De Beers Is the Largest Producer and Marketer of Gem Diamonds by Value in the World Diamonds Financial Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

12759 Debeers OFR2008.Qxd

Operating and Financial Review 2008 Living up to diamonds From natural resources to shared national wealth Group at a glance About us De Beers was established in 1888 and is the world’s leading diamond company with unrivalled expertise in the exploration, mining and marketing of diamonds. From its mining operations across Botswana, Namibia, South Africa and Canada, De Beers produces and markets approximately 40% of the world’s supply of rough diamonds. For further information about De Beers visit www.debeersgroup.com Contents Strategy 01 What we do 02 Introduction from the Chairman At De Beers we are committed to Living up to Diamonds 04 Performance overview from by making a lasting contribution to the communities the Managing Director 06 Marketplace in which we live and work. This means driving returns 08 Exploration review 10 Mining review on capital, operating sustainably and working with our 17 Sales and distribution partner governments to transform natural resources 24 Governance and risk 26 Board and Board Committee into shared national wealth. composition 28 Consolidated income statement 28 Consolidated balance sheet 29 Summary of cash flows 30 Notes 30 Other information 31 Production statistics 32 Our Principles ibc Extended contacts Strategy Front cover image: Sunset, Northwest Territories, Canada. Delivering Demand growth Profitable Added value Cost and returns on capital production opportunities working capital This report is designed to be read alongside our Report growth efficiency to Society 2008. These reports form part of our annual reporting cycle and together cover the financial and sustainability performance of the De Beers Family of Companies. Both reports adhere to Global Reporting Initiative G3 Sustainability Reporting Guidelines and 1.1Delivering Partnership Consumer Organisational form part of our Communication on Progress to the sustainability proposition confidence effectiveness DEMAND and reputation United Nations Global Compact. -

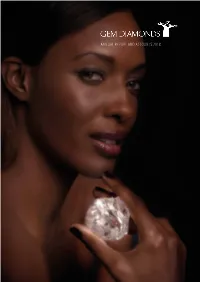

ANNUAL REPORT and ACCOUNTS 2018 Gem Diamonds Is a Leading Producer of High-Value Diamonds

ANNUAL REPORT AND ACCOUNTS 2018 Gem Diamonds is a leading producer of high-value diamonds The Group, which has its head office in the United Kingdom, owns the Letšeng mine in Lesotho and the Ghaghoo mine in Botswana. The Letšeng mine is renowned for its regular On the cover, the 910 carat Lesotho production of large, exceptional white diamonds, making it the Legend recovered in January 2018, highest average dollar per carat kimberlite diamond mine in largest gem quality diamond ever recovered at Letšeng. the world. Since Gem Diamonds acquired the mine in 2006, Letšeng has produced some of the world’s most remarkable Welcome to the Gem diamonds. Among these diamonds recovered are the 910 carat Diamonds Annual Report Lesotho Legend, the 603 carat Lesotho Promise, the 550 carat and Accounts 2018 Letšeng Star and the 493 carat Letšeng Legacy. The Annual Report and Accounts have been prepared in accordance Gem Diamonds’ strategy is underpinned by three key priorities with: to deliver maximum value for all shareholders through its – applicable English and British Virgin Islands law; business cycle. Its current focus is on enhancing the efficiency – regulations and best practice as of the Group’s operations by improving day-to-day advised by the Financial performance, driving stringent cost control and capital Reporting Council and the discipline; and selling non-core assets. The selling of diamonds Department of Business, is supported by the Group’s sales, marketing and manufacturing Innovation and Skills in the United Kingdom; and capabilities. Financial, technical and administrative services are – International Financial supported by its South African subsidiary. -

Calm Down NEW YORK — East Met West at Tiffany on Sunday Morning in a Smart, Chic Collection by Behnaz Sarafpour

