Prepared by MERRILL CORPORATION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BIBLIOGRAPHY MASTER Books 1-78 September 2020

BIBLIOGRAPHY MASTER Books 1-78 September 2020 Abrahamson, E. (2004). Change without pain. Boston: Harvard Business Press. 43 Abrams, Jennifer. (2019). Swimming in the Deep End. Bloomington, IN: Solution Tree. 75 Ackerman, D. (1990). A natural history of the senses. New York: Random House. 1 Ackerman, R. (1994). A husband’s little black book. Deerfield Beach, FL: Health Communications, Inc. 14 Ackerman, R.H. & Maslin-Ostrowski, P. (2002) The wounded leader. San Francisco: Jossey-Bass 54 Ackoff, R. (1991). Ackoff’s fables. New York: John Wiley & Sons, Inc. 11 Ackoff, R. (1999). Re-creating the corporation. New York: Oxford University Press. 18 Ackoff, R. & Greenberg, D. (2008). Turning learning right side up. Upper Saddle River, NJ: Wharton School Publishing. 44, 47, 77 Adams, James. (2001). Conceptual Blockbusting, 4th ed. New York: Basic Books 75 Adams, M. (2000). Beginning to read. Cambridge, MA: MIT Press. 34 Adams, S. (1996). The Dilbert principle. New York: HarperCollins Publishers, Inc.23 Albom, M. (1997). Tuesdays with Morrie. New York: Doubleday. 16 Albom, M. (2003). The five people you meet in heaven. New York: Hyperion. 33 Alexie, S. (1993). The Lone Ranger and Tonto fistfight in heaven. New York: The Atlantic Monthly Press. 32 Allen, D. (2001). Getting things done. New York: Penguin Putnam Inc. 21 Amabile, Teresa, & Kramer, Steven. (2011). The Progress Principle. Boston: Harvard Business Review Press. 55 Anchor, Shawn. (2010). The Happiness Advantage. New York: Crown. 58 Arbinger, Institute. (2000). Leadership and self-deception. San Francisco: Berrett-Koehler 42 Arden, Paul. (2006). Whatever you think, think the opposite. 77 Argyris, C. (1990). -

Newly Added Paperbacks Malpass Library (Main Level) December 2015 - January 2016

Newly Added Paperbacks Malpass Library (Main Level) December 2015 - January 2016 Call Number Author Title Publisher Enum Publication Date PBK A237 ha Adler, Elizabeth House in Amalfi / St. Martin's Press, 2005 (Elizabeth A.) PBK A237 hr Adler, Elizabeth Hotel Riviera / St. Martin's Press, 2003 (Elizabeth A.) PBK A237 ip Adler, Elizabeth Invitation to Provence / St. Martin's Press, 2004 (Elizabeth A.) PBK A237 nn Adler, Elizabeth Now or never / Delacorte Press, 1997 (Elizabeth A.) PBK A237 sc Adler, Elizabeth Sailing to Capri / St. Martin's Press, 2006 (Elizabeth A.) PBK A237 st Adler, Elizabeth Summer in Tuscany / St. Martin's Press, 2002 (Elizabeth A.) PBK A277 il Agresti, Aimee. Illuminate / Harcourt, 2012 PBK A285 fl Ahern, Cecelia, 1981- Flawed / Feiwel & Friends, 2016 PBK A339 tm Albom, Mitch, 1958- Tuesdays with Morrie : an old man, a young man, Broadway Books, 2002 and life's greatest lesson / PBK A395 tp Alger, Cristina. This was not the plan : a novel / Touchstone, 2016 PBK A432 jl Allende, Isabel, Japanese lover : a novel / Atria Books, 2015 PBK A461 ll Alsaid, Adi, Let's get lost / Harlequin Teen, 2014 PBK A613 is Anner, Zach, 1984- If at birth you don't succeed : my adventures with Henry Holt and 2016 disaster and destiny / Company, PBK A917 cb 2002t Auel, Jean M. Ayla und der Clan des Bären : Roman / Wilhelm Heyne, 2002 PBK A917 mm 2002t Auel, Jean M. Ayla und die Mammutjäger : Roman / Wilhelm Heyne, 2002 PBK A917 pp 2002t Auel, Jean M. Ayla und das Tal der Grossen Mutter : Roman / Wilhelm Heyne Verlag, 2002 PBK A917 sh 2002t Auel, Jean M. -

