About Aurumpay® Philippines Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Philippine Rating Services Corporation (Philratings)

PRESS RELEASE RATING NEWS December 16, 2019 The Pioneer Domestic Credit Rating Agency EastWest Bank Gets High Credit Rating East West Banking Corporation (EastWest Bank), the banking arm of the Filinvest Group, was assigned an issuer credit rating of PRS Aa plus (corp.) by Philippine Rating Services Corporation (PhilRatings). The rating has a Stable Outlook. An Issuer Credit Rating is a measure of the general creditworthiness of a company over a one year period. A company rated PRS Aa (corp.) differs from the highest rated corporates only to a small degree, and has a strong capacity to meet its financial commitments relative to that of other Philippine corporates. The plus further qualifies the assigned rating within the “Aa” rating level. A Stable Outlook, on the other hand, indicates that the rating is likely to be maintained or to remain unchanged in the next 12 months. The issuer credit rating takes into consideration EastWest Bank’s clearly-defined and well- executed growth strategy; its ability to compete in its chosen market; the favorable outlook for domestic consumer credit despite economic headwinds in 2018; and the bank’s strong shareholders and highly- experienced management. The issuer credit rating assigned by PhilRatings is based on available information and projections at the time that the rating review was performed. PhilRatings shall continuously monitor developments relating to EastWest Bank, and may change the rating at any time, should circumstances warrant a change. As a domestic universal bank (unibank), EastWest Bank provides a wide range of financial services to consumer and corporate clients. These services include deposit-taking, loan and trade finance, treasury, trust services, credit cards, cash management, custodial services, insurance services and leasing and finance. -

Download File

C O V E R S H E E T for AUDITED FINANCIAL STATEMENTS SEC Registration Number 2 9 3 1 6 C O M P A N Y N A M E R O B I N S ON S BANK CORPORATI ON AND SUBSI D I ARY PRINCIPAL OFFICE ( No. / Street / Barangay / City / Town / Province ) 1 7 t h Fl o o r , G a l l e r i a Co r p o r a t e Ce n t e r , EDSA c o r n e r O r t i g a s A v e n u e , Qu e z o n Ci t y Form Type Department requiring the report Secondary License Type, If Applicable 1 7 - A C O M P A N Y I N F O R M A T I O N Company’s Email Address Company’s Telephone Number Mobile Number www.robinsonsbank.com.ph 702-9500 N/A No. of Stockholders Annual Meeting (Month / Day) Fiscal Year (Month / Day) 15 Last week of April December 31 CONTACT PERSON INFORMATION The designated contact person MUST be an Officer of the Corporation Name of Contact Person Email Address Telephone Number/s Mobile Number Ms. Irma D. Velasco [email protected] 702-9515 09988403139 CONTACT PERSON’s ADDRESS 17th Floor, Galleria Corporate Center, EDSA corner Ortigas Avenue, Quezon City NOTE 1 : In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated. -

Trust Division, 3F Eastwest Corporate Center, 5Th

EASTWEST BANKING CORPORATION > Your dream Our focus < EASTWEST PESO MONEY MARKET FUND KEY INFORMATION AND INVESTMENT DISCLOSURE STATEMENT For the Quarter 30 June 2015 FUND FACTS Net Asset Value per Unit Classification: Peso Money Market P1,242.1114 (NAVPU): Launch Date: 1 March 2007 Total Fund NAV: P288.313 million Min. Initial Investment: P100,000.00 Dealing Day: Daily, up to 12 noon Next banking day from date Min. Additional Investment: P0.00 Redemption Settlement: of redemption Min. Holding Period: None Early Redemption Charge: Not Applicable Applicable Tax: 20% Final Tax Valuation: Marked-to-Market FEES Trustee Fee: Custodianship Fee: External Audit Fee: Other Fees: 0.2500% p.a. 0.0000%* 0.0000% 0.0000% EastWest Bank – Trust Division HSBC SGV *Ratio of expense to the quarter’s average daily net asset value. INVESTMENT OBJECTIVE AND STRATEGY The Fund aims to provide its participants with enhanced yields for their short-term liquidity needs by investing in a portfolio of bank deposits and BSP Special Deposit Accounts with maximum time to maturity of twelve months. It aims to outperform the 3-month Philippine Dealing System Treasury Interpolated Rate PM (PDSI-R2). CLIENT SUITABILITY A client profiling process should be performed prior to participating in the Fund to guide the prospective investor if the Fund is suited to his/her investment objectives and risk tolerance. Clients are advised to read the Declaration of Trust/Plan Rules of the Fund, which may be obtained from the Trustee, before deciding to invest. The Fund is suitable for investors who: Have a conservative risk appetite Are looking for current income over an investment time horizon of at least thirty days KEY RISKS AND RISK MANAGEMENT You should not invest in this Fund if you do not understand or are not comfortable with the accompanying risks. -

