CY19 June a Collection of Bitcoin Commentary from the Brightest

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Clearstream Cash & Banking New Banking Services, Easing

Clearstream Cash & Banking Newsletter New banking services, easing global market access In today’s world, financial possibilities are endless. In a single click, you can travel from your desk to halfway across the globe, buying and selling, and making investments in currencies one had never heard of 20 years ago. Click again and translate that exotic currency into another that you, your 16 customers and their customers can comprehend and settle. / It may all sound rather complicated As a meeting place for financial but at Clearstream our objective is institutions, fund managers and to find simple solutions to help our corporate treasurers, the platform customers, wherever they may want delivers that instant currency 0 2 to go. We endeavour to deliver the translation global investors require. ideal processes and the best possible solutions, including enhanced foreign This new partnership has led us to exchange services for currency review our current FX offering with the settlement and income processing. idea to leverage the synergies between the two companies. This could lead A financial world traveller needs to be to improved deadlines and pricing, able to translate currencies: much as full lifecycle reporting, the launch of we need a translator when visiting a new FX products, FX direct dealing foreign country, whose language we do and straight-through-processing. In not speak. Clearstream and its parent, addition, Clearstream already delivers Deutsche Börse, continue to strive for new automated and on-demand excellence in the areas of trade and solutions in foreign exchange services post-trade services. across the majority of its settlement and income currencies. -

Country Codes and Currency Codes in Research Datasets Technical Report 2020-01

Country codes and currency codes in research datasets Technical Report 2020-01 Technical Report: version 1 Deutsche Bundesbank, Research Data and Service Centre Harald Stahl Deutsche Bundesbank Research Data and Service Centre 2 Abstract We describe the country and currency codes provided in research datasets. Keywords: country, currency, iso-3166, iso-4217 Technical Report: version 1 DOI: 10.12757/BBk.CountryCodes.01.01 Citation: Stahl, H. (2020). Country codes and currency codes in research datasets: Technical Report 2020-01 – Deutsche Bundesbank, Research Data and Service Centre. 3 Contents Special cases ......................................... 4 1 Appendix: Alpha code .................................. 6 1.1 Countries sorted by code . 6 1.2 Countries sorted by description . 11 1.3 Currencies sorted by code . 17 1.4 Currencies sorted by descriptio . 23 2 Appendix: previous numeric code ............................ 30 2.1 Countries numeric by code . 30 2.2 Countries by description . 35 Deutsche Bundesbank Research Data and Service Centre 4 Special cases From 2020 on research datasets shall provide ISO-3166 two-letter code. However, there are addi- tional codes beginning with ‘X’ that are requested by the European Commission for some statistics and the breakdown of countries may vary between datasets. For bank related data it is import- ant to have separate data for Guernsey, Jersey and Isle of Man, whereas researchers of the real economy have an interest in small territories like Ceuta and Melilla that are not always covered by ISO-3166. Countries that are treated differently in different statistics are described below. These are – United Kingdom of Great Britain and Northern Ireland – France – Spain – Former Yugoslavia – Serbia United Kingdom of Great Britain and Northern Ireland. -

The Latin American Dollar Standard in the Post-Crisis Era

THE LATIN AMERICAN DOLLAR STANDARD IN THE POST-CRISIS ERA REID W. CLICK* Associate Professor George Washington University Department of International Business Washington, DC 20052 (202) 994-0656 [email protected] March 15, 2007 *This paper was started while I was visiting the Consorcio de Investigación Económica y Social (CIES) in Lima, Peru, during July 2006, and I am grateful for their hospitality. The work has benefited from provided by economists throughout Lima, as well as participants at the conference on Small Open Economies in a Globalized World in Rimini, Italy, August 2006. I am grateful for financial support from the U.S. Department of Education, Title VI Business and International Education Grant, to conduct this research. THE LATIN AMERICAN DOLLAR STANDARD IN THE POST-CRISIS ERA ABSTRACT This paper examines the extent to which there is currently a “dollar standard” in Latin America by empirically looking at the time series relationships between local currencies and the major global currencies using daily data over the period 2003-2006. The results indicate that three countries in the Andes – Ecuador (which is officially dollarized), Bolivia, and Peru – are on practically perfect dollar standards and might find additional financial integration fairly practicable. Four more countries – Guyana, Uruguay, Argentina, and Paraguay – are nearly on a dollar standard and might easily move closer to dollarization. Guyana, Uruguay, and Paraguay have economies substantially smaller than that of Ecuador, which has already officially dollarized, and might find similar full dollarization relatively easy. Argentina, although having abandoned its currency board mechanism, seems to be engineering (or at least allowing) a persistent, though imperfect, link to the dollar. -

