The Roi of Inclusivity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties |

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties | Investigation Discovery WFTS - ABC HD GEM Shopping Network Tennis Channel 87 1011 1331 804 TV PACKAGES SEC Extra HD WMOR - IND HD GEM Shopping Network HD FOX Sports 2 88 1012 1331 806 SundanceTV WTVT - FOX HD EWTN CBS Sports Network 89 1013 1340 807 Travel Channel WRMD - Telemundo HD AMC MLB Network SPECTRUM SELECT 90 1014 1355 815 WTAM - Azteca America WVEA - Univisión HD SundanceTV Olympic Channel 93 1015 1356 816 (Includes Spectrum TV Basic Community Programming WEDU - PBS Encore HD IFC NFL Network 95 1016 1363 825 and the following services) ACC Network HD WXPX - ION HD Hallmark Mov. & Myst. ESPN Deportes 99 1017 1374 914 WCLF - CTN HSN WGN America IFC FOX Deportes 2 101 1018 1384 915 WEDU - PBS HSN HD Nickelodeon Hallmark Mov. & Myst. NBC Universo 3 101 1102 1385 929 WTOG - The CW Disney Channel Disney Channel FX Movie Channel El Rey Network 4 105 1105 1389 940 WFTT - UniMás Travel Channel SonLife WVEA - Univisión HD TUDN 5 106 1116 1901 942 WTTA - MyTV EWTN Daystar WFTT - UniMás HD Disney Junior 6 111 1117 1903 1106 WFLA - NBC FOX Sports 1 INSP Galavisión Disney XD 8 112 1119 1917 1107 Bay News 9 IFC Freeform WRMD - Telemundo HD Universal Kids 9 113 1121 1918 1109 WTSP - CBS SundanceTV Hallmark Channel Nick Jr. 10 117 1122 1110 WFTS - ABC FX Upliftv HD BYUtv 11 119 1123 SPECTRUM TV BRONZE 1118 WMOR - IND FXX ESPN ESPNEWS 12 120 1127 1129 WTVT - FOX Bloomberg Television ESPN2 (Includes Spectrum TV Select ESPNU 13 127 1128 and the following channels) 1131 C-SPAN TBN FS Sun ESPN Deportes 14 131 1148 1132 WVEA - Univisión Investigation Discovery FS Florida FOX Sports 2 15 135 1149 1136 WXPX - ION FOX Business Network SEC Network Digi Tier 1 CBS Sports Network 17 149 1150 1137 WGN America Galavisión NBC Sports Network LMN NBA TV 18 155 1152 50 1140 WRMD - Telemundo SHOPHQ FOX Sports 1 TCM MLB Network 19 160 1153 53 1141 TBS HSN2 HD SEC Extra HD Golf Channel NFL Network 23 161 1191 67 1145 OWN QVC2 - HD Spectrum Sports Networ. -

Frontier Fiberoptic TV Florida Residential Channel Lineup and TV

Frontier® FiberOptic TV Florida Channel Lineup Effective September 2021 Welcome to Frontier ® FiberOptic TV Got Questions? Get Answers. Whenever you have questions or need help with your Frontier TV service, we make it easy to get the answers you need. Here’s how: Online, go to Frontier.com/helpcenter to fi nd the Frontier User Guides to get help with your Internet and Voice services, as well as detailed instructions on how to make the most of your TV service. Make any night movie night. Choose from a selection of thousands of On Demand titles. Add to your plan with our great premium off erings including HBO, Showtime, Cinemax and Epix. Get in on the action. Sign up for NHL Center Ice, NBA League Pass and MLS Direct Kick. There is something for everyone. Check out our large selection of international off erings and specialty channels. Viewing Options: Look for this icon for channels that you can stream in the FrontierTV App or website, using your smart phone, tablet or laptop. The availability of streaming content depends on your Frontier package and content made available via various programmers. Certain channels are not available in all areas. Some live streaming channels are only available through the FrontierTV App and website when you are at home and connected to your Frontier equipment via Wi-Fi. Also, programmers like HBO, ESPN and many others have TV Everywhere products that Frontier TV subscribers can sign into and watch subscribed content. These partner products are available here: https://frontier.com/resources/tveverywhere 2 -

