Year-In-Sports-Media-2017.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

On the Ball! One of the Most Recognizable Stars on the U.S

TVhome The Daily Home June 7 - 13, 2015 On the Ball! One of the most recognizable stars on the U.S. Women’s World Cup roster, Hope Solo tends the goal as the U.S. 000208858R1 Women’s National Team takes on Sweden in the “2015 FIFA Women’s World Cup,” airing Friday at 7 p.m. on FOX. The Future of Banking? We’ve Got A 167 Year Head Start. You can now deposit checks directly from your smartphone by using FNB’s Mobile App for iPhones and Android devices. No more hurrying to the bank; handle your deposits from virtually anywhere with the Mobile Remote Deposit option available in our Mobile App today. (256) 362-2334 | www.fnbtalladega.com Some products or services have a fee or require enrollment and approval. Some restrictions may apply. Please visit your nearest branch for details. 000209980r1 2 THE DAILY HOME / TV HOME Sun., June 7, 2015 — Sat., June 13, 2015 DISH AT&T CABLE DIRECTV CHARTER CHARTER PELL CITY PELL ANNISTON CABLE ONE CABLE TALLADEGA SYLACAUGA SPORTS BIRMINGHAM BIRMINGHAM BIRMINGHAM CONVERSION CABLE COOSA WBRC 6 6 7 7 6 6 6 6 AUTO RACING 5 p.m. ESPN2 2015 NCAA Baseball WBIQ 10 4 10 10 10 10 Championship Super Regionals: Drag Racing Site 7, Game 2 (Live) WCIQ 7 10 4 WVTM 13 13 5 5 13 13 13 13 Sunday Monday WTTO 21 8 9 9 8 21 21 21 8 p.m. ESPN2 Toyota NHRA Sum- 12 p.m. ESPN2 2015 NCAA Baseball WUOA 23 14 6 6 23 23 23 mernationals from Old Bridge Championship Super Regionals Township Race. -

Narrative Representations of Gender and Genre Through Lyric, Music, Image, and Staging in Carrie Underwood’S Blown Away Tour

COUNTRY CULTURE AND CROSSOVER: Narrative Representations of Gender and Genre Through Lyric, Music, Image, and Staging in Carrie Underwood’s Blown Away Tour Krisandra Ivings A Thesis Presented In Partial Fulfillment of the Requirement for the Degree Master of Arts in Music with Specialization in Women’s Studies University of Ottawa © Krisandra Ivings, Ottawa, Canada, 2016 Abstract This thesis examines the complex and multi-dimensional narratives presented in the work of mainstream female country artist Carrie Underwood, and how her blending of musical genres (pop, rock, and country) affects the narratives pertaining to gender and sexuality that are told through her musical texts. I interrogate the relationships between and among the domains of music, lyrics, images, and staging in Underwood’s live performances (Blown Away Tour: Live DVD) and related music videos in order to identify how these gendered narratives relate to genre, and more specifically, where these performances and videos adhere to, expand on, or break from country music tropes and traditions. Adopting an interlocking theoretical approach grounded in genre theory, gender theory, narrative theory in the context of popular music, and happiness theory, I examine how, as a female artist in the country music industry, Underwood uses genre-blending to construct complex gendered narratives in her musical texts. Ultimately, I find that in her Blown Away Tour: Live DVD, Underwood uses diverse narrative strategies, sometimes drawing on country tropes, to engage techniques and stylistic influences of several pop and rock styles, and in doing so explores the gender norms of those genres. ii Acknowledgements A great number of people have supported this thesis behind the scenes, whether financially, academically, or emotionally. -