About the Customer Business Challenge

▼ About the Customer Banexcoin is a digital platform for the exchange of cryptocurrencies and fiat money in Latin America. The platform is compliant with PCI DSS, a globally recognized information security standard, and provides traders superior security and reliability. Banexcoin is based in Lima, Peru, and plans to release an e-commerce application so that merchants can accept cryptocurrency, the US Dollar, and even Latin American currencies, such as the Peruvian Sol. ▼ Business Challenge In 2017, CEO Bruno Aller asked Co-founder Sergio Yurman Moldauer to join the executive team, as blockchain had caught both their imaginations, and they believed blockchain would be the path towards a new global economy. Based in Lima, Peru, Banexcoin’s co-founders experienced life first-hand in an underdeveloped region. They recognized that the populous needed education on new technologies, “They are very knowledgeable. They are quick to adopt new technologies, because these are the people who don’t have access to traditional financial systems,” said Moldauer, who has been a member on the Board at the Bank of Venezuela. Blockchain, open finance, and decentralized finance creates opportunity and access for underserved segments. With widespread digitization, people will be able to transact more freely, and the cost of transactions will come down, enabling people and entrepreneurs to develop their own projects and pursue opportunities that may have previously been out of reach. Banexcoin ultimately arose from an unfilled need in Latin America for a cryptocurrency marketplace that met the security and reliability standards necessary to provide peace of mind to new users in all aspects of exchange. -

V. Exchange Rates and Capital Flows in Industrial Countries

V. Exchange rates and capital flows in industrial countries Highlights Two themes already evident in 1995 persisted in the foreign exchange market last year. The first was the strengthening of the US dollar, in two phases. In spite of continuing trade deficits, the dollar edged up for much of 1996 as market participants responded to its interest rate advantage, and the prospect of its increasing further. Then, towards the end of the year, the dollar rose sharply against the Deutsche mark and the Japanese yen as the US economic expansion demonstrated its vigour. A firming of European currencies against the mark and the Swiss franc accompanied the rise of the dollar. This helped the Finnish markka to join and the Italian lira to rejoin the ERM in October and November respectively. Stronger European currencies and associated lower bond yields both anticipated and made more likely the introduction of the euro, the second theme of the period under review. Market participants clearly expect the euro to be introduced: forward exchange rates point to exchange rate stability among a number of currencies judged most likely to join monetary union. Foreign exchange markets thereby stand to lose up to 10¤% of global transactions, and have begun to refocus on the rapidly growing business of trading emerging market currencies. Possible shifts in official reserve management with the introduction of the euro have preoccupied market commentators, but changes in private asset management and global liability management could well prove more significant. Even then, it is easy to overstate the effect of any such portfolio shifts on exchange rates. -

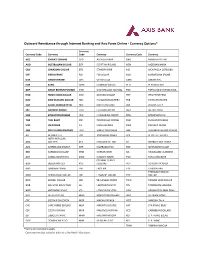

Outward Remittance Through Internet Banking and Axis Forex Online - Currency Options*

