos estudiantes a los que les fue otorgada la CARRERA DE ESTOMATOLOGÍA. En el ICBP Victoria de Girón matricularán los que residen en los municipios: La Lisa, Marianao y Playa. La Facultad de Estomatología matricula el resto de los municipios. Las Facultades de Enfermería (Lidia Doce) y Calixto García garantizarán la matrícula de aquellos estudiantes a los que les fue otorgada la CARRERA DE LIC. -

Análisis Socio-Espacial De La Cuenca Hidrográfica Superficial Del Río Quíbú

Análisis Socio-Espacial de la Cuenca Hidrográfica Superficial del Río Quíbú Dr. Isabel Valdivia Fernández Dr. Arturo Rúa de Cabo Lic. Rafael Rodríguez García Facultad de Geografía Universidad de La Habana [email protected] [email protected] INTRODUCCIÓN Desde la Cumbre de Río de Janeiro en el año 1992 hasta nuestros días, el mundo ha sido testigo de un intenso repuntar de la conciencia ambiental, manifestada en la proliferación de grupos y organizaciones de toda índole, la creación de un sin número de instituciones públicas y privadas dedicadas al tema, la celebración de innumerables conferencias, talleres y reuniones y la aprobación de cientos de leyes y reglamentos en todo el mundo, e incluso de diversos convenios ambientales internacionales. Pero lamentablemente, es también en esta etapa donde se han incrementado todas las tendencias negativas para el medio ambiente, siendo las guerras un ejemplo muy claro de maltrato al medio ambiente y, en especial, a la especie humana, dicotomía que pone en tela de juicio la efectividad del despliegue de las acciones antes señaladas, que se han movido básicamente en los ámbitos institucionales y legales sin lograr una repercusión real en el estado del medio ambiente. (Santos, O., 2002) Ciertamente, la alteración de las condiciones naturales de vida es una consecuencia indispensable del desarrollo social de la humanidad. Es también cierto que no siempre el hombre estableció de modo correcto sus relaciones con la naturaleza y todo indica que diversas sociedades, desde la antigüedad, pueden haber sucumbido o al menos adelantado su colapso por esta razón. Sin embargo, es un hecho que esos casos y procesos aislados no son en modo alguno comparables con el carácter global y urgente que hoy caracteriza al fenómeno ambiental. -

OCTUBRE En La Historia De Educación Penal (12Mo

Domingo Septiembre 29 / 2019 ¿Eres joven y decidido? ¿Tienes entre 18 y 35 años de edad? ¿Quieres superarte profesionalmente? La Dirección de Esta- Octubre blecimientos Penitenciarios del Minint, ofrece opciones para alcanzar la Licenciatura en Derecho: Cadete en la especialidad DEL DOMINGO 29 AL SÁBADO 5 DE OCTUBRE en la historia de Educación Penal (12mo. grado) con cinco años de duración. A CARGO DE NATACHA S. HERNÁNDEZ Oficial del Sistema Penitenciario (12mo. grado o técnico me- DOMINGO/29 Día dio), 11 meses de duración. Educador Penal (9no. grado), cinco 2:00 El tiempo y la memoria. 2:05 Coordenadas. 3/1965 Constitución del Comité Central del Partido Comunista de meses. También puedes optar por ocupar otros cargos civiles 2:10 Canal Habana Deportes. 5:00 Latinos. Cuba; Fidel presenta a sus integrantes, da lectura a la Carta y técnicos medios en Informática y Contabilidad. Los requisi- 5:30 Libre acceso (r). 6:00 Entre manos. 6:30 TV animal. de despedida del Che y anuncia la creación del periódico tos para optar por los cursos son: aprobar el examen médico, 6:45 Verde Habana. 7:00 Triángulo de la confi anza. Granma. psicológico y tener adecuada conducta social. Puedes dirigirte 7:30 Plataforma Habana. 8:00 Banda sonora (r). 6/1976 Terroristas pagados por la CIA hacen estallar en pleno a las Oficinas de Selección del Minint en tu provincia de resi- 8:30 Canal Etcétera. 9:00 Cine +: Effi e Gray. Reino Unido vuelo un avión de Cubana de Aviación frente a las costas dencia o en la oficina de la Dirección sita en calle 15 esquina K, de Barbados. -

