Hibernia REIT P.L.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 16 Nov 2020 08:34 GMT Upcoming Events Select headline to navigate to article Kingspan FY20 to be a year of profit growth Company Events 16-Nov Kainos Group; Q221 Results Irish Banks EU banks should focus on cost cutting and Kingspan; Q320 Trading Update need a more discerning regulator 17-Nov easyJet; FY20 Results 18-Nov Breedon Group; Q320 Trading Update UK Housebuilders Rightmove asking prices fall 0.5% in British Land Company; Half Year Results 2021 Origin Enterprises; Q121 Trading Update November SSP Group; Full year results Supermarket Income REIT Accretive acquisitions add to 20-Nov Mitchells & Butlers; Full year results 23-Nov Codemasters Group; Q221 Results occupier mix Hibernia REIT Preview ahead of Tuesday’s HY21 Results Economic Events Ireland United Kingdom United States Europe This document is intended for the sole use of Goodbody Investment Banking and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap Kingspan FY20 to be a year of profit growth Kingspan has released a trading update for Q320. -

Journal of Irish and Scottish Studies Cultural Exchange: from Medieval

Journal of Irish and Scottish Studies Volume 1: Issue 1 Cultural Exchange: from Medieval to Modernity AHRC Centre for Irish and Scottish Studies JOURNAL OF IRISH AND SCOTTISH STUDIES Volume 1, Issue 1 Cultural Exchange: Medieval to Modern Published by the AHRC Centre for Irish and Scottish Studies at the University of Aberdeen in association with The universities of the The Irish-Scottish Academic Initiative and The Stout Research Centre Irish-Scottish Studies Programme Victoria University of Wellington ISSN 1753-2396 Journal of Irish and Scottish Studies Issue Editor: Cairns Craig Associate Editors: Stephen Dornan, Michael Gardiner, Rosalyn Trigger Editorial Advisory Board: Fran Brearton, Queen’s University, Belfast Eleanor Bell, University of Strathclyde Michael Brown, University of Aberdeen Ewen Cameron, University of Edinburgh Sean Connolly, Queen’s University, Belfast Patrick Crotty, University of Aberdeen David Dickson, Trinity College, Dublin T. M. Devine, University of Edinburgh David Dumville, University of Aberdeen Aaron Kelly, University of Edinburgh Edna Longley, Queen’s University, Belfast Peter Mackay, Queen’s University, Belfast Shane Alcobia-Murphy, University of Aberdeen Brad Patterson, Victoria University of Wellington Ian Campbell Ross, Trinity College, Dublin The Journal of Irish and Scottish Studies is a peer reviewed journal, published twice yearly in September and March, by the AHRC Centre for Irish and Scottish Studies at the University of Aberdeen. An electronic reviews section is available on the AHRC Centre’s website: http://www.abdn.ac.uk/riiss/ahrc- centre.shtml Editorial correspondence, including manuscripts for submission, should be addressed to The Editors,Journal of Irish and Scottish Studies, AHRC Centre for Irish and Scottish Studies, Humanity Manse, 19 College Bounds, University of Aberdeen, AB24 3UG or emailed to [email protected] Subscriptions and business correspondence should be address to The Administrator. -

Poema De Hibernia: a Jacobite Latin Epic on the Williamite Wars

POEMA DE HIBERNIA: A JACOBITE LATIN EPIC ON THE WILLIAMITE WARS (DUBLIN CITY LIBRARY AND ARCHIVE, GILBERT MS 141) Commission Edited by PÁDRAIG LENIHAN AND KEITH SIDWELL Manuscripts Irish Copyright IRISH MANUSCRIPTS COMMISSION 2018 Published by Irish Manuscripts Commission 45 Merrion Square Dublin 2 Ireland www.irishmanuscripts.ie ISBN 978-1-906856-59-7 Commission Copyright © Irish Manuscripts Commission 2018 Keith Sidwell has asserted his right to be identified as the author of the English translation, the Latin indices (Index Auctorum, Index of LatinManuscripts Names, Index of Notable Latin Words) and the literary and textual footnotes and endnotes and as the editor of the Latin text and apparatuses contained in this volume, and as co-author of the Introduction and Glossary of Biblical and Classical Allusions in accordance with Irishthe Copyright and Related Rights Act 2000, Section 107. Pádraig Lenihan has asserted his right to be identified as the author of the historical notes and as co-author of the Introduction and Glossary of Biblical and Classical Allusions in accordance with the Copyright and Related Rights Act 2000, Section 107. Copyright No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the publisher. Cover image and frontispiece: Henri Gascar ‘James, Duke of York’, 1672–73 (BHC2797, © National Maritime Museum, Greenwich, London, Greenwich Hospital Collection) -

