2020 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

QATAR V. BAHRAIN) REPLY of the STATE of QATAR ______TABLE of CONTENTS PART I - INTRODUCTION CHAPTER I - GENERAL 1 Section 1

CASE CONCERNING MARITIME DELIMITATION AND TERRITORIAL QUESTIONS BETWEEN QATAR AND BAHRAIN (QATAR V. BAHRAIN) REPLY OF THE STATE OF QATAR _____________________________________________ TABLE OF CONTENTS PART I - INTRODUCTION CHAPTER I - GENERAL 1 Section 1. Qatar's Case and Structure of Qatar's Reply Section 2. Deficiencies in Bahrain's Written Pleadings Section 3. Bahrain's Continuing Violations of the Status Quo PART II - THE GEOGRAPHICAL AND HISTORICAL BACKGROUND CHAPTER II - THE TERRITORIAL INTEGRITY OF QATAR Section 1. The Overall Geographical Context Section 2. The Emergence of the Al-Thani as a Political Force in Qatar Section 3. Relations between the Al-Thani and Nasir bin Mubarak Section 4. The 1913 and 1914 Conventions Section 5. The 1916 Treaty Section 6. Al-Thani Authority throughout the Peninsula of Qatar was consolidated long before the 1930s Section 7. The Map Evidence CHAPTER III - THE EXTENT OF THE TERRITORY OF BAHRAIN Section 1. Bahrain from 1783 to 1868 Section 2. Bahrain after 1868 PART III - THE HAWAR ISLANDS AND OTHER TERRITORIAL QUESTIONS CHAPTER IV - THE HAWAR ISLANDS Section 1. Introduction: The Territorial Integrity of Qatar and Qatar's Sovereignty over the Hawar Islands Section 2. Proximity and Qatar's Title to the Hawar Islands Section 3. The Extensive Map Evidence supporting Qatar's Sovereignty over the Hawar Islands Section 4. The Lack of Evidence for Bahrain's Claim to have exercised Sovereignty over the Hawar Islands from the 18th Century to the Present Day Section 5. The Bahrain and Qatar Oil Concession Negotiations between 1925 and 1939 and the Events Leading to the Reversal of British Recognition of Hawar as part of Qatar Section 6. -

Listed Companies AGM & EGM Meetings

Listed Companies For the Year Ended AGM & EGM Meetings 31 December 2020 Recommendations Trading AGM / EGM Cum-Dividend Ex-Dividend No. Company’s Name Record Date Remark Symbol Date /Bonus Date /Bonus Date Payment Date Bonus Cash Dividend Shares Commercial Banks Sector 1 Ahli United Bank B.S.C. AUB 2 Al Salam Bank – Bahrain B.S.C. SALAM 3 Bahrain Islamic Bank B.S.C. BISB 4 BBK B.S.C. BBK Khaleeji Commercial Bank 5 KHCB B.S.C 6 National Bank of Bahrain B.S.C. NBB Listed Companies For the Year Ended AGM & EGM Meetings 31 December 2020 Recommendations Trading AGM / EGM Cum-Dividend Ex-Dividend No. Company’s Name Record Date Remark Symbol Date /Bonus Date /Bonus Date Payment Date Bonus Cash Dividend Shares Commercial Banks Sector 7 Ithmaar Holding B.S.C ITHMR Investment Sector Al Baraka Banking Group 8 BARKA B.S.C. 9 INOVEST B.S.C INOVEST Arab Banking Corporation 10 ABC B.S.C. Bahrain Commercial Facilities 11 BCFC Company B.S.C. Bahrain Middle East Bank 12 BMB B.S.C. Listed Companies For the Year Ended AGM & EGM Meetings 31 December 2020 Recommendations Trading AGM / EGM Cum-Dividend Ex-Dividend No. Company’s Name Record Date Remark Symbol Date /Bonus Date /Bonus Date Payment Date Bonus Cash Dividend Shares Investment Sector 13 Esterad Investment Company B.S.C. ESTERAD 14 GFH Financial Group B.S.C. GFH 15 Investcorp Holding B.S.C. INVCORP 16 United Gulf Holding Company B.S.C. UGH United Gulf Investment Corporation 17 UGIC B.S.C. -