State of Ambiguity: Civic Life and Culture in Cuba's First Republic

STATE OF AMBIGUITY STATE OF AMBIGUITY CiviC Life and CuLture in Cuba’s first repubLiC STEVEN PALMER, JOSÉ ANTONIO PIQUERAS, and AMPARO SÁNCHEZ COBOS, editors Duke university press 2014 © 2014 Duke University Press All rights reserved Printed in the United States of America on acid-f ree paper ♾ Designed by Heather Hensley Typeset in Minion Pro by Tseng Information Systems, Inc. Library of Congress Cataloging-in-Publication Data State of ambiguity : civic life and culture in Cuba’s first republic / Steven Palmer, José Antonio Piqueras, and Amparo Sánchez Cobos, editors. pages cm Includes bibliographical references and index. isbn 978-0-8223-5630-1 (cloth : alk. paper) isbn 978-0-8223-5638-7 (pbk. : alk. paper) 1. Cuba—History—19th century. 2. Cuba—History—20th century. 3. Cuba—Politics and government—19th century. 4. Cuba—Politics and government—20th century. 5. Cuba— Civilization—19th century. 6. Cuba—Civilization—20th century. i. Palmer, Steven Paul. ii. Piqueras Arenas, José A. (José Antonio). iii. Sánchez Cobos, Amparo. f1784.s73 2014 972.91′05—dc23 2013048700 CONTENTS Introduction: Revisiting Cuba’s First Republic | 1 Steven Palmer, José Antonio Piqueras, and Amparo Sánchez Cobos 1. A Sunken Ship, a Bronze Eagle, and the Politics of Memory: The “Social Life” of the USS Maine in Cuba (1898–1961) | 22 Marial Iglesias Utset 2. Shifting Sands of Cuban Science, 1875–1933 | 54 Steven Palmer 3. Race, Labor, and Citizenship in Cuba: A View from the Sugar District of Cienfuegos, 1886–1909 | 82 Rebecca J. Scott 4. Slaughterhouses and Milk Consumption in the “Sick Republic”: Socio- Environmental Change and Sanitary Technology in Havana, 1890–1925 | 121 Reinaldo Funes Monzote 5. -

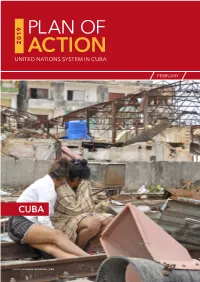

Action United Nations System in Cuba

PLAN OF 2019 ACTION UNITED NATIONS SYSTEM IN CUBA FEBRUARY CUBA PHOTO: BOHEMIA MAGAZINE, CUBA CUBA PLAN OF ACTION $14.4 to respond to the urgent needs of 253,82 affected by the tornado in the 14 popular peoples councils that suffered the greatest impact. PRELIMINARY PATH TORNADO IN HAVANA ON 27 JANUARY 2019 HAVANA ARTEMISA MAYABEQUE MATANZAS VILLA CLARA PINAR DEL RIO CIENFUEGOS CIEGO SANCTI DE AVILA SPÍRITUS CAMAGÜEY LAS TUNAS HOLGUIN GRANMA SANTIAGO GUANTANAMO DE CUBA CUBA PLAN OF ACTION 2019 CUBA SITUATION OVERVIEW On 27 January 2019, slightly more than a year after Hurricane Areas with the greatest impact Irma hit Havana, Cuba, a severe tornado hit five Havana municipalities. The EF4 category tornado (using the Enhanced The national authorities are carrying out assessments in the Fujita Scale with a maximum intensity of 5) produced winds affected municipalities of Havana and the United Nations of up to 300 kilometers per hour and travelled at a speed of 46 System is consulting with the national authorities regarding km/h to cut a 400 to 600-meter-wide path of destruction. the extent of the damage in addition to monitoring all public and official sources of information. In Havana, a city of more than 2 million inhabitants, the tornado swept across the municipalities of Cerro, 10 de Given the magnitude of the disaster, data collection on the Octubre, Regla, Guanabacoa and Habana del Este which damage continues; however, preliminary estimates now totalized 668,822 in population. From that total, some 253,682 indicate that 5,334 homes were affected, of which 505 were living in 14 People’s Councils suffered direct impact and have totally destroyed, 804 had total loss of roofs and 2,210 had been devastated by the damage. -

The WHUR World Tour 2017

Presents The WHUR World Tour 2017 WWW.ADVANTAGE-INTL.COM 1-877-428-2773 SUNDAY NOVEMBER 5TH DAY 1 (L, D) USA-CUBA Arrive in Jose Marti International Airport Terminal. Clear customs and immigration, this process takes around one hour. Meet your local tour guide who will be who will be our representative in Havana throughout the trip. Tour around the city. Take a panoramic drive around modern Havana. Your tour guide will take you around to get your bearings around this amazing city. You will be taken around the modern part of Havana, including neighborhoods like Miramar, Vedado, Centro Habana. Stop at the historic Revolution Square; a political venue since 1959. Hotel Check-in. HOTEL MELIA COHIBA ***** Welcome dinner at a “Paladar”, a term commonly used in Cuba to refer to private restaurants. Home-made cuisine and authentic flavors of Cuba characterize these establishments. This is the restaurant where former president Barrack Obama had dinner when he visited Cuba. Meet with Chef Carlos. Return to hotel MONDAY NOVEMBER 6TH DAY 2 (B, L, D) HISTORIC HAVANA Take a drive around modern Havana. Start from the Malecón seafront, an 8km-drive where locals sit and enjoy the sunset every day. Visit Hotel Nacional. Continue along Vedado neighborhood. Visit iconic buildings of modern Havana such as Hotel Habana Libre, the Coppelia Ice Cream Parlor and Riviera Hotel. Your tour guide will take you around the modern part of Havana, including neighborhoods like Miramar, Vedado, Centro Habana. Walking tour of Old Havana. The founding of Havana as one of the most important commercial cities in the New World brought about the urban growth around different squares. -