Glanbia Reports Improving Trends in Q3 2020

THIRD QUARTER 2020 INTERIM MANAGEMENT STATEMENT Glanbia reports improving trends in Q3 2020 29 October 2020 – Glanbia plc, the global nutrition group (‘Glanbia’ or the ‘Group’), is issuing this Interim Management Statement for the nine month trading period ended 3 October 2020 (“Q3 YTD” or “first nine months of 2020”). Summary Improving trends in Q3 2020 while navigating the challenges resulting from the Covid-19 pandemic; Q3 YTD wholly owned revenues up 1.0% reported. On a like-for-like* basis up 3.1% versus prior year; Good performance from Glanbia Nutritionals (“GN”) maintaining growth trajectory, Q3 YTD like-for-like revenues up 10.9% versus prior year; Foodarom acquisition closed in the third quarter; Improving trends in Glanbia Performance Nutrition (“GPN”) in the third quarter. Q3 2020 like-for-like branded revenue down 2.3% versus Q3 2019 with positive pricing. Q3 2020 EBITA margin in double digits; GPN transformation programme on track and delivering margin improvements; Joint Ventures (“JVs”) continue to deliver a robust performance; Group is in a strong financial position, net debt at Q3 period end improved by €187.7 million versus the prior year with a net debt to EBITDA ratio of 1.95 times; Glanbia announces intention to launch a share buy-back programme of up to €50 million; and In Q4 2020, notwithstanding continued Covid-19 related uncertainty, Glanbia expects GN and JVs to continue to deliver a resilient earnings performance in addition to further sequential improvement in GPN. Commenting today, Siobhán Talbot, Group Managing Director said: “I would like to again acknowledge the tremendous efforts of all my Glanbia colleagues as well as our supplier and customer partners as we navigate the challenges of 2020. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Scotch-Irish"

HON. JOHN C. LINEHAN. THE IRISH SCOTS 'SCOTCH-IRISH" AN HISTORICAL AND ETHNOLOGICAL MONOGRAPH, WITH SOME REFERENCE TO SCOTIA MAJOR AND SCOTIA MINOR TO WHICH IS ADDED A CHAPTER ON "HOW THE IRISH CAME AS BUILDERS OF THE NATION' By Hon. JOHN C LINEHAN State Insurance Commissioner of New Hampshire. Member, the New Hampshire Historical Society. Treasurer-General, American-Irish Historical Society. Late Department Commander, New Hampshire, Grand Army of the Republic. Many Years a Director of the Gettysburg Battlefield Association. CONCORD, N. H. THE AMERICAN-IRISH HISTORICAL SOCIETY 190?,, , , ,,, A WORD AT THE START. This monograph on TJic Irish Scots and The " Scotch- Irish" was originally prepared by me for The Granite Monthly, of Concord, N. H. It was published in that magazine in three successiv'e instalments which appeared, respectively, in the issues of January, February and March, 1888. With the exception of a few minor changes, the monograph is now reproduced as originally written. The paper here presented on How the Irish Came as Builders of The Natioji is based on articles contributed by me to the Boston Pilot in 1 890, and at other periods, and on an article contributed by me to the Boston Sunday Globe oi March 17, 1895. The Supplementary Facts and Comment, forming the conclusion of this publication, will be found of special interest and value in connection with the preceding sections of the work. John C. Linehan. Concord, N. H., July i, 1902. THE IRISH SCOTS AND THE "SCOTCH- IRISH." A STUDY of peculiar interest to all of New Hampshire birth and origin is the early history of those people, who, differing from the settlers around them, were first called Irish by their English neighbors, "Scotch-Irish" by some of their descendants, and later on "Scotch" by writers like Mr. -

