2019 Interim Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Request for Recruitment Program of Foreign Experts Zheijang Final

EDUCATION & RESEARCH Request for Recruitment Program of Foreign Experts 1 Client : Zhejiang Normal University Industry : Higher Education Region : Jinhua, Zhejiang Province Zhejiang Normal University(ZNU) is one of the key universities of Zhejiang Province. ZNU emphasizes in teacher education with multiple branches of learning. The University consists of 19 colleges offering 61 undergraduate programs. It has an enrolment over Client Information (main 25,700 undergraduates, 5,000 postgraduates, and 15,000 adult students in various adult areas of activity, etc. ): education programs. The total staff is about 2,700. In 2009, ZNU became a doctoral degree project construction unit. Now there are 23 senior subject master degree programs and 11 professional degree Master programs. There are complete infrastructure, rich library resources, and advanced equipment in ZNU. 1. Leverage the key discipline platform of pure and applied mathematics to strengthen international and mainland academic exchange. Invite internationally well-known scholars to visit, give seminars or short courses to introduce research results and directions in Nature of Activity frontiers of mathematics. Elevate discipline’s international recognition and influence. Requirement for 2. Carefully select research topics. Choose topics with theoretical depth or those with Experts (main task, goal prospect of wide application and in the mainstream of mathematics with research content keeping with international frontiers. Initiate and develop new research direction. to be attained, etc. ): 3. Train high quality researchers. Strengthen the training of graduate students and young faculty members; improve their creativity and implementation skills. Thru short courses to systematically introduce the current state of research, research topics and research methods. Broaden the horizon and area of our research team. -

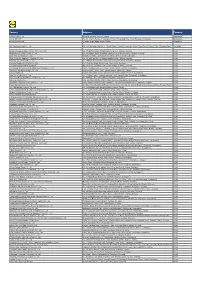

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

Witness Statement Of

Attachment 1: NCTO Review of Chinese Government Subsidies for Textile Industry Subsidy Relevance Description Financial 1 (Title Unknown) Specific Benefits under the 2006 Notice of Relevant Policies to Promote Chinese Textile Enterprises to Government funding for textile companies to set up distribution Shift to New Ways of Growth and Support Them to Go Global. -- WTO consistency questioned channels in overseas markets. 2 Brand Building Incentives (Shishi City of Applicable Shishi City of Fujian Province offers monetary incentives based on achievements in brand building. Award amounts range from RMB 100,000-500,000 Fujian Province) Under the city’s most recent award measures, textiles and apparel companies with well-known brand names recognized by the State Administration of Industry and Commerce or the Administration of Quality Supervision, Inspection and Quarantine can receive a lump-sum award of RMB 500,000; for companies with well-known export brand names, the award is RMB 400,000. In addition, companies that have received quality inspection waivers from the national government are eligible for awards of RMB 100 000 from the Shishi City government 3 Brand Development Fund Applicable The fund should serve the following purposes: To support companies in implementation of brand The Ministry of Commerce and the Ministry of Finance development programs, to support companies in participation of national and international, appropriate the fund to provincial governments who are required exhibitions., to support brand promotion activities, To support international exchanges, trainings to formulate their own measures on the administration of the and seminars related to brand building, and to support other public services that facilitate brand fund. -

![Directors, Supervisors and Parties Involved in the [Redacted]](https://docslib.b-cdn.net/cover/3590/directors-supervisors-and-parties-involved-in-the-redacted-1793590.webp)

Directors, Supervisors and Parties Involved in the [Redacted]

