ORDER by the COUNTY JUDGE of HARRIS COUNTY (Temporarily Controlling the Occupancy of a Premises)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Williamson County Texas

Williamson County Texas Total and Per Farm Overview, 2017 and change since 2012 (Z) Percent of state agriculture sales % change 2017 since 2012 Share of Sales by Type (%) Number of farms 2,634 +4 Crops 58 Land in farms (acres) 559,261 (Z) Livestock, poultry, and products 42 Average size of farm (acres) 212 -3 Total ($) Land in Farms by Use (%) a Market value of products sold 114,923,000 -11 Cropland 41 Government payments 6,359,000 +74 Pastureland 51 Farm-related income 9,386,000 +23 Woodland 5 Total farm production expenses 123,085,000 -1 Other 2 Net cash farm income 7,583,000 -55 Acres irrigated: 1,586 Per farm average ($) (Z)% of land in farms Market value of products sold 43,631 -14 Government payments Land Use Practices (% of farms) (average per farm receiving) 13,387 +144 Farm-related income 13,864 +25 No till 3 Reduced till 3 Total farm production expenses 46,729 -4 Intensive till 9 Net cash farm income 2,879 -56 Cover crop 2 Farms by Value of Sales Farms by Size Number Percent of Total a Number Percent of Total a Less than $2,500 1,424 54 1 to 9 acres 336 13 $2,500 to $4,999 349 13 10 to 49 acres 1,173 45 $5,000 to $9,999 261 10 50 to 179 acres 660 25 $10,000 to $24,999 280 11 180 to 499 acres 236 9 $25,000 to $49,999 114 4 500 to 999 acres 107 4 $50,000 to $99,999 69 3 1,000 + acres 122 5 $100,000 or more 137 5 Williamson County Texas, 2017 Page 2 Market Value of Agricultural Products Sold Rank Counties Rank Counties Sales in Producing in Producing ($1,000) State b Item U.S. -

Calculating Texas Sales Tax Texas Residents Are Required to Pay 6.25% Sales Tax to the State of Texas When Purchasing a Vehicle

Travis County Tax Office Calculating Texas Sales Tax Texas residents are required to pay 6.25% sales tax to the state of Texas when purchasing a vehicle. If sales tax was paid in another state, the vehicle owner will get credit for the sales tax already paid on the vehicle and will pay the difference between the rates when titling the vehicle in Texas. Use the following to determine how much is owed: Proof of Sales Tax Paid Sales Tax Due Bill of sale includes an itemized sales tax No sales tax is due to the state of Texas. Provide collection that is 6.25% or more proof of sales tax paid by submitting the itemized bill of sale. Bill of sale is not itemized or no sales tax has Sales tax is calculated using the following formula: been paid to the state where the vehicle was (Vehicle Price – Trade in Value) x 6.25%. purchased Example: The vehicle was purchased for $29,500 and there was a trade in value of $5,400. Step 1: Calculate the amount subject to tax 29,500 – 5,400 = 24,100 Step 2: Multiply the result by .0625% 24,100 x .0625 Sales Tax Due in Texas = $1,506.25 Provide proof of sales tax paid by submitting the itemized bill of sale along with $1,506.25. Bill of sale includes an itemized sales tax Sales tax is calculated using the following formula: collection that is less than 6.25% (Vehicle Price - Trade in Value) x (6.25% - percent paid to your state) Example: The vehicle was purchased for $29,500 and there was a trade in value of $5,400. -

