Is the Houston Sports Authority Following a Sustainable Path? -Or

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2011 Program

2 x Rio Grande Valley Sports Hall of Fame I welcome you to the 24th Annual Rio Grande Valley Sports Hall of Fame Induction Banquet. We are happy to have the banquet return to Brownsville, after having been in McAllen and Donna for the past four years. Brownsville hosted the two largest crowds of our banquet history in 2005 and 2006 with attendance of 360 guests. With the outstanding Class of 2011 being honored tonight, the attendance should surpass 300 again! I offer my congratulations to the 2011 class of seven inductees! As is usually the case, football again dominates the class that was selected by 85 voters from the group of past inductees and Hall of Fame board members, who took time to study the biographies and submit their votes last September. Six of the seven new inductees were outstanding football players representing their high schools. Two of them (Bob Brumley and Sammy Garza) went on to play professional football after highly successful collegiate careers. Another (Travis Sanders) still holds a 33-year old consecutive 100-yard rushing record for the Valley. All-State quarterback & safety (Donald Guillot) went on to NCAA baseball stardom at the University of Texas-PanAmerican, while the football coach of the class (Bruce Bush) has a stellar record of 41 successful seasons in South Texas. Another former quarterback from the state semi-finalist PSJA Bears (Carlos Vela) became a well-known trackand& field coach in the Valley. In addition, not to be outdone is the man (Ronnie Zamora) who helps players and coaches of several sports gain local, state and national recognition with his sports media writing, announcing and website work, always bringing recognition for others to the Valley. -

Watch Houston Baptist Vs Rice Live Sports Stream

1 / 5 Watch Houston Baptist Vs Rice Live Sports Stream My scholarship is my lifeline. Without it, I wouldn't be at Middle Tennessee playing the sport I love and furthering my education. I'm forever grateful for it.. Houston Baptist Huskies live score (and video online live stream*), schedule and ... In match details we offer link to watch online Houston Baptist Huskies Live stream. ... Get tickets to Rice Owls athletic events including Basketball, Football, and .... To access live or on-demand video, you will need a download speed of at least 1.0 ... we suggest using AppleTV to wirelessly stream content from a Mac or Apple mobile ... If you're attempting to watch a live or on- demand event that is free, you ... However, the only sports that include live stats output are soccer, field hockey, .... Get the latest news and information for the Houston Baptist Huskies. 2021 season schedule, scores, stats, and highlights. Find out the latest on your favorite .... Sep 3, 2019 — Things to do: September book signings and launches in Houston Houston ... 2019 college football schedule: Week 2 games, where to watch, live stream, TV channel ... Baechle boots UTEP to 36-34 win over Houston Baptist. Houston Baptist Huskies live score (and video online live stream*), schedule ... Get tickets to Rice Owls athletic events including Basketball, Football, and Baseball. ... our partners live streaming service, you can watch Houston Baptist Huskies ... Aug 28, 2020 — However, broadcast information and kickoff time is still to be ... The Bulldogs will then host Houston Baptist in their home opener on Saturday, Sept. -