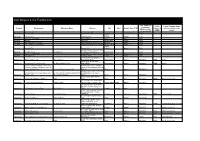

THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DIRECTORS, SUPERVISORS AND PARTIES INVOLVED IN THE [REDACTED] DIRECTORS Executive Directors Name Residential Address Nationality Mr. Sun Lianqing (孫連清) Room 3, Building E9 Chinese Paris City Versailles Jiaxing Zhejiang Province The PRC Mr. Xu Songqiang (徐松強) Room 206, Building A20 Chinese Dahua City Garden Nanhu District Jiaxing Zhejiang Province The PRC Non-executive Directors Name Residential Address Nationality Mr. He Yujian (何宇健) Room 203, Building 4 Chinese Haiyi Jiayuan Nanhu District Jiaxing Zhejiang Province The PRC Mr. Zheng Huanli (鄭歡利) Room 1005, Building 4 Chinese Zhongshan Mingdu Nanhu District Jiaxing Zhejiang Province The PRC Mr. Fu Songquan (傅松權) No. 278 Yucun Chinese Diankou Town Zhuji City Shaoxing Zhejiang Province The PRC –68– THIS DOCUMENT IS IN DRAFT FORM, INCOMPLETE AND SUBJECT TO CHANGE AND THAT THE INFORMATION MUST BE READ IN CONJUNCTION WITH THE SECTION HEADED “WARNING” ON THE COVER OF THIS DOCUMENT. DIRECTORS, SUPERVISORS AND PARTIES INVOLVED IN THE [REDACTED] Independent non-executive Directors Name Residential Address Nationality Mr. Xu Linde (徐林德) Room 2001, Building 9 Chinese Lanjiangyuan Tulip Bank Garden Wenyan Street Xiaoshan District Hangzhou City The PRC Mr. Yu Youda (于友達) Room 302, Unit 2 Chinese Building 12 Liuheyuan Shangcheng District Hangzhou City The PRC Mr. Cheng Hok Kai Frederick Flat C, 12th Floor British (鄭學啟) 10 Lai Wan Road Mei Foo Sun Chuen Kowloon Hong Kong SUPERVISORS Name Residential Address Nationality Ms. Liu Wen (劉雯) Room 302, Building 2 Chinese Tianxing Lake Apartment Nanhu District Jiaxing, Zhejiang Province The PRC Ms. -

Hangzhou Qiantang River Electric Group Co., Ltd

Hangzhou Qiantang River Electric Group Co., Ltd. A. Sales Reference in GCC Through Chinese Trading Company 2008.08.06 1MVA 11/0.416kV 1 QRE-IRAQ-08-01 IRAQ Ningbo Ville Enterprise Co., Ltd.( 630kVA 6.6/0.42kV 6 1600kVA Tel:86-574-88867775 3 QRE-IRANSTEEL-080 2008.07.19 6.6/0.42kV : 701 Fax 86-574-88867774 2000kVA 6 IRAN 6.6/0.42kV Aryana Petro Tavan Unit 264, 6th floor, Vali Asr-2 building, No. 31500kVA 2 2008.3.12 7, 36th St., Vali Asr Ave., Tehran 15167, 33/6.3kV QRE-Iran/trf-Arvand/PI2 IRAN 00801 Tel: (+98-21) 88 64 78 51 - 3 Fax: (+98-21) 88 64 78 46 2500kVA 6/0.42kV 2 Payvand Golestan Cement Co. 2500kVA 6/0.42kV 6 km.6 of Galikesh city of Golestan Province 2000kVA 6/0.42kV 1 0901/PGC-QRE/TRF/SU 2009-4-11 and around Nilkouh (Nil Fountain) PPLY www.pgcement.ir 1600kVA 6/0.42kV 2 Mr. Haj Abbas Gholi: (+98-912) 112 78 89 1 Hangzhou Qiantang River Electric Group Co., Ltd. B. Power Transformer Sales Reference (Chinese part) 1. 220kV Transformer Date Customer Type Qty. Contract No. Orient Hope Baotou Aluminum Industry 31.5MVA ONAN 220/10.5kV Power 2 Co., Ltd.(Mongolia) transformer 15.05.2003 RE High-tech Industrial Zone, Q-HBT-0602 200MVA ODAF 13.8/242kV Baotou City, NM.CN 2 Generator transformer Phone:0472-5959387 Henan Wanji Aluminum Industry Co., Ltd. 90MVA ONAF 220/35/10.5kV Power 12.04.2004 Wanji Industrial District, Xin’an 2 QT90MVA-0405 transformer County, Henan Province, China. -

Multiple Lineages of Dengue Virus Serotype 2 Cosmopolitan Genotype

www.nature.com/scientificreports OPEN Multiple Lineages of Dengue Virus Serotype 2 Cosmopolitan Genotype Caused a Local Dengue Outbreak Received: 13 August 2018 Accepted: 26 April 2019 in Hangzhou, Zhejiang Province, Published: xx xx xxxx China, in 2017 Hua Yu1, Qingxin Kong2, Jing Wang2, Xiaofeng Qiu1, Yuanyuan Wen2, Xinfen Yu1, Muwen Liu2, Haoqiu Wang1, Jingcao Pan1 & Zhou Sun2 During July to November 2017, a large dengue outbreak involving 1,138 indigenous cases occurred in Hangzhou, Zhejiang Province, China. All patients were clinically diagnosed as mild dengue. Epidemiology investigation and phylogenetic analysis of circulating viruses revealed that at least three lineages of dengue virus serotype 2 (DENV-2) Cosmopolitan genotype initiated the outbreak during a short time. The analysis of the time to most recent common ancestor estimated that the putative ancestor of these DENV-2 lineages might rise no later than March, 2017, suggesting independent introductions of these lineages into Hangzhou. We presumed that group travelers visiting dengue- endemic areas gave rise to multiple introductions of these lineages during so short a time. Co-circulating of multiple DENV-2 lineages, emerging of disease in urban areas, hot and humid weather in Hangzhou adequate for mosquito breeding, and limited dengue diagnosis abilities of local hospitals, were the reasons causing the large local outbreak in Hangzhou. Dengue is a mosquito-borne infectious disease caused by dengue viruses (DENVs) which consists of four anti- genically distinct but closely related serotypes (DENV-1, DENV-2, DENV-3, and DENV-4). Dengue prevails in tropical and sub-tropical regions worldwide. It has been estimated recently that a total of 58.40 million sympto- matic dengue viral infections, including 13.57 thousand fatal cases, occurred globally in 2013 (ref.1). -

