World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Neoliberalism and the Social Production of Credibility, in Machu Picchu, Peru

City University of New York (CUNY) CUNY Academic Works All Dissertations, Theses, and Capstone Projects Dissertations, Theses, and Capstone Projects 2005 Shades of Dispossession: Neoliberalism and the Social Production of Credibility, In Machu Picchu, Peru Pellegrino A. Luciano Graduate Center, City University of New York How does access to this work benefit ou?y Let us know! More information about this work at: https://academicworks.cuny.edu/gc_etds/1665 Discover additional works at: https://academicworks.cuny.edu This work is made publicly available by the City University of New York (CUNY). Contact: [email protected] Shades of Dispossession: Neoliberalism and the Social Production of Credibility, In Machu Picchu, Peru By Pellegrino A. Luciano A dissertation submitted to the Graduate Faculty in Anthropology in partial fulfillment of the req uirements for the degree of Doctor of Philosophy, The City University of New York. 2005 UMI Number: 3187459 Copyright 2005 by Luciano, Pellegrino A. All rights reserved. UMI Microform 3187459 Copyright 2005 by ProQuest Information and Learning Company. All rights reserved. This microform edition is protected against unauthorized copying under Title 17, United States Code. ProQuest Information and Learning Company 300 North Zeeb Road P.O. Box 1346 Ann Arbor, MI 48106-1346 ii © 2005 PELLEGRINO A. LUCIANO All Rights Reserved iii This manuscript has been read and accepted for the Graduate Faculty in Anthropology in satisfac tion of the dissertation requirement for the degree of Doctor of Philosophy. -

Sea Containers Ltd. Annual Report 1999 Sea Containers Ltd

Sea Containers Ltd. Annual Report 1999 Sea Containers Ltd. Front cover: The Amalfi Coast Sea Containers is a Bermuda company with operating seen from a terrace of the headquarters (through subsidiaries) in London, England. It Hotel Caruso in Ravello, Italy. is owned primarily by U.S. shareholders and its common Orient-Express Hotels acquired the Caruso in 1999 shares have been listed on the New York Stock Exchange and will reconstruct the prop- (SCRA and SCRB) since 1974. erty during 2000-2001 with a The Company engages in three main activities: passenger view to re-opening in the transport, marine container leasing and the leisure business. spring of 2002. Capri and Paestum are nearby. Demand Passenger transport includes 100% ownership of Hoverspeed for luxury hotel accommodation Ltd., cross-English Channel fast ferry operators, the Isle of on the Amalfi Coast greatly Man Steam Packet Company, operators of fast and conven- exceeds supply. tional ferry services to and from the Isle of Man, the Great North Eastern Railway, operators of train services between London and Scotland, and 50% ownership of Neptun Maritime Oyj whose subsidiary Silja Line operates Contents fast and conventional ferry services in Scandinavia. Company description 2 Marine container leasing is conducted primarily through GE SeaCo SRL, a Barbados company owned 50% by Financial highlights 3 Sea Containers and 50% by GE Capital Corporation. Directors and officers 4 GE SeaCo is the largest lessor of marine containers in the world with a fleet of 1.1 million units. President’s letter to shareholders 7 The leisure business is conducted through Orient-Express Discussion by Division: Hotels Ltd., also a Bermuda company, which is 100% owned by Sea Containers. -