Korsar Meiner Träume Buch Michelle Beattie Vor Jahren Brach Claires Vater Auf, Um Den Sagenhaften Schatz Der Santa Francesca Zu Finden, Doch Er Ist Nie Zurückgekehrt

MICHELLE BEATTIE Korsar meiner Träume Buch Michelle Beattie Vor Jahren brach Claires Vater auf, um den sagenhaften Schatz der Santa Francesca zu finden, doch er ist nie zurückgekehrt. Seitdem sinnt Claire Gentry auf Rache. Dafür braucht sie den zweiten Teil der Schatz- karte, die zu der verborgenen Insel in der karibischen See führt – und die besitzt niemand anderes als ausgerechnet Nate Carter. Der Mann, Korsar meiner Träume der ihr einst Liebe schwor und sie dann verließ. Nate staunt nicht schlecht, als seine einstige große Liebe Claire plötz- Roman lich mit einer geladenen Pistole vor ihm steht und die Schatzkarte ver- langt. Nie hat er den Verrat verwunden, den sie an ihm begangen hat: Statt auf ihn zu warten, heiratete sie einen anderen. Doch ohne Claires Wissen über den zweiten Teil der geheimnisvollen Karte wird er selbst den Schatz niemals finden. Auf hoher See lodern die alten Gefühle wie- Aus dem Amerikanischen der auf. Aber ist diese Leidenschaft groß genug, um Verrat und Enttäu- von Nicole Otte schung der Vergangenheit zu überwinden? Autorin Michelle Beattie lebt im kanadischen Alberta, wo sie mit ihrem Ehe- mann und ihren beiden Töchtern das Leben auf dem Land genießt. Ne- ben dem Schreiben ist Golf ihre größte Leidenschaft. Mehr über die Autorin auf ihrer Website: www.michellebeattie.com Von Michelle Beattie bei Blanvalet lieferbar: Freibeuterin der Liebe (37432) Stürmisches Paradies (37550) Buch Michelle Beattie Vor Jahren brach Claires Vater auf, um den sagenhaften Schatz der Santa Francesca zu finden, doch er ist nie zurückgekehrt. Seitdem sinnt Claire Gentry auf Rache. Dafür braucht sie den zweiten Teil der Schatz- karte, die zu der verborgenen Insel in der karibischen See führt – und die besitzt niemand anderes als ausgerechnet Nate Carter. -

Penguin Group (USA)

Penguin Group (USA) PAID INTERNSHIP PROGRAM 2014 COMPANY DESCRIPTION: Penguin Group (USA) LLC is the U.S. member of the internationally renowned Penguin Group. Learn about the world Penguin Group (USA) is one of the leading U.S. adult and children's trade book publishers, owning a of publishing wide range of imprints and trademarks, including Viking, G. P. Putnam's Sons, The Penguin Press, Riverhead Books, Dutton, Penguin Books, Berkley Books, Gotham Books, Portfolio, New American Discover career Library, Plume, Tarcher, Philomel, Grosset & Dunlap, Puffin, and Frederick Warne, among others. opportunities The Penguin Group (www.penguin.com) is a Penguin Random House Company. INTERNSHIP PROGRAM: Penguin Group (USA) offers internship opportunities in various business areas such as contracts, editorial, finance, graphic design, managing editorial, marketing, online marketing, production, publicity, sales, subsidiary rights, and operations. Internship opportunities are available in our Young Readers and Adult divisions. APPLICATION DEADLINE: Semester Deadline Program Dates Spring January 1 February 3 – April 11 Summer February 28 June 2 – August 8 Fall August 1 September 8 – November 14 APPLICATION PROCEDURE: Interested in applying for an internship? Send us your cover letter and resume. Please indicate the semester and business area(s) you are applying for in your cover letter. Penguin Group (USA) Human Resources Department Internship Coordinator 375 Hudson Street New York, NY 10014 [email protected] Fax: 212-366-2930 Penguin Group (USA) values the array of talents and perspectives that a diverse workforce brings. We are an equal opportunity employer. Visit us at www.penguin.com . -