Bankrupt Subsidiaries: the Challenges to the Parent of Legal Separation

ERENSFRIEDMAN&MAYERFELD GALLEYSFINAL 1/27/2009 10:25:46 AM BANKRUPT SUBSIDIARIES: THE CHALLENGES TO THE PARENT OF LEGAL SEPARATION ∗ Brad B. Erens ∗∗ Scott J. Friedman ∗∗∗ Kelly M. Mayerfeld The financial distress of a subsidiary can be a difficult event for its parent company. When the subsidiary faces the prospect of a bankruptcy filing, the parent likely will need to address many more issues than simply its lost investment in the subsidiary. Unpaid creditors of the subsidiary instinctively may look to the parent as a target to recover on their claims under any number of legal theories, including piercing the corporate veil, breach of fiduciary duty, and deepening insolvency. The parent also may find that it has exposure to the subsidiary’s creditors under various state and federal statutes, or under contracts among the parties. In addition, untangling the affairs of the parent and subsidiary, if the latter is going to reorganize under chapter 11 and be owned by its creditors, can be difficult. All of these issues may, in fact, lead to financial challenges for the parent itself. Parent companies thus are well advised to consider their potential exposure to a subsidiary’s creditors not only once the subsidiary actually faces financial distress, but well in advance as a matter of prudent corporate planning. If a subsidiary ultimately is forced to file for chapter 11, however, the bankruptcy laws do provide unique procedures to resolve any existing or potential litigation between the parent and the subsidiary’s creditors and to permit the parent to obtain a clean break from the subsidiary’s financial problems. -

18032 Investcorp MD&A P7-76 Tp

INVESTCORP MANAGEMENT DISCUSSION AND ANALYSIS EXECUTIVE SUMMARY During its fiscal year ended June 30, 2009 (FY09), Investcorp has witnessed what has been, arguably,the worst period of sustained stress to world economies and financial markets in living memory.The environment has had a severe impact on Investcorp across both its client and its investment businesses, and it has been the most challenging year for Investcorp since its formation in 1982. The management team has focused on dealing with these challenges head on. It has maintained an active and open dialog with clients throughout the year and has protected the balance sheet by raising capital, reducing investment risk and mitigating re-financing risk by holding high levels of cash liquidity while de-leveraging the balance sheet at the same time. The successful completion of a preference share issue in excess of $500 million, more than double the stated minimum target, in such a difficult environment is clear evidence of confidence in Investcorp’s business model and management team. Although the length and depth of the global recession is still uncertain, management believes that the firm action taken during the fiscal year will enable Investcorp to move forward and focus on the attractive business opportunities that now present themselves. BUSINESS ENVIRONMENT The sub-prime housing crisis that started in the United States in 2007 developed in late calendar year 2008 into a major systemic financial crisis, sending economic activity in the developed world into a synchronized downward spiral.This has led the IMF to make continual downward revisions to its estimate for global growth in calendar years 2009 and 2010. -

Structured Finance

Financial Institutions U.S.A. Investcorp Bank B.S.C. Full Rating Report Ratings Key Rating Drivers Investcorp Bank B.S.C. Strong Gulf Franchise: The ratings of Investcorp B.S.C. (Investcorp, or the company) reflect Long-Term IDR BB Short-Term IDR B the company’s strong client franchise in the Gulf, established track record in private equity (PE) Viability Rating bb and commercial real estate investment, strong capital levels and solid funding profile. Rating constraints include sizable balance sheet co-investments and potential earnings volatility and Investcorp S.A. Investcorp Capital Ltd. placement risks presented by the business model, which could pressure interest coverage. Long-Term IDR BB Short-Term IDR B Gulf Institutional Owners Positive: The Positive Rating Outlook reflects franchise and Senior Unsecured Debt BB earnings benefits that may accrue to Investcorp from the 20% strategic equity stake sale to Support Rating Floor NF Mubadala Development Co. (Mubadala) in March 2017, a sovereign wealth fund of Abu Dhabi. This follows a 9.99% equity stake sale to another Gulf-based institution in 2015. Fitch Ratings Rating Outlook Positive views these transactions favorably, as the relationships may give Investcorp expanded access to potential new investors as well as a more stable equity base. 3i Business Diversifies AUM: The cash-funded acquisition of 3i Debt Management (3iDM) in March 2017 added $10.8 billion in AUM and is expected to be accretive for Investcorp, adding Financial Data stable management fee income. However, the acquired co-investment assets and ongoing risk Investcorp Bank B.S.C. retention requirements do increase Investcorp’s balance sheet risk exposure. -