Nuevo Brochure Rsebelmondingles

CORPORATE SOCIAL RESPONSIBILITY TRAIN DIVISION - BELMOND PERU OUR AIM IS TO PROMOTE BETTER AND GREATER OPPORTUNITIES FOR COMMUNITIES WITHIN OUR AREA OF INFLUENCE. Michael Kerr ABOUT US BELMOND’S TRAIN DIVISION IN PERU MANAGES CORPORATE SOCIAL RESPONSIBILITY PROGRAMS IN THE AREAS SURROUNDING THE ROUTES OF BELMOND ANDEAN EXPLORER, BELMOND HIRAM BINGHAM, AND TOURIST AND LOCAL TRAINS OPERATED BY PERURAIL IN CUSCO, PUNO AND AREQUIPA. PROGRAMS ARE ALSO DEVELOPED IN THE VICINITY OF OUR FREIGHT AND ORE TRANSPORTATION DIVISION, WHICH OPERATES OUT OF THE PORT OF MATARANI. CORPORATE SOCIAL RESPONSIBILITY FOR US, BEING A SOCIALLY RESPONSIBLE COMPANY MEANS MANAGING OUR OPERATIONS, RESOURCES, HUMAN CAPITAL AND ENVIRONMENT WISELY. USING A HUMAN DEVELOPMENT APPROACH, WE SEEK TO IMPROVE THE VALUE AND COMPETITIVE SITUATION OF LOCAL COMMUNITIES IN THE AREAS IN WHICH WE OPERATE. AS PART OF OUR COMMITMENT TO THESE COMMUNITIES AND ENVIRONMENTS, WE HAVE DEVELOPED A SERIES OF PROGRAMS TO ENGAGE LOCAL PEOPLE. THE PROGRAMS ENCOURAGE NURTURING OF ABILITIES, GENDER INCLUSION, ENVIRONMENTAL CARE AND PRESERVATION, SAFETY AND LIFE CARE, AND APPRECIATION OF PEOPLES’ IDENTITY. OUR AREA OF INFLUENCE HYDROELECTRIC MACHU PICCHU OLLANTAYTAMBO CUSCO JULIACA AREQUIPA PUNO MATARANI PORT OUR CSR CORNERSTONES OUR CSR PROGRAMS FOCUS ON FOUR STRATEGIC CORNERSTONES OF ACTION. PRIORITIZED ACCORDING TO THE AREA AND TYPE OF ACTIVITY NEEDING DEVELOPMENT, THEY ARE: IDENTITY PROMOTION AND INTEGRATION ENVIRONMENTAL COMMITMENT INCLUSIVE BUSINESSES EDUCATIONAL INITIATIVES CORNERSTONE 1 IDENTITY PROMOTION AND INTEGRATION WE AIM TO SIGNIFICANTLY CONTRIBUTE TO THE PERSONAL, SOCIAL, ENVIRONMENTAL, CULTURAL AND ECONOMIC DEVELOPMENT OF POPULATIONS CLOSE TO OUR AREAS OF OPERATION. WE ALSO ENCOURAGE THE PROTECTION AND PROMOTION OF INDIGENOUS CULTURE, HERITAGE AND HISTORICAL MONUMENTS, AND THE INTEGRATION OF PEOPLE. -

Brochure Perurail

CORPORATE SOCIAL RESPONSIBILITY OUR COMPANY MANAGES A VARIETY OF PROGRAMS THAT GENERATE DEVELOPMENT OPPORTUNITIES FOR COMMUNITIES WITHIN OUR AREA OF INFLUENCE ABOUT US We directly manage Corporate Social Responsibility (CSR) programs in the regions where we operate, around the cities of Cusco, Puno, and Arequipa. Our programs also reach the division of freight transport of PeruRail which transports goods and minerals from/to the port of Matarani. OUR GOALS For us, being a socially responsible company means to managing our operations, resources, human capital, and environment wisely. We generate programs to improve the quality of life in our surroundings, developing new abilities and encouraging the creation of inclusive businesses. As part of our commitment with each one of our local communities, we have developed a series of programs that includes a wide variety of trainings which are mainly focused on 4 pillars: identity and integration, environmental protection, inclusive business, and educational initiatives. OUR AREA OF INFLUENCE Hydroelectric 3350 m.a.s.l Machu Picchu 2066 m.a.s.l Urubamba 2871 m.a.s.l Ollantaytambo Cusco 2792 m.a.s.l 3403 m.a.s.l La Raya 4338 m.a.s.l Colca Canyon 3375 m.a.s.l Juliaca 3897 m.a.s.l Crucero Alto 4500 m.a.s.l Puno 3843 m.a.s.l Arequipa LEGEND 2256 m.a.s.l Meters above sea level Matarani Port Train stations 09 m.a.s.l OUR STRATEGIC PILLARS Our company manages a range of programs that generate development opportunities for communities within our area of influence. -

