Proposed MA Legislation on Business Interruption Insurance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Protect Your Collective Bargaining Rights!

PROTECT YOUR COLLECTIVE BARGAINING RIGHTS! On April 26th, a majority of the members of the Massachusetts of House Representatives voted to dramatically restrict the rights of municipal employees to collectively bargain over the issue of health insurance. It is critically important that you let your Representative know how you feel about their vote. These Representatives voted IN FAVOR of your collective bargaining rights: Democrats: Geraldo Alicea Denise Andrews Bruce Ayers Michael Brady Paul Brodeur Thomas Calter Christine Canavan James Cantwell Tackey Chan Nicholas Collins Edward Coppinger Geraldine Creedon Mark Cusack Marcos Devers James Dwyer Lori Ehrlich Christopher Fallon Robert Fennell John Fresolo Denise Garlick Coleen Garry John Mahoney Paul Mark James Miceli Kevin Murphy Rhonda Nyman James O’Day Thomas Petrolati Denise Provost Kathi-Anne Reinstein Carl Sciortino Joyce Spiliotis Thomas Stanley David Sullivan Walter Timilty Timothy Toomey Cleon Turner Marty Walsh Steven Walsh Alice Wolf Republicans: Bradford Hill Daniel Winslow If your state representative stood up for you, it is important that you call them and thank them for their support. You can say something like this: My name is ____________________ and I live in __________________. I work for the city/town of ___________ as a _____________. I am calling because Rep. ____________ voted in favor of maintaining collective bargaining rights for municipal workers like me. I wanted to thank Rep. ______________ for standing up for my union rights. These Representatives voted AGAINST -

Presidential Candidates Senate Candidates Congressional

Presidential Candidates Presidential Candidates Party Position Joe Biden Democrat Anti-Life Endorsed by Donald Trump* Republican Pro-Life the MCFL FedPAC Senate Candidates Senate Candidate Party Position Edward Markey* Democrat Anti-Life Kevin O'Connor Republican Congressional Candidates MCFL Fed PAC Congressional Candidates Candidate's Name Party Position Endorsements First District Richard E. Neal* Democrat Anti-Life James P. McGovern* Democrat Anti-Life Second District Tracy Lyn Lovvorn Republican Third District Lori L. Trahan* Democrat Anti-Life Jake Auchincloss Democrat Anti-Life Fourth District Julie A. Hall Republican Katherine M. Clark* Democrat Anti-Life Fifth District Endorsed by Caroline Colarusso Republican Pro-Life the MCFL Fed PAC Seth Moulton* Democrat Anti-Life Sixth District John P. Moran Republican Seventh District Ayanna S. Pressley* Democrat Anti-Life Eighth District Stephen F. Lynch* Democrat Anti-Life Bill Keating* Democrat Anti-Life Ninth District Helen Brady Republican State Senate Candidates Doctor- State Senate District Candidate's Name Party Abortion Prescribed Position Suicide Position Berkshire, Hampshire, Franklin & Adam G. Hinds* Democrat Anti-Life Hampden Bristol & Norfolk Paul R. Feeney* Democrat Anti-Life First Bristol and Plymouth Michael J. Rodrigues* Democrat Mixed Anti-Life Second Bristol and Plymouth Mark C. Montigny* Democrat Anti-Life Cape & Islands Julian A. Cyr* Democrat Anti-Life First Essex Diana Dizoglio* Democrat Anti-Life Second Essex Joan B. Lovely* Democrat Anti-Life Third Essex Brendan P. Crighton* Democrat Anti-Life First Essex & Middlesex Bruce E. Tarr* Republican Mixed Second Essex & Middlesex Barry R. Finegold* Democrat Anti-Life Hampden Adam Gomez Democrat Anti-Life First Hampden & Hampshire Eric P. Lesser* Democrat Anti-Life John C. -

