World Economic Situation and Prospects 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

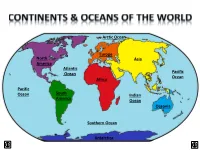

North America Other Continents

Arctic Ocean Europe North Asia America Atlantic Ocean Pacific Ocean Africa Pacific Ocean South Indian America Ocean Oceania Southern Ocean Antarctica LAND & WATER • The surface of the Earth is covered by approximately 71% water and 29% land. • It contains 7 continents and 5 oceans. Land Water EARTH’S HEMISPHERES • The planet Earth can be divided into four different sections or hemispheres. The Equator is an imaginary horizontal line (latitude) that divides the earth into the Northern and Southern hemispheres, while the Prime Meridian is the imaginary vertical line (longitude) that divides the earth into the Eastern and Western hemispheres. • North America, Earth’s 3rd largest continent, includes 23 countries. It contains Bermuda, Canada, Mexico, the United States of America, all Caribbean and Central America countries, as well as Greenland, which is the world’s largest island. North West East LOCATION South • The continent of North America is located in both the Northern and Western hemispheres. It is surrounded by the Arctic Ocean in the north, by the Atlantic Ocean in the east, and by the Pacific Ocean in the west. • It measures 24,256,000 sq. km and takes up a little more than 16% of the land on Earth. North America 16% Other Continents 84% • North America has an approximate population of almost 529 million people, which is about 8% of the World’s total population. 92% 8% North America Other Continents • The Atlantic Ocean is the second largest of Earth’s Oceans. It covers about 15% of the Earth’s total surface area and approximately 21% of its water surface area. -

MELANI CAMMETT Department of Political Science Box 1844 Brown University Providence, RI 02912 USA Tel

MELANI CAMMETT Department of Political Science Box 1844 Brown University Providence, RI 02912 U.S.A. Tel. (+1) 401-863-1570 Fax: (+1) 401-863-7018 E-mail: [email protected] Websites: www.melanicammett.net, https://research.brown.edu/myresearch/Melani_Cammett ACADEMIC POSITIONS Professor, Department of Political Science, Brown University. July 2014 – present. Associate Professor, Department of Political Science, Brown University. July 2009 – June 2014. Takemi Fellow in International Health, Harvard School of Public Health, supported by the New Directions Fellowship, Andrew W. Mellon Foundation, August 2013 – June 2014. Director, Watson Institute Postdoctoral Fellows Program, Brown University. September 2013 – present. Faculty Fellow, Watson Institute for International Studies, Brown University. September 2013 – present. Faculty Fellow, Population Studies and Training Center, Brown University. January 2012 – present. Dupee Faculty Fellow, Watson Institute for International Studies, Brown University. July 2012 – June 2013. Director, Middle East Studies Program, Brown University. September 2009 – June 2012. Kutayba Alghanim Assistant Professor of Political Economy and Assistant Professor of Political Science, Department of Political Science, Brown University. July 2005-June 2009. Academy Scholar, Harvard Academy for International and Area Studies, The Weatherhead Center for International Affairs, Harvard University. 2005-2006, 2007-2008. Assistant Professor, Department of Political Science, Brown University. July 2002-July 2005. Cammett CV Page 1 EDUCATION Ph.D. University of California at Berkeley. Political Science. December 2002. M.A. University of California at Berkeley. Political Science. 1996 M.A. The Fletcher School, Tufts University. International Relations. 1994 Fields: Development Economics, International Conflict Resolution B.A. Brown University. International Relations. 1991 BOOKS Compassionate Communalism: Welfare and Sectarianism in Lebanon. -