2021 Hispanic Co-Op Calendar

MultiVu Multimedia Broadcast 2021 HISPANIC CO-OP CALENDAR DELIVER YOUR MESSAGE TO U.S. HISPANIC TELEVISION AND RADIO AUDIENCES WITH BROADCAST CO-OP TOURS Reach your target audiences in Hispanic television and radio markets across the country with MultiVu Latino Multimedia Broadcast Co-op Tours. The tours are scheduled and designed to provide the most value for your PR video dollars and the best Co-op ROI in the industry. Through Co-op Media Tours you can clearly define your message points; then the Co-op team will develop compelling pitches, book interviews, secure studio time as well as production needs, arrange satellite space and finally track and report campaign metrics that prove ROI. MULTIVU CO-OP TOUR FEATURES: Seven-hour window for TV, radio OVER 100 MILLION IMPRESSIONS station bookings conducted in Spanish GUARANTEED, INCLUDING: and English 4+ Million Impressions via Nationally Recording of a generic interview Syndicated Segments; DirecTV en Espanol segment in Spanish & Minuto 60, the top-of-the-hour headline Participation is limited to a maximum Hispanic radio newscast of four sponsors per Co-op 80+ Million Impressions (Estimated): Live video webcast of the entire tour Branded landing page including all participants of the Co-op SMT distributed Editing of existing client B-roll to roll to English and Spanish via PR Newswire’s in during the SMT online syndication network (including 100 Pre-tour message training call with leading Hispanic sites) spokesperson Example of our Landing Page in Spanish Weekly usage reports with viewership Example of our Landing Page in English figures based on Nielsen data 34 Million Impressions (Estimated) Online Two airchecks from the tour Video Distribution (OVD) of one video from the Co-op SMT day representing all Strategic placement of generic participating brands interview segment via DIRECTV En Español 415,000 Million Impressions (Estimated Daily Impressions): Times Square Photo Spokesperson fee Distribution of your product/service image (800) 653-5313 | www.multivu.com | Copyright©2021 Cision. -

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties |

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties | Investigation Discovery WFTS - ABC HD GEM Shopping Network Tennis Channel 87 1011 1331 804 TV PACKAGES SEC Extra HD WMOR - IND HD GEM Shopping Network HD FOX Sports 2 88 1012 1331 806 SundanceTV WTVT - FOX HD EWTN CBS Sports Network 89 1013 1340 807 Travel Channel WRMD - Telemundo HD AMC MLB Network SPECTRUM SELECT 90 1014 1355 815 WTAM - Azteca America WVEA - Univisión HD SundanceTV Olympic Channel 93 1015 1356 816 (Includes Spectrum TV Basic Community Programming WEDU - PBS Encore HD IFC NFL Network 95 1016 1363 825 and the following services) ACC Network HD WXPX - ION HD Hallmark Mov. & Myst. ESPN Deportes 99 1017 1374 914 WCLF - CTN HSN WGN America IFC FOX Deportes 2 101 1018 1384 915 WEDU - PBS HSN HD Nickelodeon Hallmark Mov. & Myst. NBC Universo 3 101 1102 1385 929 WTOG - The CW Disney Channel Disney Channel FX Movie Channel El Rey Network 4 105 1105 1389 940 WFTT - UniMás Travel Channel SonLife WVEA - Univisión HD TUDN 5 106 1116 1901 942 WTTA - MyTV EWTN Daystar WFTT - UniMás HD Disney Junior 6 111 1117 1903 1106 WFLA - NBC FOX Sports 1 INSP Galavisión Disney XD 8 112 1119 1917 1107 Bay News 9 IFC Freeform WRMD - Telemundo HD Universal Kids 9 113 1121 1918 1109 WTSP - CBS SundanceTV Hallmark Channel Nick Jr. 10 117 1122 1110 WFTS - ABC FX Upliftv HD BYUtv 11 119 1123 SPECTRUM TV BRONZE 1118 WMOR - IND FXX ESPN ESPNEWS 12 120 1127 1129 WTVT - FOX Bloomberg Television ESPN2 (Includes Spectrum TV Select ESPNU 13 127 1128 and the following channels) 1131 C-SPAN TBN FS Sun ESPN Deportes 14 131 1148 1132 WVEA - Univisión Investigation Discovery FS Florida FOX Sports 2 15 135 1149 1136 WXPX - ION FOX Business Network SEC Network Digi Tier 1 CBS Sports Network 17 149 1150 LMN 1137 WGN America Galavisión NBC Sports Network 50 NBA TV 18 155 1152 TCM 1140 WRMD - Telemundo SHOPHQ FOX Sports 1 53 MLB Network 19 160 1153 Golf Channel 1141 TBS HSN2 HD SEC Extra HD 67 NFL Network 23 161 1191 BBC World News 1145 OWN QVC2 HD Spectrum Sports Networ. -

