2015 Vehicle Technologies Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Magna Seating Overview

Magna Seating Overview May 7, 2012 Seating Product Capabilities • Reconfigurable Seat Systems • In-Vehicle Stowable Seats • Manual & Power Recliners • Ease of Ingress/Egress – Disc • Comfort Systems – Pawl & Sector • Lightweight Seat Solutions – Fold Flat • Safety Systems Integration • Seat Structures & Mechanisms – Integrated Restraints • Manual & Power Adjusters – Integrated Side Impact Airbags – Fore/Aft & Lift • Seat Attach Latches – Integrated OCS • Specialty Mechanisms – Integrated Child Seats – Stow-in-Floor – Stand Up – Reversible Date Disclosure or duplication without consent is prohibited 2 Seating – Integrated Expertise + Consumer & Market Research Benchmarking Innovation Development Process (IDP) Product Delivery Process (PDP) Program Management Product Design Engineering Design for Six Sigma (DFSS) CAE Validation/Test Validation Interior & Electronic Integration Styling & Craftsmanship Comfort Development Manufacturing/Assembly & Sequencing Quality Systems Engineering Change Management Date ContinuousDisclosure Improvement/Cost or duplication without consent Management is prohibited 3 61 vehicles • 16 brands Chrysler /Fiat Group Volkswagen Daimler Renault / Nissan • Grand Dodge Caravan (NA & China) • VW Passat (NA) • Smart Fortwo (EU) • Renault Trafic / Nissan Primastar • Chrysler Town & Country (NA & China) • VW Routan (NA) • Mercedes Actros / Atego / Axor (Heavy (EU) • Chrysler Voyager (China) • VW Caddy (Europe) Duty) (EU) • Nissan Pathfinder / Navara (EU) • Jeep Grand Cherokee • VW Transporter Shuttle (Europe) • Mercedes-Benz -

Special Power Report Kia Kia Leads All Industry Brands in 2016 Initial Quality Study Soul and Sportage Receive Initial Quality Awards

July 2016 J.D. POWER Special Power Report Kia Kia Leads All Industry Brands in 2016 Initial Quality Study Soul and Sportage Receive Initial Quality Awards ia ranks highest among all automotive industry nameplates in the J.D. Power 2016 U.S. Initial Quality StudySM (IQS). This significant milestone comes just one year after Kia ranked K In ranking highest second overall in the 2015 IQS. It also represents the first time in among all brands 27 years that a non-luxury brand has led the industry in the U.S. industry-wide, Initial Quality Study. In addition to its industry-leading performance Kia earns an this year, Kia produces two award-recognized models: the 2016 overall score of 83 Soul in the Compact MPV segment (second consecutive year) and problems per 100 the 2016 Sportage in the Small SUV segment. vehicles (PP100) in the 2016 U.S. IQS, which exceeds industry average by 22 PP100 and represents a 3-point improvement 2016 NAMEPLATE IQS RANKING from 86 PP100 in 2015. Problems per 100 Vehicles (PP100) • Lower Score = Higher Quality The 2016 U.S. IQS evaluates eight problem categories that Kia 83 Porsche 84 comprise initial quality: Hyundai 92 • Exterior Toyota 93 BMW 94 • Driving Experience Chevrolet 95 • Features/Controls/Displays (FCD) Buick 96 • Audio/Communication/Entertainment/Navigation (ACEN) Lexus 96 • Seats Lincoln 96 • Heating, Ventilation, and Air Conditioning (HVAC) Nissan 101 Ford 102 • Interior GMC 103 • Engine/Transmission Infiniti 103 Volkswagen 104 The IQS measures both defects/malfunctions and design- Industry Average 105 related problems—features that may be operating as intended but are poorly located or difficult to use. -

Transit Energy Use Reduction Plan

Lake Country Transit Energy Use Reduction Plan Energy Use Reduction, Capital Expenditure, Funding and Management/Training Plan December 2015 Prepared by ICF International 620 Folsom St, Suite 200 San Francisco, CA 94107 415.677.7100 Lake Country Transit Energy Use Reduction Plan Table of Contents Table of Contents Executive Summary ............................................................................................................................. 1 1 Energy Use Reduction Plan ............................................................................................................ 4 1.1 Introduction ................................................................................................................................ 4 1.2 Facility ......................................................................................................................................... 6 1.2.1 Review of Existing Facility and Operations .................................................................................6 1.2.2 Facility, Operations and Maintenance Strategies .......................................................................7 1.3 Vehicle Fleet and Alternative Fuels .......................................................................................... 16 1.3.1 Review of Fleet Operations ...................................................................................................... 16 1.3.2 Alternative Fuel Options ......................................................................................................... -

