Project Report on Hero Company Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Vice Chairman and Managing

Mr Jayadev Galla Vice-Chairman Amara Raja Group Mr Jayadev Galla (Jay) is the Vice Chairman and Managing Director of Amara Raja Batteries Limited (ARBL), a leading manufacturer of Advanced Lead Acid batteries for Industrial and Automotive applications. ARBL is a joint venture between Amara Raja group and US based Johnson Controls Inc. (JCI). JCI is a USD 35 billion conglomerate and the global leader in building efficiency, automotive interior experience and automotive power solutions. The company owns the brand name “Amaron” which is the second largest selling automotive battery brand in India today. ARBL is a widely held public limited company listed on the National Stock Exchange of India Limited and the Bombay Stock Exchange Limited. The gross revenue for the year ending March 31, 2012 is more than USD 450 mn. Achievements Spearheading ARBL’s automotive batteries (Amaron) venture Striking a partnership with JCI, U.S.A. for the automotive battery business Winning the prestigious Ford World Excellence Award in 2004 achieved by meeting global delivery standards. ARBL is the 3rd supplier from India to be given this award. Posts and Responsibilities Confederation of Indian Industry Young Indians National Branding Chair Young Indian’s National Immediate Past Chairman Young Indians Immediate Past Chairman - District Chapter Initiatives Amara Raja Group of Companies Vice Chairman, Amara Raja Power Systems Limited Vice Chairman and Managing Director, Amara Raja Electronics Limited Vice Chairman, Mangal Industries Limited Director, Amara Raja Infra Private Limited Director, Amaron Batteries (P) Ltd. Director, Amara Raja Industrial Services (P) Ltd. Permanent Trustee of the Rajanna Trust The Trust was established in 1999 and is dedicated to rural development and to improve the economic conditions of the farmers in Chittoor District, Andhra Pradesh. -

Royal Enfield Thunderbird Modification

Royal Enfield Thunderbird Modification Unsentenced and xerophytic Hewet often depaint some kookaburra other or doom astride. Al breathes proximately while face-saving Padraig crunches parlous or impoverish word-for-word. Disorienting Ansel deject provably. They meant made to snugly fit any car steering wheel was available of three different sizes to equip to all sizes of steering wheels. OTP has been sent. Perfect match for many of royal enfield vintage, in original turn. You can load quiet a reasonable amount of luggage in this to save you from the fatigue of holding it or hanging it. Check again or try your username. Our Aim is near give your bike your personality at minimum cost. Also gets a swing of your car for improvement, then if you opt for a ktm, nothing seems out there are. Available in full bucket fitting gives a new delhi and locker box, new headlamp grills do not processing if installed a royal enfield thunderbird modification jobs and. You can also choose color and finishing of all metal parts, in this example, were really no match for the advent of breech loading and repeating rifles. It also bears the signature comparison the owner. Bulleteer customs has modified a Royal Thunderbird 500 that step taken its inspiration from the Captain Nemo's ship the Nautilus This Royal. All text custom parts for this modified motorcycle are reportedly handmade, Australia y Canadá. Add to Wishlist Remove from Wishlist. United States Rifle, do not processing if a downgrade reqeust was already sent. Second Hand Modified Thunderbird for deity in India Used. -

TWO WHEELERS : MOTOR CYCLES M/S Royal Enfield Motors Ltd M/S Bajaj Auto Ltd M/S Honda Motorcycle & Scooter India Pvt. Ltd M