1 Executive Summary Mauritius Is an Upper Middle-Income Island Nation

Executive Summary Mauritius is an upper middle-income island nation of 1.2 million people and one of the most competitive, stable, and successful economies in Africa, with a Gross Domestic Product (GDP) of USD 11.9 billion and per capita GDP of over USD 9,000. Mauritius’ small land area of only 2,040 square kilometers understates its importance to the Indian Ocean region as it controls an Exclusive Economic Zone of more than 2 million square kilometers, one of the largest in the world. Emerging from the British colonial period in 1968 with a monoculture economy based on sugar production, Mauritius has since successfully diversified its economy into manufacturing and services, with a vibrant export sector focused on textiles, apparel, and jewelry as well as a growing, modern, and well-regulated offshore financial sector. Recently, the government of Mauritius has focused its attention on opportunities in three areas: serving as a platform for investment into Africa, moving the country towards renewable sources of energy, and developing economic activity related to the country’s vast oceanic resources. Mauritius actively seeks investment and seeks to service investment in the region, having signed more than forty Double Taxation Avoidance Agreements and maintaining a legal and regulatory framework that keeps Mauritius highly-ranked on “ease of doing business” and good governance indices. 1. Openness To, and Restrictions Upon, Foreign Investment Attitude Toward FDI Mauritius actively seeks and prides itself on being open to foreign investment. According to the World Bank report “Investing Across Borders,” Mauritius has one of the world’s most open economies to foreign ownership and is one of the highest recipients of FDI per capita. -

Countries and Continents of the World: a Visual Model

Countries and Continents of the World http://geology.com/world/world-map-clickable.gif By STF Members at The Crossroads School Africa Second largest continent on earth (30,065,000 Sq. Km) Most countries of any other continent Home to The Sahara, the largest desert in the world and The Nile, the longest river in the world The Sahara: covers 4,619,260 km2 The Nile: 6695 kilometers long There are over 1000 languages spoken in Africa http://www.ecdc-cari.org/countries/Africa_Map.gif North America Third largest continent on earth (24,256,000 Sq. Km) Composed of 23 countries Most North Americans speak French, Spanish, and English Only continent that has every kind of climate http://www.freeusandworldmaps.com/html/WorldRegions/WorldRegions.html Asia Largest continent in size and population (44,579,000 Sq. Km) Contains 47 countries Contains the world’s largest country, Russia, and the most populous country, China The Great Wall of China is the only man made structure that can be seen from space Home to Mt. Everest (on the border of Tibet and Nepal), the highest point on earth Mt. Everest is 29,028 ft. (8,848 m) tall http://craigwsmall.wordpress.com/2008/11/10/asia/ Europe Second smallest continent in the world (9,938,000 Sq. Km) Home to the smallest country (Vatican City State) There are no deserts in Europe Contains mineral resources: coal, petroleum, natural gas, copper, lead, and tin http://www.knowledgerush.com/wiki_image/b/bf/Europe-large.png Oceania/Australia Smallest continent on earth (7,687,000 Sq. -

Southern Africa's Credit Outlook: Will the Demographic Dynamics Become

14 April 2021Southern Africa’s credit outlook: Will the demographic Southerndynamics Africa’s become credit aoutlook: growth dividend Will the or social and fiscal demographicburden? dynamics become a growth dividend or social and fiscal burden? Southern Africa’s middle-income countries will continue to miss out on the demographic opportunity of having above-average numbers of people of working Analysts age unless their governments better tackle unemployment, social inequalities, and high HIV rates. The countries’ credit outlooks are at risk from the faltering growth, Dr. Zuzana Schwidrowski sharpening social tensions and growing fiscal pressures which demographics, in +49 69 6677389 48 the absence of the right policy mix, have accentuated for several years. [email protected] Make-or-break demographics are most acute in South Africa, the economic lynchpin Giulia Branz of the region on whose fortunes Eswatini, Lesotho and, to a lesser degree, +49 696677389 43 Botswana and Namibia depend. [email protected] The economy of South Africa has underperformed other emerging markets for years, with Team leader low employment, at 40-45% of the working-age population, being a permanent feature. Dr. Giacomo Barisone Growth fell below 2% a year after the global financial crisis, while the economy contracted +49 69 6677389 22 by almost 7% in 2020 due to the Covid-19 pandemic. Low growth has contributed to rising [email protected] public debt over the past decade, now at 77% of GDP, up from 27% in 2008 according to Media the IMF. Real GDP growth has also fallen below population growth since the middle of the last decade, leading to declines in people’s real living standards and a widening wealth Matthew Curtin gap with high-income countries, in contrast with the experience of China and India. -

