ARC Energy Trust Suite 4301, 400 – 3Rd Avenue S.W

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Investigation of the Interrelationships Among

AN INVESTIGATION OF THE INTERRELATIONSHIPS AMONG STREAMFLOW, LAKE LEVELS, CLIMATE AND LAND USE, WITH PARTICULAR REFERENCE TO THE BATTLE RIVER BASIN, ALBERTA A Thesis Submitted to the Faculty of Graduate Studies and Research in Partial Fulfilment of the Requirements For the Degree of Master of Science in the Department of Civil Engineering by Ross Herrington Saskatoon, Saskatchewan c 1980. R. Herrington ii The author has agreed that the Library, University of Ssskatchewan, may make this thesis freely available for inspection. Moreover, the author has agreed that permission be granted by the professor or professors who supervised the thesis work recorded herein or, in their absence, by the Head of the Department or the Dean of the College in which the thesis work was done. It is understood that due recognition will be given to the author of this thesis and to the University of Saskatchewan in any use of the material in this thesiso Copying or publication or any other use of the thesis for financial gain without approval by the University of Saskatchewan and the author's written permission is prohibited. Requests for permission to copy or to make any other use of material in this thesis in whole or in part should be addressed to: Head of the Department of Civil Engineering Uni ve:rsi ty of Saskatchewan SASKATOON, Canada. iii ABSTRACT Streamflow records exist for the Battle River near Ponoka, Alberta from 1913 to 1931 and from 1966 to the present. Analysis of these two periods has indicated that streamflow in the month of April has remained constant while mean flows in the other months have significantly decreased in the more recent period. -

Environmentally Significant Areas of Alberta Volumes 1, 2 and 3

Environmentally Significant Areas of Alberta Volumes 1, 2 and 3 Prepared by: Sweetgrass Consultants Ltd. Calgary, AB for: Resource Data Division Alberta Environmental Protection Edmonton, Alberta March 1997 Environmentally Significant Areas of Alberta Volume 1 Prepared by: Sweetgrass Consultants Ltd. Calgary, AB for: Resource Data Division Alberta Environmental Protection Edmonton, Alberta March 1997 EXECUTIVE SUMMARY Large portions of native habitats have been converted to other uses. Surface mining, oil and gas exploration, forestry, agricultural, industrial and urban developments will continue to put pressure on the native species and habitats. Clearing and fragmentation of natural habitats has been cited as a major area of concern with respect to management of natural systems. While there has been much attention to managing and protecting endangered species, a consensus is emerging that only a more broad-based ecosystem and landscape approach to preserving biological diversity will prevent species from becoming endangered in the first place. Environmentally Significant Areas (ESAs) are important, useful and often sensitive features of the landscape. As an integral component of sustainable development strategies, they provide long-term benefits to our society by maintaining ecological processes and by providing useful products. The identification and management of ESAs is a valuable addition to the traditional socio-economic factors which have largely determined land use planning in the past. The first ESA study done in Alberta was in 1983 for the Calgary Regional Planning Commission region. Numerous ESA studies were subsequently conducted through the late 1980s and early 1990s. ESA studies of the Parkland, Grassland, Canadian Shield, Foothills and Boreal Forest Natural Regions are now all completed while the Rocky Mountain Natural Region has been only partially completed. -

