Petrochemical Industry Roadmap by Homer Maranan, APMP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Petron Corporation PCOR

C00168-2018 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. Date of Report (Date of earliest event reported) Jan 12, 2018 2. SEC Identification Number 31171 3. BIR Tax Identification No. 000-168-801 4. Exact name of issuer as specified in its charter PETRON CORPORATION 5. Province, country or other jurisdiction of incorporation Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office San Miguel Head Office Complex, 40 San Miguel Avenue, Mandaluyong City Postal Code 1550 8. Issuer's telephone number, including area code (63 2) 886-3888, 884-9200 9. Former name or former address, if changed since last report N/A 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Number of Shares of Common Stock Outstanding and Amount Title of Each Class of Debt Outstanding COMMON (PCOR) 9,375,104,497 PREFERRED SERIES 2A (PRF2A) 7,122,320 PREFERRED SERIES 2B (PRF2B) 2,877,680 PCOR SERIES A BONDS DUE 2021 (IN MIL 13,000 PESO) PCOR SERIES B BONDS DUE 2023 (IN MIL 7,000 PESO) TOTAL DEBT AS OF SEPT 30, 2017 (IN MIL 226,694 PESO-CONSO) 11. Indicate the item numbers reported herein Item 9. The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. -

Sustainability— What Matters?

sustainability — what matters? published by Governance & Accountability Institute, Inc. 845 Third Avenue, Suite 644 New York, New York 10022 646.430.8230 [email protected] www.ga-institute.com sustainability — what matters? 2014 | published by Governance & Accountability Institute, Inc. 845 Third Avenue, Suite 644 New York, New York 10022 646.430.8230 [email protected] www.ga-institute.com authors and architects Hank Boerner — Chairman, Chief Strategist and Co-Founder Governance & Accountability Institute, Inc. Louis D. Coppola — Executive Vice President and Co-Founder Governance & Accountability Institute, Inc. primary researchers Laura Ana Jardieanu Santiago Viteri Table of sustainability — what matters? Contents OVERVIEW page 1 Most Material | Least Material In Reporters' Views 2 Background | Sustainability Reporting Trends 3 Materiality 4 Timing 5 Methodology 6 • Scoring 6 • Sectors 7 • Sector Scoring 8 • Sector Difference Scores 8 • Additional Categories and Aspect Ranks 9 And Now The Results | Top 10 / Bottom 10 9 SECTORS Agriculture 10 Automotive 15 Aviation 20 Chemicals 25 Commercial Services 30 Computers 35 Conglomerates 40 Construction 45 Construction Materials 50 Consumer Durables 55 Energy 60 Energy Utilities 65 Equipment 70 Financial Services 75 Food and Beverage 80 Forest and Paper 85 Healthcare Products 90 Healthcare Services 95 Household and Personal Products 100 Logistics 105 Media 110 Metals Products 115 Mining 120 Public Agency 125 Sustainability – What Matters? | Governance & Accountability Institute, Inc. -

Preliminary Prospectus Dated May 20, 2019 – Part 1

n PETRON CORPORATION (a company incorporated under the laws of the Republic of the Philippines) ffer Shares may not be sold nor may an offer to an offer may be sold nor not may ffer Shares Offer in the Philippines of which such offer, solicitation or sale would be unlawful be unlawful or would sale solicitation such offer, which 15,000,000 Perpetual Preferred Shares Series 3 n inn with Oversubscription Option of up to 5,000,000 Perpetual Preferred Shares Series 3 consisting of Series 3A Preferred Shares (PRF3A): [●]% p.a. Series 3B Preferred Shares (PRF3B): [●]% p.a. at an Offer Price of ₱1,000.00 per Preferred Share to be listed and traded on the Main Board of The Philippine Stock Exchange, Inc. JOINT ISSUE MANAGERS, JOINT LEAD UNDERWRITERS AND JOINT BOOKRUNNERS1 SENIOR CO-LEAD UNDERWRITERS [●] CO-LEAD UNDERWRITERS issued in final form. Under no circumstances shall this Preliminary Prospectus constitute an offer to sell or the solicitatio the or to sell an offer constitute Prospectus Preliminary this shall circumstances Under no form. in final issued [●] PARTICIPATING UNDERWRITERS [•] SELLING AGENTS Trading Participants of The Philippine Stock Exchange, Inc. THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. This Preliminary Prospectus is dated 20 May 2019. 1 BPI Capital Corporation, one of the Joint Issue Managers, Joint Lead Underwriters and Joint Bookrunners, is the [wholly-owned] investment banking subsidiary of Bank of the Philippine Islands which is the bank which the buy be accepted prior to the time that the Prospectus is is the Prospectus time that to the accepted prior be buy jurisdictio in any Offer the Shares of sale or solicitation offer, any be there shall nor Shares Offer any to buy of an offer jurisdiction. -

