Agnès Blust Consulting Ltd., Prepared Jointly With

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Release

CREDIT SUISSE AG Paradeplatz 8 Tel. +41 844 33 88 44 P.O. Box Fax +41 44 333 88 77 CH-8070 Zurich [email protected] Switzerland Rating Overview of Swiss Companies Company CS Rating CS Outlook Changes since June 2009 S&P Moody's ABB Low A Stable A–, Stable A3, Stable Adecco Mid BBB Negative Outlook changed from Stable to Negative BBB–, Stable Baa3, Stable AFG Low BBB Stable Outlook changed from Negative to Stable n.r. n.r. Alpiq High A Stable n.r. n.r. Aryzta High BBB Stable Coverage initiation n.r. n.r. Axpo Low AA Stable n.r. n.r. Bâloise Low A Stable A–, Stable1 n.r. BKW Low AA Stable n.r. n.r. –1 notch, outlook changed from Negative to Bobst Group Low BBB Stable n.r. n.r. Stable Bucher Industries High BBB Stable n.r. n.r. CKW n.r. n.r. Drop coverage Clariant High BB Stable BBB–, Stable Ba1, Stable Coop Low A Stable n.r. n.r. –1 notch, outlook changed from Stable to Edipresse High BB Negative n.r. n.r. Negative –1 notch, outlook changed from Negative to EGL Low A Stable n.r. n.r. Stable EMS Chemie Low A Stable Outlook changed from Negative to Stable n.r. n.r. Energiedienst Low A Stable n.r. n.r. EOS n.r. n.r. Drop coverage Flughafen Zurich Mid BBB Stable BBB+, Positive n.r. Forbo Mid BBB Stable n.r. n.r. Geberit High BBB Stable A–, Stable n.r. -

Swiss Opportunity Fund

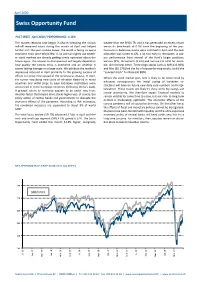

January 2021 Swiss Opportunity Fund FACT SHEET January 2021 / PERFORMANCE 0.19% After stocks ended 2020 with a such a strong performance, a The Swiss Opportunity Fund kept pace with its relevant bench- bumpy start to the new year could be expected. There was a raft mark and crept 0.19% higher. There was no clear trend among of economic news with few upside surprises. Political develop- the portfolio positions. Logitech (8.08%) and Zur Rose (44.7%) ments in the US captured the world's attention. The assault on continued to drive performance, as did some cyclical positions the Capitol Building, the formal confirmation of President-Elect such as Zehnder (10.15%), SIG (3.31%) and Sulzer (3.54%). Mean- Joe Biden’s win and the Democratic sweep of the Georgia run-off while, the rather defensive plays such as Sonova (-6.35%), Strau- election giving them control of the US Senate all happened dur- mann (-4.06%) and Vifor Pharma (-12.81%) hurt overall perfor- ing the space of 48 hours. Observers of these events may have mance. Turning to transaction activity, we opened a position in held their breath, but financial markets hardly reacted. That was Stadler Rail (10.34%) and sharply reduced our position in Zur attributable, in our opinion, to the prospect of more fiscal stimu- Rose as its share price surged on frothy sentiment. So where do lus and to statements from the relevant central banks in which we stand now after the opening month of the new year? Obvi- they pledged to keep monetary policy ultra-expansive. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