'Duncanville' Is A

Visit Our Showroom To Find The Perfect Lift Bed For You! February 14 - 20, 2020 2 x 2" ad 300 N Beaton St | Corsicana | 903-874-82852 x 2" ad M-F 9am-5:30pm | Sat 9am-4pm milesfurniturecompany.com FREE DELIVERY IN LOCAL AREA WA-00114341 The animated, Amy Poehler- T M O T H U Q Z A T T A C K P Your Key produced 2 x 3" ad P U B E N C Y V E L L V R N E comedy R S Q Y H A G S X F I V W K P To Buying Z T Y M R T D U I V B E C A N and Selling! “Duncanville” C A T H U N W R T T A U N O F premieres 2 x 3.5" ad S F Y E T S E V U M J R C S N Sunday on Fox. G A C L L H K I Y C L O F K U B W K E C D R V M V K P Y M Q S A E N B K U A E U R E U C V R A E L M V C L Z B S Q R G K W B R U L I T T L E I V A O T L E J A V S O P E A G L I V D K C L I H H D X K Y K E L E H B H M C A T H E R I N E M R I V A H K J X S C F V G R E N C “War of the Worlds” on Epix Bargain Box (Words in parentheses not in puzzle) Bill (Ward) (Gabriel) Byrne Aliens Place your classified Classified Merchandise Specials Solution on page 13 Helen (Brown) (Elizabeth) McGovern (Savage) Attack ad in the Waxahachie Daily Light, Merchandise High-End 2 x 3" ad Catherine (Durand) (Léa) Drucker Europe Midlothian Mirror and Ellis Mustafa (Mokrani) (Adel) Bencherif (Fight for) Survival County Trading1 Post! x 4" ad Deal Merchandise Word Search Sarah (Gresham) (Natasha) Little (H.G.) Wells Call (972) 937-3310 Run a single item Run a single item priced at $50-$300 priced at $301-$600 for only $7.50 per week for only $15 per week 6 lines runs in The Waxahachie Daily Light, ‘Duncanville’ is a new Midlothian Mirror and Ellis County Trading2 x 3.5" Post ad and online at waxahachietx.com All specials are pre-paid. -

Chart Action News

Thursday, November 10, 2016 NEWS CHART ACTION No. 1 Challenge Coin- Easton Corbin New On The Chart —Debuting This Week Artist/song/label—chart pos. LOCASH/Ring On Every Finger/Reviver Records— 72 Keith Walker/Me Too— 76 Nick Hickman/Rain/Break The Cycle Entertainment— 79 !Kelsey Hickman/Gone/Go Time Records— 80 Greatest Spin Increase Artist/song/label—Spin Increase Little Big Town/Better Man/Capitol Nashville— 372 Thomas Rhett/Star Of The Show/Valory Music Co— 325 Dierks Bentley/Black/Capitol Nashville— 307 Blake Shelton/A Guy With A Girl/Warner Bros.— 244 !Garth Brooks/Baby, Let’s Lay Down And Dance/Pearl Records— 214 Most Added Artist/song/label—No. of Adds Dierks Bentley/Black/Capitol Nashville—27 Little Big Town/Better Man/Capitol Nashville—15 Easton Corbin visited the MusicRow of+ice and while he was here, Justin Moore/Somebody Else Will/Valory Music Co— 10 accepted a MusicRow No. 1 Challenge Coin for his hit, “Baby Be My Love LOCASH/Ring On Every Finger/Reviver Records—9 Song,” from his third album About To Get Real. Jim Collins and Brett James Tyler Farr/Our Town/Columbia Nashville— 8 penned “Baby Be My Love Song.” All artists and songwriters who reach the Aaron Goodvin/Woman In Love/Warner Musi Canada-AJG Music Group—7 top of the CountryBreakout chart receive the challenge coin. To view the Jason Pritchett/Hung Over You/BDMG—7 full list of recipients, click here. And to read the full article from Corbin’s Kelsea Ballerini/Yeah Boy/Black River Ent— 6 !visit, click here. -