Watershed Resiliency and Restoration Program Maps

VU32 VU33 VU44 VU36 V28A 947 U Muriel Lake UV 63 Westlock County VU M.D. of Bonnyville No. 87 18 U18 Westlock VU Smoky Lake County 28 M.D. of Greenview No. 16 VU40 V VU Woodlands County Whitecourt County of Barrhead No. 11 Thorhild County Smoky Lake Barrhead 32 St. Paul VU County of St. Paul No. 19 Frog Lake VU18 VU2 Redwater Elk Point Mayerthorpe Legal Grande Cache VU36 U38 VU43 V Bon Accord 28A Lac Ste. Anne County Sturgeon County UV 28 Gibbons Bruderheim VU22 Morinville VU Lamont County Edson Riv Eds er on R Lamont iver County of Two Hills No. 21 37 U15 I.D. No. 25 Willmore Wilderness Lac Ste. Anne VU V VU15 VU45 r Onoway e iv 28A S R UV 45 U m V n o o Chip Lake e k g Elk Island National Park of Canada y r R tu i S v e Mundare r r e Edson 22 St. Albert 41 v VU i U31 Spruce Grove VU R V Elk Island National Park of Canada 16A d Wabamun Lake 16A 16A 16A UV o VV 216 e UU UV VU L 17 c Parkland County Stony Plain Vegreville VU M VU14 Yellowhead County Edmonton Beaverhill Lake Strathcona County County of Vermilion River VU60 9 16 Vermilion VU Hinton County of Minburn No. 27 VU47 Tofield E r i Devon Beaumont Lloydminster t h 19 21 VU R VU i r v 16 e e U V r v i R y Calmar k o Leduc Beaver County m S Leduc County Drayton Valley VU40 VU39 R o c k y 17 Brazeau County U R V i Viking v e 2A r VU 40 VU Millet VU26 Pigeon Lake Camrose 13A 13 UV M U13 VU i V e 13A tt V e Elk River U R County of Wetaskiwin No. -

This Work Is Licensed Under the Creative Commons Attribution-Noncommercial-Share Alike 3.0 United States License

This work is licensed under the Creative Commons Attribution-Noncommercial-Share Alike 3.0 United States License. To view a copy of this license, visit http://creativecommons.org/licenses/by-nc-sa/3.0/us/ or send a letter to Creative Commons, 171 Second Street, Suite 300, San Francisco, California, 94105, USA. THE TIGER BEETLES OF ALBERTA (COLEOPTERA: CARABIDAE, CICINDELINI)' Gerald J. Hilchie Department of Entomology University of Alberta Edmonton, Alberta T6G 2E3. Quaestiones Entomologicae 21:319-347 1985 ABSTRACT In Alberta there are 19 species of tiger beetles {Cicindela). These are found in a wide variety of habitats from sand dunes and riverbanks to construction sites. Each species has a unique distribution resulting from complex interactions of adult site selection, life history, competition, predation and historical factors. Post-pleistocene dispersal of tiger beetles into Alberta came predominantly from the south with a few species entering Alberta from the north and west. INTRODUCTION Wallis (1961) recognized 26 species of Cicindela in Canada, of which 19 occur in Alberta. Most species of tiger beetle in North America are polytypic but, in Alberta most are represented by a single subspecies. Two species are represented each by two subspecies and two others hybridize and might better be described as a single species with distinct subspecies. When a single subspecies is present in the province morphs normally attributed to other subspecies may also be present, in which case the most common morph (over 80% of a population) is used for subspecies designation. Tiger beetles have always been popular with collectors. Bright colours and quick flight make these beetles a sporting and delightful challenge to collect. -

Subsurface Characterization of the Pembina-Wabamun Acid-Gas Injection Area

ERCB/AGS Special Report 093 Subsurface Characterization of the Pembina-Wabamun Acid-Gas Injection Area Subsurface Characterization of the Pembina-Wabamun Acid-Gas Injection Area Stefan Bachu Maja Buschkuehle Kristine Haug Karsten Michael Alberta Geological Survey Alberta Energy and Utilities Board ©Her Majesty the Queen in Right of Alberta, 2008 ISBN 978-0-7785-6950-3 The Energy Resources Conservation Board/Alberta Geological Survey (ERCB/AGS) and its employees and contractors make no warranty, guarantee or representation, express or implied, or assume any legal liability regarding the correctness, accuracy, completeness or reliability of this publication. Any digital data and software supplied with this publication are subject to the licence conditions. The data are supplied on the understanding that they are for the sole use of the licensee, and will not be redistributed in any form, in whole or in part, to third parties. Any references to proprietary software in the documentation, and/or any use of proprietary data formats in this release, do not constitute endorsement by the ERCB/AGS of any manufacturer's product. If this product is an ERCB/AGS Special Report, the information is provided as received from the author and has not been edited for conformity to ERCB/AGS standards. When using information from this publication in other publications or presentations, due acknowledgment should be given to the ERCB/AGS. The following reference format is recommended: Bachu, S., Buschkuehle, M., Haug, K., Michael, K. (2008): Subsurface characterization of the Pembina-Wabamun acid-gas injection area; Energy Resources Conservation Board, ERCB/AGS Special Report 093, 60 p. -