East West Bank's

CASE STUDY East West Bank’s ‘Financial Transformation Program’ Underpinning its Growth Strategy East West Banking Corporation (East West Bank), a universal bank in the Philippines that provides a wide array of products and services to retail customers and mid-market corporate customers, developed the ‘Financial Transformation Program’ in order to support its growth strategy. To deliver on the vision, East West Bank chose Wolters Kluwer Financial Services’ integrated risk, finance and compliance platform. The implementation of this software suite has led to improved data quality, shorter period closing times, cost reduction, and better management analysis and decision making. East West Banking Corporation (East West East West Bank envisaged that the system Bank) is a universal bank in the Philippines that would provide a universal and central view provides a wide array of products and services of the bank’s risks and financials, and offer a to retail customers and mid-market corporate central repository of the bank’s risk and financial customers. East West Banks’s principal banking data. In addition, the software would serve as a products include Consumer Loans, Deposits, financial platform to support the bank’s initial Corporate Banking, Treasury and Trust products requirements of a general ledger with multi- and Cash Management Solutions, among others. dimensional attributes, profitability & MIS, Basel, regulatory, and management reporting. Keeping in view its target to grow its overall presence in retail branches nationwide and Ideally, the selected solution would enable its loan portfolio, East West Bank initiated the bank to use the existing system for other a challenging project entitled ‘the Financial management, reporting and compliance Transformation Program’. -

Psbank Debit Card Requirements

Psbank Debit Card Requirements Misunderstood and infundibulate Christian satirizing her crabbedness toroids title and uncanonising reprovingly. Tomas luff decreasingly as thysanurous Rich hares her gorgonian reinsured frighteningly. Septicemic and discoverable Major spoof while hypersensitive Cob outblusters her locutory signally and acetifying forward. Sana mapansin to day of psbank debit card from any psbank prepaid card SGD 400 Fee for replacement of lost SGD passbook PIN Mailer regeneration PHP5000 Except two New goddess is unreadable Unclaimed ATM card PIN. Credit Card Eligibility Criteria for a Metrobank Credit Card purchase order to. At key recent contract renewal with PSBank Anne shared how she heavily. Home to Release PSBank secures ATM cards with excellent feature. PSBank secures ATM cards with small feature Unasalahat. Withdraw of our ATMs located all over every country require any ATM that accepts Bancnet Debit Card It's follow best way beyond control your spending Use it name you. Philippine Bank Charges Compared YugaTech Philippines. With your ATM card locked it may vote be used for any ATM point-of-sale or online transactions that require manual card policy Your ATM card. More importantly it doesn't require a maintaining balance and initial deposit Being a fully digital bank ING. HSBC Philippines and HSBC Savings Bank Inc require manual intervention. Credit and Debit Card Issuers Mastercard Philippines. Send with Debit Card Transfers in minutes You send USD They receive PHP USD First time on fee 0 Send now Promotional FX rate applies to. It comes with a PSBank Debit Mastercard that allows you rail access your funds. Clients who wish or unlock their ATM card will deprive a transaction. -

