Sub-Saharan Africa Mobile Observatory 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3.3 Angola Telecommunications

3.3 Angola Telecommunications All commercial telecommunications in country are provided mainly by 3 companies which have almost full national coverage being; UNITEL a private mobile phone company which has larger coverage in country; Movicel mobile company subsidiary of Angola Telecom and Angola Telecom state company with a monopoly for provision of all landline phone network in the country. There are no restrictions to obtain sim cards or mobile numbers For more information on telecoms contacts, please see the following link: 4.2 Angola Additional Services Contact Lists Telephone Services Is there an existing landline telephone network? Yes Does it allow international calls? Yes Number and Length of Downtime Periods (on average) N/A Mobile Phone Providers Movicel & Unitel Approximate Percentage of National Coverage Said to be national at (90%) Telecommunication Regulation There are strict regulations in place for import and to get licenses which can only be obtained through INACOM Due to updates which may occur in the legislation or INACOM procedures is suggested to contact ITC team of UNICEF or ITC team of UNDP currently the focal points for all UN organizations in Angola. Regulations on Usage and Import Regulations in Place? Regulating Authority Satellite Yes Inacom HF Radio Yes Inacom UHF/VHF/HF Radio: Handheld, Base and Mobile Yes Inacom UHF/VHF Repeaters Yes Inacom GPS Yes Inacom VSAT Yes Inacom Individual Network Operator Licenses Required Yes, via Inacom consult INACOM Frequency Licenses Required Yes, via Inacom INACOM Existing Humanitarian Telecoms Systems Yes, there are a Humanitarian system for internal communication through radios UHF/HF actually managed by ITC team of UNICEF. -

Angola Case Study Russell Southwood 1

The Case for “Open Access” Communications Infrastructure in Africa: The SAT-3/WASC cable Angola case study Russell Southwood 1 ASSOCIATION FOR PROGRESSIVE COMMUNICATIONS (APC) APC-200805-CIPP-R-EN-PDF-0047 ISBN 92-95049-49-7 COMMISSIONED BY THE ASSOCIATION FOR PROGRESSIVE COMMUNICATIONS (APC) CREATIVE COMMONS ATTRIBUTION -NON COMMERCIAL -SHARE ALIKE 3.0 LICENCE GRAPHICS: COURTESY OF AUTHOR 1Russell Southwood is a leading analyst of the African ICT market. He is a specialist of Internet, telecommunications, and media developments on the continent. APC Publications The Case for “Open Access” Communications Infrastructure in Africa: The SAT-3/WASC cable – Angola Case Study i Table of Contents 1 Overview of report.............................................................................................. 3 2 Background.......................................................................................................... 3 2.1 Brief country profile..................................................................................... 3 2.2 Overview of Angola’s telecommunications industry............................. 5 2.2.1 Angola Telecom and its plans ............................................................. 6 2.2.2 Other telecoms players......................................................................... 8 2.2.3 Internet services..................................................................................... 9 2.3 History of the SAT-3/WASC cable in Angola ....................................... 10 2.4 The impact of SAT-3/WASC -

Creating Markets in Angola : Country Private Sector Diagnostic

CREATING MARKETS IN ANGOLA MARKETS IN CREATING COUNTRY PRIVATE SECTOR DIAGNOSTIC SECTOR PRIVATE COUNTRY COUNTRY PRIVATE SECTOR DIAGNOSTIC CREATING MARKETS IN ANGOLA Opportunities for Development Through the Private Sector COUNTRY PRIVATE SECTOR DIAGNOSTIC CREATING MARKETS IN ANGOLA Opportunities for Development Through the Private Sector About IFC IFC—a sister organization of the World Bank and member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work with more than 2,000 businesses worldwide, using our capital, expertise, and influence to create markets and opportunities in the toughest areas of the world. In fiscal year 2018, we delivered more than $23 billion in long-term financing for developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org © International Finance Corporation 2019. All rights reserved. 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. IFC does not guarantee the accuracy, reliability or completeness of the content included in this work, or for the conclusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. The findings, interpretations, views, and conclusions expressed herein are those of the authors and do not necessarily reflect the views of the Executive Directors of the International Finance Corporation or of the International Bank for Reconstruction and Development (the World Bank) or the governments they represent. -

Movicel: We Are Delivering Superior Value to Our Customers an Interview with Movicel CEO Yon Junior