Beaverhill Lake, Alberta

CANADA 28: BEAVERHILL LAKE, ALBERTA Information Sheet on Ramsar Wetlands Effective Date of Information: The information provided is taken from text supplied at the time of designation to the List of Wetlands of International Importance, May 1987 and revised by the Canadian Wildlife Service – Prairie and Northern Region in October 2001. Reference: 28th Ramsar site designated in Canada. Name and Address of Compiler: Environmental Conservation Branch, Environment Canada, Twin Atria Bldg., Room 200, 4999 - 98th Avenue, Edmonton, Alberta, T6B 2X3. Date of Ramsar Designation: 27 May 1987. Geographical Coordinates: 53°30'N., 113°30'W. General Location: The lake is situated 71 km east of Edmonton, Alberta. Area: 18 050 ha. Wetland Type (Ramsar Classification System): Inland wetlands: Type O - permanent freshwater lakes; Type Sp - permanent freshwater ponds; Type Ss - seasonal freshwater ponds, marshes, swamps including sloughs, potholes, seasonally flooded meadows and sedge marshes. Altitude: 668 - 670 m. Overview (Principal Characteristics): The site comprises 6 070 ha of land and 11 980 ha of water. The lake is located in central Alberta, at the northern edge of the aspen parkland zone. Physical Features (Geology, Geomorphology, Hydrology, Soils, Water, Climate): The Lake lies in a broad, shallow glacial basin covering approximately 13 000 ha, with an average depth of 1.5-1.8 m. The lake levels fluctuate on a long-term basis over a decade or more. This long-term decrease in water levels has exposed more than 6 070 ha of previous lake bed. The area is flat to gently-rolling and includes an abundance of depression, sloughs, and several artificial drainages. -

Eutrophication Processes in Alberta Lakes

Eutrophication processes in Alberta lakes Alexander P. Wolfe Department of Earth & Atmospheric Sciences University of Alberta, Edmonton <[email protected]> Grand Beach Lake Winnipeg Eutrophication processes in Alberta lakes • A general model for prairie lakes • Coupling of multiple elemental cycles • Coupling of inorganic and biological processes • An over-arching context involving climate/hydrological changes • Dramatic consequences for surface water quality EUTROPHICATION : The state of lakes under nutrient enrichment Grand Beach Lake Winnipeg EUTROPHICATION 20 µg/L Very common in Alberta and across the prairies; Typically accompanied by: • algal blooms • high chlorophyll • reduced biodiversity • anoxia • fish kills • esthetics and Alberta SRD property values The faces of eutrophic lakes A key role for phosphorus (P) control Experimental Lakes Area, Ontario, 1970’s, 80’s D.W. Schindler P added P concentrations >20 µg/L engender eutrophication culprits: urban and agricultural runoff, septic failures, golf courses, etc. 2 pH rises ; .) aq O + + O O 2( 2 CH 2 = ↑ O O 2 pH ∆ + + H 2 CO [P] drivesproduction algal [P] depletes Photosynthesis CO • • ves primary production Dri Chemicalconsequences: bio-inorganic bridging What goes around comes around • When algae die and settle on sediments, respiration of organic matter consumes dissolved O2, produces CO2, and pH drops as H2CO3 is produced: CH2O + O2 CO2 + H2O CO2 + H2O H2CO3 Pipit Lake, Alberta Why is this important ? • The delicate balance between oxidizing and reducing conditions (REDOX) ultimately determines the range of chemical reactions possible in lakes • In many Alberta lakes, the cycling of IRON (Fe) and SULFUR (P) can become critical in locking up (sequestering) or releasing (diffusing) PHOSPHORUS (P) stored in sediments. -

A Study of Potential Co-Product Trace Elements Within the Clear Hills Iron Deposits, Northwestern Alberta