Impacts of Changing Transportation Trends and New Mobility Technologies on Future Parking Demand

Downtown Parking Study White Paper #7: Impacts of Changing Transportation Trends and New Mobility Technologies on Future Parking Demand 1.0 Introduction Parking is inseparably tied to how people and goods move in a city and is significantly impacted by how people choose to travel. With a changing landscape of mobility technologies that enable access to a variety of travel modes, the role of parking in downtown areas is likely to change dramatically in the future. This paper explores how changes in transportation trends and new mobility technologies are likely to impact parking demand in the future. It also identifies tools and information that the City of Hood River can use to better balance the promise and perils related to new mobility future. 2.0 New Mobility Options Figure 1 shows how the landscape of mobility has changed since 2013. Before 2013, access to private automobile travel was limited to people who owned, rented, or used traditional taxi services. Since 2013, car sharing services and ridehailing apps allow vehicles to be shared or rented for single trips and short periods of time. In the future, people may be able to access an autonomous vehicle without the need to drive it or hire another person to drive the vehicle. Figure 1: Growth of Shared Mobility, 2013‐2018 Similarly, since 2013, mode choice has expanded from the traditional modes (drive alone, walk, bike, taxi, and transit) to include carshare, bikeshare, ridehailing, microtransit, e‐scooters, e‐bikes, etc. Central to these options is the concept of shared mobility, the technology that enables users to have short‐term access to a fleet of shared vehicles on an as‐needed basis. -

Master Thesis

Master Thesis Designing Value Propositions for Disruptive Innovations; Exploring Value Proposition Design in the Case of Electric Vehicles Author: J.G.A. (Jilles) Visser Student number: 10475699 Supervisor: dr. R. Bohnsack Date of submission: July 2, 2015 Study programme: MSc Executive Programme in Management Studies Track: Strategy Faculty: Faculty of Business and Economics Statement of Originality This document is written by Jilles Visser who declares to take full responsibility for the contents of this document. I declare that the text and the work presented in this document is original and that no sources other than those mentioned in the text and its references have been used in creating it. The Faculty of Economics and Business is responsible solely for the supervision of completion of the work, not for the contents. Abstract From disruptive innovation theory as well as from business model theory it has been argued that a good business model can compensate for the technological shortcomings that hinder further market penetration of a disruptive innovation. However little empirical research about this phenomenon exists. Because the value proposition is considered to be the central part of the business model, this thesis explores how value propositions are designed to increase the attractiveness of a disruptive innovation for the mainstream market. The electric vehicle, which is an example of a disruptive innovation, serves as the context for this study. By studying the value proposition, this thesis tries to respond to the quest to add more empirical insights from diverse disciplines about what factors contribute to success of the electric vehicle. Using a multiple case study approach, the value proposition of thirteen electric vehicles that are sold in the Netherlands and/or United States is analyzed. -

On-Street Car Sharing Pilot Program Evaluation Report

On-Street Car Sharing Pilot Evaluation On-Street Car Sharing Pilot Program Evaluation Report JANUARY 2017 SAN FRANCISCO MUNICIPAL TRANSPORTATION AGENCY | SUSTAINABLE STREETS DIVISION | PARKING 1 On-Street Car Sharing Pilot Evaluation EXECUTIVE SUMMARY GOAL: “MAKE TRANSIT, WALKING, BICYCLING, TAXI, RIDE SHARING AND CARSHARING THE PREFERRED MEANS OF TRAVEL.” (SFMTA STRATEGIC PLAN) As part of SFpark and the San Francisco Findings Municipal Transportation Agency’s (SFMTA) effort to better manage parking demand, • On-street car share vehicles were in use an the SFMTA conducted a pilot of twelve on- average of six hours per day street car share spaces (pods) in 2011-2012. • 80% of vehicles were shared by at least ten The SFMTA then carried out a large-scale unique users pilot to test the use of on-street parking • An average of 19 unique users shared each spaces as pods for shared vehicles. The vehicle monthly On-Street Car Share Parking Permit Pilot (Pilot) was approved by the SFMTA’s Board • 17% of car share members reported selling of Directors in July 2013 and has been or donating a car due to car sharing operational since April 2014. This report presents an evaluation of the Pilot. Placing car share spaces on-street increases shared vehicle access, Data from participating car share convenience, and visibility. We estimate organizations show that the Pilot pods that car sharing as a whole has eliminated performed well, increased awareness of thousands of vehicles from San Francisco car sharing overall, and suggest demand streets. The Pilot showed promise as a tool for on-street spaces in the future. -

