Moving Forward: Developing Highway Ppps in Lao

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Resettlement and Ethnic Development Plan Nam Ngiep 1 Hydropower

Resettlement and Ethnic Development Plan Project Number: 41924 June 2014 Document Stage: Final Nam Ngiep 1 Hydropower Project (Lao People’s Democratic Republic) Annex A Part 6 Prepared by Nam Ngiep 1 Power Company Ltd. for the Asian Development Bank The final report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. Your attention is directed to the “Terms of Use” section of this website. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Provincial level: Lao People’s Democratic Republic Peace Independence Democracy Unity Prosperity ***************** Minutes of meeting Nam Ngiep 1 Hydropower Project dated 28 April 2008 at Vientiane Province - Based on the announcement of the Head of the Office of the Ministry of Energy and 1 Mines number 453 / EM dated 19 April 2007 regarding to the survey to collect information on socioeconomic and environmental issues of Nam Ngiep 1 Hydropower Project. - Based on the proposal of the company (NCC) who is the person who surveyed the socio and environment of the project. At 8:00am on the morning of 28 April 2008 a meeting was held at the meeting room of the Thamphoxay Guest House, Viengkham District, Vientiane Province, co- chaired by Mr. Bounmee Phouthavong, Deputy Governor of Vientiane Province, and Mr. -

Initial Environmental Examination

Initial Environmental Examination Project No.: 50099-003 June 2018 REG: Fourth Greater Mekong Subregion Corridor Towns Development Pakxan Subproject Prepared by the Ministry of Public Works and Transport for the Asian Development Bank. CURRENCY EQUIVALENTS (as of 18 June 2018) Currency unit – Kip (LAK) LAK1.00 = $0.000119 $1.00 = LAK 8,412 ABBREVIATIONS ADB – Asian Development Bank AP – affected person CEMP – contractor environmental management plan CSO – combined sewer overflow DHUP – Department of Housing and Urban Planning DONRE – Department of Natural Resources and Environment DPWT – Department of Public Works and Transport EIA – environmental impact assessment EIAR – environmental impact assessment report EHS – environmental, health, and safety guidelines EMP – environmental management plan EMR – environmental monitoring report ERT – emergency response team ESO – environmental safeguard officer (of executing agency) ES – environmental specialist GHG – greenhouse gas GMS – Greater Mekong Subregion GMS-CTDP-4 – Fourth Greater Mekong Subregion Corridor Towns Development Project GRM – grievance redress mechanism HDPE – high-density polyethylene IEC – information, education and communication IEE – initial environmental examination IEER – initial environmental examination report Lao PDR – Lao People’s Democratic Republic MONRE – Ministry of Natural Resources and Environment MPWT – Ministry of Public Works and Transport PIU – project implementation unit PIC – project implementation consultant PMU – project management unit PPE – personal -

Working for Health in the Lao People's Democratic Republic, 1962-2012

YEARS Working for Health in the Lao People’s Democratic Republic 5 1962–2012 Fifty Years Working for Health in the Lao People’s Democratic Republic 1962–2012 WHO Library Cataloguing in the Publication Data Fifty years: working for health in the Lao People’s Democratic Republic, 1962-2012 1. Delivery of healthcare. 2. Health services. 3. Laos. 4. National health programs. 5. Primary health care. I. World Health Organization Regional Office for the Western Pacific. ISBN 978 92 9061 601 6 (NLM Classification: WA 530) © World Health Organization 2013 All rights reserved. The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the World Health Organization concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Dotted lines on maps represent approximate border lines for which there may not yet be full agreement. The mention of specific companies or of certain manufacturers’ products does not imply that they are endorsed or recommended by the World Health Organization in preference to others of a similar nature that are not mentioned. Errors and omissions excepted, the names of proprietary products are distinguished by initial capital letters. The World Health Organization does not warrant that the information contained in this publication is complete and correct and shall not be liable for any damages incurred as a result of its use. Publications of the World Health Organization can be obtained from Marketing and Dissemination, World Health Organization, 20 Avenue Appia, 1211 Geneva 27, Switzerland (tel: +41 22 791 2476; fax: +41 22 791 4857; email: [email protected]). -

