Marten & Co / Quoted Data Word Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Changing Times INVESTING for a NEW WORLD ORDER?

SUMMER 2018 Changing times INVESTING FOR A NEW WORLD ORDER? alliancetrustsavings.co.uk Welcome to the latest edition of Taking Stock. Changing times If this edition had a theme tune it might be something like Bob Dylan’s 1960s classic The Times They Are A-Changin’. Or at least that’s how it feels to many of us. US protectionism, Trump-style diplomacy, North Korea, Iran, Syria, Russia, China, Brexit, Facebook, Cambridge Analytica. These have all been headline makers for 2018 so far, and some have undoubtedly been implicated in increased market volatility. Around the world the political and economic power of nation states has always ebbed and flowed. Alliances are made and undone. And the fortunes of individual corporations rise and fall. But the question for investors today is, are we just looking at a variation on a theme of business as usual for the world’s established economic power base? Or is something else going on? Are we on the cusp of some more fundamental change in the world economic order? Keeping ahead of the curve Views on this matter because searching for growth necessarily involves looking ahead and understanding where the longer-term opportunities and threats are likely to be. In this edition of Taking Stock our expert contributors explore the potential implications of the developing picture. From how it’s influencing investment decisions today, to steps any investor can take to make the most of their money in uncertain times. As always, I hope you will find it an informative read. If you have any feedback or suggestions for future editions, please get in touch. -

Primary Market Fact Sheet

February 2016 Main Market Factsheet http://www.londonstockexchange.com UK Markets Analysis Fact sheets are located within the Statistics section Main Market Factsheet Table 1: Main - UK Listed Companies: New Issues (IPOs) February 2016 Equity and Fixed Interest New companies Issue Market Cap at New Money Company/ Issue type/ price admission (£m) raised Date Security Business sector (pence) (closing price) (£m)* 12/02/2016 ASCENTIAL PLC Placing 200.00 872.00 199.90 ORD GBP0.10 5555 - Media Agencies #REF! 10/02/2016 CMC MARKETS Placing 240.00 642.07 14.85 ORD GBP0.25 8777 - Investment Services #REF! 17/02/2016 COUNTRYSIDE PROPERTIES PLC Placing 225.00 1,080.00 130.00 ORD GBP1 3728 - Home Construction 08/02/2016 CYBG PLC Placing 0.00 1,785.01 0.00 ORD GBP0.10 5752 - Gambling 02/02/2016 GVC HLDGS PLC Placing transfer from AIM 422.00 1,490.40 150.00 ORD EUR0.01 5752 - Gambling 03/02/2016 HIGHLANDS NATURAL RESOURCES PLC Placing Re-admission 12.00 4.11 0.77 ORD GBP0.05 8995 - Nonequity Investment Instruments 15/02/2016 MEDICLINIC INTERNATIONAL PLC Placing Re-admission 832.00 7,144.05 600.00 ORD GBP0.10 4533 - Health Care Providers * Money raised figure in brackets is an of which fixed interest money raised Summary Money Money No. of Market raised No. of Market raised companies value (£m) (£m) companies value (£m) (£m) February 2016 Year to date New companies 4 4,379.08 344.75 7 4,388.62 351.75 of which Fixed Interest 0.00 0.00 Transfer 1 1,490.40 150.00 2 2,369.95 150.00 of which Fixed Interest 0.00 0.00 Relisting 2 7,148.16 600.76 2 7,148.16 -

Fidelity European Values PLC Annual Report

Fidelity European Values PLC Annual Report For the year ended 31 December 2012 Contents 1 Investment Objective and Highlights Financial Summary 2 Chairman’s Statement 3 Manager’s Review 5 Ten Largest Investments 7 Distribution of the Portfolio 8 Summary of Performance 10 Corporate Information 13 Board of Directors 14 Directors’ Report 15 Business Review 15 General 18 Statement of Directors’ Responsibilities 23 Corporate Governance Statement 24 Directors’ Remuneration Report 30 Financial Calendar 31 Independent Auditor’s Report 32 Financial Statements 33 Full Portfolio Listing 53 Notice of Meeting 55 Investing in Fidelity European Values PLC 58 Glossary of Terms 61 Warning to Shareholders – 63 Share Fraud Warning Investment Objective and Highlights The investment objective of the Company is to achieve long term capital growth from the stockmarkets of continental Europe The full text of the Company’s investment policy is on pages 15 and 16. Performance (year to 31 December 2012) Net Asset Value (“NAV”) per Share Total Return +24.7% Share Price Total Return +31.3% FTSE World Europe (ex UK) Index Total Return +17.8% As at 31 December 2012 Equity Shareholders’ Funds £616.3m Market Capitalisation £555.0m Final Dividend Proposed Per Ordinary Share 27.75p Capital Structure: Ordinary Shares of 25p each 43,127,073 Standardised Performance Total Return (%) 01/01/2012 01/01/2011 01/01/2010 01/01/2009 01/01/2008 to to to to to 31/12/2012 31/12/2011 31/12/2010 31/12/2009 31/12/2008 NAV per share +24.7 -11.5 +7.1 +11.3 -17.5 Share price +31.3 -8.6 -1.3 -