The Dealership of Tomorrow 2.0: America’S Car Dealers Prepare for Change

The Dealership of Tomorrow 2.0: America’s Car Dealers Prepare for Change February 2020 An independent study by Glenn Mercer Prepared for the National Automobile Dealers Association The Dealership of Tomorrow 2.0 America’s Car Dealers Prepare for Change by Glenn Mercer Introduction This report is a sequel to the original Dealership of Tomorrow: 2025 (DOT) report, issued by NADA in January 2017. The original report was commissioned by NADA in order to provide its dealer members (the franchised new-car dealers of America) perspectives on the changing automotive retailing environment. The 2017 report was intended to offer “thought starters” to assist dealers in engaging in strategic planning, looking ahead to roughly 2025.1 In early 2019 NADA determined it was time to update the report, as the environment was continuing to shift. The present document is that update: It represents the findings of new work conducted between May and December of 2019. As about two and a half years have passed since the original DOT, focused on 2025, was issued, this update looks somewhat further out, to the late 2020s. Disclaimers As before, we need to make a few things clear at the outset: 1. In every case we have tried to link our forecast to specific implications for dealers. There is much to be said about the impact of things like electric vehicles and connected cars on society, congestion, the economy, etc. But these impacts lie far beyond the scope of this report, which in its focus on dealerships is already significant in size. Readers are encouraged to turn to academic, consulting, governmental and NGO reports for discussion of these broader issues. -

The Global EV Market 5

MASTERS IN FINANCE EQUITY RESEARCH TESLA MOTORS, INC COMPANY REPORT CONSUMER GOODS 05 DECEMBER 2014 STUDENT: FREDERIC MÜLLER (#774) [email protected] Emotionally Charged? Recommendation: BUY Vs Previous Recommendation Buy Profitability is determined by mass-market entrance Price Target FY15: 249.22 € . As of today the company is serving a luxury niche Vs Previous Price Target 221.71€ market. The successful exit into the mass-market lies at the very Price (as of 02-Jan-2015) 180.10 € heart of Tesla’ profitability. Therefore the share price will highly Reuters: TSLA.OQ, Bloomberg: TSLA:US depend on the acceptance of electronic vehicles as a substitute for conventional cars. 52-week range (€) 103.71 – 221.04 Market Cap (€m) 23.443,97 . EV market growth is driven by technological break- Outstanding Shares (m) 124.62 throughs as well as governmental incentives. The latter is still 50 day moving average 186.78 Source: Bloomberg lacking sufficient engagement in many countries. Our model ex- 180% 200% pects the company to be profitable after taxes only in 2016, despite 160%180% Company vs PSI20 140%160% 200 140% perceptible revenue growth, implying negative EPS until then. R&D 120% 120% 100%150 100% expenses are as high as 13.79% of revenues in 2014 demonstrat- 80% 80% 60%100 60% ing the firm’s intentions to tackle technological innovations. 40% 40%50 . High CAPEX will diminish cash flow to investors over 20%20% 0%0%0 01/1412/1302/1401/1403/1402/1404/1403/1405/1404/1406/1405/1407/1406/1408/1407/1409/1408/1410/1409/1411/1410/1412/1411/1401/1512/14 01-01-08 01-03-08 30-04-08 29-06-08 years to come with projected positive cash flows in 2018. -