Find Your Favorites

Find your favorites January 2021 Channel Lineup Phoenix Metro Area Contour Starter (Included in all video packages) Starter 3 IND - KTVK 17 HSN 84 Movies - KTUP 97 Justice - KPNX 123 AZ Capital TV 4 Yur View Arizona 18 ION - KPPX 85 Cozi - KPHO 98 DABL - KPHO 124 C-SPAN 5 CBS - KPHO 19 Univision - KTVW 86 Comet TV - KTVK 99 Educational Access 125 C-SPAN 2 6 CW - KASW 20 Telemundo - KTAZ 87 Weather Now - KTVK 108 HSN 2 126 C-SPAN 3 7 IND - KAZT 21 TBN - KPAZ 88 PBS World 109 Charge! 127 QVC 2 8 PBS - KAET 22 Leased Access 89 QVC3 110 Daystar 405 LaTV - KPHE 9 My Network TV - KUTP 64 QVC 90 Estrella TV - KVPA 111 HSN 901-950 Music Choice 10 FOX - KSAZ 78 Jewelry TV 91 TeleXitos - KTAZ 113 EWTN 11 Government Access 79 EVINE Live 92 getTV 115 MCTV 12 NBC - KPNX 80 PBS Life - KAET 93 MeTV - KAZT 118 Grit TV 14 QVC 81 PBS Kids - KAET 94 LAFF - KNXV 119 Escape TV 15 ABC - KNXV 82 Heroes & Icons - KSAZ 95 Antenna TV 121 LX - KTAZ 16 UniMas - KFPH 83 Quest - KPNX 96 Buzzr - KUTP 122 Circle - KTVK Contour Preferred (Includes Starter channels) Preferred 23 Discovery 39 Freeform 55 The Weather Channel 72 National Geographic 160 Hallmark Drama 24 Lifetime 40 A&E 56 Azteca - KEJR 73 Fox Sports Arizona Plus 165 The Impact Network * 25 Paramount Network 41 HGTV 57 Animal Planet 74 POP 180 We TV 26 TNT 42 TLC 58 TV Land 75 Pac-12 Arizona 182 Universal Kids 27 FX 43 AMC 59 BET 76 TUDN * 187 MTV Live ^^ 28 USA Network 44 Golf Channel 60 Bravo 77 MotorTrend Network ^^ 341 Fox Sports 2 29 MTV 45 truTV 61 History 104 ID Discovery 385 IFC 30 VH1 46 Food Network 62 CNBC 106 Nick Jr. -

Channel Lineup Effective 2/25/20

Channel Lineup Effective 2/25/20 ENTERTAINMENT CHOICE XTRA ULTIMATE MÁS ÓPTIMO ENTERTAINMENT CHOICE XTRA ULTIMATE MÁS ÓPTIMO ENTERTAINMENT CHOICE XTRA ULTIMATE MÁS ÓPTIMO Local Channels* • • • • • Golf Channel 218 • • TVG 602 • • A&E 265 • • • • • Great American Country (GAC 326 • • • Universal Kids (East) 295 • • Accuweather 361 • • • • • Hallmark Channel 312 • • • • UP 338 • • • • AMC 254 • • • • • Hallmark Movies & Mysteries 565 • USA Network 242 • • • • • American Heroes Channel 287 • • HGTV 229 • • • • VH1 335 • • • • • Animal Planet 282 • • • • • History 269 • • • • • Viceland 271 • • • • • Aspire 381 • • HLN 204 • • • • • QVC 317 • • • • • AWE 387 • • • HSN 240 • • • • • QVC2 315 • • • • • AXS TV 340 • • • • • IFC 333 • • • WE tv 260 • • • • BabyFirst TV 293 • • • • • Investigation Discovery 285 • • • • Weather Channel, The 362 • • • • BBC America 264 • • • • Justice Central 383 • • • WNG America 307 • • • BBC World News 346 • • Lifetime 252 • • • • • YES Network (select areas) 631 • • • BET 329 • • • • LMN 253 • • Antena 3 458 • BET Her 330 • • Logo 272 • • ATRESERIES 420 • Bloomberg TV 353 • • • • Longhorn Network (select areas) 677 • • • Azteca 441 • Boomerang 298 • • • • • MLB Network 213 • • • BabyTV 425 • Bravo 237 • • • • • Motor Trend 281 • • • • • Bandamax 433 • BTN (select areas) 610 • • • MSG (select areas) 634 • • • Canal 22 Internacional 446 • C-SPAN 350 • • • • • MSG Plus(select areas) 635 • • • CANAL ONCE 447 • C-SPAN2 351 • • • • • MSNBC 356 • • • • • Caracol TV 417 • Cartoon Network (East) 296 • • • • • MTV 331 -