Greater Houston Convention and Visitors Bureau

GREATER HOUSTON CONVENTION AND VISITORS BUREAU 2014 - 2015 ANNUAL REPORT MISSION STATEMENT 2 STRUCTURE & FUNDING 2 2014 KEY ACCOMPLISHMENTS 2 CITY OFFICIALS 3 COUNTY OFFICIALS 3 LETTER FROM THE PRESIDENT 4 LETTER FROM THE CHAIRMAN 5 2014 BOARD OF DIRECTORS 6 2015 BOARD OF DIRECTORS 8 DESTINATION SALES 12 TOURISM 14 DESTINATION SERVICES 16 MEMBERSHIP 18 PARTNERSHIPS & EVENT DEVELOPMENT 20 MARKETING 22 HOUSTON FILM COMMISSION 24 VISITOR INFORMATION SERVICES 26 FINANCE & ADMINISTRATION 28 MISSION STATEMENT The mission of the Greater Houston Convention and Visitors Bureau is to improve the economy of greater Houston by attracting national and international conventions, trade shows, tourists and film projects to the area through sales, marketing and public relations efforts. STRUCTURE & FUNDING The Greater Houston Convention and Visitors Bureau is a 501(c)6 nonprofit corporation. The GHCVB is a marketing and service organization with a budget presently comprised of certain reserved funds and private funds raised through a variety of sources including investments in events, membership dues, advertising and in-kind contributions. At the beginning of 2014, the GHCVB’s primary source of funding was from a contract with the City of Houston which was assigned to the Houston First Corporation, or HFC, in 2011 and expired June 30, 2014. This contract funded approximately 92% of the GHCVB’s budget from a tax on hotel/ motel occupancy within the incorporated boundaries of Houston, Texas. Upon expiration of the contract on June 30, 2014, the GHCVB and HFC boards approved a strategic realignment between the two organizations to create a more efficient approach to marketing and selling Houston to tourists and conventions. -

Parks and Recreation Master Plan

District of Houston Parks and Recreation Master Plan Photos courtesy of Houston Today This report is prepared for the sole use of the District of Houston. No representations of any kind are made by Urban Systems Ltd. or its employees to any party with whom Urban Systems Ltd. does not have a contract. Copyright 2017. PARKS AND RECREATION MASTER PLAN TABLE OF CONTENTS EXECUTIVE SUMMARY ............................................................................................. i 1. OVERVIEW ............................................................................................................ 2 1.1 Parks and Recreation Master Plan .......................................................... 2 1.2 Connection to OCP .................................................................................. 3 1.3 History and Location ................................................................................ 4 2. COMMUNITY PROFILE AND INPUT ..................................................................... 6 2.1 Population Overview ................................................................................ 6 2.2 Community Input ..................................................................................... 9 2.3 PRMP Objectives .................................................................................. 12 2.4 PRMP Format ........................................................................................ 12 3. PARKS AND OUTDOOR RECREATION ............................................................. 13 3.1 Parkland -

AGENDA HOUSTON FIRST CORPORATION OPERATIONS COMMITTEE MEETING December 10, 2020 –2:00 P.M

AGENDA HOUSTON FIRST CORPORATION OPERATIONS COMMITTEE MEETING December 10, 2020 –2:00 P.M. Live Video and Audio Conference Meeting Join the Meeting Here Meeting Room Password: 708178 ____________________________________________________________________________ COMMITTEE MEMBERS: Desrye Morgan (Chair), Reginald Martin (Co-Chair), Alex Brennan-Martin, Elizabeth Brock, Dean Gladden, Kathryn McNiel, Council Member David Robinson, Tom Segesta, Bobby Singh In accordance with the modified Texas Open Meetings Act provisions announced by Texas Governor Greg Abbott on March 16, 2020, this Agenda is posted for public information, at all times, for at least 72 hours preceding the scheduled time of the meeting online at https://www.houstonfirst.com. Any questions regarding the Agenda, should be directed to Lisa K. Hargrove, General Counsel at either 713-853-8965 or [email protected] I. Call to Order II. Public Comments III. Minutes – November 12, 2020 IV. Presentations, Reports, and Updates A. Programming Update V. Committee Business A. Consideration and possible recommendation of a Landscaping Services Agreement with Western Horticultural Services, LP. VI. Adjournment III. Minutes – November 12, 2020 HOUSTON FIRST CORPORATION Operations Committee Meeting November 12, 2020 – 2:00 P.M. Live Video and Audio Conference Meeting The Operations Committee (“Committee”) of Houston First Corporation (the “Corporation” or “HFC”), a Texas local corporation created and organized by the City of Houston as a local government corporation pursuant to TEX. TRANSP. CODE ANN. §431.101 et seq. and TEX LOC. GOV’T. CODE ANN. §394.001 et seq., posted a meeting via live video and audio conference on Thursday, November 12, 2020, commencing at 2:00 p.m. -