Lessons Not Learned the Other Shell Report 2004 Dedicated to the Memory of Ken Saro-Wiwa

Lessons Not Learned The Other Shell Report 2004 Dedicated to the memory of Ken Saro-Wiwa “My lord, we all stand before history. I am a man of peace. Appalled by the denigrating poverty of my people who live on a richly-endowed land . anxious to preserve their right to life and to a decent living, and determined to usher into this country . a fair and just democratic system which protects everyone and every ethnic group and gives us all a valid claim to human civilization. I have devoted all my intellectual and material resources, my very life, to a cause in which I have total belief and from which I cannot be blackmailed or intimidated. I have no doubt at all about the ultimate success of my cause . Not impris- onment nor death can stop our ultimate victory.” —Ken Saro-Wiwa’s final statement before his execution on 10 November 1995 Guide to contents 1 Guide to contents 2 Foreword from Tony Juniper & Vera Dalm This report is based largely on evidence from people Tony Juniper, Executive Director, Friends of the Earth (England, around the world who live in the shadows of Shell’s vari- Wales & Northern Ireland) & Vera Dalm, Director, Milieudefensie ous operations. This report is written on behalf of (Friends of the Earth Netherlands) Friends of the Earth (FOE); Advocates for Environmental Human Rights; Coletivo Alternative Verde; Community In- 3 The Year in Review power Development Association; Concerned Citizens of Norco; Environmental Rights Action (FOE Nigeria); 4 Niger Delta, Nigeria Global Community Monitor; groundWork (FOE South Injustice as a Shell Trademark Africa); Humane Care Foundation Curacao; Louisiana Bucket Brigade; Niger-Delta Project for the Environment, 7 Durban, South Africa Human Rights and Development; Pacific Environment Communities Doomed with Aging Refinery Watch; Sakhalin Environment Watch; Shell to Sea; South Durban Community Environmental Alliance; and 10 Sao Paulo, Brazil United Front to Oust Oil Depots. -

Final Offer Supplement Dated October 12, 2016

Petron Corporation (a company incorporated under the laws of the Republic of the Philippines) OFFER SUPPLEMENT Offer of P15,000,000,000 Fixed Rate Bonds with an Oversubscription Option of up to P5,000,000,000 Fixed Rate Bonds consisting of Series A Bonds: 4.0032% p.a. due 2021 Series B Bonds: 4.5219% p.a. due 2023 Offer Price: 100% of Face Value to be listed in the Philippine Dealing & Exchange Corp. JOINT ISSUE MANAGERS, JOINT LEAD UNDERWRITERS & BOOKRUNNERS CO-LEAD UNDERWRITERS PARTICIPATING UNDERWRITER The proceeds of the offer will be partly used for the payment of the outstanding short-term loans of Petron Corporation from BDO Unibank, Inc., the parent company of BDO Capital & Investment Corporation. THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS OFFER SUPPLEMENT IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. The date of this Final Offer Supplement is October 12, 2016. Petron Corporation SMC Head Office Complex 40 San Miguel Avenue Mandaluyong City, Philippines Telephone Number: (632) 886 3888 Corporate Website: www.petron.com Petron Corporation (“Petron”, the “Company” or the “Issuer”), a corporation duly organized and existing under Philippine law, has prepared a Final Prospectus dated October 12, 2016 (the “Prospectus”) relating to the shelf registration and sale in the Philippines of fixed rate bonds (the “Bonds”) in the aggregate principal amount of P40,000,000,000. The Bonds will be issued in tranches within a period of three (3) years from the effective date of the Registration Statement, subject to applicable regulations (the “Shelf Period”). -