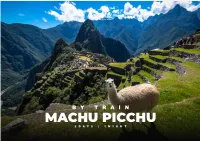

Machu Picchu by Train 2 Days.Cdr

B Y T R A I N MACHU PICCHU 2 D A Y S | 1 N I G H T DESCRIPTION Machu Picchu is a tourist desnaon that thousands of people dream of vising. Considered one of the New 7 Wonders of the World, Machu Picchu offers its visitors the architectural and engineering wonders that the Incas built and indescribable energy that renews the spirit. Andean culture, history, tradion, magic, myths, and mysteries await you in a truly impressive place. Machu Picchu opens its doors to all the visitors of our planet; live this magic experience with us! This package offers you an intense and outstanding experience in Machu Picchu. Make your dreams come true and enjoy this archaeological sanctuary to the fullest in a package that gives you, like no other tour, the greatest amount of me in Machu Picchu. Discover this sacred place wrapped in a veil of mystery and find out why it has been on the UNESCO World Heritage list since 1983. HOME MAP FULL ITINERARY INCLUDED | NOT INCLUDED BEFORE YOU GO TERMS & CONDITIONS DAY BY DAY 1 2 DAY DAY Cusco | Poroy Train Staon – Aguas Calientes Aguas Calientes – Machu Picchu – Ollantaytambo – Cusco. Cusco Machu Picchu Poroy Aguas Calientes HOME MAP FULL ITINERARY INCLUDED | NOT INCLUDED BEFORE YOU GO TERMS & CONDITIONS TREKKING BY TRAIN Treks & Expeditions Specialists CUSCO 3350 m. / 10990 ft. LEGEND Bus Train Train Vehicle Transportation POROY TRAIN STATION Archaeological site Bus round trip MACHU PICCHU 2400 m. / 7873 ft. OLLANTAYTAMBO Km.82 Km.88 PISKACUCHO QORY 2720 m. / 8923 ft. WAYRACHINA Km.106 AGUAS CALIENTES 1900 mt. -

Pontificia Universidad Católica Del Perú Escuela

PONTIFICIA UNIVERSIDAD CATÓLICA DEL PERÚ ESCUELA DE POSGRADO Planeamiento Estratégico Aplicado para la Empresa Ferrocarril Transandino S.A. TESIS PARA OBTENER EL GRADO DE MAGÍSTER EN ADMINISTRACIÓN ESTRATÉGICA DE EMPRESAS OTORGADO POR LA PONTIFICIA UNIVERSIDAD CATÓLICA DEL PERÚ PRESENTADA POR Edwin Bellido Zanabria Cristhian Eduardo Chávez Arroyo Machuca Jossimar Jairo Lazo Quispe Katherine Gabriela Zarate Umeres Asesor: Carlos Armando Bazán Tejada Cusco, Agosto 2019 Agradecimientos A Dios, por darnos la oportunidad de iniciar y mantenernos en este camino en el que podremos aportar a nuestra sociedad a través del conocimiento y experiencia ganados en este tiempo. A nuestras familias, por su apoyo y paciencia. A nuestros queridos profesores, que, con sus enseñanzas y gran exigencia, han aportado mucho en nuestra vida profesional. A nuestro asesor, Carlos Armando Bazán Tejada, MBA., por todo el profesionalismo y el apoyo brindado para el desarrollo de la presente tesis. Dedicatorias Dedico este logro a Dios y a la Virgen por toda su bendición. A mis padres Luis y Carmen por todo el apoyo incondicional que siempre me han brindado. A mis hermanos Luis y Amalia, que hacen conmigo una sola fuerza para salir adelante. A mis sobrinos, que me enseñan y motivan para ser una mejor persona y aportar a que tengan un mundo mejor. Katherine Gabriela Zárate Umeres Agradezco al Universo y a mis queridos padres Martha y Cesar, por haberme brindado el privilegio de fortalecer mis habilidades, espíritu y conocimiento. Al PhD. Gustavo Ruiz por ser uno de los principales guías en esta evolución, porque que el espíritu necesita de conocimiento para ser libre. -