330 Forest Utilization by Local People in Sang Thong

FOREST UTILIZATION BY LOCAL PEOPLE IN SANG THONG DISTRICT Khamvieng Xayabouth* 1. Introduction Lao People’s Democratic Republic is a landlocked country in Southeast Asia, occupying the northern section of the Indochinese peninsula. It is surrounded by China, Vietnam, Cambodia and Myanmar. Laos is mountainous country, particularly in the north where the peaks rise to 2,500 meters. The high mountains along the eastern border which separate Laos from Vietnam are the source of east- west rivers which cross the country emptying into the Mekong river which flows through the country for almost 500 kilometers and defines the boundary between Laos and both Thailand and Myanmar. The population of Laos is approximately 4.5 million (1996). The majority of this population lives on the fertile plains along the Mekong River. The population growth is estimated to be approximately 2.9 percent a year. Although still a minority, the percent of population living in urban areas is growing steadily and the labor force is estimated to be about 1.5 million. The economy of the country is dominated by agriculture. Agriculture products constitute 60 percent of the gross national product (GNP) with 85-90 percent of the total labor force employed in agricultural activities. The principle agriculture products are rice, wheat, potatoes, and fruits. Industry accounts for about 16 percent of the GNP. The major industrial products are tin, timber, tobacco, textiles and electric power. Laos is divided into 16 provinces, one prefecture and one special region which are further divided into districts. There are totally 112 districts and 11,424 villages (1988). -

Typhoon Haima in the Lao People's Democratic Republic

TYPHOON HAIMA IN THE LAO PEOPLE’S DEMOCRATIC REPUBLIC Joint Damage, Losses and Needs Assessment – August, 2011 A Report prepared by the Government of the Lao PDR with support from the ADB , ADPC, FAO , GFDRR, Save the Children, UNDP, UNFPA, UNICEF, UN-HABITAT, WFP, WHO, World Bank, World Vision, and WSP Lao People's Democratic Republic Peace Independence Democracy Unity Prosperity TYPHOON HAIMA JOINT DAMAGE, LOSSES AND NEEDS ASSESSMENT (JDLNA) *** October 2011 A Report prepared by the Government of the Lao PDR With support from the ADB, ADPC, FAO, GFDRR , Save the Children, UNDP, UNFPA, UNICEF, UN- HABITAT, WFP ,WHO, World Bank, World Vision, AND WSP Vientiane, August 29, 2011 Page i Foreword On June 24-25, 2011, Typhoon Haima hit the Northern and Central parts of the Lao PDR causing heavy rain, widespread flooding and serious erosion in the provinces of Xiengkhouang, Xayaboury, Vientiane and Bolikhamxay. The typhoon caused severe damage and losses to the basic infrastructure, especially to productive areas, the irrigation system, roads and bridges, hospitals, and schools. Further, the typhoon disrupted the local people’s livelihoods, assets and properties. The poor and vulnerable groups of people are most affected by the typhoon. Without immediate recovery efforts, its consequences will gravely compromise the development efforts undertaken so far by the government, seriously set back economic dynamism, and further jeopardise the already very precarious situation in some of the provinces that were hard hit by the typhoon. A Joint Damage, Losses and Needs Assessment (JDLNA) was undertaken, with field visit to the four most affected provinces from 25th July to 5th August 2011. -

Payments for Environmental Services Schemes

Effective Implementation of Payments for Environmental Services in Lao PDR Research Reports ISSN 2202-7432 THE ENVIRONMENTAL, ECONOMIC AND SOCIAL CONDITION OF THE NAM MOUANE – NAM GNOUANG CATCHMENT Research Report No. 5 October 2014 Xiong Tsechalicha1, Yiakhang Pangxang2, Saysamone Phoyduangsy3 & Phouphet Kyophilavong4 The project ‘Effective Implementation of Payments for Environmental Services in Lao PDR’ is funded by the Australian Centre for International Agricultural Research (ACIAR). The reports produced within this project are published by the Crawford School of Public Policy, Australian National University, Canberra, 0200 Australia. The reports present work in progress being undertaken by the project team. The views and interpretations expressed in these reports are those of the author(s) and should not be attributed to any organization associated with the project. Because these reports present the results of work in progress, they should not be reproduced in part or in whole without the authorization of the Australian Project Leader, Professor Jeff Bennett ([email protected]). 1Centre for Environmental Economics & Policy, University of Western Australia 2,3,4Faculty of Economics and Business Management, National University of Laos Abstract The main objective of this Research Report is to overview the environmental, economic and social condition of the Nam Mouane – Nam Gnouang catchment. This Research Report identifies threats to forest wildlife and forest cover arising from current management practices and suggests possible management actions to achieve environmental improvements. These include reducing the expansion of shifting cultivation into undisturbed forests by improving agricultural productivity of slash-and- burned; reducing poaching/ hunting of forest wildlife through increased patrolling and the collection of snares. -