November 2020

November 2020 Monthly roundup | Real estate Kindly sponsored by Aberdeen Standard Investments Winners and losers in October Best performing funds in price terms Worst performing funds in price terms (%) (%) NewRiver REIT 28.7 Panther Securities (28.6) Schroder European REIT 27.4 Raven Property Group (20.3) Helical 15.1 Grit Real Estate Income Group (11.5) Workspace Group 14.6 Empiric Student Property (11.5) Standard Life Inv. Property Income 14.1 Ground Rents Income Fund (10.2) Alternative Income REIT 12.2 Secure Income REIT (9.4) CEIBA Investments 9.3 PRS REIT (9.3) BMO Real Estate Investments 7.8 GCP Student Living (9.2) Inland Homes 6.8 Sigma Capital Group (7.8) Real Estate Investors 6.3 Alpha Real Trust (7.2) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co kjjjj October finished with the threat of a second lockdown The heaviest share price faller in October – Panther looming over the UK as COVID-19 cases continued to rise. Securities – is very illiquid so its share price can be However, this did not dampen demand for shares in some distorted with one big transaction. Of the rest, Grit Real of the companies that have already been battered during Estate Income saw a double-digit fall in its share price after the pandemic, even before news of a potential vaccine reporting a big drop in NAV. Student accommodation breakthrough broke in early November. Successful sales specialists Empiric Student Property and GCP Student of retail assets by NewRiver REIT saw its share price Living both continue to be impacted by COVID-19, with bounce 28.7% in the month to top the table. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Marten & Co / Quoted Data Word Template

QuotedData Monthly roundup | Investment companies October 2016 Winners and losers in September Livermore Investments’ results were well received by Generally, NAVs were pretty strong in September with investors. It has been doing well on its CLO investments. few funds reporting falls. Juridica’s share price It is a similar story for EPE Special Opportunities weakened after it made a cash distribution to investors. although in its case the highlight of its results was the FastForward Innovations premium reduced a little. Many merger for one of its largest holdings. SVG Capital commodities funds investing in small companies sold off. received a bid from Harbourvest. SVG has since It is interesting to see Tritax Big Box REIT and HICL confirmed that it has had other approaches. US Traded Infrastructure on the list. Both funds have been popular Life Interests sold its portfolio and will soon wind up. with investors and raising cash but were trading at big Funds exposed to Japan and to gold did well. premiums to asset value. Best performing funds in price terms in September: Worst performing funds in price terms in September: (%) (%) Livermore Investments +39.3 Juridica -30.5 EPE Special Opportunities +26.4 FastForward Innovations -13.0 SVG Capital +21.7 Polo Resources -10.8 El Oro +18.2 Baker Steel Resources -8.1 US Traded Life Interests +18.0 Infrastructure India -7.8 Industrial Multi Property +16.4 Gresham House Strategic -6.0 UIL +16.1 Marwyn Value Investors -4.0 Macau Property Opportunities +13.9 Establishment -4.0 Hg Capital +13.3 Tritax -

Interim Report and Financial Statements

Fidelity Investment Funds Interim Report and Financial Statements For the six months ended 31 August 2020 Fidelity Investment Funds Interim Report and Financial Statements for the six month period ended 31 August 2020 Contents Director’s Report* 1 Statement of Authorised Corporate Director’s Responsibilities 2 Director’s Statement 3 Authorised Corporate Director’s Report*, including the financial highlights and financial statements Market Performance Review 4 Summary of NAV and Shares 6 Accounting Policies of Fidelity Investment Funds and its Sub-funds 9 Fidelity American Fund 10 Fidelity American Special Situations Fund 12 Fidelity Asia Fund 14 Fidelity Asia Pacific Opportunities Fund 16 Fidelity Asian Dividend Fund 18 Fidelity Cash Fund 20 Fidelity China Consumer Fund 22 Fidelity Emerging Asia Fund 24 Fidelity Emerging Europe, Middle East and Africa Fund 26 Fidelity Enhanced Income Fund 28 Fidelity European Fund 30 Fidelity European Opportunities Fund 32 Fidelity Extra Income Fund 34 Fidelity Global Dividend Fund 36 Fidelity Global Enhanced Income Fund 38 Fidelity Global Focus Fund 40 Fidelity Global High Yield Fund 42 Fidelity Global Property Fund 44 Fidelity Global Special Situations Fund 46 Fidelity Index Emerging Markets Fund 48 Fidelity Index Europe ex UK Fund 50 Fidelity Index Japan Fund 52 Fidelity Index Pacific ex Japan Fund 54 Fidelity Index Sterling Coporate Bond Fund 56 Fidelity Index UK Fund 58 Fidelity Index UK Gilt Fund 60 Fidelity Index US Fund 62 Fidelity Index World Fund 64 Fidelity Japan Fund 66 Fidelity Japan Smaller -

