As of April 24, 2020 Frequently Asked Questions (Faqs)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thursday Calendar 20142018

THURSDAY Five-Year Calendar Unit 2014 20152016 2017 2018 Week # 1 Jan. 2 - Jan. 9 Jan. 1 - Jan. 8 Jan. 7 - Jan. 14 Jan. 5 - Jan. 12 Jan. 4 - Jan. 11 2 Jan. 9 - Jan. 16 Jan. 8 - Jan. 15 Jan. 14 - Jan. 21 Jan. 12 - Jan. 19 Jan. 11 - Jan. 18 3 Jan. 16 - Jan. 23 Jan. 15 - Jan. 22 Jan. 21 - Jan 28 Jan. 19 - Jan. 26 Jan. 18 - Jan. 25 4 Jan. 23 - Jan. 30 Jan. 22 - Jan. 29 Jan. 28 - Feb. 4 Jan. 26 - Feb. 2 Jan. 25 - Feb. 1 5 Jan. 30 - Feb. 6 Jan. 29 - Feb. 5 Feb. 4 - Feb. 11 Feb. 2- Feb. 9 Feb. 1 - Feb. 8 6 Feb. 6 - Feb. 13 Feb. 5 - Feb. 12 Feb. 11 - Feb. 18 Feb. 9 - Feb. 16 Feb. 8 - Feb. 15 7 Feb. 13 - Feb. 20 Feb. 12 - Feb. 19 Feb. 18 - Feb. 25 Feb. 16 - Feb. 23 Feb. 15 - Feb. 22 8 Feb. 20 - Feb. 27 Feb. 19 - Feb. 26 Feb. 25 - Mar. 3 Feb. 23 - Mar. 2 Feb. 22 - Mar. 1 9 Feb. 27 - Mar. 6 Feb. 26 - Mar. 5 Mar. 3 - Mar. 10 Mar. 2 - Mar. 9 Mar. 1 - Mar. 8 10 Mar. 6 - Mar. 13 Mar. 5 - Mar. 12 Mar. 10 - Mar. 17 Mar. 9 - Mar. 16 Mar. 5 - Mar. 15 11 Mar. 13 - Mar. 20 Mar. 12 - Mar. 19 Mar. 17 - Mar. 24 Mar. 16 - Mar. 23 Mar. 15 - Mar. 22 12 Mar. 20 - Mar. 27 Mar. 19 - Mar. 26 Mar. 24 - Mar. 31 Mar. 23 - Mar. 30 Mar. 22 - Mar. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

COVID-19 in Ontario: January 15, 2020 to April 24, 2021

DAILY EPIDEMIOLOGICAL SUMMARY COVID-19 in Ontario: January 15, 2020 to April 24, 2021 This report includes the most current information available from CCM as of April 24, 2021. Please visit the interactive Ontario COVID-19 Data Tool to explore recent COVID-19 data by public health unit, age group, sex, and trends over time. A weekly summary report is available with additional information to complement the daily report. This daily report provides an epidemiologic summary of recent COVID-19 activity in Ontario. The change in cases is determined by taking the cumulative difference between the current day and the previous day. Highlights There are a total of 445,351 confirmed cases of COVID-19 in Ontario reported to date. Compared to the previous day, this represents: An increase of 3,947 confirmed cases (percent change of -3.6%) An increase of 24 deaths (percent change of 0.0%) An increase of 4,239 resolved cases (percent change of -2.1%) In this document, the term ‘change in cases’ refers to cases publicly reported by the province for a given day. Data corrections or updates can result in case records being removed and or updated from past reports and may result in subset totals for updated case counts (i.e., age group, gender) differing from the overall updated case counts. The term public health unit reported date in this document refers to the date local public health units were first notified of the case. COVID-19 in Ontario: January 15, 2020 to April 24, 2021 1 Case Characteristics Table 1a. -