Packages & Channel Lineup

™ ™ ENTERTAINMENT CHOICE ULTIMATE PREMIER PACKAGES & CHANNEL LINEUP ESNE3 456 • • • • Effective 6/17/21 ESPN 206 • • • • ESPN College Extra2 (c only) (Games only) 788-798 • ESPN2 209 • • • • • ENTERTAINMENT • ULTIMATE ESPNEWS 207 • • • • CHOICE™ • PREMIER™ ESPNU 208 • • • EWTN 370 • • • • FLIX® 556 • FM2 (c only) 386 • • Food Network 231 • • • • ™ ™ Fox Business Network 359 • • • • Fox News Channel 360 • • • • ENTERTAINMENT CHOICE ULTIMATE PREMIER FOX Sports 1 219 • • • • A Wealth of Entertainment 387 • • • FOX Sports 2 618 • • A&E 265 • • • • Free Speech TV3 348 • • • • ACC Network 612 • • • Freeform 311 • • • • AccuWeather 361 • • • • Fuse 339 • • • ActionMAX2 (c only) 519 • FX 248 • • • • AMC 254 • • • • FX Movie 258 • • American Heroes Channel 287 • • FXX 259 • • • • Animal Planet 282 • • • • fyi, 266 • • ASPiRE2 (HD only) 381 • • Galavisión 404 • • • • AXS TV2 (HD only) 340 • • • • GEB America3 363 • • • • BabyFirst TV3 293 • • • • GOD TV3 365 • • • • BBC America 264 • • • • Golf Channel 218 • • 2 c BBC World News ( only) 346 • • Great American Country (GAC) 326 • • BET 329 • • • • GSN 233 • • • BET HER 330 • • Hallmark Channel 312 • • • • BET West HD2 (c only) 329-1 2 • • • • Hallmark Movies & Mysteries (c only) 565 • • Big Ten Network 610 2 • • • HBO Comedy HD (c only) 506 • 2 Black News Channel (c only) 342 • • • • HBO East 501 • Bloomberg TV 353 • • • • HBO Family East 507 • Boomerang 298 • • • • HBO Family West 508 • Bravo 237 • • • • HBO Latino3 511 • BYUtv 374 • • • • HBO Signature 503 • C-SPAN2 351 • • • • HBO West 504 • -