Outward Remittance through Internet Banking and Axis Forex Online - Currency Options* Currency Currency Code Currency Code Currency Currency Code Currency AED EMIRATI DIRHAM DZD ALGERIA DINAR NAD NAMIBIA DOLLAR AUD AUSTRALIAN DOLLAR EGP EGYPTIAN POUND NGN NIGERIAN NAIRA CAD CANADIAN DOLLAR ETB ETHIOPIA BIRR NIO NICARAGUA CORDOBA CHF SWISS FRANC FJD FIJI DOLLAR NOK NORWEGIAN KRONE DKK DANISH KRONE GHS GHANA CEDI OMR OMANI RIAL EUR EURO GMD GAMBIAN DALASI PEN PERUVIAN SOL GBP GREAT BRITAIN POUNDS GTQ GUATEMALAN QUETZAL PGK PAPUA NEW GUINEA KINA HKD HONG KONG DOLLAR GYD GUYANA DOLLAR PHP PHILIPPINE PESO NZD NEW ZEALAND DOLLAR HNL HONDURAN LEMPIRA PKR PAKISTANI RUPEE SAR SAUDI ARABIAN RIYAL HRK CROATIAN KUNA PLN POLISH ZLOTY SEK SWEDISH KRONA HTG HAITIAN GOURDE QAR QATARI RIYAL SGD SINGAPORE DOLLAR HUF HUNGARIAN FORINT RON ROMANIAN LEU THB THAI BAHT IDR INDONESIAN RUPIAH RUB RUSSIAN ROUBLES USD US DOLLAR ILS ISRAELI SHEKEL RWF RWANDA FRANC ZAR SOUTH AFRICAN RAND JMD JAMAICAN DOLLAR SBD SOLOMON ISLAND DOLLAR ALL ALBANIA LEK JOD JORDANIAN DINAR SCR SEYCHELLES RUPEE NETH.ANTILLIAN ANG GUILDER KES KENYAN SHILLING SLL SIERRA LEONE LEONE AZN AZERBAIJAN MANAT KHR CAMBODIA RIEL SRD SURINAME DOLLAR BBD BARBADOS DOLLAR KRW KOREAN WON SZL SWAZILAND LILANGENI BDT BANGLADESH TAKA KWD KUWAITI DINAR TND TUNISIAN DINAR CAYMAN ISLAND BGN BULGARIAN LEV KYD DOLLARS TOP TONGAN PA'ANGA BHD BAHRAINI DINAR LAK LAOS KIP TRY TURKISH LIRA TRINIDAD TOBAGO BMD BERMUDIAN DOLLAR LBP LEBANESE POUND TTD DOLLAR BND BRUNEI DOLLAR LKR SRI LANKAN RUPEE TWD TAIWAN NEW DOLLAR -

Worldwide Selections of Choice and Rare Coins, Medals, Paper Money

AMERICAN NUMISMATIC SOCIETY Volume 1 Descriptions Selections of Choice To Be Sold Only By Mail Bid Closing Date - July 18, 1975 and Rare Friday, 11:00 P.M. CDT Goins Medals PaperMoney PROUDLY PRESENTED BY: COINS OF THE WORLD Bank of San Antonio Building, Suite 208, One Romana Plaza, San Antonio, Texas 78205 Phone: 512-227-3471 BID SHEET ALMANZAR’S COINS OF THE WORLD MAIL BIDS CANNOT BE FRIDAY, BANK OF SAN ANTONIO BLDG., SUITE 208 ACCEPTED AFTER 1975 ONE ROMANA PLAZA JULY 18, SAN ANTONIO, TEXAS 78205 PLEASE ENTER THE FOLLOWING BIDS FOR ME IN YOUR AUCTION SALE OF JULY 18, 1975. I HAVE READ AND AGREE TO ABIDE BY THE TERMS OF SALE AND WILL REMIT PROMPTLY UPON RECEIPT OF INVOICE FOR ALL LOTS THAT I PURCHASE. , 1975 SIGNATURE NAME ADDRESS CITY STATE ZIP CODE LOT // BID LOT // BID LOT // BID Please bill me $1.00 for a copy of the prices realized list (fee covers postal costs). Auction catalog subscribers need not check this box. The prices realized list will be mailed as soon as the list is published and only to those persons who have subscribed, consigned items to this auction, or who have paid the $1.00 fee. As a buyer unknown to you, I wish to establish credit with your firm. My credit references include: FIRM OR INDIVIDUAL CITY STATE ZIP CODE and/or I include $ as a deposit to guarantee my intent to buy all lots for which I am the high bidder. (ALL PERSONS WHO HAVE ESTABLISHED CREDIT WITH US MAY IGNORE THIS PARAGRAPH) PLEASE PRINT OR WRITE CLEARLY. -