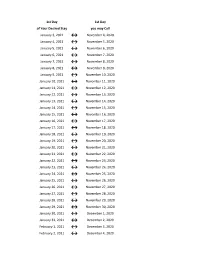

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

From: @State.Gov> Sent: Friday, April 24, 2020 6:23 PM To: Cc: @State

From: @state.gov> Sent: Friday, April 24, 2020 6:23 PM To: Cc: @state.gov; Subject: Question re asylum laws and policy Follow Up Flag: Flag for follow up Flag Status: Flagged Good evening, As you know, your questions (to provide a detailed explanation of how the policy comports with domestic and international legal obligations towards asylum seekers) covers issues that have involved significant interagency coordination from the outset. After further interagency coordination on these questions, we understand that the Department of Homeland Security recently submitted to Congress the Administration’s answers to these and other questions. Accordingly, we are forwarding the relevant information. Stay well, QUESTION: A detailed explanation of how this policy comports with domestic and international legal obligations towards asylum seekers. RESPONSE: Domestic Law Obligations: 42 U.S.C. § 265 allows the Secretary of the Department of Health and Human Services (“HHS”) to “prohibit, in whole or in part, the introduction of persons” into the United States to protect the public health of the United States. The Secretary of HHS has delegated this authority to the Director of CDC. Specifically, when introducing certain persons into the United States increases the risk of spreading communicable disease into and through the United States such that a suspension of their introduction “is required in the interest of the public health,” the statute provides that the CDC Director may “prohibit, in whole or in part, the introduction of persons . from countries or places as he shall designate in order to avert [the spread of the disease within the United States], and for such period of time as he may deem necessary for such purpose.” Invoking this authority, the CDC Director suspended the introduction of all persons who would need to be held in congregate settings at land Ports of Entry (“POEs”) or Border Patrol stations at or near the United States border with Canada or Mexico. -

COVID-19 Dashboard - Friday, April 24, 2020 Overview

4/24/2020 Quick Stats Massachusetts Department of Public Health COVID-19 Dashboard - Friday, April 24, 2020 Overview This COVID-19 dashboard presents data in an easy to interpret way and enhances the information provided in the previous daily reports with trends and situational insights into the epidemic. While this dashboard includes the same information from the daily reports, it presents new visuals of data and displays trends over time. Newly Reported Confirmed Cases Newly Reported Deaths of Cases Today Deaths Today Confirmed 50,969 COVID-19 Cases 4,946 196 2,556 Percent of All Count of Cases New Tests Total Tests Cases Currently Currently in ICU Reported Today Performed Hospitalized 8% 1,048 20,137 215,213 PLEASE NOTE: Today’s data reflects a correction of a reporting error made by Quest, a national commercial laboratory, which affected case counts in multiple states including Massachusetts. The Massachusetts Department of Public Health received a backlog this week of almost 10,000 patient results (both positive and negative) from Quest dating back to April 13. These cases are included for the first time in today’s data. To most accurately reflect real-time trends, DPH sorted the Quest backlog and incorporated confirmed cases into state data based on when those test results should have been reported. In today’s dashboard, daily case counts from April 13 through today now reflect the corrected data. Data Sources: COVID-19 Data provided by the Bureau of Infectious Disease and Laboratory Sciences, the Registry of Vital Records and Statistics, and MDPH survey of hospitals (hospital survey data are self-reported); Tables and Figures created by the Office of Population Health. -

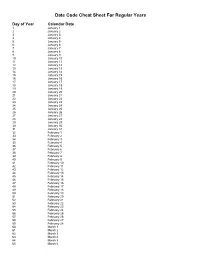

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

Date of Close Contact Exposure

Date of Close Contact Exposure 7 days 10 days 14 days Monday, November 16, 2020 Tuesday, November 24, 2020 Friday, November 27, 2020 Tuesday, December 1, 2020 Tuesday, November 17, 2020 Wednesday, November 25, 2020 Saturday, November 28, 2020 Wednesday, December 2, 2020 Wednesday, November 18, 2020 Thursday, November 26, 2020 Sunday, November 29, 2020 Thursday, December 3, 2020 Thursday, November 19, 2020 Friday, November 27, 2020 Monday, November 30, 2020 Friday, December 4, 2020 Friday, November 20, 2020 Saturday, November 28, 2020 Tuesday, December 1, 2020 Saturday, December 5, 2020 Saturday, November 21, 2020 Sunday, November 29, 2020 Wednesday, December 2, 2020 Sunday, December 6, 2020 Sunday, November 22, 2020 Monday, November 30, 2020 Thursday, December 3, 2020 Monday, December 7, 2020 Monday, November 23, 2020 Tuesday, December 1, 2020 Friday, December 4, 2020 Tuesday, December 8, 2020 Tuesday, November 24, 2020 Wednesday, December 2, 2020 Saturday, December 5, 2020 Wednesday, December 9, 2020 Wednesday, November 25, 2020 Thursday, December 3, 2020 Sunday, December 6, 2020 Thursday, December 10, 2020 Thursday, November 26, 2020 Friday, December 4, 2020 Monday, December 7, 2020 Friday, December 11, 2020 Friday, November 27, 2020 Saturday, December 5, 2020 Tuesday, December 8, 2020 Saturday, December 12, 2020 Saturday, November 28, 2020 Sunday, December 6, 2020 Wednesday, December 9, 2020 Sunday, December 13, 2020 Sunday, November 29, 2020 Monday, December 7, 2020 Thursday, December 10, 2020 Monday, December 14, 2020 Monday, November -