CODE BLEU Thank You for Joining Us at Our Showcase This Evening

PRESENTS… CODE BLEU Thank you for joining us at our showcase this evening. Tonight, we are featuring Code Bleu, led by Sean and Faith Gillen. Performing together for over twenty years, Code Bleu has become one of the most sought – after orchestras in New York. Code Bleu possesses a unique blend of fun, excitement and elegance that will leave your guests endlessly raving about your wedding. Featuring eight powerful lead vocalists, horns, keyboards, guitar, bass, drums and percussion, they can reproduce virtually any musical style. Code Bleu Members: • ELECTRIC, ACOUSTIC GUITARS, VOCALS………………………..………SEAN GILLEN • VOCALS AND MASTER OF CEREMONIES……..………………………….FAITH GILLEN • VOCALS AND KEYBOARDS..…………………………….……………………..RICH RIZZO • VOCALS AND PERCUSSION…………………………………......................SHELL LYNCH • KEYBOARDS AND VOCALS………………………………………..………….…DREW HILL • BASS……………………………………………………………………….….......DAVE ANTON • DRUMS AND SEQUENCING………………………………………………..JIM MANSFIELD • SAXOPHONE, VOCALS, FLUTE, AND GUITAR….……………ANTHONY POLICASTRO • VOCALS………………………………………………………………….…….PAMELA LEWIS • TRUMPET AND VOCALS……………….…………….………………….ALYSON GORDON www.skylineorchestras.com (631) 277 – 7777 #Skylineorchestras DANCE : BURNING DOWN THE HOUSE – Talking Heads BUST A MOVE – Young MC A GOOD NIGHT – John Legend CAKE BY THE OCEAN – DNCE A LITTLE LESS CONVERSATION – Elvis CALL ME MAYBE – Carly Rae Jepsen A LITTLE PARTY NEVER KILLED NOBODY – Fergie CAN’T FEEL MY FACE – The Weekend A LITTLE RESPECT – Erasure CAN’T GET ENOUGH OF YOUR LOVE – Barry White A PIRATE LOOKS AT 40 – Jimmy Buffet CAN’T GET YOU OUT OF MY HEAD – Kylie Minogue ABC – Jackson Five CAN’T HOLD US – Macklemore & Ryan Lewis ACCIDENTALLY IN LOVE – Counting Crows CAN’T HURRY LOVE – Supremes ACHY BREAKY HEART – Billy Ray Cyrus CAN’T STOP THE FEELING – Justin Timberlake ADDICTED TO YOU – Avicii CAR WASH – Rose Royce AEROPLANE – Red Hot Chili Peppers CASTLES IN THE SKY – Ian Van Dahl AIN’T IT FUN – Paramore CHEAP THRILLS – Sia feat. -

Preschool Television Viewing and Adolescent Test Scores: Historical Evidence from the Coleman Study

PRESCHOOL TELEVISION VIEWING AND ADOLESCENT TEST SCORES: HISTORICAL EVIDENCE FROM THE COLEMAN STUDY MATTHEW GENTZKOW AND JESSE M. SHAPIRO We use heterogeneity in the timing of television’s introduction to different local markets to identify the effect of preschool television exposure on standardized test scores during adolescence. Our preferred point estimate indicates that an additional year of preschool television exposure raises average adolescent test scores by about 0.02 standard deviations. We are able to reject negative effects larger than about 0.03 standard deviations per year of television exposure. For reading and general knowledge scores, the positive effects we find are marginally statistically significant, and these effects are largest for children from households where English is not the primary language, for children whose mothers have less than a high school education, and for nonwhite children. I. INTRODUCTION Television has attracted young viewers since broadcasting be- gan in the 1940s. Concerns about its effects on the cognitive devel- opment of young children emerged almost immediately and have been fueled by academic research showing a negative association between early-childhood television viewing and later academic achievement.1 These findings have contributed to a belief among the vast majority of pediatricians that television has “negative effects on brain development” of children below age five (Gentile et al. 2004). They have also provided partial motivation for re- cent recommendations that preschool children’s television view- ing time be severely restricted (American Academy of Pediatrics 2001). According to a widely cited report on media use by young * We are grateful to Dominic Brewer, John Collins, Ronald Ehrenberg, Eric Hanushek, and Mary Morris (at ICPSR) for assistance with Coleman study data, and to Christopher Berry for supplying data on school quality. -