Midterm Solutions

WebCT Quiz Grading http://web1.webct.com/SCRIPT/nyuifm/scripts/marker/mark_quiz?940411618+MARK+anon+1+1 Name: anon anon Attempt: 1 Max. Score: 100 Started: Oct 24, 1999 6:07 Finished: Oct 24, 1999 6:18 Time Spent: 10 min., 47 sec. Update Grade Reset Attempt Cancel Question 1 (5 marks) Since Estonia adopted a currency board, the kroon has been fixed against the Euro. Now if Estonia's reduces its balance of trade deficit, what is likely to happen to the money stock in Estonia? 0.0% 1. The currency will appreciate. 0.0% 2. The currency will depreciate. 0.0% 3. The money stock will decrease. 100.0% 4. The money stock will increase. Export surplus = Change in central bank reserves + Private capital outflows. Thus, if the exchange rate is fixed against the US dollar, presumably the central bank conducts open market transactions to maintain that parity. With strong exports, the local currency will tend to appreciate and thus to maintain the fixed exchange rate, the central bank will sell the currency in the foreign exchange market. Thus the domestic implications are an increase in the money stock (the amount of local currency in circulation). 0.0% 5. None of the above. Score: 5.0 / 5.0 Override Mark: Comments: 1 of 12 10/24/99 9:26 PM WebCT Quiz Grading http://web1.webct.com/SCRIPT/nyuifm/scripts/marker/mark_quiz?940411618+MARK+anon+1+1 Question 2 (5 marks) Toronto Dominion Bank gives you, the treasurer of Ho Inc., a quote for the Canadian dollar at C$1.1465-75/US$, what quote would it give in so-called "U.S. -

List of Currencies That Are Not on KB´S Exchange Rate

LIST OF CURRENCIES THAT ARE NOT ON KB'S EXCHANGE RATE , BUT INTERNATIONAL PAYMENTS IN THESE CURRENCIES CAN BE MADE UNDER SPECIFIC CONDITIONS ISO code Currency Country in which the currency is used AED United Arab Emirates Dirham United Arab Emirates ALL Albanian Lek Albania AMD Armenian Dram Armenia, Nagorno-Karabakh ANG Netherlands Antillean Guilder Curacao, Sint Maarten AOA Angolan Kwanza Angola ARS Argentine Peso Argentine BAM Bosnia and Herzegovina Convertible Mark Bosnia and Herzegovina BBD Barbados Dollar Barbados BDT Bangladeshi Taka Bangladesh BHD Bahraini Dinar Bahrain BIF Burundian Franc Burundi BOB Boliviano Bolivia BRL Brazilian Real Brazil BSD Bahamian Dollar Bahamas BWP Botswana Pula Botswana BYR Belarusian Ruble Belarus BZD Belize Dollar Belize CDF Congolese Franc Democratic Republic of the Congo CLP Chilean Peso Chile COP Colombian Peso Columbia CRC Costa Rican Colon Costa Rica CVE Cape Verde Escudo Cape Verde DJF Djiboutian Franc Djibouti DOP Dominican Peso Dominican Republic DZD Algerian Dinar Algeria EGP Egyptian Pound Egypt ERN Eritrean Nakfa Eritrea ETB Ethiopian Birr Ethiopia FJD Fiji Dollar Fiji GEL Georgian Lari Georgia GHS Ghanaian Cedi Ghana GIP Gibraltar Pound Gibraltar GMD Gambian Dalasi Gambia GNF Guinean Franc Guinea GTQ Guatemalan Quetzal Guatemala GYD Guyanese Dollar Guyana HKD Hong Kong Dollar Hong Kong HNL Honduran Lempira Honduras HTG Haitian Gourde Haiti IDR Indonesian Rupiah Indonesia ILS Israeli New Shekel Israel INR Indian Rupee India, Bhutan IQD Iraqi Dinar Iraq ISK Icelandic Króna Iceland JMD Jamaican -