0X0a I Don't Know Gregor Weichbrodt FROHMANN

0x0a I Don’t Know Gregor Weichbrodt FROHMANN I Don’t Know Gregor Weichbrodt 0x0a Contents I Don’t Know .................................................................4 About This Book .......................................................353 Imprint ........................................................................354 I Don’t Know I’m not well-versed in Literature. Sensibility – what is that? What in God’s name is An Afterword? I haven’t the faintest idea. And concerning Book design, I am fully ignorant. What is ‘A Slipcase’ supposed to mean again, and what the heck is Boriswood? The Canons of page construction – I don’t know what that is. I haven’t got a clue. How am I supposed to make sense of Traditional Chinese bookbinding, and what the hell is an Initial? Containers are a mystery to me. And what about A Post box, and what on earth is The Hollow Nickel Case? An Ammunition box – dunno. Couldn’t tell you. I’m not well-versed in Postal systems. And I don’t know what Bulk mail is or what is supposed to be special about A Catcher pouch. I don’t know what people mean by ‘Bags’. What’s the deal with The Arhuaca mochila, and what is the mystery about A Bin bag? Am I supposed to be familiar with A Carpet bag? How should I know? Cradleboard? Come again? Never heard of it. I have no idea. A Changing bag – never heard of it. I’ve never heard of Carriages. A Dogcart – what does that mean? A Ralli car? Doesn’t ring a bell. I have absolutely no idea. And what the hell is Tandem, and what is the deal with the Mail coach? 4 I don’t know the first thing about Postal system of the United Kingdom. -

CONGRESSIONAL RECORD— Extensions of Remarks E141 HON. MICHAEL G. FITZPATRICK HON. SAM GRAVES HON. DAVID P. ROE HON. LUKE MESSE

CONGRESSIONAL RECORD — Extensions of Remarks E141 park, a wilderness area, a national forest, a ning and resulted in the honoring of veterans RECOGNIZING DANIEL C. REESE Wild and Scenic River, a National Heritage both past and present within their community. AND HIS APPOINTMENT TO Area or a National Conservation Area; con- They even worked to preserve the environ- CHAIRMAN OF THE TENNESSEE struct a Bureau of Reclamation Water Recy- ment by cleaning up a staggering eight miles DEPARTMENT OF ENVIRONMENT cling project; modify the Coastal Barrier Re- of the Delaware Canal. AND CONSERVATION COMMIS- sources System; or remove property from the SIONER’S COUNCIL ON GREEN- National Wildlife Refuge System. The House The members of Troop 127 are prime ex- WAYS AND TRAILS Natural Resources Committee routinely con- amples of what it means to be a Boy Scout. siders dozens of these types of bills each They are conscious of country, the values of HON. DAVID P. ROE year. their country, those less fortunate than them- OF TENNESSEE It is also important to note that Congress selves, and of their faith. The members of IN THE HOUSE OF REPRESENTATIVES has legislatively created more than 60 national Troop 127 have shown maturity and are val- Wednesday, February 13, 2013 wildlife refuges throughout the United States. ued members of our community. Becoming a Mr. ROE of Tennessee. Mr. Speaker, today In my own Congressional District, the Red Boy Scout bestows a great level of responsi- River National Wildlife Refuge was established I would like to recognize Mr. Daniel C. Reese bility on the young men who are willing to take by an Act of Congress. -