Levi Strauss & Co. Factory List

Levi Strauss & Co. Factory List Published : March 2020 Total Number of LS&Co. Parent Company Name Employees Country Factory name Alternative Name Address City State Product Type (TOE) Initiatives (Licensee factories are (Workers, Staff, (WWB) blank) Contract Staff) Argentina Accecuer SA Juan Zanella 4656 Caseros Accessories <1000 Capital Argentina Best Sox S.A. Charlone 1446 Federal Apparel <1000 Argentina Estex Argentina S.R.L. Superi, 3530 Caba Apparel <1000 Argentina Gitti SRL Italia 4043 Mar del Plata Apparel <1000 Argentina Manufactura Arrecifes S.A. Ruta Nacional 8, Kilometro 178 Arrecifes Apparel <1000 Argentina Procesadora Serviconf SRL Gobernardor Ramon Castro 4765 Vicente Lopez Apparel <1000 Capital Argentina Spring S.R.L. Darwin, 173 Federal Apparel <1000 Asamblea (101) #536, Villa Lynch Argentina TEXINTER S.A. Texinter S.A. B1672AIB, Buenos Aires Buenos Aires <1000 Argentina Underwear M&S, S.R.L Levalle 449 Avellaneda Apparel <1000 Argentina Vira Offis S.A. Virasoro, 3570 Rosario Apparel <1000 Plot # 246-249, Shiddirgonj, Bangladesh Ananta Apparels Ltd. Nazmul Hoque Narayangonj-1431 Narayangonj Apparel 1000-5000 WWB Ananta KASHPARA, NOYABARI, Bangladesh Ananta Denim Technology Ltd. Mr. Zakaria Habib Tanzil KANCHPUR Narayanganj Apparel 1000-5000 WWB Ananta Ayesha Clothing Company Ltd (Ayesha Bangobandhu Road, Tongabari, Clothing Company Ltd,Hamza Trims Ltd, Gazirchat Alia Madrasha, Ashulia, Bangladesh Hamza Clothing Ltd) Ayesha Clothing Company Ltd( Dhaka Dhaka Apparel 1000-5000 Jamgora, Post Office : Gazirchat Ayesha Clothing Company Ltd (Ayesha Ayesha Clothing Company Ltd(Unit-1)d Alia Madrasha, P.S : Savar, Bangladesh Washing Ltd.) (Ayesha Washing Ltd) Dhaka Dhaka Apparel 1000-5000 Khejur Bagan, Bara Ashulia, Bangladesh Cosmopolitan Industries PVT Ltd CIPL Savar Dhaka Apparel 1000-5000 WWB Epic Designers Ltd 1612, South Salna, Salna Bazar, Bangladesh Cutting Edge Industries Ltd. -