Lessons Not Learned: the Other Shell Report

Lessons Not Learned The Other Shell Report 2004 Dedicated to the memory of Ken Saro-Wiwa “My lord, we all stand before history. I am a man of peace. Appalled by the denigrating poverty of my people who live on a richly-endowed land . anxious to preserve their right to life and to a decent living, and determined to usher into this country . a fair and just democratic system which protects everyone and every ethnic group and gives us all a valid claim to human civilization. I have devoted all my intellectual and material resources, my very life, to a cause in which I have total belief and from which I cannot be blackmailed or intimidated. I have no doubt at all about the ultimate success of my cause . Not impris- onment nor death can stop our ultimate victory.” —Ken Saro-Wiwa’s final statement before his execution on 10 November 1995 Guide to contents 1 Guide to contents 2 Foreword from Tony Juniper & Vera Dalm This report is based largely on evidence from people Tony Juniper, Executive Director, Friends of the Earth (England, around the world who live in the shadows of Shell’s vari- Wales & Northern Ireland) & Vera Dalm, Director, Milieudefensie ous operations. This report is written on behalf of (Friends of the Earth Netherlands) Friends of the Earth (FOE); Advocates for Environmental Human Rights; Coletivo Alternative Verde; Community In- 3 The Year in Review power Development Association; Concerned Citizens of Norco; Environmental Rights Action (FOE Nigeria); 4 Niger Delta, Nigeria Global Community Monitor; groundWork (FOE South Injustice as a Shell Trademark Africa); Humane Care Foundation Curacao; Louisiana Bucket Brigade; Niger-Delta Project for the Environment, 7 Durban, South Africa Human Rights and Development; Pacific Environment Communities Doomed with Aging Refinery Watch; Sakhalin Environment Watch; Shell to Sea; South Durban Community Environmental Alliance; and 10 Sao Paulo, Brazil United Front to Oust Oil Depots. -

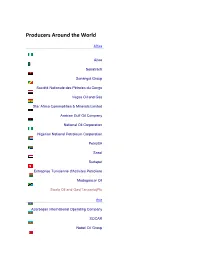

Producers Around the World

Producers Around the World Africa Aiteo Sonatrach Sonangol Group Société Nationale des Pétroles du Congo Vegas Oil and Gas Star Africa Commodities & Minerals Limited Arabian Gulf Oil Company National Oil Corporation Nigerian National Petroleum Corporation PetroSA Sasol Sudapet Entreprise Tunisienne d'Activites Petroliere Madagascar Oil Swala Oil and Gas(Tanzania)Plc Asia Azerbaijan International Operating Company SOCAR Nobel Oil Group Bahrain Petroleum Company Petrobangla Myanma Oil and Gas Enterprise CEFC China Energy CNOOC China National Petroleum Corporation CITIC Resources Geo-Jade Petroleum Shaanxi Yanchang Petroleum Sinochem Sinopec Towngas United Energy Pakistan Gujarat State Petroleum Corporation Oil and Natural Gas Corporation Oil India Essar Oil Reliance Industries Cairn India MedcoEnergi Pertamina Energi Mega Persada National Iranian Oil Company National Iranian South Oil Company Iranian Central Oil Fields Company Iranian Offshore Oil Company North Oil Company South Oil Company Missan Oil Company Midland Oil Company Delek Isramco Modiin Energy Inpex JAPEX Nippon Oil KazMunayGas Kuwait Oil Company Consolidated Contractors Company Petronas Petroleum Development Oman Oil and Gas Development Company Pakistan Petroleum Pakistan Oilfields Mari Petroleum Company Limited Petron Corporation Philippine National Oil Company Qatar Petroleum Saudi Aramco KrisEnergy Singapore Petroleum Company Ceylon Petroleum Corporation Korea National Oil Corporation Korea Gas Corporation CPC Corporation PTT Thai Oil Türkiye Petrolleri Anonim Ortaklığı Çalık Enerji Abu Dhabi National Oil Company Emirates National Oil Company Uzbekneftegaz Petrovietnam Vietsovpetro Europe OMV RAG Petrol AD INA – Industrija Nafte Moravské naftové doly DONG Energy Atlantic Petroleum Total S.A. Engie DEA AG Wintershall Hellenic Petroleum MOL Group Maxol Anonima Petroli Italiana Edison Edoardo Raffinerie Garrone Eni Saras S.p.A. -