Push for City Utility in Overdrive

$1 HIGH-TECH HEALTH MARKETPLACE AND WELLNESS Idol Minds going mobile New technology improves in video game market heart attack survival rate 5A 19A Volume 32 Issue 17 | Aug. 2-15, 2013 Push for city utility in overdrive BY JOSHUA LINDENSTEIN city told the council that the city’s [email protected] Some council members urging models for municipalization meet the requirements of the city charter and BOULDER — The city of Boul- more caution on municipalization are feasible. It came just days before a der’s exploration into creating a Federal Energy Regulatory Commis- municipal electric utility has shifted The Boulder City Council on July acquiring Xcel Energy Inc.'s distribu- sion ruling dealt Boulder’s efforts a into execution mode in recent weeks, 24 took a major step toward creating tion system, even if that meant doing minor blow but one that city staffers with some citizens and city council a municipal electric utility by passing so in condemnation court. believe can help their cause down the members arguing that the city is mov- on first reading an ordinance autho- The move came one night after an road nonetheless. ing too fast. rizing the city to begin the process of independent evaluator hired by the ➤ See Utility, 13A Round and round it goes Both sides Construction of Boulder Valley Velodrome in Erie under way in Dillard’s case await court ruling BY BETH POTTER [email protected] BOULDER — The fate of the Dil- lard’s department store building in Longmont could be decided as early as Aug. 19. That’s the day Boulder District Court Judge D.D. -

Ideson and Preservation

Volume 6 • Number 2 • Spring 2009 IDESON AND PRESERVATION UNIVERSITY of H O U S T O N CENTER FOR PUBLIC HISTORY LETTER FROM THE EDITOR Preserving the Past (If Possible) The groundbreaking for Center, and to pursue other civic endeavors. This time, their the new archival wing of efforts were in the interest of historic preservation, a quality of the Julia Ideson Building life issue whose time has come. was something to be- The articles on Julia Ideson and the preservation of the library hold. On a picture perfect building bearing her name celebrate this triumph. What a place Houston spring day in the restored, refurbished, and expanded Ideson building will January, several hundred be. This issue also includes an article on a successful case of people gathered to hear adaptive reuse, the transformation of the M&M Building into the the speeches and watch the main campus building for UH Downtown. It also has an article groundbreaking for the new on one of the most notable failures in historic preservation in wing. Mayor White spoke our city’s history—the demolition of the Shamrock Hilton. As is with enthusiasm about the often true, in this case failure triggered success; the unsuccessful impact of the preservation efforts to save the Shamrock fostered the growth of a stronger and expansion of the Ideson preservationist movement in Houston. Building on future genera- (Old editor’s cranky aside: I acknowledge that the Shamrock tions of Houstonians. was historically significant. But I also spent the night there I left the ceremony convinced that he was not exaggerating. -

NO. 2004-1059-1 City Council Chamber, City Hall, Tuesday

NO. 2004-1059-1 City Council Chamber, City Hall, Tuesday, October 12, 2004 A Regular Meeting of the Houston City Council was held at 1:30 p.m. Tuesday, October 12, 2004, Mayor Bill White presiding and with Council Members Toni Lawrence, Carol M. Galloway, Mark Goldberg, Ada Edwards, Addie Wiseman, M. J. Khan, Pam Holm, Adrian Garcia, Carol Alvarado, Mark Ellis, Gordon Quan, Shelley Sekula-Gibbs, M.D., Ronald C. Green and Michael Berry; Ms. Deborah McAbee, Division Chief, Land Use Division, Legal Department; Mr. Richard Cantu, Director Mayor’s Citizens Assistance Office; Ms. Marty Stein, Agenda Director, and Mr. Jose Soto, Deputy Agenda Director, present. At 1:54 p.m. Mayor White stated that Council would begin with presentations and called on Council Member Green who stated that this month they were excited about celebrating National Disabilities Month and invited Ms. Thelma Scott to the podium; Ms. Nancy Colvick appeared and stated that she was representing the Coalition for Disabilities Committee and thanked all for their attention and celebration of citizens and their efforts to overcome their obstacles in reaching their dreams. Council Member Green invited Ms. Angela Willowsworth to come to the podium and stated that she was a teacher in Kline ISD and presented her a Proclamation for being crowned Ms. Wheelchair Texas 2004, for promoting disability awareness, and being a member of the National Taskforce on Public Awareness for the Muscular Dystrophy Association and proclaimed October 12, 2004, as “Angela Willowsworth Day” in Houston, Texas. Ms. Willowsworth thanked all for the proclamation and stated that it was an honor to be chosen Ms. -