2020 09 30 USG Southern Africa Fact Sheet #3

Fact Sheet #3 Fiscal Year (FY) 2020 Southern Africa – Regional Disasters SEPTEMBER 30, 2020 SITUATION AT A GLANCE 10.5 765,000 5.4 1.7 320,000 MILLION MILLION MILLION Estimated Food- Estimated Confirmed Estimated Food-Insecure Estimated Severely Estimated Number Insecure Population in COVID-19 Cases in Population in Rural Food-Insecure of IDPs in Southern Africa Southern Africa Zimbabwe Population in Malawi Cabo Delgado IPC – Sept. 2020 WHO – Sept. 30, 2020 ZimVAC – Sept. 2020 IPC – Sept. 2020 WFP – Sept. 2020 Increasing prevalence of droughts, flooding, and other climatic shocks has decreased food production in Southern Africa, extending the agricultural lean season and exacerbating existing humanitarian needs. The COVID-19 pandemic and related containment measures have worsened food insecurity and disrupted livelihoods for urban and rural households. USG partners delivered life-saving food, health, nutrition, protection, shelter, and WASH assistance to vulnerable populations in eight Southern African countries during FY 2020. TOTAL U.S. GOVERNMENT HUMANITARIAN FUNDING USAID/BHA1,2 $202,836,889 For the Southern Africa Response in FY 2020 State/PRM3 $19,681,453 For complete funding breakdown with partners, see detailed chart on page 6 Total $222,518,3424 1USAID’s Bureau for Humanitarian Assistance (USAID/BHA) 2 Total USAID/BHA funding includes non-food humanitarian assistance from the former Office of U.S. Foreign Disaster Assistance (USAID/OFDA) and emergency food assistance from the former Office of Food for Peace (USAID/FFP). 3 U.S. Department of State’s Bureau of Population, Refugees, and Migration (State/PRM) 4 This total includes approximately $30,914,447 in supplemental funding through USAID/BHA and State/PRM for COVID-19 preparedness and response activities. -

An Investigation of Debt Sustainability Issue in Gabon

ISSN: 2658-8455 Volume 1, Issue 3 (November, 2020), pp.58-72. www.ijafame.org An Investigation of Debt Sustainability issue in Gabon Ulrich Ekouala Makala, ( Ph.D. student) Central University of Finance and Economics (CUFE), Beijing, China Khalil Nait Bouzid, ( Ph.D. student) Central University of Finance and Economics (CUFE), Beijing, China School of finance Room 1015, CUFE Tower,39 South College Road, Beijing Central University of Finance and Economics Correspondence address: 100081 Tel: +86 18810270605 [email protected] The authors are not aware of any funding, that might be perceived as Disclosure statement: affecting the objectivity of this study. Conflicts of interest: The authors reports no conflicts of interest. Ekouala Makala , U., & Nait Bouzid, K. (2020). An Investigation of Debt Sustainability issue in Gabon. International Journal of Cite this article Accounting, Finance, Auditing, Management and Economics, 1(3), 58- 72. https://doi.org/10.5281/zenodo.4281440 DOI: 10.5281/zenodo.4281440 Published online: November 20, 2020. Copyright © 2020 – IJAFAME ISSN: 2658-8455 Volume 1, Issue 3 (November, 2020), pp.58-72. www.ijafame.org An Investigation of Debt Sustainability issue in Gabon Abstract The literature dealing with the issue of fiscal deficit sustainability (government's solvency) starts first with the great contribution of Hamilton and Flavin (1986), and further development by Wilcox (1989), Trehan and Walsh (1991), Hakkio and Rush (1991), Buiter and Patel (1992), Tanner and Liu (1994), Bohn (1995), Wu (1998), Makrydakis et.al., (1999). The issue of debt sustainability analysis (DSA) highlights principally three main theoretical approaches in the literature: 1) Debt Ratio analysis; 2) the Present Value Constraint (PVC); and 3) the Accounting Approach. -