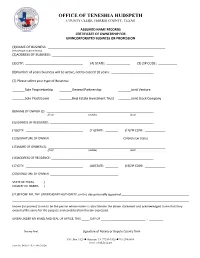

1-2 Owners Application

OFFICE OF TENESHIA HUDSPETH COUNTY CLERK, HARRIS COUNTY, TEXAS ASSUMED NAME RECORDS CERTIFICATE OF OWNERSHIP FOR UNINCORPORATED BUSINESS OR PROFESSION (1)NAME OF BUSINESS: (Please type or print clearly) (2)ADDRESS OF BUSINESS: (3)CITY: (4) STATE: (5) ZIP CODE: (6)Number of years business will be active, not to exceed 10 years: (7) Please select your type of Business: Sole Proprietorship General Partnership Joint Venture Sole Practitioner Real Estate Investment Trust Joint Stock Company (8)NAME OF OWNER (1): (first) (middle) (last) (9)ADDRESS OF RESIDENCE: (10)CITY: (11)STATE: (12)ZIP CODE: (13)SIGNATURE OF OWNER (14)Veteran Status (15)NAME OF OWNER (2): (first) (middle) (last) (16)ADDRESS OF RESIDENCE: (17)CITY: (18)STATE: (19)ZIP CODE: (20)SIGNATURE OF OWNER STATE OF TEXAS } COUNTY OF HARRIS } (21)BEFORE ME, THE UNDERSIGNED AUTHORITY, on this day personally appeared known (or proven) to me to be the person whose name is subscribed in the above statement and acknowledged to me that they executed the same for the purpose and consideration therein expressed. GIVEN UNDER MY HAND AND SEAL OF OFFICE, THIS DAY OF , . Notary Seal Signature of Notary or Deputy County Clerk P.O. Box 1525 Houston, TX 77251-1525 713-274-8686 www.cclerk.hctx.net Form No. D-02-07 (Rev. 09/03/2020) GUIDE FOR COMPLETING THE ASSUMED NAME (D/B/A/) APPLICATION Type or print all entries on your application clearly (1) The name of your business (2) Street number and street name of your business location (3) City where business is located (4) State where your business is located (5) 5-digit address mailing code of your business (6) How many years will your business name stay active, cannot exceed 10 years (7) Select your type of business/service (8) Name of the business owner (9) Street number and name of your residence location, no P.O. -

Penal Code Offenses by Punishment Range Office of the Attorney General 2

PENAL CODE BYOFFENSES PUNISHMENT RANGE Including Updates From the 85th Legislative Session REV 3/18 Table of Contents PUNISHMENT BY OFFENSE CLASSIFICATION ........................................................................... 2 PENALTIES FOR REPEAT AND HABITUAL OFFENDERS .......................................................... 4 EXCEPTIONAL SENTENCES ................................................................................................... 7 CLASSIFICATION OF TITLE 4 ................................................................................................. 8 INCHOATE OFFENSES ........................................................................................................... 8 CLASSIFICATION OF TITLE 5 ............................................................................................... 11 OFFENSES AGAINST THE PERSON ....................................................................................... 11 CLASSIFICATION OF TITLE 6 ............................................................................................... 18 OFFENSES AGAINST THE FAMILY ......................................................................................... 18 CLASSIFICATION OF TITLE 7 ............................................................................................... 20 OFFENSES AGAINST PROPERTY .......................................................................................... 20 CLASSIFICATION OF TITLE 8 .............................................................................................. -

Gonzales County Texas

Gonzales County Texas Total and Per Farm Overview, 2017 and change since 2012 Percent of state agriculture 2 sales % change 2017 since 2012 Share of Sales by Type (%) Number of farms 1,612 -4 Land in farms (acres) 614,280 +1 Crops 7 Average size of farm (acres) 381 +5 Livestock, poultry, and products 93 Total ($) Land in Farms by Use (%) a Market value of products sold 560,829,000 +8 Government payments 478,000 -60 Cropland 10 Farm-related income 4,249,000 +39 Pastureland 68 Total farm production expenses 412,189,000 -4 Woodland 18 Net cash farm income 153,367,000 +69 Other 4 Acres irrigated: 1,529 Per farm average ($) (Z)% of land in farms Market value of products sold 347,909 +12 Government payments Land Use Practices (% of farms) (average per farm receiving) 7,471 +32 Farm-related income 10,388 +30 No till 1 Total farm production expenses 255,700 -1 Reduced till 1 Net cash farm income 95,141 +75 Intensive till 1 Cover crop 1 Farms by Value of Sales Farms by Size Number Percent of Total a Number Percent of Total a Less than $2,500 503 31 1 to 9 acres 84 5 $2,500 to $4,999 196 12 10 to 49 acres 349 22 $5,000 to $9,999 216 13 50 to 179 acres 548 34 $10,000 to $24,999 251 16 180 to 499 acres 337 21 $25,000 to $49,999 156 10 500 to 999 acres 154 10 $50,000 to $99,999 117 7 1,000 + acres 140 9 $100,000 or more 173 11 Gonzales County Texas, 2017 Page 2 Market Value of Agricultural Products Sold Rank Counties Rank Counties Sales in Producing in Producing ($1,000) State b Item U.S. -