WINSTON MINES GROWTH/10 GUCCI’S GIANNINI TALKS TEAM/22 WWDWomen’s Wear Daily • The Retailers’MONDAY Daily Newspaper • September 13, 2004 • $2.00 Accessories/Innerwear/Legwear Calm Down NEW YORK — East met West at Tiffany on Sunday morning in a smart, chic collection by Behnaz Sarafpour. And in the midst of the cross-cultural current inspired by the designer’s recent trip to Japan, she gave ample play to the new calm percolating through fashion, one likely to gain momentum as the season progresses. Here, Sarafpour’s sleek dress secured with an obi sash. For more on the season, see pages 12 to 18. Hip-Hop’s Rising Heat: As Firms Chase Deals, Is Rocawear in Play? By Lauren DeCarlo NEW YORK — The bling-bling world of hip- hop is clearly more than a flash in the pan, with more conglomerates than ever eager to get a piece of it. The latest brand J.Lo Plans Show for Sweetface, Sells $15,000 Of Fragrance at Macy’s Appearance. Page 2. said to be entertaining suitors is none other than one that helped pioneer the sector: Rocawear. Sources said Rocawear may be ready to consider offers for a sale of the company, which is said to generate more than $125 million in wholesale volume. See Rocawear, Page4 PHOTO BY GEORGE CHINSEE PHOTO BY 2 WWD, MONDAY, SEPTEMBER 13, 2004 WWW.WWD.COM WWDMONDAY J.Lo Talks Scents, Shows at Macy’s Accessories/Innerwear/Legwear By Julie Naughton and Pete Born FASHION The spring collections kicked into high gear over the weekend with shows Jennifer Lopez in Jennifer Lopez in from Behnaz Sarafpour, DKNY, Baby Phat and Zac Posen. -

Country by Country Reporting

COUNTRY BY COUNTRY REPORTING PUBLICATION REPORT 2018 (REVISED) Anglo American is a leading global mining company We take a responsible approach to the management of taxes, As we strive to deliver attractive and sustainable returns to our with a world class portfolio of mining and processing supporting active and constructive engagement with our stakeholders shareholders, we are acutely aware of the potential value creation we operations and undeveloped resources. We provide to deliver long-term sustainable value. Our approach to tax is based can offer to our diverse range of stakeholders. Through our business on three key pillars: responsibility, compliance and transparency. activities – employing people, paying taxes to, and collecting taxes the metals and minerals to meet the growing consumer We are proud of our open and transparent approach to tax reporting. on behalf of, governments, and procuring from host communities – driven demands of the world’s developed and maturing In addition to our mandatory disclosure obligations, we are committed we make a significant and positive contribution to the jurisdictions in economies. And we do so in a way that not only to furthering our involvement in voluntary compliance initiatives, such which we operate. Beyond our direct mining activities, we create and generates sustainable returns for our shareholders, as the Tax Transparency Code (developed by the Board of Taxation in sustain jobs, build infrastructure, support education and help improve but also strives to make a real and lasting positive Australia), the Responsible Tax Principles (developed by the B Team), healthcare for employees and local communities. By re-imagining contribution to society. -

De Beers Debswana Enriching a Nation

De Beers Debswana ENRICHING A NATION www.debswana.com ENRICHING A NATION De Beers Debswana The world’s largest diamond producer by value, Debswana is Botswana’s largest private employer and arguably the biggest contributor to the country’s economic growth WORDS BY Will Daynes RESEARCH BY Peter Rowlston 2 [ ISSUE 83 ] BE WEEKLY BE WeeKLY [ ISSUE 83 ] DE BEERS DEBSWANA he mining industry has been an integral part of Botswana’s national H economy since the early 1990s. At “De Beers has continued to the heart of the industry for the better part of 25 years has been the country’s diamond identify ways to maximise sector, whose gem quality findings have seen the sustainable benefits Botswana solidify its position as the world’s leading producer of diamond by value. of Botswana’s natural Debswana is an important figure within this resources through the vital part of Botswana’s economy, producing in excess of 70 percent of the country’s export process of beneficiation” earnings, 30 percent of its Gross Domestic Product and 50 percent of government revenue. The originals of the company date back to 1969, when De Beers entered into a 50/50 joint obtained for its gems, is its Jwaneng Mine, venture with the government of Botswana to which became fully operational in August unlock the country’s rich diamond resources. 1982, when it was officially opened by the The joint venture, Debswana, is now the largest then President of Botswana. Currently being non-government employer in the country, mined to a depth of 350 metres, the resource employing approximately 6,300 people, itself consists of three separate volcanic 93 percent of them local. -