K-Citymarket Factory List Updated August 20Th2018

K-Citymarket Factory list Updated August 20 th 2018 Factory name Address City Province Country Hop Yick (Bangladesh) Ltd Plot #44-46, Depz (West Zone), Ganokbari, Ashuliasavar Dhaka Bangladesh Mondol Fabrics Ltd. Nayapara, Kashimpur Gazipur Dhaka Bangladesh Parkstar Apparel Ltd Kunia, Kb Bazar,Gazipur Sador, Gazipur Dhaka Bangladesh Shangu Tex Ltd - 2 Dusaid, Ashulia, Savar, Dhaka Dhaka Dhaka Bangladesh Z&Z Intimates Ltd Plot # 1, 2, 3, Road # 02, (Factory Bay Area), Cepz, Chittagong, Chittagong Chittagong Bangladesh Tianyan International (Cambodia)Fashion Co.,Ltd Phum Khva, Sangkat Dongkor, Khan Dongkor, Phnom Penh Phnom Penh Cambodia Municipal Shang Xuan Leather Products Factory No. 6 Li He Street, Li Heng Village, Qingxi Town Dongguan Guangdong China Beijing Joywin Fashion Textile Co. Ltd. No. 3, Ying Quan Street, Yan Qing County Beijing Beijing China Kahung Luggage (Zhangzhou) Co., Ltd Jinmin Road, Beidou Industrial Zone, Jinfeng Economic Development Zone, Zhangzhou Fujian China Bole Shoes Co., Ltd No. 18, Xinya Road, Sanxi Industry Park, Ouhai, Wenzhou Zhejiang China Wenzhou Jiediya Shoes Co.Ltd Dongshou 2nd Floor, No.140, Daluoshan Road, Economic Development Wenzhou Zhejiang China Zone Wenzhou Lihui Shoes Industrial Co., Ltd Yunzhou Industrial Area, Feiyun Town, Ruian Zhejiang China Changzhou Hepu Garments Co.,Ltd No.58 Zhongxing Road,Jintan, Changzhou Jiangsu China Rugao Dingfeng Knitting Textiles Co.,Ltd No 186,Taoli Road,Xiayuan Town,Rugao, Nantong Jiangsu China Taicang Jiebin Garment And Accessory Factory 58 Gangkou Rd, Liuhe -

SUPPLIER LIST AUGUST 2019 Cotton on Group - Supplier List 2

SUPPLIER LIST AUGUST 2019 Cotton On Group - Supplier List _2 COUNTRY FACTORY NAME SUPPLIER ADDRESS STAGE TOTAL % OF % OF % OF TEMP WORKERS FEMALE MIGRANT WORKER WORKERS WORKER CHINA NINGBO FORTUNE INTERNATIONAL TRADE CO LTD RM 805-8078 728 LANE SONGJIANG EAST ROAD SUP YINZHOU NINGBO, ZHEJIANG CHINA NINGBO QIANZHEN CLOTHES CO LTD OUCHI VILLAGE CMT 104 64% 75% 6% GULIN TOWN, HAISHU DISTRICT NINGBO, ZHEJIANG CHINA XIANGSHAN YUFA KNITTING LTD NO.35 ZHENYIN RD, JUEXI STREET CMT 57 60% 88% 12% XIANGSHAN COUNTY NINGBO CITY, ZHEJIANG CHINA SUNROSE INTERNATIONAL CO LTD ROOM 22/2 227 JINMEI BUILDING NO 58 LANE 136 SUP SHUNDE ROAD, HAISHU DISTRICT NINGBO, ZHEJIANG CHINA NINGBO HAISHU WANQIANYAO TEXTILE CO LTD NO 197 SAN SAN ROAD CMT 26 62% 85% 0% WANGCHAN INDUSTRIAL ZONE NINGBO, ZHEJIANG CHINA ZHUJI JUNHANG SOCKS FACTORY DAMO VILLAGE LUXI NEW VILLAGE CMT 73 38% 66% 0% ZHUJI CITY ZHEJIANG CHINA SKYLEAD INDUSTRY CO LIMITED LAIMEI INDUSTRIAL PARK SUP CHENGHAI DISTRICT, SHANTOU CITY GUANGDONG CHINA CHUANGXIANG TOYS LIMITED LAIMEI INDUSTRIAL PARK CMT 49 33% 90% 0% CHENGHAI DISTRICT SHANTOU, GUANGDONG CHINA NINGBO ODESUN STATIONERY & GIFT CO LTD TONGJIA VILLAGE, PANHUO INDUSTRIAL ZONE SUP YINZHOU DISTRICT NINGBO CITY, ZHEJIANG CHINA NINGBO ODESUN STATIONERY & GIFT CO LTD TONGJIA VILLAGE, PANHUO INDUSTRIAL ZONE CMT YINZHOU DISTRICT NINGBO CITY, ZHEJIANG CHINA NINGBO WORTH INTERNATIONAL TRADE CO LTD RM. 1902 BUILDING B, CROWN WORLD TRADE PLAZA SUP NO. 1 LANE 28 BAIZHANG EAST ROAD NINGBO ZHEJIANG CHINA NINGHAI YUEMING METAL PRODUCT CO LTD NO. 5 HONGTA ROAD -