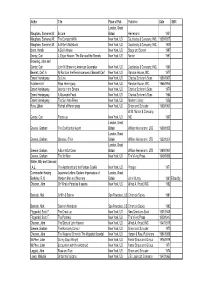

Eng Book2002

Author Title Place of Pub. Publisher Date ISBN London, Great Maugham, Somerset W. Encore Britain Heinemann 1951 Maugham, Somerset W. The Constant Wife New York, US Doubleday & Company, INC. 1926/1927 Maugham, Somerset W. A Writer's Notebook New York, US Doubleday & Company, INC. 1949 Ibsen, Henrik A Doll's House New York, US Stage and Screen 1997 Gentry, Curt J. Edgar Hoover: The Man and the Secrets New York, US Norton 1991 Browning, John and Gentry, Curt John M. Browning American Gunmaker New York, US Doubleday & Company, INC. 1964 Bennett, Cerf. A At Random the Reminiscences of Bennett Cerf New York, US Random House, INC. 1977 Ernest Hemingway By Line New York, US Charles Scribner's Sons 1956/1967 Hotchner A.E. Papa Hemingway New York, US Random House, INC. 1955/1966 Ernest Hemingway Islands in the Stream New York, US Charles Scribner's Sons 1970 Ernest Hemingway A Moveable Feast New York, US Charles Scribner's Sons 1964 Ernest Hemingway The Sun Also Rises New York, US Modern Library 1926 Ross, Lillian Portrait of Hemingway New York, US Simon and Schuster 1950/1961 W.W. Norton & Company, Gentry, Curt Frame-up New York, US INC 1967 London, Great Greene, Graham The Confidential Agent Britain William Heinemann. LTD 1939/1952 London, Great Greene, Graham Stamboul Train Britain William Heinemann. LTD 1932/1951 London, Great Greene, Graham A Burnt-Out Case Britain William Heinemann. LTD 1960/1961 Greene, Graham The 3rd Man New York, US The Viking Press 1949/1950 Wilder, Billy and Diamond, I.A.L. The Apartment and the Fortune Cookie New York, US Praeger 1971 Commander Hasting Japanese Letters: Eastern Impressions of London, Great Berkeley, R.N. -

Summer Reading Front Cover

SUMMER READING FRONT COVER The #1 New York Times-bestselling author of the “nothing short of brilliant” (People) Mrs. Everything returns with an unforgettable novel about friendship and forgiveness set during a disastrous wedding on picturesque Cape Cod. 9781501133510 | $28.00 HC 9781797108391 | $39.99 CD Atria Books The beloved author returns with a remarkable novel of both raw suspense and lyrical beauty—the story of a lost pilot and a wartime photographer that will leave its mark on every reader’s soul. 9780062834782 | $27.99 HC William Morrow & Company From the New York Times- bestselling author of American Wife and Eligible, a novel that imagines a deeply compelling what-might-have-been: What if Hillary Rodham hadn’t A debut novel of exceptional power married Bill Clinton? and urgency, haunting and beautiful, 9780399590917 | $28.00 HC brutal, vibrant, impossible to forget. Random House 9780525658696 | $25.95 HC Knopf Publishing Group 2 Summer Reading From the author of The Bookish Life of Nina Hill, a mother- and-daughter duo watch their carefully mapped-out college tour devolve into something they never expected in this hilarious and insightful new novel. 9780451491893 | $16.00 PB Berkley Books Mallery’s latest is an emotional, witty, and heartfelt story about two best friends who are determined to help one another strike things up and live life to the fullest. 9781335136961 | $26.99 HC HQN By the #1 New York Times- bestselling author of Summer of ‘69, an unforgettable story of an unconventional love that knows After marrying the heir to the one season. throne, Rebecca “Bex” Porter must 9780316420044 | $28.00 HC survive her own scandals as she 9780316497961 | $30.00 HC adjusts to life in the glamorous 9781549182853 | $40.00 CD British royal family, in this highly Little, Brown and Company anticipated follow-up to The Royal We. -