A Streaming TV Lineup

Peacock TV Tubi TV Vidgo TV Channels Peacock /FREE Peacock Prem/$5m Peacock Prem Plus/$10m FREE Vidgo Core/$45m Vidgo Plus/$55m Vidgo Lat/$20m Vidgo Lat Mas/$30m 13,000 HRS OF CONT 20,000 HRS OF CONT PEACOCK ORIGINALS ADS FREE ABC WSOC (9) CBS WBTV (3) FOX (46) FOX Sports South FOX Sports Carolinas FOX Sports Southeast my 12 my TV Network WCNC (6) NBC LIVE LIVE LIVE Telemundo TV64 WCCB The CW (18) A&E ACCN ESPN ACCN ESPN X AccuWeather Acorn TV AHC AMC AMC Premier Animal Planet Aspire Audience AXS TV Baby TV BBC America BBC World News beIN Sports BET Peacock TV Tubi TV Vidgo TV Channels Peacock /FREE Peacock Prem/$5m Peacock Prem Plus/$10m FREE Vidgo Core/$45m Vidgo Plus/$55m Vidgo Lat/$20m Vidgo Lat Mas/$30m 13,000 HRS OF CONT 20,000 HRS OF CONT PEACOCK ORIGINALS ADS FREE Bloomberg TV BTN Bravo LIVE LIVE LIVE Cartoon Network (CN) CBS Sports Network CBSN Cheddar Big News Cheddar Business Cheddar News Cinemax CINEMOI North America CLEO TV CGTN CMT CNBC CNBC World CNN CNN International Comedy Central Comet Cooking Channel Cowboy Channel COZI TV CuriosityStream Destination America Discovery Channel Discovery Family Discovery Life Disney Channel Disney Junior Disney XD Peacock TV Tubi TV Vidgo TV Channels Peacock /FREE Peacock Prem/$5m Peacock Prem Plus/$10m FREE Vidgo Core/$45m Vidgo Plus/$55m Vidgo Lat/$20m Vidgo Lat Mas/$30m 13,000 HRS OF CONT 20,000 HRS OF CONT PEACOCK ORIGINALS ADS FREE Duck TV Diy E! LIVE LIVE LIVE EPIX EPIX Drive-In ESPN ESPN 2 ESPN 3 ESPNEWS ESPN U ESPN College Extra ESPN Bases Loaded ESPN Goal Line Encore euronews -

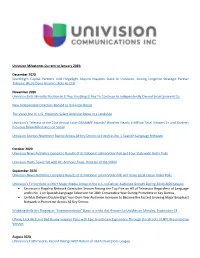

Univision Milestones Current to January 2019: December 2020

Univision Milestones Current to January 2019: December 2020 Searchlight Capital Partners And Forgelight Acquire Majority Stake In Univision, Joining Longtime Strategic Partner Televisa; Wade Davis Assumes Role As CEO November 2020 Univision Exits Minority Position In El Rey, Enabling El Rey To Continue As Independently Owned Entertainment Co. New Independent Directors Named to Univision Board The Votes Are In: U.S. Hispanics Select Univision News in a Landslide Univision’s Telecast of the 21st Annual Latin GRAMMY Awards® Reaches Nearly 6 Million Total Viewers 2+ and Shatters Previous Show Milestones on Social Univision Sweeps November Sweep Across All Key Demos to Finish as No. 1 Spanish-Language Network October 2020 Univision News Publishes Complete Results of its National Latino Voter Poll and Four Statewide Voter Polls Univision Hosts Town Hall with Dr. Anthony Fauci, Director of the NIAID September 2020 Univision News Publishes Complete Results of its National Latino Voter Poll and three Local Latino Voter Polls Univision’s TV Portfolio is ONLY Major Media Group in the U.S. to Deliver Audience Growth During 2019/2020 Season • Univision’s Flagship Network Concludes Season Among the Top Five on All of Television Regardless of Language and is No. 1 on Spanish-Language Television for 28th Consecutive Year During Primetime in Key Demos • UniMás Delivers Double-Digit Year-Over-Year Audience Increases to Become the Fastest Growing Major Broadcast Network in Primetime Across All Key Demos Wedding Bells Are Ringing as “Enamorándonos” (Love -

Find What You Love, All in One Place

Go to this link to order today: Attspoc.com/usawireless FIND WHAT YOU LOVE, ALL IN ONE PLACE. The best of Live TV, Sports, and On Demand with access to streaming apps. Plus, HBO Max™ * Access 75,000+ shows and movies On Demand Choose from a wide selection of popular TV shows and hit movies—all available 24/7. Requires subscriptions to top-tier ULTIMATE programming package, HBO Max, Cinemax, SHOWTIME, EPIX, Movie Extra Pack and Español. Other packages will have fewer shows and movies. 500 hours of Cloud DVR and access on the go 1, 2, 3 1Based on publicly available info as of 6/3/20. 2Available only in the U.S. (excl. Puerto Rico & U.S.V.I.). Req•s compatible device & data connection. 3Limit 500 hrs recording time, stored for max 90 days. on up to 3 devices at the same time so no one misses out. Available only in the U.S. (excl. Puerto Rico & U.S.V.I.). Req’s compatible device & data connection. Voice Remote with Google Assistant Req’s compatible smart home device, app, & service. Google login required. Google is a trademark of Google LLC. AT&T TV requires high speed internet. Recommend minimum 24 Mbps for optimal viewing (min 8 Mbps per stream). Limit 3 concurrent AT&T streams. * With 24-mo. agmt and CHOICE—ULTIMATE/OPTIMO ® ® ® ® Go this link Attspoc.com/usawireless in your server to order today. Access over 5,000 Access 75,000+ Record 500 hours Top sports networks popular apps - from shows and movies to your Cloud DVR and including live national, sports to movies and On Demand. -