Listed Companies BOD Meetings to Approve the Financial Results for the Period Ended 31/12/2017

Listed Companies BOD Meetings to approve the Financial Results for the Period ended 31/12/2017 BOD No. Company’s Name Symbol Remarks Date BOD Time Commercial Banks Sector Tuesday 1 Ahli United Bank B.S.C. AUB 01:00 p.m. 20/02/2018 Tuesday 2 Al Salam Bank – Bahrain B.S.C. SALAM 01:00 p.m. 13/02/2018 Monday 3 Bahrain Islamic Bank B.S.C. BISB 10:00 a.m. 12/02/2018 Monday 4 BBK B.S.C. BBK 11:00 a.m. 19/02/2018 Wednesday 5 Khaleeji Commercial Bank B.S.C KHCB 12:30 p.m. 07/02/2018 Monday 10:00 a.m. 6 National Bank of Bahrain B.S.C. NBB 29/01/2018 Thursday 7 Ithmaar Holding B.S.C ITHMR 01:00 p.m. 22/02/2018 Investment Sector Tuesday 8 Al Baraka Banking Group B.S.C. BARKA 11:00 a.m. 20/02/2018 Wednesday 9 INOVEST B.S.C INOVEST # 01:00 p.m. 28/02/2018 Sunday 10 Arab Banking Corporation B.S.C. ABC 01:00 p.m. 11/2/2018 Bahrain Commercial Facilities Company Tuesday 11 BCFC 04:00 p.m. B.S.C. 27/02/2018 Wednesday 12 Bahrain Middle East Bank B.S.C. BMB 01:00 p.m. 31/01/2018 Tuesday 13 Esterad Investment Company B.S.C. ESTERAD 01:00 p.m. 23/01/2018 Tuesday 14 GFH Financial Group B.S.C. GFH 01:00 p.m. 13/02/2018 Wednesday Through 15 Investcorp Bank B.S.C. -

Semi-Annual Market Review

Semi-Annual Market Review HEALTH IT & HEALTH INFORMATION SERVICES JULY 2019 www.hgp.com TABLE OF CONTENTS 1 Health IT Executive Summary 3 2 Health IT Market Trends 6 3 HIT M&A (Including Buyout) 9 4 Health IT Capital Raises (Non-Buyout) 14 5 Healthcare Capital Markets 15 6 Macroeconomics 19 7 Health IT Headlines 21 8 About Healthcare Growth Partners 24 9 HGP Transaction Experience 25 10 Appendix A – M&A Highlights 28 11 Appendix B – Buyout Highlights 31 12 Appendix C – Investment Highlights 34 Copyright© 2019 Healthcare Growth Partners 2 HEALTH IT EXECUTIVE SUMMARY 1 An Accumulating Backlog of Disciplined Sellers Let’s chat about fireside chats. The term first used to describe a series of evening radio addresses given by U.S. President Franklin D. Roosevelt during the Great Depression and World War II is now investment banker speak for “soft launches” of sell-side and capital raise transactions. Every company has a price, and given a market of healthy valuations, more companies are testing the waters to find out whether they can achieve that price. That process now looks a little more informal, or how you might envision a fireside chat. Price (or valuation) discovery for a company can range from a single conversation with an individual buyer to a full-blown auction with hundreds of buyers and everything in between, including a fireside chat. Given the increasing share of informal conversations, the reality is that more companies are for sale than meets the eye. While the healthy valuations publicized and press-released are encouraging more and more companies to price shop, there is a simultaneous statistical phenomenon in perceived valuations that often goes unmentioned: survivorship bias. -