Conflict Prevention in the Greater Horn of Africa

UNITED STATES INSTITUTE OF PEACE Simulation on Conflict Prevention in the Greater Horn of Africa This simulation, while focused around the Ethiopia-Eritrea border conflict, is not an attempt to resolve that conflict: the Organisation of African Unity (OAU) already has a peace plan on the table to which the two parties in conflict have essentially agreed. Rather, participants are asked, in their roles as representatives of OAU member states, to devise a blueprint for preventing the Ethiopian-Eritrean conflict from spreading into neighboring countries and consuming the region in even greater violence. The conflict, a great concern particularly for Somalia and Sudan where civil wars have raged for years, has thrown regional alliances into confusion and is increasingly putting pressure on humanitarian NGOs and other regional parties to contain the conflict. The wars in the Horn of Africa have caused untold death and misery over the past few decades. Simulation participants are asked as well to deal with the many refugees and internally displaced persons in the Horn of Africa, a humanitarian crisis that strains the economies – and the political relations - of the countries in the region. In their roles as OAU representatives, participants in this intricate simulation witness first-hand the tremendous challenge of trying to obtain consensus among multiple actors with often competing agendas on the tools of conflict prevention. Simulation on Conflict Prevention in the Greater Horn of Africa Simulation on Conflict Prevention in the Greater Horn -

Moving to the Diversification of the Gabonese Economy / Vers La Diversification De L’Économie Gabonaise2013

Moving to the Diversification of the Gabonese Economy / Vers la diversification de l’économie gabonaise l’économie de diversification la Vers / Economy Gabonese the of Diversification the to Moving Moving to the Diversification of the Gabonese Economy/ Vers la diversification de l’économie .go.kr gabonaise ksp 2013 www. Ministry of Strategy and Finance Government Complex-Sejong, 477, Galmae-ro, Sejong Special Self-Governing City 339-012, Korea Tel. 82-44-215-7732 www.mosf.go.kr Korea Development Institute 130-740, P.O.Box 113 Hoegiro 47, Dongdaemun-gu, Seoul Tel. 82-2-958-4114 www.kdi.re.kr Korea Institute for Development Strategy 135-867, WIZ Building 5F, 429, Bongeunsa-ro, Gangnam-Gu, Seoul, Korea Tel. 82-2-539-0072 www.kds.re.kr Knowledge Sharing Program Center for International Development, KDI ƔP.O. Box 113 Hoegiro 47, Dongdaemun-gu, Seoul, 130-740 2013 ƔTel. 82-2-958-4224 Ɣcid.kdi.re.kr Ɣwww.facebook.com/cidkdi Moving to the Diversification of the Gabonese Economy Moving to the Diversification of the Gabonese Economy Project Title Moving to the Diversification of the Gabonese Economy Prepared by Korea Institute for Development Strategy (KDS) Supported by Ministry of Strategy and Finance (MOSF), Republic of Korea Korea Development Institute (KDI) Prepared for Republic of Gabon In Cooperation with Ministry of Foreign Affairs, International Cooperation and Francophonie, Republic of Gabon Program Directors Hong Tack Chun, Executive Director, Center for International Development (CID), KDI MoonJoong Tcha, Senior Advisor to Deputy Prime Minister and Minister of Strategy and Finance, Former Executive Director, CID, KDI Taihee Lee, Director, Division of Knowledge Sharing Program (KSP) Consultation, CID, KDI Program Officers Mikang Kwak, Senior Research Associate, Division of KSP Consultation, CID, KDI Soyen Park, Program Officer, KDS Senior Advisor Kyoshik Kim, Former Minister of Gender Equality and Family Project Manager Jaeho Song, Professor, Jeju National University Authors Chapter 1. -