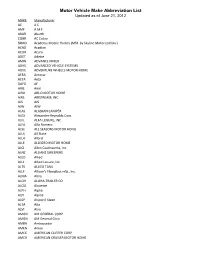

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

See Full List of Supported Cars

Best automotive diagnostic tool on market! Date: 2019.04.02 Package Full Dashboard List of supported car models CARS\ACURA\93C46 CARS\ACURA\93C56 V1 CARS\ACURA\93C56 V2 CARS\ACURA\ILX 93C66 CARS\ACURA\INTEGRA 93C66 CARS\ACURA\MDX\2005 93C56 CARS\ACURA\MDX\2008 93C76 CARS\ACURA\MDX\2016 93C66 CARS\ACURA\MDX\93C56 V2 CARS\ACURA\RDX\2008 93C66 CARS\ACURA\RDX\2013 93C66 CARS\ACURA\RDX\93C56 CARS\ACURA\RDX\93C66 CARS\ACURA\RL 93C66 CARS\ACURA\RSX\93C46 CARS\ACURA\RSX\93C66 CARS\ACURA\TL\93C46 CARS\ACURA\TL\93C66 CARS\ACURA\TL\93C86 CARS\ACURA\TSX\93C46 CARS\ACURA\TSX\93C66 CARS\ACURA\TSX\93C86 CARS\AIXAM\DASHBOARD 95020 CARS\ALFA\145/146\Motorola 64 PIN QFP CARS\ALFA\145/146\ST6249 CARS\ALFA\147 VDO - OBDII CARS\ALFA\147\147 93C86 CARS\ALFA\147\147 NEC CARS\ALFA\147\147 VDO - OBDII CARS\ALFA\155/164 CARS\ALFA\156\156 ...2002 CARS\ALFA\156\156 2002... CARS\ALFA\159\159 93C86 CARS\ALFA\159\159 VDO - OBDII CARS\ALFA\166\166 ...2002 HC11 CARS\ALFA\166\166 2002... 93C56 CARS\ALFA\4C - OBDII Page 1 Best automotive diagnostic tool on market! Date: 2019.04.02 CARS\ALFA\BRERA\BRERA 93C86 CARS\ALFA\BRERA\BRERA VDO - OBDII CARS\ALFA\ECU\EDC15 24C02 V1 CARS\ALFA\ECU\EDC15 24C02 V2 CARS\ALFA\ECU\EDC15 SP08 CARS\ALFA\ECU\EDC16 - OBDII CARS\ALFA\ECU\EDC16 95160 CARS\ALFA\ECU\EDC16 95640 CARS\ALFA\ECU\HSFI-2.0-2.5 - OBDII CARS\ALFA\ECU\IAW.4AF-4SF - OBDII CARS\ALFA\ECU\IAW.59F - OBDII CARS\ALFA\ECU\IAW.5SF Diagn. -

2018 Annual Report

2018 ANNUAL REPORT 2018 ANNUAL REPORT AND FORM 20-F 2 2018 | ANNUAL REPORT 2018 | ANNUAL REPORT 3 Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes No Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act. Large accelerated filer Accelerated filer Non-accelerated filer Emerging growth company If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: U.S. -

25 Jahre Chrysler Minivans – Ein Vierteljahrhundert Der Innovationen

25 Jahre Chrysler Minivans – ein Vierteljahrhundert der Innovationen Die Minivan-Formel Im Jahr 1977 begann ein kleines Team von Chrysler Designern und Ingenieuren an etwas zu arbeiten, dass sie den “Magic Wagon” nannten. Als das Projekt 1980 offiziell verabschiedet wurde, war der daraus neu entstehende “Minivan” so komfortabel wie jeder andere traditionelle amerikanische Kombi, dabei aber geräumiger, vielseitiger und ökonomischer – und passte außerdem in eine durchschnittliche amerikanische Garage. Ein Vorderradantrieb war die Grundvoraussetzung für einen Innenraum mit durchgehend flachem Boden. Leichter Zugang und einfache Beladung waren ebenso wichtige Kriterien und führten zu einer seitlichen Schiebetür, einer einteiligen Heckklappe und klappbaren Sitzen, die bei Bedarf auch ganz herausgenommen werden konnten. Der Dodge Caravan und Plymouth Voyager debütierten schließlich im Jahr 1983 als Fahrzeuge, in die Freunde und Familie wie in ein ganz normales Auto einstiegen konnten, statt wie bei einem ausgewachsenen Van ins Führerhaus hochklettern zu müssen. 1983-1984 Der erste Minivan wird vorgestellt (“T-115”, erster kleiner Van mit Vorderradantrieb). 2. November 1983 – Chrysler-Vorstandsvorsitzender Lee A. Iacocca startet die Produktion des ersten Minivan im Werk Windsor in Ontario, Kanada. Zu den ersten Modellen zählen der Dodge Caravan, der Dodge Caravan C/V und der Plymouth Voyager. Im ersten vollen Verkaufsjahr werden 210.000 Caravan und Voyager ausgeliefert. Bei einer Rentabilitätsgrenze von 155.000 Einheiten jährlich spielt der Minivan eine tragende Rolle bei der Rückkehr der Chrysler Corporation zu einem profitablen Unternehmen. Das US amerikanische ‚Zinc Institut‘ verlieh dem Minivans (Plymouth Voyager) 1984 ihren ersten Preis: “Excellence in Corrosion Protection”, für ihre beispielhafte Korrosionsvorsorge. 1985 Das Magazin “Car and Driver” wählt den Plymouth Voyager zu einem der “10 Besten”.