Transforming Dublin

Hibernia REIT plc Annual Report 2018 Annual Report Transforming Dublin Annual Report 2018 About us Hibernia is a Dublin- focused REIT, listed on Euronext Dublin and the London Stock Exchange, which owns and develops Irish property. All of our €1.3bn portfolio is in Dublin and we specialise in city centre offices. We aim to use our knowledge and experience of the Dublin property market, together with modest levels of leverage, to generate above average long-term returns for our shareholders. We focus on improving buildings at appropriate times in the property cycle and growing income: our portfolio is mainly a mix of regenerated properties and assets held for future repositioning. Clockwise from top left: 1SJRQ under construction 1WML 2WML (CGI) 2DC Clanwilliam Court 1 Cumberland Place Phase II (CGI) Hibernia’s Management Team at 1SJRQ Hibernia REIT plc Annual Report 2018 Strategic report Governance Financial statements Contents Strategic report IFC About us 02 Our business at a glance 03 Our portfolio 04 Why Dublin? 06 Chairman’s statement 08 CEO’s statement 12 Market review 14 Business model 16 Strategic priorities 18 Key performance indicators 19 Operational metrics 20 Strategy in action 24 Operational review 24 – Portfolio overview 26 – Acquisitions and disposals 28 – Developments and refurbishments 31 – Asset management 33 – Financial results and position 36 Risk management 40 Principal risks and uncertainties 48 Sustainability Governance 68 Chairman’s corporate governance statement 72 Board of Directors 74 Our Management Team 77 Corporate -

The True Roots and Origin of the Scots

THE TRUE ROOTS AND ORIGIN OF THE SCOTS A RESEARCH SUMMARY AND POINTERS TOWARD FURTHER RESEARCH “Wherever the pilgrim turns his feet, he finds Scotsmen in the forefront of civilization and letters. They are the premiers in every colony, professors in every university, teachers, editors, lawyers, engineers and merchants – everything, and always at the front.” – English writer Sir Walter Besant Copyright © C White 2003 Version 2.1 This is the first in a series of discussion papers and notes on the identity of each of the tribes of Israel today Some Notes on the True Roots and Origin of the Scots TABLE OF CONTENTS Introductory Remarks 3 Ancient Judah 6 Migrations of Judah 17 British Royal Throne 25 National and Tribal Emblems 39 Scottish Character and Attributes 44 Future of the Scots – Judah’s Union with the rest of Israel 55 Concluding Remarks 62 Bibliography 65 “The mystery of Keltic thought has been the despair of generations of philosophers and aesthetes … He who approaches it must, I feel, not alone be of the ancient stock … but he must also have heard since childhood the deep and repeated call of ancestral voices urging him to the task of the exploration of the mysteries of his people … He is like a man with a chest of treasure who has lost the key” (The Mysteries of Britain by L Spence) 2 Some Notes on the True Roots and Origin of the Scots INTRODUCTORY REMARKS Who really are the Scottish peoples? What is their origin? Do tradition, national characteristics and emblems assist? Why are they such great leaders, administrators and inventors? Is there a connection between them and the ancient Biblical tribe of Judah? Why did the British Empire succeed when other Empires did not? Was it a blessing in fulfillment of prophecies such as that in Gen 12:3? Why were the Scots so influential in the Empire, way beyond their population numbers? Today book after book; article after article; universities, politicians, social workers spread lies about the British Empire, denigrating it. -

Real Estate Finance Lawyers Who Understand the Market

Firm foundations Real estate finance lawyers who understand the market Eversheds Sutherland’s dynamic and client-focused real estate finance practice provides an all-Ireland service from its offices in Dublin and Belfast. Our team advises on significant financing transactions in the real estate sector and we aim to set the standard when it comes to consistent quality and innovative thinking. Our real estate finance team has acted and continues to act for major domestic and international funders, specialist real estate lenders, real estate funds, REITS and developer clients in connection with some of the largest real estate financing deals undertaken in the Irish market over recent years. The team also has significant experience in real estate securitisations and loan sales as well as structuring acquisitions and developments involving Qualifying Investor Alternative Investment Funds (QIAIFs), REITs, ICAVs and limited partnerships, real estate mergers and acquisitions, joint venture structuring and complex real estate acquisitions. Our credentials Areas we cover include: – Development finance – Regulated fund – Financial services structures/asset regulatory management – Restructuring – Project and We have the largest full service We are on the panel of more infrastructure finance – Tax structuring and tax real estate team of any global than 25 major international planning advice law firm consistently ranked in banks and several hundred – Real estate finance directories worldwide global corporations – Real estate securitisation Examples -