Business Review

BUSINESS REVIEW BUSINESS REVIEW Fiscal Year 2021 For the period July 1, 2020 to December 31, 2020 BUSINESS REVIEW Message from the Executive Chairman “The progress we have delivered on our growth and diversification strategy, coupled with our robust investment and distribution platform, has not only helped Investcorp absorb the shock from the COVID-19 pandemic, but we believe that it will drive our continued success and resilience amidst this uncertain market environment. Our first half fiscal year 2021 results were marked by solid performance across all business lines as economies partially reopened. The robust 9% AUM growth also demonstrates strong demand for our offerings as well as our ability to identify and originate products that meet the sophisticated needs of our expanding client base.” “We remain focused on executing on our plans to drive sustainable growth and value creation and we are confident in our ability to achieve our ambitious long-term objectives. As we grow, we are committed to continuing our prudent and disciplined approach to capital and liquidity management given the overall market uncertainties while advancing our evolution as a firm. During the period, we delivered important progress on our Environmental, Social and Governance and Diversity & Inclusion initiatives, from appointing new leaders to implementing new policies and practices. We look forward to building upon these areas as we move forward on behalf of our stakeholders and communities, and in pursuit of our corporate purpose to enrich the lives of future -

FT PARTNERS RESEARCH 2 Fintech Meets Alternative Investments

FT PARTNERS FINTECH INDUSTRY RESEARCH Alternative Investments FinTech Meets Alternative Investments Innovation in a Burgeoning Asset Class March 2020 DRAFT ©2020 FinTech Meets Alternative Investments Alternative Investments FT Partners | Focused Exclusively on FinTech FT Partners’ Advisory Capabilities FT Partners’ FinTech Industry Research Private Capital Debt & Raising Equity Sell-Side / In-Depth Industry Capital Buy-Side Markets M&A Research Reports Advisory Capital Strategic Structuring / Consortium Efficiency Proprietary FinTech Building Advisory FT Services FINTECH Infographics Partners RESEARCH & Board of INSIGHTS Anti-Raid Advisory Directors / Advisory / Monthly FinTech Special Shareholder Committee Rights Plans Market Analysis Advisory Sell-Side Valuations / LBO Fairness FinTech M&A / Financing Advisory Opinion for M&A Restructuring Transaction Profiles and Divestitures Named Silicon Valley’s #1 FinTech Banker Ranked #1 Most Influential Person in all of Numerous Awards for Transaction (2016) and ranked #2 Overall by The FinTech in Institutional Investors “FinTech Excellence including Information Finance 40” “Deal of the Decade” • Financial Technology Partners ("FT Partners") was founded in 2001 and is the only investment banking firm focused exclusively on FinTech • FT Partners regularly publishes research highlighting the most important transactions, trends and insights impacting the global Financial Technology landscape. Our unique insight into FinTech is a direct result of executing hundreds of transactions in the sector combined with over 18 years of exclusive focus on Financial Technology FT PARTNERS RESEARCH 2 FinTech Meets Alternative Investments I. Executive Summary 5 II. Industry Overview and The Rise of Alternative Investments 8 i. An Introduction to Alternative Investments 9 ii. Trends Within the Alternative Investment Industry 23 III. Executive Interviews 53 IV. -

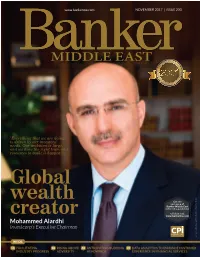

Global Wealth Creator

www.bankerme.com NOVEMBER 2017 | ISSUE 200 SAR ER RY I IV ISS N SU N E A C C Y Y E E R R L L E T E T S B S R U A D T T N IN I N E G H 18 T YEARS IN "Everything that we are doing is driven by our investors’ needs. Our ambition is large, and we have the right team and resources to make it happen." Global wealth Get the next issue of Banker Middle East before it is published. Full details at: creator www.bankerme.com Mohammed Alardhi Investcorp’s Executive Chairman Dubai Technology and Media Free Zone Authority Dubai Technology INSIDE: 14 FACILITATING 30 RISING ABOVE 60 ANTICIPATING BUDDING 70 DATA ANALYTICS TO ENHANCE CUSTOMER INDUSTRY PROGRESS ADVERSITY HEADWINDS EXPERIENCE IN FINANCIAL SERVICES 18 COVERSTORY Mohammed Alardhi, Executive Chairman, Investcorp aims to have $50 billion in AUM by 2022. www.bankerme.com COVERSTORY 19 Global wealth creator Mohammed Alardhi, Executive Chairman at Investcorp, has an ambitious vision to propel the alternative investment firm’s international presence and to broaden its returns and offerings to clients ifty billion dollars of “Our global footprint is really private equity in the region in assets under management increasing; our global brand is the 1980s and in the early 1990s, (AUM)—that is the size strengthened and we are no more following the acquisition of Tiffany F Mohammed Alardhi, the just a bridge between the Gulf and & Co. and Gucci, managing to raise executive chairman of Investcorp, a the US and Europe. -