Marriage License Requirements

REQUIREMENTS FOR MARRIAGE LICENSE APPLICATON IN GALVESTON COUNTY 1. THE MARRIAGE LICENSE DEPARTMENT IS LOCATED ON THE 2ND FLOOR OF THE JUSTICE CENTER, 600 59th STREET, GALVESTON, TX OR 174 CALDER DRIVE, LEAGUE CITY, TX. OFFICE HOURS ARE 8:00 AM TO 5:00 PM, MONDAY THROUGH FRIDAY, EXCEPT HOLIDAYS. 2. BOTH APPLICANTS MUST SUBMIT PROOF OF AGE AND IDENTITY BY PROVIDING ONE OF THE FOLLOWING: (A) DRIVERS LICENSE (B) STATE ID (C) A U.S. OR FOREIGN PASSPORT OR (D) CERTIFIED COPY OF THE APPLICANT'S BIRTH CERTIFICATE (ALONG WITH A PICTURE ID). (Section 2.005 Texas Family Code). 3. EACH APPLICANT IS REQUIRED TO KNOW OR PRESENT THEIR SOCIAL SECURITY NUMBER (IF APPLICABLE). 4. THE FEE FOR A MARRIAGE LICENSE IS $81 CASH, CREDIT OR DEBIT CARD. THE GALVESTON COUNTY CLERK'S OFFICE WILL NOT ACCEPT CHECKS. 5. APPLICANTS UNDER THE AGE OF 18 (MINORS 16-17) RESIDENTS OF TEXAS AND OUT OF STATE, MUST PETITION A COURT FOR THE REMOVAL OF THE DISABILITIES OF A MINOR BEFORE APPLYING FOR A MARRIAGE LICENSE IN GALVESTON COUNTY. ALL MINORS MUST APPEAR AND PROVIDE TO THE COUNTY CLERK A CERTIFIED COPY OF THE COURT ORDER "REMOVAL OF DISABILITIES OF MINORITY" GRANTED BY THE STATE OF TEXAS OR ANOTHER STATE, IN ORDER FOR THE MINOR TO APPLY FOR A MARRIAGE LICENSE. THIS APPLIES TO ALL MINOR MARRIAGES FILED AFTER 09/01/17. (SB1705) 6. THE COUNTY CLERK MAY NOT ISSUE A MARRIAGE LICENSE IF EITHER APPLICANT INDICATES THAT THE APPLICANT HAS BEEN DIVORCED WITHIN THE LAST 30 DAYS, UNLESS: (A) THE APPLICANTS WERE DIVORCED FROM EACH OTHER; OR (B) THE PROHIBITION AGAINST REMARRIAGE IS WAIVED BY THE COURT (Section 2.009 Texas Family Code). -

Gonzales County Texas

Gonzales County Texas 2012 2007 % change Number of Farms 1,674 1,861 - 10 Land in Farms 609,790 acres 654,077 acres - 7 Average Size of Farm 364 acres 351 acres + 4 Market Value of Products Sold $517,760,000 $404,019,000 + 28 Crop Sales $23,246,000 (4 percent) Livestock Sales $494,513,000 (96 percent) Average Per Farm $309,295 $217,098 + 42 Government Payments $1,202,000 $441,000 + 173 Average Per Farm Receiving Payments $5,645 $4,079 + 38 Farms by Size, 2012 Land in Farms, 2012 by Land Use 700 600 Pastureland 500 70.4% 400 Farms 300 Other uses 200 1.9% Cropland 100 11.3% 0 1-9 10-49 50-179 180-499 500-999 1,000+ Woodland 16.3% Acres Gonzales County – Texas Ranked items among the 254 state counties and 3,079 U.S. counties, 2012 Item Quantity State Rank Universe 1 U.S. Rank Universe 1 MARKET VALUE OF AGRICULTURAL PRODUCTS SOLD ($1,000) Total value of agricultural products sold 517,760 12 254 102 3,077 Value of crops including nursery and greenhouse 23,246 88 253 1,627 3,072 Value of livestock, poultry, and their products 494,513 8 254 45 3,076 VALUE OF SALES BY COMMODITY GROUP ($1,000) Grains, oilseeds, dry beans, and dry peas 3,689 108 238 1,857 2,926 Tobacco - - - - 436 Cotton and cottonseed (D) (D) 165 (D) 635 Vegetables, melons, potatoes, and sweet potatoes 647 60 199 1,004 2,802 Fruits, tree nuts, and berries (D) (D) 215 (D) 2,724 Nursery, greenhouse, floriculture, and sod (D) 23 165 (D) 2,678 Cut Christmas trees and short rotation woody crops - - 46 - 1,530 Other crops and hay 4,361 71 252 672 3,049 Poultry and eggs 402,262 2 241 -