FTSE Developed Europe

2 FTSE Russell Publications 19 August 2021 FTSE Developed Europe Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.01 GERMANY Avast 0.03 UNITED Cnp Assurance 0.02 FRANCE 3i Group 0.14 UNITED KINGDOM Coca-Cola HBC AG 0.06 UNITED KINGDOM Aveva Group 0.05 UNITED KINGDOM A P Moller - Maersk A 0.1 DENMARK KINGDOM Coloplast B 0.19 DENMARK A P Moller - Maersk B 0.15 DENMARK Aviva 0.19 UNITED Colruyt 0.03 BELGIUM A2A 0.03 ITALY KINGDOM Commerzbank 0.07 GERMANY Aalberts NV 0.05 NETHERLANDS AXA 0.43 FRANCE Compagnie Financiere Richemont SA 0.55 SWITZERLAND ABB 0.51 SWITZERLAND B&M European Value Retail 0.06 UNITED Compass Group 0.33 UNITED KINGDOM ABN AMRO Bank NV 0.04 NETHERLANDS KINGDOM BAE Systems 0.21 UNITED Acciona S.A. 0.03 SPAIN Continental 0.14 GERMANY KINGDOM Accor 0.06 FRANCE ConvaTec Group 0.05 UNITED Baloise 0.06 SWITZERLAND Ackermans & Van Haaren 0.03 BELGIUM KINGDOM Banca Mediolanum 0.02 ITALY ACS Actividades Cons y Serv 0.06 SPAIN Covestro AG 0.1 GERMANY Banco Bilbao Vizcaya Argentaria 0.36 SPAIN Adecco Group AG 0.09 SWITZERLAND Covivio 0.04 FRANCE Banco Santander 0.58 SPAIN Adevinta 0.04 NORWAY Credit Agricole 0.14 FRANCE Bank Pekao 0.03 POLAND Adidas 0.63 GERMANY Credit Suisse Group 0.22 SWITZERLAND Bankinter 0.03 SPAIN Admiral Group 0.08 UNITED CRH 0.35 UNITED Banque Cantonale Vaudoise 0.02 SWITZERLAND KINGDOM KINGDOM Barclays 0.35 UNITED Adyen 0.62 NETHERLANDS Croda International 0.12 UNITED KINGDOM KINGDOM Aegon NV 0.06 NETHERLANDS Barratt Developments 0.09 UNITED Cts Eventim 0.03 GERMANY Aena SME SA 0.1 SPAIN KINGDOM Cyfrowy Polsat SA 0.02 POLAND Aeroports de Paris 0.03 FRANCE Barry Callebaut 0.07 SWITZERLAND Daimler AG 0.66 GERMANY Ageas 0.09 BELGIUM BASF 0.64 GERMANY Danone 0.37 FRANCE Ahold Delhaize 0.26 NETHERLANDS Bayer AG 0.53 GERMANY Danske Bank A/S 0.1 DENMARK AIB Group 0.02 IRELAND Bechtle 0.04 GERMANY Dassault Aviation S.A. -

Notice N19 2019

Swiss Instruments to be delisted from CLXNz CH0011115703 Crealogix Holding AG LEHNz CH0022427626 LEM Holding SA SFZNz CH0014284498 Siegfried Holding AG UBS MTF effective 1 July CMBNz CH0225173167 Cembra Money Bank AG LEONz CH0190891181 Leonteq AG SGKNz CH0011484067 St Galler Kantonalbank AG CONz CH0244017502 Conzzeta AG LHNz CH0012214059 LafargeHolcim Ltd SGSNz CH0002497458 SGS SA COTNz CH0360826991 Comet Holding AG LINNz CH0001307757 Bank Linth LLB AG SIGNz CH0435377954 SIG Combibloc Group AG Symbol ISIN Issuer CPENz CH0048854746 Castle Private Equity Ltd LISNz CH0010570759 Chocoladefabriken Lindt & Spruengli AG SIKAz CH0418792922 Sika AG ABBNz CH0012221716 ABB Ltd CPHNz CH0001624714 CPH Chemie & Papier Holding AG LISPz CH0010570767 Chocoladefabriken Lindt & Spruengli AG SIMAz CH0014420878 UBS CH Property Fund - Swiss Mixed Sima ADENz CH0012138605 Adecco Group AG CSGNz CH0012138530 Credit Suisse Group AG LLQz CH0033813293 Lalique Group SA SLHNz CH0014852781 Swiss Life Holding AG ADVNz CH0008967926 Adval Tech Holding AG DAEz CH0030486770 Daetwyler Holding AG LOGNz CH0025751329 Logitech International SA SNBNz CH0001319265 Schweizerische Nationalbank ADXNz CH0029850754 Addex Therapeutics Ltd DCNz CH0008531045 Datacolor AG LONNz CH0013841017 Lonza Group AG SOONz CH0012549785 Sonova Holding AG AEVSz CH0478634105 AEVIS VICTORIA SA DESNz CH0020739006 Dottikon Es Holding AG LUKNz CH0011693600 Luzerner Kantonalbank AG SPCEz CH0009153310 Spice Private Equity AG AIREz CH0010947627 Airesis SA DKSHz CH0126673539 DKSH Holding AG MBTNz CH0108503795 -