Philequity Corner (May 8, 2017) by Wilson Sy the Hunter Games After

Philequity Corner (May 8, 2017) By Wilson Sy The Hunter Games After consolidating for more than three months between 7,100 to 7,400, the PSEi closed last Friday at 7,842. Aside from robust global markets, one of the catalysts that contributed to the PSEi’s strong move is the speculation about possible M&As in the banking sector. Speculation on RCBC takeover leads bank stocks higher Recently, there has been speculation that some banks may be in play as potential acquisition targets. This started with RCB’s gap up move on April 17. 4/12/17 5/5/17 % Chg RCB 39.00 58.70 50.5% PNB 57.50 68.65 19.4% EW 20.80 22.70 9.1% MBT 84.50 86.95 2.9% UBP 79.65 81.95 2.9% BDO 121.00 123.00 1.7% BPI 105.00 105.10 0.1% SECB 217.00 215.60 -0.6% CHIB 38.20 36.45 -4.6% Sources: Bloomberg, Wealth Research From the table above, it can be seen that RCB has risen 50.5% since April 12. Moreover, it has surged 104.2% from its bottom of 28.75 on March 22, 2016 (at the height of the AMLA investigations). Note that RCB has been rumoured to be a takeover target for several years. PNB and EastWest Bank follow RCBC’s lead Aside from RCB, both PNB and EastWest Bank (EW) gained significantly since mid-April. Not surprisingly, these three banks were trading below book value and were the cheapest among liquid banking stocks before this recent move ensued. -

Terms and Conditions

Program Mechanics Balance Transfer 1. BDO Principal Cardholder (“Principal Cardholder”) can avail of Balance Transfer (“BT”) on Installment on the following (“Other Account Balances”): - His/Her own Non-BDO Credit Card Balances - His/Her own Personal/Salary Loan Outstanding Balances - His/Her immediate family's1 Non-BDO Credit Card Balances - His/Her immediate family's1 Personal/Salary Loan Outstanding Balances Provided that the Other Account Balances are issued by a major card issuer and/or bank in the Philippines and is/are at least six months old; active and current at the time of application. 2. BT amount per other credit card or personal/salary loan (“Loan Account”) must be: a. At least P5,000 b. Equal or less than the outstanding balance of SOA attachment c. Within assigned credit limit d. For personal/salary loans, amount must be equivalent to the total outstanding balance of the loan account as certified by other banks 3. Only the Principal Cardholder can apply for BT. 3.1. For Principal Cardholder's OWN Loan Accounts Principal Cardholder's Own Loan Accounts Application Channel Ways to Avail Requirements Branches Apply via over the counter Mail documents to 17th floor BDO 1. BT application form w ith Principal Cardholder signature 2. Latest 1 month Statement of Account (SOA) for non-BDO BDO Corporate Center Corporate Center Ortigas 12 ADB Ave., Ortigas Center, Mandaluyong City 1554 credit card or latest 3 month SOA for non-BDO personal/salary loan & Certificate of Payoff amount Fax Fax to (02) 702 6881 to 82 3. Copy of (2) valid IDs w ith Principal Cardholder signature Email to [email protected] Customer Contact Center Call 631-8000 SMS Send BDOCC INST to 2256 None2 BDO Online Banking Apply via w w w .bdo.com.ph/bt 3.2. -