Rockslopes PRELIMS

THE SOUTH AFRICAN INSTITUTE OF MINING AND METALLURGY SYMPOSIUM SERIES S44 Stability of rock slopes in open pit mining and civil engineering situations THE SOUTH AFRICAN INSTITUTE OF MINING AND METALLURGY JOHANNESBURG 2006 SAIMM PUBLICATIONS THE MONOGRAPH SERIES Ml Lognormal-De Wijsian Geostatistics for Ore Evaluation (2nd ed. 1981) D.G. Krige M2 An Introduction to Geostatistical Methods of Mineral Evaluation (2nd ed. 1981) J.-M.M. Rendu M3 Principles of Flotation (1982) (3rd imp. 1986) Edited by R.P. King M4 Increased Underground Extraction of Coal (1982) Edited by C.J. Fauconnier and R.W.O. Kersten M5 Rock Mechanics in Mining Practice (1983) (3rd imp. 1986) Edited by S. Budavari M6 Assay and Analytical Practice in the South African Mining Industry (1986) W.C. Lenahan and R. de L. Murray-Smith M7 The Extractive Metallurgy of Gold in South Africa, 2 volumes (1987) Edited by G.G Stanley M8 Mineral and Metal Extraction — An Overview (1994) L.C. Woollacott and R.H. Eric M9 Rock Fracture and Rockbursts—an illustrative study (1997) Edited by W.D. Ortlepp THE SPECIAL PUBLICATIONS SERIES SPI Proceedings, Underground Transport Symposium (1986) Edited by R.C.R. Edgar SP2 Backfill in South African Mines (1988) SP3 Treatment and Re-use of Water in the Minerals Industry (1989) SP4 COREX Symposium 1990 (1990) Edited by H.M.W. Delport and P.J. Holaschke SP5 Measurement, Control, and Optimization in Mineral Processing (1994) Edited by H.W. Glen SP6 Handbook on Hard-rock Strata Control (1994) A.J.S. Spearing SP7 Rock Engineering for Underground Coal Mining (2002) J. -

“Non‐Managed Operations and Jvs” 1 Anglo American Debswana

“Non‐Managed Operations and JVs” Q1: 4 contiguous tailings dams Q6: The dam has been dormant since 1998 to March 2019. currently depositing temporarily from April 2019 until June 2019 (awaiting Orapa FRD3 completion). One paddock is currently Orapa Plant 1 Old Debswana Diamond Government of Botswana; De Beers Group Orapa‐‐21.296039, No, See Q20 for more No, See Q20 for more Anglo American Technical Standard (AA TS Yes, Yes, See Q20 for more Yes, Yes, See Q20 for more being used temporarily (sufficient freeboard) and the other 3 paddocks are full. Slimes dam operating manual available (no design) 1 Anglo American De Beers Botswana Orapa Slimes dams (A, B, C, D Non‐operated JV Active 1971 Upstream 16 28.8 28.9 2018 Minor No Both No Company of Companies 25.379076 information information 602 001) information information Q12: Design reports are not available paddocks) Q18: Conceptual only Q19: Plan in place in line with Anglo American's Long‐term Sustainable Mining Plan. Q6: Deposition was recently stopped Q15: FRD1 experienced signs of stress between 2002 and 2003. Engineers deemed it unsafe to continue operating at the time and recommended a new emergency dam, FRD2. The dam remained dormant from 2004 until 2016, after results of the stability analysis indicated that it could be recommissioned only after implementing some remedial work on it. 2019 Stability Debswana Diamond Government of Botswana; De Beers Group Orapa‐‐21.296039, Anglo American Technical Standard (AA TS Yes, 2016, See Q20 for Yes, Yes, See Q20 for more Yes, Yes, See Q20 for more analysis has shown low FoS, which are currently under further investigation. -