Einladung Zum Mord

J. D. ROBB Einladung zum Mord EEinla_z_Mord_CS3.inddinla_z_Mord_CS3.indd 1 118.06.20088.06.2008 008:33:078:33:07 Buch Niemals hätte Eve Dallas damit gerechnet, Julianna Dunne wieder zu begegnen. Vor zehn Jahren hatte Eve die schöne Giftmörderin verhaf- tet und war Hauptzeugin im Prozess gegen sie gewesen. Bereits damals hatte sich Julianna geschworen, Eve nach allen Regeln der Kunst zu zerstören, wenn sie je die Gelegenheit dazu bekäme. Jetzt ist die eiskal- te Mörderin wieder auf freiem Fuß. Und beginnt ihren Rachefeldzug mit einer Einladung zum Mord – an reiche Geschäftsmänner, die sie bei den harmlosesten Anlässen hinterrücks vergiftet. Ihr ultimatives Ziel: Roarke, Eves mysteriöser Ehemann. Doch Eve ist nicht mehr die kleine Polizei-Anfängerin von früher. Längst hat sie selbst ein paar Tricks auf Lager, um jeden, den sie liebt zu schützen. Und so beginnt sie mit Julianne ein dramatisches Katz-und-Maus-Spiel, bei dem der Tod nie weit entfernt ist … Autorin J. D. Robb ist das Pseudonym der international höchst erfolgreichen Autorin Nora Roberts. Durch einen Blizzard entdeckte Nora Roberts ihre Leidenschaft fürs Schreiben: Tagelang fesselte 1979 ein eisiger Schneesturm sie in ihrer Heimat Maryland ans Haus. Um sich zu be- schäftigen, schrieb sie ihren ersten Roman. Zum Glück – denn inzwi- schen zählt Nora Roberts zu den meistgelesenen Autorinnen der Welt. Unter dem Namen J. D. Robb veröffentlicht sie seit Jahren ebenso er- folgreich Kriminalromane. Auch in Deutschland sind ihre Bücher von den Bestsellerlisten nicht mehr wegzudenken. www. jdrobb.com und www.noraroberts.com Liste lieferbarer Titel Rendezvous mit einem Mörder (1; 35450) · Tödliche Küsse (2; 35451) · Eine mörderische Hochzeit (3; 35452) · Bis in den Tod (4; 35632) · Der Kuss des Killers (5; 35633) · Mord ist ihre Leidenschaft (6; 35634) · Liebesnacht mit einem Mörder (7; 36026) · Der Tod ist mein (8; 36027) · Ein feuriger Verehrer (9, 36028) · Spiel mit dem Mörder (10; 36321) · Sündige Rache (11; 36332) · Symphonie des Todes (12; 36333) · Das Lächeln des Killers (13; 36334) Mörderspiele. -

Trial Exhibit PX-0262 : E-Mail from Kevin Saul to Keith Moerer Re "Kevin Travel to NY" : U.S. V. Apple, Et