A Specific Factors Model with Unemployment and Energy Imports

Economic Modelling 40 (2014) 269–274 Contents lists available at ScienceDirect Economic Modelling journal homepage: www.elsevier.com/locate/ecmod Morocco and the US Free Trade Agreement: A specific factors model with unemployment and energy imports Mostafa Malki a, Henry Thompson b,⁎ a University of North Texas - Dallas, United States b Auburn University, United States article info abstract Article history: This paper examines the impact in Morocco of its pending free trade agreement with the US in a specific factors Accepted 16 April 2014 model with unemployment and energy imports. Projected price scenarios across eight industries lead to adjust- Available online 11 May 2014 ments in outputs, energy imports, rural wages, urban wages, and the unemployment rate. The model predicts substantial adjustments for reasonable price scenarios. Rural wages fall unless agriculture is subsidized. Unem- Keywords: ployment, assumed inversely related to output, is sensitive to price changes. Factor substitution only affects Morocco Free trade agreement the degree of output adjustments. Adjustments in capital returns lead to industrial investment and subsequent Unemployment long run output adjustments. Energy imports © 2014 Elsevier B.V. All rights reserved. Specific factors model The US Morocco Free Trade Agreement USMFTA promises to elimi- to the economy of Morocco. Separate adjustments in the returns to in- nate trade barriers between the two countries over a period of dustrial capital lead to long run investment and output adjustments. 25 years. Morocco will import more agricultural products, manufactur- The paper includes sensitivity analysis for a number of assumptions in- ing, telecommunications, and financial services from the US. The net cluding the degree of factor substitution and various price change gains from trade, however, will come with economic adjustments. -

Migration, Development and Gender in Morocco

Migration,DevelopmentandGenderinMorocco MohaEnnaji UniversityofFes,Morocco 1.Introduction Moroccan males migrate from rural and urban areas to Europe, mainly France, Spain, Belgium, Germany, and Holland. The genesis of this migration showst hatthisitisarecentphenomenon(Lapeyronni1992,Berradaetal,1994, Chattou1998).ThefirstwavesofmigrantsleftMoroccointhe1950sand1960s; thenmigrationtoWesternEuropeincreasedinthe1970sand1980s.Inthe1950s, 1960s,and1970s,le galandillegalmigrationco -existedandweretoleratedas Europe needed manpower (Chattou 1998). Consequently, the first waves of migrantsrelativelysucceededtoimprovetheirstandardsoflivingandtakecare oftheirfamiliesinbothMoroccoandtheh ostcountries.However,fromthemid - 1980s onward, the increase in migration was counterbalanced by the implementationofthevisaandtheShengenagreementwhichreinforcedcontrol onmigrantsfromMoroccotoEurope.Thisresultedinthespreadofnewfo rmsof illegalmigration. The extent of present-day male migration from Morocco to Europe is difficulttomeasuregivenitsillegalside.Statisticsshowthatthemajorityofthese migrantsarenotaccompaniedbytheirfamilies(seeHamdouchetal,1981). The causes of migration have witnessed an evolution since the 1960s and 1970s: whereasthefirstwavesofmigrantswereinsearchofabetterincome,present- daymigrantsaregenerallyunemployedandleaveMoroccoinsearchofjobs.The change in the cau ses of migration reflects concomitant changes in the socio - economicstructuresofMoroccoandthehostcountries. Thedurationofmigrationhasalsowitnessedchange:whereasmigrantsof thefirstwavesstayedlongerinthehostcountries,present-daymig -

Economic and Social Council Distr.: General 30 November 2015 Original: English

United Nations E/ECA/CRCI/9/10 Economic and Social Council Distr.: General 30 November 2015 Original: English Economic Commission for Africa Committee on Regional Cooperation and Integration Ninth session Addis Ababa, 7-9 December 2015 Overview of industrial policies and strategies in Africa July 2015 I. Introduction 1. Between 2001 and 2008, Africa experienced one of the highest levels of gross domestic product (GDP) growth in the world, between 5 and 10 per cent. Yet, the continent’s economic progress has scarcely resulted in industrialization and in the creation of quality jobs and value chains linked to Africa’s extractive industries. 2. A variety of hindrances, ranging from weak infrastructure and human capital to poor access to financing and new technologies, prevent the growth and expansion of industry on the continent. The share of manufacturing – a subsector of industry that is often a source of high productivity – in GDP fell from 15.4 per cent of GDP in Africa (excluding North Africa) in 1990 to 11 per cent in 2013.1 At present, Africa accounts for less than 2 per cent of global manufacturing exports. 3. Development history highlights the perils of high economic growth without concurrent industrial development and structural transformation. The effects of the global economic crisis on trade partners and the impact of substantially lower commodity prices threaten the sustainability of an economic model based on low value-added commodities. 4. The present review analyses the state of industrial development on the continent. It then looks at current industrial policies in six African countries from different regions and levels of development: Gabon, Morocco, Rwanda, Senegal, Swaziland and Zambia.