2012 Annual Report A

2012 Annual Report a 2012 Annual Report Forging Ahead Thinking Big b Petron Corporation Contents 1 We are Petron Our Vision and Mission 2 Message to Stockholders 12 Petron in Malaysia: A New Chapter in our History 18 Countdown to the Refinery of the Future 20 Meeting Customers’ Demands and More 22 Unprecedented Market Presence 25 Our Strength Within 26 Building a Strong Nation through Sustainability 30 Board of Directors 32 Management Committee Corporate Governance 42 Financial Highlights 44 Audit Committee Report 45 Financial Statements 146 List of Banks and Financial Institutions 147 Terminals and Depots 148 Product List At the end of 2012, we have completed 54% of our $2-billion Refinery Masterplan Phase 2 or RMP-2. This game-changing initiative will increase our competitive edge and enhance the country’s supply security. We are Petron 2012 Annual Report 1 Petron Corporation is the largest oil refining to households and other industrial consumers and marketing company in the Philippines. through an extensive dealership network. Supplying nearly 40% of the country’s oil requirements, our world-class products and Petron operates a lube oil blending plant in quality services fuel the lives of millions of Pandacan Oil Terminal, where it manufactures Filipinos. We are dedicated and passionate lubes and greases. These are also sold through about our vision to be the leading provider of Petron’s service stations and sales centers. total customer solutions in the energy sector and its derivative businesses. We source our fuel additives from our blending facility at the Subic Bay Freeport. Petron operates a refinery in Limay, Bataan, This gives us the capability to formulate with a rated capacity of 180,000 barrels a day. -

Energy Security Initiative

ASIA PACIFIC ENERGY RESEARCH CENTRE ENERGY SECURITY INITIATIVE: SOME ASPECTS OF OIL SECURITY 2003 Published by Asia Pacific Energy Research Centre Institute of Energy Economics, Japan Inui Bldg.-Kachidoki 16F, 1-13-1 Kachidoki Chuo-ku, Tokyo 104-0054 Japan Tel: (813) 5144-8551 Fax: (813) 5144-8555 Email: address: [email protected] ã 2003 Asia Pacific Energy Research Centre APEC#203-RE-01.3 ISBN 4-931482-22-8 Printed in Japan PAGE II FOREWORD This report, Energy Security Initiative: Some Aspects of Oil Security, continues the ongoing efforts of the Asia Pacific Energy Research Centre to inform and assist APEC member economies on the energy security issues and challenges facing the region. In these turbulent times, threats to energy supply and price volatility, especially as they pertain to oil, occur almost daily. Hence energy security issues are high on the agenda of governments, policymakers and other energy market participants. Previous APERC projects on energy security have focussed on strategic oil stockpiles. In this report, we focus on the Asian Premium pricing and export and import dependence issues as they apply to oil security. Both issues are of particular interest and concern to the oil importing economies of APEC Asia but are also of relevance to other APEC economies given the global nature of aspects of the oil industry. Thus, although energy security issues are many and varied, as are the circumstances facing each member economy, I hope that this report will contribute not only to the ongoing discussion, but also to the improvement, of energy security in APEC member economies and the APEC region as a whole. -

Special Second Division

REPUBLIC OF THE PHILIPPINES COURT OF TAX APPEALS QUEZON CITY SPECIAL SECOND DIVISION PHILIPPINE ASSOCIATED CTA Case Nos. 9579 & SMELTING AND REFINING 9580 (PASAR) CORPORATION, Petitioner, Members: -versus - CASTANEDA, JR. , Chairperson and MANAHAN, JJ. COMMISSIONER OF CUSTOMS Promulga ted: AND THE BUREAU OF CUSTOMS, JUN 2 4 2019 Respondent. ){- - - - - - - - -- - - DECISION MANAHAN, J.: Thes e consolida t ed cases are appeal, under Section 11 1 of Republic Act (RA) No. 11252 , as amended by RA No. 92823, of the Decisions both da ted March 13, 20 17 rendered by th e 1 SEC. 11 . Who May Appeal; Mode of Appeal; Effect of Appeal. - Any party adversely affected by a decision, ruli ng or inaction of the Commissioner of Internal Revenue, the Commissioner of Customs, th e Secretary of Finance, the Secretary of Trade and Industry or the Secretary of Agriculture or the Central Board of Assessment Appeals or the Regional Trial Courts may fi le an appeal with the CTA within thirty (30) days a fter the receipt of such decision or ru ling or a fter th e expiration of the period fixed by law for action as referred to in Section 7 (a )( 2) h erein. Appeal shall be m a d e by filing a p etition fo r review under a procedure analogous to th at provided for under Ru le 42 of the 1997 Rules of Civil Procedure with the CTA with in thirty (30) days from the receipt of the decision or r uling or in the case of inaction as herein provided, from the expiration of th e period fixed by lavv to act thereon. -