Houston Sports Authority

About the Sports Authority: . Formed in May of 1997, by the Texas Legislature (HB 92) . Responsible for the construction of and debt service for: - Minute Maid Park - Reliant Stadium/NRG Stadium - Toyota Center/ Tundra Garage . HB 92 established a hotel/motel tax of 2% and a car rental tax of 5%. It also required an affirmative vote of the citizens of Harris County to build each of the venues. Board appointed by City & County Houston Sports Venues Minute Maid NRG Stadium Toyota Center Opened 2000 Opened 2002 Opened 2003 $286M Total Project $519M Total Project $252M Total Project . $268M Bonds . $370.3M Bonds . $212M Bonds . $18M Astros . $26.8M Harris County/HCHSA . $20M City of Houston . $14M Rodeo . $20M Rockets/HCHSA $7.1M Annual Payments . $7.5M Aramark . $100.4M Texans . $3.4M Lease $8.5M Annual Payments . $2.5M Asset Renewal . $5.2M Lease . $1.2M Naming Rights $5.5M Annual Payments . $1.5M Maintenance . $4.0M Texans Lease . $1.6M Capital Repairs . $1.5M Rodeo Lease . $200K Naming Rights BBVA / Compass Stadium $95M Total . $60M AEG . City & County: . $15M Land . $10M TIRZ . $10M TIRZ Opened in 2012 Dallas – Cowboys Stadium . $1.3 billion spent to build Cowboys Stadium. Houston spent just over $1 billion on all four venues. MVT/HOT Comparison Variance - $11M Variance - $23M Impact of New Stadiums to Houston • Between the four stadiums, we have over 1,300 events each year with nearly 8.5+ million attendees. • The construction of the stadiums have spawned economic development and new building projects, transforming downtown Houston. Impact of New Stadiums to Houston according to studies by Central Houston . -

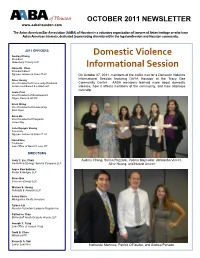

Domestic Violence Informational Session

OCTOBER 2011 NEWSLETTER www.aabahouston.com The Asian American Bar Association (AABA) of Houston is a voluntary organization of lawyers of Asian heritage or who have Asian American interests, dedicated to promotin g diversity within the legal profession and Houston community. 2011 OFFICERS Domestic Violence Audrey Chang President Greenberg Traurig LLP Informational Session Daniel H. Chen President-Elect Nguyen Jazrawi & Chen PLLC On October 27, 2011, members of the AABA met for a Domestic Violence Alice Huang Informational Session featuring DAYA Houston at the Tracy Gee Vice President of Community Relations Community Center. AABA members learned more about domestic Locke Lord Bissell & Liddell LLP violence, how it affects members of the community, and how attorneys can help. Juvie Cruz Vice President of Development Pagel, Davis & Hill PC Erick Wang Vice President of Membership DLA Piper A n n a H a Vice President of Programs Jones Day Jane Nguyen Vuong Secretary Nguyen Jazrawi & Chen PLLC David Hsu Treasurer Law Office of David S. H s u P C DIRECTORS Judy Y. Liu, Chair Audrey Chang, Saima Razzack, Vyoma Majmudar, Abhilasha Vineet, CenterPoint Energy Service Company LLC Alice Huang, and Nusrat Ameen Joyce Kao Soliman Porter & Hedges LLP Steve Bae Curocom Energy LLC Warren S. Huang Fulbright & Jaworski LLP Jenny Hyun Weingarten Realty Investors Tyrone Lin Houston Volunteer Lawyers Program Inc. Catherine Than Bickerstaff Heath Delgado Acosta LLP Joseph T. Tung Law Office of Joseph Tung Todd E. Chen Winstead PC Kenneth S. Soh Lanier Law Firm Nathaniel Martinez, Patrick O’Rourke, and Andrea Penedo 2011 Domestic Violence COMMITTEE CHAIRS Social Committee Informational Session Claire C.