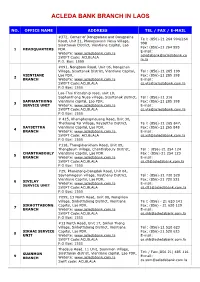

Acleda Bank Branch in Laos

ACLEDA BANK BRANCH IN LAOS NO. OFFICE NAME ADDRESS TEL / FAX / E-MAIL #372, Corner of Dongpalane and Dongpaina Te l: (856)-21 264 994/264 Road, Unit 21, Phonesavanh Neua Village, 998 Sisattanak District, Vientiane Capital, Lao Fax: (856)-21 264 995 1 HEADQUARTERS PDR. E-mail: Website: www.acledabank.com.la [email protected] SWIFT Code: ACLBLALA m.la P.O. Box: 1555 #091, Nongborn Road, Unit 06, Nongchan Village, Sisattanak District, Vientiane Capital, Tel : (856)-21 285 199 VIENTIANE Lao PDR. Fax: (856)-21 285 198 2 BRANCH Website: www.acledabank.com.la E-mail: SWIFT Code:ACLBLALA [email protected] P.O Box: 1555 Lao-Thai friendship road, unit 10, Saphanthong Nuea village, Sisattanak district, Tel : (856)-21 316 SAPHANTHONG Vientiane capital, Lao PDR. Fax: (856)-21 285 198 3 SERVICE UNIT Website: www.acledabank.com.la E-mail: SWIFT Code:ACLBLALA [email protected] P.O Box: 1555 # 415, Khamphengmeuang Road, Unit 30, Thatluang Tai Village, Xaysettha District, Te l: (856)-21 265 847, XAYSETTHA Vientiane Capital, Lao PDR. Fax: (856)-21 265 848 4 BRANCH Website: www.acledabank.com.la, E-mail: SWIFT Code: ACLBLALA [email protected] P.O Box: 1555 #118, Thongkhankham Road, Unit 09, Thongtoum Village, Chanthabouly District, Tel : (856)-21 254 124 CHANTHABOULY Vientiane Capital, Lao PDR Fax : (856)-21 254 123 5 BRANCH Website: www.acledabank.com.la E-mail: SWIFT Code:ACLBLALA [email protected] P.O Box: 1555 #29, Phonetong-Dongdok Road, Unit 04, Saynamngeun village, Xaythany District, Tel : (856)-21 720 520 Vientiane Capital, Lao PDR. -

Sustainable Rattan Production

2011 Sustainable Rattan Production Manual for Small and Medium Enterprises in Lao PDR THIS PUBLICATION FUNDED BY : The European Union through WWF’s rattan project “Establishing a Sustainable Production System for Rattan Products in Cambodia, Laos and Vietnam” AU T HOR : Vilasack Xayaphet CONSUL T AN T : Ms. Vilayvanh Saysanavongphet EDI T OR FOR ENGLISH LANGUAGE : Frazer Henderson EDI T OR : Thibault Ledecq GRAPHIC DESIGN AND LAYOU T : Noy Promsouvanh PHO T OGRAPHER : Noy Promsouvanh PRINTING HOUSE : Naxay Services Sign and Printing COPYRIGH T : 2011- WWF/LNCCI This publication has been produced with the financial assistance of the European Union. The contents of this publication are the sole responsibility of WWF and can in no way be taken to reflect the views of the European Union. 2011 Sustainable Rattan Production Manual for Small and Medium Enterprises in Lao PDR NOTE Vientiane, 11 November 2011 Dear readers, With the support of WWF Laos, the Lao National Chamber of Commerce has produced a manual on “ Sustainable Rattan Production for the Lao rattan SMEs” reflecting the experiences gained during the different projects on building a sustainable value chain for Lao rattan sector aiming at linking local producers with global value chains which will create new local income opportunities and employment, while simultaneously alleviating poverty and protecting natural resources. This manual is an important reference on how Lao rattan businesses could move on to a sustainable production. All the essential elements are ex- plained from where to get sustainable rattan to export. As the world mar- ketplace changes every year, we encourage them to move forward and be part of these changes and get the benefits from that. -