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI, -

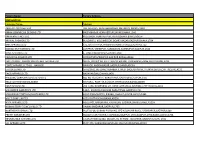

Brand Supplier/Agent Name COO Factory Name Factory Address

Brand Collective Overseas Supplier List - Version 4, 07 DECEMBER 2017 © Brand Collective Pty Ltd Supplier Brand Supplier/Agent name COO Factory name Factory Address Type CLARKS SHUCRAFT KAILICHENG SHOES LTD CHINA QIANG XING FOOTWEAR LTD NO.3 OF FIRST LANE LONGZHU ROAD,NANQU SHANG TANG INDUSTRIAL ZONE ,ZHONGSHAN CITY ,GUANGDONG PROVINCE AGENT CLARKS MACRO WAY INTERNATIONAL CORP. INDONESIA PT. SHOU FONG LASTINDO PANGMIAO, GANGPING TOWN, HUAJI, ZHAOQING AGENT CLARKS LINK-HO (JINJIANG) IMP. & EXP. CO., LTD. CHINA JIANJIANG JIEFU SHOES CO LTD。 CHIDIAN INDUSTRIAL ZONE, CHIDIAN TOWN JINJIANG AGENT CLARKS LINK-HO (JINJIANG) IMP. & EXP. CO., LTD. CHINA FUJIAN HONGPENG SHOES CO.,LTD YANGGUAN EAST RD. ,HUATINGKOU ,CHENDAI TOWN,JINJIANG CITY AGENT CLARKS JIALIANG INTERNATIONAL CO., LTD CHINA FUYANG FUYUAN SHOES CO.,LTD CHANGLING VILLAGE,YONGCHANG TOWN,FUYANG DISTRIC,HANGZHOU CITY,ZHEJIANG PROVINCE,CHINA AGENT CLARKS KARINDO PUTRA JAYA INDONESIA KARINDO PUTRA JAYA BYPASS KRIAN,DESA BALONG BENDO KM. 17 SIDOARJO,INDONESIA DIRECT CLARKS EVER SMART INTERNATIONAL ENTERPRISE LTD. CHINA WENZHOU JIETU(AOLUN) SHOES FACTORY NO.8 SHUANGBAO WEST ROAD, OUHAI ECONOMIC DEVELOPM P.C. 325014, WENZHOU, CHINA AGENT CLARKS EVER SMART INTERNATIONAL ENTERPRISE LTD. CHINA STRONG MAN 3515 SHOE CO LTD。 NO.197 RENMIN DONG ROAD. LUOHE HENAN,CHINA AGENT CLARKS JINJIANG XINYU SHOES CO., LTD CHINA JINJIANG XINYU SHOES CO., LTD NO.17 YONGJUN ROAD XINBIN TOWN JINJIANG CITY FUJIAN PROVINCE ,CHINA DIRECT CLARKS CORTINA CHINA LTD CHINA CORTINA CHINA LTD NIU DUN INDUSTRIAL ESTATE,HENGLI, WANG NIU DUN, DONGGUAN 523216,GUANGDONG PROVINCE,CHINA AGENT CLARKS HOME FUN SHOES CO., LTD MYANMAR MYANMAR SOE SAN WIN MANUFACTURING CO., LTD. -

Urban Heat Island Study Based on Landsat Remote Sensing Images: a Case Study of Hangzhou

International Journal of Industrial Electronics and Electrical Engineering, ISSN(p): 2347-6982, ISSN(e): 2349-204X Volume-5, Issue-12, Dec.-2017, http://iraj.in URBAN HEAT ISLAND STUDY BASED ON LANDSAT REMOTE SENSING IMAGES: A CASE STUDY OF HANGZHOU 1RUI WANG, 2WANGCHONGYU PENG, 3WEI CHEN, 4WEIJUN GAO 1,2,3,4Master Student, Master Student, PhD Student, Professor E-mail: [email protected], [email protected], [email protected], [email protected] Abstract— Urban is the center of the region society, economy, politics and culture. And urban is a symbol of human civilization and development. Urbanization is a common trend in many countries. In developing countries, this situation is particularly evident. With rapid urbanization, there are lots of environment problems. Among these environmental problems, the urban heat island effect is the most important. UHI has deep impacts on material cycles and energy transfers within urban ecosystems and has become an important issue in urban climate and environmental research. Hangzhou is an important city in the urban circle of the Yangtze River delta as the capital of Zhejiang Province in China. And nowadays, Hangzhou is in a period of rapid development. With the development of urban, the environmental problems become more and more important, especially the urban heat island effect. This paper, based on the Multi-time-phase TM /ETM+ Remote Sensing images, takes Hangzhou as an example to contrast four time inversions results and study the evolution rule and the characteristic of the heat island effect with Single-Channel Algorithm. Through this study, we can find the evolution law of urban heat island in Hangzhou.