2021 Working Day Calendar-5 Day-Alternative Format

2021 Working Days Calendar – 5 day The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 Non-working Day Saturday, January 2, 2021 Non-working Day Sunday, January 3, 2021 Non-working Day Monday, January 4, 2021 938 Tuesday, January 5, 2021 939 Wednesday, January 6, 2021 940 Thursday, January 7, 2021 941 Friday, January 8, 2021 942 Saturday, January 9, 2021 Non-working Day Sunday, January 10, 2021 Non-working Day Monday, January 11, 2021 943 Tuesday, January 12, 2021 944 Wednesday, January 13, 2021 945 Thursday, January 14, 2021 946 Friday, January 15, 2021 947 Saturday, January 16, 2021 Non-working Day Sunday, January 17, 2021 Non-working Day Monday, January 18, 2021 Non-working Day Tuesday, January 19, 2021 948 Wednesday, January 20, 2021 949 Thursday, January 21, 2021 950 Friday, January 22, 2021 951 Saturday, January 23, 2021 Non-working Day Sunday, January 24, 2021 Non-working Day Monday, January 25, 2021 952 Tuesday, January 26, 2021 953 Wednesday, January 27, 2021 954 Thursday, January 28, 2021 955 Friday, January 29, 2021 956 Saturday, January 30, 2021 Non-working Day Sunday, January 31, 2021 Non-working Day Monday, February 1, 2021 957 Tuesday, February 2, 2021 958 Wednesday, February 3, -

2021 Calendar

Personal Services Contract (PSC) Notification and Submission Deadlines 2021 Calendar SEIU 60-Day 30-Day Notice to 7-Day Notice to Dept PSC Due to PSC Posting PSC Due to CSC CSC Meeting Notice Unions Unions DHR Report by 11am Date October 10, 2020 November 9, 2020 December 1, 2020 December 9, 2020 December 18, 2020 December 24, 2020 January 4, 2021 November 7, 2020 December 7, 2020 December 29, 2020 January 6, 2021 January 15, 2021 January 21, 2021 February 1, 2021 December 5, 2020 January 4, 2021 January 26, 2021 February 3, 2021 February 12, 2021 February 18, 2021 March 1, 2021 December 19, 2020 January 18, 2021 February 9, 2021 February 17, 2021 February 26, 2021 March 4, 2021 March 15, 2021 January 9, 2021 February 8, 2021 March 2, 2021 March 10, 2021 March 19, 2021 March 25, 2021 April 5, 2021 January 23, 2021 February 22, 2021 March 16, 2021 March 24, 2021 April 2, 2021 April 8, 2021 April 19, 2021 February 6, 2021 March 8, 2021 March 30, 2021 April 7, 2021 April 16, 2021 April 22, 2021 May 3, 2021 February 20, 2021 March 22, 2021 April 13, 2021 April 21, 2021 April 30, 2021 May 6, 2021 May 17, 2021 March 13, 2021 April 12, 2021 May 4, 2021 May 12, 2021 May 21, 2021 May 27, 2021 June 7, 2021 March 27, 2021 April 26, 2021 May 18, 2021 May 26, 2021 June 4, 2021 June 10, 2021 June 21, 2021 April 24, 2021 May 24, 2021 June 15, 2021 June 23, 2021 July 2, 2021 July 8, 2021 July 19, 2021 May 8, 2021 June 7, 2021 June 29, 2021 July 7, 2021 July 16, 2021 July 22, 2021 August 2, 2021 May 22, 2021 June 21, 2021 July 13, 2021 July 21, 2021 July -

Federal Register/Vol. 85, No. 80/Friday, April 24, 2020/Proposed

Federal Register / Vol. 85, No. 80 / Friday, April 24, 2020 / Proposed Rules 22977 under FOR FURTHER INFORMATION requested that the EPA stay the 19. Written comments submitted by CONTACT. designation rule as it applies to the mail will be delayed and no hand Electronic Access to This Document: Uinta Basin, Utah area, pending deliveries will be accepted. Our Docket The official version of this document is reconsideration. The EPA carefully Center staff will continue to provide the document published in the Federal considered the petition and supporting remote customer service via email, Register. You may access the official information, along with information phone, and webform. For further edition of the Federal Register and the contained in the rulemaking docket, in information and updates on EPA Docket Code of Federal Regulations at reaching its decision on the petition. Center services, please visit us online at www.govinfo.gov. At this site you can The EPA denied the petition for https://www.epa.gov/dockets. view this document, as well as all other reconsideration in a letter to the The EPA continues to carefully and documents of this Department petitioner and the letter has been continuously monitor information from published in the Federal Register, in included in the rulemaking docket. The the Centers for Disease Control and text or Portable Document Format letter explains the EPA’s basis for the Prevention, local area health (PDF). To use PDF you must have denial. Because the EPA denied the departments, and our Federal partners Adobe Acrobat Reader, which is reconsideration request, the EPA also so we can respond rapidly as conditions available free at the site.