Special Report 08 A Study of Potential Co-Product Trace Elements Within the Clear Hills Iron Deposits, Northwestern Alberta NTS 83M,N, 84C,D A STUDY OF POTENTIAL CO-PRODUCT TRACE ELEMENTS WITHIN THE CLEAR HILLS IRON DEPOSITS, NORTHWESTERN ALBERTA Prepared for Research and Technology Branch, Alberta Energy Prepared by APEX Geoscience Ltd. (Project 97213) In cooperation with The Alberta Geological Survey, Energy and Utility Board And Marum Resources Ltd. February, 1999 R.A. Olson D. R. Eccles C.J. Collom A STUDY OF POTENTIAL CO-PRODUCT TRACE ELEMENTS WITHIN THE CLEAR HILLS IRON DEPOSITS, NORTHWESTERN ALBERTA TABLE OF CONTENTS SECTION PAGE ACKNOWLEDGMENTS AND DISCLAIMER ....................................................... vi 1.0 SUMMARY ........................................................................................................1 2.0 INTRODUCTION ..................................................................................................3 2.1 Preamble....................................................................................................3 2.2 Location, Access, Physiography, Bedrock Exposure .................................4 2.3 Synopsis of Prior Scientific Studies of the Clear Hills Iron Deposits, and the Stratigraphically Correlative Bad Heart Formation ...............................4 2.4 Synopsis of Prior Exploration of the Clear Hills Iron Deposits....................6 3.0 GEOLOGY ........................................................................................................7 3.1 Introduction -

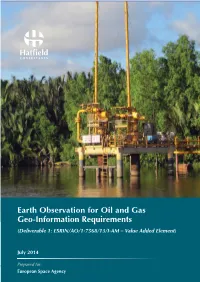

Geo-Information Requirements (Deliverable 1: ESRIN/AO/1-7568/13/I-AM – Value Added Element)

Earth Observation for Oil and Gas Geo-Information Requirements (Deliverable 1: ESRIN/AO/1-7568/13/I-AM – Value Added Element) July 2014 Prepared for: European Space Agency EARTH OBSERVATION FOR OIL AND GAS GEO-INFORMATION REQUIREMENTS (DELIVERABLE 1: ESRIN/AO/1-7568/13/I-AM – VALUE ADDED ELEMENT) Prepared for: EUROPEAN SPACE AGENCY VIA GALILEO GALILEI I – 00044 FRASCATI (RM) ITALY Prepared by: HATFIELD CONSULTANTS PARTNERSHIP #200 – 850 HARBOURSIDE DRIVE NORTH VANCOUVER, BC CANADA V7P 0A3 In association with: ARUP RPS ENERGY C-CORE CENTRUM BADAŃ KOSMICZNYCH (POLAND) JULY 2014 ESA6503.12 #200 - 850 Harbourside Drive, North Vancouver, BC, Canada V7P 0A3 • Tel: 1.604.926.3261 • Toll Free: 1.866.926.3261 • Fax: 1.604.926.5389 • www.hatfieldgroup.com ESRIN/AO/1-7568/13/I-AM HATFIELD TABLE OF CONTENTS LIST OF TABLES .............................................................................................ii LIST OF FIGURES ............................................................................................ii LIST OF APPENDICES ....................................................................................ii LIST OF ACRONYMS ..................................................................................... iii 1.0 INTRODUCTION .................................................................................1 2.0 PURPOSE ...........................................................................................1 3.0 SCOPE ................................................................................................1 4.0 APPROACH -

Petroleum Industry Oral History Project Transcript

PETROLEUM INDUSTRY ORAL HISTORY PROJECT TRANSCRIPT INTERVIEWEE: Ted Best INTERVIEWER: Susan Birley DATE: November 22, 1984 Susan: It’s November 22, 1984 and this is Susan Birley interviewing Dr. Ted Best in his office in BP. I wonder Dr. Best if you could start with where you were born and raised and just tell me a little bit about your early background. Ted: Okay, well I was born in 1927 in Windsor, Ontario and I really lived in Ontario and went to school in Ontario through to 1949, where I graduated in 1949 from the University of Wester Ontario. I had worked in Western Canada as a geology student though, in 1948 and 49. I supposed different than a lot of geologists at that time. Most of them when they graduated started working in the oil and gas industry but I decided to go to grad school and went to graduate school in the University of Wisconsin from 1949 through to the winter of 1953. During those summers I worked for the Geological Survey of Canada rather than in the Western Canadian oil and gas industry. So there was a hiatus before I came back to Western Canada in January 1953. #020 Susan: How had you become interested in geology? Were your parents in the industry or anything? Ted: No, I suppose it’s a difficult question, I really didn’t know a lot about geology when I went to university, I just went into a general science degree and enjoyed science and that. It looked like, with Canada having so many natural resources that I should go into geology, it looked like a good future. -