Simulation of Supply/Demand Balance

The Study on Power Network System Master Plan in Lao PDR Draft Final Report (Stage 3) Simulation of Supply/Demand Balance 17.1. Options for Power Development Plan up to 2030 In order to examine supply reliability and supply-demand balance based on the Lao PDR’s development situation, and considering the development status of the country’s power supply facilities and transmission facilities, a simulation is conducted for 2030. Laos’s power system is examined up to 2030 considering the demand situation in the domestic system and the expansion plans for transmission lines. The northern and central 1 areas are put together to form a Laos NC system, the central 2 a Laos C system, and the southern part an S system. Based on the results of the supply/demand balance simulations, we make recommendations for power plant expansion plans and transmission lines, and for interconnections with neighboring countries. Power Development Plan for Laos’ domestic system up to 2030 1. Power plants for analysis of supply/demand balance in Laos In examining the supply/demand balance for domestic demand in Laos up to 2030, we use the power plan approved by the MEM Minister (see Table 17.1-1). Table 17.1-1 Power Development Plan approved by minister of MEM, including existing plants No Power Plant MW Type COD Province Region 1 Nam Dong 1.00 Run of river 1970 Luangprabang NC 2 Nam Ngum 1 155.00 Reservoir 1971 Vientiane Pro NC 3 Nam Ko 1.50 Run of river 1996 Oudomxay NC 4 Nam Luek 60.00 Reservoir 2000 Saysomboun NC 5 Nam Mang 3 40.00 Reservoir 2004 Vientiane Pro -

Movement Pathways and Market Chains of Large Ruminants in the Greater Mekong Sub-Region

Movement pathways and market chains of large ruminants in the Greater Mekong Sub-region FUNDED BY THE GOVERNMENT OF PR CHINA AND AUSTRALIAN STANDZ INITIATIVE | downloaded: 4.11.2019 Polly Smith, Nancy Bourgeois Lüthi, Li Huachun, Kyaw Naing Oo, Aloun Phonvisay, Sith Premashthira, Ronello Abila, Phillip Widders, Karan Kukreja and Corissa Miller https://doi.org/10.24451/arbor.6560 source: 0 Table of Contents Executive Summary ................................................................................................................................. 1 Purpose ................................................................................................................................................... 2 Background ............................................................................................................................................. 2 Methodology ........................................................................................................................................... 3 Snowball sampling .............................................................................................................................. 4 Interview technique ............................................................................................................................ 5 Constraints .......................................................................................................................................... 6 Results .................................................................................................................................................... -

Feasibility Study Report

LAO PEOPLE’S DEMOCRATIC REPUBLIC PAKLAY HYDROPOWER PROJECT Feasibility Study Report FINAL (Chapter 2 - 4) DEVELOPER: CONSULTANT: March, 2017 Contents NO. CHAPTER 1 Executive Summary 2 Hydrology 3 Engineering Geology 4 Project Planning 5 Project Layout and Main Structures 6 M&E Equipment and Hydraulic Steel Structures 7 Construction Organization Design 8 Project Management Plan 9 Environmental and Social Impact Assessment 10 Project Cost Estimation 11 Economic Evaluation 2 Hydrology Contents 2 Hydrology ...................................................................................................................... 2-1 2.1 Catchment Overview .............................................................................................................................. 2-1 2.2 Hydrometric Station and Basic Data .................................................................................................... 2-5 2.3 Runoff .................................................................................................................................................... 2-10 2.4 Flood ...................................................................................................................................................... 2-23 2.5 Stage-Discharge Relation ..................................................................................................................... 2-44 2.6 Sediment ............................................................................................................................................... -

Preliminary Gibbon Status Review for Lao PDR 2008

Preliminary Gibbon Status Review for Lao PDR 2008 J.W. Duckworth December 2008 This work was carried out with funding from the Arcus Foundation. Preliminary gibbon status review for Lao PDR 2008 This review is a work in progress for the conservation of gibbons in Lao PDR. It is intended to be updated periodically. Any comment on this document, including further records, would be gratefully received by the author and by Fauna & Flora International, at the addresses below. Citation: J. W. Duckworth, 2008, Preliminary gibbon status review for Lao PDR 2008, Fauna & Flora International, Unpublished report. Author: J. W. Duckworth, PO Box 5773, Vientiane, Lao PDR Email: [email protected] Date: December 2008 For more information or to send further comments contact: Paul Insua-Cao Fauna & Flora Asia-Pacific Programme, 340 Nghi Tam, Hanoi, Vietnam Tel: +84-(0)43-719 4117 Fax: +84-(0)43-719 4119 Email: [email protected] Front cover photo of a captive young yellow-cheeked crested gibbon by Monty Sly. All views expressed within are the author’s alone unless attributed otherwise and do not necessarily reflect the opinion of Fauna & Flora International. While the authors and editors strive for rigour and accuracy in presenting this report, Fauna & Flora International make no representations as to completeness, suitability or validity of any information contained, and will not be liable for any errors or omissions. The editors and Fauna & Flora International take no responsibility for any misrepresentation of material resulting from translation of this report into any other language. Reproduction of any part of this report for educational, conservation and other non-profit purposes is authorised without prior permission from the copyright holder, provided that the source is fully acknowledged.