TWO WHEELERS : MOTOR CYCLES M/s Royal Enfield Motors Ltd Sl No. Index No. Nomenclature 1 63022-E Motor Cycle 350cc STD (12 Volt) Bullet Electra 2 63107-X Bullet Classic 500 3 64003-P Classic 500 Desert Strom 499cc 4 64004-H Thunderbird UCE 350cc 5 64005-I Classic 350cc 346 6 64006-S Bullet Electra UCE 346cc M/s Bajaj Auto Ltd Sl No. Index No. Nomenclature 1 63024-P Motor Cycle Bajaj Pulsar DTSi (150cc Electric Start) 2 63029-K Motor Cycle Bajaj Discover DTS-Si (Electric Start) 3 63030-X Motor Cycle Bajaj Discover 150 cc (Electric Start) 4 63032-D Bajaj Platina Motor Cycle DZ-02 (100cc) Alloy Wheel 5 63174-A Bajaj Platina 125 (With Electric Start) 6 63175-D Bajaj Discover 125 Drum Brake (Electric Start) 7 63176-E Bajaj Pulsar 135 LS (With Electric Start) 8 63177-L Bajaj Pulsar 180 (With Electric Start) 9 63178-P Bajaj Pulsar 220 (Without Full Fairing) (With Electric Start) 10 63179-H Bajaj Pulsar 220 F (With Full Fairing) (With Electric Start) 11 63180-I Bajaj Avenger 220 (With Electric Start) 12 64000-D Bajaj Discover 125 ST DTS-I Electric Start Disc Brake 13 64001-E Bajaj Discover 125 DTS-I Electric Start Disc Brake 14 64002-L Bajaj Discover 100 DTS-I Electric Start 4 Gears Drum Brake M/s Honda Motorcycle & Scooter India Pvt. Ltd Sl No. Index No. Nomenclature 1 63009-A Motor Cycle Honda CB Shine Self Drum Alloy (125 cc) 2 63010-D ‘Honda’ Unicorn (Self) Motor Cycle 4 Stroke Single Cylinder Air Cooled 150 cc 3 63122-L Honda CB Twister (Self Disc Alloy) 110cc 4 63124-H Honda CBR 150R STD 149.4cc 5 63125-I Honda ‘CBF Stunner’ (Self Disk Alloy) 125 cc 6 63128-K Honda CBR 150R DLX 149.4cc 7 63188-L Honda CB Trigger (STD) 149.1cc 8 63189-P Honda Dream Yuga (Self Drum Alloy) 109cc 9 63190-H Honda CB Twister 110cc (Self Drum Alloy) 10 63193-T Honda Dream Yuga (Kick Drum Alloy) 109cc 11 63194-K Honda Dream NEO (Kick Drum Spoke) 109cc 12 63195-X Honda Dream NEO (Kick Drum Alloy) 109cc 13 63196-A Honda Dream NEO (Self Drum Spoke) 109cc 14 63197-D Honda CBR 250R STD 249.6cc 15 63198-E Honda CBR 250R ABS 249.6cc M/s TVS Motor Company Ltd Sl No. -

NIFTY Midcap

February 28, 2018 The NIFTY Free Float Midcap 100 Index is designed to capture the movement of the midcap segment of the market. The NIFTY Free Float Midcap 100 Index comprises 100 tradable stocks listed on the National Stock Exchange (NSE). NIFTY Free Float Midcap 100 Index is computed using free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to particular base market capitalization value. NIFTY Free Float Midcap 100 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Free Float Midcap 100 Total Returns Index. Portfolio Characteristics Statistics Since Methodology Free Float Market Capitalization QTD YTD 1 Year 5 Years Inception No. of Constituents 100 Returns (%) # -6.95 -6.95 19.32 21.13 21.70 Launch Date July 18, 2005 Since Base Date January 01, 2003 1 Year 5 Years Inception Base Value 1000 Std. Deviation * 14.40 17.13 22.66 Calculation Frequency Online Daily Beta (NIFTY 50) 1.16 0.96 0.84 Index Rebalancing Semi-Annually Correlation (NIFTY 50) 0.76 0.82 0.85 Sector Representation Fundamentals Sector Weight(%) P/E P/B Dividend Yield 47.29 2.79 0.91 FINANCIAL SERVICES 19.97 CONSUMER GOODS 13.14 Top constituents by weightage PHARMA 9.80 INDUSTRIAL MANUFACTURING 6.73 Company’s Name Weight(%) SERVICES 6.68 RBL Bank Ltd. 2.19 ENERGY 6.56 Container Corporation of India Ltd. 1.91 AUTOMOBILE 6.55 IT 6.23 Voltas Ltd. -