182 Chapter 12 Hibernia: Voices of Dissent, 1968–80 Brian Trench for at Least the Last Decade of Its Existence, Spanning the 1

Chapter 12 Hibernia: voices of dissent, 1968–80 Brian Trench For at least the last decade of its existence, spanning the 1970s, Hibernia had a strong presence in Irish media as an independent, frequently dissenting voice. It provided a platform for a wider range of opinion than was represented in daily and weekly newspapers and in broadcasting. It was a springboard for young graduates into significant careers in journalism. It is often fondly remembered in anecdote but it has not been the subject of extended analysis or even of a personal memoir that offers a broader appraisal or account of its place in Irish media and society.1 In his history of Irish media, John Horgan offers a packed paragraph that recounts: [John] Mulcahy … turned it into a lively, irreverent and often well-informed magazine which specialised in an eclectic but highly marketable mix of political gossip and features, book reviews, and authoritative business and financial journalism. Its tone was crusading and investigative: by 1973 it was already carrying articles alleging conflicts of interest and possible corruption in relation to the activities of local politicians in the Greater Dublin area – an issue which resurfaced with dramatic effect, at the end of the 1990s.2 There are passing references in other works of history and reference, such as MacRedmond’s Modern Irish Lives, which refers to its ‘searching liberal critique of Irish society’ and Morash’s history of media, which describes Hibernia as ‘robustly critical … [and] … in some respects [setting] the agenda for the magazines that would follow it in the 1980s’.3 Journalists’ books covering the 1960s and 1970s, including those by Tim Pat Coogan, T. -

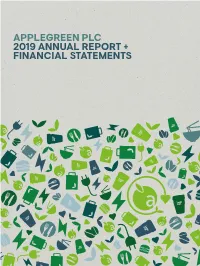

APPLEGREEN PLC 2019 ANNUAL REPORT + FINANCIAL STATEMENTS Applegreen Spalding, UK 2 APPLEGREEN PLC ANNUAL REPORT and FINANCIAL STATEMENTS 2019 3

APPLEGREEN PLC 2019 ANNUAL REPORT + FINANCIAL STATEMENTS Applegreen Spalding, UK 2 APPLEGREEN PLC ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 3 A YEAR OF GROWTH Revenue Non-Fuel Gross Profit €4bn €3.1bn €430.6m €500m €3bn €2.0bn €0.9bn €400m €247.8m €1.4bn €2bn €0.1bn €300m €186.2m €1.1bn €1.2bn €113.6m €2.2bn €200m €92.8m €1.9bn €76.9m €36.6m €1bn €182.8m €100m €149.7m FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 APGN WB APGN WB Adjusted EBITDA Site Numbers (pre-IFRS 16) €140.4m 556 €150.0 600 472 €120.0 45 500 342 43 €90.0 €82.7m 400 €58.1m 243 200 511 €60.0 €39.8m 300 429 €28.9m €32.0m €10.3m 200 €30.0 €47.8m €57.7m 100 €0.0 0 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 FY 2015 FY 2016 FY 2017 FY 2018 FY 2019 APGN WB APGN WB Welcome Break refers to the assets acquired as part of the Welcome Break transaction in 2018 4 APPLEGREEN PLC ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 5 OVERVIEW Applegreen plc is a high growth roadside convenience retail business operating in Ireland, the United Kingdom and North America 556 SITES/ Since the company’s foundation in 1992 with We have now established a large Petrol Filling one site in Dublin, we have always aimed to Station (PFS) footprint in the US and our aim 660 QUALITY provide a superior customer experience and is to expand our presence as a recognised value for money.