International Exchange Fact Sheet

International Exchange Fact Sheet GENERAL CONTACT INFORMATION APPLICATION INFORMATION OFFICIAL NAME WEBSITE The University of Texas Austin global.utexas.edu/isss/students/exchange/apply SCHOOL WEBSITE APPLICATION PROCESS utexas.edu 1. Home institution submits nomination (Students may be nominated for in-person or virtual exchange) CONTACT INFORMATION & ADDRESS 2. Student completes UT Exchange Admission Application PHYSICAL ADDRESS Some Academic departments require additional review or application International Student and Scholar materials. Please visit the exchange application page for details. Services (ISSS) The University of Texas at Austin APPLICATION DEADLINE 2400 Nueces Street, Suite B Austin, Texas 78705 FALL SEMESTER (AUGUST–DECEMBER) March 1 PHONE +1 (512) 471–2477 SPRING SEMESTER (JANUARY–MAY) October 1 EXCHANGE WEBSITE global.utexas.edu/isss/students/exchange POST-ADMISSION STEPS AND DEADLINE 1. Login to myIO portal ADMINISTRATIVE CONTACT PERSONS 2. Provide the following information in myIO a. Passport INCOMING STUDENTS CONTACT b. Current Academic Transcript c. English Proficiency Tina Ross d. Proof of Funding (required in order to obtain J-1 visa) Senior Program Coordinator e. Academic Information Sheet (course preferences) Sponsored and Exchange Programs, ISSS DEADLINE PHONE Rolling deadline. Students will not receive DS-2019 until (512) 232–9572 they have successfully completed all steps in myIO. EMAIL [email protected] IMMIGRATION AND VISA REQUIREMENTS OUTGOING STUDENTS CONTACT EXCHANGE STUDENTS Students participating in the reciprocal exchange program are Lucie Zacharova issued Form DS-2019 to apply for a J-1 visa to cover the duration Assistant Director of Education Abroad of their academic study period, usually one or two semesters. Reciprocal exchange students enroll in a non-degree academic PHONE program, according to the terms of exchange agreements between (512) 475–8769 UT Austin and their home universities. -

August 13, 2021 the Honorable Greg Abbott the Honorable Mike Morath

THE SECRETARY OF EDUCATION WASHINGTON, DC 20202 August 13, 2021 The Honorable Greg Abbott The Honorable Mike Morath Governor Commissioner The Capitol Texas Education Agency PO Box 12428 1701 N. Congress Avenue Austin, TX 78711 Austin, TX 78701 Dear Governor Abbott and Commissioner Morath: As the new school year begins in school districts across Texas, it is our shared priority that students return to in-person instruction safely. The safe return to in-person instruction requires that school districts be able to protect the health and safety of students and educators, and that families have confidence that their schools are doing everything possible to keep students healthy. Texas’s recent actions to block school districts from voluntarily adopting science-based strategies for preventing the spread of COVID-19 that are aligned with the guidance from the Centers for Disease Control and Prevention (CDC) puts these goals at risk and may infringe upon a school district’s authority to adopt policies to protect students and educators as they develop their safe return to in-person instruction plans required by Federal law. We are aware that Texas has issued an Executive Order prohibiting local educational agencies (LEAs), among other local government entities, from adopting requirements for the universal wearing of masks.1 Further, guidance released on August 5, 2021, by the Texas Education Agency (TEA) states that “school systems are not required to conduct COVID-19 contact tracing.”2 These State level actions against science-based strategies for preventing the spread of COVID-19 appear to restrict the development of local health and safety policies and are at odds with the school district planning process embodied in the U.S. -