Welcome to the Wonderful World of Hopper® Congratulations on Purchasing the Most Awarded and Technologically Advanced Whole-Home HD DVR on the Market

FEATURES GUIDE Welcome to the Wonderful World of Hopper® Congratulations on purchasing the most awarded and technologically advanced whole-home HD DVR on the market. The Hopper is your portal to smarter, more convenient entertainment. Now, let’s make sure you understand how to use it. 4) 14 Tips You’ll Love 14) PrimeTime Anytime 22) Settings 6) Home 15) TV Activity 24) Parental Controls 8) Guide 16) Movies 25) Internet Connection 10) Menu 18) Video On Demand 26) Refer a Friend 11) Search 19) DISH Anywhere 27) Remote Overview 12) DVR 20) Apps Back) Help Info This icon can be seen on certain pages throughout this guide. Press and hold INFO/HELP to access additional assistance on your TV. 14 TIPS YOU’LL LOVE Become a Hopper pro. Here are 14 quick tips and features that will have you surfing through your Hopper with stylish ease. Lose Your Remote? Press the LOCATE REMOTE button on the front panel of your Hopper receiver, and in a few seconds the remote will begin to beep to help you locate it. Binge-Watching is Awesome! It’s so easy to spend a day, night, or weekend just camped on your couch bingeing on a great show. The Hopper organizes DVR record- NEXT ings and On Demand programs by season and episode. When you finish an episode, EPISODE a pop-up will appear showing the next available episode to watch. It’s like you barely even have to move (OK, not sure that’s a good thing, but you get the idea.)! Watch in One Room, Finish in Another. -

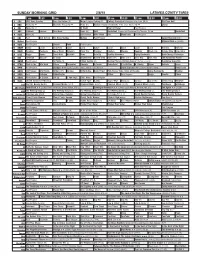

Sunday Morning Grid 2/8/15 Latimes.Com/Tv Times

SUNDAY MORNING GRID 2/8/15 LATIMES.COM/TV TIMES 7 am 7:30 8 am 8:30 9 am 9:30 10 am 10:30 11 am 11:30 12 pm 12:30 2 CBS CBS News Sunday Face the Nation (N) Major League Fishing (N) College Basketball Michigan at Indiana. (N) Å PGA Tour Golf 4 NBC News (N) Å Meet the Press (N) Å News (N) Hockey Chicago Blackhawks at St. Louis Blues. (N) Å Skiing 5 CW News (N) Å In Touch Hour Of Power Paid Program 7 ABC Outback Explore This Week News (N) NBA Basketball Clippers at Oklahoma City Thunder. (N) Å Basketball 9 KCAL News (N) Joel Osteen Mike Webb Paid Woodlands Paid Program 11 FOX Paid Joel Osteen Fox News Sunday Midday Paid Program Larger Than Life ›› 13 MyNet Paid Program Material Girls › (2006) 18 KSCI Paid Program Church Faith Paid Program 22 KWHY Como Local Jesucristo Local Local Gebel Local Local Local Local Transfor. Transfor. 24 KVCR Painting Dewberry Joy of Paint Wyland’s Paint This Painting Kitchen Mexico Cooking Chefs Life Simply Ming Ciao Italia 28 KCET Raggs Space Travel-Kids Biz Kid$ News Asia Biz Healthy Hormones Aging Backwards BrainChange-Perlmutter 30 ION Jeremiah Youssef In Touch Bucket-Dino Bucket-Dino Doki (TVY) Doki (TVY7) Dive, Olly Dive, Olly The Karate Kid Part II 34 KMEX Paid Program Al Punto (N) Fútbol Central (N) Mexico Primera Division Soccer: Pumas vs Leon República Deportiva 40 KTBN Walk in the Win Walk Prince Carpenter Liberate In Touch PowerPoint It Is Written B. -