Itinerario AEP Ingles

Cusco PERUVIAN HIGHLANDS ANDEAN PLAINS & ISLANDS OF DISCOVERY SPIRIT OF THE WATER Cusipata SPIRIT OF THE ANDES Raqchi Marangani La Raya Juliaca Taquile Island Saracocha Km 93 Pampa Cañahuas Lake Titicaca Station Sumbay Pacific Ocean Arequipa PERUVIAN HIGHLANDS ANDEAN PLAINS & ISLANDS OF DISCOVERY CUSCO - PUNO - AREQUIPA: 3 DAYS, 2 NIGHTS AREQUIPA - PUNO - CUSCO: 2 DAYS, 2 NIGHTS DAY 1 - THURSDAY DAY 1 - SATURDAY 11am Depart from Cusco - Wanchaq Station 7pm Welcome cocktails at Arequipa Station 12:30pm Lunch on board 8pm Depart from Arequipa 1:55pm Tour of Raqchi 8:30pm Dinner on board 3:30pm Canapés in the bar car Overnight on board (the train will continue traveling) 5:45pm Tour of La Raya 7:00pm Pre-dinner cocktails 7:30pm Dinner on board DAY 2 - SUNDAY 11:30pm Arrive at Puno - Lake Titicaca Station Sunrise at Lake Titicaca Overnight stay at Lake Titicaca Station (Puno) 6am Breakfast on board 8:30am Board boats to explore Lake Titicaca. Visit Uros and Taquile islands DAY 2 - FRIDAY 12:30pm Private lunch at Collata Beach, Taquile. Dance and artisanal craft displays Sunrise at Lake Titicaca 3:45pm Arrive back at Lake Titicaca Station (Puno) 4pm Afternoon tea at the station 6am Breakfast on board 4:50pm Depart to Cusco 8:30am Board boats to explore Lake Titicaca. Visit Uros and Taquile islands 7pm Pre-dinner cocktails 12:30pm Private lunch at Collata Beach, Taquile. Dance and artisanal craft displays 7:30pm Dinner on board 3:45pm Arrive back at Lake Titicaca Station (Puno) 4pm Afternoon tea at the station Arrival and overnight stay at Marangani -

Descargar Brochure

NUESTRA EMPRESA DIRIGE UNA VARIEDAD DE PROGRAMAS QUE GENERAN OPORTUNIDADES DE DESARROLLO PARA LAS COMUNIDADES DE NUESTRA ÁREA DE INFLUENCIA. SOBRE NOSOTROS Dirigimos programas de Responsabilidad Social Empresarial (RSE) de manera directa en las regiones donde operamos entre las ciudades de Cusco, Puno y Arequipa. Nuestros programas también tienen alcance a la división de transporte de carga de PeruRail, la cual transporta mercancías y minerales desde y hacia el puerto de Matarani. NUESTRAS METAS Para nosotros, ser una empresa socialmente responsable significa gestionar nuestras operaciones, recursos, capital humano y ambiente de manera inteligente. Generamos programas para mejorar la calidad de vida en nuestro entorno, desarrollando nuevas habilidades y fomentando la creación de negocios inclusivos. Como parte de nuestro compromiso con cada una de nuestras comunidades locales, hemos desarrollado una serie de programas que incluyen una amplia variedad de capacitaciones, enfocados principalmente en 4 pilares: identidad e integración, protección del ambiente, negocios inclusivos e iniciativas educativas. NUESTRA ÁREA DE INFLUENCIA Hidroeléctrica 3350 m.s.n.m Machu Picchu 2066 m.s.n.m Urubamba 2871 m.s.n.m Ollantaytambo Cusco 2792 m.s.n.m 3403 m.s.n.m La Raya 4338 m.s.n.m Cañon del Colca 3375 m.s.n.m Juliaca 3897 m.s.n.m Crucero Alto 4500 m.s.n.m Puno 3843 m.s.n.m Arequipa LEYENDA 2256 m.s.n.m Metros sobre el nivel del mar. Puerto Matarani Estaciones de tren. 09 m.s.n.m NUESTROS PILARES ESTRATÉGICOS Nuestra empresa dirige una variedad de programas que generan oportunidades de desarrollo para las comunidades de nuestra área de influencia. -