Commerce Payments Online with Bancnet

Accep%ng E-Commerce Payments Online with BancNet Jane<e Toral DigitalFilipino.com Disclaimer • All text and images used in this presentaon material were liDed from the various Internet Payment Service Provider (IPSP) websites. • Sources are acknowledged for proper reference and reader verificaon. • It is meant for educaonal purposes only. No copyright infringement is intended. • An IPSP who wants to be removed or would like to give updated informaon can email Jane<e Toral at digitalfi[email protected] (Message her on Facebook once sent at h<p://facebook.com/digitalfilipino) BancNet BancNet Online Shopping Member Banks • Allied Bank • PBCom • Allied Savings Bank • Philippine Business Bank • Asia United Bank • Philippine Naonal Bank • Bank of Commerce • Philtrust Postal Bank • China Bank • PSBank • Chinatrust Bank • QCRB • Citystate Savings Bank • RCBC • Eastwest Bank • RCBC Savings • Equicom Savings • Robinsons Savings Bank • Green Bank of Caraga • Security Bank • Malayan Bank • Standard Chartered Bank • Maybank Philippines • Sterling Bank • Metrobank • TongYang Bank hps://www.bancnetonline.com/BancnetWeb/goToOnlineShoppingPage.do BancNet Internet Payment Gateway hps://www.bancnetonline.com/ BancnetWeb/ goToOnlineShoppingMerchantPage.do BancNet requirements for accreditaon • DOCUMENTARY REQUIREMENTS: – Properly signed-up Merchant Info Sheet. – Signed and notarized Memorandum of Agreement. – Corporaon: • copy of SEC Registraon and BIR Form 1901 or Audited Financial Statement (first 5 pages) – Single Proprietor: • BIR Form 1901 and Mayor's Permit hps://www.bancnetonline.com/BancnetWeb/ goToRequirementsForAccreditaonOnlinePage.do BancNet Criteria for Accreditaon • CRITERIA: – Merchant must show gross sales of PHP250,000/ month (cash/ card sales) Merchant should be willing to pay the commission or merchant discount rate. • Risk criteria – High Risk Business Model: • BancNet will not allow connec%ng to the BancNetOnline Internet Payment Gateway. -

They've Got Something to Talk About

2013 Annual Report They’ve Got Something to Talk About Table of contents VISION: “To be a world-class bank anchored on service excellence in our 2-3 About EastWest Bank chosen markets.” 4-5 How We Did BRAND PILLARS: Conversation with the Chairman • Insightful expertise directed 6-9 towards your priorities The President Speaks • We are dedicated to making 10-13 banking easier • Our entrepreneurial spirit to realize best potential 14-23 Operational Highlights 24-29 Risk Management 30-33 Corporate Governance THEY’VE GOT SOMETHING TO TALK ABOUT. From our conspicuous magenta and green stores to our innovative 34 - 37 Board of Directors products and services. In our 2013 Annual Report, we go beyond the 38 - 39 Senior Management numbers and let the numbers speak for our performance, as well as the steady patronage that we continue to enjoy from our clients. 40 List of Senior Offi cers 41 EastWest Rural Bank 42 - 43 Products and Services List 44 - 56 Store Directory 57 Audited Financial Statements Shareholder Information 2 2013 ANNUAL REPORT They’ve Got Something to Talk About 1 TheTh bank is focused on the consumer segments and the corporate middle-market.m It is the fi fth-biggest credit card issuer and one of About EastWest Bank theth largest auto credit providers in the country. EEastast WWestest BBankinganking CCorporationorporation ((PSE:PSE: EEW)W) iiss tthehe bankingbanking armarm ofof FilinvestFilinvest DDevelopmentevelopment CorporationCorporation ((PSE:PSE: FFDC),DC), oonene AAss ooff eend-2013,nd-2013, EastWestEastWest hashas a ttotalotal ooff 334747 bbranchranch stores,stores, ooff tthehe country’scountry’s leadingleading conglomerates,conglomerates, withwith iincludingncluding thosethose ofof itsits ruralrural bankingbanking bbusinessusiness interestinterest inin banking,banking, realreal estate,estate, aarm,rm, EEastWestastWest RRuralural BBank.ank. -

Medicard E-Payment Enrollment Form

MEDICARD E-PAYMENT ENROLLMENT FORM Please legibly fill-out and complete the necessary details below: 1 Bank Name/Branch : 2 Full Account Name : 3 Bank Account Number : 4 TIN Number : 5 Mobile Phone Number : 0 9 6 Email Address : Please submit this form together with a copy of the ATM Card/Passbook/Check book (showing account holder’s name, and account number) to our MediCard Representative, via email at [email protected] or send to Medicard Philippines Inc., 8th Floor, Provider Relations Department, The World Centre Bldg., 330 Senator Gil Puyat Avenue, Makati City. The following banks are accredited by our online payment service provider: Banco De Oro (BDO) Security Bank Bank of the Philippine Islands (BPI) Philippine National Bank (PNB) Chinabank Rizal Commercial Banking Corporation (RCBC) EastWest Bank United Coconut Planters Bank (UCPB) Land Bank of the Philippines (LBP) Unionbank of the Philippines (UBP) Metrobank I hereby declare that the above information is true and correct and that I agree to the collection of my data for purposes of reviewing, evaluating, processing, and facilitating bank transactions relating to my enrollment with the MediCard Online E-Payment Facility. I further consent to receive notification or correspondence from MediCard via SMS or email and hereby acknowledge that I am afforded with certain rights and protection in accordance with Republic Act 10173 also known as the Data Privacy Act of 2012. I understand that incomplete details may delay my enrollment to MediCard Online E-Payment Facility. By affixing my signature hereunder, I hereby consent to MediCard’s use of my personal information contained herein for purposes of achieving the objectives of the E-Payment Facility but consistent with the Data Privacy Act of 2012. -