In the News Tuesday, January 11, 2011

In The News Tuesday, January 11, 2011 Tucson University Medical 01/11/2011 10-11 News This Morning - KOLN-TV Center)congresswoman giffords remains hospitalized here in critical condition but doctors are reporting some encouraging news. THE TRAUMA TEAM AT 01/11/2011 10News This Morning at 5 AM - UNIVERSITY MEDICAL KGTV-TV CENTER IN TUCSON WE'LL GET ANOTHER 01/11/2011 12 News Today - KPNX-TV UPDATE ON HER STATUS FROM THE UNIVERSITY MEDICAL CENTER IN TUCSON, ARIZONA. WE'LL GET AN UPDATE ON 01/11/2011 12 News Today - KPNX-TV HER STATUS FROM THE DOCTORS TREATING HER AT UNIVERSITY MEDICAL CENTER IN TUCSON AT 10:00 AMAND TOMORROW, PRESIDENT OBAMA WILL COME HERE TO ATTEND A MEMORIAL SERVICE FOR THE VICTIMS. CONTINUING COVERAGE 01/11/2011 16 Morning News at 5 AM - WNDU- ON THIS TUCSON TV TRAGEDY, LATER TODAY, WE STAFF AT THE UNIVERSITY 01/11/2011 16 Morning News at 5 AM - WNDU- MEDICAL CENTER IN TV TUCSON ARE EXPECTED TO GIVE AN UPDATE TODAY ON CONGRESSWOMAN GABRIELLE GIFFORD'S CONDITION, AFTER SATURDAY'S SHOOTING. THE EMOTIONS IN TUCSON 01/11/2011 2 News at 11 PM - WESH-TV REMAIN HIGH AS PEOPLE GATHER AROUND A GROWING MEMORIAL AT UNIVERSITY MEDICAL CENTER. MOURNERS AND WELL 01/11/2011 2 News Sunrise - WDTN-TV WISHERS HAVE BEEN GATHERING OUTSIDE THE UNIVERSITY MEDICAL CENTER IN TUCSON TO SHOW THEIR SUPPORT FOR THE VICTIMS. Suspect in Arizona 01/11/2011 24 Hours Vancouver | View Clip shootings appears in court Arizona shooting suspect 01/11/2011 3 News | View Clip could face death MICHAEL LEMOLE/TUCSON 01/11/2011 8 News Now at 5 AM - KLAS-TV UNIVERSITY MEDICAL CENTER) "EVERYDAY THAT GOES BY WE DON'T SEE INCREASE WE ARE SLIGHTLY MORE OPTIMISTIC. -

Obama Takes Office As 44Th President

DID ‘MALL COP’ ‘PLAYER’ MAKES BRING THE GARLAND SPEAKS: TRIUMPHANT LAUGHS? INTERIM PRESIDENT TALKS ABOUT FUTURE COMEBACK OF BAYLOR IN NEW YEAR PAGE 9 PAGE 13 PAGE 5 ROUNDING UP CAMPUS NEWS SINCE 1900 THE BAYLOR LARIAT WEDNESDAY, JANUARY 21, 2009 PRESIDENTIAL INAUGURATION 2009 BARACK OBAMA 44th President of the United States of America Whatʼs Inside Campus Reaction Students gather to watch inauguration and offer thoughts on the new president Page 6 Waco to Washington Baylor faculty member travels to Washington and reflects on the inauguration and past presidents Page 6 Through the lens Experience the inauguration through the lens of a Baylor photographer Page 7 Status Sound off Students take to Facebook and talk inauguration McClatchy Newspapers Page 6 Above: Barack Obama takes the oath as the 44th U.S. President from Supreme Court Chief Justice John Roberts at the U.S. Capitol in Washington, D.C., Tuesday. Bottom: President Barack Obama signs his first act as president Tuesday in the President’s Room of the U.S. Capitol, a proclamation, after being sworn in as the 44th President of the United States in Washington D.C. Whatʼs Online Obama takes office Lariat on the Hill Four Lariat staff as 44th president members blog about the inauguration, By Anita Pere but to lay a new foundation for will be his bond, and he’ll deliv- freezing in Editor in chief growth,” Obama said. er,” she said. Washington and He specifically mentioned the Obama also mentioned the Obama flip flops need for modernizing colleges troubled economy, suggesting a WASHINGTON – The crowd and universities, reducing the possible return to tighter restric- chanted “Obama” and “Yes, we cost of health care and harness- tions on financial markets. -