HOUSE ...No. 1608

HOUSE DOCKET, NO. 414 FILED ON: 1/13/2015 HOUSE . No. 1608 The Commonwealth of Massachusetts _________________ PRESENTED BY: Ellen Story and Byron Rushing _________________ To the Honorable Senate and House of Representatives of the Commonwealth of Massachusetts in General Court assembled: The undersigned legislators and/or citizens respectfully petition for the adoption of the accompanying bill: An Act updating the laws to protect women's health. _______________ PETITION OF: NAME: DISTRICT/ADDRESS: Ellen Story 3rd Hampshire Byron Rushing 9th Suffolk Ruth B. Balser 12th Middlesex Jennifer E. Benson 37th Middlesex Paul Brodeur 32nd Middlesex Gailanne M. Cariddi 1st Berkshire Josh S. Cutler 6th Plymouth Marjorie C. Decker 25th Middlesex Michelle M. DuBois 10th Plymouth Carolyn C. Dykema 8th Middlesex Lori A. Ehrlich 8th Essex James B. Eldridge Middlesex and Worcester Sean Garballey 23rd Middlesex Denise C. Garlick 13th Norfolk Kenneth I. Gordon 21st Middlesex Danielle W. Gregoire 4th Middlesex Jonathan Hecht 29th Middlesex Paul R. Heroux 2nd Bristol 1 of 4 Kevin G. Honan 17th Suffolk Louis L. Kafka 8th Norfolk Jay R. Kaufman 15th Middlesex Mary S. Keefe 15th Worcester Kay Khan 11th Middlesex Peter V. Kocot 1st Hampshire Stephen Kulik 1st Franklin Jason M. Lewis Fifth Middlesex Barbara L'Italien Second Essex and Middlesex Jay D. Livingstone 8th Suffolk Elizabeth A. Malia 11th Suffolk Paul W. Mark 2nd Berkshire James J. O'Day 14th Worcester Sarah K. Peake 4th Barnstable Alice Hanlon Peisch 14th Norfolk Denise Provost 27th Middlesex David M. Rogers 24th Middlesex Daniel J. Ryan 2nd Suffolk Tom Sannicandro 7th Middlesex John W. Scibak 2nd Hampshire Frank I. -

T4MA Legislative Fact Sheets

Transportation Investment Act SB1646/HB3284 Lead Sponsors: Senator Katherine Clark (Melrose); Representatives Tricia Farley-Bouvier (Pittsfield) and Carl Sciortino (Medford) Cosponsors: Senators Patricia Jehlen, Sal DiDomenico, Michael Barrett, William Brownsberger, Gale Candaras; Representatives Timothy Toomey, Frank Smizik, Benjamin Swan, Chris Walsh, Jason Lewis, Denise Andrews, Kay Khan, Mary Keefe, Anne Gobi, Jonathan Hecht, Alan Silvia, John Scibak, Marcos Devers, Stephen Kulik, Thomas Stanley, Jay Kaufman, Tom Sannicandro, Denise Provost, Cheryl Coakley-Rivera, Sean Garballey, Aaron Vega, Paul Schmid, Brian Ashe, James O’Day, Michael Brady, Thomas Conroy This legislation will guide transportation investment to build a financially stable, safer and more modern transportation system in every corner of the Commonwealth of Massachusetts from Pittsfield to Provincetown. Creating Financial Stability Eliminates the practice of using capital dollars to pay for operating expenses Eliminates the practice of putting everyday operations on a high-interest credit card Creating Regional Equity Requires that an equitable portion of revenue benefit regions throughout the Commonwealth. Provides funding to gateway cities and environmental justice neighborhoods to plan and design projects eligible for federal transportation money. Provides funding to gateway cities and environmental justice neighborhoods to invest in projects that residents care most about – such as fixing roads and bridges, RTA improvements, sidewalks, bike lanes, and projects that promote transit oriented development and affordable housing. Making Smart Transportation Investments Transportation projects must comply with stated policy goals and objectives that reduce pollution, improve public health, improve land-use coordination and meet our mode shift goals. Requires that transportation investments be analyzed for their impact on our economy, environment, public health, low-income communities and communities of color, pedestrian and bike access, and cost of operations. -