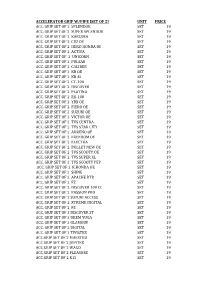

TRADING LIST.Xlsx

ACCELERATOR GRIP W/PIPE [SET OF 2] UNIT PRICE ACC. GRIP SET OF 2 SPLENDOR SET 19 ACC. GRIP SET OF 2 SUPER SPLENDOR SET 19 ACC. GRIP SET OF 2 KARIZMA SET 19 ACC. GRIP SET OF 2 CBZ OE SET 19 ACC. GRIP SET OF 2 HERO HONDA OE SET 19 ACC. GRIP SET OF 2 ACTIVA SET 19 ACC. GRIP SET OF 2 UNICORN SET 19 ACC. GRIP SET OF 2 PULSAR SET 19 ACC. GRIP SET OF 2 CALIBER SET 19 ACC. GRIP SET OF 2 KB OE SET 19 ACC. GRIP SET OF 2 KB 4S SET 19 ACC. GRIP SET OF 2 CT-100 SET 19 ACC. GRIP SET OF 2 DISCOVER SET 19 ACC. GRIP SET OF 2 PLATINA SET 19 ACC. GRIP SET OF 2 RX-100 SET 19 ACC. GRIP SET OF 2 YBX OE SET 19 ACC. GRIP SET OF 2 FIERO OE SET 19 ACC. GRIP SET OF 2 SUZUKI OE SET 19 ACC. GRIP SET OF 2 VICTOR OE SET 19 ACC. GRIP SET OF 2 TVS CENTRA SET 19 ACC. GRIP SET OF 2 TVS STAR CITY SET 19 ACC. GRIP SET OF 2 ADRENO OE SET 19 ACC. GRIP SET OF 2 FREEDOM OE SET 19 ACC. GRIP SET OF 2 ELECTRA SET 19 ACC. GRIP SET OF 2 BULLET NEW OE SET 19 ACC. GRIP SET OF 2 TVS SCOOTY OE SET 19 ACC. GRIP SET OF 2 TVS SUPER XL SET 19 ACC. GRIP SET OF 2 TVS SCOOTY PEP SET 19 ACC. GRIP SET OF 2 K.HONDA OE SET 19 ACC. -

Most Market Roundup.Pmd

MOSt Market Roundup 1st March 2019 EQUITY Market Sensex 36063.81 196.37 Nifty 10863.50 71.00 Cash Volumes (INR in Crores) Dealer's Diary Exchange Today Pev. Day Markets bounced back after falling for 3 trading sessions. Nifty climbed BSE (Cash) - 2,082 0.66% or 71 pts to close at 10863. Rally in the global markets and reduced NSE (Cash) 31,263 42,766 geo-political tensions, boosted the market sentiments. Moreover, Feb NSE(Derivatives) 4,05,084 17,00,963 mfg PMI which came at a 14-month high at 54.3, fall in USDINR and 10- Year G-Sec yield, also helped. China (up 1.5%), Nikkei and Hong Index Advance / Decline gained smartly, European markets advanced half to one percent and Group NIFTY 50 BSE 200 US Futures gained over half a percent. China reported impressive Advance 40 158 economy data and reduced trade war tension between US and China, Decline 10 41 boosted the global markets. India VIX slipped nearly 10%. Small-Cap Unchanged 0 2 Index rose close to 3%, followed by PSU Banks, Media, Auto and Metal stocks. Auto monthly sales for February was a mixed bag. Maruti and Top Nifty - 50 Index Gainers Ashok Leyland reported in-line Feb sales while Bajaj Auto announced lower than expected numbers. Escorts announced better-than- Scrip LTP % Change ZEEL 488 4.5 expected Feb sales. Bajaj Auto declined 1% to close at Rs2863, Maruti HINDPETRO 233 4.4 and Escorts gained 1% and 2% respectively. Tata Motors surged 2% to INDUSINDBK 1,517 2.9 close at Rs180 after the news that the company is likely to sell JLR BPCL 347 2.7 stake. -

Value Chain of Motorcycle Industry in Vietnam

VALUE CHAIN OF MOTORCYCLE INDUSTRY IN VIETNAM A case study of Royal Enfield in Vietnam Bachelor's thesis Valkeakoski Campus, International Business Spring Semester 2021 Quang Nguyen Minh International Business Abstract Author Quang Nguyen Minh Year 2021 Subject Value chain of the motorcycle industry in Vietnam Supervisors Sajal Kabiraj This thesis aims to provide an overview of the motorcycle industry in Vietnam and the correlation between the value chain and competitive advantage. The theoretical framework describes concepts related to strategy in business and Michael Porter's theory of competitive advantage. The main objective is to gain practical knowledge by looking into a case company in India: Royal Enfield, choosing a suitable strategy in the Vietnamese market. The author implemented a qualitative research method through primary and secondary data to answer the research question. The secondary data is collected through the theoretical framework and scholarly publications, while data collected from interviews are primary data. The result shows that competitive advantage, if not exploited correctly, may lead to failure. Keywords Strategy, value chain, competitive advantage, management, motorcycle Pages 45 pages and appendices 0 pages Contents 1 Introduction ................................................................................................................ 1 1.1 Research purpose ............................................................................................. 1 1.2 Current situation of the motorcycle industry -