NASCAR for Dummies (ISBN

spine=.672” Sports/Motor Sports ™ Making Everything Easier! 3rd Edition Now updated! Your authoritative guide to NASCAR — 3rd Edition on and off the track Open the book and find: ® Want to have the supreme NASCAR experience? Whether • Top driver Mark Martin’s personal NASCAR you’re new to this exciting sport or a longtime fan, this insights into the sport insider’s guide covers everything you want to know in • The lowdown on each NASCAR detail — from the anatomy of a stock car to the strategies track used by top drivers in the NASCAR Sprint Cup Series. • Why drivers are true athletes NASCAR • What’s new with NASCAR? — get the latest on the new racing rules, teams, drivers, car designs, and safety requirements • Explanations of NASCAR lingo • A crash course in stock-car racing — meet the teams and • How to win a race (it’s more than sponsors, understand the different NASCAR series, and find out just driving fast!) how drivers get started in the racing business • What happens during a pit stop • Take a test drive — explore a stock car inside and out, learn the • How to fit in with a NASCAR crowd rules of the track, and work with the race team • Understand the driver’s world — get inside a driver’s head and • Ten can’t-miss races of the year ® see what happens before, during, and after a race • NASCAR statistics, race car • Keep track of NASCAR events — from the stands or the comfort numbers, and milestones of home, follow the sport and get the most out of each race Go to dummies.com® for more! Learn to: • Identify the teams, drivers, and cars • Follow all the latest rules and regulations • Understand the top driver skills and racing strategies • Have the ultimate fan experience, at home or at the track Mark Martin burst onto the NASCAR scene in 1981 $21.99 US / $25.99 CN / £14.99 UK after earning four American Speed Association championships, and has been winning races and ISBN 978-0-470-43068-2 setting records ever since. -

Andrew Stewart-Jones

Andrew Stewart-Jones AEA, SAG/AFTRA FILM & TELEVISION Central Park Five Guest Star Netflix Ava DuVernay NCIS: New Orleans Guest Star CBS Mary Lou Belli The Demons of Dorian Gunn (Pilot) Guest Star PopTV Daniel Beer Shades Of Blue Recurring NBC Nick Gomez Bull Guest Star CBS Jan Eliasberg The Blacklist Guest Star NBC Bill Roe Gotham Series Regular FOX Various Beauty & the Beast Recurring CW Rich Newey The Night Of Recurring HBO Various Minority Report Guest Star FOX Mark Mylod Blue Bloods Guest Star CBS David Barrett The Tomorrow People Guest Star CW Danny Cannon The Good Wife Guest Star CBS James Whitmore III Dead Man Down Supporting Independent Niels Arden Oplev Person of Interest Guest CBS David Semel It's Complicated Supporting Universal Nancy Meyers Mr. Popper's Penguins Supporting 20th Century Fox Mark Waters Unforgettable Co-Star CBS Jean de Segonzac The Good Guy Lead Independent Julio DiPietro Wall St: Money Never Sleeps Supporting 20th Century Fox Oliver Stone 30 Rock Co-Star NBC Beth McCarthy Miller Gossip Girl Recurring CW Mark Piznarski Sex & the City Recurring HBO Michael Patrick King One Live to Live Recurring ABC Gary Donatelli Mercy Co-Star NBC David Straiton Law & Order Guest Star NBC Marisol Torres Castle Co-Star ABC Rob Bowman Third Watch Co-Star NBC Vincent Misiano The Girl in the Park Supporting Lifetime David Auburn Montclair Supporting Independent Mike Ramsdell OFF-BROADWAY Good Television Ethan Taumer Atlantic Theater Company Bob Krakower Guantanamo Jamal Al-Harith The Culture Project N. Kent/S. Wares The Overwhelming Joseph/Mizinga (us) The Roundabout Theatre Co.