Plaintiffs' Exhibit US v.Apple 12-cv-02826 PX-0262 Subject: Re: Kevin tra vel to NY Date: Sun, 13 Dec 2009 2 1:29:33-0800 From: Kevin Saul <[email protected]> To: Keith Moerer <[email protected]> Mess age-ID: <1C8BD3F4-D80A [email protected]> Thanks On Dec 13, 2009, at 7:32PM, Keith Moerer wrote: I'm flying out tomorrow afternoon. Staying at the Sheraton on 7th at 53rd. Below is the schedule for Tuesday and Wednesday, with brief overview of each publisher. Tuesday, Dec. 15 1. Hachette Time: 10:30-11: 30 am Who: David You ng, CEO and Maj a Thomas, SVP of Digital, 212-364-1587 David's Assistant: Jennifer Utley, 212-364-1262, [email protected] Address: 237 Park A venue (on Lexington between 45th and 46th streets ), 10017 , 16th floor Previously called the Time Warner Book Group, owned since 2006 by Hachctte Livre, the largest publishing company in France. Note that whi le Random House owns Stephenie Meyer's Twilight audiobooks, Hachette owns print and eBook rights. The Twilight books have had a Harry Potter-like effect on Hachette's revenues. Core titles/authors: James Patterson , Michael Connelly, Malcolm Gladwell, David Sedaris , Joyce Meyer, Stephenie Meyer, Nicholas Sparks, David Baldacci 2009 Bestsellers: all the Twilight books, The Lovely Bones, Ted Kennedy's True Compass, James Patterson's 1, Alex Cross Key Imprints: Grand Central Publishing , Little Brown , Twelve 2. Random House Time: 1-3 pm Who: Jaci Updike, SVP Director Adult Sales, Amanda Close, VP Sales of Crown Publishing (212-572-2238 or 7 18-757-6157) and Nina Von Moltke, VP of Corporate Development Jaci's Assistant: Melanie Greco, 2 12-782-9882, [email protected] Address: 1745 Broadway (between 55th and 56th), 10022 , 25th fl oor Owned since 1998 by German private media corporation Bertelsmann, biggest US publisher and the world's largest English- language general trade book publ isher. -

2020-2021 Textbook in Use

2020-2021 Textbook In Use Page 246 of 316 Textbook In Use 2020-2021 Grade Name of Textbook Publisher Copyright Course/Class Levels English/Language Arts K Reading Street Series Pearson Scott Foresman 2011 National Geographic – REACH- English as a Second Language K Level A Hampton-Brown 2011 McGraw Hill Wright Mathematics K Everyday Mathematics Group 2016 McGraw Hill Wright Mathematics K Matematicas diarias Group 2016 Science K FOSS Science Kits Delta Education 2005/2016 Social Studies K My World Pearson Scott Foresman 2013 Social Studies K Mi Mundo Pearson Scott Foresman 2013 Descubre el Español con World Language 1 Santillana - Level B Santillana 2015 Music K - 8 Making Music 2008 Silver Burdett/Pearson 2008 English/Language Arts 1 Reading Street Series Pearson Scott Foresman 2011 English Language Arts 1 Calle de Lectura Pearson Scott Foresman 2011 National Geographic – REACH- English as a Second Language 1 Level B Hampton-Brown 2011 Wright Group/ McGraw Mathematics 1 Everyday Math Hill 2016 Wright Group/ McGraw Mathematics 1 Matemáticas diarias Hill 2016 2005 & Science 1 FOSS Science Kits Delta Education 2016 Social Studies 1 My World Pearson Scott Foresman 2013 Social Studies 1 Mi Mundo Pearson Scott Foresman 2013 Descubre el Español con World Language 1 Santillana - Level B Santillana 2015 English Language Arts 2 Reading Street Series Pearson Scott Foresman 2011 English/Language Arts 2 Calle de Lectura Pearson Scott Foresman 2011 National Geographic – REACH- English as a Second Language 2 Level B Hampton-Brown 2011 Page 247 of 316 -