Univision Milestones Current to January 2019: May 2020

Univision Milestones Current to January 2019: May 2020 Univision’s TV Network Portfolio Grows Faster than Any Other Media Group in U.S. During 2019/2020 Broadcast Season • Flagship Univision Network Will Rank Top Five on All of Television, Regardless of Language, and Finish No. 1 on Spanish-Language Television for the 28th Consecutive Broadcast Season in Key Demos and Dayparts April 2020 Univision’s Uforia Unveils 2020 Census Anthem “Cuenta Conmigo” Featuring Chart-Topping Latin Artists Los Tigres del Norte, Ana Barbara, Natanael Cano and Fuerza Regida Univision Launches Comprehensive, Ongoing Multiplatform Coverage of COVID-19’s Effect on the Hispanic Community February 2020 Univision Portfolio of Television Nets is the Fastest Growing of All Media Groups in U.S. During Feb 2020 Sweep • Univision Will Finish as No. 1 Spanish-Language Network for 28th Consecutive February Sweep Among Total Viewers 2+, Adults 18-49 and Adults 18-34 Searchlight Capital Partners and ForgeLight Acquire Majority Stake in Univision Univision Crowned Thursday Night’s Big Winner on All of TV, Tops ABC, CBS, NBC & Fox with Premio Lo Nuestro January 2020: Univision and Televisa to Bring “Univision” Branded Channel to Latin America December 2019: Univision to End 2019 as #1 Spanish-Language Network for 27th Straight Year in Prime & Total Day Among Key Demos Univision’s Uforia Stations Finish 2019 With A Bang, Deliver Near Double-Digit Growth Year-Over-Year in Q4 November 2019: 20th Annual Latin GRAMMY® Awards Shines Bright on Univision, Delivers Highest-Rated Performance Since 2015 Univision Stands Tall During November 2019 Sweep • Network to Finish Sweep Among Top Five Broadcast Networks and No. -

Washington Residential Channel Lineup Ziply Fiber TV – Ziplyfiber.Com

Fiber TV Washington Residential Channel Lineup Effective Date December 2020 Welcome to Fiber TV Here’s your complete list of available channels to help you decide what to watch. On-Demand With Fiber TV, every night is a movie night. Choose from thousands of On Demand movies, TV shows, concerts and sports. TV On-The-Go For TV on-the-go, check out apps available from our entertainment partners featuring live and on-demand content. Browse the list of participating entertainment partners here: https://ziplyfiber.com/resources/tveverywhere. Simply sign into an entertainment partner’s app with your Ziply Fiber username and password. Have questions? We have answers … When you have a question or need help with your Fiber TV Service, simply visit Help on your TV, or visit www.ziplyfiber.com/helpcenter for a complete library of How Tos. 2 Quick Reference Channels are grouped by programming categories in the following ranges: Local Channels 1–49 SD, 501–549 HD Local Plus Channels 460–499 SD Local Public/Education/Government (varies by location) 15–47 SD Entertainment 50–69 SD, 550–569 HD Sports 70–99 & 300–319 SD, 570–599 HD News 100–119 SD, 600–619 HD Info & Education 120–139 SD, 620–639 HD Home & Leisure/Marketplace 140–179 SD, 640–679 HD Pop Culture 180–199 SD, 680–699 HD Music 210–229 SD, 710–729 HD Movies/Family 230–249 SD, 730–749 HD Kids 250–269 SD, 780–789 HD People & Culture 270–279 SD Religion 280–299 SD Premium Movies 340–449 SD, 840–949 HD Pay Per View/Subscription Sports 1000–1499 Spanish Language 1500-1749 International 1750-1799 Digital Music** 1800–1900 3 Fiber TV Select Kong TV Bounce 466 Included with all Fiber TV KSTW Grit 481 packages.