Caucus of Women Legislators Fourth Quarter 2007

Caucus of Women Legislators Fourth Quarter 2007 State House, Room 460 • Boston, Massachusetts 02133 • Ph: (617) 722-2266 Past and Present Legislators Gather for 157, And Counting Reunion succeed the President in the case of the F ormer Representative latter’s removal, resignation or death. In Katharine Kane smiled at both the famil- the room full of past and present female iar and unfamiliar faces around the room state representatives and senators, Ms. as she received applause. Representative Kane was the earliest-serving legislator Marty Walz (D-Boston), Ms. Kane’s state present at that night’s event held at the representative and House Chair of the Cau- College Club of Boston, and is one of the cus of Women Legislators, had just recog- earliest-serving who is still alive today. nized Ms. Kane’s legislative service from Titled 157, And Counting after the 1965 to 1968, some 40 years ago. Ms. 157 women legislators who have served in Kane served under former House Speaker Former Representative Anne Paulsen, Representative the Massachusetts General Court, the Oc- John McCormack when Lyndon Johnson Lida Harkins, Former Representatives Barbara Gard- tober 11 reception and dinner brought to- was President of the United States. She ner and Barbara Hildt (left to right) chat at 157, And gether former and current women legisla- Counting. took part in the state’s ratification of the tors for the first reunion of its kind in re- 15th amendment to the Bill of Rights, which allowed for the Vice President to cent (Continued on page 4) Brown Bag Lunches Spotlight Lung Cancer in Women and Child Hunger Caucus Hosts Lung Cancer Alliance for Dr. -

S. 2325 Lead Sponsor: Senator Sonia Chang-Díaz

AN ACT MODERNIZING THE FOUNDATION BUDGET FOR THE 21ST CENTURY S. 2325 Lead Sponsor: Senator Sonia Chang-Díaz THE PROBLEM: Every day, students across Massachusetts walk into schools that are facing dire challenges. Over the last decade, school districts have been forced to make difficult cuts year after year. Classrooms across the state have lost critical services and programs, including social- emotional supports like counselors, wrap-around services, resources like technology and books, professional development, arts classes, and preschool programs. On top of these cuts, Massachusetts has one of the worst achievement gaps in the United States – ranking 48th nationally for the achievement gap between affluent and poor students. It wasn’t supposed to be this way. In 1993, Massachusetts passed the Education Reform Act— which established the “Foundation Budget” to make sure all school districts could provide their students with a quality education. Unfortunately, in the 25 years since, we have done little to update the formula, and it’s now outdated, hampering districts’ efforts to provide each student with the quality education they deserve. The 2015 Foundation Budget Review Commission (FBRC) found that health care and special education costs have far surpassed assumptions built into the original formula. The FBRC also found that the original formula drastically understated the resources necessary to close achievement gaps for low-income and English Language Learner students. In all, the bipartisan commission of experts found that Massachusetts is underestimating the cost of education by $1-2 billion every year THE SOLUTION: To make good on our bedrock promise of providing every student in Massachusetts with equal access to quality education, we need to significantly revise the foundation budget formula. -