In the Supreme Court of Texas

FILED 20-0249 3/30/2020 12:00 AM tex-41995472 SUPREME COURT OF TEXAS BLAKE A. HAWTHORNE, CLERK NO. ______________ In the Supreme Court of Texas IN RE STEVEN HOTZE, M.D., HOTZE HEALTH & WELLNESS CENTER, PASTOR JUAN BUSTAMANTE, CITY ON A HILL CHURCH, PASTOR GEORGE GARCIA, POWER OF LOVE CHURCH, AND PASTOR DAVID VALDEZ, WORLD FAITH CENTER OF HOUSTON CHURCH, Relators, Original Proceeding Pursuant to Texas Constitution art. V, §3 EMERGENCY PETITION FOR WRIT OF MANDAMUS JARED WOODFILL Woodfill Law Firm, P.C. State Bar No. 00788715 3 Riverway, Ste. 750 Houston, Texas 77056 (713) 751-3080 (Telephone) (713) 751-3058 (Facsimile) [email protected] Counsel for Relators i IDENTITY OF PARTIES AND COUNSEL 1. Relators Steven Hotze, MD 20214 Braidwood Drive Katy, Texas 77450 (Harris County) Pastor Juan Bustamante City on a Hill Church 3902 Cochran Street Houston, Texas 77009 Pastor George Garcia The Power of Love Church 17431 Barnwood Road Houston, Texas 77090 Pastor David Valdez World of Faith Center of Houston, Inc. 8117 East North Belt Humble, Texas 77396 Lawyer for Relators: Jared R. Woodfill State Bar No. 00788715 3 Riverway, Ste. 750 Houston, Texas 77056 Tel: (713) 751-3080 Fax: (713) 751-3058 [email protected] 2. Respondent Honorable Lina Hildago Harris County Judge 1001 Preston, Suite 911 Houston, Texas 77002 ii Court Phone: (713) 274-7000 Fax Number: (713) 755-8379 Lawyer for Respondent: Vince Ryan State Bar No. 17489500 1019 Congress, 15th Floor Houston, Texas 77002 Tel: (713) 755-5101 iii TABLE OF CONTENTS Page Identity of Parties and Counsel ................................................................................. ii Table of Contents ..................................................................................................... -

Cause No. 2020-22609 Steven Hotze, M.D., § in the District

CAUSE NO. 2020-22609 STEVEN HOTZE, M.D., § IN THE DISTRICT COURT Hotze Health & Wellness Center, § THOMAS DELAY, § PASTOR JUAN BUSTAMANTE, § City on a Hill Church, § PASTOR GEORGE GARCIA, § Power of Love Church, § PASTOR DAVID VALDEZ, § World Faith Center of Houston § Church, and § 281ST JUDICIAL DISTRICT PASTOR JOHN GREINER, § Glorious Way Church, § Plaintiffs, § v. § § LINA HIDALGO, in her official § capacity as Harris County Judge, and § HARRIS COUNTY, § Defendants. § HARRIS COUNTY, TEXAS Brief of Amicus Curiae Americans United for Separation of Church and State in Support of Defendants PATRICK GRUBEL Attorney in Charge State Bar No. 24106034 [email protected] KENNETH D. UPTON, JR. State Bar No. 00797972 [email protected] Americans United for Separation of Church and State 1310 L Street NW, Suite 200 Washington, DC 20005 (202) 466-3234 (phone) (202) 466-3353 (fax) Counsel for Amicus Curiae TABLE OF CONTENTS Page(s) Table of Authorities ....................................................................................................... ii Identity and Interests of Amicus Curiae ...................................................................... 1 Introduction and Summary of Argument ..................................................................... 1 Argument and Authorities ............................................................................................ 3 I. The Order Does Not Violate The Texas Constitution’s Guarantee of Religious Freedom. ............................................................................................... -

SWP UPDATE on COVID-19 May 15, 2020 - Current

SWP UPDATE ON COVID-19 May 15, 2020 - Current COMPREHENSIVE LIST of COVID-19-RELATED ORDERS AND PROCLAMATIONS GENERAL • Texas state courts are suspending proceedings on a county by county basis. • In order to facilitate court activities, the Office of Court Administration is providing Judges the ability to stream and host court proceedings via Zoom and YouTube. • For a list of court and clerk’s office closures, partial closures, and delays, visit https://www. txcourts.gov/programs-services/court-security/emergency-court-preparedness/closures/. To access the April 14, 2020 - May 14, 2020 list please click the following link, here. To access the March 13, 2020 - April 13, 2020 list please click the following link, here. June 29, 2020 • Houston Mayor Sylvester Turner announced that all July events permitted or sponsored by the city have been canceled. • All Houston ISD campuses and district facilities will be partially closed from July 3 through July 19 amid the recent increase in confirmed novel coronavirus cases and hospitalizations. • Texas city and county leaders continue to ask Gov. Greg Abbott for authority to implement local stay-at-home orders. Houston Mayor Sylvester Turner issued an impassioned plea for Abbott to let cities and counties make decisions for themselves. Officials in Bexar County wrote a similar letter to the governor. Dallas County Judge Clay Jenkins sent a letter to Abbott over the weekend, requesting that the governor consider a list of recommendations from a citywide public health committee, such as instituting a 30-day stay-at-home order and mandating masks. *still in effect June 26, 2020 • Gov.