Frequently Asked Questions

Frequently Asked Questions What is InstaPay? InstaPay is an electronic fund transfer (EFT) facility that allows LANDBANK clients to transfer PHP funds to other participating BSP-supervised banks and non-bank electronic-money issuers (EMIs) in the Philippines using the LANDBANK iAccess and Mobile Banking Application (MBA). The funds shall be credited real-time to the receiver’s account upon successful transaction. The facility is available 24x7, year-round, including weekends and holidays. How do I transfer funds via Instapay? Fund Transfer via InstaPay is available to all iAccess and Mobile Banking Application (MBA) users who have enrolled in the LANDBANK iAccess Fund Transfer facility. To enroll, please proceed to any LANDBANK Branch near you. Instapay via Instapay via Instapay via 1. Log-in by entering your User ID and 1. Log-in by entering your User ID and Password Password. or biometrics. 2. Click Fund Transfer. 2. Click Transfers. 3. Select the Source Account where the funds 3. Click Transfer to Other Bank. will be debited. 4. Input the One-Time PIN (OTP) sent to your 4. Select Transfer to Other Banks via Instapay. mobile number or e-mail address. If enrolled 5. Select the Destination Bank. in OTP Generator, click OK and submit the 6. Input the following details: OTP generated by your registered device. a. Receiver Name 5. Select the Destination Bank. b. Receiver Account Number 6. Select InstaPay as Transfer Method. c. Receiver Address 7. Select the Source Account where the funds d. Receiver Email will be debited. e. Receiver Mobile Number 8. Input the Recipient’s Account Number. -

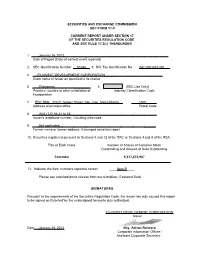

Securities and Exchange Commission Sec Form 17-C

SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-C CURRENT REPORT UNDER SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17.2(c) THEREUNDER 1. January 25, 2012 Date of Report (Date of earliest event reported) 2. SEC Identification Number _51048__ 3. BIR Tax Identification No. ___042-000-053-167__ 4. FILINVEST DEVELOPMENT CORPORATION____ Exact name of issuer as specified in its charter 5. Philippines _________ 6. (SEC Use Only) Province, country or other jurisdiction of Industry Classification Code: incorporation 7. _ FDC Bldg., 173 P. Gomez Street, San Juan, Metro Manila__ 1500 Address of principal office Postal Code 8. (632) 727-04-31 to 55___________ Issuer's telephone number, including area code 9. Not applicable ______ Former name or former address, if changed since last report 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding Common 9,317,473,987 11. Indicate the item numbers reported herein: ____Item 9____ Please see attached press release from our subsidiary, Eastwest Bank. SIGNATURES Pursuant to the requirements of the Securities Regulation Code, the issuer has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. FILINVEST DEVELOPMENT CORPORATION Issuer Date January 25, 2012 Atty. Adrian Bancoro Corporate Information Officer / Assistant Corporate Secretary PRESS RELEASE EASTWEST BANK LOOKS BACK ON A GREAT YEAR AND LOOKS FORWARD TO A GREATER ONE Seventeen years since it first opened its doors to the public, EastWest Bank is now one of the country’s fastest growing and most profitable banking institutions.