JUN 2013 VOL. 15 ● NO. 3 ● ISSUE 146 A Universal Architecture for Small CMHK Partners with ZTE for LTE ZTE: Leading R&D on 100G 20 Cell Backhaul Radio 31 Microwave Backhaul Deployment 35 and Beyond VIP Voices Movicel: We Are Delivering Superior Value to Our Customers An interview with Movicel CEO Yon Junior Telefonica UK: Moving Beyond Traditional Services An interview with Peter Bailey, messaging and voice business manager, and Leon Veiro, LBS messaging architect of Telefonica UK Special Topic: Microwave Backhaul A Flexible Unified Architecture for Point-to-Point Digital Microwave Radios Tech Forum Using Cloud Radio to Deliver Promises in the 4G Era ZTE TECHNOLOGIES Editorial Board CONTENTS Chairman: Pang Shengqing Vice Chairmen: Chen Jane, Zhao Xianming, Zhu Jinyun Members: Chen Jian, Feng Haizhou, Heng Yunjun, Huang Liqing, Huang Xinming, Jiang Hua, Li Aijun, Li Guangyong, Lin Rong, Li Weipu, Lu Ping, Lu Wei, Lv Abin, Sun Zhenge, Wang Shouchen, Wang Xiaoming, Wang Xiyu, Xin Shengli, Xu Ming, Ye Ce, Yu Yifang, Zhang Shizhuang Sponsor: ZTE Corporation Movicel: Edited By Shenzhen Editorial Office, Strategy Planning Department Editor-in-Chief: Jiang Hua We Are Delivering Executive Deputy Editor-in-Chief: Huang Xinming Editorial Director: Liu Yang Superior Value Executive Editor: Yue Lihua Editors: Jin Ping, Paul Sleswick to Our Customers Circulation Manager: Wang Pingping Movicel is a leading mobile operator in Angola. Its networks cover 18 provinces all over the Angola. Today, one third of population is using Movicel’s voice or Editorial Office data services. ZTE Technologies recently interviewed Movicel CEO Yon Junior. Address: NO. 55, Hi-tech Road South, He talked about the cooperation with ZTE, the challenges of operating in Shenzhen, P.R.China Angola, and Movicel’s strategy. -

ICT Country Profiles

Measuring the Information Society Report 2017 Volume 2. ICT country profiles International profiles 2. ICT country 2017 - Volume Telecommunication Union Place des Nations CH-1211 Geneva 20 Switzerland 4 1 3 5 1 9 789261 245214 Printed in Switzerland Geneva, 2017 Measuring the Information Society Report Report Society Measuring the Information Measuring the Information Society Report Volume 2. ICT Country profiles 2017 © 2017 ITU International Telecommunication Union Place des Nations CH-1211 Geneva Switzerland Original language of publication: English All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior permission of the International Telecommunication Union. ISBN: 978-92-61-24511-5 (Paper version) 978-92-61-24521-4 (Electronic version) 978-92-61-24531-3 (EPUB version) 978-92-61-24541-2 (Mobi version) ii Measuring the Information Society Report 2017 - Volume 2 Introduction The country profiles presented in this second volume of theMeasuring the Information Society Report 2017 represent a comprehensive effort by ITU to provide a snapshot of the status of the information and communication technology (ICT) markets in 192 economies, including significant infrastructure developments, and government policy and initiatives to improve the access and use of ICTs for households and individuals. Each profile is structured around three key areas: mobile services, fixed services, and government policy. The profiles are supported by a table showing key indicators of mobile and fixed subscription penetration rates, prices of ICT services, and data on access and use of ICTs by households and individuals. -

Work in Progress

Telecommunications Ownership and Control (TOSCO). A new dataset on ownership of internet infrastructure in Africa, 2000-2016 Tina Freyburg, Lisa Garbe and Véronique Wavre (University of St.Gallen, Switzerland) --- WORK IN PROGRESS --- The internet provides a space for sharing digital information and communication. This space is built on a physical infrastructure owned by a variety of state and private actors, foreign and domestic, that reflect a multitude of interests. This paper presents TOSCO, a new dataset on ownership and control of internet service providers (ISP) that allows for comparative large-N analysis of the determinants and effects of varying ownership structures and identities in the transforming context of African countries from 2000 to 2016. Next to a detailed discussion of the conceptualization and operationalization of ownership as a variable, we provide some descriptive statistics to illustrate varying ownership of ISP and correlational statistics to illuminate potential venues for research using our data. Keywords: Internet diffusion; internet service providers; internet control; owner identity; telecommunications 1 Access to, use of, and also the impact of ‘the internet’—familiar shorthand for information and communication technologies (ICT)—is unevenly distributed within and across countries, raising concerns for a ‘digital divide’ (Norris 2001). Existing research points to a positive relationship between the use of ICT and a country’s performance in terms of economic growth or prospects for democracy (Corrales and Westhoff 2006; Howard and Mazaheri 2009; Vu 2011). At the same time, ICT has been shown to enable repressive regimes to impose further restrictions on political, social and economic liberties (Rød and Weidmann 2015; Gohdes 2015). -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1111 – 1.XI.2016 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 1 NOVEMBER 2016) __________________________________________________________________ Geneva, 2016 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1111 of 1.XI.2016. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at www.itu.int/itu-t/inr/forms/mnc.html . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website at www.itu.int/itu-t/bulletin/annex.html . 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities. -