Eurostar Botswana Is the Largest Employer in Diamond

Eurostar Botswana is the largest employer in diamond manufacturing on the African continent Established in Antwerp, Belgium in 1978, Eurostar Diamond is the world’s largest From rough material to sparkling results. diamond manufacturer by value. DTC is the rough diamond sales and distribution arm of the De Beers Family of Companies, the number one diamond mining and trading company. The DTC sorts, values and sells approximately 75% of the world’s rough diamonds by value. In 2005 Eurostar Diamond earns a second DTC Sight in Botswana and Eurostar Botswana becomes a DTC Sightholder in its own right employing more than 450 people. PURELY NATURAL Eurostar Diamond is a certified Trained and coached by Eurostar Diamond Botswana, Diamond Trading Company Sightholder the Chinese expertise maximising the potential of each gem As one of the world’s leading diamond Our close relationship and longstanding To get our level of perfection, Eurostar Diamond Each Eurostar Diamond undergoes a stringent manufacturers, we aim to deliver the partnerships with key mining companies enable invested heavily in training and transfering skills analysis in order to extract every diamond’s highest possible value to all our stake- holders: from customers to suppliers to us to source and distribute both volume and to its employees. Experts from our state-of-the- potential. Hand-cut and hand-polished employees, wherever they may be in the variety in high quality, natural and untreated art factory in China were deployed to Botswana, combined with stunning technology to deliver world. Our goal is to continue to shape diamonds at the most competitive prices. -

Gemstones by Donald W

GEMSTONES By Donald W. olson Domestic survey data and tables were prepared by Nicholas A. Muniz, statistical assistant, and the world production table was prepared by Glenn J. Wallace, international data coordinator. In this report, the terms “gem” and “gemstone” mean any gemstones and on the cutting and polishing of large diamond mineral or organic material (such as amber, pearl, petrified wood, stones. Industry employment is estimated to range from 1,000 to and shell) used for personal adornment, display, or object of art ,500 workers (U.S. International Trade Commission, 1997, p. 1). because it possesses beauty, durability, and rarity. Of more than Most natural gemstone producers in the United states 4,000 mineral species, only about 100 possess all these attributes and are small businesses that are widely dispersed and operate are considered to be gemstones. Silicates other than quartz are the independently. the small producers probably have an average largest group of gemstones; oxides and quartz are the second largest of less than three employees, including those who only work (table 1). Gemstones are subdivided into diamond and colored part time. the number of gemstone mines operating from gemstones, which in this report designates all natural nondiamond year to year fluctuates because the uncertainty associated with gems. In addition, laboratory-created gemstones, cultured pearls, the discovery and marketing of gem-quality minerals makes and gemstone simulants are discussed but are treated separately it difficult to obtain financing for developing and sustaining from natural gemstones (table 2). Trade data in this report are economically viable deposits (U.S. -