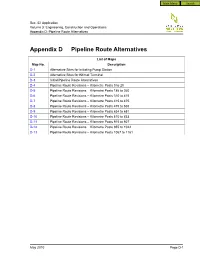

Volume 3, Appendix D: Pipeline Route Alternatives

Sec. 52 Application Volume 3: Engineering, Construction and Operations Appendix D: Pipeline Route Alternatives Appendix D Pipeline Route Alternatives List of Maps Map No. Description D-1 Alternative Sites for Initiating Pump Station D-2 Alternative Sites for Kitimat Terminal D-3 Initial Pipeline Route Alternatives D-4 Pipeline Route Revisions – Kilometre Posts 0 to 20 D-5 Pipeline Route Revisions – Kilometre Posts 186 to 260 D-6 Pipeline Route Revisions – Kilometre Posts 310 to 415 D-7 Pipeline Route Revisions – Kilometre Posts 415 to 475 D-8 Pipeline Route Revisions – Kilometre Posts 475 to 535 D-9 Pipeline Route Revisions – Kilometre Posts 634 to 681 D-10 Pipeline Route Revisions – Kilometre Posts 810 to 833 D-11 Pipeline Route Revisions – Kilometre Posts 915 to 927 D-12 Pipeline Route Revisions – Kilometre Posts 955 to 1042 D-13 Pipeline Route Revisions – Kilometre Posts 1067 to 1161 May 2010 Page D-1 114°40'0"W 114°0'0"W 113°20'0"W 112°40'0"W 112°0'0"W Bear Lake (NA) Westlock 28 18 33 Crippsdale (NA) Halfway Lake (NA) 63 Victoria Settlement (NA) Barrhead Redwater River (NA) 54°0'0"N Thunder Lake (PP) Halfmoon Lake (NA) Roselea (NA) 18 Opal (NA) 651 Redwater Newton Lake (NA) Legal Redwater (NA) r 45 e iv R le Lac La Nonne (NA) 54°0'0"N d d a P Bruderheim Majeau Lake (NA) iver Station Site bina R Pem Pembina River (NA) George Lake (NA) 2 KP 25 KP 50 Bon Accord Gibbons Bruderheim KP 75 33 KP 0 KP 100 28 Kakina Lake (NA) ALEXANDER 134 Morinville KP 125 r e v B i ea R ve n rh o il e l C g r r ee tu k S 53°40'0"N Prefontaine Brock Lakes (NA) Fort Saskatchewan 43 37 15 ALEXIS 133 Gunn (PRA) Park Court (NA) STONY PLAIN 135A 2 Elk Island National Park (NP) Bilby (NA) Mundare Lily Lake (NA) Riverlot 56 (NA) St. -

Western Grebe Surveys in Alberta 2016

WESTERN GREBE SURVEYS IN ALBERTA 2016 The western grebe has been listed as a Threatened species in Alberta. A recent data compilation shows that there are approximately 250 lakes that have supported western grebes in Alberta. However, information for most lakes is poor and outdate d. Total counts on lakes are rare, breeding status is uncertain, and the location and extent of breeding habitat (emergent vegetation, usually bulrush) is usually unknown. We are seeking your help in gathering more information on western grebe populations in Alberta. If you visit any of the lakes listed below, or know anyone that does, we would appreciate as much detail as you can collect on the presence of western grebes and their habitat. Let us know in advance (if possible) if you are planning on going to any lakes, and when you do, e-mail details of your observations to [email protected]. SURVEY METHODS: Visit a lake between 1 May and 31 August with spotting scope or good binoculars. Surveys can be done from a boat, or vantage point(s) from shore. Report names of surveyors, dates, number of adults seen, and report on the approximate percentage of the lake area that this number represents. Record presence of young birds or nesting colonies, and provide any additional information on presence/location of likely breeding habitat, specific parts of the lake observed, observed threats to birds or habitat (boat traffic, shoreline clearing, pollution, etc.). Please report on findings even if no birds were seen. Lakes on the following page that are flagged with an asterisk (*) were not visited in 2015, and are priority for survey in 2016.