El Tornado Que Afectó a La Habana En La Noche De Este 27 De Enero (+ Videos, Fotos E Infografía)

Image not found or type unknown www.juventudrebelde.cu Image not found or type unknown Un tornado azotó a La Habana este 27 de enero. Autor: Alina Mena Lotti Publicado: 28/01/2019 | 10:00 am Cobertura especial: El tornado que afectó a La Habana en la noche de este 27 de enero (+ Videos, Fotos e Infografía) Al menos cuatro personas murieron como consecuencia de las afectaciones provocadas por el fuerte tornado asociado a un fenómeno intenso y breve de rachas de vientos de gran intensidad y copiosas lluvias. El presidente cubano, Miguel Díaz-Canel Bermúdez, recorrió las zonas afectadas de esta capital Publicado: Lunes 28 enero 2019 | 09:24:25 am. Publicado por: Yurisander Guevara, Loraine Bosch Taquechel, Rouslyn Navia Jordán, Libia Miranda Camellón La región occidental del país vivió en la noche de este domingo una jornada estremecedora cuando fuertes rachas de vientos acompañadas de intensas lluvias azotaron varias zonas. Nadie imaginó que se trataba de un tornado. Ya el Instituto de Meteorología había anunciados cambios, sin embargo la sorpresa fue mayor. [Vea Aviso de alerta temprana No. 1 del Estado Mayor Nacional de la Defensa Civil sobre la situación meteorológica compleja en la mitad occidental de Cuba]. De acuerdo con datos ofrecidos por autoridades de la capital al Noticiero Nacional de Televisión, al menos cuatro personas murieron y 195 resultaron heridas como consecuencia de las afectaciones provocadas por el fuerte tornado. Datos del Instituto de Meteorología indicaron que la tormenta trajo vientos comparables con el de un huracán, pues en su momento las rachas superaron los 110 kilómetros por hora. -

Florida Cuban Heritage Trail = Herencia Cubana En La Florida

JOOOw OCGO 000 OGCC.Vj^wjLivJsj..' Florida ; Herencia Cuban : Clmva Heritage ; en la Trail ; ftcMm ^- ^ . j.lrfvf. "^»"^t ;^ SJL^'fiSBfrk ! iT^ * 1=*— \ r\+ mi,.. *4djjk»f v-CCTIXXXIaXCCLl . , - - - - >i .. - ~ ^ - - ^ ^v'v-^^ivv^VyVw ViiuvLLcA rL^^LV^v.VviL'ivVi florida cuban heritage trail La Herencia Cubana En La Florida Cuban Americans have played a significant role Los cubano-americanos han jugado un papel muy in the development of Florida dating back to significativo en el desarrollo de la Florida, que se the days of Spanish exploration. Their impact remonta a la epoca de la exploration espahola. El on Florida has been profound, ranging from influences in impacto de los cubanos en la Florida ha sido profundo en el architecture and the arts to politics and intellectual thought. dmbito de la arquhectura, las artes, la cultura, la politica y la Many historic sites represent the patriotism, enterprise intelectualidad. Muchos de los lugares aquialudidos son pruebas and achievements of Cuban Americans and the part they del patriotismo, la iniciativa y los logros de los cubano americanos have played in Florida's history. y el papel que han desempehado en la historia de este estado. In 1994, the Florida Legislature funded the Florida Cuban En 1994 la legislatura estatal proportions los fondos para la Heritage Trail to increase awareness of the connections publication de La Herencia Cubana en la Florida. El between Florida and Cuba in the state's history. The proposito del libro es dar a conocer la conexion historica entre Cuban Heritage Trail Advisory Committee worked closely Cuba y la Florida. -

Narrative Cuba

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/10/2014 GAIN Report Number: CB1416 Cuba Food and Agricultural Import Regulations and Standards - Narrative FAIRS Country Report Approved By: Michael T. Henney Prepared By: Omar Gonzalez Report Highlights: Section(s) Updated: Sections I, VII, IX & Appendices I, II & III. The United States allows for the export of agricultural products to Cuba in conformity with the Trade Sanctions Reform and Export Enhancement Act of 2000. U.S. suppliers willing to navigate a detailed set of U.S. regulatory controls related to exporting to Cuba will find that the island is fairly receptive to U.S. products. This report provides information on Cuba's regulatory environment as it relates to U.S. agricultural exports. Cuban requirements related to product labeling, sanitary product registration, and export documentation generally are similar to those of other Latin American countries. However, the key difference in exporting to Cuba, compared to other countries in the region, is that all U.S. agricultural exports must be channeled through one Cuban government agency, ALIMPORT. 1 | P a g e Contents Section I. General Food Laws: ..................................................................................................................... 3 Section II. Food Additive Regulations: .......................................................................................................