RAIL REPORT March 2010 • NO

RAIL REPORT March 2010 • NO. 599 Rocky Mountain Railroad Club • Rocky Mountain Railroad Historical Foundation PeruRail Presented by Joe McMillan February 9th, 2010 • 7:30 PM See a digital show on PeruRail, the railroad in Peru that serves Machu Picchu by narrow gauge and southern Peru by standard gauge. We will also cross the border into Chile for a few shots of a very unusual railroad. Please come join us for an enjoyable, educational evening at Christ Episcopal Church at 2950 South University Boulevard, University at Bates, where there is plen- ty of off street parking at the rear of the complex. Enter into Barnes Hall, where we hold the monthly meetings, on the mid-south side doors. Please bring a guest. All programs are intended to provide an educational experience on railroading. The general public is welcome to attend. There is no charge for this meeting. Please note: Due to additional scheduling changes at the Church, our meeting night will stay on the second Tuesday of the month. RMRRC Calendar April 13th Tuesday Meeting, Durango & Silverton Snow Fighting. May 11th Tuesday Meeting, Cumbres & Toltec and Durango & Silverton Narrow Gauge. May Possible tour of UP Cheyenne roundhouse and shops. June 8th Tuesday Meeting, with program to be announced soon. Due to circumstances beyond our control, programs and dates are subject to change without notice. Please contact Pat Mauro at [email protected] or phone 303-838-7740 with program ideas. Rocky Mountain Rail Report • Page 1 • March 2010 PeruRail The Machu Picchu train stops at Aguas Calientes in Peru on July 31, 2008. -

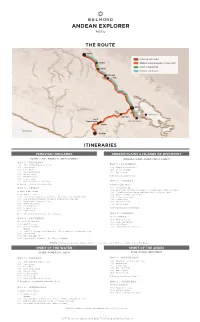

The Route Itineraries

THE ROUTE Cusco PERUVIAN HIGHLANDS Cusipata ANDEAN PLAINS & ISLANDS OF DISCOVERY SPIRIT OF THE WATER Raqchi SPIRIT OF THE ANDES Marangani La Raya Juliaca Taquile Island Saracocha Km 93 Pampa Cañahuas Titicaca lake station Sumbay Pacific Ocean Arequipa ITINERARIES PERUVIAN HIGHLANDS ANDEAN PLAINS & ISLANDS OF DISCOVERY CUSCO - PUNO - AREQUIPA: 3 DAYS, 2 NIGHTS AREQUIPA - PUNO - CUSCO: 2 DAYS, 2 NIGHTS DAY 1 - THURSDAY 11:00 Depart from Wanchaq station (Cusco) DAY 1 - SATURDAY 12:30 Lunch on board 20:00 Depart from Arequipa station 14:00 Tour of Raqchi 20:30 Pre-dinner cocktails 15:30 Afternoon tea on board 21:00 Dinner on board 16:45 Sunset in La Raya Overnight stay on board en route 18:30 Pre-dinner cocktails 19:00 Dinner on board 22:15 Arrival at Lake Titicaca station (Puno) DAY 2 - SUNDAY Overnight stay at Lake Station station (Puno) Sunrise at Lake Titicaca DAY 2 - FRIDAY 06:00 Breakfast on board 08:00 Explore Lake Titicaca and enjoy a boat ride to Uros and Taquile (Collata beach) Islands Sunrise at Lake Titicaca 12:00 Traditional dances and artisanal craft displays. Private lunch at Taquile Island 06:00 Breakfast on board 15:30 Return to Lake Titica station (Puno) 08:30 Explore Lake Titicaca and enjoy a boat ride to Uros and Taquile (Collata beach) Islands 16:00 Afternoon tea on board 12:30 Traditional dances and artisanal craft displays. Private lunch at Taquile Island 17:00 Depart to Cusco 15:30 Return to Lake Titicaca station (Puno) 18:30 Pre-dinner cocktails 16:00 Afternoon tea on board 19:00 Dinner on board 17:00 Depart to Arequipa 18:30 Pre-dinner cocktails Overnight stay on board at Marangani 19:00 Dinner on board Overnight stay on board at the shores of Lake Saracocha DAY 3 - MONDAY Sunrise at Marangani DAY 3 - SATURDAY 06:00 Breakfast on board Sunrise at Lake Saracocha 08:00 Depart from Marangani 06:00 Breakfast on board 09:05 Tour of Raqchi 09:55 Tour of Sumbay Caves 12:58 Arrival at Wanchaq station (Cusco) Optional: 11:26 Stop Km. -