ANNEX a to the 1998 FX and CURRENCY OPTION DEFINITIONS AMENDED and RESTATED AS of NOVEMBER 19, 2017 I

ANNEX A to the 1998 FX and Currency Option Definitions _________________________ Amended and Restated November 19, 2017 Amended March 16, 2020 INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. EMTA, INC. TRADE ASSOCIATION FOR THE EMERGING MARKETS Copyright © 2000-2020 by INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. EMTA, INC. ISDA and EMTA consent to the use and photocopying of this document for the preparation of agreements with respect to derivative transactions and for research and educational purposes. ISDA and EMTA do not, however, consent to the reproduction of this document for purposes of sale. For any inquiries with regard to this document, please contact: INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. 10 East 53rd Street New York, NY 10022 www.isda.org EMTA, Inc. 405 Lexington Avenue, Suite 5304 New York, N.Y. 10174 www.emta.org TABLE OF CONTENTS Page INTRODUCTION TO ANNEX A TO THE 1998 FX AND CURRENCY OPTION DEFINITIONS AMENDED AND RESTATED AS OF NOVEMBER 19, 2017 i ANNEX A CALCULATION OF RATES FOR CERTAIN SETTLEMENT RATE OPTIONS SECTION 4.3. Currencies 1 SECTION 4.4. Principal Financial Centers 6 SECTION 4.5. Settlement Rate Options 9 A. Emerging Currency Pair Single Rate Source Definitions 9 B. Non-Emerging Currency Pair Rate Source Definitions 21 C. General 22 SECTION 4.6. Certain Definitions Relating to Settlement Rate Options 23 SECTION 4.7. Corrections to Published and Displayed Rates 24 INTRODUCTION TO ANNEX A TO THE 1998 FX AND CURRENCY OPTION DEFINITIONS AMENDED AND RESTATED AS OF NOVEMBER 19, 2017 Annex A to the 1998 FX and Currency Option Definitions ("Annex A"), originally published in 1998, restated in 2000 and amended and restated as of the date hereof, is intended for use in conjunction with the 1998 FX and Currency Option Definitions, as amended and updated from time to time (the "FX Definitions") in confirmations of individual transactions governed by (i) the 1992 ISDA Master Agreement and the 2002 ISDA Master Agreement published by the International Swaps and Derivatives Association, Inc. -

BIS Papers No 90 Foreign Exchange Liquidity in the Americas

BIS Papers No 90 Foreign exchange liquidity in the Americas Report submitted by a study group established by the BIS CCA Consultative Group of Directors of Operations (CGDO) and chaired by Susan McLaughlin, Federal Reserve Bank of New York Monetary and Economic Department March 2017 JEL classification: F31, G15 The views expressed are those of the authors and not necessarily the views of the BIS. This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2017. All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated. ISSN 1609-0381 (print) ISBN 978-92-9259-035-2 (print) ISSN 1682-7651 (online) ISBN 978-92-9259-034-5 (online) Contents Executive summary ................................................................................................................................ iii Liquidity metrics ............................................................................................................................. iii Liquidity conditions ...................................................................................................................... iii Factors influencing liquidity conditions ............................................................................... iii I. Introduction ...................................................................................................................................... 1 II. Liquidity metrics and trends ..................................................................................................... -

Annex a to the 1998 Fx and Currency Option Definitions

ANNEX A to the 1998 FX and Currency Option Definitions ISDAÒ INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. EMTA® EMERGING MARKETS TRADERS ASSOCIATION THE FOREIGN EXCHANGE COMMITTEE Copyright © 1998 by INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. EMERGING MARKETS TRADERS ASSOCIATION THE FOREIGN EXCHANGE COMMITTEE ISDA, EMTA and The Foreign Exchange Committee consent to the use and photocopying of this document for the preparation of agreements with respect to derivative transactions. ISDA, EMTA and The Foreign Exchange Committee do not, however, consent to the reproduction of this document for purposes of public distribution or sale. To obtain written permission for any use of this document (other than for the preparation of agreements with respect to derivative transactions), please contact: INTERNATIONAL SWAPS AND DERIVATIVES ASSOCIATION, INC. 600 Fifth Avenue, 27th Floor Rockefeller Center New York, N.Y. 10020-2302 TABLE OF CONTENTS Page INTRODUCTION TO ANNEX A TO THE 1998 FX AND CURRENCY OPTION DEFINITIONS ................................................... i ANNEX A CALCULATION OF RATES FOR CERTAIN SETTLEMENT RATE OPTIONS SECTION 4.3. Currencies .................................................. 1 SECTION 4.4. Principal Financial Center .......................... 10 SECTION 4.5. Settlement Rate Options ............................. 15 SECTION 4.6. Certain Definitions Relating to Settlement Rate Options ........................ 37 SECTION 4.7. Corrections to Published and Displayed Rates...................................... 39 INDEX OF TERMS .................................................................... 41 ANNEX A March 1998 INTRODUCTION TO ANNEX A TO THE 1998 FX AND CURRENCY OPTION DEFINITIONS Annex A to the 1998 FX and Currency Option Definitions ("Annex A") is intended for use in conjunction with the 1998 FX and Currency Option Definitions (the "Definitions") in confirmations of individual transactions governed by (i) the 1992 ISDA Master Agreements published by the International Swaps and Derivatives Association, Inc.