De Beers - Wikipedia

6/23/2020 De Beers - Wikipedia De Beers De Beers Group is an international corporation that specialises in diamond exploration, diamond mining, diamond retail, diamond De Beers Group trading and industrial diamond manufacturing sectors. The company is currently active in open-pit, large-scale alluvial, coastal and deep sea mining.[4] It operates in 35 countries and mining takes Industry Mining and trading place in Botswana, Namibia, South Africa, Canada and Australia. of diamonds From its inception in 1888 until the start of the 21st century, De Beers controlled 80% to 85% of rough diamond distribution and was Founded 1888 accused of being a monopoly.[5] Competition has since dismantled Founder Cecil Rhodes the complete monopoly, though the De Beers Group still sells London, United [6] Headquarters approximately 35% of the world's rough diamond production Kingdom through its global sightholder and auction sales businesses.[7] Area served Worldwide The company was founded in 1888 by British businessman Cecil Key people Mark Cutifani Rhodes, who was financed by the South African diamond magnate (Chairman) Alfred Beit and the London-based N M Rothschild & Sons bank.[8][9] Bruce Cleaver In 1926, Ernest Oppenheimer, a German immigrant to Britain and (CEO) later South Africa who had earlier founded mining company Anglo Products Diamonds American with American financier J.P. Morgan,[10] was elected to Diamond marketing the board of De Beers.[11] He built and consolidated the company's Services and promotion global monopoly over the diamond industry until his death in 1957. During this time, he was involved in a number of controversies, Revenue $6.08 billion including price fixing and trust behaviour, and was accused of not (2018)[1] releasing industrial diamonds for the U.S. -

Investor Presentation June 2017 Disclaimer

Investor Presentation June 2017 Disclaimer The following presentations are confidential and are being made only to, and are only directed at, persons to whom such Presentations may lawfully be communicated (“relevant persons”). Any person who is not a relevant person should not act or rely on these presentations or any of their contents. Information in the following presentation relating to the price at which relevant investments have been bought or sold in the past or the yield on such investments cannot be relied upon as a guide to the future performance of such investments. This presentation does not constitute an offering of securities or otherwise constitute an invitation or inducement to any person to underwrite, subscribe for or otherwise acquire securities in any company within the Group. Neither this documentation nor the fact of its distribution nor the making of the presentation constitutes a recommendation regarding any securities. This presentation if for information purposes only. The presentation contains forward-looking statements which are subject to risk and uncertainties because they relate to future events. These forward-looking statements include, without limitation, statements in relation to the Group’s projected growth opportunities. Some of the factors which may cause actual results to differ from these forward-looking statements are discussed in certain slides of the presentation and others can be found by referring to the information contained under the heading “Principal risks and uncertainties” in “The Strategic Report” in our Annual Report for the year ended 2015. The Annual Report can be found on our website (www.gemdiamonds.com). No statement in this presentation is intended as a profit forecast or profit estimate and no statement in the presentation should be interpreted to mean that earnings per share for the current or future financial years would necessarily match or exceed the historical published earnings. -

PROSPECTUS US$1,500,000,000 Anglo American

PROSPECTUS US$1,500,000,000 Anglo American Capital plc US$850,000,000 3.625% Senior Notes due 2020 US$650,000,000 4.875% Senior Notes due 2025 Guaranteed by Anglo American plc This prospectus is being published by Anglo American Capital plc (the “Issuer”) in connection with Admission (as defined below) of its US$850 million of its 3.625% Senior Notes due 2020 (the “2020 Notes”) and US$650 million of its 4.875% Senior Notes due 2025 (the “2025 Notes” and, together with the 2020 Notes, the “Notes”) with such Notes to be guaranteed (the “Guarantees”) by Anglo American plc (the “Company”, “Guarantor” or “Anglo American” and, together with the Company’s subsidiaries, joint ventures and associates, “Anglo American Group”, the “Group”, “we”, “us” or “our”). Interest will be paid on the Notes semi-annually and in arrears on May 14 and November 14 of each year, commencing on November 14, 2015. The 2020 Notes and the 2025 Notes will mature on May 14, 2020 and May 14, 2025, respectively. The Issuer has the option to redeem all or a portion of the Notes at any time at the redemption prices set forth in this document. The Notes will be unsecured senior obligations of the Issuer and will rank equally with all of its other existing and future unsubordinated indebtedness. The Notes will be issued in fully registered form and only in denominations of US$200,000 and integral multiples of US$1,000 in excess thereof. For a more detailed description of the Notes, see “Description of the Notes and the Guarantees” beginning on page 141.