Documents Enron 1999

Enron Documents 1999 rDEC- 15--B ]S-48 P. 02/21 December 14.1398 Vol. 5. No. SD tandard & Poors' kmRP'M ITILITIESl :- g PERS PECTVES | BH ~I UWhy Is ectric Restrturing Moving So Slowly inStates? A the begi6s d 199S. Siamrd & PWfs iwpd between ne rulatory boj,. th Amore Ccaporior. ~3b f^ rlWdiTr!- atalrtgenbardawmuldadptericemsam- Cmmwiion ACC. and Arizna's two maor OUs. 4' " -" =- 1·;n siitionlt^ ddu teared clsttmrvwy. Leg AinaRtPbliSAniceCo. aod T-Tsn,Eleaic Pori Co. .::* ?... _.;is . __had.ialatbla aLdy.. beari dkiil dlatchbe a Fuitwraolmatthifmmisn recetltionof 6 ...... - Bhrois. Cai.frf Mass h. FvwrreBaftrd abr a new ACC crmissinc-, etfectriv Jan 4. 1999. who Otm6 -B1im ;rwwhkluymregiJacyrn inNewac. Lamw&nmodir may try to urvlJ the senJenttfs "-:'^-.~M.4P3xp - ,s l teLta s S ra MS*. Me An,lhr fact that wiU rtety delay .ruairo in 1* _:lq-.po isdbtoim*Ia licznKaStumaricnpeheawr*wder= sane sta e high torof members instae -_ - e batoadosMe, hwen.eipmsa dtO.ssqlflrnsD- haues. The tagp eumber of freshman laewm ; - j --hm :-~udii~sj. eaind nhManx jydicinsnder mwetato RCKk=s recI= tf fdled In egd zaaom doat wee oa me :'- a- ' · astax s stedecar.cicnnerfain9Bl peipice of adopinrlegislation might ndCnsareer 6 .boeerU3nstllea-s.andb Posi iinspeciy d intarstga passage of a rtstnrcuiing bill The leamin cure fa Ltpc: lCze-d~itVt Rclernda in Califonia and Massadihets eingo te new lawmakers m this aompLcx Issue could :,.--. _-.-.: ... Wn e.leritc reVimctignurib cealy steered main postpne dem. wi the newrmers insad 6 |-LO sw.ais away fm spwacing D*eir DM rututrW twouvatng on cytin f-r throuh budge and tx 7- Abills. -

Energy Security Initiative

ASIA PACIFIC ENERGY RESEARCH CENTRE ENERGY SECURITY INITIATIVE: SOME ASPECTS OF OIL SECURITY 2003 Published by Asia Pacific Energy Research Centre Institute of Energy Economics, Japan Inui Bldg.-Kachidoki 16F, 1-13-1 Kachidoki Chuo-ku, Tokyo 104-0054 Japan Tel: (813) 5144-8551 Fax: (813) 5144-8555 Email: address: [email protected] ã 2003 Asia Pacific Energy Research Centre APEC#203-RE-01.3 ISBN 4-931482-22-8 Printed in Japan PAGE II FOREWORD This report, Energy Security Initiative: Some Aspects of Oil Security, continues the ongoing efforts of the Asia Pacific Energy Research Centre to inform and assist APEC member economies on the energy security issues and challenges facing the region. In these turbulent times, threats to energy supply and price volatility, especially as they pertain to oil, occur almost daily. Hence energy security issues are high on the agenda of governments, policymakers and other energy market participants. Previous APERC projects on energy security have focussed on strategic oil stockpiles. In this report, we focus on the Asian Premium pricing and export and import dependence issues as they apply to oil security. Both issues are of particular interest and concern to the oil importing economies of APEC Asia but are also of relevance to other APEC economies given the global nature of aspects of the oil industry. Thus, although energy security issues are many and varied, as are the circumstances facing each member economy, I hope that this report will contribute not only to the ongoing discussion, but also to the improvement, of energy security in APEC member economies and the APEC region as a whole.