Mr Hani Fadayel Mr Mohammed Layas Shaikh Saleh Abdulla Kamel

SN Full Name 1 Mr Hani Fadayel 2 Mr Mohammed Layas 3 Shaikh Saleh Abdulla Kamel 4 Mr Khalid Al Bustani 5 Dr Saleh Al Humaidan 6 Gary S Long 7 Mr A K Sankar 8 Mr Adel Fakhro 9 Mr Ubaydli Ubaydli 10 Mr Ali Ben Yousuf Fakhro 11 Mr Ebrahim M S Al Rayes 12 Mr Anwar Khalifa Ibrahim Al Sadah 13 Mr Peter Kaliaropoulos 14 Dr Farid Ahmed Al Mulla 15 Mr Jacob Thomas 16 Ms Omaima Ebrahim 17 Mr Peter Green 18 Mr Mehtab Ali Kazi 19 Mr Ian Levack 20 Mr Younis Jamal Al Sayed 21 Mr Ali Moosa Hussain 22 Mr Vahid Mehrinfar 23 Mr Ashok Shetty 24 HE Dr Majeed Muhsin Al Alawi 25 Mr Francois Bourgoin 26 Mr Mohammed Tariq Sadiq 27 Mr Mahdi Abdullah Al Obaidat 28 Mr Atif A Abdulmalik 29 Mr Mohammed Abdulaziz Al Jomaih 30 Mr Abdulaziz Hamad Aljomaih Al Jomaih 31 Mr Akram Miknas 32 Mr Khamis Al Muqla 33 Mr Danny Barranger 34 Mr Robert N Lewis 35 Mr Hassan Ali Radhi 36 Mr A Hamid Al Asfoor 37 Mr Bassim Mohammed Al Saie 38 Mr Jamal Mohammed Fakhro 39 Mr Suhael Ahmed 40 Mr Tony Peek 41 Mr Sami M Jalal 42 HE Shaikh A M H bin Abdallah Al Khalifa 43 Mr David Bailey 44 Mr Hassan Ali Juma 45 Mr Abdulla Ali Kanoo 46 Ms Elham Hassan 47 Ms Jenny D'Cruz 48 Mr Anthony C Mallis 49 Mr Iqbal G Mamdani 50 Mr John McIsaac 51 Mr Khalid Ali Turk 52 Mr Jamil A Wafa 53 Mr Masaud J Hayat Masoud 54 Mr Tariq Daineh 55 Mr Sonjoy Francis Monteiro 56 Mr Asad Ali Asad 57 Mohammed Ali Naki 58 Mr Ali Al Khayat 59 Mr Jacob Philip 60 Mr Adnan Abdulaziz Al Bahar 61 Mr Bader Abdulmohsen Almukhaizeem 62 Mr Bader Musaed Bader Al Sayer 63 Mr Saleem Abbas 64 Mr Mohsen Dehghani 65 Mr Mohammad M Al Jassar -

List of Delegations to the Seventieth Session of the General Assembly

UNITED NATIONS ST /SG/SER.C/L.624 _____________________________________________________________________________ Secretariat Distr.: Limited 18 December 2015 PROTOCOL AND LIAISON SERVICE LIST OF DELEGATIONS TO THE SEVENTIETH SESSION OF THE GENERAL ASSEMBLY I. MEMBER STATES Page Page Afghanistan......................................................................... 5 Chile ................................................................................. 47 Albania ............................................................................... 6 China ................................................................................ 49 Algeria ................................................................................ 7 Colombia .......................................................................... 50 Andorra ............................................................................... 8 Comoros ........................................................................... 51 Angola ................................................................................ 9 Congo ............................................................................... 52 Antigua and Barbuda ........................................................ 11 Costa Rica ........................................................................ 53 Argentina .......................................................................... 12 Côte d’Ivoire .................................................................... 54 Armenia ...........................................................................