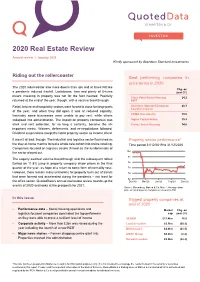

2020 Real Estate Review

2020 Real Estate Review Annual review | January 2021 Kindly sponsored by Aberdeen Standard Investments Riding out the rollercoaster Best performing companies in price terms in 2020 The 2020 rollercoaster saw more downs than ups and at times felt like Chg. on a pandemic induced freefall. Lockdowns, tiers and plenty of U-turns year (%) meant investing in property was not for the faint hearted. Positivity Triple Point Social Housing 24.2 returned at the end of the year, though, with a vaccine breakthrough. REIT Retail, leisure and hospitality sectors were forced to close for large parts Aberdeen Standard European 20.3 Logistics Income of the year, and when they did open it was at reduced capacity. Inevitably some businesses were unable to pay rent, while others CEIBA Investments 19.0 collapsed into administration. The impact on property companies was Sigma Capital Group 15.9 stark and rent collection, for so long a certainty, became the all- Civitas Social Housing 14.8 important metric. Waivers, deferments, and re-negotiations followed. Dividend suspensions swept the listed property sector as income dived. It wasn’t all bad, though. The industrial and logistics sector flourished as Property sector performance* the stay-at-home mantra forced a whole new cohort into online retailing. Time period 31/12/2019 to 31/12/2020 Companies focused on logistics assets thrived as the fundamentals of the sector played out. 102 94 The eagerly awaited vaccine breakthrough and the subsequent rollout fuelled an 11.8% jump in property company share prices in the final 86 quarter of the year, as hope of a return to some form of normality rose. -

CFA 2018 Winners

Communicate magazine WELCOME CONTENTS 4 Judges 8 Winners SPECIFICS 10 Best corporate website: FTSE 100 Crafting engaging, meaningful and 11 Best corporate website: FTSE 250 informative communications for the investment audience has never been 13 Best corporate website: AIM/small cap more important. With more scrutiny on business, increased regulation 14 Best corporate website: International and the pressure of the digital media landscape, companies have to ensure 15 Best corporate website: Unlisted CPI COLOUR PRODUCE their investor relations and corporate communications are operating at the 16 Best printed report: FTSE 100 highest possible standard. STUNNING, AWARD WINNING 18 Best printed report: FTSE 250 That’s why the Corporate & Financial Awards has, for the past seven years, 19 Best printed report: AIM/small cap ANNUAL REPORTS. OUR celebrated those companies who are setting the benchmark for excellence 20 Best printed report: International in communications. This year’s COMMITMENT TO QUALITY, winners are no different. They have 21 Best printed report: Unlisted exhibited creativity in undertaking the annual report, coherence and purpose 23 Best online report: FTSE 100 INNOVATION, EXCEPTIONAL when approaching corporate websites and effectiveness in media relations or 24 Best online report: FTSE 250 CLIENT SERVICE AND analyst engagement campaigns. They are among Europe’s best. 25 Best online report: AIM/small cap SECURITY COMPLIMENTS This year, we also celebrate two 26 Best online report: International agencies who have established themselves as the best in corporate 27 Best online report: Unlisted OUR EXTENSIVE PRINT AND and financial communications. Lansons, winning for the second 28 Best CSR or ESG report consecutive year, takes home the ‘Best IR agency or PR consultancy’ FINISHING PROCESSES. -

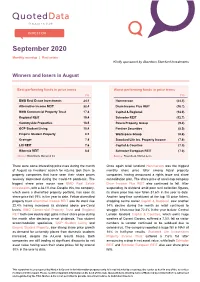

200910 August Property Roundup

September 2020 Monthly roundup | Real estate Kindly sponsored by Aberdeen Standard Investments Winners and losers in August Best performing funds in price terms Worst performing funds in price terms (%) (%) BMO Real Estate Investments 24.1 Hammerson (24.5) Alternative Income REIT 22.4 Drum Income Plus REIT (16.7) BMO Commercial Property Trust 17.4 Capital & Regional (14.0) Regional REIT 15.4 Schroder REIT (12.7) Countryside Properties 13.5 Raven Property Group (9.4) GCP Student Living 10.4 Panther Securities (8.9) Empiric Student Property 8.5 Workspace Group (8.4) Grainger 7.9 Standard Life Inv. Property Income (7.6) LXI REIT 7.6 Capital & Counties (7.5) Hibernia REIT 6.6 Schroder European REIT (7.0) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co kjjjj There were some interesting price rises during the month Once again retail landlord Hammerson was the biggest of August as investors’ search for returns took them to monthly share price faller among listed property property companies that have seen their share prices companies, having announced a rights issue and share severely depressed during the Covid-19 pandemic. The consolidation plan. The share price of small-cap company biggest share price mover was BMO Real Estate Drum Income Plus REIT also continued to fall. After Investments, with a 24.1% rise. Despite this, the company, suspending its dividend amid poor rent collection figures, which owns a diversified property portfolio, has seen its its share price has now fallen 51.6% in the year to date. share price fall 19% in the year to date. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327