Notice N19 2019

UBS MTF Market Notice Swiss Market Removal 28 June 2019 Dear Member, Following the announcement of the Swiss Federal Department of Finance on June 24 (FDF prepared to activate measure to protect Swiss stock exchange infrastructure), and further to our notice of the same date, UBS MTF will remove all instruments issued by companies with registered offices in Switzerland which are listed on Swiss trading venues. This update will take effect from 1 July. Our daily Stock Universe file, published on our website at https://www.ubs.com/global/en/investment- bank/ib/multilateral-trading-facility/reference-data.html and by SFTP, will reflect the removal of these instruments as of this date. Instruments not subject to the Swiss measure are unaffected; a list of affected instruments is attached to this notice. If you have any queries regarding this notice please contact the UBS MTF Supervisors at +44 207 568 2052 or [email protected]. UBS MTF Management Notice N19 2019 UBS MTF Notices and documentation are available at https://www.ubs.com/mtf. If you have any queries regarding this notice, or comments on the above, please contact the UBS MTF Supervisors at +44 20 7568 2052 or [email protected]. UBS MTF is operated by UBS AGLB which is authorised by the Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and Prudential Regulation Authority. UBS AG is a public company incorporated with limited liability in Switzerland domiciled in the Canton of Basel-City and the Canton of Zurich respectively registered at the Commercial Registry offices in those Cantons with Identification No: CHE-101.329.561 as from 18 December 2013 (and prior to 18 December 2013 with Identification No: CH-270.3.004.646-4) and having respective head offices at Aeschenvorstadt 1, 4051 Basel and Bahnhofstrasse 45, 8001 Zurich, Switzerland and is authorised and regulated by the Financial Market Supervisory Authority in Switzerland. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe ex UK ex 19 August 2021 Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 1&1 AG 0.02 GERMANY BMW 0.41 GERMANY Engie 0.27 FRANCE A P Moller - Maersk A 0.14 DENMARK BMW AG Pref 0.06 GERMANY Eni 0.37 ITALY A P Moller - Maersk B 0.2 DENMARK BNP Paribas 0.81 FRANCE Epiroc A 0.17 SWEDEN A2A 0.04 ITALY Boliden 0.13 SWEDEN Epiroc B 0.09 SWEDEN Aalberts NV 0.06 NETHERLANDS Bollore 0.06 FRANCE EQT Partners AB 0.1 SWEDEN ABB 0.69 SWITZERLAND Bouygues 0.09 FRANCE Equinor ASA 0.24 NORWAY ABN AMRO Bank NV 0.06 NETHERLANDS Brenntag AG 0.17 GERMANY Ericsson A 0.01 SWEDEN Acciona S.A. 0.04 SPAIN Bureau Veritas S.A. 0.11 FRANCE Ericsson B 0.45 SWEDEN Accor 0.08 FRANCE Buzzi Unicem 0.03 ITALY Erste Group Bank 0.12 AUSTRIA Ackermans & Van Haaren 0.04 BELGIUM CaixaBank 0.16 SPAIN EssilorLuxottica 0.65 FRANCE ACS Actividades Cons y Serv 0.08 SPAIN Campari 0.08 ITALY Essity Aktiebolag B 0.24 SWEDEN Adecco Group AG 0.12 SWITZERLAND Capgemini SE 0.36 FRANCE Eurazeo 0.05 FRANCE Adevinta 0.05 NORWAY Carl Zeiss Meditec 0.08 GERMANY Eurofins Scienti 0.17 FRANCE Adidas 0.85 GERMANY Carlsberg (B) 0.22 DENMARK Euronext 0.11 FRANCE Adyen 0.84 NETHERLANDS Carrefour 0.14 FRANCE Evolution AB 0.3 SWEDEN Aegon NV 0.09 NETHERLANDS Casino Guichard Perrachon 0.02 FRANCE Evonik Industries AG 0.08 GERMANY Aena SME SA 0.14 SPAIN Castellum 0.08 SWEDEN Evotec 0.08 GERMANY Aeroports de Paris 0.04 FRANCE CD Projekt SA 0.04 POLAND Exor NV 0.1 ITALY Ageas 0.12 BELGIUM Cellnex Telecom SAU 0.46 SPAIN Fastighets AB Balder B 0.08 SWEDEN Ahold Delhaize 0.35 NETHERLANDS Chr. -