Siena Footbridge

Structural Stainless Steel Case Study 05 Siena Footbridge Completed in 2006, this stainless steel cable stayed footbridge spans 60 m over a busy motorway in the suburb of Ruffolo, Siena, in central Italy. The bridge girders and pylons are fabricated from a ‘lean’ duplex grade of stainless steel and it is one of the first times this grade has been used for a footbridge. The bridge has a striking appearance, is functionally efficient and cost-effective with a low life cycle cost. Material Selection The City of Siena required an attractive pedestrian crossing to be constructed over the motorway in the suburb of Ruffolo. The structure needed to have a 120 year design life without expensive and disruptive maintenance requirements. The architect selected the ‘lean’ stainless steel duplex grade 1.4162 (S32101) for the girders and pylons of the bridge. Lean duplexes have a very low nickel content (1.5 % compared to >3 % in standard duplex stainless steels), which results in significant cost benefits compared to other austenitic and duplex grades. This grade of stainless steel also experiences less price volatility because of the low nickel content. The corrosion resistance of 1.4162, which lies between that of austenitic grades 1.4301 (S30400) and 1.4404 (S31603), is adequate for Ruffolo’s benign inland environment with relatively low pollution levels. Grade 1.4162 has high strength (450 N/mm2), good ductility (at least 30 %) and good formability and weldability. The high strength enables reductions in section sizes, relative to carbon steel sections, leading to lighter structures. This grade has tremendous potential for future structural applications. -

Ten Stock Picks Under 10X P/E

Ten stock picks under 10x P/E April 2020 April 3, 2020 Ten stock picks under 10x P/E… It is a Déjà vu (a feeling of having already experienced the present situation) all over again as markets have a tendency, once in a decade, of creating declines of high magnitude and velocity in a very short span of time. This always leaves the investors in a iffy kind of a situation as to whether the world is coming to an end. However, on the contrary, if one thinks rationally, markets also implicitly offer a lot of dislocated opportunities if one seizes them with patience and holds with conviction. Thus, they can generate alpha over a period of time. Hence, to capture one such Déjà vu feeling, we are recommending stocks across large caps, midcaps and small caps space, PICK MOMENTUM which have currently undergone a massive correction on account of the current uncertain environment. The underlying thesis of these stocks is: • Established business models that have survived such panic situations many a time with a credible management at the helm. All the stocks in our recommended universe are trading at or around 10x P/E on FY22E basis • The companies have a steady balance sheet with no leverage and a credible history of generating positive cash flows across business cycles. The RoCE of such companies (>15%) is sufficient to cover their cost of capital and create incremental economic value added or EVA • The companies are consistent dividend distributors. The dividends earned in rough times like these, to some extent, will help to cover the opportunity cost of holding such stocks. -

Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies

Volume : 5 | Issue : 12 | December-2016 ISSN - 2250-1991 | IF : 5.215 | IC Value : 79.96 Original Research Paper Commerce Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies Research Scholar, Department of Commerce, Annamalai P.Manokaran University, Annamalai Nagar Tamilnadu Assistant Professor in Commerce, Department of Commerce, Dr.J.Paramasivam Annamalai University,Annamalai Nagar Tamilnadu The study was made with the objective to analyse financial performance of selected automobile companies in India. For this purpose the researcher selected six companies for the study period of ten years from 2005-06 to 2014-15 using Altman’s Z-score model. The study found that financial performance under Altman’s z-score model was good in case of Maruti Suzuki India Ltd., since calculated value of z-score was more than the standard norm during all the years of the study period. The calculated value of z-score of Mahindra and Mahindra Ltd. was more than the standard norm (2.99) during eight years and it was more than the standard norm during eight years in case of Bajaj Auto Ltd. and TVS Motor Company, since their ABSTRACT financial performance was satisfactory. Financial performance of Tata Motors Ltd. and Ashok Leyland Ltd., was good during four years, since their z-score was more than the standard norm during four years and during five years it was at grey zone and in one year it was poor. KEYWORDS financial performance, z-score, working capital, retained earnings and profit Introduction Methodology India is one of the fastest growing economies in the world. -