House Bill No. 1577

HOUSE DOCKET, NO. 3072 FILED ON: 1/16/2015 HOUSE . No. 1577 The Commonwealth of Massachusetts _________________ PRESENTED BY: Byron Rushing and Denise Provost _________________ To the Honorable Senate and House of Representatives of the Commonwealth of Massachusetts in General Court assembled: The undersigned legislators and/or citizens respectfully petition for the adoption of the accompanying bill: An Act relative to gender identity and nondiscrimination. _______________ PETITION OF: NAME: DISTRICT/ADDRESS: Byron Rushing 9th Suffolk Denise Provost 27th Middlesex Cory Atkins 14th Middlesex Ruth B. Balser 12th Middlesex Michael J. Barrett Third Middlesex William N. Brownsberger Second Suffolk and Middlesex Paul Brodeur 32nd Middlesex Gailanne M. Cariddi 1st Berkshire Marjorie C. Decker 25th Middlesex Sonia Chang-Diaz Second Suffolk James B. Eldridge Middlesex and Worcester Tricia Farley-Bouvier 3rd Berkshire Sean Garballey 23rd Middlesex Kenneth I. Gordon 21st Middlesex Jonathan Hecht 29th Middlesex Paul R. Heroux 2nd Bristol Patricia D. Jehlen Second Middlesex Kay Khan 11th Middlesex 1 of 5 Jay R. Kaufman 15th Middlesex Mary S. Keefe 15th Worcester Peter V. Kocot 1st Hampshire Jason M. Lewis Fifth Middlesex David Paul Linsky 5th Middlesex Jay D. Livingstone 8th Suffolk Elizabeth A. Malia 11th Suffolk Brian R. Mannal 2nd Barnstable Aaron Michlewitz 3rd Suffolk James J. O'Day 14th Worcester Sarah K. Peake 4th Barnstable Jeffrey Sánchez 15th Suffolk Tom Sannicandro 7th Middlesex Ellen Story 3rd Hampshire Kate Hogan 3rd Middlesex Frank I. Smizik 15th Norfolk John W. Scibak 2nd Hampshire Benjamin Swan 11th Hampden Aaron Vega 5th Hampden Chris Walsh 6th Middlesex Gloria L. Fox 7th Suffolk Carolyn C. -

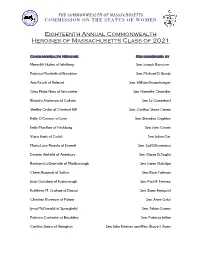

Commonwealth Heroine Class of 2021

THE COMMONWEALTH OF MASSACHUSETTS COMMISSION ON THE STATUS OF WOMEN Eighteenth Annual Commonwealth Heroines of Massachusetts Class of 2021 Commonwealth Heroine Recommended by Meredith Hurley of Winthrop Sen. Joseph Boncore Patricia Monteith of Brockton Sen. Michael D. Brady Amy Kirsch of Belmont Sen. William Brownsberger Gina Plata-Nino of Worcester Sen. Harriette Chandler Rhonda Anderson of Colrain Sen. Jo Comerford Shelley Crohn of Chestnut Hill Sen. Cynthia Stone Creem Kelly O’Connor of Lynn Sen. Brendan Crighton Emily MacRae of Fitchburg Sen. John Cronin Vaira Harik of Cotuit Sen. Julian Cyr María Lucy Pineda of Everett Sen. Sal DiDomenico Doreen Arnfield of Amesbury Sen. Diana DiZoglio Barbara LaGrenade of Marlborough Sen. James Eldridge Cheryl Rawinski of Sutton Sen. Ryan Fattman Joan Goodwin of Foxborough Sen. Paul R. Feeney Kathleen M. Graham of Dracut Sen. Barry Finegold Christina Florence of Palmer Sen. Anne Gobi Jynai McDonald of Springfield Sen. Adam Gomez Patricia Contente of Brookline Sen. Patricia Jehlen Cynthia Sierra of Abington Sen. John Keenan and Rep. Bruce J. Ayers THE COMMONWEALTH OF MASSACHUSETTS COMMISSION ON THE STATUS OF WOMEN Eighteenth Annual Commonwealth Heroines of Massachusetts Class of 2021 Commonwealth Heroine Recommended by Heather Prince Doss of Lowell Sen. Ed Kennedy Sandra E. Sheehan of Hampden Sen. Eric Lesser Laura Rosi of Malden Sen. Jason Lewis Nancy Frates of Beverly Sen. Joan B. Lovely Corinn Williams of New Bedford Sen. Mark Montigny Darlene Coyle of Leicester Sen. Michael Moore Kathleen Jespersen of North Falmouth Sen. Susan Moran and Rep. David Vieira Jennifer McCormack Vitelli of Marshfield Hills Sen. Patrick O’Connor Ndoumbe Ndoyelaye of Franklin Sen. -