Swiss Prime Site Annual Report 2019

2019ANNUAL REPORT Reporting 2019 This year, Swiss Prime Site is publishing an integrated report for the first time. The report is based on the Inte- grated Reporting (<IR>) Framework of the International Integrated Reporting Council (IIRC) and follows the Glob- al Reporting Initiative (GRI) standards. Swiss Prime Site is reporting for the first time on climate-related risks us- ing the guidelines of the Task Force on Climate-related Financial Disclosures (TCFD). Reporting consists of the online report (www.sps. swiss/reporting) and the separate sub-reports (PDF download). For reasons of sustainability, only the short report is available as a printed version. Contents Integrated Report Corporate Governance Report Compensation Report Financial Report 2019INTEGRATED REPORT Integrated Report 4 Key figures 5 Our strengths 6 Foreword by the Chairman 8 Interview with the CEO 14 Interview with the CEO Immobilien 18 Board of Directors 19 Executive Board 20 Success story 22 Our markets 24 Risk management 26 Strategy 28 Property portfolio 30 Project pipeline Value creation 32 Assuming responsibility 36 Stakeholder engagement 38 Materiality analysis 42 Sustainability goals and roadmap 48 Business model 50 Integrated value creation 53 Value creation group companies 58 Reduction pathway 64 TCFD Report Notes 70 GRI Report 100 Key figures of group companies 106 GRI Content Index 110 Independent Limited Assurance Report on selected GRI Disclosures Reporting structure 113 Information policy Reporting consists of the online report (sps.swiss/en/reporting) -

UBS Underlyings-Offering on Swiss DOTS

Public Distribution June 2014 Switzerland UBS underlyings-offering on Swiss DOTS A D I ABB Ltd. Daimler AG IBM Corporation Actelion Ltd. DAX® Infineon Technologies AG Adecco SA Dell Inc. Intel Corporation Advanced Micro Devices Inc. Deutsche Bank AG AFG Arbonia-Forster-Holding AG Deutsche Lufthansa AG J Alcatel-Lucent SA Deutsche Telekom AG Johnson & Johnson Alcoa Inc. DKSH Holding Ltd. JPMorgan Chase & Co. Allianz SE Dow Chemical Co. Julius Baer Group Ltd. Alpiq Holding AG Dow Jones Industrial Average K Amazon.com Inc. Dufry AG K+S AG Amgen Inc. Kaba Holding AG AMS AG E Kudelski SA Apple Inc. E.ON SE Kühne + Nagel International AG Aryzta AG eBay Inc. Kuoni Reisen Holding AG AXA SA EFG International AG EUR/CHF L B EUR/USD Lilly (Eli) & Co. BAIDU Inc. Euro STOXX 50® Index Logitech International SA Bâloise Holding AG Exxon Mobil Corporation Lonza Group AG Bank of America Corporation LVMH Moët Hennessy Louis Vuitton Barrick Gold Corporation F Barry Callebaut AG Facebook, Inc. M BASF SE First Solar Inc. McDonald’s Corporation Basilea Pharmaceutica AG Forbo Holding AG MDAX® BKW AG Freeport McMoRan Copper & Gold Inc. Merck & Co BNP Paribas S.A. Meyer Burger Technology AG Boeing Co. G Micronas Semiconductor Holding AG Bucher Industries Ltd Galenica AG Microsoft Corporation GAM Holding AG C Gategroup Holding AG N Caterpillar Inc. Geberit AG Nasdaq 100® Index Cembra Money Bank AG General Electric Company Nestlé SA Charles Vögele Holding AG General Motors Company Netflix Chesapeake Energy Corp. Georg Fischer AG Newmont Mining Corporation Chevron Corp. Givaudan SA Nobel Biocare Holding AG Cisco Systems, Inc. -