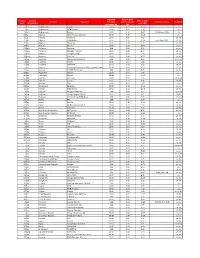

Country Code Country ISO Number Country Operator Charging

Charging Rate in USD Country Country Rate in USD Country Operator Principle per increment minimum charge Network Code ISO Number per 1 MB increment kb kb 93 af Afghanistan Etisalat 10.00 0.11 11.18 2G 93 af Afghanistan MTN (Areeba) 10.00 0.01 1.30 2G 93 af Afghanistan Roshan 10.00 0.10 10.27 20 KB then 10 KB 2G 355 al Albania AMC (Telekom Albania) 50.00 0.49 10.13 2G 355 al Albania Vodafone 10.00 0.00 0.10 2G-3G 213 dz Algeria ATM-Mobilis 20.00 0.20 10.28 50 KB then 10 KB 2G-3G 213 dz Algeria Wataniya 10.00 0.00 0.30 2G-3G 244 ao Angola Movicel 10.00 0.14 13.99 2G-3G 374 am Armenia Armentel 1.00 0.00 0.58 2G-3G 374 am Armenia Karabakh Telecom 10.00 0.08 8.24 2G-3G 374 am Armenia Orange (Ucom) 10.00 0.01 1.09 2G-3G 374 am Armenia VivaCell 10.00 0.08 8.24 2G-3G 61 au Australia Optus Communications 1.00 0.00 0.33 2G-3G-4G 61 au Australia Telstra 10.00 0.01 1.16 2G-3G 61 au Australia Vodafone 10.00 0.00 0.12 2G-3G 43 at Austria Hutchison Drei Austria GmbH (Connect- One/ Orange)100.00 0.83 8.53 2G-3G 43 at Austria T MOBILE (telering) 1.00 0.00 0.25 2G-3G 994 az Azerbaijan Azercell 10.00 0.01 1.05 2G 994 az Azerbaijan Bakcell 100.00 1.71 17.50 2G 973 bh Bahrain BATELCO 10.00 0.01 1.16 2G-3G-4G 973 bh Bahrain Viva STC 10.00 0.19 19.02 2G-3G 973 bh Bahrain Zain 10.00 0.01 1.17 2G 880 bd Bangladesh Banglalink 50.00 0.49 10.10 2G-3G 375 by Belarus MDC Velcom 10.00 0.12 12.78 2G-3G 32 be Belgium Belgacom-Proximus 1.00 0.00 0.54 2G-3G-4G 32 be Belgium Orange Belgium NV/SA 10.00 0.00 0.25 2G-3G 32 be Belgium Telenet Group BVBA (Base) 1.00 0.00 0.25 -

Development Workshop Angola: Missed Calls for Monitoring Community Water Services

Mobile for Development Utilities Development Workshop Angola: Missed Calls for Monitoring Community Water Services MAY 2016 The Innovation Fund The Mobile for Development Utilities Innovation Fund was launched in June 2013 to test and scale the use of mobile to improve or increase access to The GSMA represents the interests of mobile energy, water and sanitation services. In two phases operators worldwide, uniting nearly 800 operators of funding, grants were competitively awarded with almost 300 companies in the broader mobile to 34 organisations across Asia and Africa. Seed ecosystem, including handset and device makers, grants were awarded for early stage trials, Market software companies, equipment providers and Validation grants for scaling or replication of internet companies, as well as organisations in business models, and Utility Partnership grants to adjacent industry sectors. The GSMA also produces foster partnerships between utility companies and industry-leading events such as Mobile World innovators. Congress, Mobile World Congress Shanghai and the Mobile 360 Series conferences. The specific objective of the Innovation Fund is to extract insights from the trial and scaling of these For more information, please visit the GSMA innovative models to inform three key questions for corporate website at www.gsma.com growing the sector: Follow the GSMA on Twitter: @GSMA • How can mobile support utility services? • For a mobile-enabled solution to be adopted at Mobile for Development scale, what building blocks are needed? Utilities • What are the social and commercial impacts of delivering community services to underserved mobile subscribers? The Mobile for Development Utilities Programme These insights, as well as grant-specific learning promotes the use of mobile technology objectives, are included in individual case studies and infrastructure to improve or increase access such as this one, as well as thematic reports that will to basic utility services for the underserved. -