Name: Twitter: Facebook URL Phone: Email: Robert Deleo

Name: Twitter: Facebook URL Phone: Email: Robert DeLeo https://www.facebook.com/pages/House-Speaker-Robert-A-DeLeo/401891743246684617-722-2500 [email protected] Bradley Jones, Jr. @RepBradJones https://www.facebook.com/brad.jones.5832617-722-2100 [email protected] Denise Andrews @deniseandrews https://www.facebook.com/deniseandrews2012617-722-2460 [email protected] James Arciero @JimArciero https://www.facebook.com/jim.arciero617-722-2320 [email protected] Brian Ashe @repashe https://www.facebook.com/pages/State-Representative-Brian-Ashe/313981658724617-722-2090 [email protected] Cory Atkins @RepCoryAtkins https://www.facebook.com/pages/Representative-Cory-Atkins/43717444568617-722-2692 [email protected] Bruce Ayers @BruceJAyers https://www.facebook.com/pages/Massachusetts-State-Representative-Bruce-J-Ayers/450787785367617-722-2230 [email protected] Ruth Balser @repruthbalser https://www.facebook.com/ruth.b.balser617-722-2396 [email protected] F. Barrows https://www.facebook.com/pages/State-Representative-F-Jay-Barrows/380289168915617-722-2488 [email protected] Carlo Basile @RepBasile https://www.facebook.com/repbasile617-626-0736 [email protected] Matthew Beaton @beatonforrep https://www.facebook.com/pages/Matt-Beaton-for-State-Representative/10150091953615647617-722-2230 [email protected] Jennifer Benson @RepJenBenson https://www.facebook.com/pages/Jen-Benson/9704649510617-722-2637 [email protected] John Binienda 617-722-2692 [email protected] -

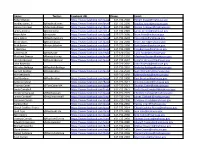

Candidate Full Name Candidate City Office Sought Office Held Alex Bezanson Abington House, 7Th Plymouth N/A, No Office Alyson M

Candidate Full Name Candidate City Office Sought Office Held Alex Bezanson Abington House, 7th Plymouth N/A, No office Alyson M. Sullivan Abington House, 7th Plymouth House, 7th Plymouth Kristen Gail Arute Accord House, 3rd Plymouth N/A, No office Benjamin Elliot Bloomenthal Acton House, 14th Middlesex N/A, No office Daniel L. Factor Acton House, 14th Middlesex N/A, No office Tami L. Gouveia Acton House, 14th Middlesex House, 14th Middlesex James Eldridge Acton Senate, Middlesex & Worcester Senate, Middlesex & Worcester Susan R. Dawson Agawam Senate, Hampden N/A, No office Forrest W. Bradford Agawam House, 3rd Hampden N/A, No office William P. Sapelli Agawam Mayoral, Agawam Mayoral, Agawam Brian P. Golden Allston House, 18th Suffolk N/A, No office James M. Kelcourse Amesbury House, 1st Essex House, 1st Essex Brianna R. Sullivan Amesbury House, 1st Essex N/A, No office Thatcher W. Kezer III Amesbury Mayoral, Amesbury N/A, No office Robert W. Lavoie Amesbury House, 1st Essex N/A, No office C. Kenneth Gray Amesbury Mayoral, Amesbury Mayoral, Amesbury Anne R. Ferguson Amesbury Mayoral, Amesbury N/A, No office Alexander L. Williams Amesbury Senate, 1st Essex N/A, No office Jennifer Rocco-Runnion Amesbury House, 1st Essex N/A, No office Theodore T. Semesnyei Amesbury Mayoral, Amesbury N/A, No office James N. Thivierge Amesbury Mayoral, Amesbury N/A, No office Kassandra M. Gove Amesbury Mayoral, Amesbury N/A, No office Matthew Burton Amesbury House, 1st Essex N/A, No office David J. Murphy Amherst Senate, Hampshire, Franklin & Worcester N/A, No office Mindy Domb Amherst House, 3rd Hampshire House, 3rd Hampshire Stanley C. -