Swiss Opportunity Fund

February 2021 Swiss Opportunity Fund FACT SHEET February 2021 / PERFORMANCE 4.12% February was a rather volatile and mixed month on stock mar- Straumann gained 11.45% and Sonova 8.27%. Although financials kets across the world, including Switzerland’s. Nevertheless, the generally attracted strong interest from buyers, the outlook for general uptrend remained intact over the past few weeks, alt- Cembra was considered to be negative. This position lost 2.41% hough momentum declined somewhat. Optimists have usually during the month under review and was one of the few disap- carried the day and their stance has been backed up by favorable pointments over the month. Portfolio transactions during the economic data and solid earnings reports. Furthermore, in many month included sales of Logitech and Zur Rose shares. These very regions and sectors the economic impact of the pandemic has successful positions were reduced significantly and profits taken. not been as bad as expected and certainly not as severe as during We bought AMS shares after its mark-down as well as Temenos the first lockdown one year ago. Major central banks are also shares, adding to our existing positions in both stocks. What's our maintaining an ultra-expansive course and governments have forecast for the near term? As already mentioned in previous kept the purse wide open. Why markets nevertheless experi- monthly reports, almost all stock markets are very highly valued enced a bumpy ride in February can mainly be blamed on the measured by price/earnings ratios. Long government bond yields lofty valuations and an uptick in bond yields. -

Swiss Listed 2019 - 2020

SWISS LISTED 2019 - 2020 Switzerland’s largest listed companies 1st edition trust communicating what matters trust communicating what matters “A man I do not trust could get no money from me on all the bonds in Christendom… I think that is the fundamental basis of business.” JP Morgan, 1912 SWISS LISTED 2019 Switzerland’s largest listed companies If a century ago trust was mainly based on personal relationships, digital plays a fundamental role in the relationship between companies and stakeholders. For this reason, we have chosen to name our research .trust (to be read “dot-trust”). The dot of the digital ecosystem is like a window through which to get to know, understand, and engage businesses and brands. Our ultimate goal is not to measure just the quality of communications but how companies are able to generate trust with customers and consumers, current and potential employees, journalists and local stakeholders. The image we have chosen to represent this concept is the interweaving of threads because we believe that trust is woven together by different strands, day by day. This new research aims to capture the ability of corporate communications to support companies’ competitiveness and inspire trust, the “currency” of business today just as it was 100 years ago. .TRUST: HOW TO GENERATE TRUST THROUGH COMMUNICATION Gaining the trust of investors, clients, and other stakeholders is the key to growing a business with solid foundations and prospects. Transparency, credibility of a company’s commitments, and strategic plans are all elements that earn it. The new Lundquist research series “.trust: communicating what matters” measures the ability of companies to generate trust. -

SOF-E-Fundfactsheet-04.20.Pdf

April 2020 Swiss Opportunity Fund FACT SHEET April 2020 / PERFORMANCE 6.13% The market rebound that began in March following the vicious weaker than the SPIEX TR, and it has generated an excess return sell-off remained intact during the month of April and helped versus its benchmark of 0.9% since the beginning of the year. further trim the year-to-date losses. The world is facing its worst Positions in defensive stocks were trimmed in April and the cash economic crisis since World War II, so one can rightly ask wheth- allocation was raised to 6%, a bit too early in retrospect. A sub- er stock markets are already getting overly optimistic about the par performance from several of the fund's larger positions, future again. The answer to that question will largely depend on Sonova (0%), Straumann (1.6%) and Sunrise (-0.73%) for exam- how quickly the corona crisis is overcome and on whether it ple, did not help either. Technology stocks such as AMS (33.96%) causes lasting damage on a large scale. We attribute the market's and Also (30.27%) led the list of top-performing stocks, as did the impressive rebound in April primarily to the growing success of “concept stock” Zur Rose (30.88%). efforts to contain the spread of the coronavirus disease. In April, Where the stock market goes next is likely to be determined by the curves visualizing new cases of infection flattened in many whatever consequences the initial easing of lockdown re- countries and initial steps to ease lockdown restrictions were strictions will have on future new daily case numbers and hospi- announced in some European countries (following China’s lead).