China's Long-Term Partner in Africa

ORIENTALNEWS ANGOLA China’s long-term partner in Africa uAllies in times of both peace and war, in recent years the bonds between China and Angola have gone from strength to strength since Angola’s civil war ended, as the two sides work together to develop bilateral relations based on sincerity, amiability, equal- ity and mutual benefit This year marks 10 years of peace, prog- forces behind the 14-year armed struggle ress and reconstruction in West Africa’s Re- against Portuguese colonial rule, along with public of Angola, after four decades of con- the FNLA (National Liberation Front of flicts and civil war left the former Portuguese Angola) and UNITA (National Union for the colony physically, socially and economically Total Independence of Angola). The MPLA torn apart. Boasting a wealth of natural re- officially declared Angola’s independence sources, including natural gas, oil, and dia- under the slogan “One People, One Nation” monds, and vast arable lands, the country is in the capital Luanda on November 11, 1975, potentially the richest in the region. It vies and the three liberation movements agreed with Nigeria for the title of Africa’s top oil pro- to form a joint transitional government, with ducer, and the current priority for Angola’s President Jose Eduardo dos Santos at the government is to develop of other sections helm. of the economy – particularly agriculture, One of the main principles of the alliance industry, fishing and mining – to convert the was to establish a program of economic and nation’s petrodollars and untapped potential social development that could take advantage into tangible socio-economic benefits for of the country’s natural resources to improve the people. -

2 Cross Border Frequency Coordination

Establishment of Harmonized Policies for the ICT Market in the ACP Countries Cross-Border Frequency Coordination: A Harmonized Calculation Method for Africa (HCM4A) Southern Africa Assessment Report Harmonization of ICT Policies in HIPSSA Sub-Saharan Africa International Telecommunication Union Telecommunication Development Bureau (BDT) Place des Nations CH-1211 Geneva E-mail: [email protected] www.itu.int/ITU-D/projects/ITU_EC_ACP/ Geneva, 2013 Establishment of Harmonized Policies for the ICT Market in the ACP Countries Cross-Border Frequency Coordination: A Harmonized Calculation Method for Africa (HCM4) Southern Africa Assessment Report Harmonization of ICT Policies in HIPSSA S u b - Saharan Africa HIPSSA –Cross-Border Frequency Coordination (HCM4A) – Southern Africa Report Disclaimer This document has been produced with the financial assistance of the European Union. The views expressed may not necessarily reflect the official opinion of the European Union. The designations employed and the presentation of material, including maps, do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country, territory, city or area, or concerning the delimitations of its frontiers or boundaries. The mention of specific companies or of certain products does not imply that they are endorsed or recommended by ITU in preference to others of a similar nature that are not mentioned. Please consider the environment before printing this report. ITU 2013 All rights reserved. No part of this publication may be reproduced, by any means whatsoever, without the prior written permission of ITU. HIPSSA –Cross-Border Frequency Coordination (HCM4A) – Southern Africa Report Foreword rd Information and communication technologies (ICTs) are shaping the process of globalisation. -

Mobile Network Codes (MNC) for the International Identification Plan for Public Networks and Subscriptions (According to Recommendation ITU-T E.212 (09/2016))

Annex to ITU Operational Bulletin No. 1162 – 15.XII.2018 INTERNATIONAL TELECOMMUNICATION UNION TSB TELECOMMUNICATION STANDARDIZATION BUREAU OF ITU __________________________________________________________________ Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions (According to Recommendation ITU-T E.212 (09/2016)) (POSITION ON 15 DECEMBER 2018) __________________________________________________________________ Geneva, 2018 Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions Note from TSB 1. A centralized List of Mobile Network Codes (MNC) for the international identification plan for public networks and subscriptions has been created within TSB. 2. This List of Mobile Network Codes (MNC) is published as an annex to ITU Operational Bulletin No. 1162 of 15.XII.2018. Administrations are requested to verify the information in this List and to inform ITU on any modifications that they wish to make. The notification form can be found on the ITU website at http://www.itu.int/en/ITU-T/inr/forms/Pages/mnc.aspx . 3. This List will be updated by numbered series of amendments published in the ITU Operational Bulletin. Furthermore, the information contained in this Annex is also available on the ITU website. 4. Please address any comments or suggestions concerning this List to the Director of TSB: International Telecommunication Union (ITU) Director of TSB Tel: +41 22 730 5211 Fax: +41 22 730 5853 E-mail: [email protected] 5. The designations employed and the presentation of material in this List do not imply the expression of any opinion whatsoever on the part of ITU concerning the legal status of any country or geographical area, or of its authorities.