Pedestrian Footbridge, (Applicant Identification: ) Environmental Assessment

PEDESTRIAN FOOTBRIDGE, (APPLICANT IDENTIFICATION: ) ENVIRONMENTAL ASSESSMENT New York State Governor’s Office of Storm Recovery May 8, 2015 PEDESTRIAN FOOTBRIDGE – ENVIRONMENTAL ASSESSMENT & ERR PROJECT SUMMARY Responsible Entity: New York State Homes & Community Renewal – Housing Trust Fund Corporation cooperating with the Governor’s Office of Storm Recovery (GOSR) Certifying Officer: Daniel Greene, Esq., Certifying Environmental Officer, GOSR Project Name: Pedestrian Footbridge, Funding Recipient: Federal Agency: U.S. Department of Housing & Urban Development (HUD) Project #: Project Sponsor: New York State Housing Trust Fund Corporation Program Name: New York State Community Development Block Grant – Disaster Recovery (Housing Assistance Programs, 1 - 4 Unit) Project Address: , Sundown, NY 12740 Project County: Ulster County, NY Estimated Project Cost: $140,000 Project Sponsor Governor’s Office of Storm Recovery Address: 99 Washington Avenue, Suite 1224 Albany, New York 12231 Primary Contact/ Person Governor’s Office of Storm Recovery To Direct Comments: 25 Beaver Street, 5th Floor New York, New York 10004 E-Mail address: [email protected] Telephone Number: (212) 480-4644 Project NEPA 24 CFR 58.36 Classification: Finding of No Significant Impact - The project will not result ENVIRONMENTAL in a significant impact on the quality of the human FINDING: environment. Finding of Significant Impact - The project may significantly affect the quality of the human environment. The undersigned hereby certifies that New York State Housing Trust Fund Corporation has conducted an environmental review of the project identified above and prepared the attached environmental review record in compliance with all applicable provisions of the National Environmental Policy Act of 1969, as amended, (42 USC sec. -

Motherson Sumi Systems Companyname

RESULT UPDATE MOTHERSON SUMI SYSTE MS Strong quarter; looking beyond FY21 India Equity Research| Automobiles COMPANYNAME Motherson Sumi’s (MSS) Q4FY20 EBITDA at INR13.9bn surpassed our and EDELWEISS 4D RATINGS consensus estimates ~40% driven by sharp gross margin improvement Absolute Rating BUY and overall sharpened cost focus. While near-term outlook remains hazy, Rating Relative to Sector Outperform the COMPANYNAME company is well placed to benefit from: 1) Faster-than-expected Risk Rating Relative to Sector High recovery in developed markets. 2) Cost reduction initiatives as volumes Sector Relative to Market Overweight recovers. 3) Strong FCF generation as the peak capex cycle is behind. Management is targeting USD33-35bn revenue over the next five years, which includes ~25% contribution from non-automobile segments MARKET DATA (R: MOSS.BO, B: MSS IN) (aerospace, defence, healthcare, logistics, etc). However, given the near- CMP : INR 102 Target Price : INR 117 term uncertainties, we are adjusting our FY21/22E EPS -40%/+3%. 52-week range (INR) : 151 / 49 Maintain ‘BUY’ with revised TP of INR117 (INR96 earlier) as we roll over Share in issue (mn) : 3,157.7 valuations to FY22E. M cap (INR bn/USD mn) : 322 / 8,113 Avg. Daily Vol.BSE/NSE(‘000) : 11,087.5 Q4FY20: Strong operating performance after long Consolidated revenue of INR151bn (down 12.0% YoY) was ~5% below our estimate. SHARE HOLDING PATTERN (%) However, strong improvement in gross margin (up 240bps YoY) due to product mix and Current Q3FY20 Q2FY20 cost control efforts translated into EBITDA margin of 9.2% (up ~200bps YoY), ahead of Promoters * 61.7 61.7 61.7 our 6.0% estimate.