An Act Relative to Reading Proficiency and Closing The

Chapter 287, An Act Relative to Third Grade Reading Proficiency (H.4243) Lead sponsors: Senator Katherine Clark and Representative Martha Walz Third grade reading matters While Massachusetts is lauded for its education achievement, a crisis lies below the surface. Almost 40% of third graders read below grade level. Research indicates that 74% of children who read poorly in third grade will continue to struggle in school, substantially reducing the likelihood that they will finish high school, attend college and contribute to our knowledge-based economy. In addition, Massachusetts has a large achievement gap, and performance in reading on the third grade MCAS has been stagnant since 2001. We can do better. Ensuring that children read proficiently by the end of third grade will help close the achievement gap. In a state whose economy depends on a pipeline of skilled, well-educated workers, it will also help secure the commonwealth’s future prosperity. About the law On September 26th Governor Deval Patrick signed into law Chapter 287, An Act Relative to Third Grade Reading Proficiency (H.4243). This law addresses several key recommendations in the 2010 research report “Turning the Page: Refocusing Massachusetts for Reading Success” to improve third grade reading scores. The report was commissioned by Strategies for Children from Nonie Lesaux, a nationally recognized literacy expert at the Harvard Graduate School of Education. What the law does • Focuses state attention on children’s language and literacy development in early education and care programs and pre-kindergarten to third grade, with a focus on five critical areas: o Comprehensive curricula anchored in rich content, using a wide variety of texts, emphasizing oral language, and balancing meaning- and code-based skills. -

MASC Legislative Directory 2020

2020 Massachusetts State Legislative Directory Massachusetts Constitutional Officers Governor Charlie Baker (617) 725-4005 Room 280 Lt. Governor Karyn Polito (617) 725-4005 Room 360 Treasurer Deborah Goldberg (617) 367-6900 Room 227 Atty. General Maura Healey (617) 727-2200 1 Ashburton Place, 18th Floor [email protected] Sec. of the State William Galvin (617) 727-9180 Room 340 [email protected] State Auditor Suzanne Bump (617) 727-2075 Room 230 [email protected] Massachusetts Senate (617) 722- Email (@masenate.gov) Room # (617) 722- Email (@masenate.gov) Room # Michael Barrett 1572 Mike.Barrett 109-D Patricia Jehlen 1578 Patricia.Jehlen 424 Joseph Boncore 1634 Joseph.Boncore 112 John Keenan 1494 John.Keenan 413-F Michael Brady 1200 Michael.Brady 416-A Edward Kennedy 1630 Edward.Kennedy 70 William Brownsberger 1280 William.Brownsberger 319 Eric Lesser 1291 Eric.Lesser 410 Harriette Chandler 1544 Harriette.Chandler 333 Jason Lewis 1206 Jason.Lewis 511-B Sonia Chang-Diaz 1673 Sonia.Chang-Diaz 111 Joan Lovely 1410 Joan.Lovely 413-A Nick Collins 1150 Nick.Collins 312-D Mark Montigny 1440 Mark.Montigny 312-C Joanne Comerford 1532 Jo.Comerford 413-C Michael Moore 1485 Michael.Moore 109-B Cynthia Creem 1639 Cynthia.Creem 312-A Patrick O'Connor 1646 Patrick.OConnor 419 Brendan Crighton 1350 Brendan.Crighton 520 Marc Pacheco 1551 Marc.Pacheco 312-B Julian Cyr 1570 Julian.Cyr 309 Rebecca Rausch 1555 Becca.Rausch 218 Sal DiDomenico 1650 Sal.DiDomenico 208 Michael Rodrigues 1114 Michael.Rodrigues 212 Diana DiZoglio 1604 Diana.DiZoglio 416-B