23Rd August, 2010.Pmd

Overseas Information Overseas Market Information Peru Fiscal Burden Synopsis of the Country Peru has moderate income tax rates. Both the flat income tax rate and the top corporate tax rate are 30 percent. Other Capital : Lima taxes include a value-added tax (VAT), a property transfer Currency : Peruvian Nuevo Sol (PEN) tax, and a capital gains tax. In the most recent year, overall Official language : Spanish, Quechua, Aymara tax revenue as a percentage of GDP was 15.1 percent. Business : Spanish, English Languages Government Intervention Population : 6831306 (July 2008 est.) Total government expenditures, including consumption and Total Area : 1285220 sq. kms transfer payments, are low. In the most recent year, GDP : $131.4 billion (2008 est.) government spending equaled 16.5 percent of GDP. The GDP Growth Rate : 4.5% (2008 est.) government has restructured the privatization agency to focus on large enterprises. A group of concessions was GDP Per Capita : $8,500 (2008 est.) offered in energy and transportation beginning in early 2008. Major Exports : Copper, gold, zinc, crude petroleum and petroleum products, coffee, Foreign Investment potatoes, asparagus, textiles, Peru provides national treatment to foreign investors and fishmeal there is no screening process. Investments in domestic and Exports Value : $33.27 billion f.o.b. (2008 est.) foreign banking and in defense-related industries require Major Countries : US, China, Canada, Japan, Chile, prior approval and certain sectors are reserved for domestic of Export Switzerland, Spain investors. Other deterrents to investment include weak Major Imports : Petroleum and petroleum products, enforcement of contracts, non-transparent and burdensome plastics, machinery, vehicles, iron bureaucracy, restrictive labour regulations, and corruption. -

Servicio Bimodal Bimodal Service

SERVICIO BIMODAL BIMODAL SERVICE CUSCO - MACHU PICCHU - CUSCO SERVICIO BIMODAL BIMODAL SERVICE Servicio integral que combina el viaje en bus y tren, partiendo y llegando ESTACIÓN / STATION a la ciudad de Cusco MACHU PICCHU TREN (transbordo) debido a la temporada de TRAIN (transfer) BELMOND HOTEL RIO SAGRADO lluvias las cuales pueden (Río Sagrado / Sacred Valley) afectar los rieles del tren. Disponible desde enero hasta el 30 de abril. BUS ESTACIÓN WANCHAQ / HOTELES (5 min del centro de Cusco) From January to April, WANCHAQ STATION / HOTELS when weather conditions (5 min from Cusco city center) may aect the railway line, we oer a bimodal service CENTRO DE CUSCO LEYENDA | LEGEND combining bus and train CUSCO CITY CENTER Trayecto en tren hacia la estación Machu Picchu / Belmond Hotel Rio Sagrado travel for guests departing Duración: 2hrs 40min aprox from and arriving into Train journey between Machu Picchu Station / Belmond Hotel Rio Sagrado Duration: 2hrs 40min approx Cusco. Ruta en bus hacia Belmond Hotel Rio Sagrado / Wanchaq Duración: 2hrs aprox Bus route between Belmond Hotel Rio Sagrado / Wanchaq Duration: 2hrs approx ITINERARIO ITINERARY WANCHAQ (Cusco) - MACHU PICCHU Tren / Train: 11 Estación de embarque en bus / Bus departure station: Wanchaq Cusco Hora de salida / Departure time: 7.20am Estación de embarque en tren / Train departure station: Belmond Hotel Rio Sagrado Hora de salida / Departure time: 9.40am Estación de llegada en tren / Train arrival station: Machu Picchu Pueblo Hora de llegada / Arrival time: 12.24pm El servicio de ida Belmond Hiram Bingham, incluye el bus privado partiendo desde la estación de Wanchaq, ubicada a 5 minutos del centro de Cusco, (el traslado a la estación Wanchaq no está inlcuida) hasta llegar a la estación Belmond Hotel Rio Sagrado.