The Author Was Never Dead

THE AUTHOR WAS NEVER DEAD: How Social Media and the Online Literary Community Altered the Visibility of the Translated Author in America Senior Thesis Presented to The Faculty of the School of Arts and Sciences Brandeis University Waltham, MA Undergraduate Program in Independent Interdisciplinary Major (Communication and Literature Studies) Elizabeth Bradfield, Advisor David Sherman, Second Reader In partial fulfillment of the requirements for the degree of Bachelor of Arts by Emily Botto April 2020 Copyright by Emily Botto Botto 2020 Abstract The American publishing industry is notorious for its disinterest in translation. Although its notoriety has made most publishers very aware of the absence of translated literature in America, its perception as an unprofitable venture has prevented publishing houses from investing in the genre and thereby improving the small number of published translations. This thesis explores the possible ways in which translated authors and their readers can alter this perception by utilizing recent technological advances in global social networking. “The Author Was Never Dead” will cover the history of and current environment surrounding literary translation in the U.S. including which translated novels have become successful and how that relates to the visibility of the translated author. Researching the slow growth in the visibility of the translated author and their cultural ambassadors on social media and online communities provides insight into how and why a translated book can gain popularity in a country known for its literary ethnocentrism. Acknowledgments Thanks to my amazing advisor, Elizabeth Bradfield, for always making time for me, answering my questions, and following my logic even when it threatened to fall out the window. -

May New Books

BROWNELL LIBRARY NEW TITLES, MAY 2018 FICTION F BALZAC Balzac, Honoré de, Old Goriot / Penguin Books,1951 Translation of: Pere Goriot. Focuses around the grasping Parisian society of the 1820s. F BARRY Barry, Sebastian, Days without end : a novel /Penguin Books, an imprint of Penguin Random House LLC, 2017. Entering the U.S. army after fleeing the Great Famine in Ireland, seventeen-year-old Thomas McNulty and his brother-in-arms, John Cole, experience the harrowing realities of the Indian wars and the American Civil War between the Wyoming plains and Tennessee. F BOHJALIAN Bohjalian, Chris, The flight attendant : a novel /Doubleday, 2018 "From the New York Times bestselling author of The Guest Room, a powerful story about the ways an entire life can change in one night: A flight attendant wakes up in the wrong hotel, in the wrong bed, with a dead man - and no idea what happened. Cassandra Bowden is no stranger to hungover mornings. She's a binge drinker, her job with the airline making it easy to find adventure, and the occasional blackouts seem to be inevitable. She lives with them, and the accompanying self-loathing. When she awakes in a Dubai hotel room, she tries to piece the previous night back together, counting the minutes until she has to catch her crew shuttle to the airport."-- F BOWEN Bowen, Rhys, The Tuscan child /: Lake Union Publishing, 2018 “In 1944, British bomber pilot Hugo Langley parachuted from his stricken plane into the verdant fields of German-occupied Tuscany. Badly wounded, he found refuge in a ruined monastery and in the arms of Sofia Bartoli. -

RR Donnelley to Produce Digitally Printed Books for Penguin Group (USA) Inc

RR Donnelley to Produce Digitally Printed Books for Penguin Group (USA) Inc. May 04, 2010 CHICAGO, May 04, 2010 (BUSINESS WIRE) -- R.R. Donnelley & Sons Company (NASDAQ:RRD) today announced an agreement with Penguin Group (USA) Inc. to provide the majority of its digital printing and binding requirements. Under the terms of the agreement RR Donnelley will produce Penguin Group (USA)'s digitally printed adult and young readers' trade hardcover, trade paperback, mass market paperback books, bound galleys and advanced reader copies. David Shanks, CEO, Penguin Group (USA), commented, "In the rapidly changing world of print manufacturing, RR Donnelley has developed new digital printing and binding technology that delivers both high quality inkjet printing and improved efficiencies. We are very pleased to be continuing our long-standing relationship with RR Donnelley as part of our ongoing mission to provide the best service possible to our authors and readers as well as booksellers." Using RR Donnelley's digital file processing and archiving service, book publishers can tap into an on-demand production platform that delivers books in quantities from the ones to the millions. The company expects to have deployed nearly 20 of its ProteusJet(TM) inkjet units by year's end. "We are proud to have been named a primary producer of Penguin Group (USA)'s digitally printed books and related materials," stated John Paloian, RR Donnelley's Chief Operating Officer. "Our extensive digital platform, which includes more than 1,000 units in over 60 facilities worldwide, extends even beyond book production to encompass the breadth of the publishing supply chain.